,.

r e:&t}

t'

i

PRACTICAL ACCOUNTING PROBLEMS

'l::

ll

;

II

BUS]NEgS COMBINATION

DATE OF ACQUISTTTON

-: :-=.i...

ACOUTSITTON OF NET ASSET5 AND ACOUTSTTTON OJ SOCKS

PROBLEM 1.

in manufacturirrg cars. On January !, ZOL3, the board of directors

of the said company has declded'to acquire'the net assets of NOVA Corporation and RISE Corporation,

quality

iuppti.o of materlafu they use in production. The merger is expected to result in producing higher

cars with lower total cost'

STAR Corporation is a company involved

the books of

The deal was closed on February 29, 2013 and the following information was gathered from

the entiLies:

NOVA

RISE

P1,375,00C

P390,000

P260,000

3,125,000

2,550;000

P2,940,000

1.700,000

P1.960,000

P210.000

780,200

10e.gqq

zgorooo

940,000

P140,000

1,186,800

STAR

Current assets

Noncurrent assets

Total assets

P325

748,500

Common stock, P100

Additional

Retained earninqs

176,500

I

1.250,00q

P4.500,000

Totalequities

113,200

520,000

P1,960,00q

common

Star will lssue 22,500 of its common stock in,exchange for the net assets of Nova and 11,200 of its

addition,

.the

stock in exchange for..the net asseti of Rise; the fair value of Star's shares is P150. In

:,

be

:.

following adjustrients shhuld

'"'

made:

:

.-ir

r

r

Current assets cf floria and Rise have a fair rralue of P450,000 and P230,000 respectively'

Noncurrent assets have a fair value of P2,150,000 and P1,975,000 for Nova and Rise, respectively'

Compute for the following balances of Star Company-on the date ol acquisition:

Stockholders'equlty

A. 'P6,118,500

B.

,l

ll!

, l.

;i

|

i

r.' ' '.

P7,980,000

c. p:;+gs,soo

'!' '

D. P9,615,000

. Assets

A.'

P10,290,000

c.

P9,240,000

P10,500,000

P9,840,000

B.

D.

:

l

i

,.

:

F

?cqr- 2

PROBLEM

'.

Denim Co. merged into Kraft Corp. on-July 1, 20t3. In exchange. for fhe net assets at fair market value of Denim

per

Co, amounting lo P696,450 , |qaft issued.68,00fl crurmon shardi at P9 par value with a market price of P12

t,

share.

Out of pocket costs of the combination were as follows:

fees for the contract of

{gqitleelgrjEg.Egrelion

combination

Q[ :!99k issue-

Printinq costs of stock certiFicates

nccguntant's feg for

Other direct cost of

--

_.9!,qqq

_ _1_4fq9_

pre

dit

-

General and allocated

Denim will pay an additionalcash conslderation of P455,000 in the event that Kraft's net'income will be equal or

greater tlran P950,000 for the period ended December 31, 2013, At aquisition date, there is a high probability of

ieaching the brget het income and the fair value of the additional ctrnslderation was determined to be P195,000.

Actual net income for the period ended December 31, 2013 amounted

to P1,250,000. The additional cash

consideration was paid.

What is the amount of goodwill to be recognizal in the statement of financial position as of December 31,

2013?

A. P295,450

B. P308,500

c,

P314,550

D. P326,550

.

What is the amoun[,bf e*pense to be recognized.in the statement of comprehensive income for the year

' '

ended December 31,

-.

2Oi3?

:'

'.. f

A, P257,200

B. P517,200,

.

'

,ri

r

:,:

:ri"

c,. P307,400

D. P412,500

:i.

.'',r.

PROBLEM 3.

l,

On October,

2OL3, Winner Corporation acquired all the assets and assumed all the liabilities of Getter

Company by issuing 20,000 shares wlth a fair value of P67.5 per share and an obligation to pay a

contingent consideration with a fair value of P750,000.

followinq acquisltion related costs:

In addition.. Winner oaid

,rid the following

Other direct cost glgsqgiglig!

F

Yrnqeb

The Statement of Flnanclal Position as of Septer.rber 30, 2013'ot Winner and Getter, together with the fair

.

market value of the assets and liabilities are presented below:

''

Winner

Value

Fair Value

Boolt

Get ter

Book Value Fair Value

P640,000

P640,000

360,000

475,000

25,000

2,000,000

800,000

700,000

335,000

390,000

P35,.0!q ____P15.0!9

70,000

54,0!q

78,000

87,000

13,500

5,000

1,550,000

900.000

Cash

Accounts receivable

Inventories

Prepaid expenses

Land

Building

Equipment

Gcodwill

Total assets

glqQ0q

723,000

*llr&000

585,000

361,500

300,000

P2,s00,000

360.000

P5,000,000

P5,750.000

312,500

937,500

2,000,000

1,000,000

750,000

312,500

980,000

Accounts payable

Notes oavable

Qpi!aLq!q4, s! per

Adgitrslel pqrd ln capital

RetaineC earninos

Total equities

2,900.000

P

200,000

700,000

8s0.000

400,000

350,000

P2,500,000

P2,860,000

200,000

765.000

Compute for the balances that will be shown on the October 7, 2013 statement of financial position of the

surviving company:

Retained earnings

/

r A. P480,000

' B. P54o,ooo

' .. , Q,. P526,000

'.;t,,r

1.

,.

D.

t-

'r

.

t

.:

P475,000'

I

'

t;r,

ti

/

,l

assets i t.ri

,

, A. P7,015,000 '

, ,, B. P6,980r000 " n\

' C. ')7,118,000

'n

Total

D.'

t'l'

.:

l,r

l

'',,-,

P,i,491,000.

PROBLEM 4,

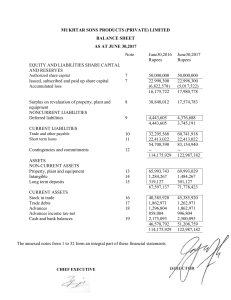

The Statement of Financial Position of Luster Corporation on June 30, 2013 is presented belowt

Current assets

P32,s00

Land

4&ool

Building

Equipnqet

TotalAssdts

Liabilitles

5 par

paid

Additional

in caoital

Retaiqq{ qarnings

Total esuities

lqpitfgtock,

Alt the assets and liabitities

It

110,000

87,500

P450,000

87.s00

150,000

137,500

75,000

P450.000

of Luster assumed to approximate their fair values except for land and building.

is estimated that the land have a fair value of P350,000 and the fair value of the building increased by

P80,000.

F

t

Ymc

rl lL

Kernel Corporation acqulred 80o/o of Luster's capital stock for

P500;000. I

I'

.

./t

,

'

/:r'

tl

/

f

.

|

t

:

Assuming the consideration paid includes control premium of pt+Z,OOb, how much is the goodwill/(gain

onacqui5ition)ontheconso|idatdfinancialstatement1.

'

A. P6o,ooo

B. P48,000

,C.

D.

/ .,'l

,I

' i l'/,,,'- : |

'

P42,000

\.'

'

'

i

't' | , )::,,.':

'it'l

P50,000

of P23,000 and the fair value of the non

goodwill/(gain

on acquisition) on the consolidated

controlling interest is PL22,750, how much is the

Assurning the conslderation pald excludes control premium

.

financial statement?

A.

B.

P78,250

P73,250

c. P69,500

i

D. P74,750

Assuming the consideration paid includes control premium oF P37,000, how much is the goodwill/{gain

on acquisition) on the consolidated financial statement?

A.

B.

P43,250

P73,250

3:

533;li3

PROBLEM 5.

Better Company has galned control over the operations of Calm Corporation by acquiring B5o/o of its

outstanding capital stOck for P2,580,000. This amoutnt includes a control premium of P30,000. Acquisition

expenses, direct and indirect, amounted to P83,000 and 42,000 respectively

Booii value

Calm

Book Value Fair Value

p3,541,500

Cash'l

Accountii receivable

300.000

Inventorids

ss0.000

rEll)r

Land

Buildinq

Equlpment

Goodwill

Total assets

Accounts pavable

![qtssp_eyable

Capital stock, 50 par

Additional paid in capital

Retained earninos

P128.000

325,C00

360,000

125,000

148,500

2,350,000

1,56o,ooo

300,000

9ze'q9!

558.000

L85q!9

300.000

P9,25!,.0!q

6/5.000

1.,1qq,000

PtgE9PW

'-

253.000

730,000

800,000

3,400,000

1.575.000

g9-0,qq9

1,70_0.Qq0

477,040

P8.750.000 __Ba!g_0,q!9_

The following was ascertained on the date of acquisition for Calm

.

.

Corporation:

,

The value of receivables and equioment has decreased by P25,000 and P14,000 respectively.

The fair value of inventories is now P436,000 whereas the value of land and building has increased by

P471,000 and P107,000 respectively.

r There was an

P738,000

unrecorded'accounts payable amounting

to P27,000 and the fair vatue

ol1

notes

is'

)

F

lagc F

Compute for the,following balances

the date of business combination:

to be presented in the consolidated statement of financial position

Total assets

A, P9,875,000

B, P10,093,000

c.

D.

r.

P10,112,000

P9,215,000

Total shareholder's equity

A.

B.

c.

D,

P7,000,000

P7,500,000

P8,200,000

P8,000,000

.l

t,,

PROBLEM 6.

On January 2, ZOI3, the Statement of Financial Position of Pepper and Steak Company prior to the

combination are:

Co.

450,000

300,000

750,000

Pepper

P

Cash

Inventories

Property and equipment (net)

Pjtoa.O.[a

P 9o,0oo

150,000

45o,ooo

Total Assets

Current Liabilities

Common Stock, P100 par

Additional Paid in'Capital

Retained Earnings

Total Liabilities and Stockholder's

810,000

Equity

.

ruJ@*AgA

,

The fair value of Steakipompany's equiprnent

Steak Co'

P 15,000

30,000

105.000

PJ50000

P

15,000

15,000

3o,ooo

90.000

PJSg*AAA

ls" FJ.53,Q.00,

:i;

1.'Assuming Pepper,Conipany acquired:70o/o of the outstanding'common stock of Steak Company for

P105,000 and Non-cohtrolling. interest. is measured at fair value of P61,000, how much is the

goddwill (Oafn o.1 ,acquisitionf. ,.

"

rC.

P(17,0001

P17,000

P23,100

D.

P(23,100)

,4.

"d.

]',

I

f,

Assuming Pepper Company acquired B0o/o of the outstanding common stock of Steak Company for

P136,800 and Non-controlling inierest is measured at Non-controlling interest's proportionate share

of Steak Company's ldentifiable net assets, how much is the consolidated stockholder's equity on

the date of acquisltion?

A. P1,410,000

B. P1,419,600

c,

D.

?

PL,446,600

P1,456,200

Assumlng Pepper Company acquired 90o/o of the outstbnding common stock of Steak Company for

P243,000

and Non-controlling interest is measured at fair value, how much is the total

acquisition? r,

consolidated assets on the date of

A.P1,542,000

B, P1,785,000

c. Pt,737,000

D.

P1,494,000

!

I

".''''

?age

I

PROBLEM 7.

Acquirer Company acquires 25o/o of Acqulred Company's comrfion stock for P190,00O cash and carries

the investment using the cost method. After three fnonths, Parent purchases another 600/o of

Subsidiary's cornmon stock for P540,000. On this date, acquired company reports identifiable net assets

with carrying value of P720,000 and fair value of P920,000. The liabilities of the acquired company has

a

book value and

a fair value of P280,000. The fair value of the

15o/o non-controlling interest is

P125,000.

How much is the goodwill or (gain on acquisition)

.A P(17,000)

B, P250,000

C; P(30.000)

D. P263,00d

PROBLEM 8.

Condensed statements of financial position of Care Corp; and Charm Corp. as

as

foflows:

,)

Care

Current assets

Noncurrent assets

Total assets

Liabilities

Common stocks, P20 par

Additional Paid-in capital

P

P225,000

P 122,500

P

P

16.2s0

137,500

750

Retained

s00

,,

Charm

16,250

106,250

P

43,750

181,250

of Decernber 31, 2012 are

8,750

75,000

6,250

32,500

l!,

On January 1, 2013, Care Corp. lssued 8,750 stocks with a market value of PZ5/share for the assets

and liabilities df Charm Corp. The book value reflects the fair value of the assets and liabilities,

except that the .noncurrent assets of Charm has a temporary appraisal of P157,500 and the

noncurrent ass€t-i; of Care are overstate(.. by P7,500. Contingent consideration, which is

p8,500 and other

determinable, ts eqLal to p3,750. Care also

Wj-io, th,e stock isiuance costs worth

acquisition costs arhb{nting to P4,750,

'/

On March 1, 2013 thd"tontingent consideration hijs a determihable amount of P5,000. On :urlC

/

2013, the provisional fair value of the noncurrent assets of Charm increased by

P2,250.

How much is the combined total assets at the end of 2013?

ts,

P435,500

P443,000

c.

P442,000

?

P4442s0

A,

tt

./

-end of handouts'I

t

'i

a

I

,I

t,