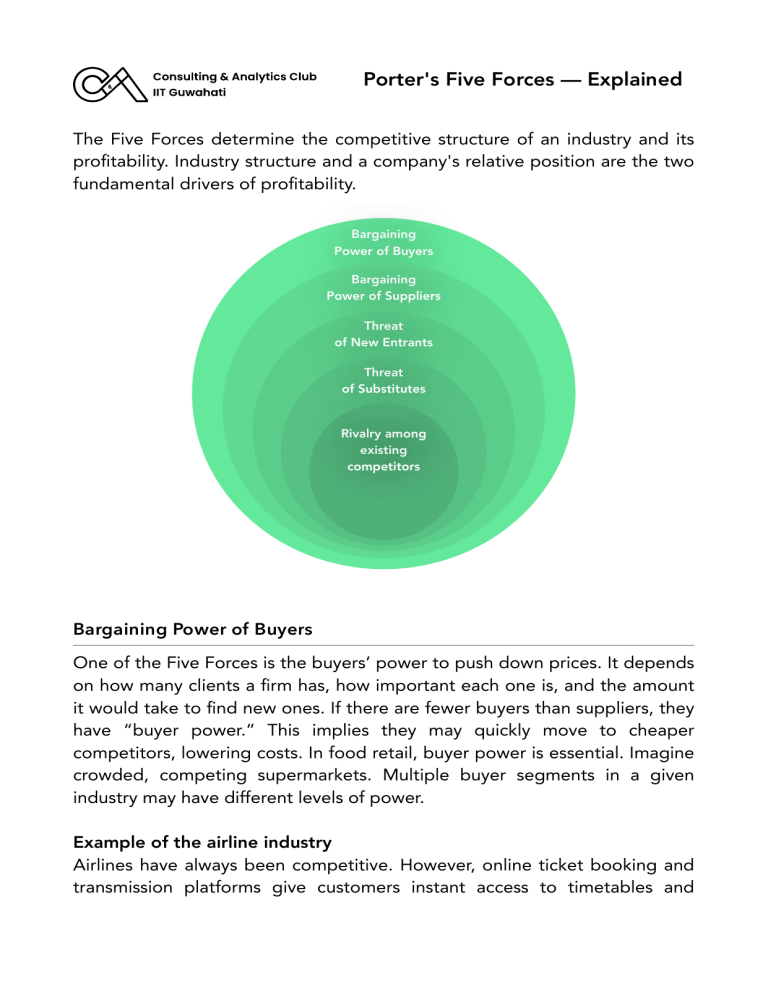

Porter's Five Forces — Explained The Five Forces determine the competitive structure of an industry and its pro tability. Industry structure and a company's relative position are the two fundamental drivers of pro tability. Bargaining Power of Buyers Bargaining Power of Suppliers Threat of New Entrants Threat of Substitutes Rivalry among existing competitors Bargaining Power of Buyers One of the Five Forces is the buyers’ power to push down prices. It depends on how many clients a rm has, how important each one is, and the amount it would take to nd new ones. If there are fewer buyers than suppliers, they have “buyer power.” This implies they may quickly move to cheaper competitors, lowering costs. In food retail, buyer power is essential. Imagine crowded, competing supermarkets. Multiple buyer segments in a given industry may have different levels of power. fi fi fi fi Example of the airline industry Airlines have always been competitive. However, online ticket booking and transmission platforms give customers instant access to timetables and fares, empowering them to make budget selections. As a result, customers have more negotiation power. Buyers have less energy when: - Suppliers have more potential buyers - Products are differentiated - High switching cost (i.e., more from one product to the other, like moving from Windows to macOS) - Price discrimination is possible (like price differences in cold drinks available in ordinary shops and outlets such as Domino’s) Buyers Many Few Monopoly for suppliers Competitive Mutual Dependence Monopsony (more bargaining power for buyers) Few Many Suppliers Bargaining Power of Suppliers fi We wish for the bargaining power of suppliers to be low. Some indicators that can indicate a low bargaining power from the suppliers: - The suppliers do not have a monopoly: If there are multiple suppliers without a monopoly, then a supplier cannot x prices of the goods/ services – another supplier pricing it lesser can always be found since nobody has complete dominance over the industry! - Existence of substitutes: If whatever the supplier sells has alternatives/ substitutes, then the supplier's bargaining power reduces- there is always an alternative to turn to in case the supplier's pricing isn't acceptable. - Pricing information is widely available: The availability of pricing information ensures that the suppliers don't start price segmentation, thereby reducing the bargaining power of suppliers. - Low switching cost: There are sometimes contracts or legal agreements between suppliers and the rm. Switching to a different supplier may be tedious and costly in such cases. If switching costs are low, switching becomes easier, reducing suppliers' bargaining power. Threat of New Entrants fi fi fi fi fi fi fi fi fi fi fi fi fi fi fi We want the threat of entrants to be low in the industry. The industry is characterised by a low threat of entrants if: - Entrants have high sunk costs: Sunk costs are investments that are asset speci c and generally cannot be recovered if the rm fails (liquidating these assets is very dif cult). A rm can gather enough capital to enter a market, but considering the high sunk costs, it may avoid doing so. - Established Brands/Already present rms have a substantial competitive advantage: What do you do if you want to look up something real quick? You google it. As a brand, Google has become synonymous with searching for something on the internet. This tells us how established a brand is. Similarly, if the industry under consideration already has rms with a substantial competitive advantage or are the face of the industry, it would be dif cult for someone to enter the market and establish their own identity. - Intellectual Property/Contracts: Having your technology/methods patented or copyrighted is always advantageous. Similarly, contracts regarding logistics can place a company in a much better place. If, as an industry, the manufacturing/production techniques are already patented, then without suf cient R&D, entering the industry can be dif cult. Similarly, if securing a good channel for logistics is challenging in an industry, the entrants are bound to face some problems. - Experience in the industry is needed: There are some industries where delivering a product/service is not just about technology! It takes years of experience in that industry for a company to deliver ef ciently. For such enterprises, if entrants are not willing to wait for some years, it may be challenging to enter and compete with the pre-existing rms! - Economies of Scale: Every rm in an industry tries to operate at a maximum cost-effective point. If reaching this point is dif cult for rms in the industry regarding the inputs and technology required, it may discourage the new entrants from becoming a part of the market. Threat of Substitutes Substitutes are products similar to our products or services but not the same. However, under speci c circumstances, they might be substituted for one another in the view of some consumers or buyers. Consider smartphones — they fall short of what a laptop can achieve in terms of functionality. However, they can often replace laptops because they have a lot of similar capabilities. The possibility of those substitutes stealing our customers becomes one of our concerns. An industry with little threat of substitution implies that the pro tability potential is higher in that industry. Some factors that characterise low threat of substitution: a. The cross-price elasticity of demand: Price sensitivity and the demand sensitivity between these two products that are substitutes for one another. Take the example of laptops. We want to determine if the price for laptops goes up, does the demand for tablets go up because everyone switches to a tablet? For instance, we could think about the case of a sort of perfectly or in nitely elastic demand. Take the case of butter and margarine. And it might help if you think about that as having just a tiny bit of slope and not being perfectly at. And the point here is that if butter prices rise, the quantity of margarine demanded will go way up. The reason is that consumers are highly price-sensitive to butter and margarine and do not mind using the latter instead of the former. fi fi fl fi This suggests that the threat of substitution of one for the other is high again because this cross-price elasticity of demand is high. On the other hand, consider the inelasticity of demand. The third graph is an example of perfectly inelastic demand. It depicts that if a rm raises the price of a product or service in a particular product class, the quantity demand for this potentially substitutable product does not go up. It suggests that it is not a substitute at all. The threat of substitutes becomes lower in this case. Most real-life cases have graphs like the one in the middle, with the slope of that graph determining the extent of elasticity. A rm must consider pricing its product accordingly, given the potential sales leakage to an alternative. b. Switching costs: These are one-time costs that are incurred to switch to the substitute product or service. If switching costs are high, the threat of buyers leaving you to go to the substitute product or service will be lower because they will be unwilling to pay a higher amount for switching costs. Rivalry among Existing Competitors fi fi fi fi fi fi Often our intuition about the intensity of rivalry is wrong. We think that if fewer competitors are rivals, the intensity of that rivalry might be more signi cant, which is not true. But this intuition is not what the intensity of rivalry from a competitive standpoint is talking about. Remember, all ve forces are trying to tell us the prospects for future pro tability in this industry. Rivalry is less intense when: 1. The number of competitors is small, and 2. Incentives to ght hard are low: - Substantial market growth potential: If an industry is growing rapidly, everyone has growth opportunities and room for everybody. So if the market growth trends in the industry are pretty positive and the trajectory looks good, that might be an indication that the intensity of the rivalry is a little bit lower. - Opportunities to differentiate: If the products or services are quite different from each other, that might lower the need to engage in direct price competition with one another. So opportunities to - differentiate within a market segment might also drive down the incentives. Low exit costs: If exit costs are high, that will be an incentive to ght each other to stay in this industry. But if the exit costs are low, that will dampen the need to compete ercely with the others in the sector. Little excess capacity: If the demand in an industry is cyclical and it comes and goes, in the offseasons, rms go head to head on pricing wars, whereas if demand is not cyclical, rivalry won't be as intense. Coordination is feasible: If there's an opportunity for rms in an industry or a market segment to even tacitly or implicitly play nice with each other a little bit and coordinate, that will also drive the rivalry down, but rms must be careful here because the explicit price and market xing are illegal and it's an antitrust violation. ____________________________________________________________________ All information in this guide is accurate and complete to the best of our knowledge. Any data, definitions or inspirations have been acknowledged wherever possible. Any redistribution or reproduction of the contents is prohibited without prior written permission from Consulting & Analytics Club, IIT Guwahati. fi fi fi fi fi fi Edited by the following members of the Undergraduate Consulting Team at IIT Guwahati: Bhadra Tendulkar, Aman Kumar, Abhishek Singh, and Aniba Agrawal