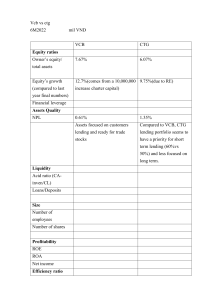

MEASURING & EVALUATING THE PERFORMANCE OF BANKS Chapter 5 William Chittenden edited and updated the PowerPoint slides for this edition. 6-2 Key topics 1. Stock values and profitability ratios 2. Measuring credit, liquidity, and other risks 3. Measuring operating efficiency 4. Performance of competing financial firms 5. Size and location effects 6. The UBPR and comparing performance Banks’ key objectives 1. Maximizing the bank value 2. Controlling wide-range risks 6-4 Value of the bank’s stock 6-5 Value of a bank’s stock rises when: Expected dividends increase Risk of the bank falls Market interest rates decrease Combination of expected dividend increase and risk decline Value of bank’s stock if earnings growth is constant D1 P0 r-g 6-6 6-7 Key profitability ratios in banking Net Income Return on Equity Capital (ROE) = Total Equity Capital Net Income Return on Assets (ROA) = Total Assets (Int erestincome Net Int erestMargin - Int erestexpense) Net Int erestIncome T ot alAsset s T ot alAsset s Noninterest revenue - PLLL Net Noninterest Margin - Noninterest expenses Net Noninterest Income T otalAssets T otalAssets 6-8 Key profitability ratios in banking (cont.) Total Operating Revenues Total Operating Expenses Net Bank Operating Margin Total Assets Net IncomeAfterT axes EarningsPer Share (EPS) CommonEquity Shares Outstanding Total Interest Income __ Total Interest Expense Earnings Spread = Total Earning Assets Total Interest Bearing Liability Earning Assets Earning Base Total Assets 6-9 Breaking down ROE ROE = Net Income/ Total Equity Capital ROA = Net Income/Total Assets x Equity Multiplier = Total Assets/Equity Capital x Net Profit Margin = Asset Utilization = Net Income/Total Operating Revenue Total Operating Revenue/Total Assets Return on equity (ROE = NI / TE) … the basic measure of stockholders’ returns ROE is composed of two parts: Return on Assets (ROA = NI / TA), represents the returns to the assets the bank has invested in Equity the Multiplier (EM = TA / TE), degree of financial leverage employed by the bank Return on assets (ROA = NI / TA) …can be decomposed into two parts: Asset Utilization (AU) → income generation Expense Ratio (ER) → expense control ROA = = AU (TR / TA) ER - (TE / TA) Where: TR = total revenue or total operating income = Int. inc. + Non-int. inc. + SG and TE = total expenses = Int. exp. + Non-int. exp. + PLL + Taxes ROA is driven by the bank’s ability to: …generate income (AU) and control expenses (ER) Income generation (AU) can be found on the UBPR (page 1) as: Int. Inc. Non. int. Inc. Sec gains (losses) AU TA TA TA Expense control (ER) can be found on the UBPR (page 1) as: Int . Exp . Non int . Exp . PLL ER TA TA TA * Note, ER* does not include taxes. 6-13 ROE depends on: Equity multiplier=Total assets/Total equity capital Leverage or financing policies: the choice of sources of funds (debt or equity) Net profit margin=Net income/Total operating revenue Effectiveness of expense management (cost control) Asset utilization=Total operating revenue/Total assets Portfolio management policies (the mix and yield on assets) Bank Performance Model Returns to Shareholders ROE = NI / TE Interest Rate Composition (mix) Volume INCOME Fees and Serv Charge Non Interest Trust Other Return to the Bank ROA = NI / TA Rate Interest Composition (mix) Volume EXPENSES Overhead Salaries and Benefits Occupancy Degree of Leverage EM =1 / (TE / TA) Prov. for LL Taxes Other Expense ratio (ER = Exp / TA) … the ability to control expenses Interest expense / TA Cost per liability (avg. rate paid) Int. exp. liab. (j) / $ amt. liab. (j) Composition of liabilities $ amt. of liab. (j) / TA Volume of int. bearing debt and equity Non-interest expense / TA Salaries and employee benefits / TA Occupancy expense / TA Other operating expense / TA Provisions for loan losses / TA Taxes / TA Asset utilization (AU = TR / TA): … the ability to generate income. Interest Income / TA Asset yields (avg. rate earned) Interest income asset (i) / $ amount of asset (i) Composition of assets (mix) $ amount asset (i) / TA Volume of Earning Assets Earning assets / TA Noninterest income / TA Fees and service charges Securities gains (losses) Other income 6-17 Determinants of ROE in a financial firm Components of ROE for all insured U.S. Banks (1992-2007) 6-18 Quick quiz Table 6.1 – p 177 What is the trend of ROE? Which factors strongly affect this trend of ROE? 6-20 A variation on ROE Net Income Pre-Tax Net Operating Income ROE = Pre-Tax Net Operating Income Total Operating Revenue Total Operating Revenue Total Assets Total Assets Total Equity Capital ROE = Tax Management Efficiency Expense Control Efficiency Asset Management Efficiency Funds Management Efficiency 6-21 Breakdown of ROA UBPR for PNC Financial ratios …PNC and Community National Bank PNC BANK, NATIONAL ASSOCIATION RISK RATIOS Pg # ROE: Net Income / Average total equity 11 ROA: Net Income / aTA 1 AU: Total Revenue / aTA 1 calc ER: Total expenses (less Taxes) / aTA 1 calc EM: aTA / Avg, Total Equity 6 calc EB: Earning Assets / aTA 6 NIM: Net interest margin (te) 1 Spread (te) 3 calc Efficiency Ratio 3 Burden / aTA 1 calc Non Interest Income / Noninterest exp. 1 calc EXPENSES: ER*: Expense ratio (Expense components) Total Interest expense / aTA 1 Memo: Interest expense / Avg. Earn assets1 Noninterest Expenses / aTA 1 Personnel expense 3 Occupancy expense 3 Other Oper Exp (Incl intangibles) 3 Provision: Loan & Lease Losses / aTA 1 Income Taxes / aTA #N/A INCOME: AU: Asset Utilization (Income components): Interest income / aTA 1 Memo: Avg, yield on earning assets 1 Noninterest income / aTA 1 Realized security gains (losses) / aTA 1 Dec-03 CALC BANK PG 1 Dec-04 CALC BANK PG 1 16.90% 16.56% 14.41% 15.59% 15.26% 1.59% 1.59% 1.28% 1.31% 1.31% 7.59% 7.59% 6.45% 7.02% 7.02% 5.18% 5.17% 4.51% 5.15% 5.14% 10.59x 10.48x 11.20x 11.59x 11.47x 82.86% 82.60% 89.84% 82.85% 82.92% 3.89% 3.82% 3.51% 3.32% 3.18% 3.74% 3.62% 3.36% 3.15% 3.02% 60.93% 60.86% 57.73% 68.01% 67.97% 0.67% 0.66% 1.12% 0.81% 0.81% 83.24% 83.42% 62.03% 79.79% 79.70% COMMUNITY NATIONAL BANK Dec-03 CALC BANK PG 4 14.55% 5.48% 5.56% 1.31% 0.41% 0.41% 6.21% 6.10% 6.10% 4.23% 5.47% 5.48% 10.65x 13.37x 13.76x 90.08% 85.43% 86.74% 3.52% 4.95% 4.80% 3.37% 4.39% 4.25% 57.92% 82.72% 82.75% 1.16% 3.37% 3.37% 59.86% 21.08% 21.08% Dec-04 CALC BANK PG 4 11.56% 8.63% 8.67% 11.72% 1.07% 0.63% 0.63% 1.09% 6.50% 5.90% 5.91% 6.23% 5.01% 4.93% 4.94% 4.73% 10.85x 13.78x 13.97x 10.67x 91.45% 86.83% 86.98% 91.76% 4.33% 4.82% 4.74% 4.36% 3.97% 4.30% 4.25% 4.04% 66.06% 75.35% 75.34% 65.99% 2.33% 2.94% 2.94% 2.39% 29.18% 24.18% 24.23% 26.23% 5.18% 0.00% 0.90% 1.09% 3.98% 1.83% 0.58% 1.57% 0.29% 0.82% 5.17% 0.90% 1.07% 3.98% 1.83% 0.58% 1.58% 0.29% 0.83% 4.51% 1.29% 1.41% 2.95% 1.37% 0.38% 1.13% 0.27% 0.66% 5.15% 0.00% 1.08% 1.34% 3.99% 2.04% 0.50% 1.43% 0.07% 0.56% 5.14% 1.08% 1.28% 3.99% 2.04% 0.50% 1.44% 0.07% 0.57% 4.23% 1.20% 1.31% 2.89% 1.38% 0.36% 1.08% 0.14% 0.67% 5.47% 0.00% 0.82% 0.95% 4.27% 2.38% 0.71% 1.17% 0.39% 0.21% 5.48% 0.82% 0.92% 4.27% 2.38% 0.71% 1.18% 0.39% 0.21% 5.01% 1.50% 1.61% 3.29% 1.79% 0.48% 1.00% 0.22% 0.42% 4.93% 0.00% 0.76% 0.87% 3.88% 2.16% 0.64% 1.07% 0.30% 0.34% 4.94% 0.76% 0.85% 3.88% 2.16% 0.64% 1.07% 0.30% 0.34% 4.73% 1.31% 1.41% 3.24% 1.78% 0.47% 0.98% 0.18% 0.41% 7.59% 4.12% 4.98% 3.32% 0.15% 7.59% 4.12% 4.89% 3.32% 0.15% 6.45% 4.57% 4.98% 1.83% 0.05% 7.02% 3.77% 4.66% 3.18% 0.07% 7.02% 3.77% 4.46% 3.18% 0.07% 6.21% 4.46% 4.88% 1.73% 0.02% 6.10% 5.08% 5.91% 0.90% 0.12% 6.10% 5.08% 5.73% 0.90% 0.12% 6.50% 5.52% 5.95% 0.96% 0.02% 5.90% 4.97% 5.69% 0.94% 0.00% 5.91% 4.97% 5.59% 0.94% 0.00% 6.23% 5.37% 5.78% 0.85% 0.01% Interest expense …composition, rate and volume effects for PNC and Community National Bank PNC BANK, NATIONAL ASSOCIATION RISK RATIOS COMMUNITY NATIONAL BANK Dec-03 Dec-04 Dec-03 Dec-04 Pg # CALC BANK PG 1 CALC BANK PG 1 CALC BANK PG 4 CALC BANK PG 4 Interest Expense: Composition, Rate and Volume Effects Rate: Avg, interest cost of interest bearing liabilities 3 1.24% Memo: Interest expense / Earning assets 1 1.09% Volume: All Interest bearing debt (avg.) / aTA 1 72.73% Mix and Cost of Individual Liabilities:* Total deposits (avg.) / aTA: 6 73.72% Cost (rate): Int bearing Total deposits 3 1.20% Core deposits (avg.) / aTA 6 67.41% All other deposits (avg.) / aTA 6-calc 55.93% Trans (NOW&ATS) Accts (avg.) / aTA 6 2.40% Cost (rate): Trans (NOW&ATS) Acts 3 #N/A MMDA's and other sav. Accts (avg) / aTA 6-calc 42.29% Cost (rate): Other savs deposits* 3 #N/A Time deposits under $100M (avg.) / aTA 6 11.24% Cost (rate): All oth time dep. (CD<100M) 3 #N/A Volatile (S.T non core) liab (avg.) / aTA 10 9.85% Large CDs (inc. brokered) (avg.) / aTA 6 3.23% Cost (rate): CD's over $100M 3 3.44% Fed funds purchased & resale (avg.)/ aTA 6 0.74% Cost (rate): Fed funds pur & resale 3 2.95% Memo: All brokered deposits (avg.) / aTA 6 2.36% All common and preferred capital (avg.) / aTA 6 9.44% 1.27% 1.62% 1.50% 1.44% 1.51% 1.51% 1.48% 1.98% 1.39% 1.34% 1.74% 1.07% 1.41% 1.34% 1.28% 1.31% 0.95% 0.92% 1.61% 0.87% 0.85% 1.41% 70.78% 80.81% 73.70% 74.97% 80.65% 53.76% 55.17% 75.51% 54.29% 56.69% 74.88% 73.84% 1.22% 68.16% 55.41% 2.23% 0.90% 42.15% 0.57% 11.03% 3.12% 11.47% 3.14% 3.66% 0.99% 1.10% 2.19% 9.54% 67.79% 1.39% 53.90% 42.13% 1.81% 0.60% 30.73% 0.70% 9.59% 2.41% 23.24% 9.02% 2.38% 8.16% 1.15% 2.29% 8.93% 72.45% 1.18% 64.84% 53.38% 2.35% #N/A 41.23% #N/A 9.80% #N/A 13.08% 3.67% 2.89% 1.55% 3.84% 2.81% 8.63% 72.30% 1.14% 64.29% 53.19% 2.15% 0.86% 41.28% 0.60% 9.76% 2.78% 12.11% 3.76% 2.81% 3.18% 1.37% 3.00% 8.72% 68.32% 1.25% 54.64% 43.03% 1.92% 0.62% 32.75% 0.69% 8.36% 2.03% 23.42% 8.99% 2.17% 8.00% 1.41% 2.81% 9.39% 91.72% 1.52% 84.26% 45.73% 6.55% #N/A 25.67% #N/A 13.51% #N/A 8.03% 7.46% 2.83% 0.56% 1.10% 0.00% 7.48% 91.94% 1.49% 84.50% 45.52% 6.58% 0.29% 25.71% 0.90% 13.23% 2.51% 4.10% 7.44% 2.79% 0.55% 1.10% 0.00% 7.27% 85.07% 1.90% 72.07% 54.88% 10.37% 0.63% 22.70% 1.08% 21.81% 2.80% 11.90% 12.41% 2.72% 1.05% 0.82% 0.51% 9.22% 92.02% 1.38% 85.00% 46.77% 7.43% #N/A 28.07% #N/A 11.27% #N/A 7.52% 7.02% 2.82% 0.50% 2.10% 0.00% 7.26% 91.96% 1.33% 84.90% 47.73% 7.02% 0.28% 29.57% 0.98% 11.14% 2.01% 4.84% 7.06% 2.78% 0.55% 1.75% 0.11% 7.16% 84.46% 1.66% 71.52% 53.88% 10.60% 0.59% 22.85% 1.00% 20.43% 2.43% 12.21% 12.39% 2.40% 1.07% 0.98% 0.84% 9.37% Interest income …composition, rate and volume effects for PNC and Community National Bank PNC BANK, NATIONAL ASSOCIATION RISK RATIOS COMMUNITY NATIONAL BANK Dec-03 Dec-04 Dec-03 Dec-04 Pg # CALC BANK PG 1 CALC BANK PG 1 CALC BANK PG 4 CALC BANK PG 4 Interest Income: Composition, Rate and Volume Effects Rate: Avg, yield on aTA Memo: Avg. yield on earn. assets (rate) 1 4.98% 4.89% 4.98% 4.66% 4.46% 4.88% 5.91% 5.73% 5.95% 5.69% 5.59% 5.78% Volume: Earn assets (avg.) / aTA 6 82.86% 82.60% 89.84% 82.85% 82.92% 90.08% 85.43% 86.74% 91.45% 86.83% 86.98% 91.76% Non earning assets (avg.) / aTA 6-calc 17.14% 17.39% 9.75% 17.15% 17.07% 9.64% 14.57% 13.27% 8.25% 13.17% 13.03% 7.93% Mix and Yield on Individual Assets:* Total Loans (Gross loans - unearn inc.) (avg.) / 6aTA 57.55% 57.17% 57.69% 57.13% 57.25% 58.22% 65.76% 64.10% 66.45% 62.05% 61.33% 67.80% Yield (rate): Total Loans & Leases (te) 3 5.48% 5.48% 5.66% 5.04% 5.04% 5.47% 6.89% 6.89% 6.91% 6.90% 6.90% 6.58% Total Investments (avg.) / aTA: 6-calc 26.33% 26.46% 26.43% 26.60% 26.52% 26.50% 20.36% 23.28% 21.82% 25.50% 26.35% 20.98% Total investment securities (avg.) / aTA 6-calc 21.41% 21.90% 22.56% 22.12% 22.03% 23.03% 16.43% 14.97% 17.89% 20.83% 20.78% 17.81% Yield (rate): Total invest secs. (TE) 3 3.99% 3.81% 4.18% 3.54% 3.51% 3.98% 2.94% 3.32% 4.08% 3.00% 2.92% 3.91% Yield (rate): Total invest secs. (Book) 3 3.99% 3.81% 4.00% 3.52% 3.48% 3.84% 2.86% 3.24% 3.75% 2.91% 2.83% 3.61% Trading account assets (avg.) / aTA 6 1.61% 1.63% 0.39% 1.92% 2.09% 0.34% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 6-25 Quick quiz 1. What individuals or groups are likely to be interested in the banks’ level of profitability and exposure to risk? 2. What are the principal components of ROE, and what does each of these components measure? 3. Suppose a bank has an ROA of 0.80% and an equity multiplier of 12x. What is its ROE? Suppose this bank’s ROA falls to 0.60%. What size equity multiplier must it have to hold its ROE unchanged? 4. What are the most important components of ROA and what aspects of a financial institution’s performance do they reflect? Bank risk …Popular measures of overall risk 1. Standard deviation (σ) or variance (σ2) of stock price 2. Standard deviation or variance of net income 3. Standard deviation or variance of ROE & ROA The higher σ and σ2, the greater the overall risk 6-27 Bank risks … most important types of risk 1. Credit risk 2. Liquidity risk 3. Market risk 7. Reputation risk 4. Interest rate risk 8. Strategic risk 5. Operational risk 9. Capital risk 6. Legal and compliance risk 6-28 Credit risk The probability that some of the financial firm’s assets will decline in value and perhaps become worthless resulting from nonpayment or delayed payment on loans and securities. 6-29 Credit risk measures 1. Nonperforming loans/Total loans 2. Net charge-offs/Total loan 3. Provision for loan losses/Total loan 4. Provision for loan losses/Equity capital 5. Allowance for loan losses/Total loan 6. Allowance for loan losses/Equity capital 7. Nonperforming loans/Equity capital Credit risk: more ratios to consider Three Questions need to be addressed: 1. What has been the loss experience? 2. What amount of losses do we expect? 3. How prepared is the bank? Credit ratios to consider What has been the loss experience? 1. 2. 3. 4. 5. Net loss to average total Loan & Lease (LN&LS) Gross losses to average total LN&LS Recoveries to avg. total LN&LS Recoveries to prior period losses Net losses by type of LN&LS What amount of losses do we expect? 1. 2. 3. 4. 5. Non-current LN&LS to total loans Total Past/Due LN&LS - including nonaccrual Non-current & restruc LN&LS / Gross LN&LS Current - Non-current & restruc/ Gr LN&LS Past due loans by loan type Credit ratios to consider (cont.) How prepared are we? 1. Provision for loan loss to: average assets and average total LN&LS 2. LN&LS Allowance to: net losses and total LN&LS 3. Earnings coverage of net loss Credit risk ratios : PNC and Community National RISK RATIOS PNC BANK, NATIONAL ASSOCIATION COMMUNITY NATIONAL BANK Dec-03 Dec-04 Dec-03 Dec-04 Pg # CALC BANK PG 1 CALC BANK PG 1 CALC BANK PG 4 CALC BANK PG 4 Credit Risk Gross loss / Avg. tot LN&LS 7 0.73% Net loss / Avg. tot LN&LS 7 0.59% Recoveries / Avg. tot LN&LS 7 0.13% Recoveries to prior credit loss 7 19.0% 0.00% 90 days past due / EOP LN&LS 8A 0.21% total Nonaccrual LN&LS / EOP LN&LS 8A 0.79% total Noncurrent / EOP LN&LS 8A 1.00% LN&LS Allowance to total LN&LS 7 1.77% LN&LS Allowance / Net losses 7 2.9x LN&LS Allowance / total nonaccural LN&LS7 1.77x Earn Coverage of net losses 7 7.44x Net Loan and lease growth rate 1 -4.55% 0.00% 0.73% 0.59% 0.13% 19.03% 0.21% 0.79% 1.00% 1.78% 2.92x 2.24x 7.44x -4.55% 0.53% 0.41% 0.12% 22.26% #NA 0.13% 0.66% 0.83% #NA 1.44% 4.18x 2.73x 10.92x 10.14% 0.40% 0.28% 0.12% 19.5% 0.00% 0.13% 0.33% 0.46% 1.34% 5.2x 2.92x 11.61x 27.51% 0.00% 0.40% 0.28% 0.12% 19.52% 0.13% 0.33% 0.46% 1.35% 5.23x 4.12x 11.61x 27.51% 0.36% 0.25% 0.11% 23.76% #NA 0.10% 0.46% 0.59% #NA 1.27% 7.51x 3.73x 19.94x 17.96% 0.54% 0.53% 0.01% 6.7% 0.00% 0.16% 0.19% 0.35% 1.07% 2.1x 3.05x 2.57x 2.16% 0.00% 0.54% 0.53% 0.01% 6.75% 0.16% 0.19% 0.35% 1.07% 2.08x 5.49x 2.57x 2.16% 0.26% 0.21% 0.06% 29.21% #NA 0.13% 0.47% 0.66% #NA 1.25% 11.89x 4.35x 23.89x 11.61% 0.21% 0.20% 0.02% 3.1% 0.00% 0.00% 0.16% 0.16% 1.23% 6.7x 7.77x 10.38x 11.49% 0.00% 0.21% 0.20% 0.02% 3.08% 0.00% 0.16% 0.16% 1.23% 6.71x 7.77x 10.38x 11.49% 0.20% 0.16% 0.05% 24.53% #NA 0.10% 0.41% 0.55% #NA 1.20% 14.52x 5.63x 30.80x 14.24% 6-34 Liquidity risk Probability the financial firm will not have sufficient cash and borrowing capacity to meet deposit withdrawals and other cash needs. 6-35 Liquidity risk measures 1. Purchased funds/Total assets 2. Net loans/Total assets 3. Cash and due from banks/Total assets 4. Cash and government securities/Total sssets Liquidity risk ratios : PNC and Community National RISK RATIOS COMMUNITY NATIONAL BANK PNC BANK, NATIONAL ASSOCIATION Dec-04 Dec-03 Dec-04 Dec-03 Pg # CALC 0.00% BANK PG 4 0.00% BANK PG 4 CALC 0.00% BANK PG 1 CALC 0.00% BANK PG 1 CALC Liquidity Risk %Total (EOP) Assets (except where noted) 11 Total equity 10 Core deposits 10 S.T Non-core funding Net loans & leases / Total Deposits 10 Net loans & leases / Core Deposits 10 Avg. Available for sale securities / aTA 6 10 Short-term investments 10 Pledged securities 9.07% 9.07% 8.95% 8.26% 8.26% 9.74% 7.29% 7.29% 9.28% 7.23% 7.23% 9.42% 67.41% 66.75% 53.75% 64.84% 63.23% 54.19% 84.26% 84.95% 71.85% 85.00% 85.04% 71.10% #N/A 11.47% 23.24% #N/A 12.11% 23.42% #N/A 4.10% 11.90% #N/A 4.84% 12.21% 73.73% 73.73% 87.72% 81.00% 81.00% 88.28% 65.90% 65.90% 78.94% 67.35% 67.35% 81.42% 81.11% 81.11% 115.16% 91.76% 91.76% 116.10% 71.36% 71.36% 93.85% 72.89% 72.89% 97.58% 21.41% 21.90% 21.11% 22.12% 22.03% 21.00% 14.44% 13.39% 15.88% 19.38% 19.04% 15.80% #N/A 2.73% 6.25% #N/A 3.02% 5.23% #N/A 5.99% 5.41% #N/A 5.72% 5.26% #N/A 0.00% 28.49% 41.20% 0.00% 29.25% 40.34% #N/A 0.00% 51.76% 54.78% #N/A 0.00% 46.50% 49.08% #N/A Market risk: comprises price risk and interest rate risk Probability of the market value of the financial firm’s investment portfolio declining in value due to a change in interest rates. 6-37 6-38 Market risk measures 1. Book-value of assets/ Market value of assets 2. Book-value of equity/ Market value of equity 3. Book-value of bonds/Market value of bonds 4. Market value of preferred stock and common stock 6-39 Interest rate risk The danger that shifting interest rates may adversely affect a bank’s net income, the value of its assets or equity. 6-40 Interest rate risk measures 1. Interest sensitive assets/Interest sensitive liabilities 2. Uninsured deposits/Total deposits Foreign exchange risk … the risk to a financial institution’s condition resulting from adverse movements in foreign exchange rates Foreign exchange risk arises from changes in foreign exchange rates that affect the values of assets, liabilities, and off-balance sheet activities denominated in currencies different from the bank’s domestic (home) currency. This risk is also often found in off-balance sheet loan commitments and guarantees denominated in foreign currencies; foreign currency translation risk 6-42 Off-balance-sheet risk The volatility in income and market value of bank equity that may arise from unanticipated losses due to OBS activities (activities that do not have a balance sheet reporting impact until a transaction is affected). 6-43 Operational risk Uncertainty regarding a financial firm’s earnings due to failures in computer systems, errors, misconduct by employees, floods, lightening strikes and similar events or risk of loss due to unexpected operating expenses. Ethics in banking and finance services Box – p.187 – France’s Societe General What is the operational risk here? Why? How big is the problem? 6-45 Legal and compliance risk Risk of earnings resulting from actions taken by the legal system. This can include unenforceable contracts, lawsuits or adverse judgments. Compliance risk includes violations of rules and regulations. 6-46 Reputation risk This is risk due to negative publicity that can dissuade customers from using the services of the financial firm. It is the risk associated with public opinion. 6-47 Strategic risk The variations in earnings due to adverse business decisions, improper implementation of decisions, or lack of responsiveness to industry changes. 6-48 Capital risk Probability of the value of the bank’s assets declining below the level of its total liabilities. The probability of the bank’s long run survival. 6-49 Capital risk measures 1. Stock price/Earnings per share 2. Equity capital/Total assets 3. Purchased funds/Total liabilities 4. Equity capital/Risk assets Quick quiz Reading: Ebanking & E-commerce (Insights and Issues - p.182) What is the story of Netbank? What are the implications for profit management? 6-51 Other goals in banking Total Operating Expenses Operating Efficiency Ratio = Total Operating Revenues Net Operating Income Employee Productivity Ratio = Number of Full Time-Equivalent Employees Average performance characteristics of banks by business concentration and size ROE and ROA (up to $10 billion in assets) increases with bank size Employees per dollar of assets decreases with bank size Larger banks have lower efficiency ratios than smaller banks Smaller banks: have proportionately more core deposits and fewer volatile liabilities than larger banks have a proportionately larger earnings base than larger banks have proportionately lower charge-offs than larger banks Bank performance measure by size Assets Size Number of institutions reporting % of unprofitable institutions % of institutions with earn gains Performance ratios (%) Return on equity Return on assets Pretax ROA Equity capital ratio Net interest margin Yield on earning assets Cost of funding earn assets Earning assets to total assets Efficiency ratio Burden ratio Noninterest inc to earn assets Noninterest exp to earn assets Net charge-offs to LN&LS LN&LS loss provision to assets < $100M $100M $1B $1B $10B > $10B 3,655 9.80 59.30 3,530 2.00 70.70 360 1.90 71.90 85 1.20 68.20 8.46 0.99 1.24 11.52 4.18 5.65 1.47 91.86 69.54 2.60 1.03 3.63 0.27 0.22 12.88 1.28 1.73 10.00 4.22 5.73 1.51 91.93 62.22 2.07 1.54 3.61 0.31 0.26 13.48 1.46 2.21 10.90 4.00 5.39 1.39 91.01 55.54 1.21 2.46 3.67 0.43 0.34 14.24 1.30 1.93 9.95 3.43 4.83 1.40 84.39 57.42 0.82 2.93 3.75 0.73 0.34 All Trend Commercial Banks with Size then generally then then 7,630 5.70 65.30 13.82 1.31 1.92 10.10 3.61 5.02 1.41 86.18 57.96 1.06 2.66 3.72 0.63 0.33 Bank risk measures by size Assets Size Asset Quality Net charge-offs to LN&LS Loss allow to Noncurr LN&LS LN&LS provision to net charge-offs Loss allowance to LN&LS Net LN&LS to deposits Capital Ratios Core capital (leverage) ratio Tier 1 risk-based capital ratio Total risk-based capital ratio Structural Changes New Charters Banks absorbed by mergers Failed banks < $100M $100M $1B $1B $10B All Trend Commercial Banks with Size > $10B 0.27 151.5 134.2 1.44 72.67 0.31 196.2 125.7 1.39 82.11 0.43 206.0 125.5 1.47 92.82 0.73 168.0 83.0 1.53 86.68 11.31 16.83 17.93 9.47 12.85 14.06 9.36 12.34 13.92 7.23 9.11 12.07 118 102 3 2 125 0 1 30 0 1 7 0 then then 0.63 174.6 89.9 1.50 86.38 7.83 10.04 12.62 122 264 3 Average performance characteristics of banks by business concentration and size Wholesale Banks Focus on loans for the largest commercial customers and purchase substantial funds from corporate and government depositors Retail Banks Focus on consumer, small business, mortgage, and agriculture loans and obtain deposits form individuals and small businesses Profitability measures of banks by business concentration All Credit Inter Institu Card national # of institutions reporting Commercial banks Savings institutions Performance ratios (%) Return on equity Return on assets Pretax ROA Equity capital ratio Net interest margin Yield on earning assets Cost of funding earn assets Earning assets to total assets Efficiency ratio Burden Noninterest inc to earn assets Noninterest exp to earn assets LN&LS loss provision to assets 8,975 7,630 1,345 34 30 4 5 5 0 13.28 1.29 1.90 10.28 3.53 5.02 1.49 87.13 58.03 0.97 2.13 3.10 0.30 22.16 4.01 6.21 20.52 9.05 11.25 2.20 82.95 45.29 -2.15 11.18 9.03 3.96 10.35 0.76 1.09 8.05 2.50 4.02 1.52 81.47 70.16 0.75 2.51 3.26 0.25 Asset Concentration Groups CommCon – Other All All Ag. Mort ercial summer spec. < Other Other Lending gage Lending Lending $1B <$1B > $1B 1,730 4,424 990 132 465 1,120 75 1,725 4,019 250 101 414 1,026 60 5 405 740 31 51 94 15 11.45 1.23 1.51 10.79 4.07 5.68 1.61 91.91 62.07 2.08 0.69 2.77 0.16 13.48 1.30 1.89 10.09 3.86 5.26 1.40 90.18 57.10 1.40 1.51 2.91 0.22 11.61 1.18 1.81 10.55 3.05 4.80 1.75 92.17 56.46 1.07 1.20 2.27 0.08 16.81 1.66 2.56 11.36 4.71 6.88 2.17 90.73 45.53 0.78 2.26 3.04 1.05 10.03 1.66 2.43 16.94 3.20 4.54 1.33 88.93 72.42 0.34 6.55 6.89 0.11 10.18 1.10 1.41 10.79 3.86 5.40 1.53 92.11 66.92 2.01 1.16 3.17 0.17 13.69 1.35 1.98 10.25 3.27 4.54 1.27 84.36 57.71 0.84 1.96 2.80 0.07 Risk measures of banks by business concentration Asset Concentration Groups All CommCon – Other All Credit Inter - Ag. Mort Institu ercial summer spec. < Other Card national Lending gage Lending Lending $1B <$1B Asset Quality Net charge-offs to LN&LS 0.56 4.67 0.91 0.21 0.30 0.12 Loss allow to Noncurr LN&LS 167.8 215.8 135.3 156.7 206.3 97.1 LN&LS provs. to net charge-offs 90.6 108.8 63.1 118.3 105.2 100.2 Loss allowance to LN&LS 1.34 4.27 1.74 1.43 1.30 0.53 Net LN&LS to deposits 91.69 239.79 69.91 76.64 93.90 120.82 Capital Ratios Core capital (leverage) ratio 8.12 16.64 6.05 10.37 8.29 9.10 Tier 1 risk-based capital ratio 10.76 14.59 8.38 14.71 10.14 15.36 Total risk-based capital ratio 13.19 17.34 12.03 15.82 12.18 16.86 Structural Changes New Charters 128 0 0 5 35 4 Banks absorbed by mergers 322 1 2 24 210 26 Failed institutions 4 0 0 0 3 0 SOURCE: FDIC Quarterly Banking Profile, http://www.fdic.gov/, http://www2.fdic.gov/qbp. All Other > $1B 1.57 259.4 85.5 1.66 135.96 0.59 168.4 67.3 1.66 33.54 0.31 155.3 99.4 1.34 67.56 0.25 156.3 52.0 1.16 80.51 8.82 13.07 14.62 15.17 34.70 35.95 10.38 17.32 18.55 7.20 9.45 12.12 1 13 0 77 6 0 5 20 1 1 20 0 Performance indicators related to the size of a firm, 2007 6-58 Questions & Problems 1. Why should banks and other corporate financial firms be concerned about their level of profitability and exposure to risk? 2. Why do the managers of financial firms often pay close attention today to the net interest margin and noninterest margin? To the earnings spread? 3. What items on a bank's balance sheet and income statement can be used to measure its risk exposure? To what other financial institutions do these risk measures seem to apply? 4. Problem 4, 10 and 11 (page 193-6) MEASURING & EVALUATING THE PERFORMANCE OF BANKS Chapter 5 William Chittenden edited and updated the PowerPoint slides for this edition.