Engineering Economics: Simple & Compound Interest Formulas

advertisement

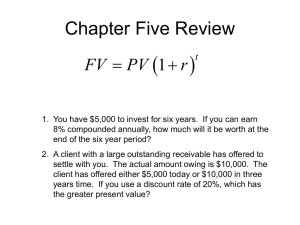

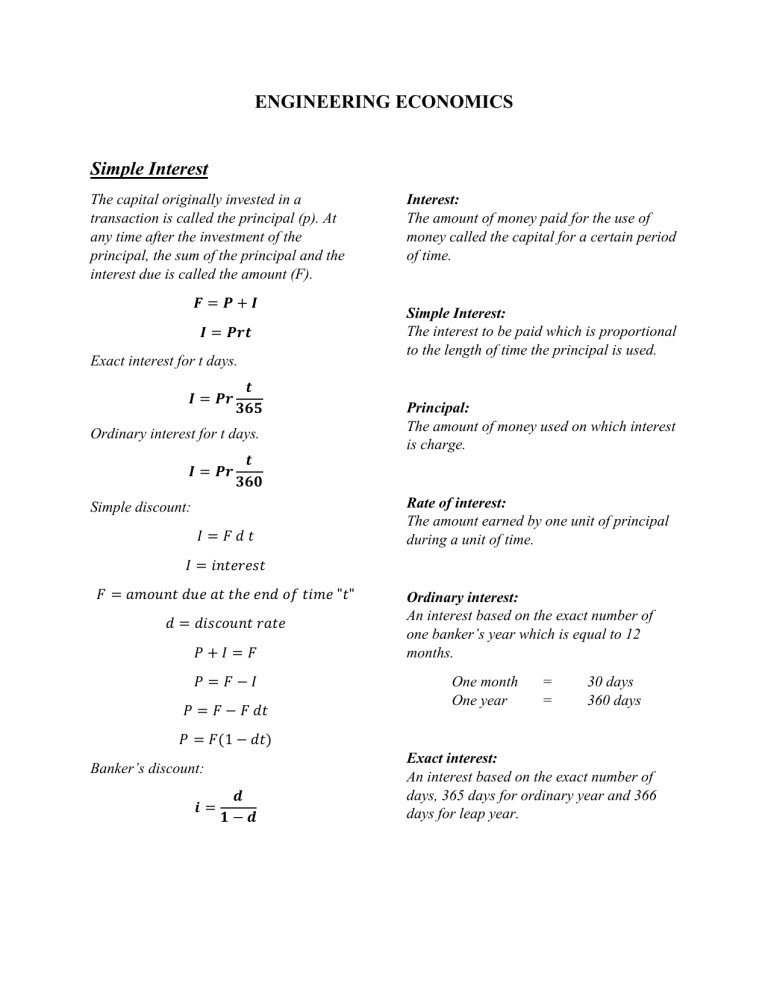

ENGINEERING ECONOMICS Simple Interest The capital originally invested in a transaction is called the principal (p). At any time after the investment of the principal, the sum of the principal and the interest due is called the amount (F). 𝑭=𝑷+𝑰 𝑰 = 𝑷𝒓𝒕 Exact interest for t days. 𝑰 = 𝑷𝒓 𝒕 𝟑𝟔𝟓 Ordinary interest for t days. 𝑰 = 𝑷𝒓 𝒕 𝟑𝟔𝟎 Simple discount: 𝐼=𝐹𝑑𝑡 Interest: The amount of money paid for the use of money called the capital for a certain period of time. Simple Interest: The interest to be paid which is proportional to the length of time the principal is used. Principal: The amount of money used on which interest is charge. Rate of interest: The amount earned by one unit of principal during a unit of time. 𝐼 = 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝐹 = 𝑎𝑚𝑜𝑢𝑛𝑡 𝑑𝑢𝑒 𝑎𝑡 𝑡ℎ𝑒 𝑒𝑛𝑑 𝑜𝑓 𝑡𝑖𝑚𝑒 "𝑡" 𝑑 = 𝑑𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝑟𝑎𝑡𝑒 𝑃+𝐼 =𝐹 𝑃 =𝐹−𝐼 𝑃 = 𝐹 − 𝐹 𝑑𝑡 Ordinary interest: An interest based on the exact number of one banker’s year which is equal to 12 months. One month One year = = 30 days 360 days 𝑃 = 𝐹(1 − 𝑑𝑡) Banker’s discount: 𝒊= 𝒅 𝟏−𝒅 Exact interest: An interest based on the exact number of days, 365 days for ordinary year and 366 days for leap year. FORMULA FOR SIMPLE INTEREST Compound Interest I = P rt I = interest P = principal i = rate of interest in decimal The interest earned by the principal which is added to the principal will also earn an interest for the succeeding periods. n = number of interest periods F = total amount F=P+1 F = P (1 + rt) When t = 1 (after one year) F= P (1 + r) 𝐹 = 𝑃(1 + 𝑖)𝑛 P = present worth or principal F = compound amount at the end of “n” periods Discount: i = rate of interest Is the difference between the future worth and its present worth. n = no. of periods Rate of discount: (1 + 𝑖)𝑛 = Single Payment Compound Amount Factor The discount on one unit of principal per unit of time d = rate of discount d = F – 𝑃1 𝑖 d = 1+𝑖 (𝑟𝑎𝑡𝑒 𝑜𝑓 𝑑𝑖𝑠𝑐𝑜𝑢𝑛𝑡) Equivalent Rate of Interest 𝑑= 𝑖 (1 + 𝑖) 𝑑 + 𝑑𝑖 = 𝑖 𝑖 − 𝑑𝑖 = 𝑑 𝑖(1 − 𝑑) = 𝑑 𝑖= 𝑑 (𝑟𝑎𝑡𝑒 𝑜𝑓 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡) 1−𝑑 1. For 8% compounded annually for 5 years i = 0.08 n = 5 periods 2. For 8% compounded semi-annually for 5 years 0.08 i = 2 = 0.04 ; n = 5(2) = 10 3. For 8% compounded quarterly for 5 years i= 0.08 4 = 0.02 ; n = 5(4) = 20 4. For 8% compounded monthly for 5 years i= 0.08 12 = 0.00667 ; n = 5(12) = 60 5. For 8% compounded bi-monthly for 5 years 0.08 i = 6 = 0.013 ; n = 5(6) = 30 Continuous Compounding 𝑭𝒐𝒓𝒎𝒖𝒍𝒂𝒔: 1. Present Worth 𝑃= 𝐹 𝑒 𝑟𝑛 𝑃 = 𝑝𝑟𝑒𝑠𝑒𝑛𝑡 𝑤𝑜𝑟𝑡ℎ 𝐹 = 𝑓𝑢𝑡𝑢𝑟𝑒 𝑤𝑜𝑟𝑡ℎ 𝑟 = 𝑟𝑎𝑡𝑒 𝑜𝑓 𝑐𝑜𝑛𝑡𝑖𝑛𝑢𝑜𝑢𝑠 𝑐𝑜𝑚𝑝𝑜𝑢𝑛𝑑 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑛 = 𝑛𝑜. 𝑜𝑓 𝑝𝑒𝑟𝑖𝑜𝑑𝑠 2. 𝐹𝑢𝑡𝑢𝑟𝑒 𝑤𝑜𝑟𝑡ℎ: 𝐹 = 𝑃 𝑒 𝑟𝑛 3. 𝐶𝑜𝑚𝑝𝑜𝑢𝑛𝑑 𝑎𝑚𝑜𝑢𝑛𝑡 𝑓𝑎𝑐𝑡𝑜𝑟: 𝑒 𝑟𝑛 = 𝑐𝑜𝑚𝑝𝑜𝑢𝑛𝑑 𝑎𝑚𝑜𝑢𝑛𝑡 𝑓𝑎𝑐𝑡𝑜𝑟 4. 𝑃𝑟𝑒𝑠𝑒𝑛𝑡 𝑤𝑜𝑟𝑡ℎ 𝑓𝑎𝑐𝑡𝑜𝑟: 1 = 𝑝𝑟𝑒𝑠𝑒𝑛𝑡 𝑤𝑜𝑟𝑡ℎ 𝑓𝑎𝑐𝑡𝑜𝑟 𝑒 𝑟𝑛 5. 𝑬𝒇𝒇𝒆𝒄𝒕𝒊𝒗𝒆 𝒂𝒏𝒏𝒖𝒂𝒍 𝒊𝒏𝒕𝒆𝒓𝒆𝒔𝒕: 𝑖𝑒 = 𝑒 𝑟 − 1 𝑖𝑒 = 𝑒𝑓𝑓𝑒𝑐𝑡𝑖𝑣𝑒 𝑎𝑛𝑛𝑢𝑎𝑙 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑟𝑎𝑡𝑒 𝑟 = 𝑛𝑜𝑚𝑖𝑛𝑎𝑙 𝑟𝑎𝑡𝑒 𝑜𝑓 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑐𝑜𝑚𝑝𝑜𝑢𝑛𝑑𝑒𝑑 𝑐𝑜𝑛𝑡𝑖𝑛𝑢𝑜𝑠𝑙𝑦