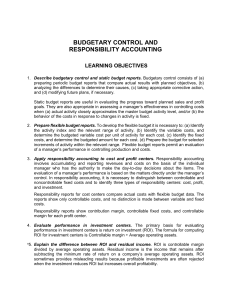

Module 4 Responsibility Accounting and Segment Evaluation Introduction In a well- managed organization, responsibilities for specific functions among its employees are clearly identified. A responsibility center is a specific unit of an organization assigned to a manager who is held accountable for its operations and resources. Each manager’s performance is judged by how well he or she manages those items under his or her control. In a budgeting program, each manager is assigned responsibility for those items of revenues and costs in the budget that he or she is able to control. Each manager is then held responsible for deviations between budgeted goals and actual results. This concept known as Responsibility accounting is central to any effective profit planning and control system. Intended Learning Outcomes At the end of this module, student should be able to: 1. Explain the importance of organizational structure to managerial reporting. 2. Elaborate the differences among centralization, decentralization and empowerment. 3. Distinguish authority, responsibility and accountability. 4. Discuss the different types of responsibility centers. 5. Explain the concept of controllability in relation to responsibility accounting. 6. Prepare a segment performance report. 7. Evaluation profit center’s performance using the segment margin analysis. 8. Evaluate investment center’s performance using the ROI, residual income, economic value added, equity spread, and other segments assessment models. Centralization, Decentralization, and Empowerment Decisions forge organizations. Decisions may be fashioned in a centralized, decentralized or empowered environment. Centralized organization exists when decisions rest only to the top management. Decentralization happens when the authority to make decisions is delegated to responsible officers in different organizational units. Either decision model, centralization or decentralization, provides great results. Managers have already realized they can produce more astounding results and accumulate more wealth by doing things along with others. When top management rains, trusts, and delegates authority to capacitated personnel operating decisions are made flexible, suitable, and faster leading to more satisfied and delighted customers. These organizational attributes are needed to stay abreast and be relevant in a competitive environment. This premise strengthens the practice of decentralization in managing large organizations. Figure 4.1 shown on the next page shows the basic difference among centralization, decentralization, and empowerment in terms of the power to make organizational decisions. Authority, Responsibility and Accountability Authority is the power to do or not to do, give orders, give command, give instructions, or make decisions. Responsibility is the duty to do or not to do an activity according to the order given. Accountability is the answerability on the consequences of what had been done, undone, or had not been done. Authority and responsibility must go together, one should not be present without the other. Authority without responsibility is absolute power and absolute power corrupts absolutely. Responsibility without authority is blind obedience, a plain servitude. Equationally, we could express that Authority = Responsibility Fig. 4.1. Decision Levels in Centralization, Decentralization and Empowerment As authority is shared to trusted men, responsibility must be performed in line with the principle of accountability. The manner on how the authority is exercised and the effects of the acts performed to fulfill a responsibility should be evaluated. This is the moving concept of accountability. Without it, there would be no logical value of assessing how things are done and what have been done. Without accountability, there would be no compelling reasons to evaluate performance fairly and objectively. In an expanded equation, we could say: Authority = Responsibility = Accountability Authority and responsibility would loose their intrinsic meanings without accountability. It is in this context that the power of individuals is harnessed, extolled, and recognized. This principle gives birth to the powerful idea of providing a reward system in organizations. Responsibility Centers A responsibility center is a unit within the organization which has control over costs, revenues and /or investment funds. In a decentralized decision-making model, divisions, departments, segments, or units are considered responsibility centers. Each center is managed by a responsible officer. A responsibility center could be an investment center, profit center, revenue center, or a cost center. An investment center manager decides on which strategic business opportunity should the company undertake. A profit center manager controls both the generation of income and incurrence of costs. A revenue center manager controls the generation of revenue. A cost center manager has a control or influence over the incurrence of costs. The diagram on the next page shows the scope and relationships of these centers. Figure 4.2 Responsibility Centers and Organizational Structure In the hierarchical organizational design presented above, there are six levels starting from the corporate headquarter chief to the division heads down to the workers. The perspective of the discussions that will follow gears towards a holding company operating domestically or internationally. The corporate headquarter is headed by the Chief Executive Officer. The holding company has divisional units that are legally separate and independent from it. A division is managed by a President with his Vice-Presidents to assist him in running the affairs of the business. Organizational designs Organizational strategy precedes structure. The overall corporate strategy defines the powers and duty to be assigned to a division manager based on organizational priority or emphasis in a given period of performance. A division is an investment center or a business segment having its separately defined business and financing activities from that of the parent or controlling company. The first layer of organizational emphasis, for example, may be on the functional areas, product lines, or geographical areas as depicted in Figure 4.3. Figure 4.3. Organizational Layer of Emphasis The layer of emphasis normally speaks of the overall strategy adopted by the enterprise. Figures 4.4 to 4.6 is an illustration on how people would be assigned throughout the organizational structure. Figure 4.4. Organizational Design with Emphasis on Functional Responsibility This organizational design emphasizes the strength of functional areas such as finance, production, marketing, sales, and administration. Hence, men are grouped along these lines and all other subsequent or lower business units would subordinate their decisions, actions, and reports to the functional managers. The lines of authority and responsibility will be delegated along these areas and performance shall be assessed accordingly. Figure 4.5. Organizational Design with Emphasis on Product Line Responsibility This organizational design emphasizes the strategic importance of product lines such as consumer products, industrial products, agro-tourism related products, health and health related services, and the like. Further, the said product lines may be sub-categorized into a more detailed products groups such as tree planting and land development, organic farming, herbal products, and wellness city for the agrotourism products. Men shall be grouped along these lines and all other subsequent or lower business units would subordinate their decisions, actions, and reports to the product line managers. The lines of powers and duties will be delegated along these product lines areas and performances shall be evaluated accordingly. Fig. 4.6 Organizational Design with Emphasis on Geographical Area of Responsibility The organizational design emphasizes the strategic importance of geographical areas such as northern operations, southern operations, eastern operations, and the like. Further, the said geographical area of operations sub-categorized into a more detailed areas such as region 1, region 2, and the like. Accordingly, men shall be grouped along these lines and all other subsequent or lower business units would subordinate their decisions, actions and reports to the product line managers. Authorities and responsibilities will be delegated according to the areas of operations and performances shall be rewarded accordingly. It should be highlighted that in the creation of organizational designs the chief executive officer stays at the top and the personnel at the bottom. The middle layers may be defined or rearranged according to the strategies adopted by the organization. Controllability and responsibility centers The span of authority given to a manager defines the area over which he has controls. Controllability refers to the power of the manager to decide or influence the incurrence or non-incurrence of an item, event or activity. This concept of controllability is extremely important in measuring a person’s performance where it states that a manager should be evaluated only on matters that he controls. A responsibility center manager has to understand the breadth and depth of his authority. The authority to the manager should commensurate with the responsibility assigned to him. Consequently, he is accountable to his actions or inaction. This model stresses the need to evaluate managerial performance. Figure 4.7. Responsibility Centers and Performance Evaluation Performance Evaluation A manager’s performance should be evaluated in line with the established objectives and standards of his center. Different responsibility center managers should be evaluated differently inasmuch as their authority, responsibility, and accountability vary from each other. Performance evaluation (i.e., performance measurement, feedback) is a control issue. It may be implemented before, during or after a process. Performance is assessed based on reports submitted to and gathered by the manager. Therefore, an effective, reliable, timely, verifiable, and relevant reporting system must be in place. Responsibility accounting reports may either be information reports or performance reports. Reports submitted by a responsibility center manager should segregate the controllable from the noncontrollable items. Managers’ performance should be measured for items they have control over with. The techniques used in measuring managers’ performance are presented below: Table 4.1. Basis of Evaluating Responsibility Centers Responsibility Center Manager Cost center manager Revenue center manager Profit center manager Investment center manager Evaluation Techniques Cost variance analysis Revenue variance analysis Segment margin analysis Return on Investment (ROI) Residual income model Economic value added (EVA) Equity spread, etc. Cost center manager’s performance A cost center manager has control or influence over the incurrence of non-incurrence of costs. The cost center manager report should separate the controllable from the non-controllable costs and should highlight the variances between the actual and budgeted costs. Let us refer to the organizational chart shown in Fig. on page. Focus on department manager 2. He reports to the Vice President for Product 2 and has 3 supervisors under him. An abbreviated example of a department manager’s report is presented in Table 4.2 shown in the following page. Variances are identified as either unfavorable (U) or favorable (F). Unfavorable variances indicate excessive costs and should be avoided. Favorable variances mean savings, however, should also be investigated. The three (3) production supervisors have already submitted their respective reports to production manager 2. The summary of these supervisors’ reports is captured in the departments manager’s report as “cost center 1”, “cost center 2”, and “cost center 3” and included in the controllable items. The other controllable costs are direct costs of operating department manager’s department. These items are captured in the report of the Vice-President for Product 2 to be submitted to the Chief Operating Officer as shown in Table 4.3 on page. Table 4.2. Department Manager's Performance Report X Corporation Department Manager 2 September 9-15, 20CY Controllable Costs Cost center 1 Cost center 2 Cost center 3 Direct materials Direct labor Indirect materials Fringe benefits Factory supplies Electricity and water Telecommunications Gas and oil Repairs and maintenance Supervisors' salaries Miscelleneous Total controllable costs Noncontrollable Costs Managers' salary Depreciation expense Rent expense Allocated costs Total noncontrollable costs Total Costs Performance Report Actual 832,000 655,000 440,000 590,000 900,000 26,000 40,000 33,000 20,000 18,000 9,000 21,000 92,000 44,000 3,720,000 Budget 845,000.00 650,000.00 450,000.00 580,000.00 920,000.00 27,000.00 38,000.00 36,000.00 25,000.00 12,000.00 10,000.00 19,000.00 90,000.00 47,000.00 3,749,000.00 Variance (13,000.00) 5,000.00 (10,000.00) 10,000.00 (20,000.00) (1,000.00) 2,000.00 (3,000.00) (5,000.00) 6,000.00 (1,000.00) 2,000.00 2,000.00 (3,000.00) (29,000.00) 70,000.00 90,000.00 22,000.00 66,000.00 248,000.00 66,000.00 95,000.00 26,000.00 66,000.00 253,000.00 4,000.00 (5,000.00) (4,000.00) (5,000.00) 3,968,000.00 4,002,000.00 U (F) F U F U F F U F F U F U U F F U F F F (34,000.00) When presented in the VP for Product 2’s report, the department manager’s 2 report becomes only a “line item”. In the same way, the report of the VP for Product 2 to the Chief Executive Officer will also be presented in a single line. At the end of the reporting line, the Chief Executive Officer has only a page of report summarizing the vital information in the organization. Table 4.3. Vice-President’s Performance Report X Corporation Vice-Presiden for Product 2 September 9-15, 20CY Performance Report Controllable Costs Department Manager 1 Department Manager 2 Department Manager 3 Office Salaries Fringe benefits Supplies Electricity and water Telecommunications Gas and oil Miscelleneous Total controllable costs Actual 3,336,000 3,720,000 2,290,000 122,000 20,000 23,000 33,000 48,000 19,000 64,000 9,675,000 Budget 3,350,000.00 3,749,000.00 2,300,000.00 120,000.00 24,000.00 25,000.00 38,000.00 50,000.00 17,000.00 69,000.00 9,742,000.00 Noncontrollable Costs VP Production Salary Depreciation expense Allocated costs Total noncontrollable costs 80,000.00 300,000.00 466,000.00 846,000.00 80,000.00 300,000.00 466,000.00 846,000.00 Total Costs 10,521,000.00 Variance (14,000.00) (29,000.00) (10,000.00) 2,000.00 (4,000.00) (2,000.00) (5,000.00) (2,000.00) 2,000.00 (5,000.00) (67,000.00) U (F) F F F U F F F F U F F - 10,588,000.00 (67,000.00) F Revenue Center Manager’s Performance A revenue center manager has control or influence in generating revenue but not of costs. His performance report should show the variances between actual revenue and budgeted revenue. When the actual revenue is greater than budgeted revenue, there is a favorable revenue variance, and vice-versa. A favorable variance at a blush maybe given a commensurate reward and recognition however should be immediately evaluated for learning and further improvements. While an unfavorable variance should be critically studied to avoid its recurrence. Responsibility centers that are responsible in developing and maintaining sources of supply such as sources of materials and labor may also be classified as revenue centers. Profit Center Manager’s Performance A profit center manager has control over revenues and costs. his managerial performance is evaluated based on controllable margin while the center’s performance is evaluated based on segment (or direct) margin. The controllable margin and segment margin computations are presented below: Table 4.4. Segment Margin Contribution margin Less: Controllable direct fixed costs and expenses Controllable margin Less: Noncontrollable direct fixed costs and expenses Segment margin P P x x x x x Deduct the allocated (or indirect or unavoidable) fixed costs and expenses from the segment margin and you will get the operating profit. The difference between controllable margin and segement margin is fixed cost and expenses controllable not by the concerned manager but by others. The actual controllable margin and segment margin should be compared with the budgeted amounts to get the variances and evaluate performances. Sample Problem 4.1. Segment Performance Bajada Corporation has been experiencing negative operating results in the last six quarters. Its most recent income statement is as follows: Sales Less: Variable costs Contribution margin Less: Fixed costs Profit P 6,300,000 3,474,000 2,826,000 2,906,000 P (80,000) The company operates three product lines which has the following related data: Sales Controllable direct fixed costs Allocated fixed costs Noncontrollable direct fixed costs Variable cost ratio Product 1 P 1,200,000 220,000 102,000 220,000 56% Product 2 P 2,100,000 880,000 102,000 100,000 42% Product 3 P 3,000,000 800,000 102,000 800,000 64% Total P 6,300,000 1,900,000 306,000 1,120,000 Required: Compute the segment margin for each of the product lines and of the corporation. Evaluate the data. Solutions/ Discussions: The segment margins of the three product lines are determined as follows: Sales - Variable costs Contribution margin - Controllable direct fixed costs Controllable margin - Noncontrollable direct fixed costs Segment margin - Allocated fixed costs Profit (loss) A 1,200,000 672,000 528,000 220,000 308,000 220,000 88,000 102,000 (14,000) B 2,100,000 882,000 1,218,000 880,000 338,000 100,000 238,000 102,000 136,000 C 3,000,000 1,920,000 1,080,000 800,000 280,000 800,000 (520,000) 102,000 (622,000) Total 6,300,000 3,474,000 2,826,000 1,900,000 926,000 1,120,000 (194,000) 306,000 (500,000) Product line B registers the best performance in terms of peso amount amounting to a segment margin of P 238,000 and margin return on sales of 11% (i.e., P 238,000/ P 2,100,000). Product line C produces a negative segment margin of P 520,000. This product line does not contribute to the overall profitability of the company but rather reduces the overall amount of the company’s profit by the amount of its negative segment margin. Product line C, based on the computations above, should be disposed. In terms of individual segment manager’s performance, the manager of product line B still registers the best performance posting a controllable margin of 16% (i.e., P 338,000/ P 2,100,000) compared to that of product line C’s manager of 9% (i.e., P 280,000 / P 3,000,000) and that of product line A’s manager of 3% (i.e., P 308,000/ P 1,200,000) Investment Center Manager’s Performance The investment center manager has authority to decide over which investment opportunity should be considered and pour in the funds for investments. As such, their performance is evaluated based on the results of investments. The cost-benefit criterion plays a vital role in the investment selection decision process. The benefit refers to the returns derived from investments while the cost refers to the amount used in undertaking the opportunity. There are several models in evaluating investment center performance. Some of these are the return on equity, return on investment (DuPont Model), residual income, economic value added, equity spread, total shareholders return, and the market value added. The Return on Investment (ROI) The ROI is sometimes referred to as return on assets (ROA), or accounting rate of return (ARR). It is computed as follows: ROI = Segment Profit/ Segment Investment Take a second look, you will notice that the ROI is a measure of benefit over cost analysis. Benefit is represented by the segment profit while the cost is the amount of the segment investment which is preferred to be the assets employed in the division. The higher the ROI, the better it will be for the business. The issue, therefore, is how to increase ROI. Quantitatively speaking, ROI is increased by increasing profit and reducing investment, as follows: Increase in ROI = Increase in Profit Decrease in Investment The Du Pont Model E. I. du Pont de Nemours and Company, commonly referred to as DuPOnt, an American chemical company that has founded in July 1802 and is one of the world’s largest chemical company based on market capitalization, evaluates the performance of its numerous business investments using an extended ROI model as follows: ROI = Profit / Net Sales x Net sales / Investment ROI = Return on sales x Assets Turnover This model encourages investment center managers to wisely take investment only for those which are of relevance to their operations. This will result to efficiency in allocating investment funds. Only those investment of which the investment center manager has control and use in operations shall be included in the ROI determination. Sample Problem 8.2. Return on Investment Frances Beau Corporation’s balance sheet indicates that the company has P 5,000,000 investment in operating assets. In 20CY, Frances Beau earned P 1,100,000 of profit on P 11,000,000 of sales. Required: Determine the following for Frances Beau: 1. Profit margin for 20CY 2. Assets turnover for 20CY. 3. Return on investment for 20CY. 4. ROI under each of the following independent assumptions: a. Sales increase from P 5 million to P 6 million and profit increase from P 1,100,000 to P 1,300,000 b. Sales remain constant, costs and expenses decrease while profit increases by P 400,000. c. The amount of investment is decreased by P 400,000 without affecting the profit. Solutions/ Discussions: 1. Profit margin or return on sales is computed as follows: Profit margin = Profit / Net sales = P 1,100,000 / P 11,000,000 = P 10% 2. The assets turnover is determined as follows: Assets turnover = Net sales/ assets = P 11 million / P 5 million = 2.2. 3. ROI = Return on sales x Assets turnover = 10% x 2.2. = 22% Or ROI may be computed directly as ROI = Profit / Average assets used = P 1,100,000/ P 5,000,000 = 22% 4.a. ROI = P 1,300,000 / P 6,000,000 = 21.67% 4.b. ROI = (P 1,100,000 + P 400,000) / P 5,000,000 = 30% 4.c. ROI = P 1,100,000 / P 4,600,000 = 23.91% The ROI and its limitations The use of ROI has several limitations. Significant differences in the amount of investment from one project to another and the difference in the life of the asset used in investment opportunities may render the use of ROI difficult to apply. To highlight these limitations, consider the following: Return on investment Amount of investment Life of assets in years Company A 20% P 1 billion 15 years Company B 40% P 1 million 2 years Using the ROI model, Company B is better BUT The size matters… Using the ROI, company B manager with 40% ROI would be better off than that of company A manager with 20% ROI. However, considering the amount of investment supervised by each manager respectively, we could easily say that managing a million worth of business (e.g., Company B) is a lot much easier than managing a billion worth of business resources (e.g., Company A). The asset life also matters… Also, considering the life span of the assets used, company B’s performance is an utter dismay because only 80% of the investment would be recovered in 2 years, which is the life of the investment, given a 40% ROI per annum. This performance falls short of recovering the entire amount of investment over its operational life. Whereas company A has a total return of 300% (e.g., 20% x 15 years) which means investment in company A is recoverable three times and is indeed better than the 80% recovery rate of company B. The special assignment matters… ROI model may not also be the most suitable method in evaluating the performance of an excellent manager who is assigned to make a business turnaround performance, say to deliver a profitable performance of a previously unprofitable operations. The Residual Income Model The limitations encountered in applying the ROI is improved by the residual income model that uses amount as a basis of evaluating the acceptance of a prospective investment or the performance of an investment project. The residual income is computed as follows: Segment income Less: Minimum income Residual income P x x (Investment x Implied Interest rate) P x The segment income is income expressed before tax. Segment income also refers to earnings before interest and tax (e.g., EBIT) or the operating profit. Minimum income is sometimes labeled as imputed income, implied income, implicit income or desired income. The investment base used in computing the minimum income is to the amount agreed upon by the corporate headquarter and the investment center manager. The imputed interest rate is to be determined by the corporate headquarter management. Normally, the imputed interest rate is based on the prevailing market rate form which the business generates profit without accepting a high business risk. The imputed rate is ordinarily the pre-tax cost of capital, and in principle, should reflect the degree of risk of the reporting responsibility center. If the residual income is positive, the performance is above standard and is, therefore, favorable. Residual income is considered superior than the ROI because it considers two levels of assessments, the compliance to minimum return and the size of the excess return over the same minimum return. Sample Problem 4.3 Residual Income Tom Corporation gathered the following data relative to Northern Division’s performance: Net sales P 12,000,000 Costs and expenses 11,000,000 Average operating assets 5,000,000 Desired minimum (or imputed) rate of return established by management 15% Average industry rate of return 28% Income tax rate 40% Compute the Northern Division’s residual income. Solutions/ Discussions: Segment profit (P 12 million – P 11 million) Less: Minimum income (P 5 million x 15%) Residual income The average industry rate of return, though may be considered in setting the minimum desired rate of return, is different from the minimum rate of return. The desired minimum income is normally expressed in amount before tax, hence, it is compared with operating income or segment profit. Since the residual income of a division is positive, the division has met the expectations or standards set by top management in terms of profitability and is therefore considered acceptable. P 1,000,000 750,000 P 250,000 Economic Value Added The economic value added (EVA) is a more specific after-tax version of residual income. It represents the business unit’s true economic profit because a change in the cost of equity capital is implicit in the cost of capital. the cost of equity is an opportunity cost, that is, the return that could have been obtained with the best alternative investment having similar risk. The EVA is computed as follows Operating Profit After Tax (EBIT x after tax rate) Less: Minimum income (Investment x Weighted Average Cost of Capital) Economic value added Px x Px The operating profit after tax (OPAT) is computed by multiplying the earnings before interest and taxes (EBIT) by the after-tax rate (i.e., 1-Tax rate). The weighted average cost of capital is computed after tax. EVA measures the marginal benefit obtained by using resources in relation to the business of increasing shareholders’ value. Some adjustments in EBIT are needed such as research and development (R&D) costs which are capitalized and amortized over 5 years. The true economic depreciation rather than the accounting depreciation used for tax purposes is to be used in computing the EVA. Sample Problem 4.4. Economic Value Added Global Holdings operates Star Corporation, a division in electronics industry, and provided you the following data with regard to the division’s 20CY performance: Divisional income before interest and taxes Interest expense Tax rate Weighted average cost of capital Average total assets Carrying amount Current value Average current liabilities P 200 million P 60 million 40% 12% P 90 million P 120 million P 40 million Required: Economic value added (EVA) assuming the investment base is: 1. Market value of long-term financing. 2. Carrying amount of long term financing. 3. Market value of total assets. 4. Carrying amount of total assets Solutions / Discussions: 1. Investment base is the market value of long-term financing. OPAT (P 200 million x 60%) Less: Minimum return on market value of long-term financing [ ( P 120 million – P 40 million) 12%] Economic value added P 120.00 million P9.60 million P 110.40 million 2. Investment base is the carrying amount of long-term financing. OPAT Less: Minimum return on carrying amount of long-term financing [ ( P 90 million – P 40 million) 12%] Economic value added P 120.00 million P 6.00 million P 114.00 million 3. Investment base is the market value of the total asset OPAT Less: Minimum return on market value of long-term assets (P 120 million x 12%) Economic value added P 120.00 million P 14.40 million P 105.60 million 4. Investment base is the carrying amount of the total asset OPAT Less: Minimum return on carrying amount of long-term assets (P 90 million x 12%) Economic value added P 120.00 million P 10.80 million P 109.20 million The economic value added is a measure of the management effectiveness in increasing investor’s value. The best investment base to use is the market value of the long-term financing. The market value is used to reflect the true amount of investment and the exercise prudence in the process. also, long-term financing is used to isolate the interest of the true investors from the short-term ones. Maximizing the interest of long-term investors, both creditors and owners, are the real intentions of enterprise management. Other investment center evaluation models Other divisional evaluation models are equity spread, total shareholders’ return and market value added. The equity spread, like the EVA, is also a straightforward method for measuring managerial performance regarding creation of shareholder value. It is computed as follows: Table 4.7. Equity Spread Shareholders’ equity – beginning x (Return on equity – Cost of equity rate) Equity spread P x x% P x Total shareholder’s return equals the change in the stock price plus dividends per share divided by the initial stock price. The market value added is the difference between the market value of the equity (i.e., market price x shares outstanding) and the equity supplied by the shareholders. References used: Agamata, Franklin T. Management Services 2019 Edition. GIC Enterprises & Co., Inc, 2019 Cabrera, Ma. Elenita B. Management Accounting Concepts and Applications. GIC Enterprises & Co., Inc, 2014