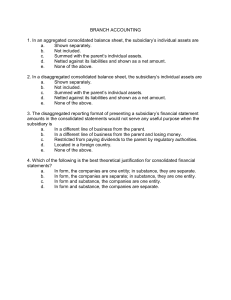

AFAR-09 ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY CPA Review Batch 44 October 2022 CPA Licensure Examination ADVANCED FINANCIAL ACCOUNTING & REPORTING (AFAR) A. DAYAG G. CAIGA M. NGINA A. CRUZ SEPARATE & CONSOLIDATED FINANCIAL STATEMENTS Objectives: PAS 27 objective of setting the standard to be applied: • in accounting for investments in subsidiaries, jointly controlled entities, and associates when an entity elects, or is required by local regulations, to present separate (non-consolidated) financial statements. PFRS 10 objective of setting the standard to be applied: • in the preparation and presentation of consolidated financial statements for a group of entities under the control of a parent; and The Concept of Control Consolidation is the process of combining the assets, liabilities, earnings and cash flows of a parent and its subsidiaries as if they were one economic entity. Since an economic and not legal perspective is adopted, transactions between companies within this economic entity and their resultant balances must be eliminated. A parent is an entity that controls one or more subsidiaries. A group is a parent and all its subsidiaries. Control as the Criterion for Consolidation A subsidiary is defined as an entity that is controlled by another entity, the parent. The criterion for identifying a parent-subsidiary relationship, and hence the basis for consolidation is control. The determination of whether one entity controls another is then crucial to the determination of which entities should prepare consolidated financial statements. PFRS 10 Guidance on Control An investor determines whether it is a parent by assessing whether it controls one or more investees. An investor considers all relevant facts and circumstances when assessing whether it controls an investee. An investor controls an investee when it is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee. PFRS 10 uses control as the single basis for consolidation. An investor controls an investee if and only if the investor has all of the following three elements of control: • Power over the investee. Power is the ability to direct those activities which significantly affect the investee’s returns. It arises from rights, which may be straightforward (e.g. through voting rights) or complex (e.g. through one or more contractual arrangements). • Exposure, or rights, to variable returns from involvement with the investee returns must have the potential to vary as a result of the investee’s performance and can be positive, negative or both. • The ability to use power over the investee to affect the amount of the investor’s returns. Separate Financial Statements of the Parent or Investor in an Associate or Jointly Controlled Entity In the parent's/investor's individual financial statements, investments in subsidiaries, associates, and jointly controlled entities should be accounted for either: • at cost; or • in accordance with PFRS 9 (fair value model) • Using equity method as described in PAS 28 Such investments may not be accounted for by the equity method in the parent's/investor's separate statements. The IASB issued amendments to IAS (PAS) 27 relating to the cost of investment in a subsidiary, jointly controlled entity or associate. These amendments: • • deleted the definition of the cost method from PAS 27 inserted paragraph 38A into PAS 27. Paragraph 38A states that: “An entity shall recognize a dividend from a subsidiary, jointly controlled entity, or associate in profit or loss in its separate financial statements when its right to receive the dividends is established”. The effect of these changes is that all dividends paid or payable by a subsidiary to a parent are to be recognized as revenue by the parent. As noted in paragraph BC66H of the Basis of Conclusions to the amendments, ‘the requirement to separate the retained earnings of an entity into pre-acquisition and posts-acquisition components as a method for assessing whether a dividend is a recovery of its associated investment’ has been removed from IFRSs’ (PFRSs’) Page 1 of 15 0915-2303213 www.resacpareview.com AFAR-09 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY SEPARATE & CONSOLIDATED FINANCIAL STATEMENTS PAS 27 does not define what is meant by ‘cost’ except in the specific set of circumstances of certain types of group reorganization and in first-time transition to PFRS. PAS 8 – Accounting Policies, Changes in Estimates and Errors – requires that in the absence of a specific guidance on IFRS (PFRS), management should first refer to the requirements and guidance in IFRS (PFRS) dealing with similar and related issues. Another point of reference might be PAS 32 – Financial Instruments: Presentation – and PFRS 9. Investments in subsidiaries, associates and joint ventures, while outside the scope of PAS 32 and PFRS 9, are clearly financial assets (and therefore financial instruments) as defined in those standards. Instead of the now deleted definition of cost method, entities are now obliged to apply a two-stage process. Once recognized, all dividends are taken to income and the parent must now determine whether or not the investment has been impaired as a result. This list of indicators of impairment in PAS 36 as amended includes the receipt of a dividend from a subsidiary, jointly controlled entity or associate where there is evidence that: 1. the dividend exceeds the total comprehensive income of the subsidiary, jointly controlled entity or associate in the period dividend is declared; or 2. the carrying amount of the investment in the separate financial statements exceeds the carrying amounts in the consolidated financial statements of the investee’s net assets, including associated goodwill. Presentation of Consolidated Financial Statements A parent is required to present consolidated financial statements in which it consolidates its investments in subsidiaries – except in one circumstance: A parent need not present consolidated financial statements if and only if all of the following four conditions are met: 1. The parent is itself a wholly-owned subsidiary, or is a partially? owned subsidiary of another entity and its other owners, including those not otherwise entitled to vote, have been informed about, and do not object to, the parent not presenting consolidated financial statements; 2. The parent's debt or equity instruments are not traded in a public market; 3. The parent did not file, nor is it in the process of filing, its financial statements with a securities commission or other regulatory organization for the purpose of issuing any class of instruments in a public market; and 4. The ultimate or any intermediate parent of the parent produces consolidated financial statements available for public use that comply with International Financial Reporting Standards. Once an investment ceases to fall within the definition of a subsidiary, it should be accounted for as an associate under PAS 28, as a joint venture under PFRS 11 or as an investment under PFRS 9, as appropriate. Furthermore, investments in subsidiaries, jointly controlled entities and associates that are accounted for in accordance with PFRS 9 in the consolidated financial statements are to be accounted for in the same way in the investor’s separate financial statements and in the financial statements of a parent that need not present consolidated financial statements. For the foregoing reason, the following disclosures have to be made in the investor’s separate financial statements and in the financial statements of a parent that need not present consolidated financial statements: 1. The reasons why separate financial statements are prepared; 2. The name of the immediate or ultimate parent and a reference to the consolidated financial statements and/or the financial statements in which associates and jointly controlled entities are accounted for under the equity method or proportionate consolidation method in accordance with PAS 28 and PFRS 11, respectively; and 3. A description of the method used to account for investments in subsidiaries, associates and jointly controlled entities. In addition to the foregoing elective option to not present consolidated financial statements, PAS 27 essentially continues the earlier standard’s prohibition based on absence of control over a subsidiary. Consolidated financial statements are to consolidate a parent and all of its subsidiaries, foreign and domestic, when those entities are controlled by the parent. For this determination, control is presumed to exist when the parent owns, directly or indirectly through subsidiaries, more than one-half of the voting power of an entity unless, in exceptional circumstances, it can be clearly demonstrated that such ownership does not constitute control. Page 2 of 15 0915-2303213 www.resacpareview.com AFAR-09 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY SEPARATE & CONSOLIDATED FINANCIAL STATEMENTS Consolidation Procedures Worksheet entries at the acquisition date The consolidation process does not result in any entries being made in the actual records of either the parent or the subsidiary. The adjustment entries are made in the consolidation worksheet prepared, and these entries change over time. In the rest of this section, the adjustment entries that would be passed in a consolidation worksheet prepared immediately after the acquisition date are analyzed. Pre-acquisition entries As noted in paragraph 15 of PAS 27, the pre-acquisition are required to eliminate the carrying amount of the parent’s investment in the subsidiary and the parent’s portion of pre-acquisition equity. The preacquisition entries then involve three areas: • The investment account, shares in subsidiary, as shown in the financial statements of the parent. • The equity of the subsidiary at the acquisition date (the pre-acquisition equity). The pre-acquisition equity is not just the equity recorded by the subsidiary but includes the business combination valuation reserve recognized on consolidation via the valuation entries. Because the accounts containing pre-acquisition equity may change over time as a result of dividends and reserve transfer, more than one pre-acquisition entry may be required in a particular year. • Recognition of goodwill. Note that, as stated in paragraph 21 of PAS 12 Income Taxes, there is no recognition of a deferred tax liability in relation to goodwill because goodwill is a residual, and the recognition of a deferred tax liability would increase its carrying amount. \ Calculating the NCI share of equity Non-controlling interest in the net assets (NCI) consists of: i. the amount of those non-controlling interests at the date of the original combination calculated in accordance with PFRS 3 Revised; and ii. the non-controlling’s share of changes in equity since the date of the combination. In relation to part (ii), changes in equity since the acquisition date must be taken into account. Note that these changes are not only in the recorded equity of the subsidiary, but they also relate to other changes in consolidated equity. As noted earlier in this chapter, the NCI is entitled to share consolidated equity under the entity concept of consolidation. This requires taking into account adjustments for profits and losses are not recognized by the group. The calculation of the NCI is therefore done in two stages: 1. the NCI share of recorded equity is determined, and 2. this share is adjusted for the effects of intragroup transactions. Non-controlling share of recorded equity of the subsidiary The equity of the subsidiary consists of the equity contained in the actual records of the subsidiary as well as any business combination valuation reserves created on consolidation at the acquisition date, where the identifiable assets and liabilities of the subsidiary are recorded at amounts different from their fair values. The NCI is entitled to a share of subsidiary equity at balance date, which consists of the equity on hand at acquisition date plus any changes in that equity between acquisition date and reporting date. The calculation of the NCI share of equity at a point in time is done in three steps: 1. Determine the NCI share of equity of the subsidiary at acquisition date. 2. Determine the NCI share of the change in subsidiary equity between the acquisition date and the beginning of the current period for which the consolidated financial statements are being prepared. 3. Determine the NCI share of the changes in subsidiary equity in the current period. The calculation could be represented diagrammatically, as shown below: Calculating the NCI share of equity Step 1 Share of equity recorded at acquisition date Time Acquisition date Page 3 of 15 Step 2 Share of change in equity from acquisition date to beginning of current period Beginning of current period Step 3 Share of change in equity in current period End of current period 0915-2303213 www.resacpareview.com AFAR-09 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY SEPARATE & CONSOLIDATED FINANCIAL STATEMENTS Note that, in calculating the NCI share of equity at the end of the current period, the information relating to the NCI share from steps 1 and 2 should be available from the precious period’s consolidation worksheet. Intragroup balances, transactions, income, and expenses should be eliminated in full. Intragroup losses may indicate that an impairment loss on the related asset should be recognized. When an acquirer obtains a majority interest, but not 100% ownership, in another entity, the process of recording the transaction is potentially more complicated. The portion of the acquired operation not owned by the acquirer, but claimed (in an economic sense) by outside interests, is referred to as noncontrolling interest. Not all standard setters agree whether, in a situation in which goodwill or negative goodwill will be reported, to value it with reference only to the price paid by the new (majority) owner, or whether to gross up the balance sheet for the minority’s share as well. PAS 22 (old standard) had allowed both approaches, but PFRS 3 specifies that assets and liabilities are valued entirely at fair value, and the non-controlling interest is correspondingly adjusted to reflect the relevant proportion of the net assets. Under PFRS 3 all identifiable (i.e., excluding goodwill) assets and liabilities are recognized at their respective fair values, including those corresponding to the non-controlling’s ownership interest. This means that there is a step-up in value to equal the valuation being placed on the enterprise indirectly by the new majority owner. Under this approach, the non-controlling interest shown in a consolidated balance sheet will be the noncontrolling percentage times the net assets of the subsidiary as reported in the parent’s consolidated balance sheet. Goodwill will be reported, as under partial goodwill or full-goodwill method depending on the option use by the acquiring company. Non-controlling interests should be presented in the consolidated balance sheet within equity, but separate from the parent's shareholders' equity. Non-controlling interests in the profit or loss of the group should also be separately presented. PAS 27 states that income attributable to non-controlling interest be separately presented in the statement of earnings or operations. Generally, this is accomplished by presenting net income before non-controlling interest, followed by the allocation to the non-controlling, and then followed by net income. Date of Acquisition I – No Fair Value of NCI given Company Z acquires 80% of Company Y for P10,000,000, carrying value of Company Y net assets at time of acquisition being P6,000,000 and fair value of these net identifiable assets being P8,000,000. Determine the following: 1. Goodwill arising on consolidation is to be valued on the proportionate basis or “Partial” Goodwill: a. P1,600,000 c. P3,600,000 b. P2,000,000 d. P4,500,000 2. Non-controlling interest arising on consolidation is to be valued on the proportionate basis or “Partial” Goodwill: a. P1,200,000 c. P2,500,000 b. P1,600,000 d. P3,000,000 3. Goodwill arising on consolidation is to be valued on the full (fair value) basis or “Full/Gross-up” Goodwill: a. P1,600,000 c. P3,600,000 b. P2,000,000 d. P4,500,000 4. Non-controlling interest arising on consolidation is to be valued on the full (fair value) basis or “Full/Grossup” Goodwill: a. P1,200,000 c. P2,500,000 b. P1,600,000 d. P3,000,000 Control Premium /Control Discount A control premium is an amount that a buyer is usually willing to pay over the current market price of a publicly traded company. This premium is usually justified by the expected synergies, such as the expected increase in cash flow resulting from cost savings and revenue enhancements achievable in the merger or consolidation. If the consideration transferred is proportionally more than the fair value of non-controlling interests, there is a control premium. In the opposite situation, a control discount (which often arises in a fire sale) or discount for lack of control (sometimes called a non-controlling interest discount) arises. II – With Fair Value of NCI given and Control Premium Entity Subsidiary has 40% of its share publicly traded on an exchange. Entity Parent purchases the 60% nonpublicly traded shares in one transaction, paying P6,300,000. Based on the trading price of the shares of Entity Subsidiary at the date of gaining control a value of P4,000,000 assigned to the 40% non-controlling interest (or fair value of non-controlling interest), indicating that Entity Subsidiary has paid a control premium of P300,000. The fair value of Entity Subsidiary’s identifiable net assets is P7,000,000 and a carrying value of P5,000,000. Page 4 of 15 0915-2303213 www.resacpareview.com ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY SEPARATE & CONSOLIDATED FINANCIAL STATEMENTS AFAR-09 Determine the following: 1. Goodwill arising on consolidation is to be valued on the proportionate basis or “Partial” Goodwill: a. P1,200,000 c. P3,300,000 b. P2,100,000 d. P4,120,000 2. Non-controlling interest arising on consolidation is to be valued on the proportionate basis or “Partial” Goodwill: a. P2,000,000 c. P4,000,000 b. P2,800,000 d. P4,120,000 3. Goodwill arising on consolidation is to be valued on the full (fair value) basis or “Full/Gross-up” Goodwill: a. P1,200,000 c. P3,300,000 b. P2,100,000 d. P4,120,000 4. Non-controlling interest arising on consolidation is to be valued on the full (fair value) basis or “Full/Grossup” Goodwill: a. P2,000,000 c. P4,000,000 b. P2,800,000 d. P4,120,000 5. Fair Value Basis (Full-goodwill Approach). Assuming the price paid amounted to P6,294,000 which includes control premium of P294,000 with no fair value of non-controlling interest given. Goodwill arising on consolidation is to be valued on the full (fair value) basis or “Full/Gross-up” Goodwill: a. P2,100,000 c. P3,294,000 b. P3,300,000 d. P4,120,000 III - Step Acquisition: With FV of NCI & FV previously held equity interest in the acquiree/subsidiary. Pares Company acquires 15 percent of Serap Company’s common stock for P500,000 cash and carries the investment as a financial asset. A few months later, Pares purchases another 60 percent of Serap Company’s stock for P2,160,000. At that date, Serap Company reports identifiable assets with a book value of P3,900,000 and a fair value of P5,100,000, and it has liabilities with a book value and fair value of P1,900,000. The fair value of the 25% non-controlling interest in Serap Company is P900,000. 1. Goodwill arising on consolidation is to be valued on the proportionate basis or “Partial” Goodwill a. P 84,000 c. P300,000 b. P100,000 d. P400,000 2. Non-controlling interest arising on consolidation is to be valued on the proportionate basis or “Partial” Goodwill: a. P300,000 c. P800,000 b. P500,000 d. P900,000 3. Goodwill arising on consolidation is to be valued on the full (fair value) basis or “Full/Gross-up” Goodwill: a. P 84,000 c. P300,000 b. P100,000 d. P400,000 4. Non-controlling interest arising on consolidation is to be valued on the full (fair value) basis or “Full/Grossup” Goodwill: a. P300,000 c. P800,000 b. P500,000 d. P900,000 5. The remeasurement gain or loss to be recognized to profit and loss account if the 15% ownership is a FVTPL (fair value through profit and loss)when the additional shares are acquired: a. Zero c. P40,000 loss b. P40,000 gain d. P68,000 loss 6. The remeasurement gain or loss to be recognized to profit or loss account if the 15% ownership is a FVTOCI (fair value through other comprehensive income)when the additional shares are acquired: a. Zero c. P40,000 loss b. P40,000 gain d. P68,000 loss Page 5 of 15 0915-2303213 www.resacpareview.com AFAR-09 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY SEPARATE & CONSOLIDATED FINANCIAL STATEMENTS IV - Bargain Purchase ComputationAttributable entirely to the Acquirer (or Parent) Parlor Company acquires 75 percent of Saloon Company’s common stock for P225,000 cash. At that date, the non-controlling interest in Saloon has a book value of P52,500 and a fair value of P82,000. Also on that date, Saloon reports identifiable assets with a book value of P400,000 and a fair value of P510,000, and it has liabilities with a book value and fair value of P190,000. 1. Gain on bargain purchase arising on consolidation if fair value of net identifiable assets is to be valued on the proportionate basis: a. Zero c. P15,000 b. P13,000 d. P17,333 2. Gain on bargain purchase arising on consolidation if fair value of net identifiable assets is to be valued on the full (fair value) basis. a. Zero c. P15,000 b. P13,000 d. P17,333 Sale of Subsidiary - Loss of Control of a Subsidiary or “Deconsolidation” Control of a subsidiary may be lost as the result of a parent’s decision to sell its controlling interest in the subsidiary to another party or as result of a subsidiary issuing its shares to others. Control may be lost, with or without a change in absolute or relative ownership levels, as a result of a contractual arrangement or if the subsidiary becomes subject to the control of government, court, administrator, or regulator (e.g. through legal reorganization or bankruptcy). Consistent with the approach taken for step acquisitions (refer to Problem III), when control of a subsidiary is lost, and an interest is retained, that interest is measured at fair value, and this is factored into the calculation of the gain or loss on disposal. It should be noted that this change applies also to situations in which an entity loses joint control of, or significant influence over, another entity. V - Deconsolidation Pedro Company owns 80,000 shares of Santa Corporation’s 100,000 outstanding common shares, acquired at book value. The December 31, 2018, consolidated balance sheet presented by Pedro and Santa included net assets of Santa in the amount of P600,000. On January 1, 2021, Pedro sells 70,000 shares of Santa for P490,000. The fair value of Pedro’s remaining 10% interest in Santa is P70,000. What amount of gain or loss, if any, should be recognized on the sale of Pedro’s shares resulting in deconsolidation, and how much of that should be attributed to Pedro? Determine the gain or loss on disposal (or deconsolidation) should be: a. P40,000 loss c. P10,000 gain b. P80,000 loss d. P80,000 gain VI - Sale of Subsidiary: Not Resulting in Loss of Control, No Additional Shares Issued. Padyak Company owns 80,000 shares of Sirkulo Corporation’s 100,000 outstanding common shares, acquired at book value. The December 31, 2020, consolidated balance sheet presented by Padyak and Sirkulo included net assets of Sirkulo in the amount of P600,000. On January 1, 2021, Padyak sells 10,000 shares (10%) of its Sirkulo stock to unrelated parties for P70,000. Determine the gain or loss on disposal of shares to be recognized in the profit or loss statement: a. Zero c. P10,000 loss b. P10,000 gain d. P5,000 loss VII - Sale of Subsidiary: Not Resulting in Loss of Control, Additional Shares Issued. Padyak Company owns 80,000 shares of Sirkulo Corporation’s 100,000 outstanding common shares, acquired at book value. The December 31, 2020, consolidated balance sheet presented by Padyak and Sirkulo included net assets of Sirkulo in the amount of P600,000. On January 1, 2021, Sirkulo issues 25,000 additional shares of common stock to unrelated parties for P175,000. The amount to be credited to “additional paid-in capital/share premium” account: a. Zero c. P 55,000 b. P16,000 d. P104,000 ***Patience is bitter but its fruit is sweet.*** ***Great passions, can elevate us to the things that we want to deliver.*** ***Wisdom is the quality that keeps you from getting into situations where you need it.*** ***Every man is the architect of his own character.*** Don’t just make a living, design a life. ***The most difficult secret of a man to keep is the opinion he has of himself*** ***Nothing great was ever achieved without determination.*** Page 6 of 15 0915-2303213 www.resacpareview.com AFAR-09 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY SEPARATE & CONSOLIDATED FINANCIAL STATEMENTS VIII - Wholly-owned The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 20x9, prior to Goodwin's business combination transaction regarding Corr, follow (in thousands): Goodwin P 2,700 1,980 P 720 Corr P 600 400 P 200 Retained earnings, 1/1 Net income Dividends Retained earnings, 12/31 P 2,400 720 ( 270) P 2,850 P 400 200 ( 0) P 600 Cash Receivables and inventory Buildings (net) Equipment (net) Total assets P 240 1,200 2,700 2,100 P 6,240 P 220 340 600 1,200 P 2,360 Liabilities Common stock Additional paid-in capital Retained earnings Total liabilities and stockholders’ equity P 1,500 1,080 810 2,850 P 6,240 P 820 400 540 600 P 2,360 Revenues Expenses Net Income On December 31, 20x9, Goodwin issued P600 in debt and 30 shares of its P10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company. Goodwin shares had a fair value of P40 per share. Goodwin paid P25 to a broker for arranging the transaction. Goodwin paid P35 in stock issuance costs. Corr's equipment was actually worth P1,400 but its buildings were only valued at P560. 1. If the combination is accounted for as an acquisition, at what amount is the investment recorded on Goodwin's books? A. P1,540 C. P1,825 B. P1,800 D. P1,860 2. Compute the consolidated revenues for 20x9: A. P3,300 C. P1,540 B. P2,700 D. P 720 3. Assuming the combination is accounted for as an acquisition; compute the consolidated expenses for 20x9: A. P1,980 C. P2,015 B. P2,005 D. P2,040 4. Compute the consolidated cash account at December 31, 20x9: A. P 460 C. P425 B. P435 D. P400 5. Compute the consolidated buildings (net) account at December 31,20x9 A. P2,700 C. P3,260 B. P3,370 D. P3,300 6. Compute the consolidated equipment (net) account at December 31, 20x9: A. P2,100 C. P3,300 B. P3,200 D. P3,500 7. Assuming the combination is accounted for as an acquisition, compute the consolidated goodwill account at December 31, 20x9. A. P 0 C. P125 B. P100 D. P160 8. Compute the consolidated common stock account at December 31, 20x9: A. P1,080 C. P1,480 B. P1,380 D. P2,280 9. Compute the consolidated additional paid-in capital at December 31, 20x9. A. P 810 C.P1,675 B. P1,350 D.P1,910 10. Assuming the combination is accounted for as an acquisition; compute the consolidated retained earnings at December 31, 20x9: A. P2,800 C. P2,850 B. P2,825 D. P3,425 Page 7 of 15 0915-2303213 www.resacpareview.com AFAR-09 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY SEPARATE & CONSOLIDATED FINANCIAL STATEMENTS IX – Partially-owned Power Corporation acquired 70 percent of Silk Corporation’s common stock on December 31, 20x9. After the date of the business combination, the book values of Silk’s net assets and liabilities approximated their fair value except for inventory, which had a fair value of P85,000, and land, which had a fair value of P45,000. The fair value of the non-controlling interest was P64,500 on December 31, 20x9. Balance sheet data for the two companies immediately following acquisition follow: Item Cash Accounts receivable Inventory Land Buildings and equipment Less: Accumulated depreciation Investment in Silk Corporation stock Total Assets Accounts payable Taxes payable Bonds payable Common stock Retained earnings Total Liabilities and Stockholders’ Equity Power P 44,000 110,000 130,000 80,000 500,000 (223,000) 150,500 P 791,500 P 61,500 95,000 280,000 150,000 __205,000 P 791,500 Silk P 30,000 45,000 70,000 25,000 400,000 (165,000) _______ P 405,000 P 28,000 37,000 200,000 50,000 ____90,000 P 405,000 For each of the question below, indicate the appropriate total that should appear in the consolidated balance sheet immediately after the business combination on the basis of full-goodwill approach: 1. What amount of inventory will be reported? A. P179,000 C. P210,500 B. P200,000 D. P215,000 2. What amount of goodwill will be reported? A. P 0 C. P40,000 B. P28,000 D. P52,000 3. What amount of total assets will be reported? A. P1,081,000 C. P1,196,500 B. P1,121,000 D. P1,231,500 4. What amount of Investment in Silk will be reported? A. P 0 C. P150,500 B. P140,000 D. P215,000 5. What total of liabilities will be reported? A. P265,000 C. P622,000 B. P436,500 D. P701,500 6. What amount will be reported as non-controlling interest? A. P42,000 C. P60,900 B. P52,500 D. P64,500 7. What amount of parent’s share or controlling interest in retained earnings be reported? A. P295,000 C. P232,000 B. P268,000 D. P205,000 8. What amount of consolidated retained earnings will be reported? A. P295,000 C. P232,000 B. P268,000 D. P205,000 9. What amount of stockholders’ equity will be reported? A. P355,000 C. P419,500 B. P397,000 D. P495,000 X – Push-down Accounting (Business Combination: Statutory Merger and Consolidation Approach) versus No push-down accounting (Stock Acquisition Approach) Prince Company acquires Duchess, Inc. on January 1, 2021. The consideration transferred exceeds the fair value of Duchess' net assets. On that date, Prince has a building with a book value of P1,200,000 and a fair value of P1,500,000. Duchess has a building with a book value of P400,000 and fair value of P500,000. 1. If push-down accounting is used, what amounts in the Building account appear on Duchess' separate balance sheet and on the consolidated balance sheet immediately after acquisition? a. P400,000 and P1,600,000 c. P400,000 and P1,700,000 b. P500,000 and P1,700,000 d. P500,000 and P2,000,000 Page 8 of 15 0915-2303213 www.resacpareview.com ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY SEPARATE & CONSOLIDATED FINANCIAL STATEMENTS AFAR-09 2. If push-down accounting is not used, what amounts in the Building account appear on Duchess' separate balance sheet and on the consolidated balance sheet immediately after acquisition? a. P400,000 and P1,600,000 c. P400,000 and P1,700,000 b. P500,000 and P1,700,000 d. P500,000 and P2,000,000 XI Par Company owns 60% of Sub Corp.’s outstanding capital stock. On May 1, 2019, Par advanced Sub P70,000 in cash, which was still outstanding at December 31, 2019. What portion of this advance should be eliminated in the preparation of the December 31, 2019 consolidated balance sheet? a. P70,000 b. P42,000 c. P28,000 d. Zero XII Dean, Inc. owns 100% of Roy Corporation, a consolidated subsidiary, and 80% of Wall, Inc., an unconsolidated subsidiary at December 31. On the same date, Dean has receivables of P200,000 from Roy and P175,000 from Wall. In its December 31 consolidated balance sheet, Dean should report accounts receivable from investees at: a. P 0 b. P35,000 c. P175,000 d. P235,000 XIII Cobb Company’s current receivables from affiliated companies at December 31, 2019 are: (1) a P75,000 cash advance to Hill Corporation (Cobb owns 30% of the voting stock of Hill and accounts for the investment by the equity method), (2) a receivable of P260,000 from Vick Corporation for administrative and selling services (Vick is 100% owned by Cobb and included in Cobb’s consolidated financial statements), and (3) a receivable of P200,000 from Ward Corporation for merchandise sales on credit (Ward is 90%-owned unconsolidated subsidiary of Cobb accounted for the equity method). In the current assets section of its December 31, 2019 consolidated balance sheet, Cobb should report accounts receivable from investees in the amount of: a. P180,000 c. P275,000 b. P255,000 d. P535,000 Reverse Acquisition (Takeovers) A reverse acquisition occurs when an enterprise obtains ownership of the shares of another enterprise but, as part of the transaction, issues enough voting shares as consideration that control of the combined enterprise passes to the shareholders of the acquired enterprise. Although, legally, the enterprise that issues the shares is regarded as the parent or continuing enterprise, the enterprise whose former shareholders now control the combined enterprise is treated as the acquirer for reporting purposes. As a result, the issuing enterprise (the legal parent) is deemed to be the acquiree and the company being acquired in appearance (the legal subsidiary) is deemed to have acquired control of the assets and business of the issuing enterprise (the legal parent is effectively the acquiree while the legal subsidiary is effectively the acquirer, although the legal parent is the entity that issues shares to acquire a legal subsidiary, a reverse acquisition is often initiated by the legal subsidiary) While not a common event, this form of business combination is often used by active non-public companies as a means to obtain a stock exchange listing without having to go through the listing procedures established by the exchange. A takeover of a public company that has a stock exchange listing is arranged in such a way that the public company emerges as the legal parent, but the former shareholders of the non-public company have control of the public company. Are there Non-controlling Interests in a Reverse Acquisition? Non-controlling interest is zero, if all of legal subsidiary’s (the acquirer) stockholders accept the offer to exchange their shares in the legal parent (the acquiree). If not all of legal subsidiary’s (the acquirer) stockholders agree to the exchange of shares, the legal subsidiary’s (the acquirer will have non-controlling profits but not consolidated net income. Structure Entities or Variable Interest Entities (VIEs) A second type of controlled enterprise is a structured entity, also known as variable interest entity or a special purpose entity. PFRS 10 provides guidance on when a structured entity (SE) should be consolidated. An SE is set up the reporting enterprise (or “sponsor”) to perform a very specific and narrow function. The difference between a subsidiary and an SE is that an SE is not controlled through voting power. Indeed, an SE may not even be a corporation but could instead be a partnership. An SE also can be created simply by delegating specific powers to certain individuals to act on behalf of the “sponsoring” corporation – in effect, by creating sort of “agency” relationship with individuals instead of corporate entities. Page 9 of 15 0915-2303213 www.resacpareview.com AFAR-09 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY SEPARATE & CONSOLIDATED FINANCIAL STATEMENTS XIV Mask, a private limited company, has arranged for Man, a public limited company, to acquire it as a means of obtaining a stock exchange listing. Man issues 15 million shares to acquire the whole of the share capital of Mask (6 million shares). The fair value of the net assets of Mask and Man are P30 million and P18 million respectively. The fair value of each of the shares of Mask is P6 and the quoted market price of Man’s shares is P2. The share capital of Man is 25 million shares after the acquisition. Calculate the value of goodwill in the above acquisition. a. P16 million b. P12 million c. P10 million d. P6 million Subsequent to Date of Acquisition XV –Cost Model/Method versus Equity Method Pedro purchased 100% of the common stock of the Sanburn Company on January 1, 20x4, for P500,000. On that date, the stockholders' equity of Sanburn Company was P380,000. On the purchase date, inventory of Sanburn Company, which was sold during 20x4, was understated by P20,000. Any remaining excess of cost over book value is attributable to building with a 20-year life. The reported income and dividends paid by Sanburn Company were as follows: Net income . . . . . . . . . . . . . . Dividends paid . . . . . . . . . . . . 20x4 P80,000 10,000 20x5 P90,000 10,000 1. Using the cost method, which of the following amounts are correct? Investment Income Investment Account Balance 20x4 December 31, 20x4 a. P10,000 P500,000 b. P70,000 P570,000 c. P70,000 P550,000 d. P10,000 P550,000 2. Using the cost method, which of the following amounts are correct? Investment Income Investment Account Balance 20x5 December 31, 20x5 a. P10,000 P500,000 b. P70,000 P570,000 c. P70,000 P550,000 d. P10,000 P550,000 3. Using sophisticated (full) equity method, which of the following amounts are correct? Investment Income Investment Account Balance 20x4 December 31, 20x4 a. P55,000 P555,000 b. P55,000 P545,000 c. P90,000 P565,000 d. P80,000 P570,000 4. Using sophisticated (full) equity method, which of the following amounts are correct? Investment Income Investment Account Balance 20x5 December 31, 20x5 a. P55,000 P 54,000 b. P55,000 P555,000 c. P85,000 P620,000 d. P90,000 P570,000 XVI – CNI under Entity Concept (PFRS 10) For 20x6, Pyna reported P500,000 of net income from its own separate operations. This amount excludes income relating to Syna, its 80%-owned created subsidiary, which reported P100,000 of net income and declared P55,000 of dividends in 20x6. What is the consolidated net income under the economic unit/entity concept? a. P536,000 c. P580,000 e. P644,000 b. P544,000 d. P600,000 Page 10 of 15 0915-2303213 www.resacpareview.com AFAR-09 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY SEPARATE & CONSOLIDATED FINANCIAL STATEMENTS XVII – CNI under Parent Company Concept For 20x6, Pyna reported P500,000 of net income from its own separate operations. This amount excludes income relating to Syna, its 80%-owned created subsidiary, which reported P100,000 of net income and declared P55,000 of dividends in 20x6. What is the consolidated net income under the parent company concept? a. P536,000 c. P580,000 e. P644,000 b. P544,000 d. P600,000 XVIII Parrett Corp. bought one hundred percent of Jones Inc. on January 1, 20x4, at a price in excess of the subsidiary's fair value. On that date, Parrett's equipment (ten-year life) had a book value of P360,000 but a fair value of P480,000. Jones had equipment (ten-year life) with a book value of P240,000 and a fair value of P350,000. Parrett used the cost model to record its investment in Jones. On December 31, 20x6, Parrett had equipment with a book value of P250,000 and a fair value of P400,000. Jones had equipment with a book value of P170,000 and a fair value of P320,000. What is the consolidated balance for the equipment account as of December 31, 20x6? a. P710,000 c. P475,000 b. P580,000 d. P497,000 XIX On January 1, 20x4, BB, Inc., reports net assets of P760,000 although equipment (with a 4- year life) having a book value of P440,000 is worth P500,000 and an unrecorded patent is valued at P45,000. HH Corporation pays P692,000 on that date for art 80 percent ownership in BB. If the patent is to be written off over a 10year period, at what amount should it be reported on consolidated statements at December 31, 20x5? a. P28,800 c. P36,000 b. P32,400 d. P40,500 XX January 1, 20x9, Payne Corp. purchased 70% of Shayne Corp.'s P10 par common stock for P900,000. On this date, the carrying amount of Shayne's net assets was P1,000,000. The fair values of Shayne's identifiable assets and liabilities were the same as their carrying amounts except for plant assets (net), which were P200,000 in excess of the carrying amount. For the year ended December 31, 20x9, Shayne had net income of P150,000 and paid cash dividends totalling P90,000. Excess attributable to plant assets is amortized over 10 years. In the December 31, 20x9, consolidated balance sheet, non-controlling interest should be reported at: a. P282,714 c. P397,714 b. P300,500 d. P345,500 XXI Photoplasm Corporation acquired 70 percent of Spectrum Company on January 1, 20x9 for P420,000. At that date Spectrum had inventory and plant assets with market values greater than book values in the amount of P50,000 and P90,000 respectively. The inventory and plant assets were assigned a remaining life of six months and five years respectively. Assuming that Spectrum has 20x9 income and dividends of P160,000 and P60,000, respectively and 20y0 income and dividends of P210,000 and P80,000, respectively, what is the balance in the non-controlling interest account at December 31, 20y0? A. P169,200 C. P136,800 B. P276,000 D. P223,200 XXII On April 1, 20x9, PP, Inc., exchanges P430,000 fair-value consideration for 70 percent of the outstanding stock of RR Corporation. The remaining 30 percent of the outstanding shares Continued to trade at a collective fair value of P165,000. RR’s identifiable assets and liabilities each had book values that equalled their fair values on April 1, 20x9 for a net total of P500,000. RR generates revenues of P600,000 and expenses of P360,000 and paid no dividends. On a December 31, 20x9, consolidated balance sheet, what amount should be reported as non-controlling interest? A. P219,000 C. P234,000 B. P237,000 D. P250,500 XXIII On January 1, 20x9, PP Company acquired an 80 percent investment in SS Company. The acquisition cost was equal to PP’s equity in SS’s net assets at that date. On January 1, 20x9, PP and SS had retained earnings of P500,000 and P100,000, respectively. During 20x9, PP had net income of P200,000, which included its equity in SS’s earnings, and declared dividends of P50,000; SS had net income of P40,000 and declared dividends of P20,000. There were no other intercompany transactions between the parent and subsidiary. On December 31, 20x9, what should the consolidated retained earnings be? A. P650,000 C. P766,000 B. P666,000 D. P770,000 *Faith may be defined briefly as an illogical belief in the occurrence of the impossible.* *The secret of life is not just to live, but to have something worthwhile to live for.* Page 11 of 15 0915-2303213 www.resacpareview.com AFAR-09 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY SEPARATE & CONSOLIDATED FINANCIAL STATEMENTS Solution to Problem I 1. Proportionate Basis (Partial-goodwill Approach) • Partial-goodwill Fair value of subsidiary (80%): Consideration transferred: Cash………………………..P10,000,000 (80%) Less: Book value of stockholders’ equity (net assets) – S Company: P6,000,000 x 80%................................ 4,800,000 (80%) Allocated excess.………………………………………………...P 5,200,000 (80%) Less: Over/undervaluation of assets and liabilities: (P8,000,000 – P6,000,000) x 80%.................................. 1,600,000 (80%) Positive excess: Goodwill (partial)……………………………. P 3,600,000 (80%) CI – 3,600,000 (80%) NCI – 0 (20%) 3. Fair Value Basis (Full-goodwill Approach) • Full-goodwill Fair value of subsidiary (100%): Consideration transferred: Cash (P10,000,000 / 80%)..P12,500,000 (100%) Less: Book value of stockholders’ equity (net assets) – S Company: P6,000,000 x 100%.............................. 6,000,000 (100%) Allocated excess.……………………………………………….. P 6,500,000 (100%) Less: Over/Undervaluation of assets and liabilities: (P8,000,000 – P6,000,000) x 100%................................ 2,000,000 (100%) Positive excess: Goodwill (full)………………………………...P 4,500,000 (100%) CI – 3,600,000 (80%) NCI – 900,000 (20%) Non-controlling interest Book Value of stockholders’ equity of subsidiary………….P 6,000,000 Adjustments to reflect fair value (over/ undervaluation of assets and liabilities): (P8,000,000 – P6,000,000)…. 2,000,000 Fair value of stockholders’ equity of subsidiary…………… P 8,000,000 Multiplied by: Non-controlling interest percentage............ 20% FV - Non-controlling interest (partial)………………………… P1,600,000 (2) Add: Non-controlling interest on full -goodwill (P4,500,000 – P3,600,000 partial-goodwill) or (P4,500,000 x 20%)*…………………………………... 900,000 FV - Non-controlling interest (full)……………………………... P2,500,000 (4) * applicable only when the fair value of the non-controlling interest of subsidiary is not given. Solution to Problem II 1. Proportionate Basis (Partial-goodwill Approach) • Partial-goodwill Fair value of subsidiary (60%): Consideration transferred: Cash………………………..P 6,300,000 (60%) Less: Book value of stockholders’ equity (net assets) – S Company: P5,000,000 x 60%................................ 3,000,000 (60%) Allocated Excess.………………………………………………….P 3,300,000 (60%) Less: Over/undervaluation of assets and liabilities: (P7,000,000 – P5,000,000) x 60%................................. 1,200,000 (60%) Positive excess: Goodwill (partial)……………………………. P 2,100,000 (60%) CI – 2,100,000 (60%) NCI – 0 (40%) 3. Fair Value Basis (Full-goodwill Approach) • Full-goodwill Fair value of subsidiary (100%): Consideration transferred: Cash ………………………..P 6,300,000 ( 60%) Fair value of NCI (given)………………………………… 4,000,000 ( 40%) Fair value of subsidiary………………………………………….P10,300,000 (100%) Less: Book value of stockholders’ equity (net assets) – S Company: P5,000,000 x 100%............................. 5,000,000 (100%) Allocated Excess.…………………………………………………P 5,300,000 (100%) Less: Over/undervaluation of assets and liabilities: (P7,000,000 – P5,000,000) x 100%............................... 2,000,000 (100%) Positive excess: Goodwill (full)………………………………...P 3,300,000 (100%) CI – 2,100,000 (60%) Page 12 of 15 NCI – 1,200,000(40%) 0915-2303213 www.resacpareview.com AFAR-09 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY SEPARATE & CONSOLIDATED FINANCIAL STATEMENTS Non-controlling interest Book value of stockholders’ equity of subsidiary………….P 5,000,000 Adjustments to reflect fair value (over/ undervaluation of assets and liabilities): (P7,000,000 – P5,000,000)…. 2,000,000 Fair value of stockholders’ equity of subsidiary……………P 7,000,000 Multiplied by: Non-controlling Interest percentage.......... 40% FV – Non-controlling interest (partial)………………………..P 2,800,000 (2) Add: Non-controlling interest on full -goodwill (P3,300,000 – P2,100,000 partial-goodwill)………….. 1,200,000 FV - Non-controlling Interest (full)……………………………...P 4,000,000 (4) 5. Fair Value Basis (Full-goodwill Approach) Fair value of subsidiary (100%): Consideration transferred (P6,294,000 – P294,000)/60% Add: Control premium. . . . . . . . . . . . . . . . . . . . . . . . . . . . Fair value of subsidiary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Less: Book value of stockholders’ equity (net assets) – Sun Company: P5,000,000 x 100% . . . . . . . . . . . . . . . . . . . . Allocated Excess . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Less: Over/undervaluation of assets and liabilities: (P7,000,000 – P5,000,000) x 100% . . . . . . . . . . . . . . . . . . Positive excess: Goodwill (full) . . . . . . . . . . . . . . . . . . . . . . . . . . . Solution to Problem III P 10,000,000 _ 294,000 P 10,294,000 ( 100%) 5,000,000 5,294,000 (100%) (100%) 2,000,000 P 3,294,000 (100%) (100%) P (100%) 1. Proportionate Basis (Partial-goodwill Approach) • Partial-goodwill Fair value of subsidiary (75%): Consideration transferred: Cash………………………..P 2,160,000 (60%) Fair value of previously held equity interest in acquiree P2,160,000/60% = P3,600,000 x 15%..... 540,000 (15%) Fair value of Subsidiary ..……………………………………… P 2,700,000 (75%) Less: Book value of stockholders’ equity (net assets) – Serap Company: (P3,900,000 – P1,900,000) x 75%. 1,500,000 (75%) Allocated Excess.………………………………………………...P 1,200,000 (75%) Less: Over/undervaluation of assets and liabilities: [(P5,100,000 – P1,900,000) – (P3,900,000 – P1,900,000)] x 75%............................. 900,000 (75%) Positive excess: Goodwill (partial)……………………………P 300,000 (75%) CI – 300,000 (75%) NCI – 0 (25%) 2. Fair Value Basis (Full-goodwill Approach) • Full-goodwill Fair value of subsidiary (100%): Consideration transferred: Cash………………………..P 2,160,000 (60%) Fair value of previously held equity interest in acquiree P2,160,000/60% = P3,600,000 x 15%..... 540,000 (15%) Fair value of NCI (given)………………………………… 900,000 (25%) Fair value of subsidiary………………………………………….P 3,600,000 (100%) Less: Book value of stockholders’ equity (net assets) – Serap Company: P2,000,000 x 100%..................... 2,000,000 (100%) Allocated Excess.………………………………………………..P 1,600,000 (100%) Less: Over/undervaluation of assets and liabilities: (P3,200,000 – P2,000,000) x 100%.............................. 1,200,000 (100%) Positive excess: Goodwill (full)………………………………...P 400,000 (100%) CI – 300,000 (75%) NCI – 100,000 (25%) Non-controlling interest Book value of stockholders’ equity of subsidiary…………..P 2,000,000 Adjustments to reflect fair value (over/ undervaluation of assets and liabilities): (P3,200,000 – P2,000,000)…. 1,200,000 Fair value of stockholders’ equity of subsidiary…………….P. 3,200,000 Multiplied by: Non-controlling Interest percentage............ 25% FV - Non-controlling interest (partial)………………………….P 800,000 (2) Add: Non-controlling interest on full -goodwill (P400,000 – P300,000 partial-goodwill)…..…………… 100,000 FV - Non-controlling Interest (full)………………………………P 900,000 (4) Page 13 of 15 0915-2303213 www.resacpareview.com AFAR-09 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY SEPARATE & CONSOLIDATED FINANCIAL STATEMENTS No. 5 – (b); No. 6 – (a): An equity interest previously held and qualified as a financial asset under PFRS 9 is being remeasured to itsacquisition-date fair value and any difference is recognize in profit or loss if *FVTPL or OCI if the financial assets is a *FVTOCI. The gain or loss is computed as follows: Fair value on previously held equity interest in acquiree P2,160,000 / 60% = P3,600,000 x 15%............................. Less: Carrying / book value at the point control is achieved (cost model)………………………………… *Gain on remeasurement to fair value (deemed sale) Solution to Problem IV Proportionate Basis (Partial Goodwill Approach) • Partial-goodwill Fair value of subsidiary (75%): Consideration transferred: Cash . . . . . . . . . . . . . . . . . . . Less: Book value of stockholders’ equity (net assets) – Saloon Company: (P400,000 – P190,000) x 75% . . . . . . . . . . . . . . . . . . . . . Allocated excess . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Less: Over/undervaluation of assets and liabilities: [(P510,000 – P190,000) – (P400,000 – P190,000) x 75% Negative excess: Bargain purchase gain (to controlling interest or attributable to parent only) . . . . . . . . . . . . Fair Value Basis (Full-goodwill Approach) • Full-goodwill Fair value of subsidiary (100%): Consideration transferred: Cash . . . . . . . . . . . . . . . . . . . Fair value of non-controlling interest (given)* . . . . . . . . Fair value of subsidiary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Less: Book value of stockholders’ equity (net assets) – Saloon Company: (P400,000 – P190,000) x 100% . . . . . . . . . . . . . . . . . . . . Allocated excess . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Less: Over/undervaluation of assets and liabilities: [(P510,000 – P190,000) – (P400,000 – P190,000) x 100% Negative excess: Bargain purchase gain (to controlling interest or attributable to parent only) . . . . . . . . . . . . P 540,000 500,000 P 40,000 P 225,000 (75%) P 157,500 67,500 (75%) (75%) _ 82,500 (75%) (P 15,000) (75%) P 225,000 82,000 P 307,000 (75%) (25%) (100%) 210,000 P 97,000 (100%) (100%) 110,000 (100%) (P 13,000) (100%) *This amount should not be lower compared to fair value of NCI of Stockholders’ equity of subsidiary [i.e.,(P510,000 – P190,000 = P320,000) x 25% = P80,000). Otherwise, the higher amount should be used. Solution to Problem V – (D) Cash proceeds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Fair value of retained non-controlling interest equity investment. . .. . . . Carrying value of the non-controlling interest before deconsolidation (15% or prior outside non-controlling interest in Subsidiary) [P600,000 x 20% (20,000/100,000)]. . . . . . . . . . . . . . . . . . . ... . . Fair value of 100% of Parent. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Less: Carrying value of Subsidiary’s net assets . . . . . . . . . . . . . . . . . . . . . Gain on deemed sale of Parent (disposal or deconsolidation). . . . . . . . Solution to Problem VI – (A) Cash proceeds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Less: Carrying value of non-controlling interest (P600,000* x 10%) . . . . . . “Gain” – transfer within equity in “Additional paid-in capital” account P 490,000 70,000 70% 10% 120,000 P 680,000 600,000 P 80,000 20% 100% 100% 100% P 70,000 __ 60,000 P 10,000 *the P600,000 is already the gross-up amount since it is the amount presented in the consolidated balance sheet. ***Courage is not having the strength to go on; it is going on when you don't have the strength.*** It's not that I'm so smart; it's just that I stay with problems longer. - -Albert Einstein A failure is not always a mistake. It may simply be the best one can do under the circumstances. The real mistake is to stop trying. - -B.F. Skinner Within the hearts men, loyalty and consideration are esteemed greater than success. - -Bryant H. McGi Page 14 of 15 0915-2303213 www.resacpareview.com AFAR-09 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY SEPARATE & CONSOLIDATED FINANCIAL STATEMENTS Solution to Problem VII – (B) Cash proceeds from issuance of additional shares ….. P 175,000 Less: Carrying Value of non-controlling from issuance of additional shares: Non-controlling interest prior to issuance of additional shares: Book value of SHE before issuance………… P600,000 x: Non-controlling interest………………….. 20%* P120,000 Non-controlling interest after issuance of additional shares: Book value of SHE before issuance………. P600,000 Additional issuance…………………..……… 175,000 BV of SHE after issuance……………………. P775,000 x: Non-controlling interest…………….......... 36%** 279,000 159,000 “Gain” – transfer within equity in Additional paid-in capital” account P 16,000 *(100,000 – 80,000) / 100,000 = 20% ownership before additional issuance of shares. ** [(20,000 + 25,000) / (100.000 + 25,000)] = 36% ownership after additional issuance of shares Or, alternatively: Carrying value of 80% ownership before issuance of additional shares: Stockholders’ equity of Sare Co. . . . . . . . . . . . . . . . . . . . . . . . . .. X: Ownership interests. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Carrying value of 64% ownership after issuance of additional shares: Stockholders’ equity of Sare Co. (P600,000 + P175,000). . . . . . . X: Ownership interests. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Additional paid-in capital.. . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . P600,000 ____80% P775,000 ____64% P 480,000 _496,000 P 16,000 Once in a Long While Once in a long while, someone special walks into your life and really makes a difference. They take the time to show you so many little ways that you matter, They see and hear the worst in you and ugliest in you, but they don’t walk away in fact, they may care about you. Their heart break with yours, their tears fall with yours, their laughter is shared with yours. Once in a long while, somebody special walks into your life and then has to go and separate ways. Every time you see a certain gesture, hear a certain laugh or phrase or return to a certain place, it reminds you of them. Your eyes filled with tears, and a big smile comes across your face, and then you thank GOD that someone can still touch your heart so deeply. You remember their words, their looks, their expressions, you remember how much of themselves they gave – not just to you, but to all. **When all else is lost, the future still remains.** **The greatest mistake you can make is to continually fear making mistakes.** ***The secret of life is not just to live, but to have something worthwhile to live for.*** ***Truth is the heart of life in a community with others, and truth, is of course, dishonored by a lie. A lie is an assertion, in a context in which genuine communication is reasonably expected, of something which one considers to be false.*** "Every accomplishment starts with the decision to try." "It is the sizes of one’s will which determines success." "PERSIST, because with an idea, determination, and the right tools, You can do great things." "Keep your dreams alive. Understand to achieve anything requires faith and belief in yourself, vision, hard work, determination, and dedication. Remember all things are possible for those who believe." Gail Devers *No one knows what he can do until he tries* *Not knowing when the dawn will come, I open every door* *The great thing in the world is not so much where you are but in what direction you are going* *There are only two things in the world to worry over; the things you can control, and the things you can’t control. Fix the first forget the second.* It is more important than appearance, giftedness, or skill.* *Develop an attitude of gratitude, and give thanks for everything that happens to you, knowing that every step forward is a step toward achieving something bigger and better than your current situation.* *Be not afraid of life. Believe that life is worth living and your belief will help create the fact.* *The remarkable thing we have is a choice every day regarding the attitude we will embrace for that day. We cannot change our past... We cannot change the fact that people will act in a certain way. We cannot change the inevitable. The only thing we can do is play on the one string we have, and that is our attitude.* *The only way to find the limits of the possible is by going beyond them to the impossible.* *Nothing great will ever be achieved without great mean, and men are great only if they are determined to be so.* Page 15 of 15 0915-2303213 www.resacpareview.com