Accounting Information System: Transaction Analysis & Recording

advertisement

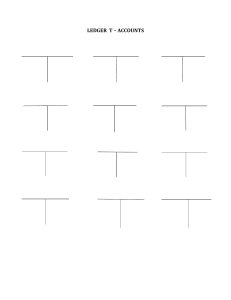

Financial Accounting: Tools for Business Decision Making Tenth Edition Kimmel ● Weygandt ● Mitchell Chapter 3 The Accounting Information System Prepared by Diane Tanner University of North Florida This slide deck contains animations. Please disable animations if they cause issues with your device. Chapter Outline Learning Objectives LO 1 Analyze the effect of business transactions on the basic accounting equation. LO 2 Explain how accounts, debits, and credits are used to record business transactions. LO 3 Indicate how a journal is used in the recording process. LO 4 Explain how a ledger and posting help in the recording process. LO 5 Prepare a trial balance. Learning Objective 1 Analyze the Effect of Business Transactions on the Basic Accounting Equation LO 1 Using the Accounting Equation to Analyze Transactions Accounting Information System • • Is a system of collecting transaction data, processing transaction data, and communicating financial information to decision-makers Is affected by factors o o o o o • Nature of the company’s business Types of transactions Size of the company Volume of data Information demands of management and others Relies on the accounting cycle LO 1 Accounting Cycle • Is the basis of an accounting information system • Implemented primarily through a computerized accounting system o Called electronic data processing systems (EDP) • Contains the same concepts and principles regardless if manual or computerized To emphasize the underlying concepts and principles, we focus on a manual accounting system. LO 1 Accounting Transactions • Are economic events that require recording in the financial statements o Not all events represent transactions • Occur when assets, liabilities, or stockholders’ equity items change as a result of some economic event • Have a dual effect on the accounting equation LO 1 Transaction Identification Process Are the following events recorded in the accounting records? LO 1 Analyzing Transactions • • • • • Is the process of identifying the specific effects of economic events on the accounting equation Based upon the accounting equation Assets = Liabilities + Stockholders’ Equity Must always balance Each transaction has a dual effect If an individual asset is increased, there must be a corresponding o Decrease in another asset, or o Increase in a specific liability, or o Increase in stockholders’ equity LO 1 Expanded Accounting Equation LO 1 Tabular Analysis • Used to demonstrate the effect that each transaction has on particular financial statements • Retained earnings is affected o When the company recognizes revenue, incurs expenses, or pays dividends LO 1 Investment of Cash by Stockholders Event (1) On October 1, cash of $10,000 is invested by investors in exchange for $10,000 of common stock. Basic Analysis: The asset Cash is increased $10,000; stockholders’ equity (specifically Common Stock) is increased $10,000. LO 1 Note Issued in Exchange for Cash Event (2) On October 1, Sierra borrowed $5,000 from Castle Bank by signing a 3-month, 12%, $5,000 note payable. Basic Analysis: The asset Cash is increased $5,000; the liability Notes Payable is increased $5,000. LO 1 Purchase of Equipment for Cash Event (3) On October 2, Sierra purchased equipment by paying $5,000 cash to Superior Equipment Sales Co. Basic Analysis: The asset Equipment is increased $5,000; the asset Cash is decreased $5,000. LO 1 Receipt of Cash in Advance from Customer Event (4) On October 2, Sierra received a $1,200 cash advance from R. Knox, a client. Basic Analysis: The asset Cash is increased $1,200; the liability Unearned Service Revenue is increased $1,200. LO 1 Services Performed for Cash Event (5) On October 3, Sierra received $10,000 in cash from Copa Company for guide services performed for a corporate event. Basic Analysis: The asset Cash is increased $10,000; the revenue Service Revenue is increased $10,000. LO 1 Services Performed on Account On account • Means that services will be paid at a later date • Revenue is recorded when services are performed Record services performed on account Record collection from the customer LO 1 Payment of Rent Event (6) On October 3, Sierra paid its office rent for the month of October in cash, $900. Basic Analysis: The expense Rent Expense is increased $900 because the payment pertains only to the current month; the asset Cash is decreased $900. LO 1 Purchase of Insurance Policy for Cash Event (7) On October 4, Sierra paid $600 for a one-year insurance policy that will expire next year on September 30. Basic Analysis: The asset Cash is decreased $600; the asset Prepaid Insurance is increased $600. LO 1 Purchase of Supplies on Account Event (8) On October 5, Sierra purchased an estimated three months of supplies on account from Aero Supply for $2,500. Basic Analysis: The asset Supplies is increased $2,500; the liability Accounts Payable is increased $2,500. LO 1 Hiring New Employees Event (9) On October 9, Sierra hired four new employees to begin work on October 15. Each employee will receive a weekly salary of $500 for a fiveday work week, payable every two weeks. Employees will receive their first paychecks on October 26. Basic Analysis: An accounting transaction has not occurred. There is only an agreement that the employees will begin work on October 15. LO 1 Payment of Dividends Event (10) On October 20, Sierra paid a $500 cash dividend. Basic Analysis: Dividends is increased $500; the asset Cash is decreased $500. LO 1 Payment of Cash for Employee Salaries Event (11) Employees have worked two weeks, earning $4,000 in salaries, which were paid on October 26. Basic Analysis: The asset Cash is decreased $4,000; the expense Salaries and Wages Expense is increased $4,000. LO 1 Summary of Transactions • Summarizes the transactions to show their cumulative effect on the basic accounting equation • Includes the transaction number in the first column on the left • The right-most column shows the specific effect of any transaction that affects revenues or expenses • Demonstrates three points ① Each transaction is analyzed in terms of its effect on assets, liabilities, and stockholders’ equity. ② The two sides of the equation must always be equal. ③ The cause of each change in revenues or expenses must be indicated. LO 1 Illustration of Summary of Transactions LO 1 Knowledge Check: Transaction Analysis Record each of Ace’s transactions in a tabular analysis of transactions for the month of June. 1. Ace issued shares of stock to stockholders for $9,000 cash. 2. Ace purchased $4,200 of equipment on account. 3. Ace received cash for $2,100 of services performed. +$9,000 +$9,000 +4,200 +2,100 +4,200 +2,100 Service Revenue LO 1 Learning Objective 2 Explain How Accounts, Debits, and Credits Are Used to Record Business Transactions LO 2 Accounts, Debits, and Credits Account • Is an individual accounting record of increases and decreases in a specific asset, liability, stockholders’ equity, revenue, or expense item • Consists of three parts o o o A title A left or debit side A right or credit side LO 2 Debits and Credits Debit = Left Dr. Credit = Right Cr. • Use of debits and credits o Describes where entries are made in accounts • Debiting o Entering an amount on the left side of an account • Crediting o Entering an amount on the right side of an account LO 2 Tabular Summary and Account Form Sierra Corporation’s Cash account LO 2 Benefits of Using the T-Account Form • • Reduces recording errors by having increases on one side and decreases on the other Helps in determining the totals of each side of the account as well as the account balance o Determining the balance • Net the two sides by subtracting one amount from the other LO 2 Understanding Debits and Credits Animation Video: Understanding Debits and Credits LO 2 Knowledge Check: Debits and Credits Identify each statement as true or false. 1. The tabular summary form of an account is used primarily to record transactions by businesses. 2. Debits indicate increases and credits indicate decreases. 3. An account is an individual accounting record of increases and decreases in a specific asset, liability, stockholders’ equity, revenue, or expense item. 4. In its simplest form, an account has three parts, a title, a left or credit side, and a right or debit side. False False True False LO 2 Debit and Credit Procedures • Debits must equal credits o Provides equality as the basis for the double-entry accounting system • Double-entry system o o o o Requires a two-sided effect of each transaction recorded in appropriate accounts Provides a logical method for recording transactions Helps to ensure the accuracy of the recorded amounts Helps detect errors LO 2 Dr./Cr. Procedures for Assets and Liabilities • Have opposite effects as they are on opposite sides of the accounting equation Debits Increase assets Decrease liabilities Credits Decrease assets Increase liabilities • Normal balances o The side where increases are recorded LO 2 Dr./Cr. Procedures for Stockholders’ Equity Common Stock • Same effects as liabilities Debits Credits Decrease Common Stock Increase Common Stock • Normal balances o The credit side where increases are recorded LO 2 Dr./Cr. Procedures for Stockholders’ Equity Retained Earnings • Is net income that is retained in the business • Increases stockholders’ equity Debits Credits Decrease Retained Earnings Increase Retained Earnings • Normal balances o The credit side where increases are recorded LO 2 Dr./Cr. Procedures for Stockholders’ Equity Dividends • Represents a distribution by a corporation to its stockholders, usually cash • Decreases stockholders’ equity Debits Credits Increase dividends Decrease dividends • Normal balances o The debit side where increases are recorded LO 2 Dr./Cr. Procedures for Stockholders’ Equity Revenues and Expenses • Revenues increase stockholders’ equity • Expenses decrease stockholders’ equity Debits Decrease revenue Increase expenses Credits Increase revenue Decrease expenses • Normal balances LO 2 Knowledge Check: Debit and Credit Procedures Identify the normal balance and debit effect of each account type. Normal Balance Debit Effect Liability Credit Decrease Expense Debit Increase Revenue Credit Decrease Asset Debit Increase Common Stock Credit Decrease Retained Earnings Credit Decrease LO 2 Stockholders’ Equity Relationships LO 2 Knowledge Check: Stockholders’ Equity Relationships Identify in which financial statement each subdivision of stockholders’ equity is reported. (One subdivision is reported in more than one statement.) Accounts Common stock Stockholders’ equity section of the balance sheet Revenues Income statement Dividends Retained earnings statement Retained earnings Stockholders’ equity section of the balance sheet and retained earnings statement Income statement Expenses LO 2 Summary of Debit/Credit Rules Relationship among the assets, liabilities and stockholders’ equity of a business • Equation must be in balance after every transaction • Total debits must equal total credits LO 2 Knowledge Check: Debit/Credit Rules Identify the normal balance and debit effect of each account. Normal Balance Debit Effect Decrease Accounts Payable Credit Salaries Expense Debit Increase Service Revenue Credit Decrease Equipment Debit Increase Common Stock Credit Decrease Accounts Receivable Debit Increase LO 2 Learning Objective 3 Indicate How a Journal is Used in the Recording Process LO 3 Using a Journal The Recording Process • Consists of three steps Analyze business transactions Journalize the transaction Post to ledger accounts • Evidenced by a source document o Such as a sales slip, check, bill, or cash register document LO 3 Illustration of the Recording Process LO 3 The Journal • Is an accounting record in which transactions recorded in chronological order • Shows the debit and credit effects on specific accounts • Contributions to the recording process o o o Discloses the complete effect of a transaction Provides a chronological record of transactions Helps to prevent or locate errors • Journalizing o Is the process of entering transaction data in the journal LO 3 Features of Journal Entries • • • • • • Date is entered in the Date column Account to be debited is entered first at the left Account to be credited is entered on the next line, indented Amounts for the debits are recorded in the Debit column Amounts for the credits are recorded in the Credit column Brief explanation of the transaction is given LO 3 Journalizing the Issuance of Stock October 1, Sierra issued common stock in exchange for $10,000 cash. Assets = Liabilities + Stockholders’ Equity Cash = Common Stock +$10,000 = +$10,000 Issued stock LO 3 Journalizing a Borrowing by Signing a Note October 1, Sierra borrowed $5,000 by signing a note. Assets = Liabilities + Cash = Notes Payable +$5,000 = +$5,000 Stockholders’ Equity LO 3 Journalizing the Purchase of Equipment October 2, Sierra purchased equipment for $5,000. Assets Cash −$5,000 + = Liabilities + Stockholders’ Equity Equipment = +$5,000 = LO 3 Knowledge Check: Journal Entries – Part A Record two entries for Handy Help. Handy Help paid May’s office rent of $850 on May 2. Handy Help performed services and billed the customer $3,100 on May 11. GENERAL JOURNAL Date May 2 11 Account Titles and Explanations Rent Expense Cash (Paid office rent for May) Accounts Receivable Service Revenue (Performed services and billed customer) Debit 850 3,100 Credit 850 3,100 LO 3 Knowledge Check: Journal Entries – Part B Record two entries for Handy Help. Handy Help purchased equipment on account on May 14 for $3,800. Handy Help paid dividends of $1,100 on May 21. GENERAL JOURNAL Date May 14 21 Account Titles and Explanations Equipment Accounts Payable (Purchased equipment on account) Dividends Cash (Paid dividends) Debit 3,800 Credit 3,800 1,100 1,100 LO 3 Learning Objective 4 Explain How a Ledger and Posting Help in the Recording Process LO 4 The Ledger and Posting Posting to Ledger Accounts • Occurs after entries are recorded in the journal • Ledger o o Consists of a record of all accounts maintained by a company and their amounts Provides the balance in each of the accounts as well as keeps track of changes in these balances Analyze business transactions Journalize the transaction Post to ledger accounts LO 4 The Ledger • • • Is a record of all accounts maintained by a company and their amounts Proves the balance in each account and tracks changes in the balances Most common ledger is general ledger o Contains all the asset, liability, stockholders’ equity, revenue, and expense accounts LO 4 Chart of Accounts Assets Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation—Equipment Liabilities Notes Payable Accounts Payable Interest Payable Unearned Service Revenue Salaries and Wages Payable Accounts in Red are used in this chapter. Stockholder's Equity Common Stock Retained Earnings Dividends Income Summary Revenues Service Revenue Expenses Salaries and Wages Expense Supplies Expense Rent Expense Insurance Expense Interest Expense Depreciation Expense LO 4 Posting Is the procedure of transferring journal entry amounts to ledger accounts • Accumulates the effects of journalized transactions in the individual accounts Two steps 1. Enter in the appropriate columns of the debited account(s) the date and the debit amount shown in the journal. 2. In the ledger, enter in the appropriate columns of the credited account(s) the date and the credit amount shown in the journal. • LO 4 Knowledge Check: The Ledger and Posting Identify each statement as true or false. 1. The general ledger tracks changes in each account balance. True 2. Regardless of size, all companies use the same accounts in their chart of accounts. False 3. A chart of accounts is a list of the names of a company’s accounts and their balances. False 4. The procedure of transferring journal entry amounts to ledger accounts is called posting. True LO 4 The Recording Process Illustrated Purpose of transaction analysis To identify the type of account involved and determine whether a debit or credit to the account is required Basic steps LO 4 Knowledge Check: Posting Posting a. b. c. d. normally occurs before journalizing. transfers ledger transaction data to the journal. is an optional step in the recording process. transfers journal entries to ledger accounts. LO 4 Knowledge Check: Posting Answer Posting a. b. c. d. normally occurs before journalizing. transfers ledger transaction data to the journal. is an optional step in the recording process. Answer: transfers journal entries to ledger accounts. LO 4 Recording Process: Investment of Cash by Stockholders On October 1, stockholders invest $10,000 cash in an outdoor guide service company to be known as Sierra Corporation. • • Debits increase assets: debit Cash $10,000 Credits increase stockholders’ equity: credit Common Stock $10,000 LO 4 Recording Process: Issue of Note Payable On October 1, Sierra borrows cash of $5,000 by signing a 3month, 12%, $5,000 note payable. • • Debits increase assets: debit Cash $5,000 Credits increase liabilities: credit Notes Payable $5,000 LO 4 Recording Process: Purchase of Equipment On October 2, Sierra used $5,000 cash to purchase equipment. • • Debits increase assets: debit Equipment $5,000 Credits decrease assets: credit Cash $5,000 LO 4 Recording Process: Receipt of Cash in Advance From Customer On October 2, Sierra received a $1,200 cash advance from R. Knox, a client, for guide services to be completed in the future. • • Debits increase assets: debit Cash $1,200 Credits increase liabilities: credit Unearned Service Revenue $1,200 LO 4 Recording Process: Services Performed for Cash On October 3, Sierra received $10,000 in cash from Copa Company for guide services performed in October. • • Debits increase assets: debit Cash $10,000 Credits increase revenues: credit Service Revenue $10,000 LO 4 Recording Process: Payment of Rent With Cash On October 3, Sierra paid office rent for October in cash, $900. • • Debits increase expenses: debit Rent Expense $900 Credits decrease assets: credit Cash $900 LO 4 Recording Process: Purchase of Insurance Policy with Cash On October 3, Sierra paid $600 for a 1-year insurance policy that will expire next year on September 30. • • Debits increase assets: debit Prepaid Insurance $600 Credits decrease assets: credit Cash $600 LO 4 Recording Process: Purchase of Supplies on Account On October 5, Sierra purchased an estimated 3 months of supplies on account from Aero Supply for $2,500. • • Debits increase assets: debit Supplies $2,500 Credits increase liabilities: credit Accounts Payable $2,500 LO 4 Recording Process: Hiring of New Employee On October 9, On October 9, Sierra hired four employees to begin work on October 15. Each employee will receive a weekly salary of $500 for a 5-day work week, payable every 2 weeks—first payment made on October 26. An accounting transaction has not occurred. LO 4 Recording Process: Payment of Dividend On October 20, Sierra paid a $500 cash dividend to stockholders. • Debits increase dividends: debit Dividends $500 • Credits decrease assets: credit Cash $500 LO 4 Recording Process: Payment of Cash for Employee Salaries On October 26, Sierra paid employee salaries of $4,000 in cash. • • Debits increase expenses: debit Salaries and Wages Expense $4,000 Credits decrease assets: credit Cash $4,000 LO 4 General Ledger for Sierra Corporation LO 4 Knowledge Check: Posting Entries Post Surf Shack’s transactions from its first month of operations. June 1 8 19 Cash Service Revenue 6,500 Accounts Receivable Service Revenue 4,000 Equipment Cash 4,100 6,500 4,000 4,100 LO 4 Learning Objective 5 Prepare a Trial Balance LO 5 The Trial Balance Analyze business transactions Journalize the transaction Post to ledger accounts Prepare a trial balance • Prepared at the end of an accounting period • Purpose is to prove that debits equal credits after posting • Useful in the preparation of financial statements • May also uncover errors in journalizing and posting LO 5 Nature of the Trial Balance • Consists of a list of accounts and their balances at a given time • Procedures for preparing a trial balance 1. List account titles and their balances • In the order in which they appear in the ledger 2. Total the debit column and the credit column 3. Verify the equality of the two columns LO 5 Illustration of a Trial Balance LO 5 Knowledge Check: Preparing a Trial Balance The ledger accounts for Sun Toys at May 31 are presented here. Salaries and Wages Expense 14,000 Equipment 25,600 Accounts Receivable 3,100 Dividends 1,200 Salaries and Wages Payable 1,500 Accounts Payable 2,500 Notes Payable (due in 2 years) 15,000 Service Revenue 33,900 Prepaid Insurance 1,100 Common Stock 10,000 Utilities Expense 5,600 Cash 12,300 List the first six accounts in the order in which they will be listed in a trial balance. Cash Accounts Receivable Prepaid Insurance Equipment Accounts Payable Salaries and Wages Payable LO 5 Limitations of a Trial Balance • Does not prove that all transactions have been recorded or that the ledger is correct • May balance even when o o o o o A transaction is not journalized A correct journal entry is not posted A journal entry is posted twice Incorrect accounts are used in journalizing or posting Offsetting errors are made in recording the amount of a transaction LO 5 Knowledge Check: Limitations of a Trial Balance Which of the following will cause a trial balance to be out of balance? a. A correct journal entry is not posted. b. A journal entry is posted twice. c. Incorrect accounts are used in journalizing or posting. d. A debit posting for an entry is omitted. LO 5 Knowledge Check: Limitations of a Trial Balance Answer Which of the following will cause a trial balance to be out of balance? a. A correct journal entry is not posted. b. A journal entry is posted twice. c. Incorrect accounts are used in journalizing or posting. d. Answer: A debit posting for an entry is omitted. LO 5 Copyright Copyright © 2022 John Wiley & Sons, Inc. All rights reserved. Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein.