Public Finance Textbook: US Government Expenditures & Policy

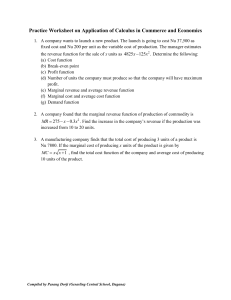

advertisement