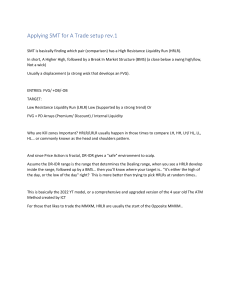

2022 ICT Mentorship Episode 2: Elements to a trade setup actors that will impact theweeklycandle: F -seasonal tendencies -interest rates -earnings seasons and the release of quarterly ER -Price action on a weekly and daily chart hen it comes to PA on the weekly chart ask yourself: W What is market most likely to draw towards? This sets initial bias for week ajority of analysis should be linked to the daily chart. Figure out where you are in the grand M scheme of things on that weekly range expanding higher or lower hen it comes to PA of the Daily chart ask yourself: W Where are the liquidity pools price can seek? (following assumption of the weekly chart) ● The Draw on Liquidity for the most part is found on the Daily Chart. ● The Daily Chart should have the majority of your time and analysis. ● The Daily Chart will give you feedback every 24 HOURS on that Weekly Candle. WE USE THAT FEEDBACK TO SUPPORT OUR ASSUMPTIONS OF THE WEEKLY CANDLE EXPANDING HIGHER OR LOWER bove old highs: Buy stops A Below old lows: Sell stops Where there are two fair value gaps he’ll let it tradedown to that lower one If you are bearish you are looking for buy stops to be ran, then a break in market structure lower. A short term low being broken. Then it needs to have a fair value gap. Imbalance: A candle thats only going higher/ and nothing else is there to offset the efficiency of price deliver on the opposite end ● One single candle passing up, and the previous candle high and the next candles low. That area is an imbalance. ny time a significant price move lower is expected always anticipate some measure of a A stophunt on buy stops or short term high being taken out. Reverse is also true: When looking for higher prices generally you will see a short term low taken out and sell stops taken before you see a very pronounced rally higher. Here is the 15 min ere is the 2 min. After the break out, let it establish a short term low. Once its broken, look for H the imbalance and once the market comes back up to it you short. 1,2,3 min timeframes work best with finding imbalances. The Fair Value Gap is the highlighted area. You mark the 1st candles lows and the 3rd candles high Use fib to find the 50% level. Anything above the 50% level is referred from an algorithmic stance s a premium market (means that its expensive). Anything in the lower 50% is a discount. If BEARISH: a after you get your entry in the FVG, you should be thinking "We are in a premium, so algos want to go to a discount. You can have all the buyers in the world come in, but if the algo is in a sell program and its going lower it does not matter. Those buyers who come in with a huge influx of buyers get crushed and squeezed. ook for run on liquidity (Buy stops or sell stops) L If bearish you're looking for buy stops to be ran, then a break in market structure lower. A short term low being broken. Then look for FVG. ook for breaks in market structure after a pool of liquidity (buy or sell stops), that have been L taken in an opposing direction of your weekly expected range. In other words are you expecting higher or lower prices on weekly range? If you are looking for lower prices your focus is on a runup of an old high. Once that forms then you are looking for a break in market structure on a lower timeframe. Once that occurs and you get an imbalance thats your trigger. Then split the range that was created and find where the 50% is. If short, find an old low or imbalance to aim for as your target. Try to get the closest target. Dont get fancy and go for the low hanging fruit. Episode 3: Internal Range Liquidity and Market Structure Shifts arket structure break means more in context versus an intraday shift in market structure, M intraday shift means that there's likely a downside or upside draw intraday by saying the term shift. In the below example: the buyside/sellside liquidity is where there will be a likelihood of a market structure shift. hen the high is taken out on that candle, its significant ONLY if the rundown has traded into W sell stops. Below and old low of some kind. It could be a double bottom, single low, or just be trading under some retail idea that is viewed as support. Reverse is true for buy side liquidity. hen that run above relatively equal highs happens, you are anticipating a market structure W shift, NOT FORCING IT OR GET AHEAD OF IT! arket dives into liquidity. At this point you may or may not know whether its a buy. YOU DONT M NEED TO. You anticipate a shift in market structure.You see that shift on the candle where the light bulb is. Thats when you are thinking “I now have a condition in the market place where I might see a opportunity intraday”.Candle does NOTneed to close over short term high. Once that candle closes, monitor the second candle and see if it creates a fair value gap. Entry is on the next candle that dips into the gap. Price then gravitates towards previous buy stops. Use those as targets. eres the 1min. When price trades back into here (highlighted zone) this is what actually H occurs: High frequency algos are hammering, just throwing orders in. That IS NOT causing the market to go higher. Its just volume thats coming in. The algos that deliver/offer price in the marketplace, thats whats beginning to spool and go higher. Regardless of where you wanna trade at, your limit orders, they may not get filled. When u buy with a market order there will be slippage. When price starts to rally, all it is is a default to the algo constantly offering price at a higher price ee those two candles there in the highlighted zone. That is one consecutive order S block.Extend it out in time. Its a good bearish order block because it has that gap and it has taken liquidity. Order Block: Change in the state of delivery. In this example the change in the state of delivery is now offering sellside, which means it will match up sell stops and keep going below old lows into an imbalance until we get down to a discount. henever there are 2 fair value gaps like this, the idea is to let it trade down to the lower one W and sacrifice the better entry. If it trades back to the second green box enter in there and expect that the lower one wont be re traded to xample of annotated chart: E In the open space write how long did it take from the market structure shift occurring to the fair value gap being filled. Also how long did it take from entry to target. Also how much drawdown did you take. Episode 5: Intraday Order Flow and Understanding The Daily Range ont trade from 12pm-1pm D Prior to 8:30 am, on the 15 min chart look for the most significant/obvious swing high/swing low hen drop down into the first lower timeframe for entry, which is the 5min chart. Watch for the 3 T little indians pattern as price approaches the swing high. It doesn't have to see that 3rd high takeout the old high. Liquidity is already being built in here because buy stops keep getting hit. On the other hand if we don't see the higher highs forming and price is steady rising up, we can anticipate the high to be taken out. isplacement: Think of an elephant falling into achildren's pool. There will be a HUGE splash. D In the above chart its obvious here the displacement here is. You want to look for a big obvious/meaty candle like that. Not lethargic/slow ones. One that displacement occurs look for the FVG. fter 1:30pm, mark the first swing low and swing high of any importance. Algos turn on at that A time. Look for a swing high/low and look for a stop hunt. Same thing you do in the morning! hen the swing low gets violated (look at pointer), that stop hunt is all thats necessary that will W start a buy program. Buy program: Algos go into the process of spooling which means it just keeps offering higher prices. VOLUME DOES NOT MATTER. THIS IS BEING MANIPULATED. So now you can get your long entries and then hold for the close. uy the sell stops that are resting below the sell side liquidity level and expect the swing high to B be taken out (referring to the pre lunch range) You then have consolidation through lunch. After 1:30 wait for the swing low to be violated then rally. What if you don't get a swing low that trades below it? ● Look for a move higher thats sudden (DISPLACEMENT HIGHER). Then look for a FVG. If it trades back down to the FVG then trade it Q! Example of the 1:30pm swing low being sweeped. Notice on the left there is a FVG where N the swing low was sweeped. ere is the 1min. Below that level there is sell stops and I have the belief that we go higher H today. I wanna be buying those stops! All the sudden, you get a aggressive drop down. Its gonna feel like the floor dropped out. ook for the REAL moves in the morning and the REAL moves in the afternoon. If you get one L in the morning dont trade the afternoon. Go to demo and practice there. Episode 6: Market Efficiency Paradigm and Institutional Order Flow mart money looks at liquidity S They are asking what is the underlying narrative in the market place right now? ● Bullish or bearish? ● Is the days daily range gonna go higher and how? Is it likely go lower beginning of the day first to sucker traders into going short and run out sell stops? (to acquire long positions at and then rally going into the close or afternoon) mart money asks how they can utilize that speculative uninformed money and its liquidity that S it provides. he easiest entry would be trading just above candle #3 high. Thats where you put your limit T order. Place stop right above candle 1 or 2. You want a big beefy bearish candle that closes low beneath that displacement low^ t 8:30am mark that lvl with a vertical line. Look left and mark the first swing high you see. Its A that simple. That is your buyside liquidity nce you have that lvl you drop down to ur 5. When it starts to trade lower in that area you go O into the lower timeframes. You then look for your FVG on the 1,2,3 min If in 2 cons, sell one at 50% level and the other at sellside liquidity. Partials at Internal range liquidity. Close trade at external range liquidity Episode 7: Daily Bias and Consolidation Hurdles fter the DAILY gets filled on the FVG, until we get to that sellside liquidity, we are anticipating A lower prices. BIAS THEREFORE BEARISH. Not every day will be a down close candle but we are going to hunt intraday PA with that in mind. If going long, which is counter trend, leverage is going to be dialed back nce price breaks the sellside liquidity and begins to hang around equilibrium, it becomes very O difficult to have a bias. This means you have to rely on the smaller time frame intraday charts and simply look for liquidity pools. rade the intraday volatility. Running old highs and running old lows. Be much more nimble and T take ur exits at precise spots. Don't overstay ur welcome NQ 15min eres the 2min. Notice how there is no FVG. ICT still went long here because he was using the H S&P as his indicator. These markets move in tandem ES 2min Q did not show the bullish market shift that ES showed. Just like this example we can also use N the DOW as an indicator ICT is looking at a period of time where, and an area in price action that maybe is going under accumulation for long positions. Look for the little fingerprint in the algorithm. What this indicates is that the DOW is unwilling to go lower that that low that tips off individuals that are looking for cracks in correlation. That correlation cracks where NQ and ES went to make new lows, the DOW didn't. ow do you know its gonna be a fake break below an old low and go higher? H How do you know its gonna be a fake break above an old high and go lower? ook for runs above old highs to set up a short position if I have the opposite of this condition L here: Where maybe the DOW didn't make a higher high whereas the S&P and nasdaq did make a higher high. By itself it doesn't mean anything. This pattern confirms the accumulation of long positions. Macro: Something inside of an algorithm that prevents or enables delivery of price. Episode 8: Applying institutional order flow to forex markets ow far will this trade too? Were not looking left at that swing high like its a middle of the range H idea. For expansion type moves (if we dont have a range to trade inside of) how can we know how far it will trade up or down? Take a fib and anchor it to a previous swing. From that low to that high after we leave this consolidation to start the trend higher. Target is standard deviation -1. Episode 9: Power of 3 and New York PM session opportunities arket traded back into a discount but did not take the recent swing low. Price formed a FVG on M the daily. Notice the indecisive candle close. If we have that and the market is trading back into a discount even though we might have a low down here that we are targeting, this may require a retracement. Power of 3: accumulation, distribution, and manipulation If bullish, expect the opening price to open near the low of the day/session. Then it trades lower making some important low and then rallies. Creates a high and then closes near high of day. Typically in London and New York session there are fake runs that start off a move. If bullish,it opens, where you think its gonna trade higher its most likely gonna be a small little move lower. Thats the move you wanna go in and hunt along. If you miss it, you wanna try and et long real close to where opening price is. You can use 8:30 am as opening price and mark g that level horizontally HOW TO FIND ORDER BLOCK: Consecutive down closed candles right before a price surge that has an imbalance igh probability order block: Your narrative whereyour bias is bullish. You are looking for H displacement and the down close candles (prior) you wanna mark that out and anticipate a return to that. eres the 1min. This sets the stage up of a market run into a higher retracement. We dont know H yet if that high is going to be the closing perimeter for a daily FVG. We dont need to know that yet but its a likely scenario to go long. If there is a lot of range movement overnight (2am-5am), when we open at 8:30 we must wait for the consolidation and be patient. We wanna see a low form with a turn away from it. When that low starts to go higher, anyone who longed overnight is gonna jam there stop loss right underneath that low. This is the scenario we look for. If there is a big run overnight, avoid the NY session! Wait until the other side of lunch. Anticipate the NY lunch lows being taken out or NY morning session lows (which is the example below) e now know the level near 14620 is the high end of that FVG. We know that bc the 14th W stopped trading and it had that indecisive candle on the daily chart. Its likely we might trade up into that range high. Hes waiting for a sweep of the low near the FVG otice how we don't have a FVG down there, but it gives us the basis for expecting the price to N start to rally into the afternoon. So what are we looking at? -we see a price run that we don't think needs to come back down here bc the logic is that overnight stops have been ran out. Theres no reason for the market to come back down there. -We have 2 lows post NY lunch (12-1pm). The likelihood of price coming all the way through the imbalance and going after the first low is not likely. Not after that run up. They dont wanna give those traders another chance to get back in. They got stopped out. Its gonna be a little more sneakier when they make these setups that continue onto a higher run. verall this is a nice little setup on the afternoon. Even though we didnt get a FVG on the O sellside sweep, it established our bullish bias. he FVG is even better when you have the sellside liquidity resting below short term low (green T price box) Episode 10: Implementing Economic Calendar Events With The Open+P3 he market has been going lower. We take out some sell stops below that sellside liquidity. We T then get a natural retracement thats reasonable. Then we start to decline, come back up one more time and fail to go above the recent swing high. Then breaks down and creates an imbalance. Then it takes down that short term low. So we rallied, took out short term low with the model suggesting the lowest lows on this chart to be taken out. Therefore any rally or upclose candle should be viewed as a potential shorting candidate. Power of 3 refers to the daily chart: ● If bearish, we will anticipate that the daily range opens, rallies, goes down and closes near its low ● If bullish, we will anticipate that the daily range opens, rallies down, then goes up and closes near it high. ower of 3 refers to Accumulation, manipulation, and distribution. P The open on a day that is bearish, the open and anything above it is accumulation of shorts. Its not limited to just open and above. It can be whatever the range is. The open to the high, whatever that range is you take that range and you subtract it from the opening price. That is your opening range. Thats where your FVG happen. Thats where your stop raids gonna happen. Thats where optimal trade entry is going to happen. Every potential shorting candidate/ every premium array, will reside in form in the range between the open and its high. very short will reside between the open and it high E The range from the opening price to that high, is what you project below the opening price. Thats your opening range. This gives you an area you can bracket out how much leeway I can give the market when it starts to go below the opening price and still take a favorable entry. here is a lot of opportunities coming in just below the opening price. This is called close T proximity entries. hen bearish: W Accumulation of shorts: Whatever the high is fromthe opening, project that down. Your sell setups will form in that.. Manipulation:is the initial rally up. Thats the suckerplay. Goes up just to go down hard Distribution:Between where the LOD is and where itcloses. Smart money's short positions are what is being distributed. They are selling at the open and above or just below it, and riding out the daily range. When it creates the LOD how do you know when the LOD is formed? Time references:If price has been really taking abeating going lower and your getting near EOD (like 3:30pm),, its probably really close to the low. Not all the time though, sometimes it creates a real fast sudden continuation and if you're not expecting it, it can be bad. Generally its the last portion of the trading day. It will create some type of a low. Wherever it closes, between that low and where it closes thats where the distribution cycle is occurring. ll I need to know is: A -Is this daily range more likely to expand higher or lower than the opening price? THIS IS THE KEY TO BIAS In the circle, we are seeing the market retrace back down into its previous run. How far can it go down? Look at your high down to your low. Its probably going to go below equilibrium to offer the market a discount. One it gets there, we are thinking its going to be the open near the low, and expand higher. Its going to be accumulation of longs at the low and then rally higher. he whole move up we are looking for longs. We may get stopped out but we are not T abandoning the bullish bias until we get above the highs highlighted in the circle. Price is drawing to it. Once it clears those highs we have to read it. Does it wanna go higher? It indeed does so you keep expecting the open, rally down, then expansion. Now looking more on the right, when price fills that FVG we now have a bearish bias until it moves back down to that sellside liquidity. ubmit to the daily range and learn how to hold to the close. Why sit out on all that range when S you should have come into the day expecting this? n efficient market will see the market go back up and repric that. It goes right back up like paint A being applied to a roller on a wall. You want to make sure you go back and forth to deposit the paint evenly so theres an even distribution. On those long drawn out candles there is a strong tendency for the price to go right back up and overlap over that entire range. hy do we have a bearish power of 3 bias on this day? W We worked the upper end of that FVG on the daily, then we had multiple shifts in market structure bearishly. We had a bearish bias on the daily chart anyway. So it gives you a high probability that this day is going to be a down close day. here will setups form? W First setup will happen above Open price Second will happen at/near the opening price 3rd inside of the range from the high to the opening projected down. Its in that vicinity there oing back to that Daily chart, we are anticipating the opening and rallying up into maybe the G high end of that FVG or something forming at the news release at 8:30. If we look at price it was starting to pump up higher ahead of the release. This is telling us they are pricing in a premium market ahead of the news. So they are going to use the news to sink it lower. Because the bearish bias is going to come into fruition. They are going to expand price lower and they already established their shorts because they accumulated above the opening price. The first FVG you encounter from the top down approach from the 5min is the one you use. reaker pattern: A high, a low, and a higher high B If we see breaker like this, think the market could potentially trade up into here. Im gonna use the breakers candle and just above that for my stop. If margins are raised, thats the exchange tipping their hand to you that huge moves are coming. BIG MONSTROUS MOVES ARE COMING aily Bias: D What swing highs and swing lows can be taken out? Look for FVG Look for where price is relative to equilibrium (premium/discount) Look for a Judas Swing 3 in bullish scenario: P Green box: Accumulation Red box: Manipulation Blue box:Distribution P3 in bearish scenario: Episode 11 wing high- simply anything that has a lower highcandle to the left of it and a lower high S candle to the right of it. The one in the middle is your SWING HIGH hat retracement back into the FVG can lull traders into thinking price is going to likely go T higher. But we are thinking we go down to that daily level. :30 opens and we get the judas swing. We are anticipating weakness and want to take a short 8 somewhere above that price. We are anticipating price to draw towards that daily level (green line). You get that imbalance there and a fvg entry and thats where you short. Episode 12: Market Structure for Precision Technicians (advanced price action theory) e are focusing on the PA in the FVG W The daily chart has the bulk of the volume thats coming into that marketplace. hen we look at price, we arent looking for just the simple HH and HL therefore its a bullish W uptrend. We are actually looking at ● Is it likely to go up for stops? Or go down for stops? ● Is it going to go higher to rebalance? Or lower to rebalance? ll minor lower time frame swings are going to be subordinate to the daily chart (the parent of A this 1hr price structure.) hould the LTH be broken to the upside, this means our daily analysis expecting that FVG to S hold price and to be a factor in the algorithm repricing and going lower at a later time, then we are wrong in our analysis. Long term highsare framed on higher timeframe resistancelevels. very single time price rebalances an old imbalance, that swing high or low should be E immediately labeled as aITH/ITL 1 hour: 15min: Break it down to a science. We don't do TA, we do technical science. ITH have two classifications: -ITH that has a lower STH to the left of it and lower STH to the right of it -Trades back up to an imbalance to rebalance If we have a break beneath an ITH/ITL, we have a significant break in market structure. If the ITH is not higher than two STH, that is telling you that the market is very weak and the algo is tipping its hand to those people who are looking at it like this. Theorder blockis one consecutive series of upclosecandles. he usefulness of that is if were bearish and it rebalances, the next STH should be lower than T that ITH. WE DO NOT EXPECT THE ITH TO BE TAKEN OUT.Therefore we are forecasting and anticipating a failed price swing in the order block.Everytime that green candle on the hourly is forming we are looking at that as a bearish order block. From the beginning of that candles low we should be looking in time on lower time frame charts(drop to the 15min). If it trades higher then that trade idea is prob flawed. Just wait for market structure to get back in sync with what ur expecting (something bearish). Inside that range in the order block, we should be hunting FVGs We dont need to see the market trade down below the last highest upclose candle. ractal: something that repeats on the smaller orhigher timeframe thats similar in its formation. F In this example its the imbalance candle in the order block ook at the underpinnings of the marketplace and examine what is it doing high to high and low L to low within a HTF premise. The premise was we go to the upper level of the daily FVG, rebalance and then eventually trade lower down below sell side liquidity. nce we establish the market structure on that hourly chart, we are not going down into lower O time frames below it and marking out all the swing highs and swing lows. We just need to know what to look for on the timeframe we're trading on. The logic is based on the daily chart going up to the imbalance to go lower. The hourly chart frames the trade. It gives us what we're looking for to start hunting entry techniques. The 15min timeframe will give you the actual get in and get out. We may not like the risk parameters on that timeframe though. So then we go into lower time frames. methods of getting Price targets: 2 -If we have a STL taken out and a ITL taken out or just an ITL taken out, then we can go back to the range of the LTH and LTL to start getting projections down. That will give you generic price targets. - If price breaks below the LTL, you can take your fib and anchor it to the highest high down to the lowest low (in this case its the ITH because this is where the swing begins on the decline) The projection is -1.5 standard deviation. That how much lower it may go under the sell side liquidity any ways to frame your trade, but you have to have something directly linked to the daily M chart. hen you see an imbalance get rebalanced, the high formed as it rebalances should not be W violated by price going higher than that if bearish Institutional order flow: When bearish, all of your upclose candles should keep price from going higher than them ook at the markets from a market structure perspective by breaking down the price swings and L labeling them. Specifically an imbalance thats rebalanced. That ITH or ITL should not be violated. Thats a key high or key low. That sets the stage for a market move that should unfold and deliver to a HTF objective (Weakness in Nasdaq to take out its daily low). hile the market is moving in your favor, youre going to continue to trust that move and hold on W to your trade bc if your bearish upclose candles should keep price below it/the. They are speed bumps. They may come back and touch them and act as a bearish order block. If bullish, down close candles should support price. If it trades back down to them its gonna act s a support structure for an order block. If it does go below it its only permissible if theres a a short term low in close proximity to it. Its then likely to go down and take out some sell stops if bullish then reaccumulate and go higher. very time the market rebalances, classify that as an ITH/ITL. Then watch how prices stay away E from violating it. Episode 13: Market Structure for Precision Technicians: he area in the circle, when that black candles trades down towards that gap, notice the draw T on liquidity above at the relative highs. We should be thinking the algorithm is not letting price go lower. So its going after everyone thats been profitable going short. So the market starts to rally and leaves that down close candle. We're gonna watch and see if that candles can trade back down into that because if it does we're going to treat it as a bullish order block. The area in the highlighted circle is the ITL hen your looking for a price move thats going to be a long term price swing. Dont be scared W by the upclose or down close candles against your trend. Trust in price not to breach them elow is the 15min chart. There's that hourly down closed candle (in the blue circle) which is a B bullish order block. Price goes away from it and creates an imbalance. That is how you determine your high probability bullish order block. It must have the imbalance coupled with the down close candle and the underlying narrative that its likely to reach higher for buyside liquidity. All it is: ● The FVG ● The down closed candle ● The idea that its likely to go higher for buy side liquidity o were trading down into that imbalance there. But now were doing it at the time of day after S the equities open at 9:30am. This means volatility, the initial move is technically the incorrect move going into the opening (JUDAS SWING). ake a step back and figure out what it is im looking for: T -Looking for a discount market ( below 50% of swing high to swing low -Inside the order block -Equities opening has happened. Were bullish and its traded lower. Public is thinking that buy side level is resistance after rejecting hard. DON'T CHASE GOING HIGHER RIGHT BEFORE EQUITIES OPEN AT 9:30 eres the 5min breakdown: H -Price hits the 1hr and 5min order block (GET LONGWHEN IT HITS IT)and then rallies -Ideal exit would be the buy side liquidity, where there is WILLING BUYERS, with buy stops to protect their short positions. When the market trades above that level the buy stops become market orders to buy the market which floods the market with liquidity for those that bought down where we did. We can sell to those willing buyers at a higher price. ntry thesis: E -Price fills in the FVG and there's an order block on the 5min (thats our entry) -It is also in line with a higher timeframe order block. -There is a hierarchy: Higher time frame to a lower time frame with the idea framed on its going higher for buy side. - We have an ITL forming at the order block. -Now when price fills the FVG, IT BECOMES AN ITL.Once it starts rallying it should not come back down there. - Remember that if price is going higher, down closed candles should support price. In the picture below notice where the candle trades above the first down closed candle. A FVG is forming and you should expect that candle to hold as support.We should look at this move in the sense that its only going down to accumulate more long positions. WE BUY MORE HERE. - Price then rallies again above the new down closed candles. We are not worrying about the market as long as it doesn't take out the previous two down closed candles. In this case price never went thru the range of those two down closed candles.It just trades down into an imbalance SO SMART MONEY CAN BUY AGAIN, LIKE WE SHOULD! -Market rallies again and goes into buy side liquidity where we exit otice in the blue circle how price doesn't even come back down into the order block. It N generally does not like to go all the way back and rebalance when it's that close to the profit objective. The algorithm only has a small retracement inside the fvg. You would be a buyer just atthatcandles low(pointed at in pic below). railing Stop: T -Once price rallies over that first high (down closed candle in blue circle), YOUR STOP LOSS MUST REMAIN UNDERNEATH THE CANDLES LOW (candle with first blue arrow) - Market then rallies above and takes out those two down closed candles.Now the stop can be raised below the next down closed candle.The ideais these down closed candles are one order block that should not be violated if bullish. If it comes down and breaks the low of them you did the right thing by securing profits. Here's the 1min: yramiding: Building the biggest position initiallyand then everytime we buy in again we build it P with a smaller position than we had prior to the one being entered now. Ex: Buy 3 at first entry, then 2 at second, and 1 at third entry. on't become a monster that day trades every single day. Imagine playing a trade like the one D above. YOUR WHOLE WEEK WOULD BE DONE. These form every single week just be patient and wait for the perfect setup. Episode 15: Live example ince this is at open, be cautious because there is a lot of volatility and price can overshoot that S low and stop you out even though you are right. That's ok, if it goes back into the FVG we will still buy it. e are watching for if it wants to go below that short term low first to take out the sell side. It W doesn't negate the FVG because we are using narrative. Narrative is that we expect people to look at that low and say “okay its going to go up” and begin to buy here. There stops are at that swing low Above is where he took an entry - So now we watch price and want to see it expanding. -If trading the open stops can be taken really easily and then reverse. -Target is the FVG at the 860 level which is also above equilibrium (premium) - There's a small FVG in the last 3 candles up. It doesn't have to fill in or even revisit. If it were to, we would expect price to be supported by that. In other words, not going below the 630 level. t this point, we could put the stop loss on at entry, and if it takes us out then we would be A sidelined and wouldn't take any trades today because its FOMC.ON FOMC DAYS YOU CAN TRADE IN THE MORNING BUT YOU HAVE TO BE DONE EARLY MISSION SUCCESS Episode 16: Idea of multiple setups inside of the trading sessions rice breaks over buy side and forms a swing high. Once that down close candle above buyside P closes, we are looking to go short the next day. So we could anticipate the bearish power of 3. Which is a rally at open upside, then fade and close near low of day. We are in a premium market here. The idea of price retracing back to that bullish Order Block is favorable. e are looking for is: W -Power of 3 -Expansion move lower because of that Daily Bullish Order Block he idea of liquidity resting beneath those relative equal lows (bottom left) without the Order T block is likely. Its is FURTHER likely if we have a discount array, which is the bullish Order Block on the daily. We have multiple factors here for that general area being probed for the purpose sell stops being raided. If that swing high trades down to that swing low, and we break that low how far can we go down? Use fibs here are two opening prices: T Midnight 12am NY open 8:30am It doesn't matter which candle to use If bearish, ideally you want to see market trade above opening price. That is called manipulation (Judas Swing). Later in the day we expect it to go below sell side liquidity. If it accelerates below that it will most likely go below relative equal lows sell side (bottom left). Then below that we have the Bullish Order Block. Notice there a lot of things are coming together that draw on a great deal of probabilities. ow much lower below the daily order block level can we go? So once we get that displacement H candle on the 15min and break the short term low, we can enter in the FVG. If price breaks that key fulcrum point, we get the range from there to swing high and extend it down. ake fibs from the bodies of candles (lowest open/close to highest open/close) T Targets would be the -0.5 fib then -1 (which is just below that Daily bullish order bock) otice how accurate that -1 Fib level was. Price bounced off the level to the CENT! The order N block level is just above, but price stabbed into what the algorithm is going to measure. The order block + relative equal lows + fib measurements= Precision recision element is only going to be beneficial if you have all the other narratives P incorporated into you analysis: -Market is going to go lower bc we ran out those relative equal highs on the DAILY -Swing high created -Broke lower aggressively, we are likely to trade into that daily bullish order block -Retracement on the 1hr/15min which fills in all the imbalance above -We get FVG on the 15min -We get the candle back into the FVG and once it closes we wanna see acceleration to the downside (which we get) -Price trades lowe and lower right to the exact fib level ibs are most meaningful when you apply and layer other things in analysis like the purpose of F running to liquidity, below those relative equal lows into a discount array (Bullish Daily order block) his move up is the market trading into a premium T -We break aggressively and have a displacement down -Did it take out a swing low? Yes -trades into imbalance? Yes -trades above opening price? Yes ere's the 5min: H It looks much different. You probably would not see this as a sell, youd have looked for the 5min fvg to get filled. The higher time frame (15min) provides you theFRAMEWORK.Price does not need to trade into that. In the morning session you typically have 2-3 setups eres the 1min: H FIRST OPPORTUNITY: We have a FVG right above a shortterm high. We trade up into it and thats a setup we should take. here are plenty more setups here on the 1min. Its ok if you miss the 15min gap fill. You can T play the continuation down. SECOND OPPORTUNITY:Target here would be the sellside liquidity from the fulcrum pivot for first partial. Then final scales on Daily OB HIRD OPPORTUNITY:You get another short term low broken off an imbalance candle. Take T an entry in FVG OURTH OPPORTUNITY:We have the imbalance after weaggressively moved lower and then F the retracement back to the FVG - YOU HAVE NO REASON TO BE MAD YOU MISSED A TRADE. TRADES ARE JUST LIKE BUSES. THEY WILL ALWAYS BE THERE AND COME AROUND. DON'T WORRY. - Your #1 goal is to understand where price is likely to go to. Where is it likely to reach for? By knowing this it is easy to know what you are looking for M Session Buy Side liquidity pool:This high wasthe most energetic one in the morning P session. It took us all the way down to the target we were looking for (Daily Bullish Order Block) ecause its friday and because it hit the daily time frame objective, its in a discount market. End B of week there's going to be a retracement back into the weekly range. It can aim for that liquidity right there because a lot of ppl are going to place there stops there over the weekend if they wanna hold their shorts. hat area is where you would anticipate on Fridays where liquidity could be a draw because T price is likely to pull up into a premium. (Draw fib from this pivot high to low highlighted in the circle to find ⬇️ 50% level) here's going to be short covering once our higher time frame objective is met. T Who is short covering? SMART MONEY! So if they are covering a short they areNO LONGERBEARISH. This means they are now bullish. If they are going to be smart money and buy down there or if they're going to go long off an imbalance down in that area, they are targeting the buy stops at PM SESSION BUY SIDE. otice the relative equal lows right before price hits the daily order block. This sells the retail N crowd that it was support broken and they're going to wanna short the retest. This creates more liquidity for buying. This engineers buy side liquidity on the basis of sell side flow. versimplified explanation of how the market works: O The algorithm seeks discount to premium, premium to discount. Within that logic, the market is reaching for liquidity (buy stops/sell stops) and/or imbalances or the creation of an imbalance FVG, or returning back to a FVG. Thats all these Algos do and they do it on the basis of time then price. ALL WE LOOK FOR: -LIQUIDITY -IMBALANCES -TIME OF DAY rice falls back into an imbalance as well as mitigation block (not taught yet). Target on this P entry is the PM session buy side liquidity. If you look to the left of the highlighted area you will see an old high. ld highs are a discount array. O If we trade above an old high it becomes a discount array. This is where old highs being broken become support (SOMETIMES). hat makes an old high/low real support or resistance? W We are saying the market is going to bounce from the Daily bullish order block up into the PM session buyside. So if the market comes back down in and touches, it couldve touched that previous high but there was an old high to the left. Price came down and hits that and also fills in an imbalance. When you have that old highs broken will act as support. rice has fulfilled part of buy side liquidity. We see a market structure shift and price going P lower. A FVG forms which presents a short entry. You aim for the low near 4526 or the bullish order block. OR wait for confirmation entry. After we get a break in the structure of the market place on the 1 minute chart, a couple imbalances are created. Price trades up into them (remember if there's more than 1 let price trade into the second one and enter when price get back into the first) Episode 17: Applying the ICT strat to forex eres a daily chart. Since that most recent down closed candle didn't hit that sell side H (highlighted) or the one below that, we have unfinished business. We are therefore still bearish. very single time price rallys up above opening price doesnt necessarily mean thats a time to E get in. BUT, when you couple that with time of day and price it becomes a lot better. rice overshoots the imbalance but what it really wanted to go to the last upclose candle P (bearish order block). We know its a bearish order block because we have the imbalance and displacement move down. Heres the 5min: Price ralles once more above the opening price at midnight. hy doesnt it take out that high to the left? W Because it has an imbalance which tells you its an intermediate term high. If we are bearish we shouldn't take that high out his is an ITH because were expecting lower prices, it went above the opening price at T midnight, and it has an imbalance. Price retraced there just to hit the OB. ow to find the Bearish order block: H -the body of last upclose candle prior to a displacement move down our buy stop is going to flood the market with buyers willing to pay at a higher price than it was Y here before it runs higher and youre going to buy the counter partys side of the smart money that wants to sell short because every buyers has to have a seller Index trading: FOCUS ON 8:30am-11am Episode 18: Good info on OB (everything in this video is specific to forex) hich is lower? W The discount low of the FVG (Bottom FVG) rice has come way down in terms of the range from the swing high to swing low. This makes P the area were in now discount. As soon as the FVG forms we know that it is likely to see it rally up into it (a short term little bounce). That occurring and trading back to the bottom FVG is enough to set the stage for a new round of selling. ow look for targets. That daily low is an ideal scenario but it is not likely to do that in one day. N Frame your previous daily Highs/Lows. The low of that FVG creating candle is your most probable intra day target.LOTS OF LIQUIDITY ON PREVIOUSDAILY HIGHS/LOWS If you mark the last 3 days highs and lows there will always be a fresh supply of setups. his is what chart would look like when FVG forms. Once you get the FVG fill you look for shorts T with the expectation of price drawing down towards daily SSL. The low of that candle will give you the intraday range. Then we watch price and look for setup on smaller timeframe We run the highs and now we wanna see a displacement. We get that here eres the 5min: H We know price must at least get up into the 15min FVG. THE HIGHER TIMEFRAME FVG ARE GOING TO BE PARENT TO THE SUBORDINATE SMALLER TIMEFRAMES. Why did we like this FVG over the others? he low of the candle being pointed to is where theorder blockbegins. T We have all three of these candles making one consecutive bearish order block That run there is the run above the imbalance and the run on liquidity. Thats the bearish order block. What makes an order block valid? It has to have an imbalance s soon as we get below that candles open, the market starts delivering sell side, then breaking A that swing low. Now we have changed gears internally. Any rally after that is just setting up another run to go lower. Therefore this high is an intermediate term high where your stop loss should be If we are going short in a FVG and it has a small one above it, expect that it might trade up there so your risk has to incorporate that. Stop loss should be here: Episode 19: mean threshold/Purge and revert We remain bullish ere's the 1hr: H Targets would be sellside liquidity grabs and ultimately the 50% equilibrium Institutional order flow is rooted on higher time frame bias. o not try to pick tops and bottoms. Theres a lot of opportunity between intermediate term highs D and lows. eres the15 min: H We have a bearish order block here. We can use thelow of the lowest upclose candle and its opening price. You draw that out in time and we hammered it. Why is this an order block?Its because its whereprice was delivered on the upside, even though they are indecisive candles there that upclose right before the displacement to the downside. O TO MINUTE 23 FOR REALLY GOOD ORDER BLOCK ANALOGY (think of the OB as a G bookmark) Daily EUR/USD: Heres the1hr: he 62% and 79% retracement levels are what ICT teaches as optimal trade entry range, but its T not optimal trading entry for the setup. In other words we could be a buyer down in that FVG highlighted and trade back up to the 62% retracement level. This is a version of a contrarian trade against the higher timeframe bias. o now we are in a sideways congestion/chop area. We have to wait for displacement now. If S we get a displacement lower, we wanna look for the same type of move down we just saw just repeated later on. If it goes higher we dont care at that point because it hit our objective. Our objective was we wanted to see euro go below that daily low. ere's the 15min: H Keep in mind we have now taken out sellside so the next thing the market may want to do is run up to take buyside liquidity. When price trades back down into that FVG, we are thinking that since it created that short term high its going to want to run back up into that to take buy stops. But, even if it doesnt, if we just get above the bodies of the candles at that high and reach up into that 62% retracement level on the hourly thats a good enough place to sell. This isnt a trade setup ICT recommends for beginners because you are going against the order flow of the market S 1D: E Below we see price hit the equilibrium/short term discount of thedaily dealing range. Because of that there is a likelihood that the daily bias is going to be bullish and retrace. What can we do with that info? If its likely to go higher the next day or the day after that, its ok if the next day price goes down/doesn't move. Simply go into the next day expecting it to go higher. --------------------------------------------------------------------------------------- — Mid point of this candle is the mean threshold Mean threshold: The half point of an order block hy should we be concerned about this highlighted green candle? W Because right before that downside displacement it was the last upclose candle. his is yourpremium array: Price is going to drawup into that. T Targets could be the low of that candle which is the easiest (bearish order block), the open, the mean threshold, and the high (less likely) s developing students we want to sell at the low hanging fruit and pick the easiest targets. In A this case that would be the low of the candle. urge and Revert:On the daily we purged selltops and its going to revert back to the high of P the last 3 days (pointed at below). This is because that level has buy stops above from ppl who are short and use trailing stops 1HR: hat is the narrative here? W -We have the market trade below that short term low about 50% of its daily range. -We purged the sell stops so now where is it going to go? Higher because it needs to go to buy side because it's now collected sell stops so smart money is going to offset those buy orders that they used to pair up with the sell stops below these lows (highlighted above). They bought those sell stops so now they are net long. -How do they get out? They have to sell them to willing buyers t that low and highlighted low, whos going to buying from them at a higher price? The buy A stops resting at those relatively equal highs Heres the 15min: Midnight price is preferably the price we want to be buying below in this case. here are times where price goes straight up from midnight and never goes below it. This is T when we use the 8:30 time because of the news drops ast ditch for power of 3 is 8:30. L This means that if bullish: if the opening price at midnight is lower than what price is trading at after 8:30, then its likely not going to be a factor. You would use 8:30. If there is a day like in the example above where we have the opening price at midnight there and we are BULLISH bias and were already below it and then after 8:30 were still below it,WE ARE REALLY IN A DISCOUNT. We are REALLY CHEAP! o if were bullish and we think its going up to those relatively equal highs, we like this S movement down. Wait for 8:30.If we drop below itsopening price and were below the opening midnight price WE ARE REALLY REALLY OVERSOLD! That move there is like a micro judas swing (building low of NY session) for the session of NY. The midnight move down was a judas swing on the daily range/candle (building low of daily candle). Both are using P3 concept eres the 5min: H There is a FVG and bullish order block. At 8:30 were looking left and asking where are our short term swing lows because we wanna absorb sell stops because smart money will pair that with their buys and looking for an imbalance. eres the 1min: H Market has a run above that short term high. So we have a shift in MS thats bullish and a FVG. You then have the bullish order block with those 3 consecutive down closed candles prior to fvg. This is your long entry. We have a second entry when price goes up over the midnight open price, it has a fvg below. Episode 20 Dollar 1hr: Heres the 15 min: ollar is inverted with the euro D EUR/USD 1h: rice went and reached into the previous weeks high and at that same instance the Dollar made P its low and hits it objective. If there is a buying opportunity on dollar its a selling opportunity on EUR/USD. EUR/USD 15min: min: 2 Has the very clean FVG after sweeping liquidity. It trades lower and breaks a short term low. hy dont we use thislow(highlighted) as the short term low to break? W The FVG forms once that green one minute candle closes. The very next candles essentially opens right at thatlow.So it hasn't really movedaway and it hasn't really shown you displacement(something energetic where itmoves awayfrom that FVG). o now we have that FVG there. Price then moves lower than that STL and we have a shift in S market structure. ook at how much money you have in account and times it by 1%. 1% is maximum risk you L should take min: 5 Targets would be equilibrium from swing low to swing high. FInal target is that FVG highlighted Episode 21: Example of P3 not working isk off scenario: Implies that generally every other market or asset class will start to decline. R Money pours into the dollar and out of foreign currencies. s the dollar went up, ES went down A May is usually a seasonal decline. We are going to be looking for signatures to warrant downward pressure in this particular asset class and reaching for those relatively equal lows on the daily chart hy did we think price would go down to the 99.92 level? W If we were making the market we would dip it down below 100 and stop somewhere short beneath that level and go to 99.5 or 99.92 then start to work it higher. Why? Because it would convince everyone out there that the dollar is probably topped. Then it rips to highs lol. hy did we think it was gonna rally from there? W We are bullish on the dollar hy did we hint that we would be going lower into the S&P relative equal lows? W As we enter into May thats a seasonal tendency ES 1D: price is going to draw towards daily SSL afterfilling FVG 1hr: 5min: 1 ICT wanted to see a bit of a judas swing here at the midnight open around 15-20 pts but we didnt get it. eep in mind we are bearish for today K Did we rally above midnight open? NO Did we rally above 8:30 open? NO hat does this indicate? W Its EXTREMELY BEARISH. Price can't even rally to a short term premium above opening price at key levels and time. - These types of movements are going to be frustrating because you will feel like they are changing something. This actually happens a lot and it's nothing to worry about. Sometimes the markets are simply too heavy and they aren't gonna rally for you to short into. idnight open price:Useful for trading the londonsession (2am-5am) and it helps us frame P3 M for the daily range. -If bearish, look for something to rally above opening price in london session -If bullish, look for decline below opening price 8:30 opening price:Use for P3 for NY session (8:30-11:00am) ondon open setup: L This was the move that setup the only real sound entry that took place today. Notice the MSS below short term low, Displacement,FVG, & Bearish OB his imbalance here can be traded to on a spike. Its ok, your entry is still on the lower FVG. You T are going to use a stop that allows the market to trade up into there. You may not like that much risk or you may not be able to even take the trade. Thats all part of the game. eres the 8:30am 5min open: H Normally with the mentorship model we are taught to look for something to the left prior to 8:30 (some type of short term high we wanna rally up to, run some stops, then break down and create displacement, run into imbalance and sell off) The model DOESNT EXIST in today 5min chart PA Heres the 4min chart: hat happens at 9:30am open? W There is initial volatility. It can be whipsaw, where it can go up and down real short term, and go both directions in a small or even large range and clear both sides of the buy and sell liquidity. Then whatever the real move is going to be for the day, we wait for that to unfold. eres the 3min: H This bearish OB here is useful because you have a bit more insight into what its doing. Its too heavy, its not likely to rally, theres no reason to look to go long. Start looking for reasons to get short and any time you get an imbalance and were above those relative equal lows on the daily chart bc its going to draw down into that. Thats the heaviness objective. Price is gravitating towards it. hen we wake up and look at the market, were looking at what has happened over night and W did we create a scenario that we would be looking to trade if we were awake during london. If it happens then we know that were really built in with an advantage on the daily bias becauseif we are bearish and it creates a rally above the midnight opening price and it starts to decline and we are below that around 7am in the morning (when ict wakes up) we know that price is likely to create another little short term rally ideally above the 8:30 open!In this case it did not do that and price just remained heavy. Heres the 2min: eres the 1min: H These are all simple little imbalances to get in sync with whats already in motion, not needing to see it rally above the 8:30 opening price bc its not likely to. It takes a bit of courage to get in and trade these types of setups but thats what you do. OR you dont do anything and just tape read You need to have time and price behind you before you start moving your stop loss Episode 22: Amazing examples of the model setup in fractals ES 1D: 1hr: 5min: 1 Price broke short term high at open and then breaks lower It then creates an imbalance down Did it take a high out? YES Did it break below a low? YES Was there displacement? YES it was energetic Did we trade back up into it? YES. In there we can be a seller and get in sync with the run to the REQ —------------------------------------------------------------------------------------------- ere the 8:30 open is marked. We traded above it, making price in a premium. Price being H above that old high also makes it a premium. This is P3 in effect. Smart money would be selling short the buy stops and riding the move down. Then offloading their shorts to sell stops below those relative equal lows. Any time the market trades above an old high, that is a short term premium. ● WHY? Because its going into liquidity ● Any time the market trades below an old low, thats a discount ot of ppl/retail out there that wanna short the break of the lows. Thats going to flood the L market with market orders to sell at the market. Thats a perfect counter part for smart money being short up there because they want to buy it at a lower price. arket structure is not the answer. It helps you frame the idea but the idea must be in alignment M with the present narrative. arrative is: Why should the market go where you think its gonna go on that particular day? N Based on the climate, the economic calendar events, and the volatility thats being offered for that particular trading day 5min: min: 1 Is there a short term low broken? YES (pointed at) Was there displacement? YES Does the market come back up into the FVG? YES Is it above opening price? YES THIS IS ENOUGH FOR A VALID SHORT ENTRY min again: 5 After 1:30 theres usually some sort of a retracementhigher when bearish Or retracement lower when bullish. Below price retraces above REH into an imbalance (You can go short here)33 ASDAQ 5min: N We ran buy stops and broke a short term low with strong displacement Notice here we have 2 FVGs. We can enter on the first one but stop has to take into account that we expect price to stab up into the higher one! ey thing to note about these FVGs: They are in a premium above equilibrium and in OTE K of displacement range. Thats why we dont mark that big ass one lso notice that we have a fractal within the setup we spoke about above. We break buyside, A take a short term low, and break it with displacement creating another small FVG. Therefore that highest high we see on the chart is considered a LONG TERM HIGH. The lower high we see next is considered an ITH. his is going to be a short term high inside of a market structure that is really predisposed to go T lower bc we have long term and intermediate term highs above us. This highlighted high should respect the underlying order flow and go lower 1min: Below we see the 5min OB highlighted, but now we must refine it efined for the 1min OB. Get in at the 50% level of it R Also notice how we get ANOTHER fractal of the MODEL SETUP: -Break of short term low on displacement, trade back up into FVG as well as bottom of the bearish OB and short. SMT: ES 5min: notice the rally after 8:30 is lower than the high around 2:30am NQ 5min: Over here the rally is higher Its showing a willingness to crack the correlation between markets. If we are bearish and expecting lower prices and we see NQ make a new high but the S&P doesn't, thats showing us that NQ is doing a stop run and it shows that S&P is REALLY weak. his gives you like an x-ray view of real accumulation and distribution. That higher high on NQ T is distribution hen using FIBS: Use the bodies of the lowest open/close of the swings W Why? Its the bulk of the volume. We look at the wicks as stop running. We want to get to the heart of the matter. Episode 23 Go short in the yellow FVG zone targeting the recent low and finally the checkered flag area. weep the high :Sweeping just above buy/sell side and coming back down. Example of this S above Running the high: Runs right over the high and doesn't look back There are 8 setups here, can u spot them? TIP: For fomc draw fibs from bodies not wicks. This takes into account the extra volatility Episode 24: Quick refresher on mentorship model Daily: We wanted for price to run the buyside THENmake its move lower. We ddnt get that h: Looking for run above highlighted BSL. If it canget above that then it could wash out and go 1 lower. Whats the reason to be interested in these REHs? Its Thursday and ahead of NFP friday. NFP can usually be messy, volatile, and unpredictable. We wanted for those highs to be taken out then create the mentorship model. V Whats the catalyst that sets the run up into those REHs? If our focus is those REHs and price is dropping down ahead of 9:30am, we are likely to see a drop down getting traders to think it will go lower and then rally up. hat FVG below is a POI for us so that we can go in and look for something that gives us our T setup. Its an area where it may/could give us a setup. o at 9:30 am we are expecting a drop down into this FVG. S We are now looking for price too meet our criteria: ● Trading beneath an old low to capture sell stops: ✅ ● Displacement back above those old lows: ❌ min: 5 We DID NOT get displacement above that old low. entorship model review: M There is no trade trigger until short term low is broken with strong displacement FVG based entry (Imagine a fvg above and price is approaching from below) Episode 25: Great top down example+stop loss tips rice should not trade above the high of this order block. We are aiming for the fvgs below and P finally that sell side. Why? Its May easonal tendencies: Times of the year where specific asset classes willusually(not always) S produce price swings that follow a seasonal tendency. aytends to be adownmonth M Every year about the last week of April going into the month of May theres usually a tendency for these markets (S&P,NQ,DOW, RUSSEL) to be WEAK. hat took place here? W Smart money sold to the buy stops. They are now sitting with a net short position. How do they get out of that position? They have to buy it back. ow can they buy it back at a cheaper price, guaranteeing them that they are going to be H buying from lower priced sellers? Find the sell stop here: nce price takes out old lows like this what can it do? O -Notice on chart there is no FVG in the prior three days -Notice what Monday's candle did: opened, extended down, and closed near low on a rather large rang day. What do we do with this information? o back to the previous day's low! This is going to be important because the next trading day, if G we open UP and bc we are below those relative equal lows on the DAILY chart and below the swing low (to the left).We are now in a DEEP discount! Retail will call this day a mixed/indecisive day. That's just not true hr: 1 Market runs above BSL at 9:30am and hits that old low. Now all the buy stops have been purged. They've been dragged into the market by their hair kicking and screaming. They are caught long or they've been short and are knocked out of their position. Either way it doesn't matter to us we just know that BSL is likely to be utilized to set up and idea for smart money to be short. Why? BIAS IS STILL BEARISH. We are not trying to pick the bottom o if were doing this like smart money and we wanna be short up there at this trigger event, S where would you wanna sell that? Prev swing low on the 1hr and PDL SSL. ets go in and use the logic with this idea of rebalancing mondays daily range keying off of the L the red level. Notice that the BSL is ran first. This is REALLY important!!! If we would have gone down and took the previous low out first THEN ran up, that is not bearish. Price running above BSL at 9:30am, hitting the PDL level without having that SSL below t aken out is BEARISH bc it in the context of the bias that were looking for. hen were operating in a bearish bias, what were essentially saying is the markets going to go W up to a premium for one of two reasons: - Run an old high or highs to take out BSL so that way smart money can counterparty them with their short positions by selling to those buy stops then seeking to buy cheaper sell side liquidity. Essentially we are just running to a premium then seeking discount. he liquidity resting below that labeled SSL is not necessarily a target or utilization for anybody T in any other retail idea. No one except smart money expects it to be taken out. 5min: 1 At 8:30 we are looking for the news embargo to lift which means the algorithm will start seeking liquidity as early as that time. It might wait till 9:30 (like below). rice is rebalancing that entire Monday range. Its going back to the old low of the previous day P prior to monday (Friday). When you see that it tricks people into thinking that it has made the low and its going to keep going up when the only thing it has done is its gone up to a logical level on that daily time frame that rebalances all of that sell off on monday. n the 15min it does not look like its an imbalance but on DAILY candle its a large down day. All O that movement is big in terms of distribution on the downside. ramework (keep in mind we have a bearish daily bias): F -Look for REH -At 8:30 price is going to start looking for high or highs to run -How far can it go? Fridays Low -Power of 3 Judas swing up? Yes min: 5 When were bearish, the hour long interval (from 8:30-9:30) we are expecting a run higher to set up shorts. The short could form inside that hour or it could provide the leg that sets up the framework that will eventually provide you the setup. All of it is a matter of studying what the markets providing you. ighlighted area is the Judas swing. At the time retail wont see this and they will be caught off H guard. ighlighted range below is the displacement price swing. That's the leg on a 5 min chart you H strip down and start going from 5,4,3,2, and 1 until you find your FVG. min: 4 Is there an FVG here? NO Why is the FVG pointed to not valid? Its in a discount and we only short in a premium. min: 3 Is there an FVG? NO min: 2 Is there a FVG? YES Lets discuss stops: Initially when you open a trade up the rule is you wanna use the high of the candle that creates the FVG and set your stop 1-2 ticks above that. hen do you start moving your stop? W You wanna see a larger shift in structure. When this low is taken out, then you can move your stop down here for example (pic on right). hy? Because it's already broke down. It's not gonna break that low and go all the way back up W where your stop is. If it does well then you're probably wrong or it's gonna consolidate which means its going to be ugly conditions to be working within anyway. ee the logic? I'm accepting the fact that I'm probably going to be wrong if it stops me out but S who cares if it does. Episode 26: Example Of Tape Reading Practice Episode 27: Counter Trend Ideas Q Daily:Price is drawing towards those REH pointedat. We want to look into the lower N timeframes for a setup that will allow us to participate in the expansion move up there. We don't have to get there though to make money NQ 1H: Q 15 min: N At 9:30 we see a manipulation move down and takes out the overnight London Low then rallies. Q 5 min: N -NY session creates LOD (judas swing) taking sell side from the REL then rallies and makes a high at 12:10 (Lunch time usually creates a retracement/consolidation of some sort). -Price then retraces lower -At 1:30 the algorithm will start seeking liquidity. If its going to continue higher, what is it likely to do? Seek SELLSIDE IN DISCOUNT his displacement on the upside is a shift in market structure in a day that's: T - likely to be bullish -Counter trend to a higher time frame -Were working with the logic that its probably going to be a retracement because we've been down for a long time now and most people are probably going to wanna get out over the weekend so that algorithm is going to start SQUEEZING on them to get their positions squared before the close of the Friday. Q 2 min: N -Here we have the down closed candles prior to displacement acting as the OB. -We have a shift in market structure creating FVG -We have an imbalance -Price retraces down and we enter long Look at how the market created this counter trend idea still using FVG principle and concept BSL rests above. The day was bullish The algorithm kept pricing higher higher and higher. Logic was delivered ake first partial at halfway from high to low because we want to take a profit once were in a T premium Episode 28: 2min example video S 1 min: E Notice the SMT which shows ES is the stronger contract because it didn't make a new low NQ 1min: ES1min step by step walk thru: Bagged and Tagged✅ Episode 29: Brief review of 5/16/22 ES 1D: S 1 min: E Around 9:30 we see the market take out a STH and decline. We dont short because it does not give us a pattern anway. The market then creates some REL then starts to rally. We want to see it create a buying opportunity. he logic behind this is that we are in a day before the FED chair speaks. So there is going to T be very low volatility as a result of that. There's going to be a small range day. This doesn't mean we cant trade it but it does take more experience. Overall its best to avoid. S and NQ 1 min: E -Notice how NQ made a lower low here when ES made a higher low. -ES resisted going lower -We then retraced higher -NQ then comes back down and makes another lower low whereas ES isnt going lower than the 10am low -We now have a divergence. The importance of that is that I already have a bullish bias. There was no short trades that were lined up with the model today. There was no interest in being short, we wanted to go long. S 1 min: E We get this nice setup off a SSL grab that displaces up and creates a MSS with FVG. We don't think price will trade all the way down to that SSL left of the chart bc we are BULLISH. Notice how many times the FVG GAVE US A CHANCE TO GO LONG! Core Content - Month 1 - Elements Of A Trade Setup -When the market consolidates, the market will be looking to do an expansion. - All markets start from a consolidation and move into an expansion. That means there's an impulse move or an impulse expansion. - After that impulse swing either it goes back into consolidation again or it goes into a retracement. - When the retracement happens it goes back down into another level of expansion or after the expansion it can go to a reversal pattern. After the reversal pattern itll see another retracement then back to potentially consolidation. - These 4 conditions interchange throughout the ups and downs of the marketplace. You're only gonna get 1 of these 4 conditions ou just need to know: Y -Where its at right now -Where its likely to go -Where it came from ll the moves that start in the marketplace start from a measure of consolidation bc that's where A the markets are building orders. - The market maker keeps the market in a tight/defined range until there's enough money on both sides of the upper and lower end of the range that's being defined. - Whichever one has the highest amount of money to be absorbed, thats the direction its going to move in. We don't always know what that is but we WAIT for the expansion. When that occurs we get the clue as to what the market is most likely going to be doing. - We then wait for either retracement or another consolidation or reversal. Sometimes it expands so far that we cant do anything with it. We have to wait for the retracement or next consolidation. -Price will always be delivered by one of these 4 conditions. hen the market drops aggressively like this there's going to be pockets where price wasn't W actually delivered on every available price level in that range. It moved too quickly and skipped or created gaps. Notice how fibs are from wicks Episode 30: Down top example min: 1 At 2pm the Fed chairman was speaking. We saw a judas swing up that fell 1 tick short of the morning high at 12535.50. The market then drops down below REL which are the LUNCH HOUR LOWS. e are taught that many times when there is an Afternoon continuation to the upside, you'll see W that the lows at lunch time will get swept. rice fell right into this imbalance. This whole move down is manipulation before the true move P up. All longs who took that flag break are trapped. Any long holders from the morning are trailing there stop below REL. So the market takes them both out before making the real move. Entries could be right in the imbalance or on the retracement to the OB min: 5 The REH was treating the retail market like “hey you can trust us price wont come back up here”. It looked too clean. otice how there was no model in the manipulation move down.These algorithmic principles are N not likely to appear in markets that aren't likely to deliver like were taught. Thats ok. We can get in on the real move up once manipulation is over. 5min: 1 Price falls back into an OTE of 15m dealing range then rallies up to BSL 1h: aily: D We were bullish bias aiming for REH If you are bullish and price consolidates during lunch, find the lunch lows, wait for it to get run out, then price will resume up. Episode 31: Top down example 1D: H: 1 Attention should have been on May 16 lows being taken out 5min: 1 Notice entry was at 15min -OB min: 5 Here that zoomed in on the 5. Stop would be where pointer is. min: 2 We can fine tune our entry a bit more here swing high is created here. Once that red candle on the right of pointer closes, we are going A to just get in short. e trust the fact that: W - we've had a FVG - we went though the fvg -we have a swing high and it's bearish -We are looking for a run below the May 16th lows Once we are in, our stop is just above the swing high. Everything Is reduced in terms of risk on this type of entry. unch time plays: L Since were bearish, look for the lunch time high to be taken out for a move further down. Price taken it out and runs right into a FVG. e then get another play shortly after. Price consolidates, takes out the stops, and runs right W into a FVG in OTE Episode 32: Consolidation/chop day example S 1d: E We had an outside day couple days ago.Price falls short of running the old low and when this happens it tends to be a choppy day. hr: 1 We will be looking deeper into this fractal It could be easy to fall victim to in this type of trading day. Its choppy, back and forth. min: 5 Statistically bias moves to 50/50 when we start trading back into the middle of the range. hy didnt price move lower and take out the STL at 3855? It went below 3872.25 STL then W started rallying towards REH at 3933.25. ICT said to add a vertical line to 3pm and 4pm. Between this time the setup that forms to take us back down into middle of the range occurs. ICT outlined how the market would use the running up to take out buystops and also induce ppl that it was going to go higher so that way it builds up liquidity below the higher lows. If we are looking for setups that are gonna be based on a run above buyside and then pullback into the range, it needs to be specific in terms of time. In this case 3-4pm min: 1 Do we have MSS/break a swing low? Yes Is there a FVG? Yes Do we trade back into the fvg? Yes Price then works lower back into the middle of the range his day was a consolidation day. Market starts trading and creates an initial range and then T stays in that range until the afternoon. At 3pm-4pm, thats sets the tone for on close orders. hat does that mean? W Market was rallying up prior to 3pm. It went up for buy side liquidity. Traders gonna look at that as a breakout to go higher and they are going to pair that with the market participants that are considered smart money. rice ran above all the buystops that are in the highlighted circles. These are where all the P shorts palace their stops. Once those are hit they become a rushing liquidity wave of willing buyers at the market. illing buyers at the market at 3pm on a day like this where its consolidated, its going to want to W go back to the middle of the range. o when you look at that type of event, its going to range bound trade between 9:30 open and S HOD (where we shorted) IF YOU ARE LOOKING AT PRICE ACTION DAYS LIKE AND IF YOURE CAUGHT UP IN IT AND DONT KNOW WHAT YOURE DOING/BEING CHOPPED UP, WAIT UNTIL 3PM. any times at 3-4pm the algorithm will do something where it goes outside the bounds of M the daily range like it did in the example above. Episode 33: example of taking fvg not in “premium” S daily: E We made a run below that May 12 low h: 1 We see price bounce off the 1hr FVG and make a strong move down sweeping sellside. 5min: 1 ICT wanted the 3915 level to be broken before placing ANY TRADES. The reason why is bc where it was previous to the break was just a bunch of consolidation. He didn't want to catch a break below a short term low and then a run over REH. We wanna know that we know price wants to go down. ogic is that price will reach for that 3855 level only if we break below 3915 and then have a L FVG. We will then look for price to break the next sell side target and see if it gets another FVG that will allow us to get in for price to deliver lower. ou could play the short down to sellside draw. Then long it off the sellside liquidity sweep. Y Target for the long reversal would be the fvg in premium of this range (pointed at) sually we measure the displacement leg and wait for price to comeback into a premium before U shorting. We don't expect it to go to a premium here bc its going to be in a hurry to get down below the 3855 lvl for the week. min: 5 Price makes a small drop back into the FVG, AFTER 3PM. The market then starts sending it into an algorithmic spool where all this price action starts running aggressively into the close Now lets take a closer look at the shorts that could have been played on the 5min: Heres a FVG. We have price rally into it a couple times then breaks lower Heres another FVG which gets traded into then sells off OTICE THAT ITS OCCURING AT THE LEVELS (old lows where SSL would be resting) N THAT WE HAVE ON THE CHART. Were using the FVG after a run below. In other words think of it like support broken, return back into FVG. DONT THINK “go back to the old low broken and act as resistance”! Thats not how we look at it! If the FVG does not exist we don't trust that level as an old support broken turned resistance min: 1 We measure the 1min displacement leg down and find that we have a FVG in equilibrium we can base our entry off of. Price trades into a premium and thats where we ENTER! Episode 34: Sundays Gaps S 15min: E We see price have a morning selloff which fills the Sunday gap and taps the top of a 15min FVG. It then reverses and draws towards our BSL target 3938.5 which is also the gap. min: 5 We get PERFECT price delivery in this 5min FVG! Same 5min chart with Sunday Gap marked more visibly: e then tap the top of that 15min fvg and get some consolidation before lunch. We then see a W TYPICAL retracement during the lunch hour all the way back to the opening range. It then breaks lower under a short term low and rebalances which also happens to be inside of the old Sunday gap which acted as resistance. It then trades lower down into an OB, then starts to accumulate, then rallies up back above the gap opening from Sunday which then trades back down into it and rallies. It falls short of reaching buyside and then retraces down into the gap which is also discount low. rice then rallies and comes back into a 5min FVG which lines up with a 15min +OB. It rallies P away from it and comes all the up to our final target of 3952.75 he opening gap on Sunday, if we plot it across the entire week we will see that many T times there's a lot of valuation around that gap. It'll be treated as a dynamic support/resistance. If we have a swing high for example and we trade down from it, if its gonna trade down into the sunday gap opening look for it to run above its high. 5min: 1 If we go back above this area (the gap) that probably means were going to go into a deeper run on the daily. d: 1 We have a Daily -OB there and a high just below it. e are looking for expansion swings to draw our fibs on to be able to long in a discount. We W DONT want to be drawing the fibs from the price leg down and look to short once it gets in premium. E ARE LOOKING FOR IMPULSIVE PRICE SWINGS IN THE DIRECTION WE ARE TRYING W TO TRADE! Episode 35: SMT example S daily: E Initial draw was the daily imbalance and bearish daily OB. The low,open, and mean threshold of the OB are the sensitive areas you are watching for. Mean threshold was taken.This bodes well for a continuation to take out this short term high 5min: 1 REH were left untouched and the low of the daily OB was right above (orange line) min: 5 Notice how the downwards price leg delivered in one single pass through. Notice how the price leg that followed up came in 2 stages ecause it had two stages to that delivery we want to use the most recent one as our dealing B range. We run a FIB on that and wait for it to drop into discount arket rallies from the FVG then drops down into a newly formed FVG at 8:30am then drops M back in and explodes up at 9:30am. Heres an example of SMT.Remember to set setting to plot on the LOW. Q made a lower low while ES made a higher low. N NQ is taking liquidity out whereas ES is accumulating there sually they move in tandem but at certain times (8:30, 9:30, news events) they'll create this U divergence. If you have a bias it's helpful. n the other hand, if you don't know where it's going, youre going to many times encounter O what would look like SMT divergence and then it disappears as they start moving in concert with one another. e are taught to know what price is reaching for. In this case bias has been bullish. W The NQ move is a stop out while in ES is the accumulation of longs is the telltale sign that its going to the higher. Price here is being compressed getting ready to explode. e are now watching to see if it can make its way up to mean threshold. The OB is on the 15 W min. hr: 1 We've completely rebalanced this whole move down. We will most likely draw towards 1hr BSL. Notice the middle of the chart. We formed a low, price rallied, and then came back into a FVG in discount then rallies. This same pattern forms 2 more times after that! e then consolidate, rally, then come back down into the smaller time frame FVG (highlighted) W where there is also SMT. Framework and BIAS is what keeps us from shorting here hy won't we short here and expect it to drop straight down through all the consolidation. W This is a High resistance liquidity run ( Its not as likely to occur/pan out). e had so many supporting ideas here to be bullish. For example the down closed candles are W supporting price. Its just finding underlying order flow that's bullish so it's likely to go up just to keep going higher. NOT GO UP TO GO DOWN. e have A LOT of ranges we would have to break through and that requires a lot of intent, not W selling pressure. The INTENT is to send this higher on the daily chart. Final words from episode: ecause it gave a nice run here here earlier before 7am, that means were probably going to B have a deep retracement and look for an ideal scenario like we outlined with the SMT divergence. MT will usually occur around a 9:30am time period when there has already been a nice early S run before or at 7am. If we get an early run like this, our first thought is, we need to go to SMT later on at 9:30 bc its going to require some kind of a crack in correlation to setup the next leg if its going to have one. Episode 36: 1hr down to 1 min example h: 1 Market drops down into a discount. Market is in an oversold condition min: 5 We get MSS, displacement, FVG, then move down into FVG. The FVG is in a discount of the displacement range and we enter long there and aim for HOD (red line). We end up trading higher than that going into FVG in a really deep premium min: 1 We consolidated in the premium then dropped down to take sellside. nyone who was lucky to long at the bottom and rides it to the top of this range gets stopped A out. The algorithm drops down and clears the board taking out the sell stops below here in order to go higher. We are buying those sell stops. min: 1 This was a counter trend play (highlighted). We are expecting price to move back into a premium prior to dropping further. We see a MSS and drop back into FVG. We didn't believe we were going to take out the lows here because we should have done it at 8:30 news but it couldn't do it so we view this as deep retracement which then rallies into a premium right before 9:30am. otice there is no model entry on the huge move down. That's the market tipping its hand to us. N Because there is no real setup and its a rush to get down here its clearing out SSL. It rallies a but suckering in longs bottom picking. They get knocked out and now they are not able to go long again (Retail won't usually reenter after taking a loss like that, they are afraid) here are also some great 1min trades off the FVG you can simply scalp. Sell at FVG above T REH. Episode 37: Top down example S Daily: E We came down and filled the daily fvg which also aligned with bullish breaker. If price doesn't take out BSL over night and at 8:30 am were above the fvg high, we would expect for price to attempt to get through that level. It doesn't have to go through it but the bias is that it attempts to take it. Non farm payroll is occurring on that very day so you should NOT be trading it anyways. It good to study though and watch price action. ON NFP WEEKS STOP TRADING ON WEDNESDAY BY NY SESSION ip for daily bias: T When the market has moved from a low like this and starts to trade higher and creates a swing low, its easy to assume that it might wanna come back to that most recent swing high. otice how each day up to it was bullish. We would be bullish bias until we take out that high. N Then we have a day or two of retracement which is logical because we create a FVG. 1h: 5min: 1 Notice P3 in effect here. We accumulated around midnight open. We saw manipulation down in the morning session and then price rallied up. min: 5 Notice the fvg above. Our expectation was to draw up into it from here (where circle is) in the PM session. In other words, as we go into lunch and on the other side of lunch we could have easily traded into the 5min fvg as an upside objective. min: 2 We were not given a model down where the 15min sell side was taken. This trade down below was the only entry to have been able to play this move up.Its a continuation trade here is still some time before lunch for price to potentially deliver to the 5min FVG above. Also T note how we already had a manipulation move down creating LOD and we are now above midnight open price. otice the 2min +OB and FVG that is formed on the displacement up. Draw fib from that N displacement leg up which starts at the 2min OB. Price falls into a discount+FVG+OB which triggers an entry. Sell at 5min FVG Episode 38: Changing gears w Bias aily: D Going into the day we were expecting price to draw towards 4070 SSL. instead price has bounced away from the daily FVG and is drawing towards previous HOD hr: 1 Going into the morning we were looking for a potential run into 4070. We did not get that otice what were seeing: Multiple lows are being taken as we inch towards 4070 and then N market reverses all while never presenting any high opportunity short setups. 4070 level never got tagged. DH (4168.25) was not traded to. Also notice the bearish FVG to the left of it. We now have 2 P premium arrays that may be a draw on liquidity 5min: 1 We see displacement and a short term shift in market structure relative to the 15min. That is our area to watch and see if price supports a run. If it digs into that FVG and starts to repel higher and we take out that short term high to the left, that is enough to set up a stage for the afternoon trend/setup or price swing. hy? W The market failed to get to an objective we were looking for. It was also respecting that daily FVG and it rallied up. Price also displaces up and takes out that short term high to the left which means we now have absolute market structure shift bullish. We are now looking for entry in the FVG created by the MSS (highlighted in second pic) min: 5 Notice the imbalance pointed at and the REH/BSL just right of it. Bc of this we would look to take partials prior to breaking BSL. This is bc this could easily be a stop run and price makes a lower high after our entry. We are protecting ourselves in case this scenario unfolds. If we've been in a bullish market structure and order flow is bullish (everythings going in one direction and markets obviously going higher on all time frames) then thats an easy trading scenario. In this case were inside that little trading range area on the daily chart. Market is more difficult to read -Initially we wanted that 4070 level. We failed to go outside the shaded area (daily FVG) -If we're bullish we want to be buying at/close to the opening price. If you know the market is likely to go down to go up, then you can wait for price to give you this setup right here: ● Price goes down ● You get a shift in market structure ● Come back down into a 15m FVG ● This is a day trade setup (not scalp) We also got an SMT with ES and NQ where ES showed strength printing a higher low Price then rallies once more of the 15min fvg Once we see this happen we are good to go and are waiting for the afternoon setup. If you are bullish, the market has ran higher in the morning then consolidates into the lunch hour. After the lunch hour it'll drop down and sweep the sell stops or below some short term low made in lunch. otice what happens here: Price creates a low ahead of the lunch hour at noon then drops N down into the FVG. This is doing what the rules said in terms of what liquidity is doing in the afternoon post NY lunch. What's the difference? It's not consolidating. Its retracing ecause it's a retracement going IN TO LUNCH, that signals that the algo will work through B lunch. he algo drops into a discount then creates that short term low. It rallies a bit and leaves smooth T highs. Retail will see it as resistance. Price then drops one more time below that STL and triggers sell stops. nce price crosses over here (highlighted), we are immediately thinking it could potentially be O running PDH. We don't know it yet so we don't take an entry. We don't want to be premature and stopped out hen price drops into here (highlighted), and then rallies from that then I KNOW its going for W that PDH. That's the narrative. We want to see something that makes sense logically. his basically means: T Do we see displacement? OH YEAH WE DO Is that an energetic price run? OH YEAH IT IS We now get the measurement of that low to high to see premium/discount and seek to enter in discount What happens if price went here and rallied? Well we would have missed the move and thats ok e are looking for sellside liquidity. We want to see a stop run bc what that's doing and how this W fits into narrative is: If I'm thinking that this move (swing leg zoomed on) is setting up an afternoon run potentially to PDH by close of day, we wanna be like smart money and buy sell stops. ICT executions for study: MT S Notice on NQ there is a higher low. When were bullish plot the NQ comparison below as a compare and contrast tool. In this case we pull it out bc price is in a discount, in a fvg, in OTE and breaking STL lassic Buy Day: C Open at midnight Trade down creating LOD Rally then creating a OTE or FVG or youre gonna buy the STL during SMT diversions heres real accumulation here between NQ and ES. This SMT divergence here is telling us that T NQ is failing to go lower so its under accumulation. What's happening with ES is just a stop hunt below that short term low. Episode 39: Diving into TIME aily and 1H: D We were interested in price drawing towards 4070 today and if we traded past that, into the Daily FVG. We don't think its going to sweep 4070 to go up. We are expecting price to trade into FVG. e don't just assume every time we sweep REL we sweep those and just go the other way. W Narrative must be understood! Narrative is learned through EXPERIENCE! n the 1h chart we have a swing low traded through with DISPLACEMENT and a FVG. Price O rallied up and traded into the FVG and bearish OB. We expect price to take 4076 low. o we have a bearish bias and a clear draw on liquidity. Now look for P3! Notice the S accumulation and manipulation run up into a short term premium. The market then distributes lower past sell side ultimately into daily FVG. If we are short we take partials at 4070 and leave runners and submit to the daily range. That means wait until 3-4pm. We will get the delivery of price into the daily FVG during that time 15 and 5 min: m: 5 During the London session price rallies and starts building in a premium ahead of the 8:30 time window. The market creates the high and goes lower, taking short term SSL. Price then retraces up into premium of displacement range down. It then consolidated for the majority of the afternoon. Then it breaks lower and aggressively attacks the sell side below 4070 and then going to 4040 level. We then consolidate and close inside the Daily FVG. The rules for an afternoon session trade: ● Before you even consider trading the afternoon session, you must consider what the daily range trying to do. ● Is it trying to expand higher or lower? ● Did it reverse in the morning session and is it going to have a counter trend move? ● Is it going to consolidate bc its waiting on a big news event the following day? oday we had a big news event (employment data). The market consolidated and we had a T bearish bias. We were looking for 4070 to be broken then move into daily FVG. The framework was one sided and it was not ambiguous. If we are bearish the market will clear stops during the lunch hour. This is bc they dont want participants to be profitable that may have assumed a short position from the morning secession. At 1pm the algorithm reprices and runs to take the stops above BSL. If you are aggressive you can place a trade on that stop raid bc we are in a directional move and are trying to anticipate a large range day.Largerange days can typically form with a busy lunch schedule. If its going to be a fast market, during the lunch hour it can create a significant high or low. hat is a breaker? W A breaker is a pattern where price runs out a pool of liquidity, then retraces and trades back down below that short term low. If it trades back up to that and the narrative is BEARISH its valid(YOU MUST KNOW WHAT THE MARKETS LIKELY TO BE REACHING FOR). If you leave that part out its a gamble/guess. e expect price to reject off this breaker and go lower. We don't expect to reverse once we take W the highlighted sellside. We wanna see it go through it and accelerate down towards 4070 SSL since its the larger pool of liquidity. Then we wanna see it aggressively run un to the daily FVG bc thats the imbalance that the algorithm is going to want to reprice to. otice how fast price accelerates down past 4070 without retracements or return back to old N lows broken.This is an algorithmic sell day. Retail doesnt get to do a lot of those retail concepts. 1min: ● ● ● ● ● hat Time of day W What Day of week What week of month What month of year What seasonal influences hese are several factors encoded in the algorithm that will seek these recurring phenomena T that can be capitalized on by those individuals that know their hunting. READ THESE NOTES BELOW e're looking for days where we can go in and engage price when there is a medium or W high impact news event OR if there is a lack of one, we can practice but we shouldn't be engaging with our normal risk percentage. hat's the first element to algorithmic theory?TIME W 8:30 am news embargo lifts 9:30 am NY open id the market rally above the opening midnight price AT 8:30? YES D Are we bearish? YES otice we take out short term high at 8:30am. The algorithm doesn't care how much N volume/orders is above that STH,it just has to takeout a short term high. rice is now at a premium and it took out BSL. What's it likely to do now bc its a bearish day and P were above the opening price and its at 8:30am?Repricefor sell side at 4100. he algorithm goes from BSL at 8:30am on a bearish day above the opening price. T Wait for the market to trade lower which it does. Then watch for the break of the swing low. We see price trades through it and creates a FVG. We take a short entry there expecting to run to SSL. This is the 2022 model ICT teaches his son to exit position once up 5pts when first trading live money. No matter how far the target is, sell immediately at 5pts and just observe price deliver. He's looking for his 5pt trade at 8:30 or 9:30am. If he doesnt get a win he can wait for the afternoon. If he wins, paper trade afternoon. This teaches you to have confidence that you can make money from this system and don't have to worry about it ever not working he next area of opportunity is 9:30am. We should expect price to sweep BSL at 4105 and hit T that FVG above. We short there and sell at SSL which was LOD. his setup eventually came back and came all the way back up to midnight open price. We are T now in a premium. Price consolidates and then breaks down In short, what should have happened was we run BSL at 9:30am, creating the hod and then break lower. Because price took out the OB, after taking multiple levels of SSL, what's the algorithm gonna do?SEEK BUY SIDE t 1:30 (lunch session starts) we leave an area of buy stops that have been taken, breaking A down then returning to a bearish breaker. We see displacement off it creating a FVG. That could've been an entry right there. e then see price trade below REL. What's resting below that? SSL on a BEARISH day. W Does it wanna drive down into the REL? IT DOES Does it create an imbalance there? IT DOES Does it trade back up into it? YES.Thats where wesell short and sell when we are up 5 points. We then watch and study to see if it goes to that 4070 level or that daily FVG mentioned. Doing this will deposit pseudo experience that over time evolves into real experience ICTs son model There's 3 opportunities a day (8:30,9:30,afternoon) Looking for just one of them to just yield 5pts o take a look for yourself how many 5pt moves you can find at these specific times outlined in G this episode. Episode 40: Key to daily bias US/CAN Daily and Hourly: e see price trade above BSL and create a swing high. The day after candle 3 we would expect W the market to trade lower. otice the highlighted circle. That rally happened prior to 8:30am open. That's MANIPULATION N that runs us up into a FVG running a STH/buyside. 5 and 5 min: 1 Take first partial at the FVG discount array. Final target the SLL. 4min: We need price to get above equilibrium or higher to short These are our possible entries. Top price is the SL. In depth 4 min chart: KEYS TO DAILY BIAS: e're not trying to get a daily bias every day. We are trying to determine the DIRECTION of the W weekly expansion: -Does it want to run to an old low? -Does it look like its gonna run to an old high? -Is it running to an imbalance below or above the market price? -Is it likely not to move because there is no data for it that week ? hink of WHO IS IN the crosshairs? T Have people been making money going long? Is there a low they're gonna try to run down and stop them out with it? That will be enough for us to frame an expansion going lower. here are the high or medium impact news events for the market that you trade? W What day of the week and what time? ets say for example we are expecting the weekly range to expand lower, on the news L events we wanna hopefully see something that runs us higher into a FVG or run above stops, then break down showing displacement then creating a FVG to SHORT!. We are looking for these setup intraday in our kill zones at the time the economic calendar says the news drops. o sum it up SIMPLY: T We are looking for the higher time frame weekly to expand in a specific direction: THIS STARTS OUR BIAS Then… If I think it's going higher/lower for a specific target or imbalance, then we will go to the economic calendar to look for when that might occur. hr: 1 The movement being pointed at is whipsawing both sides of the market place taking out SSL and BSL. Whenever we see price action like this we ignore both large wicks. The real range is the swing that follows o now that we have determined our swing range, if price is going to go higher its gonna want S to go into a premium. Why don't we consider this FVG a premium? Itsoverlappingwith that equilibrium level. We wannasee it dig into a premium. Therefore we highlight this FVG as our expected spot (low hanging fruit approach) 15min: London creates the higher low most of the times (if you're directional bias is correct) We then rally and see a short term shift in market structure which is bullish min: 5 Price rallies away from the OB then back down into the last down closed candle on the 5min chart. We have the market starting with a run from a low to a lower low. Whats took place there? he market then comes back down into a short term discount, rallies, and at 9:30 consolidates T then starts to run. 3min: e can buy this FVG (highlighted) and trust it wont take previous low out. Why? W Because we already had a stop run event (labeled below). Market drops into a discount prior to that run up in the NY session. It already made a move of manipulation with the stop raid earlier, we then retrace into discount, then off to the races. e are trading into an hourly discount and hit OB (blue line). Then it creates a short term W discount relative to the swing it just formed. The market then rallies and comes back into a OB+FVG entry in discount and rallies. It consolidates at 9:30. PRICE IS NOT LIKELY TO COME BACK AND TAKE THAT LOW OUT (BLUE CIRCLE). his is because its already closed in the only FVG thats here. Price has rebalanced it and T theres no reason to go down. If were likely to see lower prices on Dollar Cad, were likely to see lower dollar and higher foreign currency. When the dollar goes down its easy for ES to go higher. isk on: Foreign currencies, index futures, stocksgo higher: Dollar goes down R Risk off:Dollar higher and everything else goingdown. If you go into the day with the idea of risk off risk on, it makes it a lot easier to look for supporting ideas with intermarket relationships. Episode 41: Final episode/risk management ES 1h: S 15m: E We had the Powell event at 10am. The market runs up and takes intraday BSL but we were looking for BSL on the hourly chart above to be swept. We dont reach our 1h level but we draw back down and fill in a 15m FVG. otice how there is a smaller FVG right above the one marked. N Why dont we use that one? The reason is that since the bottom of that first FVG is also the top of the bigger one, its likely to go over it and stab into the bigger one. Its doing this as we go into NY lunch until 1:00 where it makes the low of the session after closing in the FVG. Then from 1:30-4pm (Afternoon session) the market creates a willingness to want to go higher, drawing all the way up to our 1hr target we looked for in the morning! Initially in the morning we were looking to go above that 1h BSL then sell off and go back down into the FVG area in discount and then go beyond 3805. We didnt get that so we wait e prefer to see some type of stop run in the lunch hour. We got tha and price runs into a FVG W in deep discount between swing low to high. ES 5 min: ICT recommends to wait until 1:30 to begin trading as there is cleaner price action ake your attention to the highlighted circle. The market starts to rally away and draws back into T a +OB AND FVG. We then have a 5min MSS which leads to a small return to the new FVG. min morning session: 2 Since we never saw strong displacement beneath the pivot being highlighted, we couldn't short in that 2m FVG. If we did we would absolutely short it and ride it down to the LOD pivot. If we didnt get there by 12pm we would just close positon. min afternoon session: 2 We see a short term shift in market structure at a key time of day (1:30pm). Price trades back down into an OB with FVG(not marked) in OTE. THIS IS IS THE GOLD STANDARD OF PATTERNS. This is all happening within the 15m FVG. 5min: 5min w entry annotations: e trade into the 15min FVG. Does is show willingness to go higher?YES W Is there a short term shift in market structure?YES Is there a FVG?YES Down closed candle to the left of it?YES Price then drops down into bullish OB in OTE where we should have alimit order at 3754.75(a tick below fvg). Our stop is about9 ptsaway. OurTP is above that pivot marked in premium of our swing range down, about25.5 pts. Thats about2.5 RR. hat do you do if you get stopped out here?On thenext trade use 0.5%. Before you can go W back you have to make 50% of what you originally lost. For example you get stopped here and take a -$100 loss. You must now make 50$ back using 0.5% risk before going back to full 1% risk. What happens though if you also get stopped on the 0.5% trade?You now use 0.25% risk. Stop management: rom SL to entry, split that range in terms of pts. For example if this went up 12.5 F pts(half of 25), then your SL can be trimmed by 25% of that range. ow that you have your stop set just watch and analyze price delivery: N -Do down closed candles keep supporting price? -Does it run below STL then run higher with a lot of energy? -Is it dropping down into a FVG and reaccumulating and sending another price leg higher? s long as price is doing those things collectively or individually you are on the right side of the A market and you should keep holding for your position to hit target.