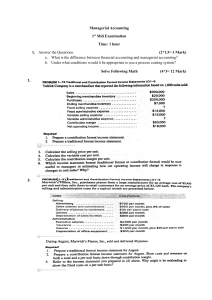

Quick Guide Chapter 1 Chapter highlights: This chapter provides an understanding of what is meant by managerial accounting; who uses managerial accounting information; the difference between financial and managerial accounting; key players in company’s organization structure; and the role of management accountants. These learning objectives are summarized below: 1) What is ‘managerial accounting’? Managerial accounting is the process of providing accounting information to help managers make decisions. 2) The difference between financial and managerial information. The following table summarizes the important differences between financial and managerial accounting Users Primary accounting product Purpose Content and presentation Underlying basis of information Type of information Frequency of reports Verification Financial Accounting External users: creditors, investors, tax authorities Financial statements Help make investment/lending decisions. Follows GAAP Retrospective: report on past performance. Financial Quarterly / annually External auditor Managerial Accounting Internal users such as managers Internal accounting reports (e.g. cost reports). Help plan, direct, and control operations and make decisions. No prescribed rules Primarily prospective: forward looking. Financial/non-financial As needed Not externally audited 3) Describe a company’s typical organizational structure and identify main players in a corporation. A public corporation is owned by shareholders who elect a board of directors to manage the company on their behalf. The board hires the CEO who manages the company on a daily basis and sets company’s strategic objectives. The CEO hires the COO who is responsible for all company’s operations and the CFO for all financial matters. The controller prepares managerial and financial accounting reports. The treasurer is responsible for investing and raising funds. The internal auditor reviews company’s risk management and internal controls processes and reports to the audit committee which provides oversight of the financial reporting process including reviewing the work of the external auditor. 4) Distinguish between traditional and contemporary roles of managerial accountants. Traditionally, managerial accountants’ role was confined to providing information to departmental managers to make decisions. They were physically separated as their role was limited to scorekeeping or number-crunching. Contemporarily, they serve on cross-functional teams with other members of the value chain to tackle a decision problem collectively so they’re taking an active role in the decision making process.