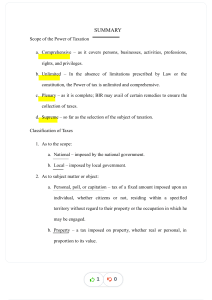

CLASSIFICATION OF TAXES 1. As to subject matter or object a. Personal, poll or capitation – tax of a fixed amount imposed on individuals, whether citizens or not, residing within a specified territory without regard to their property or the occupation in which they may be engaged. Example: community tax b. Property – tax imposed on property, whether real or personal, in proportion either to its value or in accordance with some other reasonable method of apportionment. Example: real estate tax c. Excise – tax imposed upon the performance of an act, the enjoyment of a privilege o the engaging in an occupation. Examples: estate tax, donor’s tax, income tax, value-added tax. CLASSIFICATION OF TAXES 2. As to who bears the burden a. Direct – tax demanded from persons who are intended or bound by law to pay the tax. Examples: community tax, income tax, estate tax, donor’s tax b. Indirect – tax which the taxpayer can shift to another. Examples: custom duties, value-added tax, some percentage taxes. CLASSIFICATION OF TAXES 3. As to determination of amount a. Specific – tax imposed based on a physical unit of measurement, s by head or number, weight, or length or volume. Examples: tax on distilled spirits, fermented liquors, cigars wines, fireworks, etc. b. Ad valorem – Tax of a fixed proportion of the value of property; needs an independent appraiser to determine its value. Examples: real estate tax, certain customs duties, excise taxes on cigarettes, gasoline and others Excise taxes on certain specific goods imposed under the NIRC are either specific or ad valorem taxes CLASSIFICATION OF TAXES 4. As to purpose a. General, fiscal or revenue – tax with no particular purpose or object for which the revenue is raised, but is simply raised for whatever need may arise. Examples: income tax, value-added tax a. Special or regulatory – tax imposed for a special purpose regardless of whether revenue is raised or not, and is intended to achieve some social or economic end. Example: protective tariffs or customs duties on certain imported goods to protect local industries against foreign competition. CLASSIFICATION OF TAXES 5. As to authority imposing the tax or scope a. National – tax imposed by the national government. Examples: internal revenue taxes, tariff and customs duties b. Municipal or local – tax imposed by municipal governments for specific needs. Example: real estate taxes, municipal licenses. CLASSIFICATION OF TAXES 6. As to graduation or rate a. Proportional – tax based on a fixed percentage of the amount of property income or other basis to be taxed. Examples: percentage taxes, real estate taxes b. Progressive or graduated – tax rate increases as the tax base increases. Examples: income tax, estate tax, donor’s tax. c. Regressive – tax rate decreases as the tax base increases. Example: value-added tax TAX DISTINGUISHED FROM OTHER FEES 1. From toll. TOLL is a sum of money for the use of something, generally applied to the consideration which is paid for the use of a road, bridge or the like, of a public nature. A toll is a demand of proprietorship, is paid for the use of another’s property and may be imposed by the government or private individuals or entities; while tax is a demand of sovereignty, is paid for the support of the government and may be imposed only by the State. TAX DISTINGUISHED FROM OTHER FEES 2. From penalty. PENALTY is any sanction imposed as a punishment for violation of law or acts deemed injurious. Violation of tax laws may give rise to imposition of penalty. A penalty is designed to regulate conduct and may be imposed by the government or private individuals or entities. Tax, on the other hand, is primarily aimed at raising revenue and may be imposed only by the government. TAX DISTINGUISHED FROM OTHER FEES 3. From special assessment. SPECIAL ASSESSMENT is an enforced proportional contribution from owners of lands for special benefits resulting from public improvements. SPECIAL ASSESSMENT is levied only on land, is not a personal liability of the person assessed, is based wholly on benefits and is exceptional both as to time and place. Tax is levied on persons, property, or exercise of privilege, which may be made a personal liability of the person assessed, is based on necessity and is of general application. TAX DISTINGUISHED FROM OTHER FEES 4. From permit or license fee. PERMIT or LICENSE FEE is a charge imposed under the police power for purposes of regulations. LICENSE FEE is imposed for regulation and involves the exercise of police power while tax is levied for revenue and involves the exercise of the taxing power. Failure to pay a license fee makes an act or a business illegal while failure to pay a tax does not necessarily make an act or a business illegal. TAX DISTINGUISHED FROM OTHER FEES 5. From debt. A DEBT is generally based on contract, is assignable and may be paid in kind while a tax is based on law, cannot generally be assigned and is generally payable in money. A person cannot be imprisoned for non-payment of debt while he can be for non-payment of tax (except poll tax). TAX DISTINGUISHED FROM OTHER FEES 6. From revenue. REVENUE is broader than tax since it refers to all funds or income derived by the government axes included. Other sources of revenues are government services, income from public enterprises and foreign loans. 7. From custom duties. Customs duties are taxes imposed on goods exported from or imported to a country. Customs duties are actually taxes but the latter is broader in scope. TAX DISTINGUISHED FROM OTHER FEES 7. From custom duties. Customs duties are taxes imposed on goods exported from or imported to a country. Customs duties are actually taxes but the latter is broader in scope KINDS OF TAXES • Income Tax – Tax on all yearly profits arising form property, possessions, trades or offices – Tax on a person’s income, emoluments and profits • Estate Tax – Tax on the right of the deceased person to transmit property at death • Donor’s Tax – Tax imposed on donations inter-vivos or those made between living persons to take effect during the lifetime of the donor. • Value-added Tax (VAT) – Tax imposed and collected on every sale, barter, exchange or transaction deemed sale of taxable goods, properties, lease of goods, services or properties in the course of trade as they pass along the production and distribution chain KINDS OF TAXES Excise Tax – Tax applicable to specified goods manufactured in the Philippines for domestic sale or consumption – Specific tax: imposed on certain goods based on weight or volume capacity or any other physical unit of measurement (Specific tax = volume x tax rate) » Alcohol products, petroleum products, tobacco products – Ad valorem tax: imposed on certain goods based on selling price or other specified value of the goods (Ad valorem tax = selling price x tax rate) » Mineral products, automobiles KINDS OF TAXES Final withholding tax: – A system of collecting taxes whereby the amount of income tax withheld by the withholding agent is constituted as a full payment of the income tax due form the payer on the said income. The payer is not required to file an income tax return for the particular income • Withholding tax for compensation income: – Commonly referred to as pay as you go or pay as you earn. – A method of collecting the income tax at source upon receipt of the income.