Chapter Five Review

advertisement

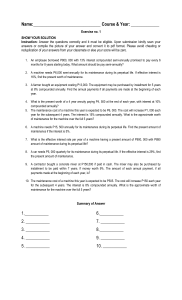

Chapter Five Review FV PV 1 r t 1. You have $5,000 to invest for six years. If you can earn 8% compounded annually, how much will it be worth at the end of the six year period? 2. A client with a large outstanding receivable has offered to settle with you. The actual amount owing is $10,000. The client has offered either $5,000 today or $10,000 in three years time. If you use a discount rate of 20%, which has the greater present value? Chapter 5 Review 3. Four years ago, you invested $6,000. Today, it has grown to $10,000. What is your annually compounded rate of return? 4. You invested $4,000 with a friend. He has assured you that he can double your money in five years. If he does, what is the annually compounded rate of return he has earned? 5. Another friend has offered a different deal. He tells you that he can offer you 12% compounded annually. At that rate of return, how many years will it take for your money to double? 6. The rule of 72 tells us to divide the interest rate earned into 72 to find the approximate number of years required for our money to double. First, how many years does the rule of 72 suggest it will take for our money to double if it earns 10%? What is the exact amount of time required?