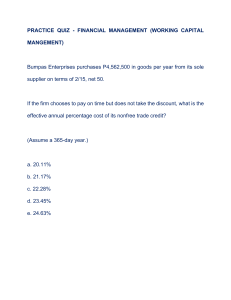

Simple Interest LEARNING OUTCOMES At the end of this topic, the students must have: 1. Familiarized about simple interest. 2. Stated the similarity and difference between ordinary interest and exact interest Two Types of Interest • Simple Interest is the interest in which only the original principal bears interest for the entire term of the loan. Here, the principal and present value is equal. • Compound Interest is the interest added to the principal at the end of a certain period of time after which the interest is computed on the new principal, and this process is repeated until the end of the term of the loan is reached. SIMPLE INTEREST It is defined as the product of principal, rate, and time. 𝐼 =𝑃×𝑟×𝑡 where: 𝐼= simple interest 𝑃= principal 𝑟= rate or percent 𝑡= units of time Other formula can be derived from the above. 𝐼 𝐼 𝑃= 𝑟= 𝑟×𝑡 𝑃×𝑡 Final Amount formula: 𝐹 =𝑃+𝐼 𝐼 𝑡= 𝑃×𝑟 𝐼 =𝐹−𝑃 Term if the loan is the period during which the borrower has the use of all or part of the borrowed money. The term or time may be stated in any of the following ways: be: When the time is expressed in number of year(s), our formula will 𝐼 = 𝑃 × 𝑟 × 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑦𝑒𝑎𝑟(𝑠) When the time is expressed in number of month(s): 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑚𝑜𝑛𝑡ℎ(𝑠) 𝐼 =𝑃×𝑟× 12 When the time is expressed in number of days, there are two (2) ways of computing interest, namely: Ordinary Interest (𝑰𝑶 ) 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝐼𝑜 = 𝑃 × 𝑟 × 360 Exact interest (𝑰𝒆 ) 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝐼𝑒 = 𝑃 × 𝑟 × 365 When the time is expressed between dates, there are four (4) ways of computing interest, namely: 𝐴𝑐𝑡𝑢𝑎𝑙 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 ∗ 𝑰𝒐 − 𝑨𝒄𝒕. 𝒕𝒊𝒎𝒆 = 𝑃 × 𝑟 × 360 𝐴𝑝𝑝𝑟𝑜𝑥𝑖𝑚𝑎𝑡𝑒 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝑰𝒐 − 𝑨𝒑𝒑. 𝒕𝒊𝒎𝒆 = 𝑃 × 𝑟 × 360 𝐴𝑝𝑝𝑟𝑜𝑥𝑖𝑚𝑎𝑡𝑒 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝑰𝒆 − 𝑨𝒄𝒕. 𝒕𝒊𝒎𝒆 = 𝑃 × 𝑟 × 360 𝐴𝑝𝑝𝑟𝑜𝑥𝑖𝑚𝑎𝑡𝑒 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝑰𝒐 − 𝑨𝒑𝒑. 𝒕𝒊𝒎𝒆 = 𝑃 × 𝑟 × 365 * Known as the Banker’s Rule, this is the formula being applied by banks in computing the interest on savings deposits Examples: 1. Find the interest and amount on ₱ 800 at 6 ½ % simple interest for 5 years. 2. Find the interest and amount on ₱ 900 at 7 ¼ % simple interest for 9 months. 3. Find the interest and amount on ₱ 1,200 at 11 ¾ % simple interest for 2 years and 5 months. 4. If a principal of ₱ 2,500 earns interst of ₱ 185 in 3 years and 3 months, what interest rate, is in effect? 5. A principal earns interest of ₱ 385 in 2 years and 9 months at a simple interest of 9 ½ %. Find the principal invested. 6. How long will it take for ₱ 8,000 to earn, ₱ 2,400, if it is invested at 6 ½ % simple interest? 7. Marteena Moefy borrowed ₱ 15,000 from a bank at 11 ¼ % simple interest for 2 years and 9 months. How much did Marteena Moefy pay back the bank? Simple Interest and Simple Discount LEARNING OUTCOMES At the end of this topic, the students must have: 1. Differentiated simple interest from compound interest 2. Compared approximate and exact time. 3. Wrote a promissory note. ORDINARY AND EXACT INTEREST If the interest in computed with a denominator of 360, the interest is called Exact. Note: Ordinary interest is greater than exact interest. When interest (𝐼𝑜 𝑜𝑟 𝐼𝑒 ) is not specified in any problem it is assumed as ordinary. (𝐼𝑜 ). Let us work on the following examples to illustrate the application of the above. 1. Find the ordinary and exact and exact interest in ₱ 8,800 for 85 days at 11 ¾ % simple interest. 7 2. Jerry invested ₱ 25,000 at 9 % simple interest for 125 days. Find 8 the ordinary interest and amount in the end of the term. ACTUAL AND APPROXIMATE TIME Actual Time is the exact or actual number of days in any given month. Approximate Time where all the months within in a year contain 30 days. Let us work on the following to show how to determine the actual and approximate time. 1. Find the actual and approximate time from March 23 to October 16, 2005. 2. Find the actual and approximate time from April 21, 2005 to October 4, 2005 3. Find the actual and approximate time from November 1, 2007 to March 23, 2008. INTEREST BETWEEN DATES In the previous cases, the time for which interest is calculated is directly given in terms of years, months, or days. In cases, when interest is to be computed from a certain date to another date exclusively, there are four methods of computation, namely: Ordinary Interest for Actual Time (𝐼𝑜 − 𝐴𝑐𝑡) Ordinary Interest for Approximate Time (𝐼𝑜 − 𝐴𝑝𝑝) Exact Interest for Actual Time (𝐼𝑒 − 𝐴𝑐𝑡) Exact Interest for Approximate Time (𝐼𝑒 − 𝐴𝑝𝑝) Let us work on the following examples to illustrate the application of the above. 1. Find the interest using the four methods on ₱ 8,000 at 11 ½ % from August 2, 2006 to November 27, 2006. AMOUNT AND PRESENT VALUE AT SIMPLE INTEREST At the end of the term for which interest is to be computed, the amount due on a lender is the sum of the principal and interest and is designated by the symbol (F). This is called final amount or maturity value and is given by the formula. 𝐹 =𝑃+𝐼 𝐹 = 𝑃 + 𝑃𝑟𝑡 By factoring, we have 𝐹 = 𝑃 1 + 𝑟𝑡 Accumulation is the process of determining the amount F of a given principal P due at a specified time t. To accumulated a principal P for t years means to solve for the final amount by applying the formula 𝑭 = 𝑷(𝑰 + 𝒓𝒕) Discounting is the process of determining the present value P of any amount due in the future. To discount the amount F for t years, means to solve for P applying the formula 𝑭 𝑷= (𝟏 + 𝒓𝒕) Examples: 1. A businessman borrows ₱ 9,900 for 2 years at 9 ¼ % simple interest. What amount must he repay? 4 2. Accumulate ₱ 10,100 for 8 months at 10 % simple interest. 5 Try to solve this: 1 1. Accumulate ₱ 11,800 for 115 days at 11 % simple interest. 8 2. 3 Accumulate ₱ 7,700 at 15 % simple interest from November 5 6, 2006 to April 11, 2007. 1 3. Discount ₱ 5,500 for 11 months at 14 % simple interest. 4 SIMPLE DISCOUNT A discount is a deduction from the final amount F or maturity value MV of a loan or obligation. A simple discount is often called bank discount or interest-in-advance. The amount of money that the borrower receives is called proceeds. Bank discount or interest-in-advance can be computed by means of the formula: 𝑫=𝑭×𝒅×𝒕 Where: D = amount of discount F = final amount d = discount rate t = time or term of discount Other formulas that can be derived from above. 𝑑= 𝑑 ; 𝐹×𝑡 𝑡= 𝐷 ; 𝐹×𝑑 𝐹= 𝐷 𝑑×𝑡 Present Value Formula: 𝑃 = 𝐹 − 𝐷 or 𝑃 = 𝐹 1 − 𝑑𝑡 Final Amount Formula: 𝑃 𝐹= (1 − 𝑑𝑡) Examples: 1 1. Mr. Pat borrowed ₱ 15,800 for 9 months from Ms. Jawo who charged 11 % 8 simple discount. How much money did Mr. Pat receive? 2. How much loan would Mr. Sy ask for, if he needs ₱ 12,500 cash which will be 4 repaid in two years and 3 months with 10 % simple discount? 5 PROMISORRY NOTES Promissory Note is a written promise signed by the maker or debtor to pay a certain sum of money on demand or at fixed and determined future date, either to the bearer or to the order of a designated person. The important features of a promissory note are the following: 1. 2. 3. 4. 5. 6. Face Value (FV) of the note – the amount borrowed. Date of Note (Gn) – the date the note was written. Maturity Date (Md) – the promised date of payment or due date. Interest Rate (r) – the simple interest rate. Lender or Payee – the person to whom payment is due. Maker – the borrower Sample of a Promissory Note ₱ 50,000 Quezon City, May 5, 2005 One hundred twenty days AFTER DATE, I PROMISE TO PAY TO THE ORDER OF Pamela Alfonso the amount of FIFTY THOUSAND PESOS ₱ (50,000) 1 plus interest at 12 % p.a. 2 (Sgd) Micaela Moefy When the holder of a promissory note finds himself in need of cash before the maturity date, he may sell the note to other persons or to bank, this process is called discounting or selling the promissory note. Notations: F = Face Value MV = Maturity Value I = Interest tn = Term of Note r = Interest rate d = Discount rate Dn = Date of Note Dd = Discounting Date Md = Maturity Date Td = Term of Discount Bd = Bank Discount Pro = Proceeds Formula: 𝐼 = 𝐹𝑉 × 𝑟 × 𝑡𝑛 𝑀𝑉 = 𝐹𝑉 + 𝐼 𝐹𝑉 = 𝑀𝑉 − 𝐼 𝑀𝑑 = 𝐷𝑛 + 𝑡𝑛 (Table 1) 𝑡𝑑 = 𝑀𝑑 − 𝐷𝑑 (Table 1) 𝐵𝑑 = 𝑀𝑉 × 𝑑 × 𝑡𝑑 𝑃𝑟𝑜. = 𝑀𝑉 − 𝐵𝑑 𝑃𝑟𝑜. = 𝑀𝑉 1 − 𝑑 × 𝑡𝑑 𝑀𝑉 − 𝐹𝑉 1 + 𝑟 × 𝑡𝑛 Examples 1. A merchant has a note for ₱ 14,500 dated March 17, 2006. The note 1 is due in 120 days with interest at 11 %. If he sells the note on May 8 5 6, 2006 at a bank charging a discount rate of 10 %. Find the: I, MV, 8 Md, td, Bd, and Proceeds. Try solving this: 1. A note of ₱ 13,700 dated November 27, 2007 will mature on 90 days 3 with interest at 12 %. The note is discounted on January 6, 2008 at 4 a discounted rate of 11 ¼ %. What are the proceeds. 2. A 4-month note dated July 4, 2004 with face value of ₱ 25,000 bears 3 interest at 13 %. The note is discounted on September 13, 2004 at 5 3 a bank whose discount rate is 12 %. Find the proceeds. 8 Thank you!