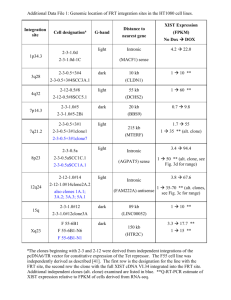

FPT Retail (FRT) [BUY +43.7%] Industry: Report Date: Retailing April 23, 2018 Listing Price: Target Price Upside to TP: Dividend Yield: TSR: Market Cap: Foreign Room: ADTV30D: State Ownership: Outstanding Shares: Fully Diluted Shares: 3-yr PEG Dao Nguyen Senior Analyst dao.nguyen@vcsc.com.vn +848 3914 3588 ext. 185 Phap Dang Senior Manager phap.dang@vcsc.com.vn +848 3914 3588 ext. 143 VND125,000 VND177,700 +42.1% +1.6% +43.7% $220.3mn $38.8mn NA 0.0% 40.0 mn 40.0 mn 0.7 Initiation Rev Growth EPS Growth GPM NPM EV/EBITDA P/Op CF P/E 2017 21.1% 39.7% 13.8% 2.2% 12.4x 28.0x 17.2x 2018F 17.1% 32.6% 14.2% 2.5% 9.9x 94.4x 13.0x 2019F 22.5% 26.8% 14.5% 2.6% 8.0x 28.1x 10.3x P/E (ttm) P/B (curr) Net D/E ROE ROA FRT 17.2x 7.6x 40.5% 44.2% 6.8% Peers* 18.0x 2.3x 22.8% 15.6% 3.3% VNI 19.4x 3.0x N/A 15.1% 2.3% 2020F 19.4% 24.7% 14.8% 2.7% 6.6x 18.2x 8.2x Company Overview Established in 2012, FPT Retail has quickly become the second-largest mobile phone retailer in Vietnam with nearly 15% market share in 2017. To sustain long-term growth, the company has entered the pharmacy market. * Domestic and foreign peers using adjusted market multiples. A proven retailer with a bright growth outlook • • • • • • We initiate on FRT with a BUY rating, total return of 44%. Attractive 3-yr PEG of 0.7. FRT is a proven retailer. Backed by its creative initiatives, FRT’s legacy mobile segment still boasts a robust outlook, while its entry into pharmacy looks promising. NPAT CAGR of 21% for the mobile segment during 2017-2022F driven by resilient SSSG, expansion in both traditional format and Apple stores and margin improvement. We project FRT’s pharmacy will reach a total store count of 208 by YE2022 vs eight at YE2017, contributing to a total NPAT CAGR of 25% for FRT during 2017-2022F. Upside catalysts: (1) mobile SSSG outperforms our expectation on FRT’s consumer financing and price subsidy programs, (2) pharmacy roll-out outpaces our projections. Downside catalysts: (1) excessive bad debt from financing and price subsidy programs, (2) price competition from e-commerce and (3) stricter drug prescription enforcement. Why FRT even though we already recommend MWG? Because these two companies boast distinct growth drivers despite some overlap. Our current thesis on MWG is premised on its minimart foray and the still fast-growing consumer electronics segment. On the other hand, we like FRT due to the bright outlook of its mobile segment and pharmacy foray. While FRT’s continuing expansion will likely undercut MWG’s market share in the mobile phone segment, the impact should be manageable for MWG. FRT’s pioneer consumer financing (F.Friends) and price subsidy programs underpin its mobile segment. F.Friends allows qualified customers to pay in installments at zero interest. Meanwhile, in the price subsidy program, FRT partners with mobile telcos to reduce the total price a customer pays for their phone and data. These programs will enable FRT to acquire market share while improving its margins due to minimal marginal operating expenses. The downside is that FRT bears risks on receivables. FPT to accelerate roll-out of Apple Premium Reseller (APR) stores to take up a larger portion of the Apple pie. FRT owns 12/15 APR stores in Vietnam. This format will benefit from Apple’s new warranty policy in Vietnam, which disregards unauthorized hand-carry products. To open APR stores, one must meet Apple’s many rigorous requirements and FRT has the advantage of having worked with Apple (32% of FRT’s sales) for a long time. Acquisition of Long Chau an early win for FRT in pharmacy. In January 2017, FRT acquired Long Chau, which is a prestigious pharmacy brand in HCMC and boasts much higher sales/store than competitors (an average of USD136,000/store/month or 4x the second highest competitor). After acquiring know-how from the previous owner, FRT is building up retail capabilities for the chain and will speed up its roll-out from 2018. See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 1 Contents A proven retailer with a bright growth outlook .............................................................................. 1 Why FRT despite MWG? .................................................................................................................. 3 FRT’s growth = mobile phone + pharmacy ......................................................................... 3 MWG’s growth = consumer electronics + minimart ............................................................. 3 Company overview........................................................................................................................... 5 Established as an FPT Corp subsidiary, it inherits the brand equity of Vietnam’s largest IT company ............................................................................................................................. 5 Strong management team: entrepreneurial, pragmatic, execution-focused and detailoriented ............................................................................................................................... 6 There is no shame in being a follower ................................................................................ 7 A focus on big-ticket and premium products, especially Apple, is how FRT differentiates itself .................................................................................................................................... 9 Pharmacy: promising business off to a good start ............................................................ 10 Historical business performance .................................................................................................. 11 Strong top-line growth on the back of aggressive store openings ..................................... 11 Margins are expanding in conjunction with scale .............................................................. 12 F.Friends: FRT’s self-created consumer financing program ............................................. 13 Telco price subsidy: a potential game changer ................................................................. 14 Mobile phone business outlook .................................................................................................... 16 FPT Shop: resilient SSSG and selective store openings .................................................. 16 F.Studio: store expansion to speed up .............................................................................. 17 Online sales should continue to take off ........................................................................... 17 Margins to expand on the back of larger scale and higher contribution from F.Friends and telco subsidy programs ..................................................................................................... 18 Long Chau pharmacy outlook ....................................................................................................... 19 We opt to be more conservative than management in terms of future store openings at this early stage ........................................................................................................................ 20 Summary of P&L projections ........................................................................................................ 22 Key investment risks ..................................................................................................................... 24 Bad debt from F.Friends and price subsidy programs ...................................................... 24 Price war from pure e-commerce players ......................................................................... 25 Long Chau – stricter enforcement on drug prescription .................................................... 25 Valuation ......................................................................................................................................... 26 Discounted Cash Flows – Mobile (FPTShop and F.Studio) .............................................. 26 Discounted Cash Flows – Long Chau ............................................................................... 27 Peer comparison ............................................................................................................... 28 Financial Statements ..................................................................................................................... 29 Rating and Valuation Methodology .............................................................................................. 31 Disclaimer ....................................................................................................................................... 32 Contacts .......................................................................................................................................... 33 See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 2 Why FRT despite MWG? This is a question that naturally comes up when we make an investment case for FRT given our bullish stance on MWG. Our view is that FRT and MWG do not have to be mutually exclusive from an investment perspective because while both companies have made their names by retailing mobile phones, their future growth will come from different avenues. In addition, while MWG still undeniably possesses the best management team in Vietnam’s retailing sector, we believe FRT’s management team should be appreciated more given the company’s proven track record since its establishment in 2012. FRT’s growth = mobile phone + pharmacy In our current projections, mobile phone will be responsible for 78% of FRT’s NPAT growth between 2017-2022 with the remaining 22% contributed by pharmacy. In our view, given that MWG (45% market share in 2017) has stopped store expansion for its mobile chain, FRT (13% market share in 2017) is best positioned to spearhead growth in this industry on the back of further footprint expansion of its flagship chain (FPT Shop), the roll-out of APR stores to obtain market share in Apple products and its self-initiated consumer financing and price subsidy programs to buoy SSSG. On the other hand, FRT is off to a good start with its pharmacy foray thanks to the acquisition of Long Chau, a prestigious pharmacy brand in HCMC. Besides the brand, FRT also attained valuable know-how. FRT has been constructing back-end capabilities for Long Chau over the last year and as this shapes up, Long Chau’s pace of store expansion will gradually pick up in the coming years. MWG’s growth = consumer electronics + minimart In our current projections, consumer electronics will account for 49% of MWG’s NPAT growth between 2017-2022 while minimarts will contribute 40%. The footprint coverage of MWG’s mobile chain (TGDD) has been saturated with nearly 1,100 standalone stores in addition to the mobile phone sections built into every consumer electronics store (642 of them as of YE2017). Therefore, future growth of this chain will primarily be derived from organic industry growth. Under our current projections, MWG’s mobile market share will slide from 45% currently to 40% in 2022 while FRT’s will swell from 13% to 23%. Nevertheless, this is not to say that TGDD’s sales will decline, as we still project a 5% revenue CAGR during 2017-2022 for this chain vs a 7%-8% CAGR for the overall mobile phone market, per GFK. In other words, FRT is going to occupy a larger part of a growing pie thanks to its more aggressive store expansion and sales initiatives now that TGDD has ceased expanding its store network. We note that MWG also bought a pharmacy chain itself, namely An Khang (previously known as Phuc An Khang). Nonetheless, unlike FRT, which has already come to grips with how its pharmacy format is going to be, MWG will likely undergo two to three years of experimentation with An Khang before it scales up the chain more aggressively. Therefore, contribution from pharmacy to MWG will likely be insignificant in the next three to five years. See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 3 Figure 1: 2017-2022 NPAT projections for FRT (VNDbn) 1,000 Figure 2: 2017-2022 NPAT projections for MWG (VNDbn) 7,000 800 5,000 600 3,000 400 1,000 200 0 -1,000 2017 2018 2019 Mobile 2020 2021 Pharmacy 2022 2017 2018 2019 Mobile CE 2020 2021 2022 Grocery Source: VCSC See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 4 Company overview Established as an FPT Corp subsidiary, it inherits the brand equity of Vietnam’s largest IT company FRT was founded in 2012 as a subsidiary of FPT Corp (HSX: FPT). FPT owned 85% of FRT with the remaining stake held by individual investors (likely FPT insiders). FPT is the leading IT company in Vietnam and the second leading player in fixed-line broadband with a brand associated with prestige, quality and service. As such, since its inception, FRT, with its flagship brand FPT Shop, has benefited from FPT’s brand equity. Figure 3: FPT Shop format Source: FRT In December 2017, FPT completed a partial sell-down in FRT. This was in accordance with FPT’s strategy to focus on its core businesses of Software and Telecom. FPT sold 30% of FRT to Dragon Capital and VinaCapital in August 2017 and followed that with another 8% stake sale to retail investors in December 2017 to facilitate the listing of FRT on the Ho Chi Minh Stock Exchange. Figure 4: FRT’s shareholder structure as of April 6, 2018 Others, 13% Insiders, 8% FPT, 47% Foreign investors, 31% Source: FRT’s prospectus See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 5 Strong management team: entrepreneurial, pragmatic, executionfocused and detail-oriented It is easy to think of FRT as a “copycat” of MWG given the company’s strategy of “follow the leader” since its inception. It is common to see an FPT Shop located nearby MWG’s stores while FRT has also imitated many of MWG’s pioneer customer services. However, credit should be given when due. This strategy has proven to be successful, enabling FRT to shortcut its learning process in a sophisticated sector. FRT quickly became the second largest mobile phone retailer, surpassing other players with longer tenures, such as Vien Thong A and Viettel Store. And FRT has shown itself to be more than just a copycat by pioneering in creative financing and price subsidy packages to acquire customers, which we will detail later on page 14. In addition, FRT made a valuable acquisition to enter the fragmented pharmacy market, which took place about one year earlier than MWG’s own transaction in this space. FRT is led by CEO Ms. Nguyen Bach Diep and Deputy CEO Ms. Trinh Hoa Giang, who have been with the company since its establishment. In 2016, FRT welcomed Mr. Nguyen Viet Anh, who heads the company’s business development strategies. Figure 5: FRT’s key personnel Name/Title Background - 07/2013 - now: CEO of FPT Retail. - 05/2012 - 06/2013: Deputy CEO of FPT Retail. - 05/2010 - 12/2010: Project Manager of Alfa Mart parnership – FPT Trading. Ms. Nguyen Bach Diep - 10/2008 - 04/2010: Head of FPT Telecom, Southern branch. Chairwoman cum CEO - 09/2003 - 09/2005: Deputy Head of FPT Mobile Technology Company Limited, HCMC. - 05/2003 - 08/2003: Director of FIS BANK HCM Center. - 05/1995: Joined FPT as a Sales Officer at FPT HCMC Branch. Ms. Trinh Giang - 2012-present: Deputy CEO cum Board member of FPT Retail. Hoa - 2007-2011: Head of Sales cum Deputy CEO of FPT Retail. BOD member cum Deputy CEO - Joined FPT in 2003, in charge of FPT Mobile showroom network. - 2001-2003: Head of HR, VKO Shopping Center. - Joined FRT in March 2016, in charge of merchandizing, marketing and business development strategies. - 2014-2015: Head of Sales – Apple South Asia Pte Ltd. Mr. Nguyen Viet Anh - 2010-2011: Head of Finance and Head of Sales – Nokia. Deputy CEO - 2009-2010: Head of Supply Chain – L’OREAL Group. - 2004-2008: P&G Vietnam, undertook various roles including Finance Director, Business Development Director, Director of Financial Analysis (Asia). Source: FPT, FRT See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 6 There is no shame in being a follower FRT is the youngest company among the leading mobile phone retailers in Vietnam, which include Vien Thong A (established in 1997), MWG (2004) and Viettel Store (2006). Recognizing MWG’s undefeatable power but knowing the market had room for more than one player, FRT has pursued a strategy of mirroring MWG, particularly in terms of customer services and store locations. At the same time, it has concentrated on building up backend capabilities, including IT, internal management systems and human resources. Second largest store network in Vietnam... FRT operated 473 stores as of YE2017. This trails MWG’s 1,072 standalone mobile stores and 642 consumer electronics stores (each of which contains a separate section for selling mobile phones), but is well ahead of other competitors such as Viettel and Vien Thong A. Furthermore, our observation suggests that FRT’s store traffic only trails that of MWG and is far superior than the other two retailers. …which doubles up as delivery hubs for online sales. In 2017, FRT’s online sales surged by 120% to USD89mn, representing 15% of total sales. This is compared to USD250mn and 9% at MWG. Similar to MWG, by using physical stores as shipping points, FRT can offer one-hour delivery for customers located within 10 km of its stores across Vietnam. Meanwhile, Viettel and Vien Thong A can only commit to one-hour delivery in HCMC and Hanoi. Figure 6: Standalone store count of leading mobile phone retailers in Vietnam 1,072 473 336 209 Thegioididong FRT Viettel Vien Thong A Source: VCSC compilations (store count as of YE2017) See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 7 Figure 7: Market share structure of mobile phone retail market in 2013 vs 2017 2013 2017 MWG, 19% FRT, 6% Momand-pop, 50% Other retail chains, 26% Momandpop, 10% Other retail chains, 32% MWG, 45% FRT, 13% Source: VCSC estimates Customer centric. From H2 2015 to 2016, FRT launched an employee training program called ““We” love FPT Shop”, carried out directly by the CEO and the training director across its store network with the purpose of standardizing and upgrading its customer services. As part of this program, the company incorporated customer satisfaction as a critical KPI for the sales force in addition to revenue. Sales staff were trained in skills such as how to greet customers and serve them while they are in the store. In addition, FRT introduced a 30-day product return policy in which customers can exchange a faulty product for a new one within 30 days of their purchase, while also extending warranty periods. As a result of this program, FRT’s brand awareness, customer satisfaction and loyalty all displayed marked improvement. See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 8 A focus on big-ticket and premium products, especially Apple, is how FRT differentiates itself Figure 8: FRT’s sales by product ASP in comparison to others (2017) < USD440 > USD440 60% 38% FRT Others Source: FRT Apple accounts for 32% of FRT’s revenue vs ~15% for MWG. Besides FPT Shop, FRT has obtained authorization for all three levels of Apple concepts: AAR (Apple Authorized Reseller), APR (Apple Premium Reseller) and iCorner. AAR and APR stores only sell Apple products and strictly follow Apple’s standards in terms of design and staff training. As of YE2017, FRT operates 12 Apple APR stores (under the F.Studio brand). Figure 9: FRT’s different Apple concepts APR AAR iCorner Source: FRT Laptops and tablets constitute 12% of FRT’s revenue vs 5% of MWG. According to GFK, FRT’s average market share for laptops in H1 2017 was around 23% in terms of value, well above the combined market share of MWG, Vien Thong A and Viettel of 18%. While laptops and tablets bolster the average ticket size of FRT, the flip side is this category is growing very sluggishly. See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 9 Figure 10: FRT’s 2017 revenue by category Accessories, 10% Others, 3% Laptops and tablets excl Ipad, 12% Apple, 32% Mobile phones excl iPhone, 43% Source: FRT Pharmacy: promising business off to a good start In January 2017, on behalf of FRT, CEO Nguyen Bach Diep purchased 100% of Long Chau, a renowned pharmacy brand in HCMC. FRT plans to consolidate Long Chau in H2 2018 or 2019 once it finishes formalizing Long Chau’s back-end operations, such as supply chain, paperwork, inventory management and IT infrastructure. So far, apart from know-how transfer, FRT has focused on developing software for Long Chau to better manage inventories, credit and sales commissions as well as tools to support the sales staff. For example, FRT is building an app that its sales staff can use to search information about various drugs so they can consult customers more effectively. New stores are generating encouraging sales levels backed by Long Chau’s brand name. At the time of FRT’s acquisition, Long Chau was running five stores, all of them located on Hai Ba Trung Street, District 3, and generating around USD132,000 in monthly sales/store. Since then, FRT has opened four new Long Chau stores in other districts, which are displaying positive sales progress and approaching the level of the legacy stores. Currently, 60% of Long Chau sales come from western drugs. The remaining 40% are derived from vitamin supplements, beauty products and medical equipment. Long Chau sources 60% of its products directly from the manufacturers and the rest from wholesalers. Figure 11: Long Chau Pharmacy Source: FRT See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 10 Historical business performance Strong top-line growth on the back of aggressive store openings From only 50 stores back in 2012, FRT reached 473 stores by YE2017, implying a pace of 85 new stores/year compared to 140 by MWG during the same period. Figure 12: FRT’s historical store count 473 500 400 300 200 100 50 0 2012 2013 2014 2015 2016 2017 Source: FRT Figure 13: FRT’s historical revenue (VND bn) 14,000 12,000 10,000 8,000 6,000 4,000 2,000 2012 2013 2014 2015 2016 2017 Source: FRT See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 11 Margins are expanding in conjunction with scale FRT’s margins have been strengthening consistently since 2012 as a growing scale bolsters its bargaining power with vendors. Margins have also been ratcheting up on the back of better store efficiency and expense rationalization. Figure 14: FRT’s historical NPAT (VND bn) and NPAT margin 2.2% 1.8% 1.9% 0.8% 290 -35 208 146 -32 41 -1.1% -2.9% 2012 2013 2014 NPAT 2015 2016 2017 NPM Source: FRT, VCSC We see more room for margin expansion as FRT’s scale and store efficiency continue to improve. Compared to MWG’s mobile chain, whose NPAT margin is around 4.5% currently, FRT’s NPAT margin is still far behind. We attribute this sizeable difference to (1) product mix: Apple products, which account for a bigger part of FRT’s revenue, typically yield a thinner GPM (10%-11%) than other brands; (2) MWG’s back-end costs are shared by its mobile and CE chains; and (3) scale, i.e., bargaining power against vendors. While the first and second factors are unlikely to change, we believe FRT can enhance its same-store sales, which, coupled with new store openings, will bolster FRT’s scale and enable it to negotiate for better terms with vendors. See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 12 F.Friends: FRT’s self-created consumer financing program FRT, MWG and other brands offer traditional consumer finance packages in their stores. In addition, FRT has developed the F.Friends as a more cost-competitive option. Figure 15: Comparison between F.Friends and other consumer financing options Bank loan Interest rates Down payment Applicable periods 9-11% 0 All year Applicable products All products Eligible for use with other promotions (except flash sales, stock clearance) Yes Traditional consumer finance 30% 40-60% All year Minimum value of USD132 Credit cards F.Friends 0-30% 0 Seasonally Minimum value of USD132 0% 0 All year Minimum value of USD44 Yes No Yes Source: FRT F.Friends contributed 4.5% to FRT’s revenue in 2017 and management targets to nudge this up to 15% in the next five years. FRT started piloting F.Friends in October 2016 and officially launched the program in January 2017. How F.Friends works • FRT approaches Vietnamese companies and makes them members of the F.Friends program. • Current membership base: 2,000 companies with 650,000 members. • Qualified employees (see more below) can buy products from FRT and pay in monthly installments over six months at zero interest. • Monthly installments are taken directly from the employees’ payroll bank account via a platform developed between FRT and its partner banks. How FRT controls credit risks • • • • Only employees with (1) at least eight months of tenure and (2) a salary paid via bank transfer qualify for the program. Loan amounts range from 1.5x-2x the employee’s monthly salary, depending on how long they have been with their company. Because payments are deducted directly from an employee’s monthly salary account, the employee can only default on the loan if he quits his job. For Samsung phones (largest market share in Vietnam), if FRT does not receive the payments in due course, the phones will be remotely shut down (rendering them unusable) via a program (software) embedded inside the phone’s chip, which is co-developed by FRT and Samsung. FRT expects to implement a similar software with Oppo (third biggest market share in Vietnam behind Samsung and Apple) later in 2018. Figure 16: F.Friends process Approach the companies Member registration Credit limit approval Money collection via debitting employee's monthly salary account Source: FRT See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 13 The economics of F.Friends Per FRT, major expenses (as a percentage of sales value) for F.Friends include: • 2% for bad debt provisions. Up to now, actual bad debt has been <1%, per FRT; • 3% for interest expenses, assuming the company will finance the loans with 100% bank borrowings at 6% interest rate/year and will pay them back after six months; • 1% for other expenses, e.g., expenses for acquiring members. Given a GPM of around 14%, the EBIT margin of F.Friends could amount to approximately 8%. Since F.Friends transactions take place at FRT’s existing stores (qualified customers will bring necessary documents to the stores), F.Friends will improve FRT’s EBIT margin as it generates incremental traffic and sales without requiring additional store-related costs, such as rent and staff expenses. Telco price subsidy: a potential game changer In November 2017, FRT began to roll out a new program where it sells phones at a discount to customers who subscribe to telephone data packages. How it works • FRT partners up with telcos, who will subsidize phone prices for FRT customers. In exchange, the phone buyers will subscribe to a 12-month data package provided by the telcos. • In our observation, the subsidy amount ranges from 7%-58% of the phone price, depending on the models and data packages. No data has been provided on the actual average subsidy across all models up to now. • For consumers, it means that they will get the phone and the data package for a lower bundle price compared to buying each separately. • For FRT, it will first receive the down payment. After that, every month, FRT will receive the monthly payment from the telcos after the latter has received data subscription payments from the customers. This will take place over 12 months. Figure 17: Barriers and opportunities for telco subsidy program Barriers Opportunities 4G LTE was rolled out in October 2016 Low ARPU: USD5-6/month Higher data consumption higher demand for buffet carrier packages Prepaid subscribers: 95% Mobile number portability Intense competition between telcos to retain customers Vietnamese telcos do not own strong retail networks and expertise Mobile phones sold without carrier subsidy: 99% No centralized system for personal credit history Risk of bad debt Source: FRT See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 14 How FRT controls credit risks • • Compared to F.Friends, in which only employees of member companies can participate, this price subsidy program is open to everyone. As such, to manage credit risks, only Samsung phones are eligible for this program at the moment. If a customer does not pay in due course, FRT will remotely shut down his phone. As FRT develops more embedded programs with other vendors, such as Oppo, more products will become eligible for this program. FRT buys trade receivables insurance. Per FRT, as of now, insurance covers 100% of FRT’s receivables, unless in the case of late customer payments, FRT’s embedded program does not function properly. Figure 18: Illustration of the price subsidy package for Samsung Note 8 Insurance company Pays for bad debt Premium FRT USD33/month Samsung Upfront: USD595, or USD99/month over six months Customer 12-month package: FPT990 USD44/month Telcos Source: VCSC In November 2017, FRT and Vietnamobile (No.4 mobile telco company in Vietnam) started a pilot program with the Samsung Note 8 model. Vietnamobile subsidizes VND9mn (USD396) of a total phone price of VND22.5mn (USD990). In return, the phone buyers subscribe to a 12-month data package that costs USD44/month. Mobifone (No.3 mobile telco) joined forces with FRT in early 2018. This is a positive development given Mobifone’s much larger market share of 16% in 2016 vs Vietnamobile’s 2% in 2016, according to the Ministry of Information and Communication. Currently, about a dozen Samsung models are available for this program, including Galaxy S9 | S9+ | Galaxy Note 8 | Galaxy S8 | Galaxy S8+ | Galaxy A8 2018 | Galaxy A8 Plus 2018 | Galaxy J7 Pro | Galaxy J7+| Galaxy J3 Pro | Galaxy J2 Pro 2018, whose retail prices range from USD150 to USD1,035. With Apple unlikely to be keen on the software interference, this program will likely only cover Android phones. Currently, outside of Samsung, FRT is working on this See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 15 technology with Oppo. Apple will likely stay away due to its stringent security and privacy control. FRT has high expectations for this program. Management said that if the program continues to yield positive results, i.e., a low default rate, the company will ramp this program up to at least 15% of total revenue in the next five years compared to 5% since the program was launched. In 2018, FRT will work on on-boarding the remaining telcos, namely Viettel (58% market share) and Vinafone (24%). The economics of the price subsidy program Per FRT, major expenses (as a percentage of sales value) for this program include: • 2-3% of bad debt expenses, inclusive of insurance premiums. So far, actual bad debt has been around 1%, per FRT; • 3% for interest expenses, assuming an average down-payment ratio of 50% and FRT will finance the receivable amount with bank borrowings at a 6% interest rate/year and pay them back after 12 months. • 1% for other expenses. As such, EBIT margin of this program should be similar to F.Friends and it can enhance FRT’s EBIT margin the same way F.Friends does. Mobile phone business outlook FPT Shop: resilient SSSG and selective store openings The mobile phone market in Vietnam is expected to grow 7%-8% per annum over the next five years, driven mainly by ASP as Vietnam enters a replacement cycle. This is slower than the 22% CAGR during 2013-2017, which was fueled by a surge in smartphone penetration. According to Nielsen, smartphone penetration in key cities jumped to 84% in 2017 vs 30% in 2012 and 52% in 2014. Meanwhile, smartphone penetration in rural areas currently stands at 68%. We project a total store count of 555 by YE2020 for FPT Shop vs 473 as of YE2017 as FRT pursues a “piggyback” strategy. Specifically, we pencil in 50 new stores in 2018, 20 in 2019 and another 10 in 2020. FRT’s store count is less than half of MWG’s standalone mobile stores. If we count MWG’s consumer electronic stores (642 of them as of YE2017), which dedicate a separate section for selling mobile phones, then FRT’s store count is just about one-fourth of MWG. As such, there is still room for FRT to widen its FPT Shop’s footprint. Having said that, given the aforementioned decelerating growth of the overall market, FRT will be selective in terms of location. The company will only open stores where its competitors are generating around VND3bn (USD132,000) in sales/store/month. F.Friends and price subsidy programs will buoy SSSG despite closer store proximity and cannibalization from online sales. Thanks to F.Friends and the telco subsidy program, we project 11% SSSG in 2018 for FPT Shop, which will taper down to 4%-5% in 2019-2022, compared to flat SSS without these programs in our projections. Our assumptions are relatively conservative compared to management’s targets as we only project a combined 16% revenue contribution from these two programs in 2022, up from 6%-7% in 2017, but well below management’s target of at least 30%. See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 16 F.Studio: store expansion to speed up Hand-carried, unauthorized Apple products remain prominent in Vietnam. These products are VAT-free and hence sold at a discount vs authorized products sold by retailers such as MWG and FRT. Thus, we estimate that currently, MWG and FRT occupy only 44% of the Apple category in Vietnam, compared to 65% in other brands. Apple’s new warranty policy is a boon to authorized sellers. In January 2018, Apple changed its guarantee allowance. Now, it only accepts authorized products with proof of purchase, i.e., a receipt. Thus, unauthorized hand-carried products, which typically only have one receipt for a whole batch, will not qualify. Apple did this to not only create a more level playing field for the authorized retailers such as MWG and FRT, but also to project its brand image and retail price stability. FRT should be the top beneficiary from this shift given Apple’s substantial contribution to its revenue. Apple accounted for 32% of FRT’s revenue in 2017. Against this backdrop, FRT looks to speed up the roll-out of F.Studio. Management is targeting to reach a total store count of 102 for F.Studio by YE2020 compared to 12 as of YE2017. Our assumptions are slightly more conservative, as we currently pencil in 20 new stores in 2018 and 30 per annum in 2019 and 2020. Underpinned by F.Studio’s fasttrack expansion, we project FRT will increase its market share in Apple to over 30% in the next five years from ~15% currently. F.Studio’s same-store sales (SSS) typically start low and then pick up quickly. According to FRT, FRT’s revenue/store tends to be low in the first year at around USD88,000/month. Nonetheless, annual SSSG after the first year can range from 15%20%. This is because F.Studio customers tend to be very loyal and so they will not only come back but also recommend the service to their friends and relatives. Figure 19: Estimated market share in Apple products (2017 vs 2022) 2017 2022 44% 56% MWG and FRT 45% 55% Mom-and-pop and other small chains Source: VCSC Online sales should continue to take off We are projecting a 29% CAGR for FRT’s online sales in the next five years due to the widening popularity of online shopping among Vietnamese consumers and FPT continuing to utilize its physical store network to provide an omni-channel experience for customers. In 2022, online sales will constitute 30% of FRT’s revenue based on our projections, compared to 15% in 2017. See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 17 Figure 20: VCSC’s revenue forecasts for FRT’s mobile phone business New stores 25,000 F.Studio 20,000 Online sales 15,000 F.Friends and telco subsidy 10,000 Same store sales (excl. F.Friends and subsidy) 5,000 2017 2018 2019 2020 2021 2022 Source: VCSC forecasts Margins to expand on the back of larger scale and higher contribution from F.Friends and telco subsidy programs GPM is boosted by a larger scale, but is partly reined in by a widening contribution from F.Studio. Per FRT, iPhone sales only yield a GPM of 10%-11% compared to an average of ~15% for other brands. Due to F.Studio’s rising contribution to revenue, the upward trend in FRT’s GPM will start to phase out starting from 2022, per our projections. Net margin to be further aided by increasing contributions from F.Friends and telco subsidy programs. As we explained above, additional sales from these programs will prop up margins of FRT’s mobile segment. We currently assume that the combined contribution from F.Friends and telco subsidy programs will balloon to 15.6% of mobile revenue in the next five years compared to 6%-7% in 2017. Again, this is more conservative than management’s target of at least 30%. Figure 21: VCSC’s margin projections for FRT’s mobile segment 15% 14.2% 14.4% 14.5% 14.5% 14.5% 13.8% 5% 14% 13% 2.8% 3.0% 3.2% 11% 3.3% 3.4% 3.4% 2.9% 3.0% 4% 3% 12% 2.2% 6% 2.5% 2.6% 2.8% 2% 1% 10% 0% 2017 2018 GPM (LHS) 2019 2020 EBIT margin (RHS) 2021 2022 NPM (RHS) Source: VCSC See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 18 Long Chau pharmacy outlook Extensive growth headroom as Vietnam’s pharmacy market remains dominated by mom-and-pop stores. Vietnam’s pharma sector boasts a market size of USD4.7bn in 2017, according to BMI, in which pharmacies account for one-third of the market. There are over 40,000 pharmacies in Vietnam, but only less than 250 are owned by modern chains. The largest chain by store count, Pharmacity, only has 100 stores currently. Long Chau boasts superior sales/store thanks to its prestigious brand and an extensive range of SKUs. According to FRT, Long Chau’s average monthly sales per store are USD136,000 currently, head and shoulders above other chains (see Figure 22). This is owing to: • Long Chau is a top-of-mind brand when it comes to prescription drugs. • Long Chau’s extensive product assortment, which consists of more than 5,000 SKUs, 5x-6x larger than its closest competitor. This makes Long Chau a one-stop shop for customers as most of the time, they can find everything they need for their prescription at Long Chau instead of having to go to different stores. • Experienced pharmacists (>10 years of experience on average), who will stay with Long Chau post-FRT’s acquisition. These senior pharmacists will play an important role in training new staff as FRT expands its store network. Figure 22: Revenue/store of Long Chau vs other pharmacy chains (USD ’000/month) 136 11 Pharmacity 18 Phano 32 25 Eco Pharma An Khang (MWG) Long Chau Source: FRT New stores are surprisingly displaying similar sales progress as legacy stores. As mentioned above, prior to FRT’s acquisition, all five of Long Chau’s stores were located on the same Hai Ba Trung street in District 3. Since taking over Long Chau, FRT has opened another four stores in District 7, District 3, Go Vap District and Tan Binh District. Per FRT, sales at these stores ranged from USD66,000 to USD88,000/month/store in the first one to two months and then gradually ramped up to USD154,000-USD198,000 after four to six months, which is very impressive. When launching a new store, in its marketing and promotion campaigns, FRT uses a headline of “Long Chau is now present in District X” to leverage Long Chau’s brand name. See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 19 Figure 23: Long Chau draws strong traffic thanks to its prestige and extensive SKUs Source: VCSC We opt to be more conservative than management in terms of future store openings at this early stage We project 25 new stores per annum for 2018-2019 and 50 stores per annum during 2020-2027. Before further accelerating the pace of store roll-outs, Long Chau will need to fine tune its back-end capabilities, strengthen its understanding of locations, i.e., which types of locations work best, as well as prepare human resources, i.e., the pharmacist pool. Compared to mobile phones, pharmacies are a more challenging format due to (1) its broader range of SKUs, (2) product expiry, (3) the need for capable pharmacists who can reliably consult customers and also have good sales skills and (4) a wide variety of suppliers. Management’s aggressive plan. Management is targeting a total of 390 stores by YE2021 compared to our projection of 158. As such, there is material upside to our forecasts if FRT can deliver on its pharmacy game plan. See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 20 Figure 24: Long Chau’s new store opening projections (FRT vs VCSC) 390 80 30 25 50 25 2018 2019 50 2020 FRT's guidance 158 150 120 2021 Total store count as of YE2021F VCSC's projection Source: FRT, VCSC We project Long Chau will contribute 18% and 15% to FRT’s revenue and NPAT, respectively, in 2022. We assume that the chain will be consolidated in 2019. For new stores, we pencil in VND2bn (USD88,000) in sales/month in the first year, which will grow at an annual rate of 10%-15% in the following five years. In 2018-2019, we conservatively pencil in an NPAT margin of 2% for Long Chau as we assume GPM improvement, which will be driven by a larger scale, will be partly offset by FRT’s back-end investments as well as spending on marketing and promotions. NPAT margin is then projected to step up gradually to 2.4% in 2022 as a result of cost rationalization and continuing scale expansion. Figure 25: Margin projections for Long Chau during 2018-2022 18.0% 17.0% 17.0% 16.5% 17.2% 5.0% 16.5% 4.0% 16.0% 15.0% 17.4% 2.5% 2.5% 2.0% 2.0% 2.7% 2.9% 3.0% 3.0% 14.0% 13.0% 12.0% 2.2% 2.3% 2.0% 2.4% 1.0% 11.0% 10.0% 0.0% 2018 2019 GPM (LHS) 2020 EBIT margin (RHS) 2021 2022 NPM (RHS) Source: VCSC See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 21 Summary of P&L projections Figure 26: VCSC’s base-case projections for FRT VND bn 2018 2019 2020 2021 2022 15,397 17% 18,854 22% 22,507 19% 26,591 18% 30,543 15% 14,725 672 0 16,131 1,368 1,355 17,739 2,347 2,421 19,326 3,342 3,923 20,749 4,219 5,575 2,184 2,739 3,323 3,970 4,579 20% 25% 21% 19% 15% 2,110 74 0 2,365 150 224 2,653 258 412 2,928 368 675 3,145 464 970 EBIT YoY In which: FPTShop F.Studio Long Chau 467 29% 595 27% 731 23% 888 21% 1,019 15% 462 6 0 562 0 34 659 7 65 747 28 114 791 60 167 NPAT YoY In which: FPTShop & F.Studio Long Chau 384 33% 487 27% 608 25% 754 24% 890 18% 384 460 555 663 756 0 27 52 91 134 14.2% 2.5% 14.5% 2.6% 14.8% 2.7% 14.9% 2.8% 15.0% 2.9% Revenue YoY In which: FPTShop F.Studio Long Chau Gross profit YoY In which: FPTShop F.Studio Long Chau GPM NPM Source: VCSC See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> 2017-2022 CAGR 18% 20% 23% 25% April 23, 2018| 22 We provide below an alternative projection, in which we incorporate FRT’s aforementioned guidance for Long Chau store expansion instead of using our own assumptions. The number of new stores in 2022 is assumed to be 150, similar to FRT’s 2021 plan. Figure 27: Projections for FRT if management’s plan for Long Chau is incorporated VND bn 2018 2019 2020 2021 2022 15,397 17% 19,652 28% 24,951 27% 31,403 26% 38,356 22% 14,725 672 0 16,131 1,368 2,153 17,739 2,347 4,864 19,326 3,342 8,735 20,749 4,219 13,388 2,184 2,871 3,738 4,798 5,938 20% 31% 30% 28% 24% 2,110 74 0 2,365 150 355 2,653 258 827 2,928 368 1,502 3,145 464 2,330 EBIT YoY In which: FPTShop F.Studio Long Chau 467 29% 615 32% 797 30% 1,028 29% 1,253 22% 462 6 0 562 0 54 659 7 131 747 28 253 791 60 402 NPAT YoY In which: FPTShop & F.Studio Long Chau 384 33% 503 31% 662 31% 870 31% 1,089 25% 384 460 557 668 768 0 43 105 203 321 14.2% 2.5% 14.6% 2.6% 15.0% 2.7% 15.3% 2.8% 15.5% 2.8% Revenue YoY In which: FPTShop F.Studio Long Chau Gross profit YoY In which: FPTShop F.Studio Long Chau GPM NPM Source: VCSC See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> 2017-2022 CAGR 24% 27% 28% 30% April 23, 2018| 23 Key investment risks Bad debt from F.Friends and price subsidy programs The following situations could undermine FRT’s NPAT: - Runaway bad debt in F.Friends. - Increases in insurance fees in the price subsidy program if the default rate proves higher than the expectations of insurance providers. Non-life insurance contracts are typically renewed on a yearly basis. We currently factor in 3% bad debt in 2018 for these two programs, which will gradually increase to 4% in 2022 as FRT intensifies its roll-out. These assumptions are higher than FRT’s 2% guidance. However, we believe this risk will be under control and our bad-debt assumptions are highly conservative. We understand that for traditional consumer finance players such as FE Credit, Home Credit and HDSaison, NPLs in consumer durable loans are below 5%. Given FRT’s much stricter approval process and protection mechanism, we think it is reasonable to expect that NPLs in F.Friends and price subsidy programs will be much lower than 5%. Figure 28: VCSC’s base-case projections for F.Friends and price subsidy programs Base case F.Friends + price subsidy as % of FRT’s total revenue Bad debt/revenue for F.Friends and price subsidy FRT’s total NPAT (VND bn) Source: VCSC 2018 2019 2020 2021 2022 11.8% 13.5% 14.1% 15.0% 15.6% 3.0% 3.2% 3.5% 3.8% 4.0% 384 487 608 754 890 2021 2022 Figure 29: Scenario analysis FRT’s assumptions Bad debt/revenue for F.Friends and price subsidy FRT’s total NPAT (VND bn) % vs base case 2018 2.0% 2.0% 2.0% 2.0% 399 104% 507 105% 632 106% 784 107% 925 108% 2020 2021 2022 See important disclosure at the end of this document 2019 5.0% 5.2% 5.5% 5.8% 6.0% 355 92% 448 92% 559 92% 693 92% 818 92% 2018 Bad debt/revenue for F.Friends and price subsidy FRT’s total NPAT (VND bn) % vs base case Source: VCSC 2020 2.0% 2018 Bad debt/revenue for F.Friends and price subsidy FRT’s total NPAT (VND bn) % vs base case 2019 2019 2020 2021 2022 10.0% 10.2% 10.5% 10.8% 11.0% 281 73% 349 72% 436 72% 542 72% 638 72% www.vcsc.com.vn | VCSC<GO> April 23, 2018| 24 Price war from pure e-commerce players E-commerce players have been aggressively undercutting on prices to chase GMV (Gross Merchandize Value). Most notable are Lazada and Tiki, as demonstrated in Figure 30 below, whose offerings are very attractive to price-sensitive consumers. Figure 30: Selling price (VND) comparison between Lazada, Tiki, MWG and FRT Model iPhone X (64GB) Samsung Galaxy S9+ Samsung Galaxy A8+ Samsung Galaxy S8 Source: VCSC compilations Lazada 25,790,000 23,490,000 11,528,000 15,800,000 Tiki 25,890,000 19,490,000 12,990,000 14,890,000 MWG and FRT 29,990,900 23,490,000 13,490,000 15,990,000 MWG and FRT hold the advantage in terms of customer trust, services and delivery. As we mentioned above, MWG and FRT’s extensive store network allows them to provide quick delivery even in rural areas and seamless omni-channel experiences for customers, something that pure e-commerce players cannot offer. Figure 31: MWG and FRT offer the most attractive after-sales policies Return/Exchange policy Lazada Tiki Faulty products Seven-day exchange Seven-day exchange; after seven-30 days, send to warranty service Non-faulty products No exchange/return 30-day return, if the product remains unused MWG and FRT * First month: free exchange or 80% refund. *Second month onward: percentage of refund declines five ppts after each month past e.g. Refund 75% in second month, 70% in third month… * First month: free exchange or 80% refund *Second month onward: percentage of refund declines five ppts after each month past e.g. Refund 75% in month two, 70% in month three… Source: VCSC compilations Long Chau – stricter enforcement on drug prescription A more stringent enforcement of prescription drug usage could hurt pharmacies. In 2016, the Ministry of Health issued Circular 05/2016/TT-BYT regulating drug prescription in outpatient treatment. Under the Circular and its listed regulations, pharmaceutical retailers are not allowed to sell medicines outside of the “non-prescription” drug list without prescriptions from doctors. Having said that, up to now, enforcement has been rather loose as it is challenging to manage all >40,000 POS across Vietnam, especially those in remote areas. Consequently, it remains ubiquitous for pharmacies to sell drugs without prescriptions in Vietnam. A tightening in enforcement, if it happens, will dampen pharmacy sales. See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 25 Valuation We adopt a Sum-of-the-Parts (SoTP) valuation for FRT, which includes a combination of: (1) An average of five-year DCF and adjusted-PER methods for the mobile segment; and (2) A ten-year DCF for Long Chau with a 25% cost of equity given the high uncertainty of our forecasts at this juncture. This will be phased out in the future as visibility of the progress of the chain improves. Adopting management’s store opening guidance for Long Chau, our TP would be 9% higher. If we incorporate management’s store expansion plan for Long Chau from 2018 to 2022 and keep the pace of new store openings at 100 stores per annum from 20232027, our Long Chau’s valuation would jump by 131% vs our base case, adding an additional VND15,700/share to our TP for FRT. Figure 32: Valuation summary Weighting Equity value (VNDbn) Target price (VND) Contribution (VND/sh) DCF 50% 8,297 207,428 103,714 TTM PER @ 18x* 50% 5,061 126,513 63,257 100% 428 10,704 10,704 Method FPTShop and F.Studio Long Chau DCF Target Price 177,700 2017 PER at TP 25.3x 2018F PER at TP 19.1x Source: VCSC, *domestic and regional peer median Discounted Cash Flows – Mobile (FPTShop and F.Studio) Figure 33: DCF Valuation Cost of Capital FCFF (Five Year) Beta Market Risk Premium % Risk Free Rate % Cost of Equity % Cost of Debt % Debt % Equity % 0.8 8.0 3.2 9.6 6.0 25.1 74.9 PV of Free Cash Flows PV of Terminal Val (2.5% g) PV of FCF and TV + Cash & ST investments - Debt - Minority Interest Equity Value Corporate Tax Rate % 20.0 Shares (mn) WACC % See important disclosure at the end of this document 8.4 Price per share, VND www.vcsc.com.vn | VCSC<GO> 1,546 7,286 8,832 638 -1,173 0 8,297 40 207,428 April 23, 2018| 26 Figure 34: DCF FY18 FY19 FY20 FY21 FY22 EBIT - Tax + Depreciation - Capex - Working cap increase Free Cash Flow Present Value of FCF 539 -110 90 -73 -332 113 106 638 -130 88 -53 -220 322 280 761 -155 78 -43 -207 433 350 893 -182 55 -18 -220 528 395 993 -203 40 -13 -214 603 416 Cumulative PV of FCF 106 386 735 1,130 1,546 Source: VCSC Discounted Cash Flows – Long Chau Figure 35: DCF Valuation Cost of Capital FCFF (Five Year) Beta Market Risk Premium % Risk Free Rate % Cost of Equity % Cost of Debt % Debt % Equity % NA NA NA 25%* NA NA 100% PV of Free Cash Flow PV of Terminal Val (3.0% g) PV of FCF and TV + Cash & ST investments - Debt - Minority Interest Equity Value Corporate Tax Rate % 20% 25%* Shares (mn) WACC % Source: VCSC 69 359 428 0 0 0 428 40 Price per share, VND 10,704 *We apply a high cost of equity for Long Chau to reflect the high uncertainty of our long-term assumptions given that the chain remains in its early stage Figure 36: Cash flows VND bn FY18 FY19 EBIT 15 - Tax -3 + Depreciation - Capex - WC increase Free Cash Flow PV of FCF Cumulative PV of FCF FY20 FY21 FY22 FY23 FY24 FY25 FY26 FY27 34 65 114 167 225 290 331 373 452 -7 -13 -23 -33 -45 -58 -66 -75 -90 6 11 21 31 41 47 51 51 51 51 -30 -25 -50 -50 -50 -55 -50 -50 -50 -50 -123 -58 -151 -145 -162 -73 -127 -3 -91 -86 -135 -45 -127 -73 -37 99 106 263 208 277 -108 -28 -65 -30 -12 32 35 86 68 91 -108 -136 -201 -231 -244 -211 -176 -90 -22 69 Source: VCSC See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 27 Peer comparison Figure 37: Comparable peers (USD mn) Ticker MWG VN Country Mkt cap TTM Net Sales Y-o-Y% TTM NPAT Y-o-Y % Debt/ Equity ROE TTM P/E Adjusted TTM P/E LQ P/B Vietnam 1,451.1 2,920.2 48.7 97.1 39.8 115.1 45.3 14.3 14.3 5.5 India 962.6 6,132.8 16.0 69.2 9.6 43.2 15.2 13.4 12.9 2.0 Thailand 730.0 664.5 31.5 18.0 49.7 72.8 28.4 36.8 46.3 9.9 China 393.6 78.7 (7.3) 9.8 (30.3) 25.4 4.3 37.3 27.2 1.6 Thailand 260.9 372.6 17.9 14.5 11.8 231.3 15.9 17.1 21.6 2.5 Indonesia 257.2 1,811.0 17.9 25.4 28.7 47.3 9.7 10.4 10.5 1.0 Median 561.8 1,237.8 17.9 21.7 20.3 60.1 15.6 15.7 18.0 2.3 Average 675.9 1,996.6 20.8 39.0 18.2 89.2 19.8 21.6 22.1 3.8 REDI IN COM7 TB 002296 CH JMART TB ERAA IJ Source: Bloomberg See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 28 Financial Statements INCOME STATEMENT (VND bn) 2017A 2018F 2019F BALANCE SHEET (VND bn) Revenue 13,147 15,397 18,854 Cash & cash equivalents -11,330 -13,213 -16,115 1,816 2,184 2,739 COGS Gross Profit Sales & Marketing exp. -1,154 -1,365 -1,717 General & Admin exp. -300 -352 -427 Operating Profit (EBIT) 362 467 595 Financial income Short term investment Accounts receivables Inventories Other current assets Total Current assets 2017A 2018F 2019F 638 538 512 0 0 0 306 472 639 1,723 2,059 2,737 842 842 842 3,509 3,911 4,729 54 55 62 Fix assets, gross 46 46 106 -82 -70 -77 - Depreciation -7 -9 -25 -79 -70 -77 Fix assets, net 39 38 82 0 0 0 LT investment 0 0 0 29 29 29 LT assets other 323 396 449 363 480 609 Total LT assets -73 -96 -122 NPAT before MI 290 384 487 Minority Interest 0 0 0 NPAT less MI, reported 290 384 487 NPAT less MI, adjusted 290 384 487 Other ST liabilities EBITDA 448 558 694 Total current liabilities EPS basic reported, VND 7,247 9,607 12,179 EPS basic adjusted, VND 7,247 9,607 12,179 EPS fully diluted, VND 7,247 9,607 12,179 Total Liabilities 2017A 2018F 2019F Preferred Equity Financial expenses In which, interest expense Share profit/loss from associates Net other income/(loss) Profit before Tax Income Tax RATIOS Growth 362 434 531 Total Assets 3,871 4,345 5,259 Accounts payable 1,499 1,668 2,069 Short-term debt 1,173 1,173 1,280 403 403 403 3,075 3,244 3,752 Long term debt 0 0 0 Other LT liabilities 0 0 0 3,075 3,244 3,752 Paid in capital/Issued capital Revenue growth 21.1% 17.1% 22.5% Add’l share capital/share premium Operating profit (EBIT) growth % 57.3% 29.1% 27.4% Retained earnings PBT growth % 40.0% 32.3% 26.8% EPS growth %, adjusted 39.7% 32.6% 26.8% Gross Profit Margin % 0 400 0 0 0 701 1,108 Other equity 0 0 0 Minority interest 0 0 0 796 1,101 1,508 3,871 4,345 5,259 2017A 2018F 2019F 1,458 638 538 290 384 487 86 91 99 104 -332 -320 -301 -90 -88 179 53 178 Liabilities & equity 13.8% 14.2% 14.5% Operating Profit, (EBIT) Margin % 2.8% 3.0% 3.2% CASH FLOW (VND bn) EBITDA Margin % 3.4% 3.6% 3.7% Beginning Cash Balance NPAT less MI Margin, adj. % 2.2% 2.5% 2.6% Net Income ROE % 44.2% 40.5% 37.4% Dep. & amortization ROA % 6.8% 9.4% 10.1% Change in Working Capital Other adjustments Efficiency 0 400 396 Total equity Profitability 0 400 Cash from Operations Days Inventory On Hand 59.1 52.2 54.3 Days Accts. Receivable 5.9 9.2 10.8 Capital Expenditures, net -52 -73 -85 Days Accts. Payable 47.1 43.7 42.3 Investments, net 315 0 -147 Cash Conversion Days 17.9 17.7 22.7 Cash from Investments 263 -73 -231 Dividends Paid 0 -80 -80 Current Ratio x 1.1 1.2 1.3 ∆ in Share Capital 0 0 0 Quick Ratio x 0.6 0.6 0.5 ∆ in LT debt 0 0 0 Cash Ratio x 0.2 0.2 0.1 ∆ in ST debt -1,262 0 107 Debt / Assets 30.3% 27.0% 24.3% Other financing cash flows Debt / Capital 59.6% 51.6% 45.9% Cash from Financing Net Debt / Equity 67.2% 57.7% 51.0% 4.6 6.6 7.8 Liquidity Interest Coverage x Net Change in Cash Ending Cash Balance See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> 0 0 0 -1,262 -80 27 -819 -100 -27 638 538 512 April 23, 2018| 29 Appendix Figure 1: 2017-2022 NPAT projections for FRT (VNDbn) ................................................................. 4 Figure 2: 2017-2022 NPAT projections for MWG (VNDbn) ............................................................... 4 Figure 3: FPT Shop format ................................................................................................................ 5 Figure 4: FRT’s shareholder structure as of April 6, 2018 ................................................................. 5 Figure 5: FRT’s key personnel .......................................................................................................... 6 Figure 6: Standalone store count of leading mobile phone retailers in Vietnam ................................ 7 Figure 7: Market share structure of mobile phone retail market in 2013 vs 2017 .............................. 8 Figure 8: FRT’s sales by product ASP in comparison to others (2017) ............................................. 9 Figure 9: FRT’s different Apple concepts .......................................................................................... 9 Figure 10: FRT’s 2017 revenue by category ................................................................................... 10 Figure 11: Long Chau Pharmacy .................................................................................................... 10 Figure 12: FRT’s historical store count ............................................................................................ 11 Figure 13: FRT’s historical revenue (VND bn) ................................................................................. 11 Figure 14: FRT’s historical NPAT (VND bn) and NPAT margin ....................................................... 12 Figure 15: Comparison between F.Friends and other consumer financing options ......................... 13 Figure 16: F.Friends process .......................................................................................................... 13 Figure 17: Barriers and opportunities for telco subsidy program ..................................................... 14 Figure 18: Illustration of the price subsidy package for Samsung Note 8 ........................................ 15 Figure 19: Estimated market share in Apple products (2017 vs 2022) ............................................ 17 Figure 20: VCSC’s revenue forecasts for FRT’s mobile phone business ........................................ 18 Figure 21: VCSC’s margin projections for FRT’s mobile segment .................................................. 18 Figure 22: Revenue/store of Long Chau vs other pharmacy chains (USD ’000/month) .................. 19 Figure 23: Long Chau draws strong traffic thanks to its prestige and extensive SKUs ................... 20 Figure 24: Long Chau’s new store opening projections (FRT vs VCSC) ......................................... 21 Figure 25: Margin projections for Long Chau during 2018-2022 ..................................................... 21 Figure 26: VCSC’s base-case projections for FRT .......................................................................... 22 Figure 27: Projections for FRT if management’s plan for Long Chau is incorporated ..................... 23 Figure 28: VCSC’s base-case projections for F.Friends and price subsidy programs ..................... 24 Figure 29: Scenario analysis ........................................................................................................... 24 Figure 30: Selling price (VND) comparison between Lazada, Tiki, MWG and FRT ........................ 25 Figure 31: MWG and FRT offer the most attractive after-sales policies .......................................... 25 Figure 32: Valuation summary ........................................................................................................ 26 Figure 33: DCF Valuation ................................................................................................................ 26 Figure 34: DCF ................................................................................................................................ 27 Figure 35: DCF Valuation ................................................................................................................ 27 Figure 36: Cash flows...................................................................................................................... 27 Figure 37: Comparable peers .......................................................................................................... 28 See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 30 Rating and Valuation Methodology Absolute, long term (fundamental) rating: The recommendation is based on implied total return for the stock defined as (target price – current price)/current price + dividend yield, and is not related to market performance. This structure applies from May 27, 2015. RATING BUY OUTPERFORM (O-PF) MARKET PERFORM (M-PF) UNDERPERFORM (U-PF) SELL NOT RATED RATING SUSPENDED DEFINITION Total stock return including dividends over next 12 months expected to exceed 20% Total stock return including dividends over next 12 months expected to be positive 10%-20% Total stock return including dividends over next 12 months expected to be between negative 10% and positive 10% Total stock return including dividends over next 12 months expected to be negative 10%-20% Total stock return including dividends over next 12 months expected to be below negative 20% The company is or may be covered by the Research Department but no rating or target price is assigned either voluntarily or to comply with applicable regulation and/or firm policies in certain circumstances, including when VCSC is acting in an advisory capacity in a merger or strategic transaction involving the company. A rating that happens when fundamental information is insufficient to determine an investment rating or target. The previous investment rating and target price, if any, are no longer in effect for this stock. Unless otherwise specified, these performance parameters only reflect capital appreciation and are set with a 12month horizon. Future price volatility may cause temporary mismatch between upside/downside for a stock based on market price and the formal recommendation, thus these performance parameters should be interpreted flexibly. Risks: Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security or related instrument mentioned in this report. For investment advice, trade execution or other enquiries, clients should contact their local sales representative. See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 31 Disclaimer Analyst Certification of Independence I, Dao Nguyen, hereby certify that the views expressed in this report accurately reflect my personal views about the subject securities or issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. The equity research analysts responsible for the preparation of this report receive compensation based upon various factors, including the quality and accuracy of research, client feedback, competitive factors, and overall firm revenues, which include revenues from, among other business units, Institutional Equities and Investment Banking. VCSC and its officers, directors and employees may have positions in any securities mentioned in this document (or in any related investment) and may from time to time add to or dispose of any such securities (or investment).VCSC may have, within the last three years, served as manager or co-manager of a public offering of securities for, or currently may make a primary market in issues of, any or all of the entities mentioned in this report or may be providing, or have provided within the previous 12 months, significant advice or investment services in relation to the investment concerned or a related investment. Copyright 2013 Viet Capital Securities Company “VCSC”. All rights reserved. This report has been prepared on the basis of information believed to be reliable at the time of publication. VCSC makes no representation or warranty regarding the completeness and accuracy of such information. Opinions, estimates and projection expressed in this report represent the current views of the author at the date of publication only. They do not necessarily reflect the opinions of VCSC and are subject to change without notice. This report is provided, for information purposes only, to institutional investors and retail clients of VCSC in Vietnam and overseas in accordance to relevant laws and regulations explicit to the country where this report is distributed, and does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction. Investors must make their investment decisions based upon independent advice subject to their particular financial situation and investment objectives. This report may not be copied, reproduced, published or redistributed by any person for any purpose without the written permission of an authorized representative of VCSC. Please cite sources when quoting. U.K. and European Economic Area (EEA): Unless specified to the contrary, issued and approved for distribution in the U.K. and the EEA by VCSC issued by VCSC has been prepared in accordance with VCSC’s policies for managing conflicts of interest arising as a result of publication and distribution of investment research. Many European regulators require a firm to establish, implement and maintain such a policy. This report has been issued in the U.K. only to persons of a kind described in Article 19 (5), 38, 47 and 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons"). This document must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this document relates is only available to relevant persons and will be engaged in only with relevant persons. In other EEA countries, the report has been issued to persons regarded as professional investors (or equivalent) in their home jurisdiction. Australia: This material is issued and distributed by VCSC in Australia to "wholesale clients" only. VCSC does not issue or distribute this material to "retail clients". The recipient of this material must not distribute it to any third party or outside Australia without the prior written consent of VCSC. For the purposes of this paragraph the terms "wholesale client" and "retail client" have the meanings given to them in section 761G of the Corporations Act 2001. Hong Kong: The 1% ownership disclosure as of the previous month end satisfies the requirements under Paragraph 16.5(a) of the Hong Kong Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission. (For research published within the first ten days of the month, the disclosure may be based on the month end data from two months prior.) Japan: There is a risk that a loss may occur due to a change in the price of the shares in the case of share trading, and that a loss may occur due to the exchange rate in the case of foreign share trading. In the case of share trading, VCSC will be receiving a brokerage fee and consumption tax (shouhizei) calculated by multiplying the executed price by the commission rate which was individually agreed between VCSC and the customer in advance. Korea: This report may have been edited or contributed to from time to time by affiliates of VCSC. Singapore: VCSC and/or its affiliates may have a holding in any of the securities discussed in this report; for securities where the holding is 1% or greater, the specific holding is disclosed in the Important Disclosures section above. India: For private circulation only, not for sale.Pakistan: For private circulation only, not for sale.New Zealand: This material is issued and distributed by VCSC in New Zealand only to persons whose principal business is the investment of money or who, in the course of and for the purposes of their business, habitually invest money. VCSC does not issue or distribute this material to members of "the public" as determined in accordance with section 3 of the Securities Act 1978. The recipient of this material must not distribute it to any third party or outside New Zealand without the prior written consent of VCSC. Canada: The information contained herein is not, and under no circumstances is to be construed as, a prospectus, an advertisement, a public offering, an offer to sell securities described herein, or solicitation of an offer to buy securities described herein, in Canada or any province or territory thereof. Any offer or sale of the securities described herein in Canada will be made only under an exemption from the requirements to file a prospectus with the relevant Canadian securities regulators and only by a dealer properly registered under applicable securities laws or, alternatively, pursuant to an exemption from the dealer registration requirement in the relevant province or territory of Canada in which such offer or sale is made. The information contained herein is under no circumstances to be construed as investment advice in any province or territory of Canada and is not tailored to the needs of the recipient. To the extent that the information contained herein references securities of an issuer incorporated, formed or created under the laws of Canada or a province or territory of Canada, any trades in such securities must be conducted through a dealer registered in Canada. No securities commission or similar regulatory authority in Canada has reviewed or in any way passed judgment upon these materials, the information contained herein or the merits of the securities described herein, and any representation to the contrary is an offence. Dubai: This report has been issued to persons regarded as professional clients as defined under the DFSA rules. United States: This research report prepared by VCSC is distributed in the United States to Major US Institutional Investors (as defined in Rule 15a-6 under the Securities Exchange Act of 1934, as amended) only by Decker&Co, LLC, a broker-dealer registered in the US (registered under Section 15 of Securities Exchange Act of 1934, as amended). All responsibility for the distribution of this report by Decker&Co, LLC in the US shall be borne by Decker&Co, LLC. All resulting transactions by a US person or entity should be effected through a registered broker-dealer in the US. This report is not directed at you if VCSC Broker or Decker&Co, LLC is prohibited or restricted by any legislation or regulation in any jurisdiction from making it available to you. You should satisfy yourself before reading it that Decker&Co, LLC and VCSC is permitted to provide research material concerning investment to you under relevant legislation and regulations. See important disclosure at the end of this document www.vcsc.com.vn | VCSC<GO> April 23, 2018| 32 Contacts Corporate www.vcsc.com.vn Head Office Bitexco Financial Tower, 2 Hai Trieu Street District 1, HCMC +84 28 3914 3588 Hanoi Branch 109 Tran Hung Dao Hoan Kiem District, Hanoi +84 24 6262 6999 Transaction Office 10 Nguyen Hue Street District 1, HCMC +84 28 3914 3588 Transaction Office 236-238 Nguyen Cong Tru Street District 1, HCMC +84 28 3914 3588 Research Research Team +84 28 3914 3588 research@vcsc.com.vn Barry Weisblatt, Head of Research, ext 105 barry.weisblatt@vcsc.com.vn Long Ngo, Senior Manager, ext 123 Banks, Securities, Insurance - Cameron Joyce, Manager, ext 163 - Nghia Dien, Analyst, ext 138 - Son Tong, Analyst, ext 116 - Anh Dinh, Analyst, ext 139 Macro - Luong Hoang, Senior Analyst, ext 364 - Nguyen Truong, Analyst, ext 132 Real Estate, Construction and Materials Hong Luu, Senior Manager, ext 120 - Anh Nguyen, Senior Analyst, ext 174 - Vy Nguyen, Senior Analyst, ext 147 Consumer and Pharma Phap Dang, Senior Manager, ext 143 - Dao Nguyen, Senior Analyst, ext 185 - Nghia Le, Analyst, ext 181 Industrials and Transportation Lucy Huynh, Senior Manager, ext 130 - Phu Pham, Analyst, ext 124 - Trang Tran, Analyst, ext 149 Oil & Gas and Power Duong Dinh, Manager, ext 140 - Tram Ngo, Senior Analyst, ext 135 - Thanh Nguyen, Analyst, ext 173 - Nam Hoang, Analyst, ext 196 Retail Client Research Duc Vu, Senior Manager, ext 363 - Ha Dao, Analyst, ext 194 - Tra Vuong, Analyst, ext 365 - Ninh Chu, Analyst, ext 129 Institutional Sales and Brokerage & Foreign Individuals Head of Institutional Sales Michel Tosto, M. Sc. +84 28 3914 3588 ext 102 michel.tosto@vcsc.com.vn Vietnamese Sales Dung Nguyen +84 28 3914 3588 ext 136 dung.nguyen@vcsc.com.vn Retail & Corporate Brokerage Ho Chi Minh City Quynh Chau +84 28 3914 3588 ext 222 quynh.chau@vcsc.com.vn See important disclosure at the end of this document Hanoi Quang Nguyen +84 24 6262 6999 ext 312 quang.nguyen@vcsc.com.vn www.vcsc.com.vn | VCSC<GO> April 23, 2018| 33