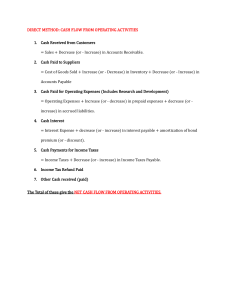

expenses account DEFINITION Accrual : income or expenses that have occurred during the period but are unpaid at the year end Prepayments : income or expenses that are paid for in advance of the period they relate to PROFORMA income account ACCRUALS Prepaid expenses are not included in expenses in the period they are paid and are asset at the year end dr income (SOPL) cr deffered income (SOFP) deffered (prepaid) income is not included as income in the period money is received and is a liability at the year end dr. expenses (SOPL) cr. accrued expenses (SOFP) Accrued income is included in income for the period and is an asset at the year end dr Accrued income (SOFP) cr income (SOPL) Although paid ACCRUALS AND PREPAYMENTS dr prepaid expenses (SOFP) cr expenses (SOPL) Accrued expenses are include in expenses for the period and are a liability at the year end under the accrual basis, revenue and costs are both: Although paid in advance accrued (recognised as earned or incurred) recorded in the financial statements of the period they relate PREPAYMENTS ACCRUAL CONCEPT matching concept : expenses incurred in generating revenue to be matched against in the revenue in determining profit or loss for the period receivables and payables accrual concept is applied to : business expenses and income