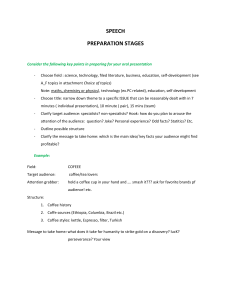

Coffee in Southeast Asia Modernising retail of the daily beverage November 2023 This report is part of Momentum Works’ F&B & new retail coverage “Sip Innovate Repeat” Immersive Workshop by Momentum Academy Reports Coming soon Coming soon Burning questions, report enquiries, customised insights Get in touch: hello@mworks.asia 2 1. All about coffee in Southeast Asia Momentum Works 2023. All rights reserved. The material contained in this document is the exclusive property of Momentum Works. Any reliance on such material is made at the users’ own risk. 2. The business behind coffee chains 3. Competitive landscape and key players 4. Conclusion & perspectives 3 Why are we doing this report? 1 Across Southeast Asia, modern coffee is a US$ 3.4 B market in 2023 Industry annual turnover 2 3 In this report, we decode: $ 284M $ 364M $ 445M $ 947M $ 572M $ 807M ● How is the coffee & modern coffee retail landscape like in Southeast Asia? ● What are the key competitive advantages and success factors behind coffee chains? ● What are some lessons to be learned from the competitive landscape as well as case studies from key coffee chains in Southeast Asia? Coffee chain is a very crowded market, yet more (incl. Luckin Coffee) are entering Players are trying different growth strategies when coffee consumption in the region is not really growing Estimated coffee consumption in Southeast Asia between 2018 - 2021 (kg/capita) 1.31 2018 Source: International Coffee Organisation; World Bank; Momentum Works Insights © Momentum Works 1.33 1.32 2019 2020 1.34 2021 4 Momentum Works 2023. All rights reserved. The material contained in this document is the exclusive property of Momentum Works. Any reliance on such material is made at the users’ own risk. 1. All about coffee in Southeast Asia 5 A brief history of coffee in Southeast Asia … over 500 years Arabica cultivation began in MY Outbreak of coffee rust (a type of plant disease) that almost annihilated Arabica Arabica / Liberica cultivation began in PH cultivation in SEA 1600s 1700s 1800s 1900s Arabica cultivation began in VN Arabica cultivation began in ID Liberica cultivation began in MY Excelsa cultivation began in PH Starbucks and The Coffee Bean & Tea Leaf opened first Southeast Asian store in SG Robusta cultivation began in ID, VN, MY, PH 2000s TH started coffee cultivation as an alternative to growing Opium poppies Founding of local coffee chains selling traditional coffee Entry of newer global players and founding of local chains specialising in modern coffee Luckin opened first Southeast Asian store in SG 2023 Luckin’s success in China (2018-2019) inspired a wave of venture-funded, tech-enabled coffee chain startups in SEA Arabica introduced to TH but not commercially cultivated Colonialism introduced coffee cultivation and consumption habits to many parts of SEA Source: Momentum Works Insights © Momentum Works Rise of instant coffee driving demand for coffee Growth of modern, freshly-brewed coffee market with entry of global players and growth of local players 6 Most of Southeast Asia is located in the “Coffee belt” Southeast Asia Tropic of Cancer Tropic of Capricorn Source: Momentum Works Insights © Momentum Works COFFEE BELT The best coffee in the world is grown in the regions located within the “Coffee Belt”, as they have the most ideal growth conditions (climate, soil composition, altitude etc). 7 Know your beans (Arabic and Robusta are not the only ones) Proportion of global production & consumption Arabica Robusta Liberica Excelsa 75% 25% 2% - 3% < 2% Sweet and tart, chocolatey, fruity and berry flavour Strong, sharp bitter taste, with woody earthy aroma Smoky, earthy, woody or nutty flavours Tart notes, berry and fruity flavours, with unique aroma Caffeine content Acidity Bitterness Taste Source: Momentum Works Insights © Momentum Works 8 Southeast Asia is the largest producer of Robusta beans globally 2nd largest Vietnam coffee producer globally Dominant type: Thailand Produced in smaller amounts: Dominant type: Located along the “Coffee Belt”, Southeast Asia is one of the largest coffee-producing regions in the world. Produced in smaller amounts: Unlike Central and South America which produce the bulk of the popular Arabica beans, the climate and elevation of Southeast Asia favours the growth of the Robusta beans. Vietnam alone contributes to at least 50% of global Robusta supply. Philippines Malaysia Dominant type: Dominant type: Produced in smaller amounts: Produced in smaller amounts: Types of coffee beans produced in SEA Arabica Liberica Robusta Excelsa Indonesia coffee producer globally Dominant type: Produced in smaller amounts: Source: International Coffee Organisation (ICO); Vietnam Briefing; Momentum Works insights © Momentum Works 4th largest Interestingly, Liberica and Excelsa beans are now predominantly harvested and consumed in Southeast Asia, unlike Arabica and Robusta which are more popular globally and are cultivated in multiple regions. 9 Coffee has become a tradition in each of the major Southeast Asian countries Vietnam Thailand Cà Phê Sữa โอเลี้ยง (Oliang) Made by passing hot water through Robusta beans in a phin (traditional Vietnamese coffee filter), into a cup containing condensed milk Prepared from a mixture of Robusta beans, brown sugar and various grains and seeds (like corn, soybeans etc). The Philippines Kapeng Baroko Brewed by letting ground Liberica beans boil in water mixed with brown sugar or muscovado Malaysia & Singapore Kopi Coffee beans are dry-roasted with sugar and a little butter / margarine. Brewed with a sock-like cotton strainer in watering can-sized pots SG: Robusta beans are used MY: Mixture of Robusta & Liberica beans used Source: Momentum Works Insights © Momentum Works Indonesia Kopi Luwak World’s most expensive coffee beans from Civet poop are produced in ID Kopi Tubruk Brewed without a filter. Hot water is poured directly over fine Robusta grounds and sugar 10 Each traditional coffee has staple food pairings, with the exception of Vietnam ปาทองโก, Patongo (fried dough) Pandesal (Filipino bread) 油条, Youtiao (fried dough sticks) Kaya toast & soft-boiled eggs Source: Momentum Works Insights © Momentum Works Gorengan (Indonesian deep-fried snacks) Coffee is enjoyed on its own (or sometimes leisurely with hạt hướng dương / sunflower seeds) 11 Sophistication of coffee ordering is not unique to Italy, but in Southeast Asia as well Traditional Southeast Asia coffee types Western coffee types + Southeast Asia’s coffee culture is now a blend of traditional and Western/new coffee types Source: Momentum Works Insights © Momentum Works 12 SE Asia consumes less coffee coffee per capita than developed world = growth opportunity? Europe China 4.4 ● Predominantly coffee drinkers (with tea still being popular in the UK) ● Mature coffee market ● Predominantly tea-drinkers ● Western influence, perception of coffee as a status symbol, workplace pressure & venture capital spurred coffee consumption growth lately Japan North America 5.0 ● Predominantly coffee drinkers ● Mature coffee market Southeast Asia Coffee consumption 1 in year 2020/21 (kg/capita) ● Prevalence of both coffee and tea ● Colonial past strongly influenced many countries’ coffee adoption 1. Estimated based on ICO numbers Source: International Coffee Organisation (ICO); World Bank; Momentum Works insights © Momentum Works 1.3 0.1 3.5 ● Traditionally tea-dominant ● Post-war industrialisation & westernisation spurred exponential growth in coffee consumption Korea 2.9 ● Traditionally tea-dominant ● Rise of themed cafes and cafe culture popularised coffee consumption in the last two decades 13 Coffee consumption (in kilos) in SE Asia has not been growing - (in value) might, though Estimated per capita growth of coffee consumption and GDP in Southeast Asia 1 between 2018 - 2021 GDP per capita Coffee consumption per capita (kg/capita) $5,000 GDP per capita ($/capita) CAGR = 2.65% $4,405 $4,340 $4,000 $4,106 $4,072 1.40 $3,000 CAGR = 0.80% 1.34 1.33 1.31 Coffee consumption per capita (kg/capita) 1.50 It seems that Southeast Asian consumers are already accustomed to drinking coffee. This might leave little room for further growth in terms of absolute coffee consumption in the near term. This is unlike traditionally tea-dominant markets, like China, where significant growth is imaginable (or realised, as in the case of Korea and Japan. It seems that the growth of coffee market size might have to come from the shift in coffee consumption e.g. from instant coffee to cafe coffee, from mass traditional coffee to slightly more premium, franchised coffee. The key here is about raising the value of each cup of coffee sold to the same consumer base. 1.32 $0 0 2018 2019 2020 1. Estimated based on ICO numbers for ID, VN, PH, and TH. Source: International Coffee Organisation; World Bank; Momentum Works Insights © Momentum Works 2021 14 The presence of different forms of coffee consumption Instant coffee ● ● ● Coffee viewed as a commodity and is mass-produced Prioritise convenience and accessibility People drink coffee for caffeine or just as a… habit (a.k.a. tradition) Still common through informal /street vendors, home (and hotel) consumption Source: Momentum Works Insights © Momentum Works Modern coffee ● ● ● ● Consumers are accustomed to coffee and wanted something better Prioritise cafe culture with some emphasis on quality of coffee (as opposed to sugar & fat) People drink coffee for the experience Success of modern coffee chains like Starbucks inspired the founding of local brands Majority of the SEA coffee players covered in this report are here Specialty coffee ● ● ● ● Consumers are sophisticated Prioritise high-quality coffee and education around coffee industry People drink coffee for the coffee Rise of specialty coffee (stores) with innovation in coffee production styles (roasting, brewing etc) Some players/consumers here, but will remain a niche (a.k.a. small) market 15 Modern coffee is a US$3.4 billion market in 2023 in Southeast Asia Largest players 2023, Southeast Asia modern coffee market size (total annual turnover) # stores in SEA Total size: US$ 3.4 B Thailand $807 M Vietnam $572 M Brands with the largest presence in each country Philippines Malaysia $364 M Singapore $284 M Indonesia $445 M $947 M > 3,900 > 2,000 > 1,300 > 1,000 900 > 800 > 700 Southeast Asia’s consumers are more accustomed to coffee, with the bulk of the consumption driven by instant coffee and traditional brews sold by individual merchants in the mass market. The region’s growing purchasing power has driven demand for higher value and better quality coffee, sparking the growth of both local and foreign-owned modern coffee chains. Indonesia and Thailand are the largest modern coffee markets in Southeast Asia, with growth largely driven by the expansion of local coffee chains. Vietnam, the third largest market, sees very limited presence of foreign-owned chains. Singapore, as usual, spends the most per capita on modern coffee in the region, As the region develops, future growth will be largely driven by the increase in the value of the coffee sold (i.e.: consumption upgrades from instant coffee to freshly brewed coffee), as mentioned earlier. Note: These figures include modern coffee shops, exclude non-modern retail (e.g. hawker coffee in Singapore, and traditional roadside stalls in Vietnam and the Philippines, warung kopi in Indonesia). Modern coffee shops constitute < 10% of the coffee market, the rest of the 90% is by instant coffee and non-modern retail stores. Note that non-modern retail will largely overlap with instant coffee as the coffee in non-modern retail shops (e.g.: hawker coffee) is made with instant coffee. Sources: Industry practitioners interviews; Momentum Works estimates and insights. © Momentum Works 16 Luckin’s initial quick ascent inspired venture investments into coffee chains in SEA Funds raised by coffee chain companies 2018 - 2023 (US$ M) Raised $400M in 2018 500M 100M Raised $150M, IPO 40M 20M 2018 2019 2020 2021 2022 2023 Funding sources Luckin IPO Source: Crunchbase; Reuters; Momentum Works Insights © Momentum Works 17 Momentum Works 2023. All rights reserved. The material contained in this document is the exclusive property of Momentum Works. Any reliance on such material is made at the users’ own risk. 2. The business behind coffee chains 18 First, why do people buy coffee from coffee shops? 1 2 For the function 3 For the beverage For the taste Product-driven People need coffee for the caffeine to stay awake or for a mood booster (which is more essential than many think in this stressful world) 4 Coffee is consumed as a habitual beverage (just like bubble tea, juice, etc). Often associated with flavoured coffee (with, more often than not, sugar & fat) For the space 5 Coffee enjoyed for its taste, flavour and aroma. For true coffee lovers who enjoy high-quality coffee (and often do not believe taste is subjective) For the style Experience-driven Source: Momentum Works Insights © Momentum Works Coffee shops provide alternate spaces for work, relaxation, hanging out (and unfortunately, study, for many). People are willing to pay a premium to enjoy a comfortable space Offering aesthetically pleasing, highly instagrammable decor, drawing people to visit and hang out (They might not come back again after posting on Instagram) 19 Different coffee concepts to meet different consumer needs Many product offerings (often with patience needed) Fewer product offerings (and often faster) Grab & Go Seating space & light bites With full-fledged food offerings Functional use Main consumer needs targeted Beverage Taste Space Style Source: Momentum Works Insights © Momentum Works 20 Players offer coffee at different price points for different budgets … By price point and brand positioning Non-exhaustive (obviously) Mass Premium Instant coffee Street vendors Traditional coffee shops Price: < 3 times the price of coffee sold by hawkers Price: > 4 times the price of coffee sold by hawkers Often found in high-traffic areas with many grab-and-goers, includes both formal and informal coffee vendors Tend to be found in more premium locations and prioritise customer experience and store ambience Product offerings skew towards instant and traditional coffee, with the focus placed on price advantage Premium product offerings that use higher-quality coffee beans and more sophisticated preparation techniques Source: Momentum Works Insights © Momentum Works 21 Coffee shops are set up at different formats of locations Traditional and informal Neighbourhood coffee shops & food courts Streetside pushcarts & informal merchants Modern Malls © Momentum Works Office buildings Roadside outlets and kiosks Drive-thru Source: Momentum Works Insights Blended in retail Petrol stations Robotic kiosks Vending machines Convenience stores 22 Coffee chains often sell more than coffee to increase revenue Freshly-brewed coffee beverages Main product offering Food Supplementary products Coffee-related products + 26% of Starbucks’ retail sales mix comes from supplementary products Merchandise Others Some cafes even operate as bistros at night and offer alcohol However, this could add operational complexities to the business, becoming a drag if not executed well Source: Starbucks; Momentum Works Insights © Momentum Works 23 Coffee chains also rely on different expansion models to grow Many coffee chains start with self-operated model, expand into franchising as operations and supply chain mature Cons Pros Revenue stream Self-operated model Franchise model Mainly from consumers through sales of goods Mainly from franchisees through fees (like initial franchise fees and royalties) and sales of goods. Some can come from suppliers through rebates 1 Full control over every aspect of the business, ease of standardisation of quality over operations, product quality, branding etc. Access to external sources of capital, making it easy and fast for the brand to scale without additional leverage and financial risk Higher capital requirements to scale (therefore slower to scale) Loss of complete brand control. Challenging to maintain consistent quality across all outlets due to varying degrees of franchisees’ commitment and ability to meet brand standards. 1. Franchisors make supply arrangements between suppliers and franchisees and receive some commissions from the supplier Source: Momentum Works Insights © Momentum Works 24 The coffee chain market is very crowded, with more still seeking to enter An incomplete list of coffee chain brands in Singapore Southeast Asia’s modern coffee chain market has become very attractive to investors, entrepreneurs, coffee plantation owners and conglomerates with large retail food print. Just in Singapore alone (the smallest among 6 major markets), there are 30+ coffee chains operating, with a few more in preparation to enter the market. While these players often differentiate in concepts, ambience, menu and (if applicable) food pairings, fundamentally many are often more similar to each other than not. Source: Momentum Works Insights © Momentum Works 25 Even retail stores leverage (the aroma of) coffee to engage consumers Source: Momentum Works Insights © Momentum Works 26 With slow coffee consumption growth, coffee chains in SE Asia have two ways to grow As mentioned on page 14, coffee consumption growth in Southeast Asia is slower than GDP growth, both on a per capita basis. Estimated coffee consumption in Southeast Asia 1 between 2018 - 2021 (kg/capita) Which means, for coffee chain players to grow their business, in addition to adding food and other items to the menu, there are two ways (which can be used in conjunction): 1. 1.31 2018 1.33 2019 1. Estimated based on ICO numbers for ID, VN, PH, and TH. Source: International Coffee Organisation; World Bank; Momentum Works Insights © Momentum Works 1.32 2020 1.34 2021 2. Take market share from other players or forms of consumption; Convince the consumers to upgrade and spend more on each cup (some call it premiumisation); To achieve each (or both), players need to have a clear and valid strategy, sound understanding of the evolving competitive dynamics, and of course good execution. 27 Having good value propositions is not enough to stand out Value propositions used by tech platforms 多 快 好 省 Selection Speed Quality Savings Ecommerce platforms As such, competing on products alone will no longer be sufficient and players need to find other methods to make themselves stay ahead of the competition. * Non-exhaustive © Momentum Works Within the coffee space, many players are offering multiple value propositions to differentiate themselves and stay ahead of the competition. However, unlike in ecommerce which is fairly consolidated with dominant giants in each space, the coffee market remains very crowded (a.k.a. fragmented) with multiple players competing within the same value propositions. The same can be applied to coffee Source: Momentum Works Insights “多快好省 (Selection, Speed, Quality, Savings)” , which was initially the guiding principle introduced by Chairman Mao Zedong of China to build up a “socialist economy”, is now used by many Chinese tech companies as their value propositions. This same concept can be applied to other businesses as well. Sip, Innovate, Repeat: Immersive workshop through coffee and bubble tea - a programme by Momentum Academy 28 In fact, most differentiations are superficial and will not convert into lasting advantage Four typical differentiations that do not last: 1 Coffee taste 2 Novelty attracts initial attention, but wears off quickly (6 months is usually a good gauge). This means the need for constant reinvention to maintain a competitive edge, which makes it an unsustainable business model. Taste is highly subjective and most customers lack discerning palates for nuanced flavors in coffee. Scaled chains aim for mass appeal, prioritizing consistency in taste over complexity or sophistication. 3 4 Source: Momentum Works Insights © Momentum Works Novelty concept Sourcing Quality, personalised service Owning a plantation offers supply chain control and brand appeal. However, as coffee is a commodity where individual plantations do not set the price - the key is your scale as a customer, not a grower. Personalized service enhances brand value but faces cost and consistency challenges for mass brands. Besides, it is hard to beat (or even match) Starbucks at its own game. 29 How to build lasting advantage at scale 3 important factors for a winning coffee chain proposition Clear category leadership Efficient operations (Tech & data) Strategic locations The key to outperforming competitors: Extensive use of tech & data in areas like: Location impacts visibility and accessibility: 1. Define the category 1. Store operations 1. Shopping malls & streetside Competing with Starbucks their way can only succeed if they make a fatal mistake (which you can’t bet on) Ordering, payment, inventory management etc Ability to accommodate multiple cafes. More intense competition for patrons 2. Category has to be big enough Acquisition, consumer behaviour, loyalty etc 2. Other prime locations Large categories offer more customers, economies of scale, and extensive revenue potential than niches. 3. Product development Includes office buildings and petrol stations. High-traffic areas but limited openings 3. Way better than your competitors 4. Franchise management A slight edge won't significantly change consumer behavior or make you stand out. Supply chain, communication & training etc. Source: Momentum Works Insights © Momentum Works 2. User operations Research, innovation, quality control etc. It is a retail business, after all. And we all remember the mantra “location, location, location” 30 Leading coffee chains in China are taking learnings from tech companies x User operations Product development and iteration Customers have to register for user accounts online before they can order. Every order is made online and the data is captured. Have a complete user record of each customer and the system can push prompts to get the users to spend more Data-driven product development. Companies are not focused on launching the perfect product at once. Instead, the focus is placed on making incremental improvements every time a product launches based on sales numbers and customer feedback. Operations management Extensive use of tech and data to manage entire operation. This reduces the need for human intervention for mundane tasks, minimises operational choke points (eg: ordering, payment etc) while automating other operations (eg: inventory management, production) * See Luckin case study (pages 43 - 45) for more information Source: Momentum Works Insights © Momentum Works 31 Momentum Works 2023. All rights reserved. The material contained in this document is the exclusive property of Momentum Works. Any reliance on such material is made at the users’ own risk. 3. Competitive landscape and key players 32 Comparison of a few notable players in the region (1/2) Starbucks Cafe Amazon Trung Nguyen Kopi Kenangan Yakun Luckin Presence in SEA # stores in SEA > 2,000 Local licensing > 3,900 Franchise > 600 Self-operated + Franchise > 860 Self-operated > 70 Franchise 20 (growing) Self-operated Premium Non-premium Non-premium Non-premium Non-premium Premium (non-premium in China) Brand positioning Strategy Focus on customer experience (through personalisation) Extensive menu with regular launch of products as well as seasonal or country-specific specials Source: Momentum Works Insights © Momentum Works Leverage parent company, PTT’s (Thai energy giant) extensive gas stations network as main locations and for fast expansion Focus on tradition and appeal to the masses with affordable pricing Specialised in locally sourced and traditional coffee Gained leverage from selling packaged, instant coffee Targets mass market with low pricing strategy Focus on grab-and-go stores with limited seating areas in kiosks Operates through a “no franchise” model Leverages technology to optimise operations (100% app-based orders and payments, digitalisation of coffeemaking operations and Coffee is often paired with food (especially the inventory management brand’s iconic toasts) to etc.) raise sales Focus on the nostalgia element with product offerings prepared in the traditional way 33 Comparison of a few notable players in the region (2/2) Highlands Coffee ZUS Coffee Kopi Janji Jiwa Toast Box Inthanin Tealive Presence in SEA # stores in SEA Brand positioning Strategy > 700 Self-operated + some franchise > 280 Self-operated 900 Franchise > 80 Franchise > 1,000 Self-operated + Franchise > 800 Franchise Non-premium Non-premium Non-premium Non-premium Non-premium Non-premium Owned by Jollibee Vietnam Focus on providing an authentic Vietnamese coffee culture experience through its coffee menu (traditional coffee, locally-inspired drinks) and cafe ambience and design Source: Momentum Works Insights © Momentum Works Part of Indonesian F&B chain Jiwa Group; High store density (often kiosk format) with affordable products, Leverages technology to often provides bundle optimise operations (app packages and ordering etc.). Looks and promotions feels very similar to Luckin Focus on making specialty, hand-drafted coffee affordable for the masses Leverage parent company, Bangchak’s (Thai petroleum and energy conglomerate), petrol stations network Toast Box outlets are typically attached to the as main locations. main BreadTalk bakery or A key alternative to Cafe in a BreadTalk-owned Amazon (previous page) food court for better footfall and to raise sales Owned by the BreadTalk Group (a Singapore F&B corporation) Malaysia’s most recognised bubble tea brand that expanded product offerings to include coffee Leverage the existing store network to increase overall sales and attract new consumers 34 The subsequent slides cover case studies on a few specific players in the region Case study 1 Case study 2 Case study 3 Case study 4 Case study 5 Starbucks Kopi Kenangan Yakun Kaya Toast Luckin Coffee Flash Coffee ● Most renowned coffee chain with over 34,000 stores worldwide ● Synonymous with premium coffee and its unique customer experience, which comes with ops complexity ● 2nd largest coffee chain in Indonesia serving authentic Indonesian coffee with a modern flavor twist ● Venture funded, reaching unicorn status in 2021 (valuation > $1 B) Source: Momentum Works Insights © Momentum Works ● Singapore brand which standardizes traditional coffee, toasts with an element of nostalgia ● Recognised as a ”cultural icon” by Singapore Tourism Board ● Largest coffee chain in China with over 10,000 stores, overtaking Starbucks in China ● Runs on a fully online ordering and payment system, leverages tech and data for all operations ● Once among the fastest growing tech-enabled coffee chains in SEA - now crumbling ● Bright yellow storefront and “tech-driven” business model inspired by Luckin has it learnt effectively? 35 Case study 1: Starbucks Founded in 1971, Starbucks is now a globally renowned coffeehouse chain that has become synonymous with premium coffee and its unique customer experience. Starbucks had made a successful turnaround from a major existential crisis in the 2000s and continued its remarkable growth story. Pre-1990s 1992 1995 - 2003 2004 - 2007 2008 1971: Founding of Starbucks as a coffee bean and equipment seller IPO on Nasdaq Begun serving Frappuccino Introduced the Starbucks card Customers started leaving due to poor customer experience 165 stores Debuts first album “Blue Note Blend”, containing soundtracks played in stores Launched My Starbucks Rewards loyalty programme 2005: > 10,000 stores Stock price dropped by 45% Among one of the first businesses to offer free unlimited Wifi to customers Schultz came back; 18,000 jobs cut, closed > 900 underperforming stores Started On a First-Name Basis initiative where baristas wrote customers’ names on cups Exited entertainment business to refocus on coffee Acquired Teavana Transited into coffeehouse concept and started serving latte Opened first store outside of US in Vancouver, Canada Howard Schultz kept coming back (as CEO) Founding Source: Momentum Works Insights © Momentum Works Started looking for new business opportunities (Launched first movie and record label) Expanded beyond North America, starting with Japan and SG 2006: Stock price reached $19.82 1987 - 2000 2009 - 2012 2014 - 2017 2014: > 20,000 stores Launched Starbucks Mobile Order & Pay Opened first Starbucks Reserve Roastery Crisis 2019: > 30,000 stores Opened first-ever Starbucks Pick-up only store Introduced strawless lids for iced beverages Opened first Starbucks Signing Store which hired individuals with hearing impairment 2022 - 2023 2008 - 2017 Exponential growth 2019 - 2023 Rebound 36 Customer experience at the heart of the strategy Customer service Personalisation and customisation Ambience and environment Starbucks’ baristas undergo rigorous training not just in coffee-making, but also in areas of hospitality and crisis/conflict management, so to ensure a warm and seamless experience for the customers. Starbucks has more than billions of ways for customers to customise a drink that best suits their needs. This is further supported by the baristas’ efforts to personalise each cup with the customer’s name and build emotional connections with the customers. Heavy emphasis placed on creating an inviting cafe environment through the usage of ambient lighting, cosy furniture, warm colours and free WiFi. This effectively helped to characterise Starbucks as a “third place” for customers to work or socialise outside of the home and office. Starbucks is more than just a place to buy a cup of coffee, it is a place to experience a good cup of coffee Source: Starbucks; Momentum Works Insights © Momentum Works 37 Starbucks’ focus on customer experience also brings huge complexity (and long queues) 383 billion Number of different possibilities to order a latte Starbucks’ customisation options value-add to the overall experience that customers have with the brand. Despite bringing good revenue for the brand (since these additions are charged accordingly), the myriad of combinations add operational complexities. Employees are often overwhelmed and overall production time is increased. As a result, customers have to wait longer which translates into lower customer satisfaction & store throughput. 5 mins Average waiting time for a cup of coffee at Starbucks In addition, this also translates into higher (and continuous) training costs (as well as a smaller recruitment pool) for the baristas. Howard Schultz’s return to the company in 2022 saw the creation of a speed-up plan to tackle this issue. While this seems like a step in the right direction, more time is needed to see the true effects of such changes. Perhaps some inspiration can be taken from how Elon Musk radically restructured the manufacturing process (with significant enhancements in throughput) at the Tesla Gigafactory. Source: Bloomberg; Starbucks;Technomic; Momentum Works Insights © Momentum Works 38 Case study 2: Kopi Kenangan Founded in 2017, Kopi Kenangan is one of the fastest-growing grab-and-go coffee chains in Indonesia with the aim of offering high-quality coffee at affordable prices. The company has also expanded horizontally since then and has multiple F&B brands under its umbrella. 2017 … Founded: Co-founders Edward Tirtanata and James Prananto started the brand to fill the huge void between low-priced coffee sold by street vendors and premium coffee by global chains 2019 Launched mobile app 2020 2021 2022 2023 Launched Kenangan Academy to offer training to employees Achieved unicorn status Launched bottled ready-to-drink coffee, Kenangan Hanya Untukmu (“Just for you”) > 800 outlets in ID, 5 outlets in MY Launched Chigo (fried chicken brand) and Kenangan Manis (soft-baked cookies brand) Launched Cerita Roti (bread brand) Launched Kenangan Heritage Café (premium coffee brand) Expanded horizontally, added several brands under the umbrella of “Kenangan Brands”. Source: Momentum Works Insights © Momentum Works Expanded to SG Expanded to MY Regional expansion 39 Minimising operational costs to keep coffee affordable for the price-sensitive masses Cost breakdown of coffee chains Rental costs are kept to a minimum Store-level margins ~ 90% of outlets do not have seating areas Cost of goods sold Franchise fees Manpower Rental ~ 10% of outlets have a Typical global chain store Source: Kopi Kenangan; Tech In Asia; Momentum Works insights © Momentum Works Kopi Kenangan mainly targets the grab-and-go market (inclusive of both self-pickup and delivery), eliminating the need for seating and creating of ambience that cater to better customer experience. This means that outlets do not have to be big or in the most visible/premium locations, reducing overall rental costs. The company can then invest the capital into improving operations through better technology and equipment and purchase higher quality ingredients. This allows Kopi Kenangan to offer decent quality coffee at low prices. That said, while Kopi Kenangan (or Kenangan Coffee, as it is known internationally) is doing much better compared to many ventured funded coffee chains from the region (Case study 5), its level of technology use is still not at the same league as Luckin Coffee (case study 4). simple cafe environment 40 Case study 3: Yakun Kaya Toast Founded in 1944, Ya Kun’s brand is a Singaporean household name best known for its coffee and kaya toasts that are still made with traditional recipes. With outlets in major malls, this cultural icon of Singapore has also expanded to more than 10 countries. 1936 … Loi Ah Koon started his food store business selling, coffee, eggs and toasts 1944 Founding: Loi formally registered the business as Yakun Coffeestall … 1972 - 1984 … Multiple rounds of store relocation due to location and rental issues Yakun Coffeestall’s popularity grew during this period due to its good toast and coffee 1998 - 1999 2000 2003 Renamed to Yakun Kaya Toast Launched franchise model Launched first overseas outlet in ID … 2023 > 70 outlets in SG, 50 outlets globally Loi retired and his son took over the business Opened second store Small family-run business with no ambition to expand Source: Momentum Works Insights © Momentum Works Expansion and franchising under new leadership 41 Standardisation of the traditional coffee drinking experience Historically, traditional Singaporean coffee is often sold in open-air hawker centres or kopitiams (coffee shops) at low prices. As a brand that anchors on the idea of tradition and nostalgia, Yakun aims to not just recreate the ambience that most Singaporeans are familiar with, but to improve upon and standardise the entire experience through its all cafes. Hawker coffee stores Price of Kopi Traits S$ 1.10 Yakun’s cafes S$ 2.00 Open-air stores Air-conditioned stores Individual stores with different suppliers and methods of production Standardisation: Same suppliers (incl. Yakun’s own factory) and production methods across stores Source: Momentum Works Insights © Momentum Works Many of Yakun’s stores are located in shopping malls and offer a modern and comfortable air-conditioned space for people to sit down and enjoy their cup of traditional coffee (or even have a casual business meeting). Despite the slight premium paid for a cup of coffee in Yakun’s cafe, prices are still much lower than that of most multinational chains. 42 Case study 4: Luckin Coffee Founded in 2017, Luckin Coffee is now the largest coffee chain in China with more than 10,000 stores. Notorious for its accounting fraud and delisting from Nasdaq, Luckin Coffee has since redeemed itself and emerged as a much stronger business. Its partnership with Moutai has also gained much traction among Chinese consumers with a record sales of 5 million cups in one day. It started global expansion through Singapore in 2022, opening 20+ stores within half a year. 2017 Founding of Luckin Coffee by Jenny Zhiya Qian and Charles Zhengyao Lu 2018 2019 2020 2021 2022 IPO on Nasdaq Muddy Waters report published; US$340m of sales was fabricated Luckin declared bankrupt Luckin completed debt restructuring and ended bankruptcy 2,000 stores Luckin delisted from Nasdaq First store opened in Beijing Fully self-operated model Qian, Lu, and COO Jian Liu fired 4,500 stores Expanded into franchise model Launched Coconut Latte. 100 million cups sold within first year of launch > 7,000 stores Achieved full-year operating profit for the first time in 2022 2023 10,000 stores, overtaking Starbucks as the largest coffee chain in China Launched Moutai Latte. Sold 5 million cups in a day Launched franchising-withown-store model 1 Jinyi Guo appointed as new chairman and CEO 1. Franchising-with-own-store model (带店加盟模式) aims to encourage people who own shops in strategic locations (like malls) to become franchisees, so to speed up expansion plans and secure good locations Source: Momentum Works Insights © Momentum Works Expanded to SG 43 Tech & data mandate translates into competitive advantages across multiple fronts Luckin Coffee functions more like an ecommerce/tech business, not traditional F&B retail User operations App-based ordering captures comprehensive customer data. This How Luckin enables tailored and automated marketing does it based on preferences, order frequency, timing, and favorite products 100% Customer data captured Source: Industry practitioners interview; Momentum Works Insights © Momentum Works Product development and iterations Store operations Every aspect of the product (eg: tastes, flavours etc) is quantified so to make it simpler to track trends. Big data identifies popular items, enabling R&D to create innovative / better product combinations, facilitating product innovation. Fully online ordering and payment, self-service pick-up with QR codes, and automated coffee machines streamline in-store operations. Inventory management is also simplified through tracking of data from ingredient usage in machines and total product sales 108 New products launched in 2022 < 2 mins For the staff to prepare 1 order 44 Luckin’s recent Singapore expansion does not fully mirror its China playbook Luckin Singapore takes a more premium and flexible positioning Momentum Works’ poll with ~1,300 community members (Nov 2023): What do you think of Luckin’s performance in Singapore? China Singapore Mass Premium US$ 1.40 (RMB 9.90) US$ 4.70 (S$ 6.40) Luckin app, WeChat mini programme Luckin app Store format Mostly grab & go style, minimal seating Mixture of both stores with and without seating No. of stores > 10,000 > 20 Positioning Price of Coconut Latte (after discount) Ordering format Source: Google Reviews; Momentum Works Insights © Momentum Works 3% No so great 18% None of my business 54% Unexpectedly good 23% So so 45 Case study 5: Flash Coffee Founded in 2019, Flash Coffee was among the fastest-growing tech-enabled coffee chains in Southeast Asia. With the aim to replicate Luckin’s success and “conquer Asia”, it was very aggressive in its expansion - opening 250 stores in 7 markets within 2 years of founding. However, this quickly turned into a crumble as it started shutting stores in multiple markets from 2022 onwards. 2020 Founding of Flash Coffee by David Brunier (ex-FoodPanda) and Sebastian Hannecker (ex-Bain) 2021 Expanded to Thailand Expanded to Expanded to Expanded to Singapore Taiwan Hong Kong 2022 Expanded to South Korea Built regional HQ in Singapore Expanded to Japan Exited Japan Announced multiple layoffs across different markets 2023 Exited Taiwan Announced $50M funding (which was actually secured the year before) “voluntary liquidation” in Singapore First store opened in Indonesia Period of aggressive growth Source: Momentum Works Insights © Momentum Works Period of downfall 46 Flash Coffee collapsed not because it was fast Lack of industry understanding within the founding team Unclear value proposition Founders had experience in tech, but not retail and (especially) F&B and had to rely on hiring experienced executives to help run their coffee business. For a company that positions itself as a “tech company at its core”, there hasn’t been much tech being developed for Flash to differentiate from its competitors in a crowded market. With such core functions not being handled by founders in the early stages of a startup, it is difficult for Flash Coffee to build a solid foundation. Other than a consumer app that customers are not obligated to use for ordering, Flash does not fully leverage tech to help in the user, product and operation optimisation (unlike Luckin). Leadership focused on funding, rather than operations Despite a tough funding environment, leadership seemed oblivious and focused growth and expansion over cost-cutting and survival. This neglect led to lower product and operations quality due to inadequate management. Investors grew cautious and leadership ended up spending more time fundraising instead of managing operations - a vicious cycle. 47 © Momentum Works Every company tries to stand out, with varying effects Different mindsets of coffee chains Non-premium Premium Location Grab & Go Cafe ambience Store focus Online In-person Service touchpoints Eg: Ordering, payment Employees would only focus on production Smallest selection Employees handle multiple tasks (cashier, production etc) Largest selection Product Eg: tea, coffee, food merchandise Decent number of product that are also highly customisable Source: Industry practitioners interview; Momentum Works Insights © Momentum Works Fast iteration of product innovation Physical environment could directly impact the scalability. Demand for seating (hence large space) in prime locations increases costs and makes it more difficult to acquire new locations as compared to smaller and non-prime locations. Online touchpoints help increase efficiency of operations but eliminate the warmth in customer experience that in-person service can bring. (Does that matter?) Vast selection of products can appeal to a more diverse group of consumers while also giving them more reasons to come back and try other products, but also runs the risk of overwhelming consumers. 48 Through the POP-Leadership lens Leadership: As seen from the case studies, a strong leadership is crucial in steering the company towards success or downfall. Howard Schultz grew Starbucks into an empire during its early days and was called back twice more during times of crisis to steer Starbucks back on track. In contrast, Flash Coffee’s leadership made the critical mistake of focusing on expansion rather than cost-cutting amidst a rapidly deteriorating funding environment, resulting in lapses in operation management and insufficient funds to run existing stores. People: For coffee chains, store employees/baristas are the ones who portray the brand image and determine the quality of the products and services, and hence the sales. Brands like Starbucks and Kopi Kenangan have extensive training programmes (and even built dedicated academy sites) to equip their baristas with the right skills to serve the customers, adding to the overall brand experience. Luckin, however, took the opposite route of minimizing human touch in favour of digital touchpoints. Organization: Within such a competitive industry, all levels of the company need to be agile to respond to rapid changes in the market. Luckin leverages tech and data to create a real-time mechanism connecting the headquarters with the stores to facilitate seamless day-to-day operations. Product: Every company has its flagship product. While some focus on extensive customisation POP-Leadership is a strategy framework created by Guoli Chen, professor of strategy at INSEAD, and Jianggan Li, CEO of Momentum Works. Source: Momentum Works Insights © Momentum Works options (like Starbucks), others prefer to offer a smaller product range that emphasises the story behind the brand (like Yakun). Regardless, companies need to consider their operational abilities before expanding their product range to avoid adding complexities that end up hurting the business. Check out our new book “Seeing the unseen behind Chinese tech giants’ global venturing”, which analyzes experiences, challenges and lessons learnt by Chinese tech companies. Order the book on Amazon now. 49 Momentum Works 2023. All rights reserved. The material contained in this document is the exclusive property of Momentum Works. Any reliance on such material is made at the users’ own risk. 4. Conclusion & perspectives 50 Conclusion With a history of 500 years, Southeast Asia is among the largest coffee producers in the world, especially for Robusta beans. The consumption of coffee has become a tradition in most Southeast Asian countries, where consumption was through instant coffee or a myriad of formats of traditional and/or informal coffee shops and vendors. Over the years, the modern coffee chain market in Southeast Asia has become increasingly attractive to investors, entrepreneurs and conglomerates with large retail footprint, with many local and multinational chains seeking to enter or expand their presence within the region. The initial surge of Luckin Coffee (prior to the fraud case) in 2018 - 2019 led to a surge of venture capital-backed chains in the region. We estimate the modern coffee market in Southeast Asia to be worth $3.4 billion in 2023. Excitement aside, on a per capita basis Southeast Asia’s coffee coffee consumption is still behind the developed world (Western Europe, North America, Korea and Japan). While many interpret this as an indication of huge growth potential, data in the past few years (2018 to 2021) suggest that the growth in per capita coffee consumption (CAGR: 0.80%) lags behind that of GDP per capita growth (CAGR 2.65%). The opportunities, therefore, lie with taking market share from existing players, adding more than coffee to the menu, and increasing the value of each cup of coffee sold to the same consumer base (a key contributor). Otherwise, most of the proposed differentiation revolves around products and services which are largely superficial and do not translate into a lasting moat in the crowded space. Players, therefore, need to look beyond product level and start finding ways to improve their business models while leveraging tech and data to raise operational efficiency across multiple fronts. Such improvements have to be supported by a strong leadership team, a solid organisation structure and capable people. The constantly evolving market offers many case studies, with lessons not only for this industry, but also for all organisations in different sectors looking to innovate. Source: Momentum Works Insights © Momentum Works 51 Introducing the Frappuccino index, a fresh lens on global purchasing power (and affluence) In a world where economic indicators often seem detached from daily experience, we bring you the Frappuccino Index - a practical measure that taps into the ubiquitous presence of Starbucks to offer insights into the relative cost of living and disposable income across the globe. Frappuccino Index 1 2023 of key global cities (NYC = 100) Bangalore Hanoi, Ho Chi Minh Bangkok Jakarta Using the price of a Frappuccino in New York (NYC) as a benchmark, the Frappuccino Index1 provides a unique, lighthearted perspective for assessing economic status, affordability, and the premium placed on global brands in various locales. Here is how to interpret the Index: 1) Consumer Economic Status (affluence): The proximity to the base reflects the similarity in consumers' purchasing power to that of NYC. 2) Brand Perception: The closer to the base, the less premium Starbucks is seen in the city, offering insights into local consumer culture and the brand's integration into consumers’ daily lives 3) Market Penetration: The nearer to the base, the broader the consumer base for Starbucks products, implying successful market penetration and competitive pricing with NYC. Dubai Kuala Lumpur Manila Paris Shanghai Singapore London Tokyo New York City While the Frappuccino index is not a definitive measure of affluence or economic status, it nonetheless offers a digestible interpretation of the complex economic conditions and consumer behaviour. 1. The Frappuccino Index was created using the 2023 price of a cup of Caramel Frappuccino in size Grande of various key cities globally, benchmarked against that of New York, USA. Source: Momentum Works Insights © Momentum Works 52 Frappuccino Index - the Methodology The Frappuccino Index aims to offer insights into the relative cost of living and disposable income across key global cities by looking into the prices of a specific beverage - grande sized caramel frappuccino - offered by Starbucks. The product is popular amongst consumers in many cities we are familiar with, and the spending on it (hence the pricing), which is largely discretionary, offers a glimpse of affluence of a particular city’s consumers, brand perception and market penetration of international brands. The Index uses New York City as the base (= 100), and computes the other cities’ numbers accordingly. The closer to the base, the more similar that the consumer affluence, brand perception and market penetration are to the level of New York City. Data Collection: ● The contents are based on data and information provided by World Bank and Starbucks and are further supplemented using open-source online data. ● The price of a cup of Grande-sized Caramel Frappuccino from each of the key global cities was obtained from Starbucks’ menu (both physical menus and on the local Starbucks app) of the respective locations. For cities in which physical menus were referenced, we assumed that all stores within the same city charged the same price for their products. We avoid using atypical locations like the airports and duty free malls. ● Leveraging the World Bank’s existing database, the Purchasing Power Parity (PPP) conversion factor (in relation to the US dollar) of each country can be easily acquired. We made the assumption that the key global cities’ PPP conversion factors are equivalent to that of their respective countries. Data Analysis: ● With the data collected, the PPP-adjusted price of the Grande-sized Caramel Frappuccino was calculated by dividing the original price in local currency by the country’s PPP conversion factor. ● The index was subsequently derived by benchmarking the PPP-adjusted price of the Grande-sized Caramel Frappuccino of the respective key global cities against that of New York City. Do note that the Frappuccino Index is meant to be an easy to digest, light-hearted approximation of the complex economic conditions and consumer behaviour across key global cities. It is, however, not meant to be a definitive, accurate measure of affluence or economic status. Source:World Bank PPP Conversion factor; Starbucks; Momentum Works Insights © Momentum Works 53 © Momentum Works About Momentum Works We leverage our insights, community and experience to inform, connect and enable the tech/new economy ecosystem. Academy Advisory Ventures Cultivating dynamic leadership through tech insights and experience Connecting real dots for investors and corporate decision makers Empowering real builders, entrepreneurs and smart investors ● ● ● ● Leadership briefings Workshops & simulations Innovative immersions Bespoke programmes ● Customised research ● Due diligence ● Consulting on strategy, innovation and expansion hello@mworks.asia © Momentum Works ● ● ● ● Investment & deals Cross border expansion [selective] Venture building Angel network Get further insights & leadership briefings from Momentum Works Ecommerce & ecosystem Company anatomy Macro & investment Customised reports: hello@mworks.asia Leadership briefings: academy@mworks.asia Access to all our reports: insights.momentum.asia © Momentum Works Engage Momentum Academy for immersive learning experiences Cultivating dynamic leadership through tech insights and experience Sip Innovate Repeat innovation workshop Infuse customer centricity of Luckin, Starbucks, and other coffee/bubble tea successes into your organisation’s innovation strategy China Digital Leadership immersion Experience cutting edge business innovations, network with business leaders in China & explore business collaboration opportunities Find out more: momentum.academy © Momentum Works Talk to us: academy@mworks.asia Stay up to date with the most current perspectives from Momentum Works TheLowDown blog The Impulso Podcast Candid, unfiltered perspectives from our team and our community Weekly commentary on latest events, and in-depth commentaries on trending topics Subscribe to our newsletter: (click or scan the QR below) thelowdown.momentum.asia © Momentum Works Read our latest book on people, organisation and leadership “Seeing the unseen - behind Chinese tech giants’ global venturing” analyses experiences, learnt by Chinese & Chinese inspired tech companies and bring this back to your organisation. The book vividly illustrates the distinct strategies, practices and leadership styles behind their global success. It is thought-provoking and is filled with insightful lessons and interesting examples. The book is a must-read. This book connects the unique experiences of Chinese entrepreneurs from different generations and brings to life real insights and practical lessons for explorers, investors and other stakeholders. - W. Chan Kim, The BCG Chair Professor, INSEAD; co-director, INSEAD Blue Ocean Strategy Institute; world’s #1 management thinker, Thinkers 50 Get your copy from: © Momentum Works and major bookstores in your country - Eddie Wu, Chairman, Vision Plus Capital; co-founder, Alibaba Group Insights Community Insights | Community | Experience Inform, Connect and Enable tech and new economy in emerging markets hello@mworks.asia Ventures Experience