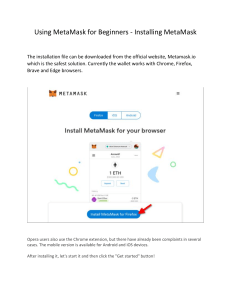

Money orders are financial certificates or notes used in place of cash in order to make a payment. They do not require the person getting them to have a bank or credit account, so they often are the go-to option when a person isn’t affiliated with a financial institution. Money orders are readily accepted and converted to cash, and are often used by people without access to a standard checking account. These instruments are an acceptable form of payment for small debts, both personal and business, and can be purchased for a small service fee from most institutions. Debit cards are a very convenient form of payment and are relatively safe as, before payment is made, a code number known as the PIN has to be tapped into the cardholding machine at the time of purchase. Debit cards can be used at the ATMs (automated teller machines) to withdraw cash-but there may be a charge for this. A bank draft is a payment on behalf of a payer that is guaranteed by the issuing bank. Typically, banks will review the bank draft requester's account to see if sufficient funds are available for the check to clear. A telegraphic transfer (TT) is an electronic method of transferring funds utilized primarily for overseas wire transactions. Typically telegraphic transfer is complete within two to four business days, depending on the origin and destination of the transfer, as well as any currency exchange requirements. The telegraphic transfer is a means of wiring funds from one location to another. Originally, this process made use of the telegraph as a means of transferring money between a point of origin and a point of termination. A bank-to-bank transfer occurs when someone transfers money from an account at one bank to an account at another bank, credit union or other financial institution. A mobile wallet is a virtual wallet that stores payment card information on a mobile device. Mobile wallets are a convenient way for a user to make in-store payments and can be used at merchants listed with the mobile wallet service provider.