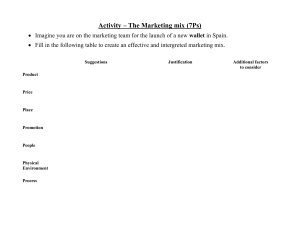

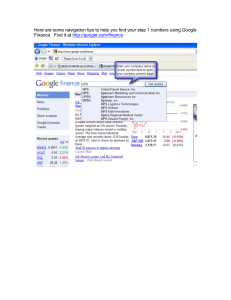

Your Name(S): Lenny Lee Lesnikowski Date: 2/6/23 S2020-[Mon 6-8:50pm] Assignment #: 2 [What are the major drivers of mobile computing?] The major drivers of mobile computing are increased demand for convenience, advancements in technology, decreased costs, and a growing mobile workforce. Consumers today expect increasing amounts of convenience as technology advances. Mobile technology provides ubiquity, instant connectivity, customization, localization, and facilitates mobile or M-Commerce. Advancements in mobile technology like mobile wallets, advertising, and gaming have fueled its popularity, making it a lucrative market for businesses to tap into. With the cost of mobile technology decreasing, it has become more accessible to a wider range of consumers and businesses, driving its adoption even further. As mobile technology has become more advanced. The cost of said technology has decreased dramatically. Lower costs mean greater accessibility, meaning more and more people & businesses can adopt mobile technology. As remote work becomes increasingly common, mobile computing provides the necessary tools for employees to stay productive. Its combination of convenience, affordability, and advanced technology makes it a valuable investment for businesses looking to stay competitive ● Mobility and broad reach create five value-added attributes that break the barriers of geography and time: ubiquity, convenience, instant connectivity, personalization, and localization of products and services. ● The small fees generated every time consumers swipe their cards add up to tens of billions of dollars annually in the United States alone. The potential for large revenue streams is real because mobile wallets have clear advantages. ● Mobile devices are increasingly becoming an integral part of workflow applications. [Describe wireless financial services.] Wireless financial services refer to financial transactions and services that are conducted through mobile devices. This t allows consumers to manage their finances, make payments, and access financial information from anywhere, at any time. For example, before the advent of mobile/online banking, if someone wanted to make a large purchase, but was unsure as to the amount of money they had in their checking account. That consumer would have to break their purchasing cycle, drive to the bank and ask a teller for a Lesnikowski 1 bank statement to understand how much cash they had on hand. Now, with mobile banking, all you need to do is pull out your phone, tap your screen two or three times, and you have access to all the personal financial information you need. This example perfectly illustrates the convenience and flexibility wireless financial services provide. Wireless financial services are transforming the way consumers interact with their banks, making it easier and more convenient to manage their finances. ● Location-based services provide information that is specific to a given location. For example, a mobile user can (1) request the nearest business or service, such as an ATM or a restaurant; (2) receive alerts, such as a warning of a traffic jam or an accident; and (3) locate a friend. ● Google Wallet is a mobile wallet that uses near-field communications to allow its users to store debit cards, credit cards, loyalty cards, and gift cards on their smartphones. With Google Wallet, users launch an app and then type in a PIN so Google can access their stored card credentials. Google Wallet also provides a peer-to-peer payment system that can send money to a real, physical Google Wallet card. ● Facial recognition aims to simplify and accelerate the checkout process even more. Customers scan their items at an automated checkout booth, have their identity checked by scanning their faces and matching the scans to their online shopping account, and then enter their mobile phone number to complete the transaction. Lesnikowski 2