MY OWN 20+ LETTER TEMPLATE TO REMOVE ANY NEGATIVE

ACCOUNT FROM YOUR CREDIT REPORT AND HELP RAISE

YOUR CREDIT SCORE TREMENDOUSLY

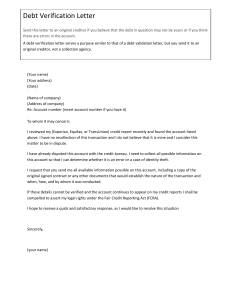

To Whom it May Concern,

Free yourself from bad credit and obtain all the things you

want to achieve in life. Many people wish to find the best

secrets to help fix and improve their credit score. Luckily in

this ebook I will provide all the tips and tricks to remove all

negative accounts from your report and improve your

financial situation.

HERE’S WHAT YOU’LL GET

- Personal information letters

- Collection/ charge off letters

- Inquiries letters & phone script

- Late payment letters

- Validation letters

- Medical collection letters

- Bankruptcy letters

- Certified mail disputing process

V/R

BAMM Credit Consulting

BULLY THE BUREAUS

Equifax Information Services, LLC

P.O. Box 740256

Atlanta, GA 30374-0256

Experian

P.O. Box 4500

Allen, TX 75013

TransUnion Consumer Solutions

P.O. Box 2000

Chester, PA 19016

If they do not respond within the 30 to 45 days that is a violation and

the negative accounts should be removed immediately. A failure to

notice letter will below if this happens to you

Please send all letters certified mail for proof of dates and to track your

process.

Here are the items that are required to send with your removal letter

: 1) Photocopy of identification card

2) Photocopy of your Social security card

3) Photocopy of a Proof of current address (phone bill, utility bill,

rent bill, bank statements

Most common errors on your

credit report

-

Incorrect names

-

Wrong or old addresses

-

Accounts not belonging to you

-

An account listed twice

-

Incorrect credit limits

-

Outdated information

PERSONAL INFORMATION

This step is very important and can be very effective but

easily forgotten when looking to remove negative

accounts from your credit.

Before you submit any dispute to the credit bureaus you

always want to have the advantage where they can’t verify

any information or link anything towards that bad debt

You will be sending this letter to each credit bureau

Experian, Transunion, Equifax

Personal information letters

15 U.S. Code § 1681a (2) - Permissiblepurposes of

consumer reports

FIRST NAME LAST NAME

CLIENT ADDRESS

SOCIAL SECURITY NUMBER

CREDIT BUREAU ADDRESS

CURRENT DATE

To Whom It May Concern:

I have recently checked out a copy of my credit profile and unfortunately, it has come to my

attention that some of my personal information is incorrect. If you would please be so kind as to

delete this inaccurate information from my credit profile within the next thirty days, I would

greatly appreciate it. I’ve listed the details on my personal information in which you are

inaccurately reporting and must remove right away. Please see below:

My name is FIRST NAME LAST NAME. I do NOT have any OTHER NAMES or aliases and I

do NOT desire any OTHER NAMES or aliases to be retained or reported, if ANY DELETE

NOW or produce PROOF of your legitimate AUTHORITY to retain much less report

without infringing my consumer rights thank you.

My current and only address is {Your Address}. I do NOT have any OTHER CURRENT

addresses and I do NOT desire any OTHER ADDRESSES to be reported, if ANY DELETE

NOW or produce PROOF of your legitimate AUTHORITY to retain much less report

without infringing my consumer rights.

My date of birth is {bdate}. I do NOT have any OTHER Dates of Birth and I do NOT desire

any OTHER Dates of Birth to be retained or reported, if ANY DELETE NOW or product

PROOF of your legitimate AUTHORITY to retain much less report without infringing my

consumer rights.

I do NOT have any employers and I do NOT desire any employers to be retained or

reported if ANY DELETE NOW or product PROOF of your legitimate AUTHORITY to

retainmuch less report without infringing my consumer rights.

By reporting these inaccuracies you are in violation of 15 USC 1681b ( a ) ( 2 ) ; for a

consumer reporting agency may furnish a consumer report under the following

circumstance and no other ; in accordance with the written instructions to the

consumer to whom it relates. CREDIT REPORTING AGENCY has in fact knowingly

furnished my consumer report with inaccuracies multiple times without having wet ink,

written instructions to do so. These actions have caused my family and I a great deal of

injury.

Furthermore, I am filing this consumer complaint and consumer check for compliance

of these particular items that you are reporting under FACTA Title 1 sec. 151.

I have enclosed copies of my state issued identification and social security number to

validate my identity.

Thank you, in advance, for honoring my requests. It’s my understanding that you have up to

thirty days to follow through on my request so if I don’t receive any updates from you within

thattime frame, then I know that these inaccuracies must be removed automatically. Once you

have removed the inaccurate information I would like my full completed and corrected credit

report showing these changes mailed to (client address).

Best Regards,

Last:First-Middle [Agent/Beneficiary]

Without Prejudice, All Natural Inalienable Rights Reserved

Date

YOUR NAME

YOU ADDRESS

Credit Reporting Agency

Address

RE: Update Personal Information

Dear Credit Reporting Agency Name,

I recently reviewed my credit file and unfortunately found that some of my personal

information was incorrect. You are reporting Information that belongs to someone else.

I am writing to ensure you have the most accurate information in my credit file at all

times. Please delete the following inaccurate information from my credit file within the

next 30 days. I know that you have up to thirty days to meet my requirements. If I do

not receive any updates from you during this period, I know that these inaccuracies

should be automatically removed. I have listed the information about my personal

information that you incorrectly reported and should be deleted immediately.

Please delete the follow inaccurate names: List all misspelled orinaccurate

names

Please delete the following inaccurate addresses: List all old andinaccurate

addresses

Please delete the following invalid telephone numbers: List all old and inaccurate

telephone numbers Please delete the following inaccurate employers: List all old

employers

By reporting these inaccuracies you are in violation of 15 USC 1681b (a) ( ) ; for a

consumer reporting agency may furnish a consumer report under the following

circumstance and no other ; in accordance with the written instructions to the

consumer to whom it relates. CREDIT REPORTING AGENCY NAME has in fact

knowingly furnished my consumer report with inaccuracies multiple times without

having wet ink, written instructions to do so. These actions have caused my family and

i great deal of injury.

Furthermore, I am filing this consumer complaint and consumer check for compliance

of these particular items that you are reporting under FACTA Title 1 sec. 151.

I have enclosed copies of my state issued identification and social security number to

validate my identity.

Regards,

Last:First-Middle [Agent/Beneficiary]

Without Prejudice, All Natural Inalienable Rights Reserved

Collection/ Charge offs

DID YOU KNOW?

Collection agencies are purchasing your debt for just

pennies.

These collection companies have satisfied your debt when

they purchase it from the original creditor

You should never pay a collection

You did not go into contract with the collector, you went

into contract with the creditor. Therefore, you owe the

debt collector nothing.

You will be sending this letter to each collection agency

YOUR FIRST NAME & LAST NAME

YOUR ADDRESS

BIRTHDATE

SSN

CREDIT BUREAUS NAME

CREDIT BUREAUS ADDRESS

DATE

Re: ACCOUNT NAME

ACCOUNT NUMBER

Dear Collector,

My credit report shows a collection from your agency. I was never notified of this

collection. What’s more, I do not believe this debt is accurate because 1. I did not receive

a letter from your agency asking can you furnish any information from me which I know

is a huge violation on my privacy rights. Under the FAIR DEBT COLLECTION PRACTICES

ACT, I have the right to request and receive validation of the debt. Therefore, please

provide me with a copy of all the following:

1) An explanation of what this alleged account balance is for.

2) A complete Audit Trail calculation of this balance, including the complete payment history on

this account, so I have proof that the amount is correct.

3) Documentation that shows I agreed to pay this debt with my signature and documentation

shows I gave you permission to have my information and paperwork showing I gave you the

authorization to report this to my credit report. No consent to you having my information and

unauthorized use of my social security number is identity theft and you will be reported for such.

4) The Agreement grants you authority to collect on this alleged debt.

5) A copy of your state license, including the license number that gives you rights to collect in

my state.

6. (The purchase agreement)

7. (Swear under penalty of perjury you were present during the alleged debt)

Reporting information that you know to be inaccurate or failing to report information correctly

violates the Fair Credit Reporting Act.

Also, you have committed the following FDCPA Violations:

15 U.S. Code §?1692d-Harassment and abuse

A debt collector may not engage in any conduct the natural consequence of which is to

harass, oppress, or abuse any person in connection with the collection of a debt. (1)The

use or threat of violence or other criminal means to harm the physical person, reputation,

or property of any person. You are harming my reputation which is a violation.

15 U.S. Code §?1692e-False or misleading representations

A debt collector may not use any false, deceptive, or misleading representation or means

in connection with the collection of any debt. (2)The false representation of—(A)the

character, amount, or legal status of any debt. This debt is being reported falsely.

15 U.S. Code §?1692f-Unfair practices

A debt collector may not use unfair or unconscionable means to collect or attempt to

collect any debt.

(8)Using any language or symbol, other than the debt collector’s address, on any

envelope when communicating with a consumer by use of the mails or by telegram,

except that a debt collector may use his business name if such name does not indicate

that he is in the debt collection business. You used symbols on envelopes that violated

the law.

15 U.S. Code §?1692g-Validation of debts(a)Notice of debt; content within five days after

the initial communication with a consumer in connection with the collection of any debt,

a debt collector shall, unless the following information is contained in the initial

communication or the consumer has paid the debt, send the consumer a written notice

containing—(2)the name of the creditor to whom the debt is owed; I am the creditor

under 15 u.s code 1692a so the debt is owed to me.

15 U.S. Code § 1692j - Furnishing certain deceptive forms

(a)It is unlawful to design, compile, and furnish any form knowing that such form would

be used to create the false belief in a consumer that a person other than the creditor of

such consumer is participating in the collection of or in an attempt to collect a debt such

consumer allegedly owes such creditor, when in fact such person is not so participating.

I am not participating in the collection of this alleged debt.

Stop contacting me about this or any other matter you have. cease and desist ASAP and

delete this account from my credit reports, except to provide me with accurate validation

of this debt by U.S. mail only.

I also submitted this letter to the Consumer Financial Protection Bureau (CFPB), My State

Attorney General Office, and The Better Business Bureau to have confirmation of proof if you

respond without the proper validation request or not in the 15-day timeframe you have.

You have 15 days from the date of this letter to respond with all items requested or this is

considered an insufficient validation response and this item must be removed immediately or I

will seek litigation for Monetary damages along with the violations you have already committed.

Best Regards,

Last:First-Middle [Agent/Beneficiary]

Without Prejudice, All Natural Inalienable Rights Reserved

DATE

COLLECTION AGENCY NAME COLLECTION AGENCY ADDRESS COLLECTION AGENCY CITY,

ADDRESS, ZIP

RE: {account_number}

To Whom It May Concern:

I am writing due to the negative marks you’ve made on my credit file. I would be willing to

accept this debt if it were mine and upon Validation and Proof of Claim but i know there’s no way

that you can validate it. I'm sure you are aware of the provisions of the Fair Debt Collection

Practices Act (FDCPA) so let it be known that I am requesting full validation of this debt. I am

requesting proof that I am indeed the party you are asking to pay this debt, and that there is

some contractual obligation that is binding on me to pay it. I request that you stop contacting me

by telephone and restrict your contact with me to writing only, and only when you can provide

adequate validation of this alleged debt. To refresh your memory on what constitutes legal

validation, here is a list of the required documentation:

●

Complete payment history, the requirement of which has been established by Spears v

Brennan, 745 N.E.2d 862; 2001 Ind. App. LEXIS 509. Please provide verification by line

item (with an explanation of each item such as when the purchase took place, how much

the item was, where the goods were received, when were the goods were received, etc.)

for the entire amount you say I owe obtained directly from the Original Creditor.

●

Date of Last Activity

●

My full, complete and correct social security number may help to identify me as the

correct person you are trying to collect from.

●

The agreement bears the signature of the alleged debtor wherein he agreed to pay the

original creditor.

●

The obligation between you and me that allows you to collect on the alleged debt and

any transactions between your company binds me to an agreement to pay your

company any money that you claim I owe.

●

Proof of photo identification (i.e., driver's license, state identification card, or another

government-issued identification card) that was presented to you at the time of incurring

this debt.

●

Letter of sale or assignment from the original creditor to your company. (Agreement with

your client that grants you the authority to collect on this alleged debt.) Coppola v. Arrow

Financial Services, 302CV577, 2002 WL 32173704 (D.Conn., Oct. 29, 2002) information relating to the purchase of bad debt is not proprietary or burdensome. The

debtor must phrase their request clearly to obtain: The source of a debt and the amount

a bad debt buyer paid for the plaintiff's debt, how the amount sought was calculated,

where at issue a list of reports to credit bureaus, and documents conferring authority on

the defendant to collect a debt.

●

Proof that this debt has not been written off as a tax liability.

●

Any other intimate knowledge of the creation of the debt by you, the collection agency.

I'm sure you know, under FDCPA Section 809(b), you are not allowed to pursue collection

activity until this debt is validated. You should be made aware that in Boatley v. Diem

Corporation, No. Civ 03-0762 (D.C. Ariz. 2004), the court ruled that reporting a collection

account is, indeed, considered collection activity. You should also note that this is not a

request for “Partial” Validation but rather, it’s a request for EVERYTHING listed here in order to

constitute full and sufficient validation of this debt.

While I prefer not to litigate, I will use the courts as needed to enforce my rights under the

FDCPA and other statutes. I look forward to an uneventful resolution of this matter.

Best Regards,

Last:First-Middle [Agent/Beneficiary]

Without Prejudice, All Natural Inalienable Rights Reserved

INQUIRIES

You can remove any inquiry from your credit report that’s

not connected to an open account

You will be sending this letter to each credit bureau

Experian, Transunion, Equifax

INQUIRY REMOVAL LETTER

YOUR NAME

YOU ADDRESS

CREDIT REPORTING AGENCY NAME

CREDIT REPORTING AGENCY ADDRESS

RE: INQUIRY REMOVAL

While checking my most recent credit report, I noticed you are reporting unauthorized

and fraudulent credit inquiries made by the following companies below :

Inquiries:

ACCOUNT NAME, Inquiry Date:

ACCOUNT NAME, Inquiry Date:

ACCOUNT NAME, Inquiry Date:

I did not authorize anyone employed by these companies to make any inquiry and view

my credit report on my behalf. In addition, I did not give you (Credit Reporting Agency)

permission to furnish this information on to my credit report without my consent. This is a

violation of the Credit Reporting Act Section 1681b(c) which constitutes fraudulent activity

and is also a serious breach of my privacy rights which is affecting me for future credit

approvals.

Please validate this information with these companies and provide me with copies of

any documentation associated with these accounts bearing my signature, authorizing an

inquiry.

I also demand you, (Credit Reporting Agency) to produce a contract between you

and I, consumer, bearing my signature showing that I gave you permission to

furnish any information on my behalf.

In the absence of any such documentation bearing my signature, I formally request that

these fraudulent inquiries be immediately deleted from the credit file you maintain under

my Social Security number.

Please note that you have 30 days to produce the requested contract and to

complete this investigation, as per the Fair Credit Reporting Act section 611.

My contact information is as follows:

Best Regards,

Last:First-Middle [Agent/Beneficiary]

Without Prejudice, All Natural Inalienable Rights Reserved

Date

Name

Your

AddressSSN

Name of Credit Reporting

AgencyAddress

RE: You Violated the United States Code Law 15 U.S.C. § 1681(c)(1)(A)(B)(i)(3)

FURNISHING reports in connection with credit or insurance transactions that are not

initiated by consumers.

After pulling a copy of my Consumer credit report I noticed that your agency is in multiple

violations and I’m entitled to monetary compensation under FCRA 15 U.S. Code § 1681s–2 - 15

U.S.C. § 1681(c)(1)(A)(B)(i)(3) FURNISHING reports in connection with credit or insurance

transactions that are not initiated by a consumer (Inquires)-(1)In general A consumer

reporting agency may furnish a consumer report relating to any consumer pursuant to

subparagraph (A) or (C) of subsection (a)(3) in connection with any credit or insurance

transaction that is not initiated by the consumer only if—

(A)the consumer authorizes the agency to provide such report to such person or

(B)(i)the transaction consists of a firm offer of credit or insurance.

(3) INFORMATION regarding inquiries

Except as provided in section 1681g(a)(5) of this title, a consumer reporting agency shall not

furnish to any person a record of inquiries in connection with a credit or insurance transaction

that is not initiated by a consumer. Under FCRA 15 U.S. Code § 1681n(b) (B) in the case of

liability of a natural person for obtaining a consumer report under false pretenses or knowingly

without a permissible purpose, actual damages sustained by the consumer as a result of the

failure or $1,000, whichever is greater (2) such number of punitive damages as the court may

allow.

I did not initiate any of these inquiries furthermore if you feel like I did please send me copies of

my writing signature giving consent to this matter, please.

The items below should all be removed from my consumer report under 15 US Code

1681(c)(1)(A)(B)(i)(3).

{dispute_item_and_explanation}

under 15 US Code 1681n(b) civil liability of a natural person, I’ve been violated. Also, we were

already involved and sent this letter to the Complaint portal for (Consumer Financial

Protection Bureau, State Attorney General’s Office, Better Business Bureau, and Federal

Trade Commission).

Sincerely,

Best Regards,

Last:First-Middle [Agent/Beneficiary]

Without Prejudice, All Natural Inalienable Rights Reserved

Late payment

No one can’t furnish anything on your report without your

permission and agreement to provide information on your

report

The letter listed below you will send to Experian,

Transunion, Equifax

The definition of a credit card under 15 USC 1681 is the same as it is

under 1602 (I) which states, The term CREDIT CARD means any

card, plate, coupon book or other credit device existing for the purpose

of obtaining money, property, labor, or service on credit. Notice,

Congress said ANY card.

The credit card is my social security card. This is the credit card that

was fraudulently used to originate every consumer credit transaction

below.

FIRST & LAST NAME

ADDRESS

DOB

SSN

CREDIT BUREAUS NAME

CREDIT BUREAUS ADDRESS

Re: Victim of Identity Theft.

This is not a mistake or in

errorDATE

Legal Department,

I declare under penalty of perjury (under the laws of the United States, if executed outside of the United

States) that the foregoing is true and correct to the best of my knowledge. Further, I certify that I am

permitted by FEDERAL and STATE LAW to file this dispute. I also understand that knowing and willful

misstatements or omissions of material facts constitutes a FEDERAL CRIMINAL VIOLATION punishable

under 18 U.S.C 1001. Additionally, these misstatements are punishable as perjury under 18 U.S.C 1621.

The items found within my credit report that I listed on the following pages are not related to any

transaction that I made. I am alleging that a person or company - without my authorization - used my

personally identifying information to apply for goods, services, or money; and, was successful in creating

some accounts. Please remove the items as soon as possible. If you think this is not true, please swear

under penalty of perjury that you were present during these transactions.

This “DISPUTE LETTER” is being submitted in light of the recent “Overhaul of Consumer Records by the

Credit Bureaus”. I have recently paid for a copy of my credit reports, reviewed my credit file, as is being

reported with you, and noticed there are several inaccurate accounts and/or items on my report. This

means that the below-listed accounts were not opened by me and that I did not profit from these accounts

having been opened. All are being investigated by the FTC

The following Also Known As are reported due to unauthorized use of my personal identifying

information

1. NAME

The following Current Addresses are reported due to unauthorized use of my personal identifying

information

2. ADDRESS

The following Previous Addresses are reported due to the unauthorized use of my personal identifying

information

3. PREVIOUS ADDRESS

The following Employers are reported due to the unauthorized use of my personal identifying information

4. EMPLOYER

The below-listed accounts by the alleged Original Creditors, who have reported these accounts within my credit

reports, were not opened by me. I also did not give my authorization for anyone else to open these accounts.

Someone else who did these that I do not know.

They are being listed as follows:

CREDITORS Account name & Account number

5. INPUT

I am well aware of my rights as a consumer. The Fair Credit Reporting Act requires that you, the credit-reporting

agency, report accurate and/or correct account information within my credit file. My credit issues are very specific, these

accounts and/or items do not belong to me. This means that you are reporting incorrect account information within my

credit report. It is with this in mind that I request that these listed accounts and items be BLOCKED and DELETED!

Policy states…

According to the FAIR CREDIT REPORTING ACT “FCRA”, Section 1681c (2)

Block ofinformation resulting from identity theft.

1. Block. Except as otherwise provided in this section, a consumer reporting agency shall block the reporting of any

information in the file of a consumer that the consumer identifies as information that resulted from alleged identity

theft, not later than four (4) business days after the date of receipt by such agency of…

1. Appropriate proof of identity of the consumer.

2. A copy of an identity theft report

3. The identification of such information by the consumer; and

4. A statement by the consumer that the information relating to the transaction by the consumer.

I have provided all of the above-listed four (4) items within this package. Therefore, I expect these listed accounts to

be deleted and blocked within four (4) business days. This is clearly an identity theft issue. I am also entitled to

receive a free copy of my credit report, so I am requesting a free credit report and that all of these accounts, public

records items, and inquiries be permanently blocked and deleted.

Furthermore, You Violated 15 U.S. Code § 1681a(2)(B) Exclusions from a consumer Report

any authorization or approval of a specific extension of credit directly or indirectly by the issuer of a credit card or similar

device; Exclusions mean the process or state of excluding or being excluded and left out of and not be included.

The definition of a credit card under 15 USC 1681 is the same as it is under 1602 (I) which states, The term CREDIT

CARD means

any card, plate, coupon book or other credit device existing for the purpose of obtaining money, property, labor, or service

on credit. Notice, Congress said ANY card.

The credit card is my social security card. This is the credit card that was fraudulently used to originate every consumer

credit transaction below.

They should all be removed from my consumer report under 15 USC 1681a(2)(B).

As a consumer by law, these accounts on this letter must be deleted immediately or I will seek monetary damages for

violation of my right 15 USC 1681a(2)(B) in small claims court in my city and state under 15 USC 1681n civil liability

because I’ve been violated. Also, we were already involved and sent this letter to the Complaint portal for (Consumer

Financial Protection Bureau, State Attorney General’s Office, Better Business Bureau, and Federal Trade Commission).

These accounts are not mine they are fraudulent, and I did not give you permission to report them

All furnishers of consumer reports must comply with all applicable regulations, including regulations promulgated after

this notice was first prescribed in 2004. Information about applicable regulations currently in effect can be found at the

Consumer Financial Protection Bureau's website, consumerfinance.gov/learnmore.

NOTICE TO FURNISHERS OF INFORMATION:

OBLIGATIONS OF FURNISHERS UNDER THE FCRA

The federal Fair Credit Reporting Act (FCRA), 15 U.S.C. § 1681-1681y, imposes responsibilities on all

persons who furnish information to consumer reporting agencies (CRAs). These responsibilities are found

in Section 623 of the

FCRA, 15 U.S.C. § 1681s-2. State law may impose additional requirements on furnishers. All furnishers of information

to CRAs should become familiar with the applicable laws and may want to consult with their counsel to ensure that they

are in compliance. The text of the FCRA is set forth in full at the Bureau of Consumer Financial Protection's website at

consumerfinance.gov/learnmore. A list of the sections of the FCRA cross-referenced to the U.S. Code is at the end

of this document.

Section 623 imposes the following duties:

Accuracy Guidelines

The banking and credit union regulators and the CFPB will promulgate guidelines and regulations dealing with the

accuracy of information provided to CRAs by furnishers. The regulations and guidelines issued by the CFPB will be

available at consumerfinance.gov/learnmore when they are issued. Section 623(e).

General Prohibition on Reporting Inaccurate Information

The FCRA prohibits information furnishers from providing information to a CRA that they know or have reasonable

cause to believeis inaccurate. However, the furnisher is not subject to this general prohibition if it clearly and

conspicuously specifies an address towhich consumers may write to notify the furnisher that certain information is

inaccurate. Sections 623(a)(1)(A) and (a)(1)(C).

Duty to Correct and Update Information

If at any time a person who regularly and in the ordinary course of business furnishes information to one or more CRAs

determinesthat the information provided is not complete or accurate, the furnisher must promptly provide complete and

accurate information to the CRA. In addition, the furnisher must notify all CRAs that received the information of any

corrections and must thereafter report only the complete and accurate information. Section 623(a)(2).

Duties After Notice of Dispute from Consumer

If a consumer notifies a furnisher, at an address specified by the furnisher for such notices, that specific information is

inaccurate, and the information is, in fact, inaccurate, the furnisher must thereafter report the correct information to

CRAs. Section 623(a)(1)(B).

If a consumer notifies a furnisher that the consumer disputes the completeness or accuracy of any information

reported by the furnisher, the furnisher may not subsequently report that information to a CRA without providing

notice of the dispute. Section 623(a)(3).

The federal banking and credit union regulators and the CFPB will issue regulations that will identify when an information

furnisher must investigate a dispute made directly to the furnisher by a consumer. Once these regulations are issued,

furnishers must comply with them and complete an investigation within 30 days (or 45 days, if the consumer later

provides relevant additional information) unless the dispute is frivolous or irrelevant or comes from a “credit repair

organization.” The CFPB regulations will be available at consumerfinance.gov. Section 623(a)(8).

Duties After Notice of Dispute from Consumer Reporting Agency

If a CRA notifies a furnisher that a consumer disputes the completeness or accuracy of information provided by the

furnisher, the furnisher has a duty to follow certain procedures. The furnisher must:

•

Conduct an investigation and review all relevant information provided by the CRA, including information given

to the CRA bythe consumer. Sections 623(b)(1)(A) and (b)(1)(B).

•

Report the results to the CRA that referred the dispute, and, if the investigation establishes that the information

was, in fact, incomplete or inaccurate, report the results to all CRAs to which the furnisher provided the information that

compiles and maintains files on a nationwide basis. Sections 623(b)(1)(C) and (b)(1)(D).

•

Complete the above steps within 30 days from the date the CRA receives the dispute (or 45 days, if the consumer

later providesrelevant additional information to the CRA). Section 623(b)(2).

• Promptly modify or delete the information or block its reporting. Section 623(b)(1)(E).

Duty to Report Voluntary Closing of Credit Accounts

If a consumer voluntarily closes a credit account, any person who regularly and in the ordinary course of business

furnishes information to one or more CRAs must report this fact when it provides information to CRAs for the time

period in which the account was closed. Section 623(a)(4).

Duty to Report Dates of Delinquencies

If a furnisher reports information concerning a delinquent account placed for collection, charged to profit or loss, or subject to

any similar action, the furnisher must, within 90 days after reporting the information, provide the CRA with the month and the

year of thecommencement of the delinquency that immediately preceded the action, so that the agency will know how long to

keep the information in the consumer's file. Section 623(a)(5).

Any person, such as a debt collector, that has acquired or is responsible for collecting delinquent accounts and that reports

information to CRAs may comply with the requirements of Section 623(a)(5) (until there is a consumer dispute) by reporting

the same delinquency date previously reported by the creditor. If the creditor did not report this date, they may comply with

the FCRA by establishing reasonable procedures to obtain and report delinquency dates, or, if a delinquency date cannot

be reasonably obtained, by following reasonable procedures to ensure that the date reported precedes the date when the

account was placed for collection, charged to profit or loss, or subjected to any similar action. Section 623(a)(5).

Duties of Financial Institutions When Reporting Negative Information

Financial institutions that furnish information to “nationwide” consumer reporting agencies, as defined in Section 603(p),

must notify consumers in writing if they may furnish or have furnished negative information to a CRA. Section 623(a)(7). The

Consumer Financial Protection Bureau has prescribed model disclosures, 12 CFR Part 1022, App. B.

In the absence of any such documentation bearing my signature, I formally request that these fraudulent

inquiries be immediately deleted from the credit file you maintain under my Social Security number.

Please note that you have 30 days to produce the requested contract and to complete this investigation,

as per the Fair Credit Reporting Act section 611.

My contact information is as follows:

Best Regards,

Last:First-Middle [Agent/Beneficiary]

Without Prejudice, All Natural Inalienable Rights Reserved

DATE

YOUR NAME

YOU ADDRESS

CREDIT REPORTING AGENCY NAME

CREDIT REPORTING AGENCY

ADDRESS

Dear {bureau_name},

I received a copy of my credit report and I have found the following items listed below to be in error.

Pursuant to 15 USC 1666b A creditor may not treat a payment on a credit card account under an

open end consumer credit plan as late for any purpose, unless the creditor has adopted

reasonable procedures designed to ensure that each periodic statement including the information

required by section 1637 ( b ) of this title is mailed or delivered to the consumer not later than 21

days before the payment due date.

I NEVER gave You, Credit Reporting Agency OR ({creditor_name}) any written instruction to furnish any

information on my consumer report which is a violation of 15 USC 1681b. Credit Reporting Agency has

caused severe stress and anxiety due to the abusive and unfair practices.

You, CREDIT REPORTING AGENCY, should be ashamed of yourself for ASSUMING this role

andposition to constantly commit fraud and cause harm to consumers!

These accounts are listed with late or missed payments and that is incorrect. The following

accounts were NEVER late and should be listed as PAYS or PAID AS AGREED.

ACCOUNT NAME :

ACCOUNT NUMBER:

I was never late on (Month/Year) on this account please update the account as Paid/Current.

By the provisions of the Fair Credit Reporting Act, I demand that these items be investigated and

removed from my report, and I demand that you provide me with concrete evidence and all

documentation proving that I am or have been late.

It is my understanding that you will recheck these items with the creditor who has posted them.

Please remove any information that the creditor cannot verify. I understand that under 15 U.S.C. Sec. 1681i(a),

you must complete this reinvestigation within 30 days of receipt of this letter.

Please send an updated copy of my credit report reflecting the requested changes

Best Regards,

Last:First-Middle [Agent/Beneficiary]

Without Prejudice, All Natural Inalienable Rights Reserved

MEDICAL COLLECTION

In order for the credit bureaus to provide this account on

your report you have given them permission to release the

information. According to (HIPAA) you have the right to protect the

privacy of my personal information and medical records from all third party

reporting agencies.

The letter listed below you will send to experian,

tranusunion, equifax

{client_first_name} {client_last_name}

{client_address}

{bdate}

{ss_number}

{bureau_name}

{bureau_address}

{curr_date}

Re: Medical Violation

To {bureau_name}:

Recently checked my credit reports and realized your agency and this debt collector is in

violation of 15 U.S. Code § 1681a(3)Restriction on sharing of medical information.

—Except for information or any communication of information disclosed as provided in,

the exclusions in paragraph (2) shall not apply with respect to information disclosed to

any person related by common ownership or affiliated by corporate control, if the

information is—

(A)

medical information;

(B)

an individualized list or description based on the payment transactions of the consumer for

medical

products or services; or

(C)

an aggregate list of identified consumers based on payment transactions for medical products

or services.

And 15 US Code 1681b (4)Limitation on redisclosure of medical information

Any person that receives medical information pursuant to paragraph (1) or (3) shall not disclose such

information to any other person, except as necessary to carry out the purpose for which the information was

initially disclosed, or as otherwise permitted by statute, regulation, or order.

Under 15 U.S.C. Sec. 1681i(a), you must complete this reinvestigation within 30 days and you

must delete the items from my credit file immediately.

{dispute_item_and_explanation}

Thank you for your time and help in this matter.

Sincerely,

{client_first_name} {client_last_name}

Date

Your Name

Your Address

Name of Credit Reporting Agency

Address

YOU ARE BREAKING THE LAW!

UNTIL YOU CAN PROVIDE ME WITH A DOCUMENT PROVING THAT I GAVE

(PROVIDER NAME) MY REQUEST TO RELEASE INFORMATION TO YOU,

(CREDIT REPORTING AGENCY) I DEMAND YOU DELETE THE FOLLOWING

ACCOUNT(S)!

Under the Health Insurance Portability and Accountability Act of 1996 (HIPAA). I reserve

the right to protect the privacy of my personal information andmedical records from all

third party reporting agencies.

Please send the above requested information to my mailing address listed above.

This letter is a request for validation and I request full documentation containing all

information you received from the service provider of this alleged debt.

Continuing to report this Medical debt without properly validating and providing me

proof of permission is a violation of the FCRA (Fair Credit Reporting Act).

You have 30 day to respond to this request or this debt will be considered invalid and

the demand for removal from your reporting agency will be required.

Best Regards,

Last:First-Middle [Agent/Beneficiary]

Without Prejudice, All Natural Inalienable Rights Reserved

BANKRUPTCY

The courts do NOT provide any information to credit

reporting agencies, nor do they ever validate and/or

confirm public records.

The letter listed below you will send to Experian,

TransUnion, Equifax

{client_first_name} {client_last_name}

{client_address}

{bdate}

{ss_number}

{bureau_name}

{bureau_address}

{curr_date}

RE: Your agency Violated my rights to privacy. The law you are violating is clearly here.

The civil liability law under which I will sue is clearly here.

15 U.S. Code § 1681 (a)(4) - Congressional findings and statement of purpose (Consumer Right

to Privacy)

(a)Accuracy and fairness of credit reporting The Congress make the following findings:

(4)There is a need to ensure that consumer reporting agencies exercise their grave

responsibilities with fairness, impartiality, and respect for the consumer’s right to privacy.

Failure to Comply or delete these items

15 U.S. Code § 1681n - Civil liability for willful noncompliance

(a)In general, any person who willfully fails to comply with any requirement imposed under this

subchapter with respect to any consumer is liable to that consumer in an amount equal to the

sum of—(1)(A)any actual damages sustained by the consumer as a result of the failure or

damages of not less than $100 and not more than $1,000;

15 U.S. Code § 1681o Civil liability for negligent noncompliance-(a)In general Any person

who is negligent in failing to comply with any requirement imposed under this subchapter with

respect to any consumer is liable to that consumer in an amount equal to the sum of—(1)any

actual damages sustained by the consumer as a result of the failure; and(2)in the case of any

successful action to enforce any liability under this section, the costs of the action together with

reasonable attorney’s fees as determined by the court.

Under 15 US Code 1681a(4) as a consumer, I have the right to privacy and this

bankruptcy must be deleted from my consumer report or I will seek monetary damages in

small claims court in my city and state. Also, I already sent this letter to the Consumer

Financial Protection Bureau, Attorney General’s Office, Better Business Bureau, and

Federal Trade Commission.

{dispute_item_and_explanation}

Sincerely,

{client_first_name} {client_last_name}

Date:

Your Name

Your Address

Credit Reporting Agency Name

Credit Reporting Agency Address

RE: Bankruptcy File Number

Dear (Credit Reporting Agency):

After reviewing my credit report, I noticed that there is a U. S. Bankruptcy Court items

listed on my credit reports. Per the FCRA 623(a)(5): “If the Credit Bureau cannot

VALIDATE the information with the ORIGINAL CREDITOR, they must remove said

information from the consumer credit file”.

The original creditor in this case would be the U.S. Bankruptcy Courts. The bankruptcy

courts mailed me a letter stating that they do NOT provide any information to credit

reporting agencies, nor do they ever validate and/or confirm public records.

LexisNexis has provided documentation that it could not validate this public record

information. It is the credit reporting agencies, and/or other third-party providers who

collect information regarding public cases from public records. Public records

information is NEVER validated by the Recorder of Deeds nor the U. S. Court system

due to the Fair Credit Reporting Agency PRIVACY LAW.

Public records information is NEVER validated by the Recorder of Deedsnor the U. S.

Court system due to the Fair Credit Reporting Agency PRIVACY LAW.

You, CREDIT REPORTING AGENCY, ARE BREAKING THE LAW AND ARE

COMMITING FRAUD AS YOU NEVER validated or verified these public record entries

on my credit report which is a violation of violation of 15 USC 1681a ( e ). An investigative

consumer report is when any portion of which information on a consumer’s character,

general reputation, personal characteristics, or mode of living is obtained through

personal interviews with neighbors, friends, or associates of the consumer reported on

or with others with whom he is acquainted or who may have knowledge concerning any

such items of information.

You are also violating 15 USC 1681b (a) (2) considering you do NOT have my

consent to furnish any information.

Per 15 USC 1681c (a) Bankruptcy information is Excluded from the

consumer 's report.

You, CREDIT REPORTING AGENCY and your fraudulent activity and continuous violations

are causing me great injury as you are preventing me from receiving credit to support and

sustain my family.

I need the bankruptcy information currently showing under my social security number

to be PERMANENTLY DELETED from my credit report immediately.

As such, if this unauthorized public record information is not deleted from my credit

report within the next 30 days, I will be filing a complaint to the Federal Trade

Commission and Consumer Financial Protection Bureau.

Failure to respond in a satisfactory manner within 30 days of receipt of this certified

letter will result in a small claims action against your company.

I will be seeking no less than $5,000 in damages for, but not limited to:

1) Defamation

2) Negligent Enhancement of Identity Fraud;

3) Violation of the Fair Credit Reporting Act and Consumer Financial Protection Bureau.

Thank you,

Last:First-Middle / [Agent/Beneficiary]

Without Prejudice, All Natural Inalienable Rights Reserved

REPOSSESSION

Date

Your Name

Address

Credit Reporting Agency

Address

Name of Original Creditor

Original Creditor Address

I am writing this letter in regards to the account (Account Name - Account #)

referenced above that is being listed on my credit report by (NAME OF COMPANY).

This account has not been properly verified and as you know failure to comply with

federal regulations by credit reporting agencies are in serious violation of the Fair

Credit Reporting Act and may be investigated by the FTC.

For obvious reasons, I am maintaining very detailed records of all my

correspondence with you in preparation to file a complaint with the Attorney General’s

office and the Consumer Financial Protection Bureau if you continue to list this item

on my credit report. I was given no evidence of my obligation to pay this debt.

The FCRA requires you to verify the validity of the item within 30 days. If the account

can not be verified, you are obligated by law to remove the item and if you do verify this

item please provide the complete name of the person who verified this information,

telephone number, the date you spoke, all documentation provided to you, and the

method of verification as well

In the event that you can not verify the item pursuant to the FCRA, and you continue to

list the disputed item on my credit report I will find it necessary to sue you for actual

damages and declaratory relief under the FCRA.

According to this regulation, I may sue you in any qualified state or federal court,

including small claims court in my area. While I prefer not to litigate, I will use the

courts as needed to enforce my rights under the FCRA.

Best Regards,

Last:First-Middle [Agent/Beneficiary]

Without Prejudice, All Natural Inalienable Rights Reserved