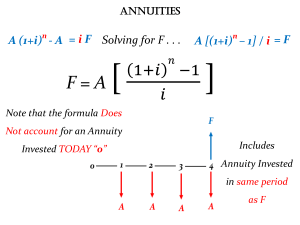

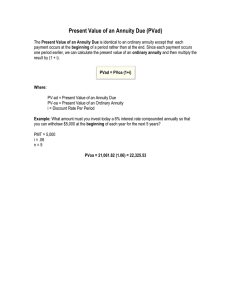

FAR/Harry Y/Appendix/Time Value of Money/P. 1 1. Time value of money Time value of money indicates the relationship between time and money A dollar received today is worth more than a dollar promised at some time in the future When deciding among investment or borrowing alternatives, it is essential to be able to compare today’s dollar and tomorrow’s dollar on the same footing—to “compare apples to apples.” PV based accounting measurement: 1. Notes 2. Leases 3. Pensions and Other postretirement benefits 4. Long-term assets 5. Stock based compensation 6. Business combinations 7. Disclosures 8. Environmental liabilities Annuities are transactions that result in identical periodic payments or receipts at regular intervals Annuity requires: 1. Periodic payments or receipts (called rents) of the same amount, 2. Same-length interval between such rents, and 3. Compounding of interest once each interval. Present value concepts are divisible into 3 board categories (6 types) 1. Single-sum problems A. PV of 1 B. FV of 1 2. Ordinary annuity – Occur at the end of each period A. PV of an ordinary annuity B. FV of an ordinary annuity 3. Annuity – Occur at the beginning of each period A. PV of an annuity due B. FV of an annuity due 1.1. The nature of interest Payment for the use of money Excess cash received or repaid over the amount lent or borrowed (principal) Variables in interest computation 1. Principal – The amount borrowed or invested 2. Interest rate – A percentage of the outstanding principal 3. Time – The number of years or fractional portion of a year that the principal is outstanding Two types of basic concepts: 1. Simple interest 2. Compound interest FAR/Harry Y/Appendix/Time Value of Money/P. 2 1.1.1. Single interest Interest computed on the principal only For example: Simple interest Barstow Electric Inc. borrows $10,000 for 3 months at a simple interest rate of 8% per year, the interest is computed as follows. Interest = p × i × n = $10000 * 8% * 3/12 = $200 1.1.2. Compound interest Compound interest on: Principal and Interest earned that has not been paid or withdrawn There are different types of compound interest tables 1. Single-sum problems A. PV of 1 B. FV of 1 2. Ordinary annuity – Occur at the end of each period A. PV of an ordinary annuity B. FV of an ordinary annuity 3. Annuity – Occur at the beginning of each period A. PV of an annuity due B. FV of an annuity due For example: Compound interest Vasquez Company deposits $10,000 in the Last National Bank, where it will earn simple interest of 9% per year. It deposits another $10,000 in the First State Bank, where it will earn compound interest of 9% per year compounded annually. In both cases, Vasquez will not withdraw any interest until 3 years from the date of deposit. FAR/Harry Y/Appendix/Time Value of Money/P. 3 1.1.2.1.Single sum problem 1.1.2.1.1. PV of 1 The present value of $1 is the amount that must be invested now at a specific interest rate so that $1 can be paid or received in the future 𝐹𝑉 𝑃𝑉 = = 𝐹𝑉 ∗ 𝑃𝑉 𝑜𝑓 1 𝑓𝑜𝑟 𝑎𝑝𝑝𝑟𝑜𝑝𝑟𝑖𝑎𝑡𝑒 𝑛 𝑎𝑛𝑑 𝑟 (1 + 𝑟)𝑛 Where: r = Periodic interest rate n = Number of periods For example: PV of 1 FAR/Harry Y/Appendix/Time Value of Money/P. 4 1.1.2.1.2. FV of 1 The future value of $1 is the amount that would accumulate at a future point in time if $1 were invested now The interest factor causes the future value of 1 to be greater than 1 𝐹𝑉 = 𝑃𝑉 ∗ (1 + 𝑟)𝑛 For example: FV of 1 1.1.2.2. Ordinary annuity – Occur at the end of each period 1.1.2.2.1. PV of an ordinary annuity The present value of an ordinary annuity is the current worth of a series of identical periodic payments to be made in the future 1 (1 + 𝑟)𝑛 𝑃𝑉𝐹 − 𝑂𝐴𝑛,𝑟 = 𝑟 𝑃𝑉 𝑜𝑓 𝑜𝑟𝑑𝑖𝑛𝑎𝑟𝑦 𝑎𝑛𝑛𝑢𝑖𝑡𝑦 = 𝐴𝑛𝑛𝑢𝑖𝑡𝑦 ∗ 𝑃𝑉𝐹 − 𝑂𝐴𝑛,𝑟 For example: PV of ordinary annuity 1− FAR/Harry Y/Appendix/Time Value of Money/P. 5 1.1.2.2.2. FV of an ordinary annuity The future value of an ordinary annuity is the value at a future date of a series of periodic payments Rents occur at beginning of each period Interest will accumulate during 1st period Annuity Due has one more interest period than Ordinary Annuity Factor = multiply future value of an ordinary annuity factor by 1 plus interest rate 𝐹𝑉𝐹 − 𝑂𝐴𝑛,𝑟 (1 + 𝑟)𝑛 − 1 = 𝑟 𝐹𝑉 𝑜𝑓 𝑜𝑟𝑑𝑖𝑛𝑎𝑟𝑦 𝑎𝑛𝑛𝑢𝑖𝑡𝑦 = 𝑃𝑒𝑟𝑖𝑜𝑑𝑖𝑐 𝑝𝑎𝑦𝑚𝑒𝑛𝑡𝑠 ∗ 𝐹𝑉𝐹 − 𝑂𝐴𝑛,𝑟 For example: FV of an ordinary annuity 1.1.2.3. Annuity due – At the beginning of the period The only difference in the calculations of an annuity due and ordinary annuity is the timing for payments For an annuity due, the payments occurs at the beginning of the period 1.1.2.3.1. PV of an annuity due Present value of a series of equal rents to be withdrawn or received at equal intervals. Periodic annuity occur at the beginning of the period. 1 (1 + 𝑟)𝑛−1 𝑃𝑉𝐹 − 𝐴𝐷𝑛,𝑟 = 1 + 𝑟 𝑃𝑉 𝑜𝑓 𝑎𝑛 𝑎𝑛𝑛𝑢𝑖𝑡𝑦 𝑑𝑢𝑒 = 𝑃𝑉 𝑜𝑓 𝑜𝑟𝑑𝑖𝑛𝑎𝑟𝑦 𝑎𝑛𝑛𝑢𝑖𝑡𝑦 ∗ (1 + 𝑟) 1− 𝑃𝑉 𝑜𝑓 𝑎𝑛 𝑎𝑛𝑛𝑢𝑖𝑡𝑦 𝑑𝑢𝑒 = 𝐴𝑛𝑛𝑢𝑖𝑡𝑦 ∗ 𝑃𝑉𝐹 − 𝐴𝐷𝑛,𝑟 FAR/Harry Y/Appendix/Time Value of Money/P. 6 For example: PV of an annuity due 1.1.2.3.2. FV of an annuity due Rents occur at beginning of each period Interest will accumulate during 1st period Annuity Due has one more interest period than Ordinary Annuity Factor = multiply future value of an ordinary annuity factor by 1 plus interest rate [(1 + 𝑟)𝑛 − 1] ∗ (1 + 𝑟) 𝑟 𝐹𝑉 𝑜𝑓 𝑎𝑛 𝑎𝑛𝑛𝑢𝑖𝑡𝑦 𝑑𝑢𝑒 = 𝑃𝑒𝑟𝑖𝑜𝑑𝑖𝑐 𝑓𝑎𝑐𝑡𝑜𝑟 ∗ 𝐹𝑉𝐹 − 𝐴𝐷𝑛,𝑟 𝐹𝑉𝐹 − 𝐴𝐷𝑛,𝑟 = 𝐹𝑉 𝑜𝑓 𝑎𝑛 𝑎𝑛𝑛𝑢𝑖𝑡𝑦 𝑑𝑢𝑒 = 𝑃𝑒𝑟𝑖𝑜𝑑𝑖𝑐 𝑝𝑎𝑦𝑚𝑒𝑛𝑡 ∗ 𝐹𝑉𝐹 − 𝑂𝐴𝑛,𝑟 ∗ (1 + 𝑟) For example: FV of an annuity due – Using future value of ordinary annuity table: Bayou Inc. will deposit $20,000 in a 5% fund at the beginning of each year for 7 years beginning January 1, Year 1. What amount will be in the fund at the end of Year 7? FV of an ordinary annuity of 1 table: Step 1: FVF-OA * (1+r) =8.14202 * 1.05 = 8.5491105 FAR/Harry Y/Appendix/Time Value of Money/P. 7 Step 2: Calculate the FV of an annuity due: Deposit * Factor = Future Value = $20000 * 8.5491105 = $170982.21