Corporate Entrepreneurship: Innovation in Established Firms

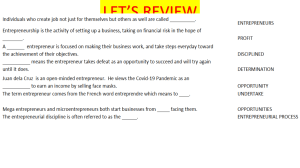

advertisement