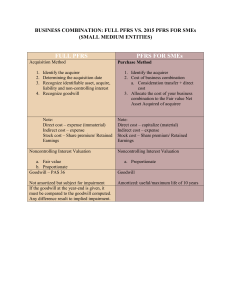

PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION AFAR04 BATCH 2020 BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION RELATED STANDARDS: PFRS 3 – BUSINESS COMBINATIONS – TOPIC OUTLINE Basic Concepts and Introduction BUSINESS COMBINATIONS (PFRS 3) Accounting for Business Combination Accounting for Cost of Business Combination PFRS for SMEs LECTURE NOTES BASIC CONCEPTS AND INTRODUCTION DEFINITION A business combination is a transaction or other event in which an acquirer obtains control of one or more businesses. Transactions sometimes referred to as "true mergers" or "mergers of equals" are also business combinations as that term is used in PFRS 3. Essential elements in the definition of a business combination are: (1) Control Control is the power to govern the financial and operating policies of an entity so as to obtain benefits from its activities. Control is normally presumed to exist when the acquirer holds more than 50% interest (QUANTITATIVE THRESHOLD) in the acquiree voting rights. However, this is only a presumption because control can be obtained in some other ways, such as when (QUALITATIVE THRESHOLD): (a) The acquirer has the power to appoint or remove the majority of board of directors of the acquiree. (b) The acquirer has the power to cast the majority of votes at board meetings or equivalent bodies within the acquiree. (c) The acquirer has power over more than half of the voting rights of the acquiree because of an agreement with other investors (d) The acquirer controls the acquiree’s operating and financial policies because of law or an agreement. An acquirer may obtain control of an acquiree in variety of ways, for example: (a) by transferring cash or other assets (b) by incurring liabilities (c) by issuing equity securities (d) by providing more than one type of consideration (e) without transferring consideration, including by contract alone (2) Business A business is defined as "an integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing a return in the form of dividends, lower costs or other economic benefits directly to investors or other owners, members or participants". CLASSIFICATION OF BUSINESS COMBINATION ACCORDING TO STRUCTURE (BUSINESS POINT OF VIEW) (a) Horizontal Integration – this type of business combination is one that involves companies within the same industry that have been previously competitors. Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 1 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION (b) (c) (d) BATCH 2020 Vertical Integration - this type of business combination take place between two companies involved in the same industry but at different levels. It normally involves a combination of a company and its supplier or customers. Conglomerate Combination – is one involving companies in unrelated industries having little, if any, production or market similarities for the purpose of entering into a new market or industry. Circular Combination – entails some diversification, but does not have a drastic change in operation as a comglomerate. ACCORDING TO METHOD (LEGAL POINT OF VIEW) (a) ASSET ACQUISTION – The acquirer purchases the assets and assumes liabilities of the acquiree in exchange of cash or other non-cash consideration. Under the Corporation Code of the Philippines, a business combination effected through asset acquisition may be either: Merger – occurs when two or more companies merge into a single entity which shall be one of the combining entities. For example: A Corp. + B Corp. = A Corp. or B. Corp. Consolidation – occurs when two or more companies consolidate into a single entity which shall be the consolidated entity. For example: A Corp. + B Corp. = C Corp. (b) STOCK ACQUISITION – instead of acquiring the assets and assuming the liability of the acquiree, the acquirer obtains control over the acquiree by acquiring majority ownership interest in the voting rights of the acquiree. In stock acquisition, the acquirer is known as the parent while the acquiree is known as subsidiary. After the acquisition, the entities retain their separate legal existence but for financial reporting purposes, both entities are viewed as a single reporting entity. ACCOUNTING FOR BUSINESS COMBINATIONS Business combinations are accounted for using the ACQUISITION METHOD. This method requires the following steps or procedures: (1) IDENTIFY THE ACQUIRER (a) In a business combination effected primarily by transferring cash or other assets, or by incurring liabilities, the acquirer is usually the entity that transfers the cash or other assets, or incurs the liabilities. (b) In a business combination effected primarily by exchanging equity interests, the acquirer is usually the entity that issues its equity interests. (c) The acquirer is usually the combining entity whose relative size measured in terms of assets, revenue or profit is significantly greater than that of the other combining entities. (d) In a business combination involving more than two entities, determining the acquirer shall include a consideration of which of the combining entities initiated the combination as well as the relative size of the entities. (e) If a new entity is formed to issue equity interests to effect a business combination, one of the combining entities that existed before the combination shall be identified as the acquirer. (f) The combining entity whose owners as a group receive the largest proportion of the voting rights in the combined entity is likely the acquirer. (g) Where there is a large minority interest in the combined entity and no other owner has a significant voting interest, the holder of the large minority interest is likely the acquirer. (h) Where one entity has the ability to select the management team or the majority of the members of the governing body of the combined entity, such entity is likely the acquirer. (2) DETERMINE THE ACQUISITION DATE The acquisition date is the date on which an ACQUIRER OBTAINS CONTROL over the acquiree. The acquisition date is normally the date on which the acquirer legally transfers the consideration, acquires the assets and assumes the liabilities of the acquiree. The acquisition date is also known as, the "CLOSING DATE”. However, it is possible for control to pass to the acquirer before or several dates are key to a business combination, it is the date determines the acquisition date. For example, the acquisition date written agreement provides that the acquirer obtains control of the closing date. (3) after the closing date. Where on which control passes that precedes the closing date if a acquiree on a date before the RECOGNIZING AND MEASURING GOODWILL On acquisition date, the acquirer computes and recognizes goodwill (or gain or bargain purchase) using the following formula: Consideration transferred xxx NCI in the acquiree xxx Previously held equity interest in the acquiree xxx Total xxx Less: Fair value of net identifiable assets acquired xxx Goodwill / (Gain on Bargain Purchase) xxx Goodwill is recognized as an asset while gain on bargain purchase is presented as gain in profit or loss. Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 2 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION BATCH 2020 NOTE: NCI and Previously held equity interest in the acquiree are to be discussed on the next topic. Consideration transferred The consideration transferred may include assets or liabilities of the acquirer that have carrying amounts that differ from their fair values at the acquisition date. The following are the considerations that the acquirer may transfer or incur and their proper measurement: (1) Cash or other monetary assets – The fair value is the amount of cash or cash equivalent dispersed. (2) Deferred payment – the fair value to the acquirer is the amount the entity would have to borrow to settle their debt immediately. Basically, the amount should be at present value. (3) Non-monetary assets - Their fair values on acquisition date. (4) Equity instruments – If an acquirer issues its own shares as consideration, it will need to determine the fair value of those shares at the date of exchange. (5) Debt instruments or liabilities undertaken – The fair values of liabilities undertaken are best measured by the present value of future cash flows. (6) Contingent consideration – The acquirer shall recognize the acquisition-date fair value of contingent consideration. Changes that are result of the acquirer obtaining additional information about facts and circumstances that existed at the acquisition date, and that occur within the measurement period (which may be a maximum of one year from the acquisition date) are recognized as adjustments against the original accounting for the acquisition (in other words are adjusted in goodwill). Changes resulting from events after the acquisition date are not measurement period adjustments. Such changes are therefore accounted for separately from the business combination. Recognition and Measurement of Acquired Assets and Liabilities Recognition Principle On acquisition date, the acquirer recognizes the identifiable assets acquired and liabilities assumed. To qualify for recognition, the identifiable assets and liabilities must meet the definition of assets and liabilities in the Conceptual Framework for Financial Reporting. Unidentifiable assets are NOT RECOGNIZED. Examples of which are as follows: Goodwill recorded by acquiree prior to the business combination Assembled workforce Potential contracts that the acquiree is negotiating with prospective mew customers at the acquisition date. Measurement Principle 1. The acquirer shall measure the identifiable assets acquired and the liabilities assumed at their acquisition-date fair value. 2. For each business combination, the acquirer shall measure any non-controlling interest in the acquiree either at: a. Fair value b. The non-controlling interest's proportionate share of the acquiree's identifiable net assets. Specific Recognition Principle (1) Operating Leases Acquiree is the lessee General Rule: The acquirer does not recognize any assets or liabilities related to an operating lease in which the acquiree is the lessee. Exception: The acquirer determines whether the terms of each operating lease in which the acquiree is the lessee are favorable or unfavorable If the terms of the lease relative to market terms is: Favorable – the acquirer recognizes an intangible asset. Unfavorable – the acquirer recognizes a liability. Acquiree is the lessor If the acquiree is the lessor, the acquirer does not recognize any separate intangible asset or liability regardless whether the terms of the operating lease are favorable or unfavorable when compared with market terms. (2) Intangible assets PFRS 3 requires the acquirer to recognize IDENTIFIABLE ASSETS acquired regardless of the degree of probability of an inflow of economic benefits. An intangible asset is identifiable if it: can be separated or meets the contractual-legal criterion. (If it arises from legal or contractual right regardless of separability. Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 3 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION Exception to the Recognition Principle (1) Contingent Liabilities recognized when they represent a present obligation and their fair value is determinable even if the outflow is improbable Exceptions to both the Recognition and Measurement Principle (1) Deferred Taxes - PAS 12 is applied (2) Employee Benefits - PAS 19 is applied (3) Indemnification assets recognized and measured on the same basis as the indemnified item. BATCH 2020 Exception to the Measurement Principle (1) Reacquired rights measured based on the remaining terms of the related contract (2) Share-based payment - PFRS 2 is applied (3) NCA Held for Sale measured at fair value less costs to sell Measurement Period If the initial accounting for business combination is incomplete by the end of the reporting period in which the combination occurred, the acquirer can use provisional amounts to measure any of the following for which the accounting is incomplete: Consideration transferred NCI in the acquiree Previously held equity interest in the acquiree Identifiable assets acquired and liabilities assumed Within 12 MONTHS FROM THE ACQUISITION DATE (the measurement period), the acquirer retrospectively adjusts the provisional amounts for any new information obtained that provides evidence of facts and circumstances that existed as of the acquisition date, which if known would have affected the measurement of the amounts recognized on that date. Any adjustment to a provisional amount is recognized as an adjustment to goodwill or gain on bargain purchase. ACCOUNTING FOR COSTS OF BUSINESS COMBINATION Acquisition-related Costs Examples Professional fees paid to accountants, legal advisors, valuers Direct Costs and other consultants (finders and brokerage fees) to affect the combination General and administrative costs, Indirect Costs including the costs of maintaining an internal acquisitions department transaction costs such as stamp duties, professional adviser's fees, Cost of Issuing Equity Securities underwriting costs and brokerage fees Cost of Issuing Debt Securities Treatment Expensed as incurred Expensed as incurred Debit to APIC or Share Premium Account Deducted from Carrying Amount of Financial Liability Bond issue costs PFRS FOR SMEs FULL PFRS PFRS for SMEs Accounting Method PFRS 3 requires the use of ACQUISITION PFRS for SMEs requires the use of PURCHASE METHOD METHOD Acquisition Related Costs Expensed except for costs of issuing debt or Included in the cost of business combination equity securities except for costs of issuing debt or equity securities Operating Lease PFRS 3 has a specific provision for operating PFRS for SMEs has no specific provision for leases. operating leases. Intangible Assets Acquired Recognized if the intangible asset is either (a) separable or (b) arises from legal or Recognized if its fair value can be measured contractual right reliably Contingent Liabilities Recognized if it is a present obligation and its Recognized if its fair value can be measured Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 4 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION fair value can be measured reliably BATCH 2020 reliably Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 5 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION BATCH 2020 DISCUSSION EXERCISES STRAIGHT PROBLEMS: 1. On January 1, 2019, ALABAMA CORP. acquired all the assets and assumed all of the liabilities of ALABANG INC. As of this date, the carrying amounts and fair values of the assets and liabilities of ALABANG acquired by ALABAMA are shown below: Carrying amounts Fair value Petty cash fund 10,000 10,000 Receivables 200,000 120,000 Allowance for doubtful accounts (30,000) Inventory 520,000 350,000 Building – net 1,000,000 1,100,000 Goodwill 100,000 20,000 Payables 400,000 400,000 On the negotiation for the business combination, ALABAMA incurred transaction costs amounting to P100,000 for legal, accounting and consultancy fees. REQUIREMENTS: (a) If ALABAMA paid P1,500,000 cash as consideration for the assets and liabilities of ALABANG, how much is the goodwill or gain or bargain purchase on the business combination? (b) (c) Consideration transferred Fair value of net identifiable assets (P1,580,000 – P400,000) Goodwill P1,500,000 (1,180,000) P320,000 Consideration transferred Fair value of net identifiable assets (P1,580,000 – P400,000) Goodwill P1,000,000 (1,180,000) P180,000 If ALABAMA paid P1,000,000 cash as consideration for the assets and liabilities of ALABANG, how much is the goodwill or gain or bargain purchase on the business combination? If ALABAMA is an SME and paid P1,500,000 cash as consideration for the assets and liabilities of ALABANG, how much is the goodwill or gain or bargain purchase on the business combination? Consideration transferred (P1,500,000 + 100,000) Fair value of net identifiable assets (P1,580,000 – P400,000) Goodwill 2. P1,600,000 (1,180,000) P420,000 On January 1, 2020, ALASKA CORP. acquired all the assets and assumed all the liabilities of CONDENSADA CORP for the following considerations: Cash of P200,000 plus an installment payment of P1,000,000 on December 31, 2020. The incremental borrowing rate of ALASKA is 5% per annum. (Round-off present value factors in 2 decimal places) Bonds payable with a face value of P500,000. At the acquisition date, the bonds are trading at 110. The bonds are classified as financial liability at amortized cost. ALASKA agreed to pay additional P200,000 on January 1, 2022 if the average income of CONDENSADA during the 2-year period of 2020 – 2022 exceeds P10 million per year. The expected value is P200,000 calculated based on the 40% probability of achieving the target average income. As of this date, the carrying amounts and fair values of the assets and liabilities of CONDENSADA are shown below: Carrying amounts Fair value Current assets 500,000 800,000 Building – net 400,000 200,000 Equipment – net 200,000 150,000 Patent 200,000 Computer software 150,000 Current liabilities 300,000 350,000 Additional information: CONDENSADA is a defendant in a pending litigation for which no provision was recognized because CONDENSADA believes that it will win the case. The fair value of settling the litigation is P100,000. ALASKA is renting out a building to CONDENSADA under an operating lease. The terms of the lease compared with market terms are favorable. The fair value of differential is P50,000. CONDENSADA has research and development projects with a fair value of P150,000. However, CONDENSADA recognized the costs expenses. The assets include an equipment which was assigned a provisional amount of P150,000. This equipment was assigned a tentative useful life of 10 years and to be depreciated using straightline method. The equipment’s fair value on October 1, 2020 is P300,000. In addition, ALASKA had an out-of-pocket costs of P10,000 for direct cost, P5,000 for indirect costs and P20,000 for bond issuance costs. REQUIREMENTS: (a) Compute the amount of goodwill arising from the business combination. Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 6 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION Consideration transferred: Cash Notes payable (1,000,000 x 0.95) Bonds payable (500,000 x 1.10) Contingent consideration Fair value of net identifiable assets: Current assets Building – net Equipment – net Patent Research and development costs Operating lease – intangible assets Current liabilities Contingent liabilities Goodwill Adjustment for provisional amounts Adjusted amount of goodwill (b) (c) (d) P200,000 950,000 550,000 200,000 800,000 200,000 150,000 200,000 150,000 50,000 (350,000) (100,000) BATCH 2020 P1,900,000 1,100,000 P800,000 150,000 P950,000 Assuming that the terms of the lease compared with market terms are unfavorable, compute for the amount of goodwill arising from the business combination. Consideration transferred: Cash Notes payable (1,000,000 x 0.95) Bonds payable (500,000 x 1.10) Contingent consideration Fair value of net identifiable assets: Current assets Building – net Equipment – net Patent Research and development costs Operating lease – liability Current liabilities Contingent liabilities Goodwill Adjustment for provisional amounts Adjusted amount of goodwill P200,000 950,000 550,000 200,000 800,000 200,000 150,000 200,000 150,000 (50,000) (350,000) (100,000) P1,900,000 1,000,000 P900,000 150,000 P1,050,000 Assuming that before the contingency period is over, the probability present value of the earnings contingency declines to P150,000 and the change in value is within measurement period, compute for the amount of goodwill arising from the business combination. Consideration transferred: Cash P200,000 Notes payable (1,000,000 x 0.95) 950,000 Bonds payable (500,000 x 1.10) 550,000 Contingent consideration 200,000 Fair value of net identifiable assets: Current assets 800,000 Building – net 200,000 Equipment – net 150,000 Patent 200,000 Research and development costs 150,000 Operating lease – intangible assets 50,000 Current liabilities (350,000) Contingent liabilities (100,000) Goodwill Adjustment for provisional amounts (150,000 – 50,000) Adjusted amount of goodwill P1,900,000 1,100,000 P800,000 100,000 P900,000 Assuming that before the contingency period is over, the probability present value of the earnings contingency declines to P150,000 and the change in value is beyond measurement period, compute for the amount of goodwill arising from the business combination. Consideration transferred: Cash Notes payable (1,000,000 x 0.95) Bonds payable (500,000 x 1.10) Contingent consideration Fair value of net identifiable assets: Current assets Building – net Equipment – net Patent Research and development costs Operating lease – intangible assets Current liabilities Contingent liabilities P200,000 950,000 550,000 200,000 P1,900,000 800,000 200,000 150,000 200,000 150,000 50,000 (350,000) (100,000) 1,100,000 Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 7 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION Goodwill Adjustment for provisional amounts Adjusted amount of goodwill 3. BATCH 2020 P800,000 150,000 P950,000 The following data relates to the balance sheets of ARIZONA COMPANY and ARENA INC. on December 31, 2020 just before the business combination: ASSETS ARIZONA ARENA Current Assets P400,000 P500,000 Land 100,000 150,000 Buildings (net) 200,000 150,000 Total P700,000 P800,000 LIABILITIES & EQUITY Accounts Payable P100,000 P90,000 Bonds Payable 300,000 380,000 Share Capital - Ordinary (P10 par) 100,000 120,000 APIC 50,000 80,000 Retained Earnings 150,000 130,000 Total P700,000 P800,000 On January 1, 2021, ARIZONA acquired the net assets of ARENA for the following consideration: Cash of P600,000. Issuance of 5,000 shares with a market value of P20 per share at the date of combination. Bonds payable with a face value of P200,000. At the acquisition date, the bonds are trading at 110. The bonds are classified as financial liability at amortized cost. The following items have a fair value different from their book values that are relevant for business combination: ARIZONA ARENA Land P150,000 P200,000 Building 150,000 250,000 Accounts Payable 120,000 150,000 The following out-of-pocket costs of the combination were as follows: Legal fees for the contract of business combination P2,000 Direct Costs Audit fee for SEC registration of share issue 3,000 SIC Printing costs of share certificates 1,000 SIC Broker’s fee 2,000 Direct Costs Accountants fee 1,500 Direct Costs Lawyer’s fee 3,000 Direct Costs Other direct cost of acquisition 1,500 Direct Costs Internal secretarial, general and allocated expense 2,500 Indirect Costs Documentary stamp tax on new shares 1,000 SIC Bond issue cost 5,000 BIC REQUIREMENTS: Using the following assumption (a) Compute the amount of goodwill at the date of acquisition; (b) The total assets after business combination; (c) Total liabilities after the business combination; (d) Total retained earnings after business combination; (e) Total shareholders’ equity after business combination (1) Assume that ARIZONA acquires the net assets of ARENA. Consideration transferred: Cash Issuance of shares (5,000 shares x P20) Bonds payable (200,000 x 1.10) Fair value of net identifiable assets: Goodwill (2) P300,000 100,000 220,000 P620,000 420,000 (a) P200,000 Current Assets (400,000 + 500,000 – 300,000 – 22,500) Land (100,000 + 200,000) Building (200,000 + 250,000) Goodwill Total assets 577,500 300,000 450,000 200,000 (b) 1,527,500 Accounts payable (100,000 + 150,000) Bonds payable (300,000 + 380,000 + 220,000 – 5,000) Total liabilities 250,000 895,000 (c) 1,145,000 Retained earnings (150,000 – 12,500) Share capital (100,000 + 50,000) Share premium (50,000 + 50,000 – 5,000) Total shareholder’s equity (d) P137,500 150,000 95,000 (e) 382,500 Assume that ARIZONA acquires all of the outstanding shares of ARENA. Consideration transferred: Cash Issuance of shares (5,000 shares x P20) Bonds payable (200,000 x 1.10) P300,000 100,000 220,000 Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 P620,000 Page 8 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION Fair value of net assets: Goodwill (3) 420,000 (a) P200,000 Current Assets (400,000– 300,000 – 22,500) Land Investment in subsidiary Building Total assets 77,500 100,000 620,000 200,000 (b) 997,500 Accounts payable Bonds payable (300,000 + 220,000 – 5,000) Total liabilities 100,000 515,000 (c) 615,000 Retained earnings (150,000 – 12,500) Share capital (100,000 + 50,000) Share premium (50,000 + 50,000 – 5,000) Total shareholder’s equity (d) P137,500 150,000 95,000 (e) 382,500 Assume that ARIZONA acquires the net assets of ARENA but with no cash consideration. Consideration transferred: Issuance of shares (5,000 shares x P20) Bonds payable (200,000 x 1.10) Fair value of net identifiable assets: Gain on bargain purchase (4) 4. BATCH 2020 100,000 220,000 P320,000 420,000 (a) P100,000 Current Assets (400,000 + 500,000– 22,500) Land (100,000 + 200,000) Building (200,000 + 250,000) Total assets 877,500 300,000 450,000 (b) 1,627,500 Accounts payable (100,000 + 150,000) Bonds payable (300,000 + 380,000 + 220,000 – 5,000) Total liabilities 250,000 895,000 (c) 1,145,000 Retained earnings (150,000 + 100,000 – 12,500) Share capital (100,000 + 50,000) Share premium (50,000 + 50,000 – 5,000) Total shareholder’s equity (d) P237,500 150,000 95,000 (e) 482,500 Assume that ARIZONA acquires the net assets of ARENA and it is an SME. Consideration transferred: Cash Direct costs Issuance of shares (5,000 shares x P20) Bonds payable (200,000 x 1.10) Fair value of net identifiable assets: Goodwill P300,000 10,000 100,000 220,000 P630,000 420,000 (a) P210,000 Current Assets (400,000 + 500,000 – 300,000 – 22,500) Land (100,000 + 200,000) Building (200,000 + 250,000) Goodwill Total assets 577,500 300,000 450,000 210,000 (b) 1,537,500 Accounts payable (100,000 + 150,000) Bonds payable (300,000 + 380,000 + 220,000 – 5,000) Total liabilities 250,000 895,000 (c) 1,145,000 Retained earnings (150,000 – 2,500) Share capital (100,000 + 50,000) Share premium (50,000 + 50,000 – 5,000) Total shareholder’s equity (d) P147,500 150,000 95,000 (e) 392,500 ARKANSAS INC. issued shares in exchange for 100% interest in CALIFORNIA CORP. Relevant information follows: ARKANSAS CALIFORNIA COMBINED (Carrying Amounts) (Fair Values) ENTITY Identifiable Assets 2,400,000 1,600,000 4,000,000 Goodwill ? Total Assets 2,400,000 1,600,000 ? Liabilities 700,000 900,000 1,600,000 Share Capital 600,000 300,000 700,000 Share Premium 300,000 250,000 1,200,000 Retained Earnings 800,000 150,000 ? Total Liabilities & Equity 2,400,000 1,600,000 ? Additional Information: ARKANSAS’ share capital consists of 60,000 ordinary shares with par value of P10 per share. Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 9 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION BATCH 2020 CALIFORNIA’s share capital consists of 3,000 ordinary shares with par value of P100 per share. REQUIREMENTS: Compute for the following: (1) Number of shares issued by ARKANSAS (2) (3) (4) Increase in ARKANSAS’ share capital Divided by ARKANSAS’ par value Number of shares issued Fair value per share of the shares issued P100,000 10 10,000 Fair value of consideration transferred Divided by number of shares issued Acquisition date fair value 1,000,000 10,000 100 Consideration transferred Fair value of identifiable net assets (1,600,000 – 900,000) Goodwill 1,000,000 700,000 300,000 Goodwill recognized on acquisition date Retained earnings of the combined entity immediately after the business combination P800,000 MULTIPLE CHOICE: (THEORIES) 1. S1: Under PFRS 3, the acquirer is the entity that obtains control of the acquiree. In a business combination effected primarily by transferring cash or other assets, or by incurring liabilities, the acquiree is usually the entity that transfers the cash or other assets, or incurs the liabilities. S2: Under PFRS 3, the acquisition date should always be the closing date. A. True, false C. False, false B. False, true D. True, true 2. Under PFRS 3, which of the following statements is incorrect? A. The acquirer shall recognize the acquisition-date fair value of any contingent consideration as part of the consideration transferred in exchange for the acquiree. The acquirer shall classify the obligation to pay the contingent consideration as either liability or equity. B. If the resulting amount in the computation of goodwill is "negative", the acquirer shall recognize a "gain on bargain purchase" as a contra asset account. C. The acquirer shall account for acquisition-related costs as expenses in the period in which the costs are incurred, except the costs of issuing debt and equity securities. D. Under PFRS 3, the acquirer shall account for each business combination under acquisition method. 3. Which of the following is not an exception from the recognition principle of items acquired in business combination under PFRS 3? A. Deferred taxes C. Employee benefits B. Contingent liabilities D. Non-current asset held for sale 4. Which of the following statements is correct? A. The PFRS for SMEs does not address the accounting for business combinations. B. An SME cannot recognize any goodwill. C. The PFRS for SMEs requires the use of the purchase method in accounting for business combinations. D. Control is not an essential criterion in identifying business combination between SMEs. 5. The A. B. C. D. 6. S1: If the consideration transferred in a business combination is deferred, the consideration may be measured at present value. S2: An intangible asset that is unrecorded by the acquiree may nevertheless be recognized by the acquirer in a business combination. S3: The acquisition method shall be applied only to business combinations wherein the acquirer obtains control of the acquiree by transferring consideration to the latter. A. True, true, false D. False, false, false B. False, false, true E. True, true, true C. True, false, false 7. Provisional amounts may be used if accounting is incomplete by the end of the reporting period in which the business combination occurs. Provisional amounts are adjusted A. prospectively for information obtained during the measurement period. B. retrospectively for information obtained during the measurement period. C. not adjusted for any information obtained during the measurement period. D. PFRS 3 (revised) outlawed the use of provisional amounts. PFRS for SMEs differs from PFRS 3 in all of the following respects, except the measurement of the consideration transferred. the treatment of NCI in the computation of goodwill. the treatment of acquisition-related costs. the recognition criteria for contingent liabilities. Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 10 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION 8. BATCH 2020 Under PFRS 3, contrary to PAS 37, what is the recognition principle of contingent liability assumed in a business combination? A. The acquirer shall recognize as of the acquisition date a contingent liability assumed in a business combination if it is a present obligation that arises from past events and its fair value can be measured reliably even only reasonable possible. B. The acquirer shall recognize a contingent liability assumed in a business combination at the acquisition date only if it’s probable that an outflow of resources embodying economic benefits will be required to settle the obligation. C. The acquirer shall recognize a contingent liability assumed in a business combination at the acquisition date only if it is virtually certain that an outflow of resources embodying economic benefits will be required to settle the obligation. D. The acquirer shall recognize a contingent liability assumed in a business combination at the acquisition date only if it is remote that an outflow of resources embodying economic benefits will be required to settle the obligation. Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 11 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION BATCH 2020 QUIZZER (DO-IT-YOURSELF DRILL) THEORIES 1. Which of the following statements best describes the term "control"? A. The mutual sharing of risks and benefits B. The holding of a significant proportion of the share capital in another entity C. The power to participate in the financial and operating policy decisions of an entity D. The power to govern the financial and operating policies of an entity so as to obtain benefits from the activities 2. The application of the acquisition method of accounting for a business combination requires all of the following, except A. Identifying the acquirer B. Determining the acquisition date C. Not recognizing gain from bargain purchase D. Recognizing and measuring the identifiable assets acquired, the liabilities assumed and any noncontrolling interest in the acquiree. 3. In different types of business combination, which of the following is not considered as an acquirer? A. The remaining or absorbing corporation in case of merger. B. The absorbed corporation in case of consolidation. C. The corporation that acquires more than 50% of the other corporation’s ordinary shares. D. The corporation that controls the acquiree. 4. In a business combination, goodwill is measured as the excess of A. The consideration transferred over the identifiable net assets acquired. B. The total of the consideration transferred and the amount of any non-controlling interest in acquiree over the identifiable net assets acquired. C. The total of the consideration received and the fair value of the previously held interest in acquiree over the identifiable net assets acquired. D. The total of the consideration transferred, the amount of any non-controlling interest in acquiree and the fair value of previously held interest in the acquiree over the identifiable assets acquired. the the the net 5. Which of the following statements in relation to a business combination is true? I. The acquirer shall recognize the acquiree's contingent liabilities if certain conditions are met. II. The acquirer shall recognize the acquiree's contingent assets if certain conditions are met. A. I only C. Both I and II B. II only D. Neither I nor II 6. As of acquisition date, the acquirer shall recognize, separately from goodwill, the identifiable assets acquired, the liabilities assumed and any non-controlling interest in the acquiree. As a general rule, the acquirer shall measure the identifiable assets acquired and the liabilities assumed at their A. Acquisition date fair values C. Acquisition date face values B. Acquisition date book values D. Acquisition date carrying values 7. What is the measurement of the consideration transferred or given up in a business combination? A. Acquisition date fair values C. Acquisition date face values B. Acquisition date book values D. Acquisition date carrying values 8. If the initial accounting for a business combination is incomplete by the end of the reporting period in which the combination occurs, the acquirer shall report in its financial statements provisional amounts for the items for which the accounting is incomplete. What is the maximum term or period of the measurement period? A. One year or 12 months from the acquisition date B. 6 months from the acquisition date C. 3 months from the acquisition date D. 1 month from the acquisition date 9. Which of the following statements in relation to an acquisition date of a business combination is incorrect? A. The acquisition date can never precede the closing date. B. The acquisition date is the date on which an acquirer obtains control over the acquiree. C. Where several dates are key to a business combination, the date on which control passes is the acquisition date. D. The acquisition date is normally the "closing date" or the date on which the acquirer legally transfers the consideration, acquires the assets and assumes the liabilities of the acquiree. 10. What is the requirement with respect to the allocation of the cost of a business acquisition? A. Cost to be allocated based on fair value. B. Cost to be allocated based on original cost. C. Cost to be allocated based on carrying amount. Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 12 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION 11. BATCH 2020 D. None of these During the current year, an entity acquired another entity in a transaction properly accounted for as a business combination. At the time of the acquisition, some of the information for valuing assets was incomplete. How should the acquirer account for the incomplete information in preparing the financial statements immediately after the acquisition? A. Record the uncertain items at the carrying amount of the acquiree. B. Do not record the uncertain items until complete information is available. C. Record a contra account to the investment account for the amount involved. D. Record the uncertain items at a provisional amount measured at the date of acquisition. 12. The contingent consideration of the acquired entity shall be recognized at fair value. The existence of contingent consideration is often reflected in a lower purchase price. Recognition of such contingent consideration shall A. Increase the value attributed to goodwill, thus increasing the risk of impairment of goodwill. B. Decrease the value attributed to goodwill, thus decreasing the risk of impairment of goodwill. C. Decrease the value attributed to goodwill, thus increasing the risk of impairment of goodwill. D. Increase the value attributed to goodwill, thus decreasing the risk of impairment of goodwill. 13. Which of the following accounting treatments for costs related to business combination is incorrect? A. Acquisition related costs such as finder’s fees; advisory, legal, accounting, valuation and other professional and consulting fees; and general administrative costs, including the costs of maintain an internal acquisitions department shall be recognized as expense in the Profit/Loss in the periods in which the costs are incurred. B. The costs related to issuance of stock or equity securities shall be deducted/debited from any share premium from the issue and any excess is charged to “share issuance cost” reported as contract-equity account against either (1) share premium from other share issuances or (2) retained earnings C. The costs related to issuance of financial liability at fair value through profit or loss shall be recognized as expense while those related to issuance of financial liability at amortized cost shall be recognized as deduction from the book value of financial liability or treated as discount on financial liability to be amortized using effective interest method. D. The costs related to the organization of the newly formed corporation also known as preincorporation costs shall be capitalized as goodwill or deduction from gain on bargain purchase. 14. After this type of business combination, the acquired entity ceases to exist as a separate legal or accounting entity. The acquirer records in its accounting records the assets acquired and liabilities assumed in the business combination. A. stock acquisition B. acquisition of control without transfer of consideration C. combination of mutual entities D. asset acquisition 15. How is goodwill or gain from bargain purchase computed? A. The difference between the consideration transferred, including non-controlling interest in the acquiree, and the acquisition-date fair value of net identifiable assets acquired. B. The difference between the purchase price and the acquisition-date fair value of net identifiable assets acquired. C. The difference between the sum of (a) consideration transferred; (b) non-controlling interest in the acquiree; and (c) acquisition-date fair value of the acquirer’s previously held equity interest in the acquiree; and the acquisition-date fair value of net identifiable assets acquired. D. The excess of the acquisition-date fair value of net identifiable assets acquired and there carrying amounts in the acquiree's books. 16. The A. B. C. D. 17. A business combination may be legally structured as a merger, a consolidation, an investment in stock, or a direct acquisition of assets. Which of the following best describes a business combination that is legally structured as a merger? A. The surviving company is one of the two combining companies B. The surviving company is neither of the two combining companies C. An investor-investee relationship is established D. A parent-subsidiary relationship is established 18. Which is true? I The acquiree is the entity that obtains control after the business combination. II The acquisition date in a business combination is normally the closing date. costs of issuing debt securities in a business combination are expensed included in the initial measurement of the debt securities issued accounted for like a “discount" on liability b and c Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 13 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION 19. 20. BATCH 2020 A. I only C. Both I and II B. II only D. Neither I nor II Which is false? I According to PFRS 3 Business Combinations, a “gain on a bargain purchase” (or ‘negative goodwill) is recognized as an allocated deduction to the net identifiable assets acquired in the year of business combination II An intangible asset that is unrecorded by the acquiree may nevertheless be recognized by the acquirer in a business combination. A. I only C. Both I and II B. II only D. Neither I nor II Consider the following I The two important elements in the definition of business combination under PFRS 3 are “business” and “combination.” II Under PFRS 3 Business Combinations, business combinations are accounted for using the purchase method. A. True, true C. False, false B. True, false D. False, true PROBLEMS Use the following information in answering the next item(s): CALIFORNIA CORP. acquired the net assets of CALA INC. by issuing 10,000 ordinary shares with par value of P10 and bonds payable with face amount of P500,000. The bonds are classified as financial liability at amortized cost. At the time of acquisition, the ordinary shares are publicly quoted at P20 per share. On the other hand, the bonds payable, classified as financial liability at amortized cost, are trading at 110. CALIFORNIA paid P10,000 share issuance costs and P20,000 bond issue costs. CALIFORNIA also paid P40,000 acquisition related costs and P30,000 indirect costs of business combination. Before the date of acquisition, CALIFORNIA and CALA reported the following data: CALIFORNIA CALA Current assets 1,000,000 500,000 Noncurrent assets 2,000,000 1,000,000 Current liabilities 200,000 400,000 Noncurrent liabilities 300,000 500,000 Ordinary shares 500,000 200,000 Share premium 1,200,000 300,000 Retained earnings 800,000 100,000 At the time of acquisition, the current assets of CALIFORNIA have fair value of P1,200,000 while the noncurrent assets of CALA have fair value of P1,300,000. On the same date, the current liabilities of CALA have fair value of P600,000 while noncurrent liabilities of CALIFORNIA have fair value of P500,000. 1. What is the goodwill or gain on bargain purchase arising from business combination? A. 50,000 goodwill B. 150,000 gain on bargain purchase C. 120,000 goodwill D. 70,000 gain on bargain purchase 2. What total amount should be expensed as incurred at the time of business combination? A. 20,000 C. 30,000 B. 70,000 D. 50,000 3. What is CALIFORNIA’s amount of total assets after the business combination? A. 4,520,000 C. 4,750,000 B. 4,810,000 D. 4,440,000 4. What is CALIFORNIA’s amount of total liabilities after the business combination? A. 2,240,000 C. 2,320,000 B. 2,150,000 D. 2,130,000 5. COLORADO INC. paid P300,000 for the outstanding common stock of COLOR CORP. At that time, COLOR had the following condensed balance sheet: Carrying amounts Current assets P 40,000 Plant and equipment, net 380,000 Liabilities 200,000 Stockholders’ equity 220,000 Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 14 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION 6. 7. BATCH 2020 The fair value of the plant and equipment was P60,000 more than its recorded carrying amount. The fair values and carrying amounts were equal for all other assets and liabilities. What amount of goodwill, related to COLOR’s acquisition, should COLORADO report in its consolidated balance sheet? A. P20,000 C. P60,000 B. P40,000 D. P80,000 On October 1, 20X8, FLORIDA INC. acquired 100% of FLOUR CORP. for P275,000. On that date, the carrying values of FLOUR's assets and liabilities were P450,000 and P200,000, respectively. The fair values of FLOUR's assets and liabilities were P550,000 and P200,000, respectively. Additionally, FLOUR had identifiable intangible assets at the time of acquisition with a fair value of P60,000. What is the gain to be reported on FLORIDA's December 31, 20X8 consolidated income statement? A. P0 C. P75,000 B. P25,000 D. P135,000 GEORGIA CORP. issues 390,000 shares of its own P10 par ordinary shares for the net assets of GEORGY INC. in a merger consummated on August 30, 2014. On this date, the GEORGIA stock is quoted at P12 per share. Balance sheets for the combining entities at August 30, 2014 just before combination are as follows: GEORGIA GORGY Current assets P14,400,000 P1,200,000 Plant and Property 17,600,000 5,200,000 P32,000,000 P6,400,000 Liabilities P9,600,000 P1,600,000 Ordinary shares, P10 par 16,000,000 2,400,000 Share premium 2,400,000 800,000 Retained earnings 4,000,000 1,600,000 P32,000,000 P6,400,000 GEORGIA also paid finder's fees of P50,000; as well as indirect expenses of P30,000. The cost of registering and issuing the stocks is P150,000. The amount of Retained Earnings on the balance sheet to be presented by GEORGIA at August 30, 2014 will be A. P4,040,000 C. P5,070,000 B. P4,950,000 D. P5,600,000 Use the following information in answering the next item(s): HAWAII INC. decided to acquire the net assets of HELLO CORP. on January 1, 2014 in exchange for 50,000 of its own shares with a par value of P4.00 and a market value of P4.50 per share. HAWAII’s stockholders' equity at this date showed Share Capital of P400,000 Share Premium of P500,000 and Retained Earnings of P300,000. Additional costs incurred were: consultancy fees, P50,000 and cost of registration of stocks, P27,000. The balance sheet of HELLO just before combination follows: Book Value Fair Value Current assets P152,500 P142,500 Plant assets 230,000 201,000 Goodwill 25,000 P407,500 Liabilities Share capital Share premium Retained earnings 8. P95,000 200,000 65,000 47,500 P407,500 How much will be the share premium shown in the shareholders' equity post combination? A. P423,000 C. P498,000 B. P489,000 D. P500,000 9. How much will be the retained earnings presented in the shareholders' equity post combination? A. P215,700 C. P271,500 B. P253,700 D. P273,500 10. How much will be the total shareholders' equity post combination? A. P1,175,300 C. P1,371,500 B. P1,357,100 D. P1,713,500 11. On June 30, 2013 INDIANA CORP. issued 100,000 shares of its P20 par value common stock for the net assets of INDIAN INC. The market value of INDIANA's common stock on June 30 was P36 per share. INDIANA paid a fee of P100,000 to the broker who arranged this acquisition. Costs of SEC registration and issuance of the equity securities amounted to, P50,000. Contingent consideration determined to be paid after acquisition amounts to P 120,000. What amount should INDIANA capitalize as the cost of acquiring INDIAN's net assets. A. P3,700,000 C. P3,720,000 Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 15 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION B. P3,650,000 D. BATCH 2020 P3,750,000 12. The stockholders' equities of KANSAS INC. and KANSER CORP. at July 1, 2013 were as follows: KANSAS KANSER Capital stock, P100 par P15,000,000 P8,000,000 Additional paid in capital 2,000,000 4,000,000 Retained earnings 6,000,000 3,000,000 On July 2, 2013, KANSAS issued 150,000 of its shares with a market value of P120 per share for the assets and liabilities of KANSER, and KANSER was dissolved. On the same day, KANSAS paid P50,000 for professional fees and P100,000 for SEC registration of equity securities. After the combination, what is the total stockholders' equity of KANSAS? A. P41,000,000 C. P41,150,000 B. P40,850,000 D. P40,900,000 13. MONTANA CORP. will issue common shares with a par value P10 for the net assets of HANA CORP. MONTANA's common stock has a current market value of P40 per share. HANA's statement of financial position on the date of acquisition follow: Current assets P320,000 Common stock, P5 par P80,000 Property and equipment 880,000 Additional paid in capital 320,000 Liabilities 400,000 Retained earnings 400,000 HANA's current assets are appraised at P400,000 and the property and equipment was also appraised at P1,600,000. Its liabilities are fairly valued. Accordingly, MONTANA issued shares of its common stock with a total market value equal to that of HANA's net assets including goodwill. To recognize goodwill of P200,000, how many shares were to be issued by MONTANA A. 45,000 C. 50,000 B. 40,000 D. 55,000 14. MARYLAND INC. was merged into JOSEPHLAND INC. in a combination properly accounted for as an acquisition. Their condensed statement of financial position before the combination are: MARYLAND JOSEPHLAND Current assets P3,288,000 P1,627,600 Property and equipment, net 4,654,000 1,040,000 Patents 260,000 Total assets P7,942,000 P2,927,000 Liabilities P3,704,000 P171,600 Capital stock, Par P100 2,600,000 1,300,000 Additional paid in capital 390,000 350,000 Retained earnings 1,248,000 1,106,000 Total liabilities and equity P7,942,000 P2,927,600 Per appraisal's report, Horse assets have fair values of: Current assets P1,653,600 Property and equipment 1,248,000 Patents 338,000 MARYLAND purchases the net assets of Horse for P3,168,000 cash. What is the total asset of MARYLAND after the combination? A. P7,354,000 C. P8,113,600 B. P7,254,000 D. P9,181,600 15. NEBRASKA INC. and ALASKA CORP. agreed to combine their businesses, with NEBRASKA as the surviving entity. NEBRASKA will issue 48,000 shares of its capital stock, with a par value of P100 per share, and a fair market value of PI75 per share. NEBRASKA incurred the following additional acquisition-related costs: Professional fees P120,000 Broker's fees 80,000 Costs to register and issue stock 50,000 Before combination, their respective statement of financial position showed stockholders' equity accounts as follows: NEBRASKA ALASKA Capital stock P7,200,000 P3,600,000 Additional paid in capital 3,120,000 360,000 Retained earnings 6,000,000 2,040,000 The total stockholder's equity of NEBRASKA after the combination is: A. P24,720,000 C. P24,670,000 Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 16 PSBA: AFAR 04_BUSINESS COMBINATIONS: STATUTORY MERGERS & FULL STOCK ACQUISITION B. P24,470,000 D. BATCH 2020 P24,890,000 Use the following information in answering the next item(s): UTAH INC. issued 120,000 shares of P10 par common stock with a fair value of P2,550,000 for all the outstanding stock of JAZZ CORP. In addition UTAH incurred the following costs: Professional fees to arrange the business combination P27,000 Cost of SEC registration 12,000 Cost of printing and issuing stock certificates 3,000 Immediately before the business combination in which JAZZ was dissolved, JAZZ's assets and equities were as follows (in thousands): Book value Fair value Current assets P1,000 P1,100 Plant assets 1,500 2,200 Liabilities 300 300 Common stock 2,000 Retained earnings 200 16. What is the amount of goodwill (gain on acquisition)? A. P 450,000 C. P(450,000) B. P(550,000) D. P 500,000 17. Using the data, how much additional paid in capital is recorded by UTAH? A. P1,350,000 C. P1,365,000 B. P1,335,000 D. P1,330,000 18. Using the data, UTAH should recognize expense of: A. P32,000 C. P15,000 B. P27,000 D. P12,000 19. Using the data, the net increase (decrease) in the retained earnings of UTAH is: A. P2,600,000 C. P3,300,000 B. P3,000,000 D. P2,200,000 20. OHIO CORP. exchanged its common stock worth P280,000 for all of the net assets of OHELLO INC. in a business combination treated as a purchase. At the date of combination, OHIO’s net assets had a book value of P480,000 and a fair value of P680,000. OHELLO’s net assets had a book value of P260,000 and a fair value of P272,000. Immediately following the combination, the net assets of the combined company should have been reported at what amount? A. P740,000 C. P760,000 B. P752,000 D. P952,000 - END OF HANDOUTS - Advanced Financial Accounting & Reporting by Karim G. Abitago, CPA of 16 Page 17