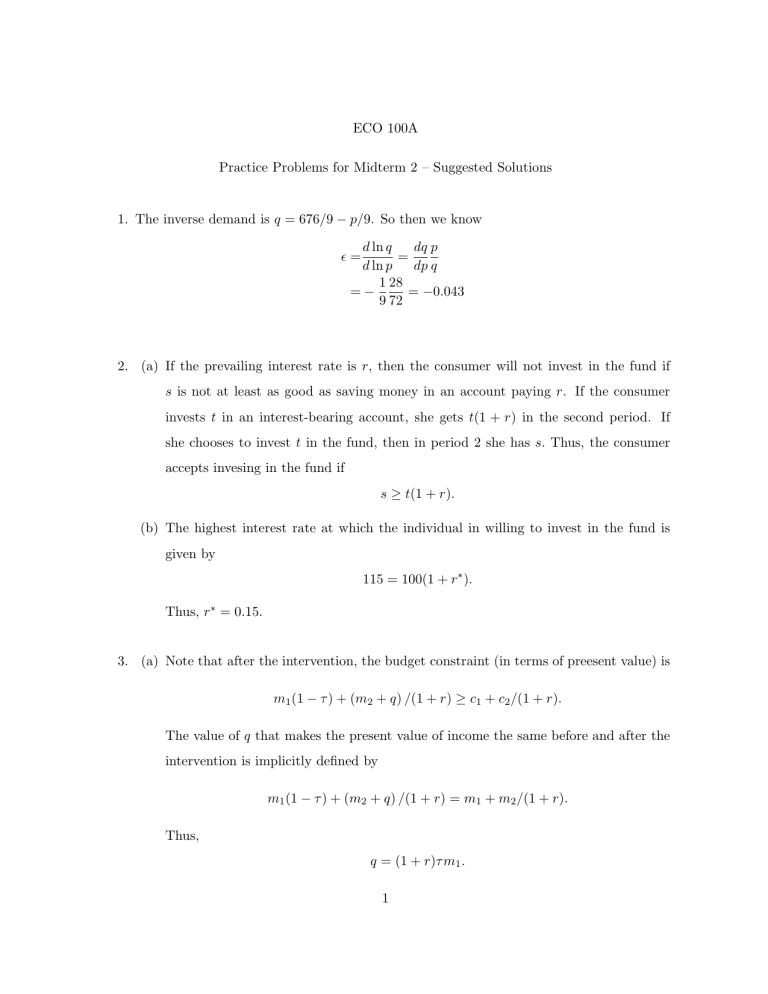

ECO 100A Practice Problems for Midterm 2 – Suggested Solutions 1. The inverse demand is q = 676/9 − p/9. So then we know d ln q dq p = d ln p dp q 1 28 =− = −0.043 9 72 ϵ= 2. (a) If the prevailing interest rate is r, then the consumer will not invest in the fund if s is not at least as good as saving money in an account paying r. If the consumer invests t in an interest-bearing account, she gets t(1 + r) in the second period. If she chooses to invest t in the fund, then in period 2 she has s. Thus, the consumer accepts invesing in the fund if s ≥ t(1 + r). (b) The highest interest rate at which the individual in willing to invest in the fund is given by 115 = 100(1 + r∗ ). Thus, r∗ = 0.15. 3. (a) Note that after the intervention, the budget constraint (in terms of preesent value) is m1 (1 − τ ) + (m2 + q) /(1 + r) ≥ c1 + c2 /(1 + r). The value of q that makes the present value of income the same before and after the intervention is implicitly defined by m1 (1 − τ ) + (m2 + q) /(1 + r) = m1 + m2 /(1 + r). Thus, q = (1 + r)τ m1 . 1 (b) Note that the intervention change neither the present value of income nor the relative prices of present and future consumption. Thus, the consumer will select the same consumption levels before and after the intervention. Nevertheless, while the present value is the same, the policy shifts more income into period 2 at the expense of period 1. To arrive at the same (c1 , c2 ), a consumer who borrowed without the taxand-transfer policy will have to borrow more. In addition, a consumer who saved without the tax-and-transfer policy will save less after the intervention, and possibly become a borrower. 2