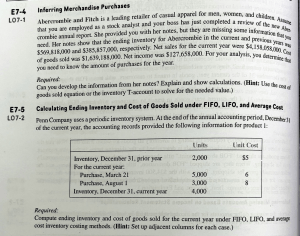

Accounting Adjustments - Inventory valuation and impact on Financial Statements 1 Objective • Understand different cost formulas used for valuing inventories • Understand how to adjust a company’s reported financial statements from LIFO to FIFO for purposes of peer comparison • Perpetual vs. periodic inventory method • Understand the concepts of LIFO reserve and LIFO liquidation and their effects on financial statements and ratios 2 Method of valuing inventory and Cost flow assumptions/cost formulas • Inventories are valued at lower of – Cost or – Net realisable value • “The cost of inventories shall comprise all costs of purchase, direct labour, costs of conversion, variable and fixed production overheads and other costs incurred in bringing the inventories to their present location and condition” • Net realisable value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale. 3 Method of valuing inventory and Cost flow assumptions/cost formula • IFRS, US GAAP as well as IND AS exclude the following costs from inventory: – abnormal costs incurred as a result of waste of materials, labour or other production conversion inputs, – any storage costs (unless required as part of the production process or unless those costs are necessary in the production process before a further production stage) and – administrative overheads that do not contribute to bringing inventories to their present location and condition; and – Selling Costs • These excluded costs are treated as expenses and recognised on the income statement in the period in which they are incurred. 4 Method of valuing inventory and Cost flow assumptions/cost formulas • Including costs in inventory defers their recognition as an expense on the income statement until the inventory is sold. • Therefore, including costs in inventory that should be expensed will overstate profitability on the income statement (because of the inappropriate deferral of cost recognition) and create an overstated inventory value on the balance sheet. • The practice of writing down inventories below cost to net realisable value is consistent with the view that assets should not be carried in excess of amounts expected to be realized from their sale or use • Inventory valuation follows “Conservatism” principle of accounting since it recognizes – Losses or declines in market value are recognized as they occur – Profits are reported only when inventory is sold 5 Example - Treatment of InventoryRelated Cost Acme Enterprises, a manufacturer tables, prepares its financial statements in accordance with IFRS. In 2019, the factory produced 900,000 finished tables and scrapped 1,000 tables. For the finished tables, raw material costs were €9 million, direct labour conversion costs were €18 million, and production overhead costs were €1.8 million. The 1,000 scrapped tables (attributable to abnormal waste) had a total production cost of €30,000 (€10,000 raw material costs and €20,000 conversion costs; these costs are not included in the €9 million raw material and €19.8 million total conversion costs of the finished tables). During the year, Acme spent €1 million for freight delivery charges on raw materials and €500,000 for storing finished goods inventory. Acme does not have any work-in-progress inventory at the end of the year. 1 What costs should be included in inventory in 2019? 2 What costs should be expensed in 2019? Source: CFA level 1 FSA 6 Solution • Total inventory costs for 2019 are as follows: Raw materials €9,000,000 Direct labour 18,000,000 Production overhead 1,800,000 Transportation for RM 1,000,000 Total inventory costs €29,800,000 • Total costs that should be expensed (not included in inventory) are as follows: Abnormal waste €30,000 Storage of finished goods inventory 500,000 Total €530,000 7 Cost formulas • Cost formulas for measuring cost of inventories and that charged to COGS are – Specific identification – FIFO – LIFO (Not permitted as per IND AS-2 and IFRS and many other GAAP, US GAAP still has the provision) – Weighted average cost • Lookup disclosures on Inventories in annual reports -“Inventories” for Titan, Kalyan Jewelers and Tata Motors 8 Inventory and COGS Formula Beginning Inventory (BI) Purchases / (Purchases + conversion) (P) Cost of Goods Sold (COGS) Ending Inventory (EI) Equation – BI + P = COGS + EI Preparation of income statement and Balance sheet requires allocation of these costs (BI + P) between COGS and ending inventory 9 First-in, First-out (FIFO) • Expenses costs of oldest purchases first i.e. costs of items purchased first are deemed to be costs of items sold first and enter the COGS • Costs of most recently purchased goods are in the inventory on the balance sheet – Likely but not necessary to follow actual flow of goods – Ending inventory under FIFO method approximates current cost of goods 10 LIFO • Expenses cost of recent purchases first i.e. costs/price of items latest purchased are assumed to be costs of items sold first and enter the COGS • Ending inventory is made up of earliest cost incurred • Impact of its use in the income statement – Enhanced measurement of periodic income results as it is a better matching of current sales prices with current costs – Conversely, the balance sheet’s distortion of the current value of inventory produces a measurement of inventory and current assets which is understated under inflationary conditions 11 LIFO • Firms often adopt the LIFO approach for the tax benefits during periods of high inflation • Studies indicate that firms with the following characteristics are more likely to adopt LIFO – – Rising prices for raw materials and labor – An absence carry forward of other tax losses • When firms switch from FIFO to LIFO in valuing inventory, there is likely to be a drop in net income and a concurrent increase in cash flows (because of the tax savings). The reverse will apply when firms switch from LIFO to FIFO • Given the income and cash flow effects of inventory valuation methods, it is often difficult to compare firms that use different methods 12 Example • Use the inventory data in the following figure to calculate the cost of goods sold and ending inventory under the FIFO, LIFO, and weighted average cost methods. 7 units sold for Rs. 40 Date Particulars Amount 1, January 2 units @ $2/unit 4 10, January 3 units @ $3/unit 9 20, January 5 units @ $5/unit 25 Units sold on 25, January 7 units 13 Choice of Inventory method and its impacts on operating results Give effect as Higher or lower under each of the method when prices are increasing Particulars LIFO FIFO COGS Income before taxes Income taxes Net income Inventory balance (B/S) Working Capital Current ratio Inventory turnover ratio 14 Choice of Inventory method affects operating results • In the period of rising prices (inflationary trend) and stable or increasing inventory quantities Particulars LIFO FIFO COGS Higher Lower Income before taxes Lower Higher Income taxes Lower Higher Net income Lower Higher Inventory balance (B/s) Lower Higher Working Capital Lower Higher Current ratio Lower Higher Inventory turnover ratio Higher Lower 15 Example 2 Global Sales, Inc. (GSI) is a distributor of consumer products, including bars of violet essence soap. The soap is sold by the kilogram. GSI began operations in 2019, during which it purchased and received initially 100,000 kg of soap at 110 yuan/kg, then 200,000 kg of soap at 100 yuan/kg, and finally 300,000 kg of soap at 90 yuan/kg. GSI sold 520,000 kg of soap at 240 yuan/kg. GSI stores its soap in its warehouse so that soap from each shipment received is readily identifiable. During 2019, the entire 100,000 kg from the first shipment received, 180,000 kg of the second shipment received, and 240,000 kg of the final shipment received was sent to customers. Answers to the following questions should be rounded to the nearest 1,000 yuan. 1 What are the reported cost of sales, gross profit, and ending inventory balances for 2019 under the specific identification method? 2 What are the reported cost of sales, gross profit, and ending inventory balances for 2019 under the weighted average cost method? 3 What are the reported cost of sales, gross profit, and ending inventory balances for 2019 under the FIFO method? 4 What are the reported cost of sales, gross profit, and ending inventory balances for 2019 under the LIFO method? Source: CFA level 1 FSA 16 Example 2 sol. (in ‘000 yuan) Solved in Excel sheet as well 17 Weighted Average • Under the weighted average approach, both inventory and the cost of goods sold are based upon the average cost of all units purchased during the period. 18 Perpetual Vs. Periodic Inventory System - Example • The periodic inventory system is a method of inventory valuation for financial reporting purposes in which a physical count of the inventory is performed at specific intervals, usually the end of the reporting year • A perpetual inventory system keeps continual track of your inventory balances. Updates are automatically made when you receive or sell inventory. Purchases and returns are immediately recorded in your inventory accounts. 19 Perpetual Vs. Periodic Inventory System - Example 20 Solution Refer to Excel sheet for solution 21 LIFO Reserve • To adjust these differences and study companies on same footing, firms that choose to use the LIFO approach to value inventories have to specify in a footnote (I.e., in notes to the accounts), the difference in inventory valuation between FIFO and LIFO, and this difference is termed as LIFO reserve. • This can be used to adjust the beginning and ending inventories, and consequently the cost of goods sold, and to restate income based upon FIFO valuation • Since 1972, SEC made it mandatory for publicly traded companies, to disclose the excess of current cost or replacement cost of inventory over the LIFO values stated on the balance sheet when these differences are material. • LIFO Reserves are also termed as “Excess of current cost over LIFO cost/Replacement cost of inventory” • Large LIFO reserves signal to the market an inflationary environment • The LIFO reserve serves as a direct indicator of the materiality of the balance sheet distortions which may result from LIFO use over a period of time 22 Adjusting LIFO to FIFO • Balance sheet adjustment – – – – • Add LIFO Reserve to Inventory (as reported under LIFO) Equity is increased by LIFO Reserve (after tax) (LIFO reserve *(1-tax rate) Adjust deferred tax liability by adding the income taxes on the LIFO reserve (LIFO Reserve * tax rate) Thus the accounting equation matches Income statement adjustment – COGS as per FIFO = Reported COGS as per LIFO Less change in LIFO Reserve – Tax adjustment = Reported Tax as per LIFO Add (Change in LIFO reserve * Effective tax rate) – Net Profit = Net Profit reported as per LIFO Add (Change in LIFO reserve * (1-effective tax rate) • • Income statement i.e. COGS is generally not adjusted to FIFO as the LIFO method results in costs of goods sold that are more indicative of replacement-cost values, and the best matching to revenues. While it might be desirable to adjust for those companies that use FIFO or average costs methods, the data generally are unavailable When a company using the LIFO method has inventory balances that decrease over a period of time, LIFO liquidation may result and hence following adjustment – Adjustment to COGS; COGSL less change in LIFO reserve from previous year end – COGS = COGSL – (LIFO Reserve ending balance- LIFO Reserve beginning balance ) – Add the income taxes on the change in the LIFO reserve to income tax expense (Change in LIFO reserve*tax rate) 23 LIFO Liquidation • LIFO liquidation occurs when inventory levels are reduced below their beginning balance i.e., when more goods are sold than are purchased/manufactured in a given year. – Lifo liquidation is also called as “inventory gains due to combined effects of LIFO inventory accumulations and drawdowns”, (Refer to exxon mobil AR 2020 page 75) – This could occur when companies face strikes, recession or declining demand for a particular product line, or purposely resorts to for momentary gain • Matches previous periods’ costs against current period’s revenues i.e. older, less-recent layers of inventory are turned into cost of goods sold • As LIFO liquidation gains are non-operating and artificial in nature and report more income than is sustainable over time; they should be excluded from earnings for the purpose of analysis – Assuming an inflationary environment, cost of goods sold is reduced by LIFO liquidation, and as a result, income increases – LIFO Liquidation gain = (Current cost of replacing the inventory- LIFO layer cost) X Quantity Liquidated (i.e. no. of units utilized from earlier layers) – To capture the true sustainable profitability of a company, the gains generated from LIFO liquidation generally are excluded from current profitability measures and ratios 24 Case • Exxon Mobil Corporation (AR_2011) • Colgate Palmolive (AR_2011) 25 Example-Exxon Mobil Corporation • AR_2020, Pg 75 26 Adjustment of FIFO and Average COGS to LIFO • Generally the FIFO and weighted average methods are criticized as they do not book the recent cost of goods sold against revenue • However to adjust COGS as per this method no information is made available in the foot notes • One approximation that can be made is – Adjusting FIFO COGS to LIFO • COGS Lifo = COGS FIFO +(Cost of Beginning inventory under FIFO X r) • r = specific inflation rate appropriate for the product in which the firm deals – Adjusting Weighted average cost to LIFO • COGS LIFO = COGS weighted average + (cost of Beginning inventory under weighted average method X r/2) • Balance sheet adjustment is not required as FIFO gives better replacement cost valuation for inventory than LIFO 27 Issues that Analysts Should Consider in inventory disclosures • Change in the method of inventory valuation – Company may change to LIFO to reduce the tax burden – Company may change to FIFO to inflate the reported profits • • • • • • Inventories can provide signal about a firms future revenues and earnings An increase in raw materials and/or work-in-process inventory may be an indication of an expected increase in demand. Higher demand should result in higher revenues and earnings. (How would you determine if this is the right way to think?) Conversely, an increase in finished goods inventory, while raw materials and work-inprocess are decreasing, may be an indication of decreasing demand and potential inventory write-downs in the future Finished goods inventory growing faster than sales may indicate declining demand and excessive or potentially obsolete inventory. Although high inventory turnover is considered good and desirable, a very high turnover ratio might indicate that the company is not carrying sufficient inventory to meet customer demand. If the trend has changed over the years, it may also indicate that the company has outsourced its manufacture and has limited stock rm and wip inventory To further assess the explanation for high inventory turnover, we can look at inventory turnover relative to sales growth within the firm and industry. – High turnover with slower growth may be an indication of inadequate inventory quantities. – Alternatively, sales growth at or above the industry average supports the conclusion that high inventory turnover reflects greater efficiency. 28 Funding of current assets • Current assets are to be financed using – Current liabilities – Working capital facilities from banks – Excess of long-term sources (term-liabilities) • Banks generally fund only the working capital gap after taking into account the Net working capital from longterm source 29 Funding of current assets • Current liabilities are more than current assets and a part of short-term funds (current liabilities) have been diverted to finance fixed assets • Here the company is not being able to provide any Net working capital or fund from long-term sources towards financing of current assets • Current ratio < 1 • This should be examined as it signals diversion of funds as part of current liabilities are used to finance fixed assets 30 MPBF – Inventories play a major role • Studies on assessment of working capital needs were conducted by different committees nominated by RBI from time to time – Tandon Committee ( 3 methods for computation of PBF) – Nayak Committee recommended the Turnover method (generally for SSI units requiring Working capital up to 5 crores) – Kannan committee recommended the cash budget method for WC appraisal 31