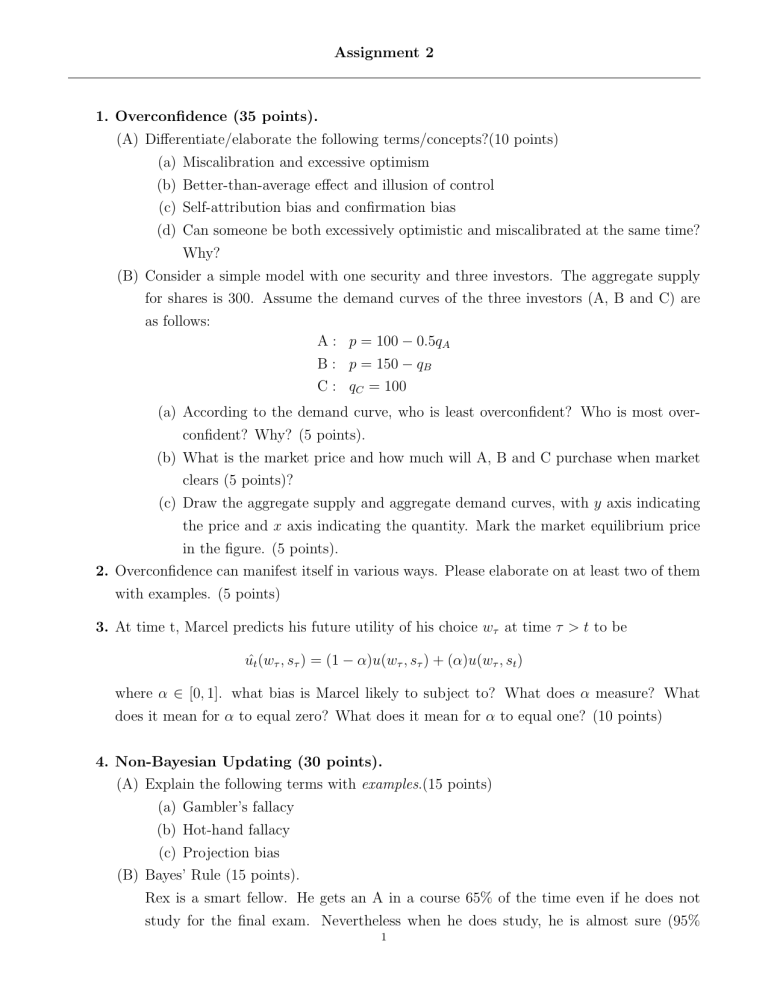

Assignment 2 1. Overconfidence (35 points). (A) Differentiate/elaborate the following terms/concepts?(10 points) (a) Miscalibration and excessive optimism (b) Better-than-average effect and illusion of control (c) Self-attribution bias and confirmation bias (d) Can someone be both excessively optimistic and miscalibrated at the same time? Why? (B) Consider a simple model with one security and three investors. The aggregate supply for shares is 300. Assume the demand curves of the three investors (A, B and C) are as follows: A : p = 100 − 0.5qA B : p = 150 − qB C : qC = 100 (a) According to the demand curve, who is least overconfident? Who is most overconfident? Why? (5 points). (b) What is the market price and how much will A, B and C purchase when market clears (5 points)? (c) Draw the aggregate supply and aggregate demand curves, with y axis indicating the price and x axis indicating the quantity. Mark the market equilibrium price in the figure. (5 points). 2. Overconfidence can manifest itself in various ways. Please elaborate on at least two of them with examples. (5 points) 3. At time t, Marcel predicts his future utility of his choice wτ at time τ > t to be ût (wτ , sτ ) = (1 − α)u(wτ , sτ ) + (α)u(wτ , st ) where α ∈ [0, 1]. what bias is Marcel likely to subject to? What does α measure? What does it mean for α to equal zero? What does it mean for α to equal one? (10 points) 4. Non-Bayesian Updating (30 points). (A) Explain the following terms with examples.(15 points) (a) Gambler’s fallacy (b) Hot-hand fallacy (c) Projection bias (B) Bayes’ Rule (15 points). Rex is a smart fellow. He gets an A in a course 65% of the time even if he does not study for the final exam. Nevertheless when he does study, he is almost sure (95% 1 likely) to get an A. Still he likes his leisure, only studying for the final exam in half of the courses he takes. (a) What is the probability that he gets an A? (5 points) (b) Assuming he got an A, how likely is it he studied? (5 points) (c) If someone estimates the above to be 75%, what error are they committing? Explain. (5 points). 5. Behavioral Corporate Finance (20 points). (a) Provide one example to show rational managers cater to investor’s non-standard preference in making corporate policies. (4 points) (b) What is the implication for corporate dividend policy if investors exhibit referencedependent preference? (4 points) (c) True or False: Shleifer and Vishny’s model can explain a good number of stylized facts about mergers and acquisitions, such as that glamour acquirers are more likely to pay with stock than with cash?(4 points) (d) Which of the following is most incorrect about dividend patterns?(4 points) (A) Modigliani and Miller suggest that in a world of perfect markets, dividend policy is irrelevant to firm value. (B) In a world of perfect market, shareholders can generate “home-made dividends” in case their firms omit dividend payment. (C) Managers often cut dividend in response to capital needs. (D) In the real world, managers carefully design dividend policies. (e) One of John Lintner’s conclusions in his classic study of dividend policy is that managers do not seem to change dividend payment in response to capital requirements for new investment (Lintner, J., 1956, ”Distributions of incomes of corporations among dividends, retained earnings and taxes,” American Economic Review 46, 97-113). Consider this finding in light of the chapter discussion.(4 points) 2