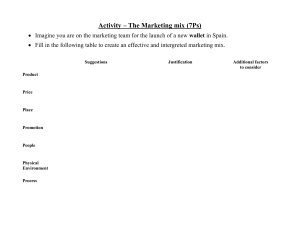

PROJECT REPORT ON Consumer Preference towards Using Mobile Wallets After the impact of demonetisation Under the Guidance of Dr. Charu Rawat Assistant Professor Submitted by Adrika Singh Session 2022 - 2025 Amity Business School Amity University, Lucknow CONFIDENTIALITY AGREEMENT This AGREEMENT is between the office of the register Amity University Uttar Pradesh Lucknow Campus and Adrika Singh a student presently studying at the Amity Business School. The student named above desires to undertake summer project intern in Amity University as a part of her studies. The competent authority of the institute where the student is presently studying has officially recommended the student, confirming her antecedents, track record and good moral character. CONFIDENTIALITY: Confidential information means any information of a secret or confidential nature relating to the internship / training workplace. Confidential information may include, but is not limited to, trade secrets, proprietary information, customer information, customer lists, methods, plans, documents, data, drawings, manuals, notebooks, reports, models, inventions, formulas, processes, software, information system, contracts, negotiations, strategic planning, proposals, business, alliances, and trading materials and I or any other intellectual property of the University. The student / intern agrees to observe the confidentiality requirements of the Amity University, its Disciplinary procedure in all respects and any additional requirements set out by the Amity University. Specifically, the students / intern agrees to observe confidentiality in the following respects. As University intern, I agree that: .1 I will use confidential information only as needed by me to perform my legitimate duties as intern. This means, among other things that. A. I will not seek confidential information for which I have no legitimate need to know, B. I will not any way divulge share, copy, release sell loan revise, alter or destroy any confidential information except as properly authorized within the scope of my internship: C. I will not misuse confidential information or carelessly care for confidential information; and D. I will strive to protect the privacy of all confidential information that I come into contact with. 2. I will safeguard and will not disclose my access code or any other authorization I have that allows me to access confidential information. I accept responsibility for all activities undertaken using my access code and other authorization. 3. I will report to my Head / supervisor activities by any individual or entity that I suspect may compromise the confidently of confidential. Reports made in good faith about suspect activities will be held in confidence to the extent permitted by law, including the identity of the individual reporting the activities; 4. I will be responsible for my misuse or wrongful disclosure of confidential information and for my failure to safeguard my access code or other authorization to access confidential information. I understand that I have no right or ownership interest in any confidential information referred to in this agreement. The University may at any time revoke my access code, other authorization or access or confidential information. At all time during my internship with Amity University, I will act in the best interests of PMC. I have read and understand the above definition of "confidential information "I agree that I will not at any time, both during and after my enrollment in University Internship, communicate or disclose confidential information to any person corporation or entity. It is understood that any breach of confidentiality will result in immediate termination of the internship and that a report of the breach will be made by the concerned Head of Institution. HAVE READ THE ABOVE CONFIDENTIALITY AGREEMENT AND AGREE TO ITS TERMS. AGREED -Adrika Singh (SIGNATURE) Adrika Singh (PRINTED FULL NAME) 10.07.2023 (DATE) Signature of Authorized signatory of the institution (Institution deputing the students) ACCEPTED REGISTRAR AMITY UNIVERSITY, UP LUCKNOW DECLARATION Title of Project - CONSUMERS PREFERENCE TOWARDS MOBILE WALLETS AFTER DEMONETISATION I understand what plagiarism is and am aware of the Amity University's policy in this regard. I declare that a) The work submitted by me in partial fulfillment of the requirement for the award of-degree B.COM HONS assessment in this Term Paper is my own; it has not previously been presented for another assessment. b) I declare that this Te r m P a p e r is my original work. Wherever work from other source has been used, all debts (for words data, arguments and ideas have been appropriately acknowledged and referenced in accordance with the requirements of NTCC Regulation and Guidelines. c) I have not used work previously produced by another student or any other person to submit it as my own. d) I have not permitted, and will not permit, anybody to copy my work with the purpose of passing it off as his or her own work. e) The work conforms to the guidelines for layout, content and style as set out in the Regulations and Guidelines. Adrika Singh Enrollment No- A7004622083 B.com honors STUDENT'S CERTIFICATE Certified that this report is prepared based on the Term Paper undertaken by me from 5th June 2023 to 2h July 2023, under the able guidance of Dr. Chaaru Rawat in partial fulfillment of the requirement for award of degree of Bachelors of Commerce from Amity University, Uttar Pradesh. Dr Chaaru Rawat, Assistant Professor, ABS ADRIKA SINGH A7004622083 FACULTY CERTIFICATE Forwarded here with a Term Paper on “Consumer Preference towards Using Mobile Wallets After the impact of demonetisation” submitted by ‘Adrika Singh Enrollment No A7004622083’ student of B.com (hons) This project work is partial fulfillment of the requirement for the degree of Bachelor's in Commerce from Amity University Lucknow Campus, Uttar Pradesh. Dr Chaaru Rawat Assistant Professor Amity University, Lucknow PREFACE In the contemporary world, mobile phones are ubiquitous. Everything is now attainable with just one touch thanks to technological innovation. The users of mobile phones may transfer money to anyone at any time by utilising the software that are pre-installed on the devices. The key factor influencing the prevalence of mobile wallets is the rise in mobile phone and internet usage. This research was done to determine what influences customers' preferences for mobile wallets. From 150 respondents, the first-level data was gathered using a structured questionnaire. To identify the variables influencing customer preference, frequency analysis and ANOVA were utilised. Additionally, an analysis was done on the effects of demographic characteristics on customer choice for mobile wallets. . TABLE OF CONTENTS Serial No. Topic 1. Title Page/ Cover Page - 2. Student’s Declaration - 3. Certificate - 4. Preface - 5. Acknowledgement - 6. Introduction 1-13 7. Objectives of The Study 14 8. Literature Review 1522 9. Sigificance of The Study 23 10. Research Methodology 2425 11. Data Analysis 2644 12. Findings 45 13. Conclusions 4647 14. Managerial Implications &Future Research Directions 4851 15. Limitations 52 16. References 5354 17. Annexures 5560 INTRODUCTION Today's world has made smartphones a vital component of daily life. The number of smartphone users has drastically grown as they have become more accessible. In addition to the creation of smartphones, several services have been developed to make use of the capabilities of cellphones. Smartphones aren't just used for communication; they may also be used for socialising, entertainment, internet research, and even make payments. Thanks to new age technology, mobile users may now use their cellphones to conduct financial transactions or make payments utilising the phone's built-in applications. Along with accepting/ making payments, consumers may save invoices, coupons, business cards, and receipts in their cellphones. "Digital Wallet" or, more commonly, "Mobile Wallet" is the term used when cellphones may serve as leather wallets. The research's inspiration came from a variety of sources. The word "mobile wallet" is new, to start. In other words, it is a "trendy" subject that has been debated in financial and technical forums recently for a number of years. Even though he may repeatedly see the term "Mobile Wallet" on the internet, he is unsure of what it actually is. In order to better understand how customers view this novel technical service, the research was conducted out of personal desire to learn about mobile wallet in practise. Second, I use a smartphone and would like to make the most of it's capabilities. It's possible that other users share similar desire. I conduct this study in order to get data on people's perceptions of this new service for that reason. Every disturbance, it has been said that offers new chances, and the demonetization declaration done by Prime Minister Mr. Narendra Modi on November 8, 2016, was one such disruption. India’s demonetization ded digital wallet manufacturers took advantage of the ability to grow their market share as a substantial growth opportunity for digital payments. Indian consumers now have a unique platform to accept digital payments in place of cash thanks to demonetization. Prime Minister Mr. Narender Modi has actively advocated the usage of cashless transactions as part of governmental changes since the demonetization of high value notes of Rs. 500 and 1000, which accounted for 86% of the circulation of cash at the time. The demonetization process resulted in an unprecedented rise in digital payments.By February of current year, digital wallet businesses had grown by 271%, reaching US$2.8 billion (Rs. 191 crores) in total. The Indian government and private sector companies Paytm, Freecharge, and Mobikwik, as well as the National Payments Corporation of India (NPCI), which created the Bharat Interface for Money (BHIM) app, had been aggressively promoting a number of digital payment applications, including the Aadhaar Payment app, the UPI app, and others. Digital transfers made possible by apps have altered behaviour and accelerated the use of electronic payments. As a result, isolated places that were previously unaffected by digital payment methods can now transfer money more easily. The digital payment industry has recently risen to the top of the most enticing investment prospects because of India's potential for rapid development. Numerous reasons are supporting the growth of digital payments and the transition away from an economy centred on cash to one with fewer actual currency units. Among these enablers include the rising popularity of mobile internet connectivity, one-touch payments, the expansion of the financial technology sector, and government efforts like tax breaks and incentive schemes. These all help create an atmosphere that is suitable for the growth of digital payments. Online Payment Modes in India In India, there are several online payment options. Which are: Online or mobile wallets: These can be used online and via applications on smartphones. On the app, money can be refilled with debit or credit cards, as well as through net-banking. Following self-declaration and KYC verification, the monthly limits for consumer and merchant wallets are established at Rs. 20,000 and Rs. 50,000 and Rs. 100,000, respectively. Prepaid credit cards: The user's bank account is used to preload these cards. Customers can make purchases using the funds on the card, much like with a gift card, as opposed to utilising credit that has been borrowed from the bank. may receive a limited amount of recharges similar to a cell phone. Debit/RuPay cards are associated with an individual's bank account. can be used to make purchases at ATMs, micro-ATMs, retailers, online, and in stores. Debit cards have eclipsed credit cards in India. There were 630 million debit cards in December 2015 as opposed to 22.75 million in December 2014. • AEPS: The Aadhaar Enabled Payment System enables bank-to-bank transactions at point-of-sale (PoS) by using the 12-digit unique Aadhaar identification number. AEPS services include financial transfers from one Aadhaar to another and balance inquiries. • USSD: refers to leveraging unstructured supplemental service data for mobile banking. It is connected to the merchant's bank account and allows for payments of up to Rs 5,000 per day per client using a GSM mobile phone. • United Payments Interface (UPI): With the help of this technology, many bank accounts will be usable on a single mobile application platform (of any participating bank). combines a number of banking operations, ensures secure fund transfer, and facilitates merchant payments. It facilitates P2P money transactions. The Mobile wallet (M-wallet) combines all of the functionality of today's wallet on a single convenient smart card in place of several cards. The M-Wallet will also include a variety of security features that are unavailable to users of regular wallet carriers. Every credit card transaction requires identification, and the card has a deactivating feature in case it is tampered with. A digital wallet called Mobile-Wallet, commonly referred to as an M-wallet, enables users to trade rapidly and securely in electronic commerce. Commercial mobile wallets for pocket-sized, palm-sized, portable, and desktop PCs are readily accessible and particularly helpful for regular online consumers. They provide a handy, practical, and safe tool for internet buying. They keep track of a variety of financial and personal details, including credit card numbers, passwords, and PINs. M-wallet is an electronic wallet storing the most crucial personal data, including account numbers, passwords, credit card information, and calling cards. M-wallet stores data on cards, almost like a genuine wallet does. A username, a password, and a URL, for example, are many connected pieces of information. Cards can be customised further by adding symbols, colours, and, on certain systems, images. The generated cards are placed in categories to aid in maintaining organisation. One may make different/ separate wallets as needed and store different types of data in each wallet. As an illustration, we might have a personal wallet file for our own cards and a shared office wallet file with our team or an assistant. If necessary, duplicates of the same cards can be kept in additional folders. For instance, depending on the situation, we could wish to store duplicates of the same cards in several folders. For added convenience, we could want our company credit card to be listed in both of our wallet files. Many businesses are launching mobile wallet services to speed up the credit-card ordering process. Mwallets provide us the ability to remember our billing and shipping information so that we can quickly enter it on the websites of participating merchants. E-checks, electronic currency, and our credit card data for various cards may all be stored in m-wallets. Microsoft Wallet is a well-known example of an M-wallet on the market. One must create a Microsoft Passport in order to use Microsoft Wallet. A Microsoft M-wallet may be created after a Passport has been setup. M-wallets can then be used for small payments. Online consumers benefit from increased speed and efficiency as they also remove the need to repeatedly enter personal information on forms. Microsoft Passport offers a number of services, such as wallet, kids passport services, and single sign-on. A client may sign in with just one name and password at an increasing number of participating e-commerce websites thanks to single sign-in services. The customer can utilise a wallet service to make quick online transactions. The Kid's Passport programme aids in securing and managing kids' internet privacy. Our wallet file has to be password-protected. Before we can view the data on any of the cards in a wallet that is password-protected, we must first input the wallet's password. Any wallet that doesn't require a password can be opened by anyone, hence we should always set one for any wallet containing sensitive data. A digital wallet is an electronic gadget or internet service that enables users to conduct transactions online. This may involve utilising a computer to make online purchases or a smartphone to make purchases in-person. The digital wallet can also be connected to a person's bank account. Additionally, they may have stored on their phone their driver's licence, health card, loyalty card(s), and other identification papers. Near field communication (NFC) allows the credentials to be wirelessly sent to a merchant's terminal. Digital wallets are being developed more often for purposes other than the most basic financial transactions, such as credential authentication. The mobile commerce engine is the digital wallet. Customers must type a wealth of data into a form that is limited by the smartphone's screen size if they don't have a digital wallet. While the notion of a digital wallet has been in use since the early days of internet commerce, the mobile wallet area for in-store purchases has only just developed with the release of Apple Pay in the 2014 (soon followed by Google's Android Pay and Samsung Pay). In order to serve eBay, the first significant online marketplace, PayPal developed a digital wallet. The idea of keeping payment information with an internet provider to enable transactions outside of eBay has been around for a while, and PayPal has tried to expand the offering's appeal outside of eBay. When Amazon 1-Click debuted in 2006, it raised the bar for user experience (UX) and expanded how users and businesses perceived the potential of the digital wallet. Since then, other digital and mobile wallets have appeared, and there are currently several distinct methods for making online and mobile proximity payments that are all included under the umbrella term "digital wallet." Digital wallets usually incorporate P2P payments and other payment methods, balance enquiry and reporting capabilities, support for loyalty programmes (rewards, discounts), and other features. The main purpose of digital wallets is to speed up transactions, which deters the use of cash. This boom clearly shows how demonetization has had an impact. The focus of this study is the expansion of mobile wallets in India. mobile wallet technology A digital wallet includes both software and data. The programme offers safety and encryption for both the actual transaction and the personal information. The majority of e-commerce websites may be used seamlessly with digital wallets because they are frequently kept on the client side, are easy to manage, and are kept private. Often referred to as a server-side digital wallet, a thin wallet. A corporation creates and maintains a wallet on its servers. Server-side digital wallets are becoming more and more common among major retailers because to the security, efficiency, and added usefulness it provides to the end-user, which increases their pleasure with their entire purchase. Essentially, the information component is a database of user-submitted data. The shipping and billing addresses, payment information (such as credit card numbers, expiration dates, and security codes), and other specifics are all included in this data. The fact that digital wallets are made up of both digital wallet systems and devices is the most crucial factor to keep in mind. Some digital wallet solutions, like the Dunhill biometric wallet, combine a Bluetooth mobile connection with a physical device for storing cash and credit cards.Advantages of M-Wallet The several advantages of M-wallet include Lower Price Nowadays, cash is not needed to make purchases because tapping on a mobile device has simplified the shopping procedure. The point of sale system lowers the cost of doing business in transactions. Competitive Benefit Mobile wallet software gives clients a more comfortable transaction experience, offering companies who use it a competitive edge in the market. A modern mobile wallet introduces several business prospects and a bigger possibility for revenue, opening up a completely new aspect to payment methods on broad marketplaces. Convenience Customers may make a purchase in a matter of seconds by touching on their mobile device.Customers are satisfied since purchasing is made quicker and easier. The following are some advantages of M-wallets: Transact in payments from anywhere in the world. Transfers are limitless. Simple transfer and regular payments. Utilise our mobile device to manage our account. A prepaid MasterCard bearing the World Ventures logo is offered. Protection of the credit card and bank account numbers. After transactions, emails or SMS notifications Quicker access to commissions. Transfer funds from any bank account to our M-wallet. Get money transferred or wired immediately into your M-wallet. Any bank account in the globe. Transfer money across M-wallets without disclosing personal account information. RATIONALE FOR THE STUDY Due to the government's demonetization programme, mobile wallet usage has become more widely known among Indians. The adoption of M- wallets was restricted by several security concerns and risk factors. Studying user perceptions and understanding of Mwallet usage in India is crucial. The M-wallet provider will benefit from an increase of users in the future. This study will highlight a few of the difficulties users may encounter while utilising e-wallets for their financial activities. This study also discovered that the demonetization accelerated the development of E-wallets in India. Categories of M-wallets Open wallets, semi-open wallets, closed wallets, and semi-closed wallets are the four subtypes of M wallets. Open Wallets: As the name suggests, open wallets are accessible to a wide range of services, enabling users to make purchases, send money to others, and withdraw money from ATMs and banks. Semi-open Wallets: These wallets must be linked to a certain company in order to function. Customers can load funds into an app and utilise those funds to make purchases. • Closed wallets: They are particularly well-liked with e-commerce businesses. In the event that a customer returns or cancels a purchase, the merchant reserves a certain minimum amount. Semi-Closed Wallets: With the caveat that they do not offer redemption or withdrawals, these wallets are highly sought after by retailers. This wallet enables you to establish an account in your name by making purchases from the listed merchants. India's digital wallet : A ground-breaking method of mobile payment in India is PhonePe. On PhonePe, you can do anything from UPI payments to recharges, money transfers to online bill payments. PhonePe provides you with the safest and quickest online payment experience in India, making it much superior than Internet Banking. Google Wallet Google developed Google Pay, a digital wallet platform and online payment system that enables users to make payments with Android phones, tablets, or watches, in order to support in-app and tap-to-pay transactions on mobile devices. Airtel Cash Users may simply reload prepaid accounts or pay postpaid bills with the Airtel Money app. If you have money put into your digital wallet, you may also purchase online. Additionally, it is incredibly secure since you need a 4-digit mPin for every purchase or transaction you complete. Citimasterpass Citi Master Pass, a free digital wallet, speeds up the checkout process while purchasing online. Simply click the Master Pass button once you've entered all your payment and shipping information into your Citi Wallet, and it will handle the rest. Citrus Pay One of the most popular e-wallets in India, Citrus Pay, provides payment options for both companies and consumers through its Citrus wallet. It has unquestionably earned its place as one among the finest mobile wallets in India with a huge client base of 800 million users. Ezetap: Founded in 2011, Bangalore-based Ezetap provides company owners with ways to take card payments using smart devices. Additionally, it delivers electronic receipts to clients via email or SMS. Freecharge: Freecharge, one of the most well-known brands in India right now for digital payments, is well-known for focusing all of their marketing efforts on young people. It's a terrific way to save money by receiving equal amounts of coupons for each recharge you complete. HDFC Pay Zapp : HDFC Pay Zapp, One of the most popular online wallets in India makes digital payment processing simple with one-click transactions. The software allows users to effortlessly compare hotel and travel prices, as well as to purchase music and make payments. Once you've connected your debit or credit card, you can stop worrying about paying bills. Pocket by ICICI They do have a very nifty wallet software, however you might find a Pocket card superfluous given that you're using an e-wallet app to avoid using a card. It is powered by VISA and can be used to pay your friends quickly and effortlessly on any Indian website as well as to send money to email addresses and WhatsApp connections. Jio Money JioMoney, launched recently in 2016 by Jio, is a digital payment app. With JioMoney, one can receive great discounts and offers. Users can also bookmark their frequently visited retailers so shopping can be made quicker than usual. Juspay A payment browser called JusPay Safe processes more than 650 transactions every day. They provide a browser that allows customers to rapidly pay with cards with only two clicks. LIME: Launched by AXIS in 2015, Lime LIME was the first smartphone app in India to offer wallets, shopping, payments, and banking. They allow you to track your expenditure in addition to doing the usual tasks, including processing payments. Their ingenious feature that collects all of your spare change and invests it in both a deposit and a shared wallet tool has surely earned them a spot on the top list of mobile wallets in India. Mobikwik Indian electronic wallet service Mobikwik is based in Gurgaon and lets users keep their money. With only one tap, users of this digital wallet, which Bipin Singh and Upasana Taku established in 2009, may recharge, pay bills, and complete transactions with third parties. Momoexpress : MomoeXpress, an Indian digital wallet with headquarters in Bangalore, promises to offer the quickest checkout process. Despite only being present in Bangalore, they provide a variety of services to locals there. There are more than 3000 shops at your disposal, from paying for your rickshaw trip to hairdressers and spas. MoneyOnMobile The Reserve Bank of India has granted MoneyOnMobile permission to allow consumers to purchase goods, services, and merchandise from registered merchants. With millions of users and access to distant parts of the country, it is a bilingual software that enables online payments for a sizable portion of the population. Mswipe The first mobile point-of-sale system, called Mswipe, was launched in India in 2012. They do offer a device that can be connected to your mobile device in order to accept card payments, even if they don't really provide an app. This app, while not technically a digital wallet, does enable cashless transactions. Olamoney In India, Ola launched its digital wallet, Ola Money, in 2015. It may be used for a variety of items, including buying groceries or plane tickets, but is mostly used to pay for Ola cab rides, making cashless travel a reality. Oxigen, a FinTech company founded in July 2004, is one of the primary providers of digital payment in India. You can send gift cards and online messages to loved ones. Paymate Ajay Adiseshann started PayMate in 2006, and the company released PayPOS in 2012 as a way for small business owners to easily accept debit and credit card payments and conduct online transactions. • Paytm Paytm, which debuted in 2010, is currently the most well-known mobile wallet app in India. Since Paytm payments are practically accepted everywhere, it is tough to avoid making the full transition. Paytm allows users to accomplish almost anything, including everything from pay cell phone bills to buy movie tickets. • PayUmoney: A subsidiary of PayU India, PayUmoney is a free payment gateway service that enables companies to accept payments from customers using debit/credit cards, net banking, and other options. For companies without websites, they also provide SMS and email invoicing services. Buddy State Bank State Bank of India's online wallet, State Bank Buddy, is offered in 13 different languages in India. Users (including those without SBI accounts) may send money to other bank accounts or via Facebook, book hotels or movie tickets, and do a lot more. MOBILE WALLET OVERVIEW Going back in time, the idea of the "Digital Wallet" is where the mobile wallet concept was born. The patent was originally submitted in the US in 1996 by Sam Pitroda, the creator of Digital Wallet. Specifically, he "professed that a digital wallet would consist of a liquid crystal display not much larger than a regular plastic bank card, with preferably a touch-sensitive screen and simple user interface that lets the user flip through the digital wallet in the same manner he/she flips through a leather wallet." (2010) Pitroda S., Desai M. The term "Mobile Wallet" has not yet been given a clear meaning by a particular academicMobile wallets are described as "software applications on a mobile handset that function as a digital container for payment cards, tickets, loyalty cards, receipts, vouchers, and Other items that might be found in a conventional wallet" in the NonConfidential GSMA White Paper. The user may handle a wide range of mobile NFC [Near Field Communication] services from several businesses using the mobile wallet, according to GSMA (2012). In other words, a mobile wallet is "formed" when your smartphone behaves like a leather wallet, allowing you to keep digital cards, receipts, coupons, money (transactions), and more on it. This suggests that you download programmes developed by companies like Google Inc., Apple Inc., or PayPal to your phone and use those programmes to pay for the items you have directly purchased (online or offline). According to Kevin Erickson (2013), a technology writer from the US-based Credera (a technology consulting organisation), mobile wallets aim to provide the following functionalities for a single user: • Showcase and save discounts or account offers from companies that customers have subscribed to or interacted with Find current specials and deals at various business locations. • Provide a search engine and tool for evaluating local businesses like stores and restaurantsact as a credit and debit card payment method. Top five digital wallets in India PAYTM: Launched in 2010, Paytm is an Indian e-commerce retail platform with its headquarters in Noida. One97 Communications owns it. The business started off by providing mobile recharging before moving on to bill payment and ecommerce in India, where it sold products that competed with those from Flipkart, Amazon, and Snapdeal. 2015 saw the RBI grant Paytm a licence to create India's first payments bank. The Paytm QR code supports both offline transactions like mobile recharges, utility bill payments, travel, movie ticket purchases, and event registrations as well as online transactions like parking, tolls, pharmacies, and dining establishments. [On November 18, 2016, PayPal, a company based in California, complained to the Indian trademark authority about Paytm's use of a logo that was similar to its own.[3] As of January 2018, Paytm's market value was $10 billion. MOBIKWIK: Founded in 2009 by Bipin Preet Singh and Upasana Taku, Mobikwik is an Indian mobile wallet and online payment system with headquarters in Gurgaon. It has partnerships with a number of online retailers, including e-Bay, BookMyShow, Dominos, Shopclues, and Snapdeal, to make their wallets accessible as a payment method on e-commerce websites. Mobikwik allows for the recharging of prepaid mobile, DTH, and data cards as well as the utility payments for power, gas and landline connections, as well as postpaid mobile bills. Customers add money to an online wallet so they can make purchases. In 2013, the Reserve Bank of India authorised the business to utilise the MobiKwik wallet, and in May 2016, the business began providing small loans to consumers as part of its service. For people who utilise obsolete 2G mobile networks and reside in areas with poor internet connection, the company developed its MobiKwik Lite mobile app in November 2016. As of November 2016, the company reported having 1.5 million merchants using its service and a user base of 55 million customers. BHIM: Bharat Interface for Money (BHIM) is a smartphone application built using the Unified Payment Interface (UPI) by National Payments Corporation of India (NPCI). On December 30, 2016, during the Digi Dhan Mela at the Talkatora Stadium in New Delhi, Prime Minister Narendra Modi debuted it. It was created to support epayments made directly through banks as part of the 2016 Indian banknote demonetisation and push towards cashless transactions, and it bears B. R. Ambedkar's name. OXIGEN: Being linked with NPCI (National Payments Corporation of India), Oxigen is the first virtual wallet in India to support instant money transfers at any time. Mr. Pramod Saxena established Oxigen Services India Pvt. Ltd. in July 2004 in collaboration with Blue Label Telecom, a South African business, with the goal of providing services to the general population of India through a virtual network for payments and services. The RBI has authorised this mobile wallet. Oxigen has now handled more than 2 billion transactions in 2015. With the assistance of Blue Label Telecom, the business was founded in 2004 by an IIT Roorkee alumni, and it was listed on the South African Stock Exchange. • The supplier of payment solutions enables clients to pay utility bills, recharge mobile/DTH services, move money between accounts, use the Oxigen Wallet, and make other similar payments. As of January 2016, the company purportedly completed 2 billion transactions across 200,000 active retail establishments. According to a study from June 2016, Oxigen has a client base of more than 150 million people and a transaction volume rate of 600 million per year. FREECHARGE: An e-commerce website called Free Charge is based in Mumbai, Maharashtra. In August 2010, Kunal Shah and Sandeep Tandon launched Freecharge. Any prepaid mobile phone, postpaid mobile phone, DTH, and Datacards in India may be recharged online with this service. To reward consumers that recharge with them, Freecharge has partnered with some of the greatest and most well-known food brands, like Peter England, McD, and KFC. Gurgaon is home to the e-commerce website FreeCharge. Any prepaid mobile phone, postpaid mobile phone, DTH, and data cards in India may be recharged online with this service. After rival MakeMyTrip's purchase of Ibibo, Snapdeal purchased Freecharge on April 8, 2015, marking both the largest venture capital exit in India to date and the secondlargest takeover in the Indian e-commerce sector to date. The transaction involved about $400 million USD in cash and shares. For $60 million, Axis Bank purchased FreeCharge on July 27, 2017. LITERATURE REVIEW This section discusses some of the fundamental ideas behind customer acceptance of technology innovations or any innovation at all. Concept of adoption "Adoption" is one of the oldest and most significant notions in the literature on the dissemination of innovations (Eveland, 1979). A procedure, an event, or a state of being can all be referred to as adoption, sometimes all at once.Adoption carries a lot of good connotations and a sense of closure. According to Zenobia (2008), "Adopters are those who adopt as opposed to rejecters who choose not to adopt or non-adopters who have not yet started the process of becoming adopters. Adoption idea has been used as the major variable in many diffusion of innovation studies, and it has effectively provided the primary foundation for generalizability (Eveland, 1979). Zenobia (2008) summarized the Rogers (2003, 5th edition) proposed three different adoption options in his book Diffusion of Innovations: - A single person, such as the consumer, decides whether to adopt optionally. - A decision about collective adoption is made by group consensus. - The choice to accept authority is made by a very small number of people who are in positions of power, prestige, or technical expertise within a group. This research study will primarily focus on customers' optional adoption choices, which implies that it will examine consumer adoption choices. The term "optional" does not, however, indicate that the adoption was made without consideration of outside influences like other people's opinions (family, friends, etc.) or the impact of the image that an advertising agency imposed (Katz, 1962). As a result, adoption is fundamentally a social activity (Zenobia, 2008). Innovation-decision process According to Rogers (1983, p. 165), the innovation-decision process is "a process through which an individual (or other-decision making unit) passes from first knowledge of an innovation, to forming an attitude towards the innovation, to a decision to adopt or reject, to implementation of the new idea, and to confirmation of this decision" (Figure 4). The method was named the Technology Adoption Decision Process (TADP) by Zenobia (2008), and it is also the model that has been referenced the most frequently. The TADP model is ideally suited for use in a wide range of investigations, including those of this size (Ettlie, 1980). Rogers (1983, p. 163) lists 5 steps that make up this conceptualization: - Knowledge: An individual is made aware of the presence of an invention so that she or he can develop a fundamental grasp of the functionality of the innovation. -Persuasion: An individual develops favourable or unfavourable views towards the invention. -Decision: When an individual takes actions that influence their decision to accept or reject innovation. Implementation is the act of a person putting an idea to use. When a person needs confirmation of an innovative decision they have already made. In the event if the innovation's signals clash, he or she may also choose to go back on the earlier choice. Knowledge stage Knowledge stage inaugurates when an individual is introduced about the existence of a person can learn a little bit about the functionality of the invention (Rogers, 1983, p. 164). It's interesting to note that the person unintentionally picks up the existence signal of innovation, according to Rogers (1983). As a result, until people are aware that innovation exists, they cannot actively seek it out. As we can see, in the medical sphere, doctors and other medical professionals are able to learn about new medications that are already on the market thanks to communication channels and messages like salespeople and marketing efforts (Coleman, 1966). With mobile wallet, the situation is the same. The business stakeholders in Finland have a responsibility to disseminate the information by running advertisements, writing blogs, or organising seminars to enlighten the public about mobile wallets. In this stage, Rogers (1983, p. 167) brought up the dichotomy of need vs awareness. "Does a need precede knowledge of a new idea, or does knowledge of an innovation create a need for that new idea?" he questioned. He clarified that up until 1983, there had not been any study that could adequately address this subject. A person may have a need while they are aware of an invention, and vice versa; when they are in need, they will look for the information. As a result, consumer adoption might be motivated by knowledge of an innovation's existence (Rogers, 1983 P 168). Rogers (1983) also highlighted different information types and how they affect customer awareness. However, this section won't receive much attention in this essay. Persuasion stage The mere fact that someone is aware of the invention does not guarantee they will use it. The adoption will be impacted by the decision-making unit's features. They are social standing, beliefs, etc.Such a person might not find the new innovation valuable for him or that it fits into his circumstances at the time. The knowledge will continue to move through the innovation-decision process in order to become relevant. The persuading phase begins at this point. At this point, a person develops a positive or negative attitude towards innovation (Rogers, 1983, p. 169). The knowledge that person knows right now will cause them to think psychologically. He'll look for further details on the invention. Therefore, it's crucial that he uses the knowledge that he finds how he analyses the signals he gets in order to further his own understanding. It's possible to consider innovation to be quite unclear (Feldman, 1994). As a result, it causes a certain amount of doubt in the person, which makes him feel the need for social reinforcement of his attitudes towards the new notion. To make sure he is "walking" in the correct direction, he wants to compare his ideas to those of others. During this phase, customers frequently inquire about the following: "What are the effects of the innovation?" and "What are its advantages and disadvantages in my circumstance?" (1983, Rogers, p. 170). people questions ought to be answered by people who developed mobile wallets. This has a major impact on whether people have a positive or negative opinion of mobile wallets. Adoption or rejection does not directly follow from the development of these attitudes. But it does develop a propensity. Undoubtedly, we are frequently persuaded to accept a new thought when someone informs us of its favourable reputation (Rogers, 1983, p. 170). However, if the innovation is unwelcome, support for rejection [rather than acceptance] will be sought (Seligman, 2006, p. 116). Deciding Phase When a person (or other decision-making unit) engages in actions that result in the adoption or rejection of an invention, the decision stage is said to have occurred. The choice to employ an invention is referred to as adoption. Furthermore, rejecting an invention means choosing not to use it (Rogers, 1983, p. 172). In actuality, if customers haven't used the innovation yet, they won't embrace it. It is vital to assess the invention to determine its applicability to one's circumstances. In other situations, the invention cannot be tested. As a result, ideas that can be tested in smaller groups will have a greater chance of being accepted quickly (p. 172). Seligman (2006) expressed a position that was similar to ours, stating that "partial adoption and vicarious trial adoption allow the individual encounter new stimuli for further adjustment of perceptions of technology for understanding how the innovation can be incorporated into the individual's environment." Distribution of free samples to customers/clients is one of the ideas suggested to help with innovation testing (Rogers, 1983). Implementing a mobile wallet trial is difficult since it involves many different parties who are involved in the operation and might be expensive. To test mobile wallet, it could be necessary for marketing teams to come up with clever and original ideas. It is difficult to overlook that at this point, a person might reject the invention for a number of reasons. Eveland (1979) created 2 distinct categories of rejections: -Active rejection: When a person considers adopting an invention (with or without trying it out) but ultimately chooses against doing so. -Passive rejection (or non-adoption): When a person never gives the invention a second thought. Implementation stage Implementation happens when a person (or other decision-making unit) uses an invention and looks for technical information to support the implementation (Rogers, 1983, p. 174) (Seligman, 2006). The queries "Where do I obtain the innovation?" "How do I use it?" "What operational problems am I likely to encounter and how can I solve them?" are likely to come up for customers in this stage, according to Rogers (1983). (p. 174). In the context of the mobile wallet instance, the businesses should be accountable for making these solutions accessible to customers and providing them with technical support as needed. In this implementation stage, Rogers (1983) proposed the concept of "reinvention" of technology. According to Rogers (1983, p. 176), it indicated "the extent to which an innovation is changed or modified by the user in the process of its adoption and implementation." Simply put, innovation is adaptive and perhaps even evolutionary (Swanson, 1994). The implementation phase may come to a close at this point when the new invention gets institutionalised and regularised as a part of the adopter's continuing activity. Additionally, it may signal the end of the entire innovation-decision process for the majority of consumers. However, for some people, it may go on to the last step, known as "the confirmation stage" (Rogers, 1983, p. 175). Confirmation stage The innovation-decision process model ends with this phase. If the person (or other decision-making unit) receives contradictory messages from the innovation, he may decide to change his mind (Rogers, 1983, p. 184). The individual (or other decisionmaking unit) wants the reinforcement for the innovation decision that he has already made. Depending on the facts he gets, the person may be encouraged by dissonance and change his mind (Seligman, 2006, p. 117). Rogers (1983) proposed that the agents be required to perform the extra task of conveying supportive messages to customers in order to avoid the "conflicting message" from occurring. The agent's belief that adoption will continue automatically once it is achieved, he said, is one explanation for the high incidence of discontinuation in inventions. However, if consumer efforts are not maintained, the discontinuation will occur since most consumers' brains already contain negative messages about innovation (Rogers, 1983, p. 186). Potential determinants of customer acceptance of mobile payments A study paper titled "Exploring Consumer Adoption of Mobile Payments - A Qualitative Study" was released in 2006 by Niina Mallat of the Helsinki School of Economics in Finland. In this work, a qualitative research approach was used to investigate customer acceptance of mobile payments. Since the respondents were from the Helsinki metropolitan region in Finland, six focus group sessions were established and conducted in late 2002 to gather the empirical data (Mallat, 2006). OBJECTIVES OF THE STUDY To research young awareness of mobile wallets in India To determine the preference of mobile wallets among young people following the effects of demonetization, as well as to investigate how users see mobile wallets. To determine how demographic characteristics, affect customer choice for mobile wallet. To determine the variables influencing consumer choice for mobile wallet. RESEARCH METHODOLOGY Meaning of research Research is defined as the creation of new knowledge and the creative use of already available knowledge to offer new concepts, theories, and understandings. "Research is a careful, methodical, and objective investigation conducted to obtain true facts, reach judgements, and establish rules regarding a specific issue in some field of knowledge." Research Methodology Research methods can be used to carefully tackle the research challenge. It may be thought of as a science that investigates how scientific research is carried out. “ Research methodology is the methodical, theoretical evaluation of the methodologies employed in a field of study. In order to address an issue, it involves strategies for describing, analysing, and anticipating events; it is the "hows"; the process or procedures of conducting research. A methodology does not aim to provide solutions, but it does provide the theoretical groundwork for understanding which process, or combination of processes, may be deployed to a specific situation. Research methodology includes all of the following: research designs, target populations, sample sizes and sampling methodologies, data collection instruments, and data processing techniques. Research design The study's management value is influenced by the fact that it was carried out utilising a questionnaire, in which several questions were answered to help the company's strategies be refined. Customers' reviews of the services' quality are investigated and examined. The research aids the business in concentrating on areas for development and the kinds of modifications that need to be made. If the survey results are favourable towards the product, it spurs them on to implement additional policies and programmes. Additionally, it offers client feedback that benefits the business by reflecting on their overall performance. In order to improve all of its workers' capabilities and competitive skills, the firm goes to great lengths to upskill and continuously train them. Target audience My research is focused on professionals, students, and others in India who are familiar with Instagram. Investigational methodology Exploratory research was done for the project. A strong research design consistently has an outstanding impact on the data and elevates the reliability of the gathered and evaluated research data. The optimal study design is sometimes regarded as the one that produces the fewest errors. Hypothesis of the study A hypothesis is either a put out explanation for an event that has been seen or a wellsupported forecast of a possible unintended relationship between multiple phenomena. In Greek, where the word "hypostenia" initially arose, it meant "to put under" or "to suppose." two types of separate hypotheses A null hypothesis is one that might be disproved by the evidence provided by the observed data. This often puts forward an overarching or default stance, like there is no distinction between the therapy and the control. Alternative theory: The constraint being evaluated is invalid. Simply said, it is the opposite of the null hypothesis. This investigation is detailed. After demonetization, a significant section of the populace expressed fear about using mobile wallet or online banking programmes to pay bills, etc. Primary and secondary data are used in this study. Information is gathered from students at several Kanpur-area colleges. Since the data is only gathered once and is finished in two months, this study is cross-sectional. It uses convenience sampling. A Google Docs document was used to generate an online survey that was distributed to responders in order to gather data. Based on previously completed research projects, factors extracted from a literature analysis, expert views, and a pilot study, the questionnaire was constructed and organised. The SPSS (statistics software for the Social Sciences) statistics software and ANOVA statistical tool are used to analyse the data that has been gathered. FINDINGS Sixty two percent of responders are men and 38 percent are women. In the survey, 24% of respondents are under 25, 42% are in their 25s to 35s, 16% are in their 36s to 45s, 10% are in their 46s to 55s, and 8% are above 55. •10% of respondents have completed their high school education, 12% have earned diplomas, 54% have earned their undergrad degrees, 18% have earned their postgraduate degrees, and 6% have earned other degrees. •14% of respondents said they worked for the government, 64% said they worked in the private sector, 10% claimed they were students, and 12% said they did not know. •Only 34% of respondents and 66% of respondents are completely and fully aware of the functions of electronic wallets, respectively. •In response to a question 44% of respondents indicated social media as their primary source of e-wallet knowledge, followed by 34% friends, 10% periodicals, and 12% television. • Every responder uses an electronic wallet to conduct financial activities. •When asked why they chose an e-wallet over other payment methods, respondents gave three responses: time savings (62%), ease of use (28%), and security (10%). •When asked which type of wallet they prefer most often, 12% of respondents replied Paytm, 16% said Phonepe, 54% said Google Pay, and 4% said Apple Pay. Four percent of respondents said Freecharge, four percent mentioned Mobikwik, six percent mentioned Amazonpay, and four percent mentioned others. •When asked what their main reasons were for utilising an e-wallet, 16% of respondents stated money transfers, 52% said recharges, 20% said bill payments, and 12% said all of the above. •When asked why they use an e-wallet, 10% said it made checkout quicker (saving time), 50% said it gave them access to coupons, rewards, and discounts, 8% said it made shopping more convenient, 8% said it was more secure than using cash or a credit card, 6% said it was hassle-free, 14% said it saved them money, and 4% said it was for another reason. •When asked how often they use e-wallets, 10% of respondents indicated once to five times, 14% once to ten times, 20% once to fifteen times, and 56% once to more than fifteen times. • When asked how frequently they used their e-wallets prior to demonetization, 16% replied weekly and 84% stated monthly. •When asked how often they use their e-wallets after demonetization, 12% of respondents replied everyday, 54% said once a week, and 34% said once a month. •When asked how to make payments using an e-wallet, 22% of respondents replied scanning a QR code, 20% said using a UPI ID, and 58% said using a third-party application. •When asked if they agree or disagree that e-wallet usage has increased since demonetization, 86% of respondents said they agree and 14% said they disagree. •Every responder concurred that the use of e-wallets is increased by cash back incentives. •92% of respondents say they are satisfied, while 8% say they are neutral. •Everyone who responded is likely to want to keep using the e-wallet. •Only 24% of respondents said they had trouble using their electronic wallets, while 76% said they had no trouble at all. •58.3% of respondents claimed that setting up would take too long, and 41.7% said that it couldn't be utilised for international transactions. CONCLUSION The purpose of this study was to determine how E-wallets were developing in India. The survey showed that most individuals are aware of electronic wallets and that most educated people routinely use them for financial transactions. The majority of customers choose Google Pay as their electronic wallet. E-wallets will undoubtedly change the other online payment methods in the future. The E-wallet's users are quite happy with how it works. Some of the elements that influence the user's choice Pricing (transaction fees, service fees), Convenience, Ease of Use, Brand Loyalty, Secured Privacy, Utility of Innovation, and E-Wallet Usefulness are factors to consider while selecting e-wallets. Following demonetization, e-wallet usage has swiftly expanded, aiding in the expansion of the industry in India. However, there are several areas where e-wallet providers may do better. MANAGERIAL IMPLICATIONS AND FUTURE RESEARCH DIRECTIONS People should be completely aware of the operation of electronic wallets in order to reap the full benefits of utilising them. •Instead of utilising alternative payment methods, users should start using e-wallets for their financial activities. •To promote the use of e-wallets, the bank system should be properly connected with them. •Small vendors like vegetable dealers, tea shops, and platform-based enterprises should incorporate e-wallets. •The E-wallet providers must increase vendor awareness in the smaller market and improve integration. •The Indian government needs to push businesses to accept payments using electronic wallets. •Providers should strengthen the security of E-wallets. •Payment failure should be prevented going forward, and users should receive cash refunds swiftly. Cash refunds may take three days to a week. •In order to enhance e-wallet usage in the future, e-wallet providers could provide more cash back incentives, scratch cards, and discounts to increase their usage. They should also encourage others to use e-wallets. •In the future, all transactions should be supported via e-wallets. •International transactions should be available, and transaction times should be kept to a minimum. Limitations Unawareness of the mobile wallet and a lack of familiarity with its use. • The platform's unavailability. •Some respondents don't respond to all the questions, which causes a delay in data collecting •The study's time frame was constrained. •The main method of data gathering was a single questionnaire. The responders' responses might not be correct. •Due to scheduling constraints, the study's sample size was capped at 50. •As M-Wallet usage varies from person to person, the study's conclusions might not apply to everyone. REFERENCES 1.Ambarish Salodkar, Karan Morey and Prof. Mrs. Monali Shirbhate, “Electronic Wallet”, International Research Journal of Engineering and Technology (IRJET), Volume 2, Issue 9, December 2015 2.Pinal Chauhan, “E-Wallet: The Trusted Partner in our Pocket”, International Journal for Research in Management and Pharmacy , Vol. 2, Issue 4, April 2013 3.Roopali Batra, Neha Kalra, “Are Digital Wallets The New Currency?”, Apeejay Journal of Management and Technology, Vol 11, No 1, January 2016 4.Trilok Nath Shukla, “Mobile Wallet: Present And The Future”, International Journal in Multidisciplinary and Academic Research (SSIJMAR),Vol. 5, No. 3, June 2016 5.Pawan Kalyani, “An Empirical Study about the Awareness of Paperless E-Currency Transaction like E-Wallet Using ICT in the Youth of India”, Journal of Management Engineering and Information Technology (JMEIT),Volume -3, Issue- 3, Jun. 2016 6.Poonam Painuly and Shalu Rathi (2016) “Mobile wallet: An upcoming mode of business transactions “International journal in management and social science .volume 4 pp356- 363. 7.Dr.Hem Shweta Rathore (2016) “Adoption of digital wallet by consumers” BVIMSR’s journal of management research. Volume 8 issue 1, pp 69-75. ANNEXURES QUESSIONNAIRE Q1. Your age o 18-25 o 26-35 o 36-45 o oAbove 45 Q2. Occupation o Student o Employee o Self employed o Business o oHome maker o Retired o Any other Q3 INCOME o 0-2,50,000₹ per month o 2,50,000-5,00,000 ₹ per month o 5,00,000-10,00,000 ₹ per month o Above 10,00,000 ₹ per annul Q4 Do you use smart phone ? o Yes o No o I used to. Not anymore Q5 Have you used a smartphone for making (online) payment? o Yes o No Q6 Which mode of payment do you prefer the most? o Debit card o Credit card o Mobile wallet/e-wallet o Any other Q7 Are you aware about the mobile wallet payment gateway ? o Hearing about it for the 1st time. o Heard about it & used it. o Heard about it but never used it. Q8 which of these M-wallet payment gateways are you aware of? o Paytm o Mobikwik o Citrus o Oxigen o Free charge o oAny other Q9 which one of the following M-wallet payment services you prefer using the most? o Paytm o Mobikwik o Citrus o Oxigen o Free charge o Any other Q 10.You prefer using M- wallet for completing transactions? o Recharge o Utility bill payments o Transportation o Food/Movie tickets o Online shopping o Transfer money o Any other Q11 how often do you use M-wallet? (per month) o Daily o Once o Twice o Thrice Q12 Rate the M-wallet services that you have used ? o Highly satisfied o Satisfied o Neutral o Dissatisfied Q13 Would you like to use the Mobile wallet service when it is widely available ? o Very likely o Likely o Neutral/ it does not matter o Unlikely o Very unlikely, can you tell me why? Q 14 Would you prefer to continue using a Mobile wallet? O Very likely o Likely o Neutral o Unlikely o I stopped using M-wallets Q15 Are there any problems when you use Mobile Wallet ? o No o Yes o If yes, than what are the problems faced?