Joint Product and By- Product Costing

advertisement

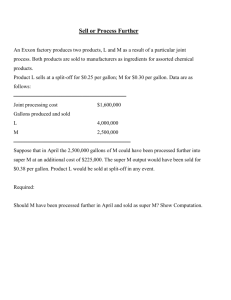

Joint Product and ByProduct Costing Prepared by Douglas Cloud Pepperdine University 7-1 Objectives 1. Identify the characteristics After studying of thisthe joint production process. chapter, you should 2. Allocate joint product be ablecosts to: according to the benefits-received approaches and the relative market value approaches. 3. Describe methods of accounting for byproducts. Continued 7-2 Objectives 4. Explain why joint cost allocations may be misleading in management decision making. 5. Discuss why joint production is seldom found in service industries. 7-3 Joint Production Process Pork Meat Material: Hog Processing Split-Off Point Hides 7-4 Independent MultipleProduct Production Processing Mustang Processing Taurus Material: Steel 7-5 Joint Production Process Joint products are two or more products produced simultaneously by the same process up to a “split-off” point. The split-off point is the point at which the joint products become separate and identifiable. Separable costs are easily traced to individual products and offer no particular problem. 7-6 The distinction between joint and by-products rests solely on the relative importance of their sales value. A by-product is a secondary product recovered in the course of manufacturing a primary product. 7-7 By-products can be characterized by their relationship to the main products in the following manner: By-product resulting from scrap, trimmings, and so forth, of the main products in essentially nonjoint product types of undertakings (e.g., fabric trimmings from clothing pieces). Scrap and other residue from essentially joint product types of processes (e.g., fat trimmed from beef carcasses). A minor joint product situation (fruit skins and trimmings used as animal feed). 7-8 Examples of Joint Products and By-Products Industry Agriculture and Food Industries: Flour milling Extractive Industries: Copper mining Chemical Industries: Soap making Manufacturing: Cement Joint Products and By-Products Patent flour, clear flour, bran, and wheat germ Copper, gold, silver, and other metals Soap and glycerine Concrete pipe and aggregate 7-9 Accounting For Joint Product Costs Benefits-Received Approaches Physical Units Method Weighted Average Method Allocation Based on Relative Market Value Sales-Value-at-Split-Off-Method Net Realizable Value Method 7-10 Accounting For Joint Product Costs Physical Units Method A sawmill processes logs into four grades of lumber totaling 3,000,000 board feet as follows: Grades First and second Board Feet 450,000 Percent of Units 0.15 No. 1 common No. 2 common No. 3 common 1,200,000 600,000 750,000 0.40 0.20 0.25 Totals 3,000,000 Joint Cost Allocation $ 27,900 74,400 37,200 46,500 $186,000 7-11 Accounting For Joint Product Costs Weighed Average Method A peach canning factory purchases $5,000 of peaches and grades and cans them by quality. The following data pertains to this operation: Number Grades of Cases Fancy 100 Choice 120 Standard 303 Pie 70 Totals Weight Weighted No. Allocated Factor of Cases Percent Joint Cost 1.30 130 0.21667 $1,083 1.10 132 0.22000 1,100 1.00 303 0.50500 2,525 0.50 35 600 0.05833 292 $5,000 7-12 Accounting For Joint Product Costs Sales-Value-at-Split-Off Method Using the lumber mill example from earlier-- Grades Quantity Produced (board ft.) First and second 450,000 No. 1 common 1,200,000 No. 2 common 600,000 No. 3 common 750,000 Totals 3,000,000 Price at Split-Off (per 1,000 board ft.) $300 200 121 70 Sales Value at Split-Off $135,000 240,000 72,600 52,500 $500,100 Percent of Total Market Value 0.2699 0.4799 0.1452 0.1050 Allocated Joint Cost $ 50,201 89,261 27,007 19,530 $185,999 * *Rounding error 7-13 Accounting For Joint Product Costs Net Realizable Value Method A company manufactures two products, Alpha and Beta, from a joint process. One production run costs $5,750 and results in 1,000 gallons of Alpha and 3,000 gallons of Beta. Neither product is salable at the split-off point, but must be further processed. The separable cost for Alpha is $1 per gallon and for Beta is $2 per gallon. Alpha Beta Market Price Further Processing Cost Hypothetical Market Price $5 4 $1 2 $4 2 Hypothetical Allocated Number Market Joint of Units Value Cost 1,000 3,000 $ 4,000 6,000 $10,000 $2,300 3,450 $5,750 7-14 Accounting For Joint Product Costs Constant Gross Margin Percentage Method Revenue ($5 x 1,000) + ($4 x 3,000) Costs [$5,750 + ($1 x 1,000) + ($2 x 3,000)] Gross margin Percent $17,000 100 % 12,750 75 % $ 4,250 25 % Alpha Eventual market value Less: Gross margin at 25% of market value Cost of goods sold Less: Separable costs Allocated joint costs Beta $ 5,000 $12,000 1,250 3,000 $ 3,750 $ 9,000 1,000 6,000 $2,750 $ 3,000 7-15 Accounting For Joint Product Costs Sales-to-Production Ratio Method % of Product Total Sales A B C D E 10 20 15 40 15 100 *rounding % of Production Sales-toProduction Ratio 10 15 25 30 20 100 1.0000 1.3333 0.6000 1.3333 0.7500 5.0166 Percent Costs Assigned Sales/Production 19.9338 % $ 199,338 26.5778 % 265,778 11.9603 % 119,603 26.5778 % 265,778 14.9504 % 149,504 100.001*% $1,000,001 error 7-16 Accounting for ByProduct Costs One possibility is to show net By-product revenue also sales of by-products in the “Other can be treated as a Income” section of the income deduction from the cost statement. of the main product. 7-17 Effect of Joint Product Costs on Cost Control and Decision Making It is important to understand when the use of allocated joint product costs may be misleading. In making decisions relative to jointly produced articles, it must be remembered that the products are necessarily produced jointly. Some areas that can be affected by joint cost allocations are: Output decisions Further processing of joint products Pricing jointly produced products 7-18 End of Chapter 7-19 7-20