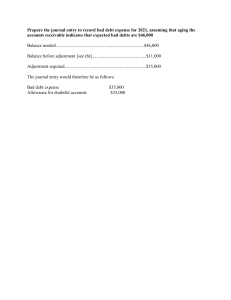

Audit of receivables AUDIT PROGRAM FOR RECEIVABLES Audit objectives: To determine that: 1. Receivables represent valid claims against customers and other parties and have been properly recorded. 2. The related allowance for doubtful accounts, returns and allowances, and discounts are reasonably adequate. 3. Receivables are properly describe 4. Disclosures with respect to the accounts are adequate. Audit Procedures: 1. Obtain a list of aged accounts receivable balances from the subsidiary ledger, and: Foot and cross-foot the list. Check if the list reconciles with the general ledger control account. Trace individual balances to the subsidiary ledger. Test the accuracy of the aging Adjust non-trade accounts erroneously include in customers’ accounts. Investigate and reclassify significant credit balances. 2. Test accuracy of balances appearing in the subsidiary ledger. 3. Confirm accuracy of individual balances by direct communication with customers. Investigate exceptions reported by customers and discuss with appropriate officer for proper disposal. Send a second request for positive confirmation requests without any replies from customers. If the second request does not produce a reply from the customer, perform extended procedures, like: Reviewing collections after year-end Checking, supporting documents. Discussing the account with appropriate officer. Discuss with appropriate officer, confirmation request returned by the post office and perform extended procedures. Prepare a summary of confirmation results. 4. Review correspondence with customers for possible adjustments. 5. Test propriety of cutoff: Examine sales recorded and shipments made a week before and after the end of the reporting period and ascertain whether the sales were recorded in the proper period. Investigate large amounts of sales returned shortly after the end of the reporting period. 6. Perform analytical procedures, like: Gross profile ratio Accounts receivable turnover Ratio of accounts written off to sales or balance of accounts receivable. Compare with prior year and industry averages. 7. Review individual balances and age of accounts with appropriate officer, and: Determine accounts that should be written off. Determine adequacy of allowance for doubtful accounts. 8. Obtain analyses of significant other receivables. 9. Ascertain whether some receivables are pledged, factored, discounted, or assigned. 10. Determine financial statement presentation and adequacy of disclosures. 11. Obtain receivable representation letter from client. Problem 2-1 Computaton of Accounts Receivable Balance Shown below is Gorospe COMPANY’ S aging schedule of its accounts receivable on December 31, 2010. Customers AA Co. BB, Inc. CC Corp. DD, Inc. EE Transport FF, Inc. GG Co. HH Corp. II Company Balance Due P 23,000 105,000 87,500 93,500 40,000 31,000 1,000 64,000 60,000 Totals P 505,000 P Current 0 62,000 23,000 53,000 0 15,000 1,000 20,000 60,000 Days Past Due 1-30 P 0 20,000 14,500 20,500 0 16,000 0 18,000 0 P 234,000 P89,000 31-60 P 23,000 13,000 10,000 10,000 0 0 0 16,000 0 P 72,000 Over 60 0 10,000 40,000 10,000 40,000 0 0 10,000 0 P110,000 The accounts receivable balance per general ledger is P505,000 on December 31, 2010. The following are audit comments for possible adjustments: AA Company Merchandise found defective; returned by the customer on November 10 for credit, but the credit memo was issued by Gorospe only on January 2, 2011 BB, Inc Account is good but usually pays late. CC Corp. Merchandise worth P40,000 destroyed in transit on June 4, 2010. The carrier was billed on July 1.( See EE Transport and II Company) DD Inc. Customer billed twice in error for P10,000. Balance is collectible. EE Transport Collected in full in January 15, 2011. FF, Inc. Paid in full o December 29, 2010 but not recorded. Collections were deposited January3, 2011. GG Co. Received account confirmation from customer for P11,000. Investigation revealed an erroneous credit for P10,000 ( see HHCorp.) HH Corp. Neglected to post P10,000 credit to customer’s account. II Company Customers wants to know the reason for receipt of P40,000 credit memo as its accounts payable is P100,000. Based on the foregoing information, what should be the adjusted balance of the Accounts Receivabletrade at December 31, 2010? Solution 2-1 Accounts Receivable per general ledger P 505,000 AA Co. – delayed issuance of credit memo ( 23,000) CC Corp. – Damaged merchandise credited to II Company ( 40,000) DD, Inc. -Double billing ( 10,000) FF Inc. - Collection not recorded (31,000) GG Co. –Erroneous posting of credit for HH Corp. 10,000 HH Corp. – Payment credited in error to GG Co. ( 10,000) II Company- credit for CC corp. erroneously posted to II Co . 40,000 Adjusted balance of accounts receivable- trade P441,000 Problem 2-2 DAFFODIL AUTO PARTS sells new parts to auto dealers. Company policy requires that a prenumbered shipping document be issued for each sale. At the time of pick-up or shipment, the shipping clerk writes the date on the shipping document. The last shipment made in the year ended December 31, 2010, was recorded on document 3167. Shipments are billed in the order that the billing clerk receives the shipping documents. For late December 31, 2010 and early January 2011, Shipping Documents are billed on sales invoices as follows: Shipping Document No. 3163 3164 3165 3166 3167 3168 3169 3170 3171 3172 Sales Invoice No. 5332 5326 5327 5330 5331 5328 5329 5333 5335 5334 The December 2010 and January 2011 sales journal have the following information included: SALES JOURNAL-DECEMBER 2010 Day of Month 30 30 31 31 31 Sales Invoice No. 5326 5329 5327 5328 5330 Amount of Sale Sales Invoice No. 5332 5331 5333 5335 5334 Amount of Sale P 264,131 10,639 85, 206 125,050 64,658 P 72,611 191,430 41,983 62,022 4,774 SALES JOURNAL- 2011 Day of Month 1 1 1 2 2 1. What is the net overstatement (understatement) of Daffodil’s sale for the year ended December 31, 2010? A. B. C. D. P21,318 P253,452 (P253,452) (P 21,318 ) 2. What adjusting entry is necessary to correct Daffodil’s financial statements for the year ended December 31, 2010? A. Accounts Receivable Sales B. Accounts Receivable Sales C. Sales Accounts Receivable D. Sales Accounts Receivable 21,318 21,318 253,452 253,452 21,318 21,318 253,452 253,452 3. Cutoff test designed to detect credit sales made before the end of the year that have been recorded in the subsequent year provide assurance about management’s assertion of A. B. C. D. Rights and Obligation Completeness Existence Valuation and Allocation 4. Tracing shipping documents to prenumbered sales invoices provides evidence that A. B. C. D. No duplicate shipments or billings occurred Shipments to customers were properly invoiced All goods ordered by customers were shipped. All prenumbered sales invoices were accounted for 5. An author most likely would review an entity’s periodic accounting for the numerical sequence of shipping documents and invoices to support management’s financial statement assertion of A. Existence B. Rights and Obligations C. Valuation and allocation D. Completeness Solution 2-2 1. December Shipping Misstatemen Overstatement or 2010 Sales Invoice No. 5326 5329 5327 5328 5330 t Documen t No. 3164 3169 3165 3168 3166 In Sales Cutoff Understatement of December 31 Sales P191,430 Overstatement 62,022 overstatement 253,452 January 2011 Sales 5332 5331 5333 5335 5334 3163 3167 3170 3171 3172 264,131 10,639 Understatement Understatement 21,318 Answer: D 2. Accounts receivable 21,318 Sales Answer: A 3. Completeness Answer: B 4. Shipments to customers were properly invoiced. Answer: B 5. Completeness Answer: D 21,318 Problem 2-3 Recording Sales, Sales Returns and Collections HOOLAND TULIPS, INC. sold goods costing P12, 000 on account for P18, 000 on March 21. It collected P12, 000 off this account on April 3. Also on this date, the customer reported that the goods did not meet the required specifications and returned goods costing P4, 000(with a sales price of P16, 000). Holland Tulips, Inc. uses a perpetual inventory system. Prepare the journal entries necessary on March 21 and April 3. Solution 2-3 JOURNAL ENTRIES March 21 Accounts Receivable 18,000 April Sales 21 Cost of goods sold Inventory 3 Cash Accounts Receivable 3 Sales returns and allowance Accounts Receivable 3 Inventory Cost of goods sold 18,000 12,000 12,000 12,000 12,000 6,000 6,000 4,000 4,000 Problem 2-4 Computation of Accounts Receivable Balance The following information is from GUMAMELA CORP.’ first year of operation: 1. 2. 3. 4. Merchandise purchased P450,000 Ending merchandise inventory 123,000 Collections from customers 150,000 All sales are on account and goods sell at 30% above cost. What is the accounts receivable balance at the end of the company’s first year of operations? A. P275,100 B. P78,900 C. P595,000 D. P435,000 Solution 2-4 Purchases Less: Merchandise inventory, ending Cost of goods sold Multiply by sales ratio Sales Less : Collections from customers Accounts receivable, ending P450, 000 (123,000) 327,000 X 130% 425,100 (150,000) P275,100 Answer: A Problem 2-5 Computation of Accounts Receivable Balance BANABA CO. reported the following information at the end of its first year operations, December 31, 2010: Bad debt expense for 2010 P271,000 Uncollectible accounts written off during 2010 Net realizable value of accounts receivable 35,400 895,000 What is the accounts receivable balance at December 31, 2010? A. B. C. D. P 1,166,000 P930,400 P1,201,400 P1,130,600 SOLUTION 2-5 Bad debt expense for 2010 P271, 000 Less: Accounts Written Off during 2010 (35,400) Allowance for bad debts, December 31, 2010 235,600 Add: Net Realizable value of the accounts Receivables, Dec. 31, 2010 895,000 Accounts Receivable, Dec. 31, 2010 P1,130,600 Answer : D Problem 2-6 Computation of Accounts Receivable and Allowance for bad debts SUNFLOWER COMPANY sells a variety of imports goods. By selling on credit, Sunflower cannot expect to collect 100% of its accounts receivable. At December 31, 2009, Sunflower reported the following on its statement of financial position: Accounts Receivable LESS: Allowance for bad debts Accounts receivable, net P 2197,500 (133,500) P 2,064,000 During the year ended December 31, 2010, Sunflower earned sales revenue of P537,702,500 and collected cash of 528,070,500 from customers. Assume bad debts expense for the year was 1% of sales revenue and that sunflower wrote off uncollectible accounts receivable totaling P5,439,500. 1. What is the accounts receivable balance at December 31, 2010? A. P 6390,000 C. P 11,829,500 B. P 2197,500 D. P 6,318,975 2. What is the December 31, 2010, balance of the Allowance for bad debts account? A. P 133,500 B. P 71,025 C. P 61,975 D. P71,525 Solution 2-6 1. Accounts Receivable, Jan. 1, 2010 Sales Collections Accounts written off Accounts receivables, Dec. 31, 2010 Answer: A Allowance for bad debts, Jan.1 2010 Bad debt expense (537,702,500 x 1 %) Accounts written off Allowance for bad debts, December 31, 2010 Answer: B P 2,197,500 537,702,500 528,070,500 (5,439,500) 6,390,000 P 133,500 5,377,025 5,439,500 P 71,025 Problem 2-7 Determining the allowances for bad debts The following information pertains to ACACIA, INC. for the year ended December 31, 2010: Credit sales during 2010 Collection of accounts written off in prior periods Worthless accounts written off in 2010 Allowance for doubtful accounts, Jan. 1, 2010 P4, 450,000 170,000 191,000 155,000 Acacia, Inc provides for doubtful accounts based on 1 ½ % of credit sales. What is the balance of the allowance for doubtful accounts at December 31, 2010? A. P345,750 B. P66,750 C. P200,750 D. P242,750 Solution 2-7 Allowance for Doubtful Accounts Accounts written off P 155,000 Balance, Jan 1, 2010 In 2010 P191,000 66,750 Bad debt expense For 2010 (4,450,000 x 1 ½ %) 170,000 Recovery of accounts Written off P 200,750 Balance, 12/31/2010 Answer: C Problem 2-8 Computing the net realizable value of accounts receivable MAHOGANY COMPAY’S analysis and aging of its account receivable at December 31, 2010 disclosed the following: Accounts receivable P 460,000 Accounts estimated to be uncollectible (per aging) 95,000 Allowance for bad debts (per books) 103,000 What is the net realizable value of mahogany’s receivable at December 31, 2010? A. P357,000 C. P460,000 B. P262,000 D. P365,000 Solution 2-8 Accounts receivable P 460,000 Less: accounts estimated to be uncollectible 95,000 Net realizable value 365,000 Answer: D Problem 2-9 Computation of Net Sales The allowance for doubtful accounts has a credit balance of P150,000 at December 31,2009. During 2010, uncollectible accounts of P35,000 had been written off. The company estimates its bad debt expense to be2% of net sales. The balance of the allowance account at the end of 2010 was P437,000. The company’s Net Sales for 2010 amounted to A. P 12,600,000 B. P16,000,000 C. P21,850,000 D. P14,350,000 Solution 2-9 Allowance for bad debts, Jan. 1, 2010 Uncollectible Accounts written off Bad debts expense( SQUEEZE) Allowance for bad debts, December 31, 2010 Bad Debt expense= 2 % of net Sales Net sales(P322,000\2%) P150,000 (35,000) 322,000 P437,000 P16,100,000 Answer: B Problem 2-10 Computation Accounts Receivable Balance The following amounts are shown on the 2010 and 2009 financial statements of SAN FRANCISCO CO.: 2010 ? 20,000 2,600,000 1,900,000 Accounts Receivable Allowance for Bad debts Net Sales Cost of goods sold 2009 P 470,000 10,000 2,400,000 1,752,000 San Francisco Co.’s accounts receivable turnover for 2010 is 6.5 times. What is the accounts receivable balance at December 31, 2010? A. P820,000 C. P360,000 B. P340,000 D. P470,000 Solution 2-10 (X=Net receivable, December 31, 2010) A\R turnover 6.5 =net sales \ Ave. net receivables =P2,600,000\P460,000+ X 2 P2,990,000+6.5X= P2,600,000 2 P2,990,000+6.5X=P 5,200,000 6.5X=P 2,210,000 X = P 340,000 Net receivables, December 31, 2010 P340,000 Add: Allowance for bad debts Dec. 31, 2010 20,000 Accounts receivable, Dec. 31, 2010 P360,000 Answer: C Problem 2-11 Computation of accounts receivable written off The policy of ILANG-ILANG, INC. is to debit bad debt expense for 3% of all new sales. The following are the company’s sales and allowance for bad debts for the past four years. Year Sales 2007 2008 P3,000,000 2,950,000 Allowance for Bad Debts Year-end Balance P45,000 56,000 2009 2010 3,120,000 2,420,000 60,000 75,000 The accounts written off in 2008, 2009, and 2010 amounted to A. B. C. D. 2008 P99,500 77,500 11,000 12,500 2009 P97,600 89,600 4,000 22,400 2010 P 87,600 57,600 15,000 62,400 Solution 2-11 Allowance balance, beginning Add: Estimated uncollectible* Total allowance before write-off Less: Allowances balance, ending Accounts written off 2008 P45,000 88,500 133,500 (56,000) 77,500 2009 P56,000 93,600 149,600 (60,000) 89,600 2010 P60,000 72,600 132,600 (75,000) 57,600 *3% of sales Answer: B Problem 2-12 ROSES, INC. offers sales discount to customers who will pay their accounts in full within 10 days from date of sale. On October 1, it sold goods on account for P420, 000. Payment of P411, 600 in satisfaction of this account was received on October 9. What is the sales discount rate? A. B. C. D. 2% 0% 2.04% 0.04% Solution 2-12 Gross Receivables Less: Amount Received Sales Discount Divide by gross receivable Sales Discount Rate P 420,000 411,600 P 8,400 P420,000 2% Answer: A Problem 2-13 Accounts Receivable Aging Schedule CALACHUCHI CORP.’S accounts receivable subsidiary ledger shows the following information: CUSTOMER Aruy, Inc. ACCOUNT BALANCE DEC. 31, 2010 P 35,180 Naku Co. 20,920 Syak Corp. 30,600 Trip Co. 45,140 Uy Co. 31,600 Xak Corp. 17,400 INVOICE DATE 12/06/10 11/29/10 09/27/10 08/20/10 12/08/10 10/25/10 11/17/10 10/09/10 12/12/10 12/02/10 09/12/10 AMOUNT P14,000 21,180 12,000 8,920 20,000 10,600 23,140 22,000 19,200 12,400 17,400 The estimated bad debt rates below are based on Calachuchi Corp.’s receivable collection experience. Age of Accounts 0-30 days 31-60 days 61-90days 91- 120 days Over 120 days Rate 1% 1.5% 3% 10% 50% The allowance for bad of debts account had a debit balance of P5, 500 on December 31, 2010, before adjustment. 1. The company’s accounts receivable under “61-90 days” category should be A. P32,600 B. P44,230 C. P44,600 D. P42,000 2. The company’s accounts receivable under “ 91-120 days” category should be A. P38,320 C. P29,400 B. P 40,000 D. P12,000 3. The allowance for bad debts to be reported on the state of financial position at December 31, 2010 is A. P 9,699 C. 4,199 B. P15,199 D. 5,500 4. What entry should be made on December 31, 2010 to adjust the allowance for bad debts account? A. Bad debt expense 15,199 Allowance for bad debts 15,199 B. Bad debt expense 4,199 Allowance for bad debts 4,199 C. Allowance for Bad debts 5,500 Bad Debt Expense 5,500 D. Bad Debt Expense 9,699 Allowance for Bad Debts 9,699 5. A. B. C. D. What is the net realizable value of accounts at December 31, 2010? P165, 641 P171, 141 P196,039 P186, 340 Solution 2-13 Customer Aruy, Inc. Naku Co. Syak Corp. Trip Co. Uy Co. Xak Corp. Balance 12-31-10 P 35, 180 20,920 30,600 45,140 31,600 17,400 180,140 Calachuchi Corp ACCOUTS RECEIVABLE AGING SCHEDULE December 31,2010 0-30 31-60 61-90 Days Days Days P14,000 P21,180 20,000 23,140 10,600 22,000 P44,320 P32,600 Days Days Days Days Over 120 Days 12,000 8,920 P29,400 P8,920 31,600 P65,600 1. Answer: A 2. Answer : C 3. COMPUTATION OF REQUIRED ALLOWANCE DECEMBER 31, 2010 0-30 31-60 61-90 91-120 91-120 Days P65,600 44,320 32,600 29,400 X X X X 1% 1.50% 3% 10% = = = = P 656 665 978 2,940 Over 120 Days 8,920 X Answer: A 4. Bad debt expense Allowance for Bad debts 50% = 4,460 9,699 15,199 15,199 Required allowance (see no. 2) Add: Allowance balance-debit Increase in allowance P9,699 5,500 P15,199 Answer: A 5. Accounts receivable Less: Allowance for bad debts (see no. 2) Net realizable value, Dec. 31, 2010 Answer: B P180, 840 ( 9,699) P171,141 Problem 2-14 Adjusting Entry for Estimated Bad Debts ORCHID COMPANYS accounts receivable at December 31, 2010 had a balance of P 1,200,000. The allowance for bad debts account had a credit balance of P40, 000. Net sales in 2010 were P 6,704,000(net of sales discount of P56, 000). An aging schedule shows that P150, 000 of the outstanding accounts receivable are doubtful. What is the adjusting entry for estimated bad debt expense? A. Bad debt expense Allowance for bad debts B. Bad debt expense Allowance for bad debts C. Bad debt expense Allowance for bad debts D. Allowance for bad debts Bad debt expense Solution 2-15 150,000 150,000 110,000 110,000 190,000 190,000 110,000 110,000 Bad debt expense Allowance for bad debts 110,000 110,000 Required allowance P150,000 Less: Allowance balance 40,000 Increase in Allowance P110,000 Answer: B Problem 2-15 Estimating Bad Debt Expense by Aging Accounts Receivable YELLOW BELL’S, INC. estimates its bad debt losses by aging its accounts receivable. The aging schedule of accounts receivable at December 31, 2010, is presented below: Age of Accounts 0-30 days 31-60 days 61-90 days 91-120 days over 120 days Amount P 843,200 461,000 192,400 76,650 39,400 P 1,612,650 Yellow Bells Inc.’s uncollectible accounts experiences for the past years are summarized in the following schedule: Year 2009 2008 2007 2006 2005 A/R Balance 0-30 Dec. 31 Days 1,312,500 0.3% 999,999 0.5% 465,000 0.2% 816,000 0.4% 1,243,667 0.9% 31-60 Days 1.8% 1.6% 1.5% 1.7% 2.0% 61-90 Days 12% 11% 9% 10.2% 9.7% 91-120 Days 38% 41% 50% 47% 33% over 120 Days 65% 70% 69% 81% 95% The balance of the allowance for bad debts account at December 31, 2010, (before adjustment) is P84, 500. 1. What is the average bad debt expense rate rate for “91-120” days accounts? A. 76% B. 8.6 % C. 10.38% D. 41.80 % 2. What is the average bad debt expense rate for “ 31-60 days A. 10.38 % B. 41,80% C. .46% D. 1.72% 3. The net realizable value of the Company’s account receivable on December 31, 2010, should be A. P1,518,887 B. P1,612, 650 C. P1,528,150 D. P1, 603, 358 4. What entry should be made to adjust the allowance for bad debts on Dec. 31, 2010? A. Bad debt expense 178,263 Allowance for bad debts 178,263 B. Bad debt expense 93,763 Allowance for bad debts 93,763 C. Bad debt expense 9,263 Allowance for bad debts 9,263 D. Allowance for bad debts 9,263 Bad debt expense 9,263 5. In evaluating the adequacy of the allowance for bad debts, an auditor most likely reviews the entity’s aging of receivables to support management’s financial statement of A. Existence B. Valuation and Allocation C. Completeness D. Rights and obligation Solution 2-15 1. COMPUTATION OF AVERAGE BAD DEBT EXPENSE RATE 0-30 31-60 61-90 91-120 Over 120 Year Days Days Days Days Days 2009 0.3% 1.8% 12% 38% 65% 2008 0.5 1.6 11 41 70 2007 0.2 1.5 9 50 69 2006 0.4 1.7 10.2 47 81 2005 0.9 0.9 9.7 33 95 Total 2.3% 8.6% 51.9% 209% 380% 0.46 10.38 Average % 1.7% % 41.38% 76% 1.ANSWER : D 2. Answer: D 3. COMPUTATION OF REQUIRED ALLOWANCE BALANCE AR Balance Age of Accounts 12/31/10 Rate Estimated Uncollectible 0-30 days P 843, 200 0.46% P 3,878.72 31-60 days 461,000 1.72 7,929.20 61-90 days 192,400 10.38 19,971.12 91-120 days 76,650 41.8 32,039.70 over 120 days 39,400 76 29,944.00 P1612, 650 P93,762.74 Accounts receivable P1,612, 650 Less: Required allowance balance per aging ( 93,763) Net Realizable value, December, 2010 P1,518,887 Answer: A 4. Bad debt expense Allowance for bad debts 9,263 9,263 Required allowance per aging P 93,763 Less: Allowance balance before adjustment (84,500) Increase in allowance 9,263 Answer: C 5.Assertions about valuation and allocation concern whether assets, liabilities and equity interest are included in the financial statements at appropriate amounts and any resulting valuation or allocation adjustment are properly recorded, Management for example, asserts that account receivable are stated at net realizable value, e.i, the amount that is expected to be received from its customers(gross receivable minus allowance for bad debts ) Aging the receivable is a procedure for assessing the reasonableness of the allowance for bad debts. Answer: B PROBLEM 2-16: Estimating Bad Debts Using the Percentage of Sales Method The following selected transactions occurred during the year ended December 31, 2010: Gross sales (cash and credit) Collections from credit customers, net of 2% cash discount Cash sales Uncollectible accounts written off Credit memos issued to credit customers for sales returns and allowances Cash refunds given to cash customers for sales returns and allowances Recoveries on accounts receivable written off in prior years (not included in cash received stated above) P750,000 245,000 150,000 16,000 8,400 12,640 5,421 At year-end, the company provides for estimated bad debt losses by crediting the Allowance for Bad Debts account for 2% of its net credit sales for the year. 1. What is the company’s net credit sales in 2010? A. P600,000 B. P586,600 C. P591,600 D. P595,000 2. The bad debts expense for 2010 is A. P11,832 B. P11,900 C. P11,732 D. P12,000 Solution 2-16 1. Gross credit sales (P750,000 – P150,000) Less: Sales discount (P245,000 ÷ 98% = P250,000 x 2%) Sales returns and allowances Net credit sales P600,000 P5,000 8,400 13,400 P586,600 Answer: B 2. Bad debt expense (P586,600 x 2%) P11,732 Answer: C PROBLEM 2-17: Estimating Bad Debts Expense COCONUT CO. estimates its bad debts expense to be 3% of net sales. The company’s unadjusted trial balance at December 31, 2010, includes the following accounts: Debit Allowance for bad debts Sales Sales return and allowances Credit P8,000 2,600,000 P45,000 What is the company’s bad debt expense for 2010? A. P76,650 C. P68,650 B. P78,000 D. P70,000 Solution 2-17 Net sales (P2,600,000 – P45,000) Multiply by bad debt rate Bad debt expense P2,555,000 x 3% P 76,650 Answer: A PROBLEM 2-18: Estimating Bad Debts Expense BANAWE, INC. estimates its uncollectible accounts to be 3% of the accounts receivable balance. The following information was taken from the company’s statement of financial position at December 31, 2010: Debit Net sales (including cash sales of P825,000) Allowance for bad debts Accounts receivable P Credit P3,460,000 69,000 2,460,000 What is the bad debt expense to be reported for 2010? A. P79,050 C. P73,800 B. P69,000 D. P142,800 Solution 2-18 Required allowance, Dec. 31, 2010 (P2,460,000 x 3%) Add: Allowance balance before adjustment-debit Bad debts expense for 2010 P 3,800 69,000 P142,800 Answer:D PROBLEM 2-19: Accounts Receivable Factoring On December 5, 2010, BANDERA ESPAÑOLA, INC. sold its accounts receivable (net realizable value, P260,000) for cash of P230,000. Ten percent of the proceeds was withheld by the factor to allow for possible customer returns and other account adjustments. The related allowance for bad debts is P40,000. 1. The loss on factoring of accounts receivable is A. P10,000 C. P20,000 B. P30,000 D. P0 2. What is the entry to record the factoring of accounts receivable? A. Cash Allowance for bad debts Loss on factoring Accounts receivable B. Cash 230,000 40,000 30,000 300,000 207,000 Loss on factoring Receivable from factor Accounts receivable 30,000 23,000 C. Cash Loss on factoring Accounts receivable 230,000 30,000 D. Cash Allowance for bad debts Loss on factoring Receivable from factor Accounts receivable 207,000 40,000 30,000 23,000 260,000 260,000 300,000 Solution 2-19 1. Net realizable value of accounts receivable Less: Cash proceeds Loss on factoring P260,000 230,000 P 30,000 Answer: B 2. Cash (P230,000 x 90%) Allowance for bad debts Loss on factoring Receivable from factor (P230,000 x 10%) Accounts receivable 207,000 40,000 30,000 23,000 300,000 Answer: D PROBLEM 2-20: Assignment of Accounts Receivable On April 1, 2010, SAMPAGUITA CORPORATION assigned accounts receivable totalling P400,000 as collateral on a P300,000, 16% note from Iwahig Bank. The assignment was done on a nonnotification basis. In addition to the interest on the note, the bank also receives a 2% service fee, deducted in advance on the P300,000 value of the note. Additional information is as follows: 1. Collections of assigned accounts in April totalled P191,100, net of a 2% discount. 2. On May 1, Sampaguita Corporation paid the bank the amount owed for April collections plus accrued interest on note to May 1. 3. The remaining accounts were collected by Sampaguita Corporation during May except for P2,000 accounts written off as worthless. 4. On June 1, Sampaguita Corporation paid the bank the remaining balance of the note plus accrued interest. Prepare the journal entries to record the above transactions on the books of Sampaguita Corporation. Solution 2-20 April 1 Accounts receivable - assigned Accounts receivable 400,000 Cash Finance charge (P300,000 x 2%) Notes payable 294,000 6,000 (1) Cash Sales discounts Accounts receivable - assigned (P191,100 ÷ 98% ) 191,100 3,900 (2) Notes Payable Interest Expense (P300,000 x 16% x 1/12) Cash 195,000 4,000 (3) Cash Allowance for bad debts Accounts receivable - assigned (P400,000 - P195,000 ) 203,000 2,000 (4) Notes Payable (P300,000 - P195,000) Interest Expense (P105,000 x 16% x 1/12) Cash 105,000 1,400 1 400,000 300,000 195,000 199,000 205,000 106,400 PROBLEM 2-21: Estimating Bad Debts LAGUNDI COMPANY applies the allowance method to value its accounts receivable. The company estimates its bad debts based on past experiences, which indicates that 1.5% of net credit sales will be uncollectible. Its total sales for the year ended December 31, 2010, amounted to P4,000,000 including cash sales of P400,000. After a thorough evaluation of the accounts receivable from Nolog company amounting to P20,000, Lagundi has decided to write off this account before year-ended adjustments are made. Shown below are Lagundi’s account balances at December 31, 2010, before any adjustments and the P20,000 write off, Sales Accounts receivable Sales discounts Allowance for bad debts Sales return and allowances Bad debt expense P4,000,000 1,500,000 250,000 33,000 350,000 0 Lagundi has decided to value its accounts receivable using the statement of financial position approach as suggested by its external auditors. Presented below is the aging of the accounts receivable subsidiary ledger accounts at December 31, 2010. Account Antiporda Balbakwa Curdapia Dagul Empoy Total % collectible Balance P 100,000 256,000 654,000 50,000 420,000 P1,480,000 Less than 60 days P100,000 180,000 500,000 61-90 days 91-120 days Over 120 days P76,000 154,000 50,000 P780,000 P230,000 P420,000 P420,000 99% 95% 85% P50,000 60% 1. The entry to write off Lagundi’s accounts receivable from Nolog of P20,000 will A. Decrease total assets and net income for 2010 B. Increase total assets and decrease net income for 2010 C. Have no effect on total assets and net income for 2010 D. Have no effect on total assets and increase net income for 2010 2. Lagundi’s estimated bad debt expense for 2010 based on net credit sales is A. P60,000 C. P45,000 B. P12,000 D. P56,250 3. The final entry to adjust the allowance for bad debts account is A. Bad debt expense Allowance for bad debts B. Bad debt expense Allowance for bad debts C. Bad debt expense Allowance for bad debts D. Allowance for bad debts Bad debt expense 44,300 44,300 45,000 45,000 24,300 24,300 24,300 24,300 4. What is the net realizable value of Lagundi’s account receivable on December 31, 2010? A. P1,435,700 C. P1,397,700 B. P1,435,000 D. P1,377,700 5. Which of the following most likely would give the most assurance concerning the valuation and allocation assertions of accounts receivable? A. Vouching amounts in the subsidiary ledger to details on shipping documents. B. Comparing receivable turnover ratios with industry statistics for reasonableness. C. Inquiring about receivables pledged under loan agreements. D. Assessing the allowance for uncollectible amounts for reasonableness. Solution 2-21 1. No effect on total assets and net income for 2010. The entry to record the write off is: Allowance for bad debts Accounts receivable 20,000 20,000 Answer: C 2. Credit sales (P4,000,000 - P400,000) Less: Sales discounts Sales return and allowances Net Sales Multiply by bad debt rate Bad debt expense P3,600,000 P250,000 350,000 600,000 3,000,000 x 1.5% P 45,000 Answer: C 3. Bad debt expense Sales return and allowances 44,300 44,300 A/R Balance P780,000 230,000 420,000 50,000 Age Less than 60 days 61 - 90 days 91 - 120 days Over 120 days Required allowance Allowance balance (P33,000 + P45,000 – P20,000) Adjustment – increase in allowance Rate 1% 5% 15% 40% Amount P 7,800 11,500 63,000 20,000 102,300 58,000 P 44,300 Answer: A 4. Accounts receivable Less: Allowance for bad debts (see no. 3) Net realizable value, Dec. 31, 2010 Answer: C P1,480,000 102,300 P1,377,700 5. Assessing the allowance for uncollectible accounts for reasonableness. Answer: C PROBLEM 2-22: Estimating Bad Debts From inception of operations to December 31, 2010, MAKAHIYA CORP. provided for uncollectible accounts receivable under the allowance method: provisions were made monthly at 2% of credit sales; bad debts written off were charged to the Allowance account; recoveries of bad debts previously written off were credited to the Allowance account; and no year-end adjustments to the Allowance account were made. Makahiya’s usual credit terms are net 30 days. The balance in the Allowance for Bad Debts account was P143,000 at January 1, 2010. During 2010, credit sales totalled P15,000,000, interim provisions for doubtful accounts were made at 2% of credit sales, P140,000 of bad debts were written off, and recoveries of accounts previously written off amounted to P43,000. Makahiya installed a computer facility in November 2010 and an aging of accounts receivable was prepared for the first time as of December 31, 2010. A summary of the aging is as follows: Classification by Month of Sale November – December 2010 July – October 2010 January to June Prior to January 1, 2010 Balance in Each Category P2,160,000 1,300,000 840,000 300,000 P4,600,000 Estimated % Uncollectible 2% 10% 25% 70% Based on the review of collectibility of the account balances in the “prior to January 1, 2010” aging category, additional receivables totalling P120,000 were written off as of December 31, 2010. The 70% uncollectible estimate applies to the remaining P180,000 in the category. Effective with the year ended December 31, 2010, Makahiya adopted a new accounting method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging analysis of accounts receivable. 1. What is the balance of the allowance for Bad Debts accounts before the change in accounting estimate? A. P300,000 C. P226,000 B. P143,000 D. P346,000 2. What is the journal entry for the year-end adjustment to the Allowance for Bad Debt account balance as of December 31, 2010? A. Bad Debts Expense 283,200 Allowance for Bad Debts 283,200 B. Bad Debts Expense 163,200 Allowance for Bad Debts C. Allowance for Bad Debts Bad Debts Expense D. Bad Debts Expense Allowance for Bad Debts 163,200 143,000 143,000 509,200 509,200 3. For the year ended December 31, 2010, Makahiya’s bad debt expense would be A. P626,200 C. P300,000 B. P283,200 D. P583,200 4. The net realizable value of Makahiya’s accounts receivable at December 31, 2010 should be A. P4,374,000 C. P3,970,800 B. P3,896,800 D. P4,090,800 5. An auditor’s purpose in reviewing credit ratings of customers with delinquent accounts receivable most likely is to obtain evidence concerning management’s ascertain about A. Completeness B. Existence C. Rights and obligations D. Valuation and allocation Solution 2-22 1. Allowance for bad debts, Jan. 1 Add: Bad debt expense for 2010 (P15,000,000 x 2%) Recoveries of accounts previously written off Total Less: Accounts written off (P140,000 + P120,000) Allowance for bad debts, Dec. 31 P143,000 P300,000 43,000 343,000 486,000 260,000 P226,000 Answer: C 2. Bad debts expense Allowance for bad debts Classification Balance November – December 2010 P2,160,000 July – October 2010 1,300,000 January – June 2010 840,000 Prior to January 1, 2010 (P300,000 – P120,000 write off) 180,000 Required Allowance balance, Dec. 31, 2010 Less: Allowance balance before adjustment (see no. 1) Increase in allowance Answer:A 283,200 283,200 Rate 2% 10% 25% Amount P 43,200 130,000 210,000 70% 126,000 P509,200 226,000 P283,200 3. Bad debt expense recorded Additional bad debt expense to arrive at the required allowance based on aging Correct bad debt expense for 2010 P300,000 283,200 P343,000 Answer: D 4. Accounts receivable (P4,600,000 – P120,000) Less: Required allowance per aging Net realizable value, Dec. 31, 2010 P4,480,000 509,200 P3,970,800 Answer: C 5. Valuation and allocation Answer: D PROBLEM 2-23: Various Adjustments to Correct Accounts Receivable and Related Accounts You are examining the financial statements of SALUYOT COMPANY for the year ended December 31, 2010. Your audit of the accounts receivable and other related accounts disclosed the following information: 1. The December 31, 2010 balance in the Accounts Receivable control account is P788,000. 2. The only entries in the Bad Debts Expense account were: a. A credit of P1,296 on December 1, 2010, because customer A remitted in full for the account charged off October 31, 2010. b. A debit on December 31 for the amount of the credit to Allowance for Bad Debts. 3. The Allowance for Bad Debts account is presented below: Date Particulars Jan. 1 Balance Oct. 31 Uncollectible: Customer A B C Dec. 31 3% of P788,000 Debit P1,296 3,280 2,256 Credit P6,032 P23,640 Balance P15,250 9,218 32,858 4. An aging schedule of the accounts receivable as of December 31, 2010, and the decisions are shown in the table below: AGE Net Debit Amount to which the allowance is to be adjusted after 0-1 month 1-3 months 3-6 months Over 6 months Balance P372 ,960 307, 280 88,7 20 24,0 00 adjustments and corrections have been made 1% 2% 3% Definitely uncollectible, P4,000; P8,000 is considered to be 50% uncollectible; the remainder is estimated to be 80% collectible . P792 ,960 5. There is a credit balance in one account receivable (0-1 month) of P8,000; it represents an advance on a sales contract; also there is a credit balance in one of the 1-3 months accounts receivable of P2,000 for which merchandise will be accepted by the customer. 6. The Accounts Receivable control account is not in agreement with the subsidiary ledger. The differences cannot be located, and the company’s accountant decides to adjust the control to the sum of the subsidiaries after corrections are made. 1. The adjustment to correct the entry made on December 31, 2010, is A. Bad Debts Expense Accounts receivable B. Bad Debts Expense Allowance for Bad Debts C. Accounts receivable Allowance for Bad Debts D. No adjusting entry is necessary. 1,296 1,296 1,296 1,296 1,296 1,296 2. The required allowance balance (per aging) on December 31, 2010, is A. P29,354 C. P19,858 B. P19,058 D. P32,858 3. The net realizable value of Saluyot’s accounts receivable on (per aging) on December 31, 2010, is A. P779,902 C. P793,200 B. P774,142 D. P788,664 4. Saluyot should report bad debt expense for 2010 of A. P13,344 C. P10,296 B. P22,344 D. P33,936 5. What entry is necessary to adjust the allowance account at December 31, 2010? A. Bad Debts Expense Allowance for Bad Debts B. Bad Debts Expense Allowance for Bad Debts C. Allowance for Bad Debts Bad Debts Expense D. Allowance for Bad Debts Bad Debts Expense 10,296 10,296 13,800 13,800 10,296 10,296 13,800 13,800 Solution 2-23 1. ADJUSTING ENTRY Bad debts expense Allowance for bad debts 1,296 1,296 ENTRY MADE Cash 1,296 Bad debt expense 1,296 CORRECT ENTRIES Accounts receivable Allowance for bad debts # Cash Accounts receivable 1,296 1,296 1,296 1,296 Answer: B 2. Age 0-1 month 1-3 months 3-6 months Over 6 months Net Debit Balance P372,960 307,280 88,720 24,000 Adjustment P8,000 2,000 (4,000) Total P792,960 P6,000 Adjusted Balance P380,960 309,280 88,720 8,000 12,000 P798,960 Rate 1% 2% 3% 50% 20% Required Allowance P3,810 6,186 2,662 4,000 2,400 P19,058 Answer: B 3. Unadjusted balances Understatement of accounts written off Control Account P788,000 Subsidiary Ledgers P792,960 on October 31 (P6,832 – P6,032) Write off of uncollectible accounts in the “over 6 months” category Customers’ credit balances (P8,000 + P2,000) Corrected balance Unlocated difference (P798,960 – P793,200) Adjusted balances (800) (4,000) 10,000 793,200 5,760 P798,960 Accounts receivable, Dec. 31, 2010 Less: Required allowance per aging Net realizable value, Dec. 31, 2010 (4,000) 10,000 798,960 P798,960 P798,960 19,058 P779,902 Answer:A 4. Bad debt expense recorded Adjustment to arrive at the required allowance Correct bad debt expense for 2010 P23,640 (10,296) P13,344 Answer: A 5. Allowance for bad debt Bad debt expense Required allowance balance (see no. 2) Allowance balance, December 31: Per books Recovery of account written off Understatement of write off on Oct 1 (P6,832 – P6,032) Unrecorded write off Adjustment – decrease in allowance P10,296 P10,296 P19,058 P32,858 1,296 (800) (4,000) 29,354 P10,296 Answer:C PROBLEM 2-24: Analysis of Accounts Receivable and Related Accounts The following information is based on a first audit of SABILA COMPANY. The client has not prepared financial statements for 2008, 2009 nor 2010. During these years, no accounts have been written off as uncollectible, and the rate of gross income on sales has remained constant for each of the three years. Prior to January 1, 2008, the client used the accrual method of accounting. From January 1, 2008 to December 31, 2010, only cash receipts and disbursements records were maintained. When sales on account were made, they were entered in the subsidiary accounts receivable ledger. No general ledger postings have been made since December 31, 2007. As a result of your examination, the correct data shown in the table below are available: Account receivable balances: Less than one year old One to two years old Two to three years old Over three years old Total accounts receivable Inventories 12/31/07 12/31/10 P15,400 1,200 P16,600 P28,200 1,800 800 2,200 P33,000 P11,600 P18,800 P5,000 P11,000 Accounts payable for inventory purchased Cash received on accounts receivable in: Applied to: Current year collections Accounts of the prior year Accounts of two years prior Total Cash sales Cash disbursements for inventory purchased 2008 2009 2010 P148,800 13,400 600 P162,800 P161,800 15,000 400 P177,200 P208,800 16,800 2,000 P227,600 P17,000 P26,000 P31,200 P125,000 P141,200 P173,800 1. The company’s sales revenue for the three-year period amounted to A. P658,200 C. P625,400 B. P74,200 D. P415,300 2. What is the company’s total sales revenue for 2009? A. P206,400 C. P268,200 B. P183,600 D. P180,400 3. The aggregate amount of purchases for the three-year period is A. P131,000 C. P434,000 B. P440,000 D. P446,000 4. What is the company’s gross income ratio in each of the three-year period? A. 33.33% C. 35.16% B. 28.35% D. 31.15% 5. What is the company’s gross income for each of the three-year period? 2008 2009 2010 A. B. C. D. P60,933 55,533 122,400 61,200 P68,200 60,133 137,600 68,800 P80,000 79,000 178,800 89,400 Solution 2-24 1. Accounts receivable, Dec. 31, 2010 Add: Collections, 2008 – 2010 Total Less: Accounts receivable, Jan. 1, 2008 Total credit sales Add: Cash sales, 2008 – 2010 Total sales, 2008 – 2010 P 33,000 567,600 600,600 16,600 584,000 74,200 P658,200 Answer:A 2. Sales revenue for 2009 (see no. 5) P206,400 Answer: A 3. Accounts payable, Dec. 31, 2010 Add: payments to suppliers Total Less: Accounts payable, Jan. 1, 2010 Total purchases, 2008 – 2010 P 11,000 440,000 451,000 5,000 P446,000 Answer:D 4. Sales (see no. 1) Less: Cost of sales Inventory, Jan. 1, 2008 Add: Purchases (see no. 3) Goods available for sale Less: Inventory, Dec. 31, 2010 Gross Income Gross income ratio (P219,400 ÷ P658,200) P658,200 P 11,600 446,000 457,600 18,800 438,800 P219,400 33 1/3% Answer:A 5. Cash sales Collections in: 2008 2009 2010 2008 P 17,000 2009 P26,000 2010 P31,200 Total P74,200 148,800 15,000 2,000 161,800 16,800 208,800 148,800 176,800 227,600 A/R, Dec. 31 Total sales Multiply by gross income ratio Gross income 800 183,600 33 1/3% P61,200 1,800 206,400 33 1/3% P68,800 28,200 268,200 33 1/3% P89,400 30,800 658,200 33 1/3% P219,400 Answer:D PROBLEM 2-25 Analysis of Account Receivable and Allowance for Bad Debts You are auditing the accounts receivable and the related allowance for bad debts account of IKEBANA COMPANY. The following data are available: General Ledger Accounts Receivable 2010 Dec. 31 424,000 Allowance for Bad Debts 2010 July 31 GJ – Write off 8,000 2010 Jan. 1 Dec. 31 Balance GJ – Provision Summary of Aging Schedule The summary of the subsidiary ledger balances as of December 31, 2010 is shown below: Debit balances: Under one month One to six months Over six months Credit balances: AA Co. BB Co. CC Co. P180,000 184,000 76,000 P440,000 P 4,000 - OK; additional billing in Jan. 2011 7,000 - Should have been credited to DD Co.* 9,000 - Advance on a sale contract P20,000 * Account is in “one to six months” classification. 10,000 24,000 The customer’s ledger is not in agreement with the accounts receivable control. The client instructs the auditor to adjust the control to the subsidiary ledger after corrections are made. Allowance for Bad Debts Requirements It is agreed that 1 percent is adequate for accounts under one month. Accounts one to six months are expected to require an allowance of 2 percent. Accounts over six months are analysed as follows: Definitely bad Doubtful (estimated to be 50% collectible) Apparently good, but slow (estimated to be 90% collectible) Total P24,000 12,000 40,000 P76,000 1. The adjusted balance of Ikebana’s “1 to 6 months” accounts receivable is A. P164,000 C. P177,000 B. P171,000 D. P184,000 2. The adjusted balance of Ikebana’s “over 6 months” accounts receivable is A. P74,000 C. P69,000 B. P52,000 D. P45,000 3. The adjusted accounts receivable balance on December 31, 2010 should be A. P404,000 C. P409,000 B. P420,000 D. P413,000 4. The required balance of the allowance for bad debts account on December 31, 2010 is A. P47,340 C. P15,480 B. P15,340 D. P21,340 5. The entry to adjust the allowance for bad debts account is A. Bad debts expense Allowance for bad debts B. Allowance for bad debts Bad debts expense C. Bad debts expense Allowance for bad debts D. Bad debts expense Allowance for bad debts 13,340 13,340 2,000 2,000 17,340 17,340 15,340 15,340 Solution 2-25 Control Account Subsidiary Ledger CR DR A G I N G Under 1 1 to 6 Over 6 Month Months Months Unadjusted balances Accounts with credit balances Write off Unlocated difference P424,000 13,000 (24,000) (4,000 P409,000 1. Answer: C 4. Under 1 month 1 to 6 months Over 6 months: Doubtful Good but slow Required allowance P20,000 (20,000) P440,000 P180,000 P184,000 P76,000 (7,000) (7,000) (24,000) (24,000) -- P409,000 P180,000 P177,000 P52,000 2. Answer: B Adjusted Balance P180,000 177,000 12,000 40,000 3. Answer: C Rate 1% 2% Amount P 1,800 3,540 50% 10% 6,000 4,000 P15,340 Answer: B 5. Bad debts expense Allowance for bad debts 13,340 Required allowance (see no. 4) Allowance balance (P10,000 + P24,000 – P24,000 – P8,000) Adjustment – increase in allowance 13,340 P15,340 2,000 P13,340 Answer: A Problem 2-26 Estimating Bad Debts PITO-PITO COMPANY produces herbal tea and other slimming products that are sold throughout the Philippines. While the company is experiencing a steady growth in sales, it has become noticeable that collections of accounts receivable from customers are no longer as fast as they used to be. Pito-Pito Company’s products are sold on payment terms of 2/10, n/30. In the past, more than 75% of the credit customers have availed of the discount by paying within the discount period. During the year ended December 31, 2010, there has been an increase in the number of customers taking the full 30 days to pay. The company estimates that less than 60% of the customers are taking advantage of the discount. Bad debt losses as a percentage of gross credit sales have increased from the 1.5% provided in prior years to about 4% in the current year. The determination of accounts receivable collections has prompted the company’s controller to prepare the following report. ACCOUNTS RECEIVALBE COLLECTIONS December 31, 2010 A. It is normal that some receivables will prove uncollectible. In fact, annual bad debt write-offs has been 1.5% of total credit sales for many years. However, this rate has increased to 4% during the current year. B. The accounts receivable balance at December 31, 2010, is P3,000,000. The condition of this balance in terms of age and probability of collection is presented below. Proportion of Total Age Categories Probability of Collection 64% 1 to 10 days 99% 18% 11 to 30 days 97.5% 8% Past due 31 to 60 days 95% 5% Past due 61 to 120 days 80% 3% Past due 121 to 180 days 65% 2% Past due to over 180 days 20% C. The allowance for bad debts has a credit balance of P54,600 on January 1, 2010. D. The P 640,000 bad debts expense provided during the year is based on the assumption that 4% of total credit sales will be uncollectible. E. Accounts written-off during the year totalled P 585,000. 1. What is the required allowance balance on December 31, 2010? A. P 154,200 C. P 109,600 B. P 209,200 D. P 55,000 2. What year-end adjustment is necessary to bring Pito-Pito Company’s allowance for doubtful accounts to the balance indicated by the aging analysis? A. Bad debts expense Allowance for doubtful accounts 10,400 10,400 B. Allowance for doubtful accounts 10,400 Bad debts expense 10,400 C. Bad debts expense 44,600 Allowance for doubtful accounts D. Bad debts expense 44,600 154,200 Allowance for doubtful accounts 154,200 3. What is the net realizable value of Pito-Pito Company’s accounts receivable at December 31, 2010? A. P 2,955,400 C. P 2,736,200 B. P 2,845,800 D. P 1,675,800 4. Pito-Pito should report bad debts expense for 2010 of. A. P 9,600 C. P 640,000 B. P 595,400 D. P 686,600 5. Pito-Pito’s total credit sales for 2010 is A. P 16,000,000 C. P 25,600,000 B. P 42,666,667 D. P 14,625,000 SOLUTION 2-26 1. AGING SCHEDULE Category 1 to 10 days 11 to 30 days Past due 31 to 60 days Past due 61 to 120 days Aging Ratio 64% 18% 8% 5% Account Receivable Balances P 1, 920,000 540,000 240,000 150,000 Uncollectible Rate Amount 1% 2.5% 5% 20% P 19,200 13,500 12,000 30,000 Past due 121 to 180 days Past due over 180 days Total 3% 2% 90,000 60,000 P 3,000,000 35% 80% 31,500 48,000 P 154,200 Answer: A 2. Bad debts expense Allowance for bad debts 44,600 44,600 Allowance for bad debts, January 1, 2010 Add: 2010 bad debts expense Total Less: Accounts written off Allowance balance before adjustment, December 31, 2010 Required allowance per aging Adjustment – increase in allowance Answer: C 3. Accounts receivable Less: Allowance for bad debts Net realizable value, December 31, 2010 P 3,000,000 154,200 P 2, 845, 800 Answer: B 4. Bad debts expense recorded Add: Adjustment to bring the allowance balance to the amount indicated by the aging analysis (see no.2) Correct bad debts expense for 2010 Answer: D Alternative computation P 640,000 44,6000 P 684,000 P 54,600 640,000 694,600 585,000 109,600 154,200 P 44,600 Allowance for bad debts, January 1, 2010 Accounts written off Bad debts expense (SQUEEZE) Allowance for bad debts, December 31, 2010 P 54,600 (585,000) 684,000 154,200 5. Total credit sales for 2010 (P 640,000/4%) P 16,000,000 Answer: A Problem 2-27 Factoring of Accounts Receivable ROSAL FINANCE CORP. purchase the accounts receivable of other companies on a without recourse, notification basis. At the time the receivables are factored, 15% of the amount factored is charged to the client as commission and recognized as revenue in Rosal’s books. Also, 10% of the receivables factored is withheld by Rosal as protection against sales return and other adjustments. This amount is credited by Rosal to the Client Retainer account. At the end of each month, payments are made by Rosal to its client so that the balance in the Client Retainer account is equal to 10% of unpaid factored receivables. Based on Rosal’s bad debts of 5% of all factored receivables is to be established. Rosal makes adjusting entries at the end of each month. On January 3, 2010, Poor, Inc. factored its account receivable totalling P 1,000,000. By January 31, P 800,000 on these receivables had been collected by Rosal. Prepare the entries on Rosal’s and Poor’s books to record the above information. Solution 2-27 ROSAL’S BOOKS 2010 January 3 31 Accounts receivable factored Commission Income (P 1,000,000 x 15%) Client Retainer (P 1,000,000 x 10%) Cash Cash 1,000,000 150,000 100,000 750,000 800,000 Accounts receivable factored 31 Client Retainer Cash 31 Bad debts expense Allowance for bad debts (P 1,000,000 x 5%) 800,000 80,000 80,000 50,000 50,000 POOR, INC.’s BOOKS 2010 January 3 31 Cash Receivable from factor 750,000 100,000 Commission Accounts receivable 150,000 1,000,000 Cash 80,000 Receivable from factor 80,000 Problem 2-28 Noninterest-bearing Note On January 1, 2010, WALING-WALING CO. sells its equipment with a carrying value of P 160,000. The company receives a non-interest bearing note due in 3 years with a face amount of P 200,000. There is no established market value for the equipment. The prevailing interest rate for a note of this type is 21%. The following are the present value factors of 1 at 12% Present value of 1 for 3 periods .071178 Present value of an ordinary annuity of 1 at 3 periods 2.40183 1. What is the gain or loss to be recognized on the sale of the equipment? A. P 17,644 loss C. P 17,644 gain B. P 122 gain D. P 40,000 gain 2. The discount on note receivable on January 1, 2010, is A. P 57,644 C. P 40,000 B. P 0 D. P 17,644 3. The discount amortization at the end of the third year using the effective interest method is A. P 13,333 C. P 21,428 B. P 19,215 D. P 0 Solution 2-28 1. Sales price/Present value of note (P 200,000 x 0.71178) Less: Book value of equipment Loss on sale of equipment P 142,356 160,000 P 17, 644 Answer: A 2. Face value of note Less: Present value of note (see no. 1) Discount of note receivable P 200,000 142,356 57,644 Answer: A 3. Present value of note, Jan. 1, 2010 P 142,356 Add: Interest income in 2010 (P 142,356 x 17,083 12%) Present value of note, Jan. 1, 2011 159,439 Add: Interest income in 2011 (P 159,439 x 19,133 12%) Present value of note, Jan. 1, 2012 178,572 Face value of note 200,000 Discount amortization at the end of the third 21,428 year Answer: C Problem 2-29 Note Receivable with an Unreasonable Low Interest Rate On January 2, 2010, a tract of land that originally cost P 800,000 was sold by VIETMAN ROSE COMPANY. The company received a P 1,200,000 note as payment. It bears interest rate of 4% and is payable in 3 annual instalments of P 400,000 plus interest on the outstanding balance. The prevailing rate of interest for a note of this type is 10%. The present value table shows the following present value factors of 1 at 10%: Present value factor of 1 for 3 periods 0.75132 Present value factor of 1 for 2 periods 0.82645 Present value factor for 1 period 0.90909 Present value of an ordinary annuity of 1 for 3 periods 2.48685 1. The gain to be recognized on the sale of the land is A. P 400,00 C. P 194,740 B. P 276,847 D. P 0 2. The interest income to be reported for 2010 should be A. P 59,685 C. P 48,000 B. P 120,000 D. P 107,685 Solution 2-29 1. AMOUNT OF CASH TO BE RECEIVED EACH YEAR Year 2010 2011 2012 (P 1,200,000 x 4%) (P 800,000 x 4%) (P 400,000 x 4%) Interest P 48,000 32,000 16,000 Principal P 400,000 400,000 400,000 Total 448,000 432,000 416,000 P 96,000 1,200,000 P 1,296,000 PRESENT VALUE OF THE NOTE AT 10% INTERST RATE Year 2010 2011 2012 Cash to Received P 448,000 432,000 416,000 P 1,296,000 Net present value of note Less: Cost of land Gain on sale of land Present Value Factor 0.90909 0.82645 0.75132 Present Value P 407,272 357,026 312,459 P 1,076,847 P 1,076,847 800,000 P 276,847 Answer: B 2. Interest income for 2010 (P 1,076,847 x 10%) P 107,685 Answer: D Problem 2-30 Discounting of Notes Receivable During your audit of FOREVER COMPANY for the year ended December 31, 2010, you find the following account. Notes Receivable Date Sep. 1 Oct. 1 1 Nov. 1 30 Dec. 30 1 1 Cornea, 20%, due in 3 months Hunk Co., 24%, due in 2 months Discounted Cornea note at 25% Valerie, 24%, due in 13 months Cellular Co., no interest, due in one year Discounted Cellular note at 18% Tictic, 18%, due in 5 months O. Reyes, President, 12% due i3 months (for cash loan given to O. Reyes) Debit P 80,000 300,000 Credit P 80,000 600,000 500,000 500,000 900,000 1,200,000 All notes are trade notes unless otherwise specified. The Cornea note was paid on December 1 as per notification from the bank. The Hunk Co. note was dishonoured on the due date but the legal department has assured management of its full collectability. The company, with your concurrence, will treat the discounting as a conditional sale of note receivable. 1. At what amount on the current asset section of the December 31, 2010 statement of financial position will the Notes receivable-trade be carried? A. P 1,500,000 C. P 2,400,000 B. P 1,800,000 D. P 2,080,000 2. What amount of loss on notes receivable discounting should be reported in the 2010 income statement of the company? A. P 90,500 C. P 90,000 B. P 90,833 D. P 0 3. Based on the ledger account presented, what amount of interest income should be accrued at December 31, 2010? A.P 59,685 C. P 48,000 B. P 120,000 D. P 107,685 Solution 2-30 1. Valerie Tictic Total notes receivable-trade, Dec. 31, 2010 P 600,000 900,000 P 1,500,000 Answer: A 2. Net proceeds: Principal Interest ( P 80,000 x 20% x 3/12) Maturity value P 80,000 4,000 84,000 Discount (P84,000 x 25% x 2/12) Book value Principal Accrued interest receivable (P80,000 x 20% x 1/12) 3,500 P 80,000 1,333 Loss on discounting of Cornea note Principal/Maturity Value Discount (P 500,000 x 18%x 1 year) Net proceeds Book value Loss on discounting of Cellular note Total loss on discounting (P833 + 90,000) P 80,500 81,333 P 8,333 P 500,000 (90,000) 410,000 500,000 P 90,000 P 90,833 Answer: B 3. Hunk (P 300,000 x 24% x 3/12) Valerie (P 600,000 x 24% x 2/12) Tictic (P 900,000 x 18% x 1/12) O. Reyes (P 1,200,000 x 12% x 1/12) Total accrued interest receivable, Dec. 31, 2010 P 18,000 24,000 13,500 12,000 67,500 Problem 2-31 Various Receivable Transactions The AUTOMATIC COMPANY sells plastic products to wholesalers. The end of the company’s reporting period is December 31. During 2010, the following transactions related to receivables occurred: March 31 Sold merchandise to Mismo Co. and accepted a 10% note. Payment of P 120,000 principal plus interest is due on March 31, 2011 April 12 Sold merchandise to Abe Co. for P 20,000 with terms 2/10,n/30. Automatic uses the gross method to account for cash discounts. 21 Collected the entire amount due from Abe co. 27 A customer returned merchandise costing Automatic P 60,000. Automatic reduced the customer’s receivable balance by P 80,000, the sales price of the merchandise. The company records sales return as they occur. May 30 Transferred receivables of P 1,000,000 to factor without recourse. The factor charged Automatic a 2% fiancé charge on the receivables transferred. The criteria to derecognized the asset are met. July 31 Sold merchandise to Fabon Company for P 150,000 and accepted an 8%, 6-month note. 8% is an appropriate rate for this type of note. Sep. 30 Discounted the Fabon Company at the bank. The bank’s discount rate is 12%. The note was discounted without recourse. Required: 1. Prepare the necessary journal entries to account for the above transactions. For transactions involving the sale of merchandise, ignore the entry for the cost of goods sold. 2. Prepare any necessary adjusting entries at December 31, 2010. Adjusting entires are only recorded at year-end. Solution 2-31 Mar April 31 12 21 27 Notes receivable Sales 120,000 120,000 Accounts receivable Sales 20,000 Cash (P 20,000 x 98%) Sales discounts (P 20,000 x 2%) Accounts receivable 19,600 400 Sales returns 80,000 20,0000 20,000 Accounts receivable Inventory Cost of goods sold May July Sep. 30 31 30 31 60,000 60,000 Cash (P 1, 000,000 x 98%) Loss on factoring (P1,000,000 x 2%) Accounts receivable 980,000 20,000 Notes receivable Sales 150,000 Cash Loss on note receivable discounting Notes receivable Interest income 149,760 2,240 Net proceeds: Principal Interest (P150,000 x 8% x 6/12) Maturity value Discount (P 156,000 x 12% x 4/12) Book value: Principal Accrued interest (P 150,000 x 8% x 2/12) Loss on discounting Dec. 80.000 Accrued interest receivable Interest income (P 120,000 x 10% x 9/12) 1,000,000 150,000 150,000 2,000 P 150,000 6,000 156,000 (6,240) P 150,000 2,000 P 149,760 152,000 2,240 9,000 9,000 Problem 2-32 Discounting of Notes Receivable The notes receivable account of CAIMITO, INC. consisted of the following: 1. 60-day note of P 10,000 dated May 15 with a 9% interest rate, discounted at the bank on June 8 at 12%. 2. 120-day note of P 100,000 (face amount) dated October 1 with no stated interest and a market rate of 9% interest, discounted at the bank on November 30 at 12%. This note was received from the sale of equipment. 1. The proceeds from discounting of the 60-day note amount to A. P 10,000 C. P 10,028 B. P 10,059 D. P 10,150 2. How much was received by the company from the discounting of the 120-day note? A. P 101,920 C. P 98,000 B. P 99,960 D. P 100,000 Solution 2-32 1. 60-DAY NOTE Face amount Add: Interest ( P 10,000x 9% x 60/360) Maturity value Less: Bank discount ( P10,150 x 12% x 36/360) Net proceeds P 10,000 150 10,150 122 P 10,028 Answer: C 2. 120-DAY NOTE Maturity value (same as amount) Less: Bank discount (P 100,000 x 12% x 60/360) Net proceeds Answer: C Problem 2-33 P 100,000 2,000 P 98,000 Notes Receivable: Classification and Interest Computation The following long-term receivables were reported in the December 31, 2009, statement of financial position of MANGO CORPORATION: Note receivable from sale of plant Note receivable from officer P 3,000,000 800,000 The following transactions during 2010 and other information relate to the company’s long-term receivables: 1. The note receivable from sale of plant bears interest at 12% per annum. The note is payable in 3 annual instalments of P 1,000,000 plus interest on the unpaid balance every April 1. The initial principal and interest payment was made on April 1, 2010. 2. The note receivable from officer is dated December 31, 2009, earns interest at 10% per annum, and is due on December 31, 2012. The 2010 interest was received on December 31, 2010. 3. Mango sold a piece of equipment to Banana, Inc. on April 1, 2010, in exchange for a P 400,000, non-interest bearing note due on April 1, 2012. The note had no ready market, and there was no established exchange price for the equipment. The prevailing interest rate for a note of this type at April 1, 2010, was 12%. The present value factor of 1 for two periods at 12% is 0.797. 4. A tract of land was sold by Mango to Orange Inc. on July 1, 2010, for P 2,000,000 under an instalment sale contract. Orange signed a 4-year 11% note for P 1,400,000 on July 1, 2010, in addition to the down payment of P 600,000. The equal annual payments of principal and interest on the note will be P 451,250 payable on July 1, 2011, 2012, 2013 and 2014. The land had an established cash price of P 2,000,000, and its cost to Mango was P 1,500,000. The collection of the instalments on this note is reasonable assured. 1. The amount to be reported as noncurrent receivables on the statement of financial position at December 31, 2010, is A. P 3,096,242 C. P 3,221,550 B. P 3,067,550 D. P 3,250,242 2. The current portion of notes receivable on December 31, 2010 should be A. P 1,451,250 C. P 2,097,250 B. P 1,297,250 D. P 2,297,250 3. The accrued interest receivable on December 21, 2010 should be A. P 257,000 C. P 285,692 B. P 180,000 D. P 334,000 4. On December 31, 2010, the unamortized discount on note receivable from sale of equipment should be A. P 42,944 C. P 0 B. P 109,892 D. P 52,508 5. The total interest income for the year ended December 31, 2010 A. P 427,000 C. P 375,692 B. P 455,692 D. P 532,692 Solution 2-33 1. NONCURRENT RECEIVABLES ( NET OF CURRENT PORTION) Notes receivable from sale of plant: Balance, 12/31/10 (P 3,000,000-1,000,000) Less: Installment due April 1, 2011 Note receivable from officer due Dec. 31, 2012 Note receivable from sale of equipment: Present value of note on April 1, 2010 (P 400,000 x 0.797) Add: Interest income, April 1 – Dec. 31, 2010 (P 318,800 x 12% x 9/12) Note receivable from sale of land: Balance, Dec. 31, 2010 Less: Installment due July 1, 2010 P 2,000,000 1,000,000 P 1,000,000 800,000 P 318,800 28,692 P 1,400,000 347,492 Total amount to be received Less: Interest (1,400,000 x 11%) P451,25 0 154,000 297,250 Total Answer: D 2. CURRENT PORTIONN OF NONCURRENT RECEIVABLES Note receivable from sale of plant Note receivable from sale of land (see no.1) Total P 1,000,000 297,250 1,297,250 Answer: B 3. ACCURED INTEREST RECEIVALBE, DEC. 31, 2010 Note receivable from sale of plant, April 1 – Dec.31 (P 2,000,000 x 12% x 9/12) Note receivable from sale of land, July 1 – Dec.31 (P1,400,000 x 11% x 6/12) Total Answer: B P 180,000 77,000 P257,000 4. UNAMORTIZED DISCOUNT, DEC. 31, 2010 Unamortized discount, April 1, 2010 (P400,000 – 318,800) Less: amortization, April 1 – Dec.31 (see no. 1) Total P 81,200 28,692 P52,508 Answer: D 5. INTERST INCOME FOR THE YEAR ENDED DEC. 31,2010 Note receivable from sale of plant: Interest income, Jan.1 – Mar. 31 (P 3,000,000 x 12% x 3/12) P 90,000 1,102,750 P3,250,242 Interest income, April 1 – Dec.31 (P 2, 000,000 x 12% x 9/12) Note receivable from officer (P 800,000 x 10%) Note receivable from sale of equipment (see no.1) Note receivable from sale of land (see no.3) Total 180,000 P270,000 80,000 28,692 77,000 P455,692 Answer: B Problem 2-34 Various Notes Receivable Transactions The Notes Receivable account of Bunsoy Co. has a debit balance of P 239,200 on December 31, 2010. There was no balance at the beginning of the year. Your analysis of the account reveals the following: 1. Notes amounting to P 845,000 were received from customers during the year. 2. Notes of P 416,000 were collected on due dates and notes amounting to P 221,000 were discounted at the Aggressive Bank. The Notes Receivable account was credited for the notes discounted. 3. Of the P 221,000 notes discounted, P 104,000 was paid on maturity dates while a note for P 31,200 was dishonoured and was charged back to Notes Receivable account. 4. Cash of P 33,000 was received as partial payment on notes not yet due. The amount received was credited to Liability on Partial Payment account. 5. A note of P 50,000 was pledged as collateral for a bank. 6. Included in the company’s cash account balance is a three-month note from an officer amounting to P 8,000 which is over a month past. Assuming that Busoy Co. will use a Notes Receivable Discounted account, the adjusted balance of the Notes Receivable account on December 31, 2010 is A. P 260,800 C. P 364,800 B. P 232,200 D. P 175,000 Solution 2-34 Unadjusted balance (P 845,000 – P 416,000 – P221,000 + P 31,200) Partial collection recorded as a liability Notes receivable discounted still outstanding (P 221,000 – P 104,000 – P31,000) Dishonoured notes Adjusted balance P 239,200 (33,000) 85,800 (31,200) P 260,800 Problem 2-35 Loan Impairment Loss YOKOHANA BANK loaned P 5,000,000 to Bargain Company on January 1, 2010. The initial loan repayment terms include a 10% interest rate plus annual principal payments of P 1,100,000 on January 1 each year. Bargain made the required interest payment in 2010 but did not make the P 1,100,000 principal payment nor the P 550,000 interest payment for 2011. Yokohana is preparing its annual financial statements on December 31, 2011. Bargain is having financial difficulty, and Yokohana has conducted that the loan is impaired. Analysis of Bargain’s financial condition on December 31, 2011, indicated the principal payments will be collected, but the collection of interest is unlikely. Yokohana did not accrue the interest on December 31. 2011. The projected cash flows are: December 31, 2012 December 31, 2013 December 31, 2014 P 1, 750,000 2, 000,000 1, 750,000 5, 500,000 1. What is the loan impairment loss on December 31, 2011? A. P 941,500 C. P 0 B. P 550,000 D. P 5,500,000 2. What is the interest income to be reported by Yokohana Bank in 2012? A. P 501,435 C. P 455,850 B. P 0 D. P 550,000 3. What is the carrying value of the loan receivable on December 31, 2013? A. P 1,590,785 C. P 3,264,350 B. P 1,750,000 D. P 4,558,500 4. What is the interest income in 2013? A. P 159,079 C. P 455,850 B. P 550,000 D. P 326,435 5. What is the interest income for 2014? A. P 159,079 C. P 326,435 B. P 550,000 D. P 455,850 Solution 2-35 1. Book value of loan receivable Present value of projected cash flows: Dec. 31, 2012 (P1,750,000 x 0.9091) Dec. 31, 2013 (P2,000,000 x 0.8264) Dec. 31, 2014 (P1,750,000 x 0.7513) Loan impairment loss P5,500,000 P 1,590,925 1,652,800 1,314,775 4,558,500 P941,500 Answer: A Date Dec. 31, 2012 Loan Receivable Before Current Payment P 5,500,000 Dec. 31, 2013 Dec. 31, 2014 3,750,000 1,750,000 2. Interest income in 2012 Answer: C Allowance for Loan Net Loan Impairment Receivable P941,500 P4,558,50 0 485,650 3,264,350 159,215 1,590,785 Interest Payment Income Received P455,850 P1,750,000 326,435 159,079 P 455,850 2,000,000 1,750,000 3. Loan receivable(P 5,500,000 – 1,750,000 – 2,000,000) Allowance for loan impairment Carrying value, Dec. 31, 2013 P 1,750,000 (159,215) P1,590,785 Answer: A 4. Interest income in 2013 P 326,435 Answer: D 5. Interest income in 2014 Answer: A P 159,079