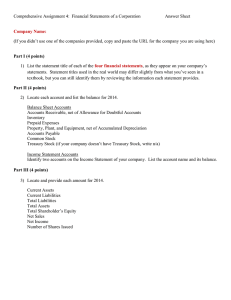

Comprehensive Problem [Overview of Financial Statement Analysis] Q.No.1. The comparative financial statements of Reynolds Company are presented below: Reynolds Company Comparative Statements of Financial Position December 31 2020 Particulars 2019 Assets Cash $54,000 $37,000 Accounts receivable 68,000 26,000 Inventory 54,000 0 Prepaid expenses 4,000 6,000 Land 45,000 70,000 Buildings 2,00,000 2,00,000 Accumulated depreciation—buildings (21,000) (11,000) Equipment 1,93,000 68,000 Accumulated depreciation—equipment (28,000) (10,000) $5,69,000 $3,86,000 $ 23,000 $ 40,000 10,000 0 Bonds payable 1,10,000 150,000 Common stock ($1 par) 220,000 60,000 Retained earnings 206,000 136,000 $5,69,000 $3,86,000 Totals Assets Liabilities and Stockholders’ Equity Accounts payable Accrued expenses payable Totals Liabilities and Stockholders’ Equity Particulars Reynolds Company Statements of Financial Performance For the Year Ended December 31, 2020 Amount ($) Sales revenue $8,90,000 Less: Cost of goods sold $465,000 Gross Profit Less : Operating expenses Income from operations 4,25,000 221,000 2,04,000 Less: Interest expenses (12,000) Less: Loss on sale of equipment (2,000) Earnings before taxes 1,90,000 Less: Income tax expenses 65,000 Net Income $1,25,000 ================ Additional information: (i) Operating expenses include depreciation expense of $30,000. (ii) Operating expenses include amortization expense of $2,000. (iii) Operating expenses include impairment expense of $1,000. (iv) Charges from prepaid expenses $2,000 (v) Land was sold at its book value for cash. (vi) Bonds of $30,000 were converted into common stock. (vii) Cash dividends of $55,000 were declared and paid in 2020. (viii) Equipment with a cost of $166,000 was purchased for cash. (ix) Equipment with a cost of $41,000 and a book value of $36,000 was sold for $34,000 cash. (x) Bonds of $40,000 were redeemed at their face value for cash. (xi) Common stock ($1 par) of $160,000 was issued for cash. (xii) Accounts payable pertain to merchandise suppliers. Required: 1. Prepare a statement of cash flow statement for 2020, under the indirect method. 2. Prepare a statement of cash flow statement for 2020, under the direct method. 3. Prepare a statement of free cash flow for 2020. 4. Explain the primary reason why: (a) the amount of cash provided by operating activities was substantially greater than the net income. (b) There was a net decrease in cash over the year, despite the substantial amount of cash provided by operating activities. 5. Prepare a supplementary schedule that should accompany the statement of cash flows in order to disclose the non-cash aspects of the company’s investing and financing activities. 6. Explain how Reynolds Company achieved positive cash flows from operating activities, despite incurring a net loss for the year. 7. Does the financial position appear to be improving or deteriorating? Explain. 8. Reynolds Company controller thinks that through more efficient cash management, the company could have held the increase in accounts receivable for the year to $10,000; without affecting the net income. Explain how holding down the growth in receivable affects cash. Compute the effect that limiting the growth in receivable to $10,000 would have on the company’s net increase or decrease in cash or cash equivalents for the year. 9. Prepare the Horizontal analysis for 2020 10. Prepare the Vertical analysis for 2020. 11. Calculate the following ratios for Reynolds publications as of June 30, 2020 (i) Working capital (ii) Current ratio (iii) Acid-test ratio (iv) Accounts receivable turnover ratio (v) Average Collection period (vi) Days to sell inventory (vii) Total debt to equity (viii) Long-term debt to equity (ix) Times interest earned (x) Return on assets (xi) Return on common equity (xii) Gross profit margin (xiii) Operating profit margin (pretax) (xiv) Net profit margin (xv) Cash turnover (xvi) Accounts payable turnover (xvii) Inventory turnover (xviii) Working capital turnover (xix) PPE turnover (xx) Total asset turnover (xxi) Price-toearnings (xxii) Earnings yield (xxiii) Dividend yield (xxiv) Dividend payout rate (xxv) Price-to-book (xxvi) Cash ratio (xxvii) CFO ratio (xxviii) Average days inventory in stock (xxix) Operating cycle (xxx) Net trade cycle or cash cycle (xxxi) Average PPE age (xxxii) Average days payables outstanding (xxxiii) Average PPE useful life (xxxiv) Return on invested capital (ROIC) (xxxv) Cash return on assets (xxxvi) Financial leverage (xxxvi) CFO to interest (xxxvii) CFO to debt (xxxviii) Cash flow adequacy (xxxix) CFO to Operating earnings (xxxx) Current cash debt coverage (xxxxi) Dividend cover (xxxxii) Dividend per share (xxxxiii) Operating Cash Flow Ratio (OCF Ratio or CFO Ratio) (xxxxiv) Operating Cash Flow to Long-Term Debt (OCF/ LTD) (xxxxv) Operating Cash Flow to Total Debt Ratio (OCF/ TD) 12. What does each of the following ratios indicate? Mention in one or two sentences only. [Methods of classification are not required]. (a) Current ratio (b) Acid-test ratio (c) Accounts receivable turnover ratio (d) Average collection period (e) Inventory turnover (f) Working capital turnover (g) PPE turnover (h) Total asset turnover (i) Price-to-earnings (j) Time Interest earned (k) Operating profit margin (l) Price earnings ratio. 13. Is it becoming easier for the company to meet its current debts on time and to take advantage of cash discounts? 14. Is the company collecting its accounts receivable more rapidly over time? 15. Is the company’s investment in accounts receivable decreasing? 16. Are dollars invested in inventory increasing? 17. Is the company’s investment in plant assets increasing? 18. Is the owner’s investment becoming more profitable? 19. Is the company using its assets efficiently? 20. Did the dollar amount of selling expenses decrease during the three-year period 21. Justify the Altman Z-Score Test and comment 9,10,11,12