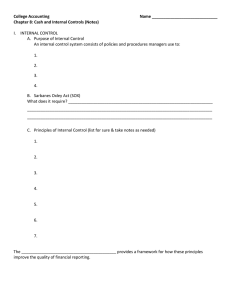

Senior High School Fundamentals of Accountancy, Business and Management 2 Quarter 2 – Module 7.1: Bank Reconciliation Statement \ What I Need to Know This module was designed and written with you in mind. It is here to help you master the Bank Reconciliation Statement. The scope of this module permits it to be used in many different learning situations. The language used recognizes the diverse vocabulary level of students. The lessons are arranged to follow the standard sequence of the course. But the order in which you read them can be changed to correspond with the textbook you are now using. The module has one lesson, namely: Lesson 1: Describe and identify the common reconciling items of a bank reconciliation statement and its nature After going through this module, you are expected to: 1. describe the nature of a bank reconciliation statement; 2. identify common reconciling items and describe each of them. What I Know LET’S CHECK YOUR KNOWLEDGE! YOU MIGHT ALREADY KNOW THEM. Choose the letter of the best answer. Write the chosen letter on a separate sheet of paper. 1. It is a statement prepared to reconcile the difference between cash book and bank balance. A. Bank Statement C. Income Statement B. Bank Reconciliation Statement D. Financial Statement 2. How many reciprocal accounts should be reconciled in a bank reconciliation? A. 1 C. 3 B. 2 D. 4 3. After all the adjustments made, what should be the result of the reciprocal accounts have? A. Different balance C. Unpredicted Balance B. Same balance D. Zero balance 4. Bank reconciliations statement prepared __________ to show that the cash balance per book and bank records has no discrepancy. A. Annually C. Monthly B. Daily D. Quarterly 5. These are items added made by the bank but not yet recorded by the depositor. A. Credit Memo B. 1 Debit Memo C. Deposit in Transits D. NSF Checks 6. A cash or check deposit recorded by the company but not recorded by the bank that deposited after the cut-off. A. Credit Memo C. Deposit in Transits B. Debit Memo D. NSF Checks 7. These are items deducted made by the bank but not yet recorded by the depositor. A. Credit Memo C. Deposit in Transits B. Debit Memo D. Outstanding Checks 8. Which is not a bank reconciling items? A. Bank errors C. NSF Checks B. Deposit in Transits D. Outstanding Checks 9. Which is not a book reconciling items? A. Credit Memo C. NSF Checks B. Debit Memo D. Outstanding Checks 10. Which is a book reconciling items? A. Bank Errors C. Auto Debit B. Deposit in Transit D. Outstanding Checks 11. Which of the following is not an example of a Credit Memo? A. Bank Service Charge B. A collection made by the bank C. Interest Income earned by the account holder D. Proceed from loan added by the bank 12. Which of the following is an example of a Debit Memo? A. Automatic payments of bills on behalf of the account holder B. A collection made by the bank on behalf of the account holder C. Deposit in Transit D. Outstanding Checks 13. Why is bank reconciliation being prepared? A. To gather data from the company’s record and bank statement B. It explains the difference between the reposted cash balance per book and bank C. Provide information for adjusting journal entries D. For reporting 14. Items that are erroneously recorded by the company. A. Book errors C. Collection by the banks B. Bank errors D. Payments of Loan 15. Items that are correctly recorded by the company but erroneously recorded by the bank A. Book errors B. 2 Bank errors C. Collection by the banks Lesson 1 D. Payments of Loan Describe and identify the common reconciling items of a bank reconciliation statement and its nature The word “reconcile,” which, according to Merriam-webster dictionary, means “to cause people or groups to become friendly again after an argument or disagreement.” This concept is related to the bank reconciliation statement, which resolves two different account balances: the book of the business and its bank account balance. What’s In Write down what you think the best answer there is. Write your answer on a separate sheet of paper. Answer the following questions. 1. What is a bank statement? 2. Why does the depositor need a bank statement? 3. Once a bank statement is received, what will the company do? What’s New Read the situation carefully, then reread it again until you understand and find the right answer. Write your answer on a separate sheet of paper. Read the following transactions and identify the cause based on time difference or errors made by the business firm/bank. Put a check sign (√) for the correct cause. TRANSACTIONS TIME ERRORS made by DIFFERENCE the company/bank 1. Bank Fees deducted to the company’s current account by the bank. 2. Checks deposited into the bank but not yet cleared by the bank. 3. Interest added by the bank but not recorded in the company’s cash book. 4. Checks amounting to P4,000 given to ABC Company but recorded as P400 in the cash book. 5. Checks issued to customers for payment but not presented in the bank 3 What is It Nature of Bank Reconciliation Statement Bank reconciliation statement is a monthly report that is prepared to reconcile two reciprocal accounts: the cash balance per book records and the cash per bank balance to show that there is no discrepancy. These reciprocal accounts should have the same balance after an adjustment has made. In preparing a bank reconciliation, we compare the cash balance of the business records corresponding to the amount of the bank statement, which determines the differences between the two to correct the accounting records, check fraudulent transactions and resolve discrepancies. When a bank statement was received, it should be reviewed and compared with the business accounting records. A business that has two or more bank accounts will have separate bank reconciliations statements. The common causes of discrepancy are as follows. Timing differences - prevent either the company or the bank from recording the transaction in the same period. For example, a bank statement that ends March 31, 2019, the company collected the cash of P50,000 at 5:00 in the afternoon. Bank usually closes at 4:00 in the afternoon. In this scenario, it was recorded in the company’s book the cash collected but not reflected in the bank as a deposit. Errors- erroneously record the transaction either of the company or the bank. For example, a check was issued by the company to PLDT, amounting to P5,000. Erroneously the company recorded this as P500. The check amounting to P5,000 was cleared at the bank. In this scenario, there is an error between the company's records and the bank records. These three methods of preparing a bank reconciliation statement of business as follows: a. The adjusted method is a method that adjusts both balances per bank and balances per book to determine the correct cash balance separately. b. Book to Bank Method is a method that adjusts the book balance to agree with the bank balance. c. Bank to Book Method is a method that adjusts the bank balance to agree with the book balance. Bank Reconciliation Format using Adjusted Method PER BOOK Unadjusted Book Balance Add: Credit Memo Interest Income Collection received by the bank Less: Debit Memo NSF Checks Bank Service Charge Add/Less: Book errors Adjusted Book Balance 4 P XX XX XX (XX) (XX) XX P XX Reconciling Items per Book PER BANK Unadjusted Bank Balance P XX Add: Deposit in Transit (DIT) XX Less: Outstanding Checks (OC) (XX) Add/Less: Bank errors XX Adjusted Bank Balance P XX Credit Memo- are additions made by the bank to the account of the depositor. Examples are bank collections and interest income. a. Bank Collections collection of receivables made by the bank on behalf of the depositor. b. Interest Income appears as an addition to the depositors' account given by the bank as an interest to the depositors' account balance. Debit Memo - are deductions made by the bank to the account of the depositor. Examples are bank charges for returned checks due to no sufficient fund (NSF Checks), automatic debits, or payment of bills made by the bank on behalf of the depositor and bank service charge such as for printing, checkbooks, and mailing the bank statement. Bank service charges - are fees such as check printing and processing that the bank deducts from the depositor. NSF (no sufficient fund) check - is a check that was dishonored and returned by the bank to the person or company writing the check because that account did not have enough funds. Book Errors - are items erroneously recorded by the company. For example, the company deposit P20,000 but recorded it P2,000. Reconciling Items per Bank Deposit in Transit- amounts received and recorded by the company but not yet deposited or the amount deposited after the bank's cut-off time. It often happens where deposits were mailed to the bank or checks were cleared after the cut-off. For example, on January 30, 2019, at 2:00 PM, HUGOT Company received a P4,000 check from a customer is recorded at the book. The company deposited the check at 3:30 PM and were informed that their cut-off time is 11:30 AM. In this scenario, the check was credited to HUGOT Company on February 1, 2019. Outstanding Checks - checks issued by the company to payees but not yet encashed with the bank or cleared by the bank. For example, on April 27, 2019, AKO Company issued and recorded a P1,000 check in favor of IKAW Company. April 28, 2019, IKAW Company picked -up the check and was deposited on May 1, 2019, and cleared by the bank on May 2, 2019. In this scenario, the check deducted to the book cash balance in April; however, deduction in the bank was made in May. Therefore, comparing the balance of the company's book and bank records shows that bank records have a higher balance than the company's book. Which of the two records is correct? The company's accounting record is correct that aims to determine the amount of cash it can use, and it was already promised to the payee the amount of P1,000 on April 28, 2019. Bank Errors - are items erroneously recorded by the bank. For example, a check deposit of P10,000 was recorded P1,000. Notes to the Teacher The adjusted method will be used for our learners. As they wish to pursue an accounting degree, the two remaining method will be discussed in their higher accounting subjects. The adjusted method is commonly used in actual accounting practice. 5 What’s More Activity 1 WORD SEARCH! It will boost your brain. Search the corresponding word to identify what is asked below. Write your answer on a separate sheet of paper. 1. What are checks that have been issued by the company but have not yet presented to the bank? 2. What check received then recorded by the company but not deposited in the bank due to the cut-off time? 3. An example of this fee is a check printing deducted to the company's bank account. What kind of check is it? 4. What is the amount added to the company's bank account made by the bank? 5. What is the amount deducted to the company's bank account made by the bank? I P K Q R L V X P U H A Z Q E R L O J C T U S B E X M R W N S U B N F I V M I W J T Q X L B K W D U A W X K S M E E L I N P R G E U F P H Y E S I C I U W M I D X B L C F T T F H L A R B V C B N T F F J Z S X T C D D M L P I K M H E K I W G S K C E H C G N I D N A T S T U O D G N E G R A H C E C I V R E S K N A B E V V L T I S N A R T N I T I S O P E D R O D D E B I T M E M O V A F D F A C F C W N Assessment 1 CROSSWORD PUZZLE Solve the crossword puzzle. It will enhance your speed in thinking 6 Fill in the blank of the correct answer by answering the crossword puzzle provided above. Write your answer on a separate sheet of paper. Down: Across: 1._______ ex. payment of loans 4. _________ex. interest income 2. NSF is no sufficient ________ 5. time difference and ________ 3. Deposit in ___________ 6. compared ________ reciprocal account Activity 2 WHAT AM I? Identify what reconciling item of the book or bank the following independent transaction. Write your answer on a separate sheet of paper. TRANSACTION 1. ABC company deposited a check paid by the customer but was returned by the bank due to the issuer's lack of funds. 2. ABC Company received P2,000 from Romel. The bookkeeper recorded the amount as P200. 3. The deposits of ABC Company earned an interest of P200 for the month. 4. The bank charges a fee for its services of P45. 5. ABC Company received cash of P1,450 on March 31 and was recorded on the company's books. Due to an unforeseen event, the liaison officer was able to deposit the P1,450 in the bank on April 1. 6. ABC Company issued a check of P30,000 to a supplier. Supplier not yet deposited to the bank for payment. 7. ABC Company bank statement for the month of March shows that bank charges of P45 have been incorrectly recorded twice by the bank. 7 RECONCILING ITEM 8. The bank collected P40,000 from the customer. 9. P10,000 monthly payment for the PLDT bill directly charge out of the bank account of ABC Company 10. ABC company bank account was deducted a monthly P6,000 for the payment of its company car loan. Assessment 2 TRUE or FALSE Write the word “True” if the statement is correct and “False” if it is incorrect. Write your answer on a separate sheet of paper. 1. Debit memos are items added by the bank but have not been added by the book as of the cut-off date. 2. Credit memos are items that have been deducted by the bank but have not been deducted per book. 3. Debit memos are collections from receivables by the bank on behalf of the company and proceeds from loans directly added by the bank to the account of the depositor. 4. One of the internal control features in every company is a monthly bank reconciliation in which it is created to report that there is no discrepancy between the cash balance per book records and the cash balance per bank records. 5. After all, adjustments have been made. Reciprocal accounts should have the same balance. 6. Bank reconciliation statement is prepared to reconcile the difference between cash book and bank balance. 7. When a company has two bank account, only one bank reconciliation is prepared for all the accounts. 8. The account holder prepares the bank reconciliation statement. 9. Company’s prepared the bank reconciliation twice in a month. 10. The adjusted (correct) cash balance made from the bank reconciliation is to be reported in the financial statement. What I Have Learned Answer the question to test your understanding. Write your answer on a separate sheet of paper. 1. What is bank reconciliation? ______________________________________________________________________________ ______________________________________________________________________________ 2. What are the three methods of a bank reconciliation? ______________________________________________________________________________ ______________________________________________________________________________ 3. What is the book reconciling items? Explain by giving an example on one of the items? ______________________________________________________________________________ 8 ______________________________________________________________________________ 4. What are the bank reconciling items? Explain by giving an example on one of the items? ______________________________________________________________________________ ______________________________________________________________________________ 5. What are the common causes of discrepancy between cash balance per book and bank? Explain each. ______________________________________________________________________________ ______________________________________________________________________________ What I Can Do Find the match of items in Column A to Column B. Write your answer on a separate sheet of paper. Column A Column B _______1. Deposits that have been mailed by the company to the bank but have not yet received by the bank. a. NSF Checks _______2. Checks which have been issued by the company but not yet cleared in the bank. b. Interest Income _______3. Bank fees deducted by the bank, which is not known to the company before the issuance of a bank statement. c. Service Charges _______4. Deposit of the company that earned interest, which is not usually entered in the company's cash account before the issuance of a bank statement. d. Outstanding Checks _______5. Checks deposited by the company in a bank account, but the bank returned the check and unable to receive payment due to taxpayer’s funds is not enough. a. Deposits in Transit Assessment WORD BOX. Choose from the box the missing word on the sentence below. Write your answer on a separate sheet of paper. additions deductions reconcile difference sufficient encash monthly cut-off bank errors time difference separate reviewed 9 account adjusted same book Errors 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. Outstanding Checks are checks been issued by the company to payee but not yet ___________cleared by the bank. Deposit in Transit often happens where deposits were mailed to the bank or checks were cleared after ___________. Bank reconciliation statement is a ___________ report that is prepared to reconcile two reciprocal accounts. NSF stands for no ___________ funds. Debit Memo is ___________ made by the bank to the account of the depositor. ___________ are items erroneously recorded by the company. A business that has two or more bank accounts will have ___________ bank reconciliations statements. ___________ method is a method that adjusts both balances per bank and balances per book to determine the correct cash balance separately. Credit Memo is ___________ made by the bank to the account of the depositor. According to Merriam-webster dictionary, ___________ means “to cause people or groups to become friendly again after an argument or disagreement.” The common causes of discrepancy seen in bank reconciliation are ___________ and errors. These reciprocal accounts should have ___________ balance after adjustment have made. Once a bank statement was received, it should be ___________ and compared with the business accounting records. A bank reconciliation statement is prepared by the ___________ holder. A bank reconciliation statement is mainly prepared for reconciling the ___________ between the bank balance shown by the cash book and bank passbook. Additional Activities MATCHING TYPE: From the items in the box, classify the items as to reconciling items per bank or per book. Indicate whether the adjustment is an addition (+) or deduction (-) using the related symbol. Write your answer on a separate sheet of paper. Debit Memo Book Errors Outstanding Checks Bank Service Charge Credit Memo Bank Errors NSF Checks Collections of the bank Deposit in Transit Interest Income Box A: Reconciling items per Book Box B: Reconciling items per Bank 10