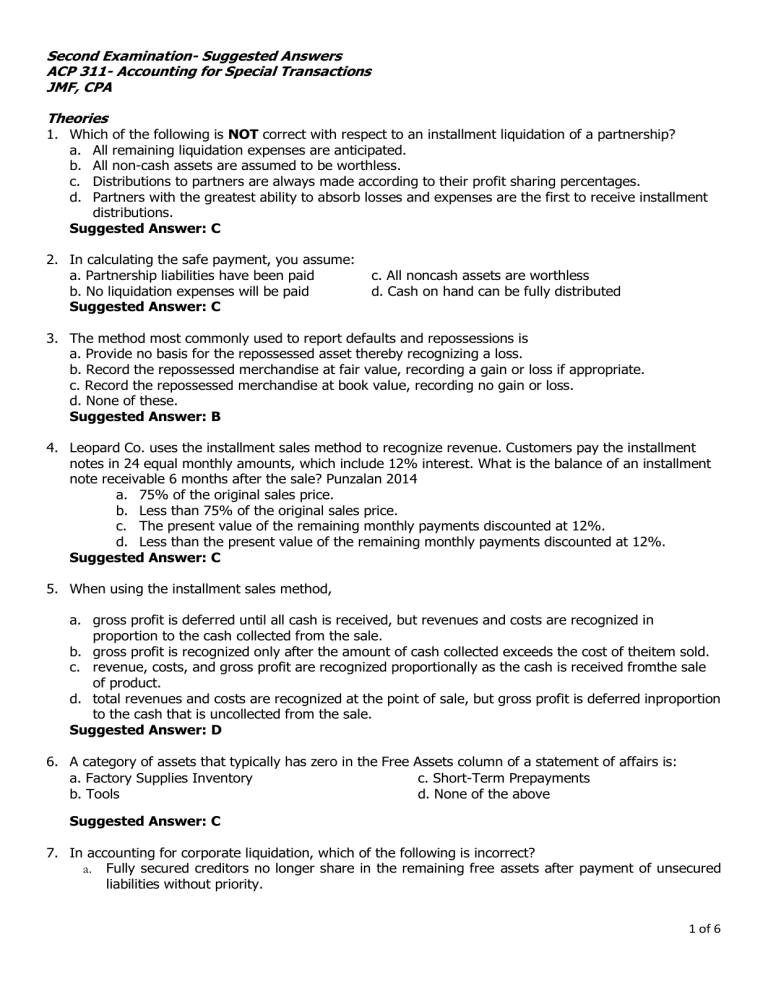

Second Examination- Suggested Answers ACP 311- Accounting for Special Transactions JMF, CPA Theories 1. Which of the following is NOT correct with respect to an installment liquidation of a partnership? a. All remaining liquidation expenses are anticipated. b. All non-cash assets are assumed to be worthless. c. Distributions to partners are always made according to their profit sharing percentages. d. Partners with the greatest ability to absorb losses and expenses are the first to receive installment distributions. Suggested Answer: C 2. In calculating the safe payment, you assume: a. Partnership liabilities have been paid b. No liquidation expenses will be paid Suggested Answer: C c. All noncash assets are worthless d. Cash on hand can be fully distributed 3. The method most commonly used to report defaults and repossessions is a. Provide no basis for the repossessed asset thereby recognizing a loss. b. Record the repossessed merchandise at fair value, recording a gain or loss if appropriate. c. Record the repossessed merchandise at book value, recording no gain or loss. d. None of these. Suggested Answer: B 4. Leopard Co. uses the installment sales method to recognize revenue. Customers pay the installment notes in 24 equal monthly amounts, which include 12% interest. What is the balance of an installment note receivable 6 months after the sale? Punzalan 2014 a. 75% of the original sales price. b. Less than 75% of the original sales price. c. The present value of the remaining monthly payments discounted at 12%. d. Less than the present value of the remaining monthly payments discounted at 12%. Suggested Answer: C 5. When using the installment sales method, a. gross profit is deferred until all cash is received, but revenues and costs are recognized in proportion to the cash collected from the sale. b. gross profit is recognized only after the amount of cash collected exceeds the cost of theitem sold. c. revenue, costs, and gross profit are recognized proportionally as the cash is received fromthe sale of product. d. total revenues and costs are recognized at the point of sale, but gross profit is deferred inproportion to the cash that is uncollected from the sale. Suggested Answer: D 6. A category of assets that typically has zero in the Free Assets column of a statement of affairs is: a. Factory Supplies Inventory c. Short-Term Prepayments b. Tools d. None of the above Suggested Answer: C 7. In accounting for corporate liquidation, which of the following is incorrect? a. Fully secured creditors no longer share in the remaining free assets after payment of unsecured liabilities without priority. 1 of 6 b. Assets used as security for partially secured liabilities are offsetted to their secured debts and can no longer be used to pay unsecured liabilities. c. Unsecured credits with priority such as liabilities to employees and taxes due to government can always be fully recovered by the said creditors in every corporate liquidation. d. The unsecured portion of the liabilities to partially secured creditors are added to unsecured credits without priority in the computation of recovery percentage of the unsecured creditors without priority. Suggested Answer: C Problems A statement of financial position for the partnership of Dy, Sy and Lee, who share profits and losses in the ratio of 2:1:1, shows the following balances just before liquidation: Cash Other Assets Liabilities P12,000 59,500 20,000 Dy, Capital Sy, Capital Lee, Capital P22,000 15,500 14,000 On the first month of the liquidation, certain assets are sold for P32,000. Liquidation expenses of P1,000 are paid, and additional liquidation expenses are anticipated. Liabilities are paid amounting to P5,400, and sufficient cash is retained to insure the payment to creditors before making payments to partners. On the first payment to partners, Dy receives P6,250. 8. The total cash distributed to the partners in the first installment is: Suggested Answer: 20, 000 On August 30, 2014, Robert Alat, Roy Anghang, and JayR Tamis who share earnings at 5:3:2, respectively, decided to liquidate their partnership. At this time, their condensed balance sheet follows: Cash P 62,500 Accounts payable P 75,000 Non-cash assets 312,500 Robert Alat, capital 100,000 Roy Anghang, capital 112,500 . JayR Tamis, capital 87,500 Total P375,000 Total P 375,000 The first sale of assets with a carrying value of P187,500 realized only P150,000. Roy Anghang received P60,000 from the initial cash distribution to partners. 9. Compute the amount of expected liquidation expenses retained from the cash distribution. Suggested Answer: 12, 500 Claudia, Petra, Mona, and Hilda are partners who share profits and losses at 40%, 30%, 20%, and 10%, respectively. Since two of them have given intention to withdraw, they have decided to liquidate the partnership instead. At this point, the capital balances of the partners are as follows: Claudia P48,000 Petra 21,600 Mona 34,400 Hilda 16,000 10. Which of the following statements is true? A. The first available P1,600 will go to Hilda. B. The first available P2,400 will go to Mona. C. Claudia will be the last partner to receive any available cash. D. Claudia will collect a portion of any available cash before Hilda receives anything. Suggested Answer: B 2 of 6 GREEN BERET, INC. is very financially distressed and the Securities and Exchange Commission ordered its prompt liquidation. The company has the following assets at this point: Book Value Fair Value Current assets P64,000 P28,000 Land 80,000 72,000 Buildings 56,000 61,600 Equipment 24,000 26,400 The company's liabilities at the same date are as follows: Income taxes P 6,400 Notes payable, secured by land 96,000 Accounts payable 68,000 Salaries payable 4,800 Bonds payable 56,000 Administrative expenses for liquidation 16,000 11. Calculate the estimated net amount available for the payment of all unsecured creditors Suggested Answer: 88, 800 12. Calculate the amount of estimated payment to holders of note payable in the event of liquidation. Suggested Answer: 86, 400 The following data were taken from the statement of realization and liquidation of Bagsak Corporation for the three months period ended December 31, 2020: Assets to be realized P1,375,000 Assets acquired 750,000 Assets realized 1,200,000 Assets not realized 1,375,000 Liabilities assumed 1,625,000 Liabilities liquidated 1,875,000 Liabilities not liquidated 1,700,000 Supplementary credits 2,800,000 Supplementary charges 3,125,000 Net Gain 425, 000 13. What is the amount of the liabilities to be liquidated for the period? Suggested Answer: 2, 250, 000 EVERGREEN COMPANY started operations on January 2, selling its merchandise on regular and on installment plans. The following data are available for its first two years operation. 2013 2014 Regular Installment Regular Installment Sales P400,000 P320,000 P500,000 P400,00 Cost of sales 260,000 192,000 325,000 280,00 Cash collections during the year 2013 Regular sales 100,000 150,000 2014 Regular sales 200,000 2013 Installment sales 168,000 120,000 2014 Installment sales 240,000 14. Calculate the realized gross profit recognized in EVERGREEN'S income statement for 2014 Suggested Answer: 295, 000 3 of 6 Octopus Retail Company sells goods for cash, on normal credit (2/10, n/30). However, on July 1, 20x4, the company sold a used computer for P22,000; the inventory carrying value was P4,400. The company collected P2,000 cash and agreed to let the customer make payments on the P20,000 whenever possible during the next 12 months. The company management stated that it had no reliable basis for estimating the probability of default. The following additional data are available: (a) collections on the installment receivable during 20x4 were P3,000 and during 20x5 were P2,000, and (b) on December 1, 20x5, Octopus Retail repossessed the computer (estimated net realizable value, P7,000). 15. Determine the realized gross profit on instalment sales for the year 20x4. Suggested Answer: 4, 000 Maranan Motors Sales cars on the installment basis. Presented below are data for the past three years: Installment sales Cost of sales Collection on: 2019 installment sales 2018 installment sales 2017 installment sales 2019 P2,880,000 1,728,000 2018 P2,304,000 1,440,000 2017 P1,543,000 1,002,950 1,008,000 391,000 478,000 921,000 462,000 578,000 Repossessions on defaulted accounts included one made on a 2017 sale for which the unpaid balance amounted to P20,000. The depreciated value of the car repossessed was P10,000. 16. The unrecovered cost of the car in 2017 and repossessed in 2019 is : Suggested Answer: 13, 000 The following selected accounts appeared in the trail balance of Valentine’s Company as of December 31, 2019: Installment receivable – 2018 sales P15,000 Repossessions P 3,000 Installment receivable – 2019 sales 200,000 Installment sales 425,000 Inventory, December 31, 2018 70,000 Regular sales 385,000 Purchases 555,000 Deferred gross profit – 2018 54,000 Operating expenses 92,000 Additional information: Installment receivable – 2018 sales, December as of December 31, 2018 is 120, 000 Inventory of new and repossessed merchandise as of December 31, 2019 is 95, 000 Gross profit percentage on regular sales in 2019 is 30% on sales. Repossessions were made during the year and were recorded correctly. It was a 2018 sale and the corresponding uncollected account at the time of repossession was P6,200. 17. What is the net income for 2019 Suggested Answer: 152, 352.5 4 of 6 Comprehensive Problems The following selected accounts were taken from the trial balance on Dec. 31, 2020 of Antigo Company: Accounts Receivable – charge sales Installment Receivable - 2018 Installment Receivable – 2019 Installment Receivable – 2020 Merchandise Inventory Purchases Freight-in Repossessed Merchandise Repossessed Loss Cash Sales Charge Sales Installment Sales Deferred Gross Profit-2018 Deferred Gross Profit -2019 75,000 15,000 45,000 270,000 52,500 390,000 3,000 15,000 24,000 90,000 180,000 446,400 22,200 39,360 The following additional information were also taken from the records of Antigo Company: Gross profit rate on 2018 installment sales was 30% and for 2019, the rate was 32% Installment sales exceed cash sales price by 24%, while charge sales prices exceed cash sales prices by 20%. The entry for repossessed goods was Repossessed Merchandise Repossessed loss Installment Receivable – 2018 Installment Receivable – 2019 15,000 24,000 18,000 21,000 Merchandise on hand at the end of 2020 (new and repossessed) was P70,500 Required: a. Realized Gross Profit Suggested Answer: 114, 471 b. How much is the cost of goods sold on installment sales in 2020? Suggested Answer: 234, 000 c. The cash collections on installment sales for 2018, 2019 and 2020? Suggested Answer: 41, 000, 57, 000 and 176, 400 respectively. 5 of 6 The partnership of Rent-A-Pet find it financial feasible to continue operations and have agreed to liquidate the partnership. The balance sheet just prior to the start of liquidation appears as follows: Partners Bryan, Donelle, and Christopher share income and loss in the ratio 5:3:2, respectively. Assets Cash P 200,000 Noncash assets 1,300,000 P1,500,000 Liabilities and Capital Accounts payable P 300,000 Loan from Bryan 50,000 Bryan, capital 350,000 Donelle, capital 600,000 Christopher, capital 200,000 P1,500,000 a. Second priority using Cash distribution program Suggested Answer: Donelle and Christopher b. If the first sale of noncash assets having a book value of P750,000 realizes P500,000 and all available cash is distributed, determine the amount of cash distributed to Bryan. Suggested Answer: 0 c. If each partner properly received some cash in the distribution after the second sale, the cash to be distributed amounts to P120,000 from the third sale, and unsold assets with an P80,000 book value remain, the share of Donelle must be: Suggested Answer: 36, 000 The following data were presented in the statement of affairs for Dubidubidapdap Company Unsecured liabilities without priority P900,000 Stockholder’s equity 360,000 Loss on realization of assets 450,000 Estimated administrative expenses that have not been recorded 45,000 Unsecured liabilities with priority 100,000 Based on the foregoing data, what percentage of their claims should unsecured, without priority creditors expect on the liquidation of Dubidubidapdap Company? Suggested Answer: 90% End of Second Exam 6 of 6