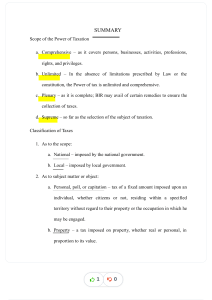

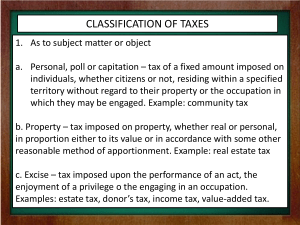

SUMMARY Scope of the Power of Taxation a. Comprehensive – as it covers persons, businesses, activities, professions, rights, and privileges. b. Unlimited – In the absence of limitations prescribed by Law or the constitution, the Power of tax is unlimited and comprehensive. c. Plenary – as it is complete; BIR may avail of certain remedies to ensure the collection of taxes. d. Supreme – so far as the selection of the subject of taxation. Classification of Taxes 1. As to the scope: a. National – imposed by the national government. b. Local – imposed by local government. 2. As to subject matter or object: a. Personal, poll, or capitation – tax of a fixed amount imposed upon an individual, whether citizens or not, residing within a specified territory without regard to their property or the occupation in which he may be engaged. b. Property – a tax imposed on property, whether real or personal, in proportion to its value. 1 0 c. Excise – any tax which does not fall w/in the classification of a poll tax or a property tax. 3. As to who bears the burden: a. Direct – a tax which is demanded from the person who also shoulders the burden of the tax or tax which taxpayer cannot shift to another. b. Indirect – a tax which is demanded from one person in the expectation and intention that he shall indemnify himself at the expense of another. 4. As to determination of amount: a. Specific – tax of fixed amount imposed by the head or number. b. Ad Valorem – tax fixed proportion of the value of the property with respect to which tha tax is assessed. 5. As to purpose: a. Primary, Fiscal, or Revenue Purpose – tax imposed generally for government. b. Secondary, Regulatory, Special or Sumptuary Purpose – tax imposed for a specific. 6. As to graduation or rate: a. Proportional – tax based on a fixed percentages. 1 0 b. Progressive or graduated – tax the rate of which increases as the tax base. c. Regressive – tax rate of which decreases as the tax base. 7. As to taxing authority: a. National – taxes imposed under the National Internal Revenue Code. b. Local – taxes imposed by local Government units. 1 0