1. Silverman Company reports net income of P200,000 each year and pays on

dividend of P70,000. The company holds net assets of P1,500,000 on

January 1, 20x3. On that date, Weights Company purchases 50 percent of

the outstanding stock for P900,000, which gives it the ability to have joint

control with Treadmill over Silverman. At the purchase date, the excess of

Weights's cost over its proportionate share of Goldman's book value was

assigned to goodwill. On December 31, 20x4, what is the investment in

Silverman Company balance (equity method) in Weights's financial records?

___390,000___ (1,030,000)

Assume that Silverman Company's ownership structure is as follows:

80% is needed to direct relevant activities:

50% ownership of Weights Company;

30% ownership of Treadmill Company; and

20% ownership of Punchbag Company

What is the amount of Income from Investment in Silverman 's Company in

Weights financial records as of December 31, 20x5?

___391,000___ (100,000)

Assuming that Silverman Company's ownership structure is as follows:

55% is needed to direct relevant activities:

15% ownership of Weights Company;

40% ownership of Treadmill Company;

10% ownership of Punchbag Company; and

Widely dispersed - other companies

What is the amount of Income from Investment in Silverman 's Company in

Weights financial records as of December 31, 20x5?

___569,000___ (10,500)

Assuming that Silverman Company's ownership structure is as follows:

50% is needed to direct relevant activities:

20% ownership of Weights Company;

30% ownership of Treadmill Company; and

10% ownership of Punchbag Company

Widely dispersed - other companies

What is the amount of Income from Investment in Silverman 's Company in

Weights financial records as of December 31, 20x5?

________ (40,000)

1 / 3 points

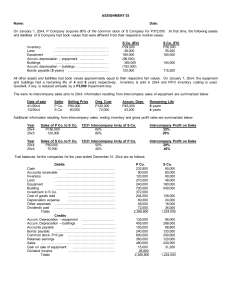

2. On July 1, 20x4, Joey Company acquired 30% of the shares of Leo Company

for P200,000. On that date the equity of Leo was P500,000 with all

identifiable assets and liabilities being measured at fair value. Profits/

(losses) made since the date of acquisition are as follows:

Year ended 30 June

20x5

20x6

20x7

20x8

20x9

Profit/(Loss)

P 30,000

(300,000)

(400,000)

15,000

30,000

There have been no dividends paid or movements in reserves since the date of

acquisition.

On June 30, 20x5 the equity method accounted balance of the investment in Lea

was:

___371,000___ (209,000)

On June 30, 20x7 the equity method accounted balance of the investment in Leo

was:

___0___(33.33 %)

At 30 June 20X8 the equity method accounted balance of the investment in Leo

was:

___0___ (3,500)

0 / 2 points

3. Aye Company purchases 40% of Cee Company on January 1 for P1,000,000

that carry voting rights at a general meeting of shareholders of Bee

Company. Aye Company are Bee Company immediately agreed to share

control (wherein unanimous consent is needed to all the parties involved)

over Cee Company. Cee reports assets on that date of P2,500,000 with

liabilities of P1,000,000. One building with a five-year life is undervalued on

Bee's books by P250,000. Also Cee's book value for its trademark (10-year

life) undervalued by P450,000. During the year, Cee reports net income of

P200,000, while paying dividends of P50,000. What is the Investment in Cee

Company balance (equity method) in Aye's financial records as of December

31?

___2,008,000___ (1,022,000)

The Income from Investment in Cee Company in Aye's financial records as of

December?

___1,028,000___ (42,000)

0 / 1 point

4. Ray Corporation purchased 25 percent of Dee Company's stock in January 2, 20x5 for

P800,000. At the acquisition date, Dee has equipment with a market value P180,000

greater than book value. The equipment has an estimated remaining life of 10 years.

In 20x5, Dee has net income of P320,000 and pays P100,000 of dividends. What is the

balance in the investment account on Ray's financial records at the end of 20x5?

___855,000___ (850,500)

0 / 8 points

5. Flower Corporation purchased 30 percent of Down Company's stock in

January 1, 20x5 for P1,500,000. At the acquisition date, Down has

equipment with a market value P500,000 greater than book value. On that

date, Flowers Corporation gives the ability to have joint control with another

entity over Down Company's. The equipment has an estimated remaining

life of 10 years. In 20x5, Down has net income of P250,000 and pays

P100,000 of dividends. What is the balance in the investment account on

Flower's financial records at the end of 20x5?

___1,650,000___ (1,530,000)

The income from investment in Flower's financial records at the end of 20x5:

___250,000___ (60,000)

Assuming the same information except that the Joint Venturer (investor] does not

prepare Consolidated Financial Statements:

The investment account in Flower's financial records at the end of 20x5;

___1,400,000___ (1,530,000)

The income from investment in Flower's financial records at the end of 20x5:

___1,000,000___ (60,000)

Assuming the same information except that the Joint Venturer (Investor) prepares

Consolidated Financial Statements:

The investment account in Flower's financial records at the end of 20x5:

___300,000___ (1,500,000)

The income from investment in Flower's financial records at the end of 20x5:

___250,000___ (30,000)

The investment account in the consolidated financial statements at the end of

20x5:

___100,000___ (1,530,000)

The income from investment in the consolidated financial statements at the end of

20x5:

___200,000___ (60,000)

1 / 1 point

6. Peter Inc. owns 40 percent of Wendy and applies the equity method. During

the current year, Peter buys inventory costing P89,000 and then sells its

Wendy for P145,000. At the end of the year. Wendy still holds only P36,250

of merchandise. What amount of unrealized gross profit must Peter defer in

reporting this investment using the equity method?

___5,600___

7.

1 / 1 point

Investor owns 35% of Investee and applies the equity method. In 20x2, Investor sells

merchandise costing P50,000 to Investee for P90,000. Investee's ending inventory

includes 45,000 purchased from Investor. What amount of unrealized gross profit

must be deferred in the equity method entry?

___7,000___

8.

1 / 1 point

Investor owns 30% of Investee and applies the equity method. In 20x2, Investee sell

merchandise costing P20,000 to Investor for P50,000. Investor's ending inventory

includes P10,000 purchased from Investee. What amount of unrealized gross must be

deferred in the equity method entry?

___1,800___

0 / 2 points

9. Apple Company has an investment balance amounting to P250,000 in the

voting shares of Pear Ltd. On December 31, 20x5 Pear reported a net income

of P1,000,000 and declared dividends of P500,000. During 20x5, Apple had

sales to Pear of P450,000, and Prince had sales to Apple of P250,000. On

December 31, 20x5, the inventory of Apple contained an intercompany

profit of P50,000, and the inventory of Pear contained an intercompany

profit of P75,000. On January 1, 20x5, Apple sold equipment to Pear and

recorded an profit of P100,000 on the transaction. The equipment had a

remaining useful life of five years on this date. Apple uses the equity method

to account for its investment in Pear. Apple owns 25% of Pear, and Pear is a

joint venture using equity method.

The investment account in Apple's financial records at the end of 20x5:

___550,000___ (348,750)

The investment income in Apple's financial records at the end of 20x5:

___50,000___ (223,750)

6.003 / 15 points

10.X Co. and Y Inc. formed XY Company on January 1, 20x4. X Co. invested

equipment with a carrying amount of P420,000 and a fair value of P980,000

for a 25% interest in XY Company, while Y Inc. contributed equipment, which

was similar to the equipment contributed by X Co., with a total fair value of

1,225,000, for a 60% interest in XY Company. The equipment has an

estimated useful life of 10 years. On December 31, 20x4, XY Company

reported a net income of P250,600. Assume that the transaction does not

have a commercial substance in this situation because X Co. owned a similar

portion of the same type of equipment both before and after the

contribution to the joint venture.

Determine the unrealized gain on transfer to XY Company (the separate vehicle) on

January 1, 20x4.

___560,000___(6.67 %)

Determine the realized gain through depreciation on transfer of equipment to XY

Company on December 31, 20x4.

___56,000___(6.67 %)

Determine the gain on transfer of equipment to be presented in the 20x4 income

statement,

___56,000___(6.67 %)

The same data are identical in all respects to those from previous problem except

that the Y Co. contributes technology (rather than equipment) with a fair value of

P1,225,000. Assume that the transaction does have commercial substance in this

situation because X Co. owned equipment before its contribution to the joint

venture but indirectly owned a portion of equipment and technology after the

contribution.

Determine the unrealized gain and realized gain on transfer to XY Company (the

vehicle) on January 1, 20x4 :

Unrealized gain on January 1, 20x4:

___224,000___ (140,000)

Realized gain on January 1, 20x4:

___336,000___ (420,000)

Determine the realized gain in income statement on transfer of equipment to XY

Company

on December 31, 20x4.

___22,400___ (434,000)

The same data facts are identical in all respects to those from previous problem

except that that X Co. receives a 25% interest in XY Company, plus P245,000 in cash

in return for investing equipment with a fair value of P980,000, while Y Inc.

contributed equipment with a for value of P806,400 plus cash of P245,000, for a

total contribution of P966,900.

Determine the immediate gain from selling equipment to X Inc. on January 1, 20x4.

___140,000___(6.67 %)

Determine the unrealized gain on transfer to XY Company (the separate vehicle) on

January 1, 20x4.

___420,000___(6.67 %)

Determine the realized gain through depreciation on transfer of equipment to XY

Company on December 31, 20x4.

___14,000___ (42,000)

Determine the gain on transfer of equipment to be presented in the 20x4 income

statement

___182,000___(6.67 %)

Using the same information, assume the increase in the amount of cash that X Co.

received when it invested equipment for a 25% interest in XY Company and the

cash received was P571,667. Because Y Inc. invested only P245,000 cash in the

joint venture, the additional P326,667 was borrowed by XY Company.

Determine the sales proceeds and the return of equity of X Company. (round up to

nearest whole number)

___408,333___ (490,000)

Determine the immediate gain from selling equipment to Y Inc. on January 1, 20x4.

(use rounded-up answer in previous question for the ratio)

___252,000___ (280,000)

Determine the unrealized gain on transfer to ST Company (the separate vehicle) on

January 1,20x4.

___308,000___ (280,000)

Determine the realized gain through depreciation on transfer of equipment to XY

Company on December 31, 20x4.

___30,800___ (28,000)

Determine the gain on transfer of equipment to be presented in the 20x4 income

statement.

___282,800___ (308,000)

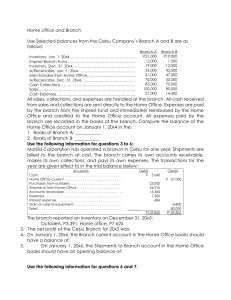

Use the following Information for questions 1 to 4:

On January 1, 20x4, XX Company and YY Company signed an agreement to form a

joint operation to manufacture a product called plasma. This product is used in the

manufacturing of television. The following are transactions transpired in relation to

joint operations for 20x4:

To commence the operation, both operators contributed P252,000 in cash.

Contributions of cash by the operators.

Use of cash and loan to buy machinery & equipment costing P134,400 (cash paid,

P84,000 and the balance on a loan account) and raw materials purchase on account costing

P109,200.

Labor incurrence amounting to P120,960 with P131,600 paid in cash.

Loans from the bank, P100,800.

Repayment of loan - machinery and equipment, P16,800, raw materials amounting to

P70,560 and other factory expenses, of P218,400.

Depreciation of machinery and equipment, P13,440.

Transfer of materials, labor and overhead to Work-in-Process: payroll, P120,960;

Materials, P80,640; Factory overhead – heat, light and power, P218,400 and depreciation of

P13,440.

Transfer of Work-in-Process to Finished Goods Inventory, P302,400

Transfer of Finished Goods Inventory, P268,800 to Joint Operators throughout the year

Determine the ending balance in cash:

P0

P 80,640

P151,200

None of the above

Question 2

Determine the work in process ending balance amounted to:

P 117,600

P 131,040

P 433,440

1/1

point

None of the above

1/1

point

Question 3

The December 31, 20x4 total assets amounted to:

P263,760

P381,360

P394,800

None of the above

0/1

point

Question 4

The December 31, 20x4 XX's investment amounted to:

P235,200

P117,600

P252,000

None of the above

1/1

point

Question 5

AA Company and BB Company agreed to form a joint operation to offer health

services. To start the operation the joint operators agreed to contribute cash of

P300,000 each. The joint operation will record which of the following entries to

recognize this event?

DR Joint operator contributions

600,000

CR Cash

600,000

DR Cash

600,000

CR Joint operator contributions

600,000

CR Venturer's equity-AA

CR Venturer's equity-BB

CR Cash

300,000

300,000

600,000

CR Cash

600,000

CR AA-Joint operation contribution 300,000

CR BB-Joint operation contribution 300,000

1/1

point

Question 6

Cash contributed to a joint operation was used to purchase Equipment (P100,000)

and raw materials (P70,000). The following entry would be part of the

overall recording of these transactions:

DR Equipment

DR Raw materials

CR Cash

DR Work in progress

CR Joint operation capital

100,000

70,000

170,000

170,000

170,000

DR Cash

170,000

CR Contribution to joint operation

170,000

DR Cash

CR Equipment

CR Raw materials

170,000

100,000

70,000

Question 7

1/1

point

Three joint operators are involved in a joint operation that manufactures ships

chandlery. At the beginning of the year the joint operation held P50,000 in cash.

During the year the joint operation incurred the following expenses: Wages paid

P20,000. Overheads accrued P10,000. Additionally, creditors amounting to P40,000

were paid and the joint operators contributed P15,000 cash each to the joint

operation. The balance of cash held by the joint operation at the end of the year is:

P 5,000

P25,000

P 35,000

P 75,000

Question 8

Books of JOINT OPERATOR(S): Reporting Proportionate Share of the Assets,

Liabilities, Revenues, and Expenses of the Joint Operation

1/1

point

XX Company and YY Company formed a joint operation and share in the output of

the joint operation 60:40. The joint operation paid a management fee of P20 000 to

XX Company during the current period. The cost to XX Company of supplying the

management service was P14,000. XX Company records the management fee

revenue as follows:

CR Cash

DR Fee revenue

20,000

20,000

CR Cash

DR Fee revenue

14,000

14,000

CR Cash

DR Fee revenue

12,000

12,000

CR Cash

DR Fee revenue

8,000

8,000

1/1

point

Question 9

Company A and Company B formed a joint operation and share equally in the output

of the joint operation. The joint operation paid a management fee of P20,000 to

Company A during the current period. The cost to Company A of supplying the

management service was P14,000. Company A records the management fee revenue

as follows:

CR Cash

DR Fee revenue

20,000

20,000

CR Cash

DR Fee revenue

14,000

14,000

CR Cash

DR Fee revenue

6,000

6,000

CR Cash

DR Fee revenue

10,000

10,000

Question 10

1/1

point

Company A Limited and Company B Limited formed a joint operation and share in the

output of the joint operation 60:40. The joint operation paid a management fee of

P20,000 to Company A Limited during the current period. The cost to Company A

Limited of supplying the management service was P14,000. The amount of profit that

Company A Limited will recognise in relation to the provision of the management fee

to the joint operation is:

NIL

P2,400

P3,600

P6,000

1/1

point

Question 11

A joint operation holds Equipment with a carrying amount of P1,200,000. The two

joint operators participating in this arrangement share control equally. They also

depreciate Equipment using the straight-line method. The Equipment has a useful life

of 5 years. At reporting date each joint operator must recognize the following entry,

in relation to depreciation, in its records:

Depreciation, P240,000

Depreciation, P120,000

Investment in joint operation, P240,000

Assets in joint operation, P120,000.

1/1

point

Question 12

A 50:50 joint operation was commenced between two operators. Operator One

contributed cash of P50 000, and Operator Two contributed a building with a fair

value of P50,000 and a carrying amount of P40,000. Using the line-by-line method of

accounting, Operator Two would record:

DR Building in JO

CR Building

40,000

40,000

DR Building in JO

CR Building

CR Gain on sale of building

50,000

40,000

10,000

DR Investment in joint operation

50,000

DR Building

40,000

CR Gain on sale of building

10,000

DR Cash in JO

DR Building in JO

CR Building

CR Gain on sale of building

25,000

20,000

40,000

5,000

1/1

point

Question 13

A 60:40 joint operation was commenced between two participants. Participant One

contributed cash of P60,000, and Participant Two agreed to provide technical

services to the joint operation over a period of two years. The fair value of the

services was determined to be P40,000 and the cost to provide the services was

estimated to be P35,000. Using the line-by-line method of accounting, Operator Two

would record:

DR Cash in JO

CR Obligation to JO

30,000

30,000

DR Cash in JO

CR Obligation to JO

24,000

21,000

CR Profit on provisions of services

3,000

DR Cash in JO

CR Obligation to JO

24,000

24,000

DR Cash in Joint Operation

DR Receivable in JO

CR Obligation to JO

24,000

16,000

40,000

1/1

point

Question 14

Three joint operators agree to an arrangement in which they have an equal share in

an agricultural joint operation. The work undertaken in setting up the joint operation

cost P300,000 and each operator contributed in cash. Each operator will need to

recognize the following accounting entry:

DR Cost of joint operation product 300,000

CR Cash

300,000

DR Inventory in JO

CR Cash

100,000

100,000

DR Cash in JO

CR Cash

300,000

300,000

DR Cash in JO

100,000

CR Cash

100,000

1/1

point

Question 15

A 50:50 joint operation was commenced between two participants. Joint Operator

One contributed cash of P50 000, and Joint Operator Two contributed a Building with

a fair value of P50,000 Using the line-by-line method of accounting Joint Operator

One would record:

Building in JO

Cash

50,000

50,000

Cash in JO

Cash

50,000

50,000

Investment in joint operation

Cash

50,000

50,000

Cash in JO

Building in JO

Cash

25,000

25,000

50,000

Question 16

1/1

point

Use the following information for questions 16 and 17:

AA and BB have established the AB Joint Operation. AA has a 60% interest in the joint

operation and BB has a 40% interest.

A contributed an asset with a carrying amount of P90,000 and a fair value of

P120,000 and BB agreed to provide technical services to the joint operation over the

first two years of operations. The fair value of the technical services was agreed to be

P80,000 and the cost to provide the services was estimated at P65,000 at the

inception of the joint operation.

As part of its initial contribution, the journal entry for joint operator AA:

Debit against the Services Receivable in JO account of P32,000;

Debit against the Plant in JO account of P54,000;

Credit against the Plant of P120,000;

Credit against the Gain on Sale of plant of P18,000.

Question 17

1/1

point

As part of its initial contribution entry BB will record a:

Debit against the Services Receivable in JO account of P32,000;

Debit against the Plant in JO account of P36,000;

Credit against the Obligation to JO of P39,000;

Credit against the Gain on Provision of Services of P6,000.

1/1

point

Question 18

On July 1, 20x5, the Ears & Eyes Joint Operation was established. The two joint

operators participating in this arrangement, Ears and Eyes share control equally. Both

joint operators contributed cash to establish the joint operation. The joint operation

holds equipment with a carrying amount of P1,200,000. Both joint operators

depreciate equipment using the straight-line method and the depreciation is

regarded a cost of production. The equipment has a uselife of 5 years. At June 20,

20x6 Ears had sold all of the inventory distributed to it and Eyes had sold 50% of the

inventory distributed to it. At June 30, 20x6 Joint operator Eyes must recognize the

following entry, in relation to depreciation, in its records:

Dr. Depreciation expense

P240 000;

Dr. Accumulated depreciation

P120 000;

Dr. Inventory

Dr. Cost of goods sold

P 60 000;

P120 000.

1/1

point

Question 19

Use the following information for questions 19 to 21:

On July 1, 2015, Abel entered into a 50:50 joint operation with Cain to develop an oil

field off the coast of Aparri, Cagayan. Each operator's initial contribution was P2

million. Abel contributed P1 million cash and equipment with a fair value of P1

million and a book value of P500,000. Cain's contributed P2 million cash.

Additional information:

Production costs for the JO for the year ended June 30, 20x6 were:

Purchases

Wages

P'000

750

1,300

Management fee

Total production costs

Less: Work in progress

Cost of production

400

2,450

(650)

1,800

The remaining useful life of the equipment contributed by Abel is 5 years.

Cain is responsible for the day to day management of JO and has recognized the

management fee received during the year as revenue.

The costs of providing these management services to JO were P225,000.

Tasman has sold all of the oil distributed to it and Abel has sold 50% of the oil distributed

to it by June 30, 20x6.

An extract of JO's balance sheet at June 30, 20x6 shows: ('000)

Assets

Cash

Work in progress

Finished goods inventory

Plant & equipment

Accounts payable

Net assets

P650

650

100

1,000

(100)

P2,300

Which of the following will not form part of Abel's initial contribution entry?

Debit against the Cash in JO account of P1,500,000;

Debit against the Equipment in JO account of P500,000;

Credit against the Cash of P1,000,000

Credit against the Gain on Equipment of P250,000

Question 20

1/1

point

Cain's initial contribution entry will include a debit to the Cash in JO account of:

P1,000,000

P1,500,000

P2,000,000

P3,000,000

Question 21

1/1

point

The value of inventory distributed to Abel Ltd by the joint venture and subsequently

sold by June 30, 20x6 is:

P425,000

P850,000

P900,000

P1,700,000

1/1

point

Question 22

Use the following information for questions 22 to 24:

On January 1, 2021. Entity MM together with another joint operator set up a

separate vehicle to undertake a joint operation. The arrangement provides for both

parties to have joint control over the separate vehicle. For its capital contribution,

Entity MM has recorded its interest in the joint operation at P300,000, being the

amount of cash contribution upfront. Apart from recording its assets and liabilities in

the joint operation directly. Entity MM has rights to a 60% share in the property,

plant and equipment of the separate vehicle, a 50% share in the current assets, and a

75% share of the liabilities incurred by the separate vehicle. Its share of the revenue

from the sale of the output produced by the separate vehicle is 55%, while its share

of the expenses incurred jointly is 60%.

Extracts of the financial statements of the separate vehicle follows:

Revenue from the sale of outputs of the vehicle

Less: Expenses

Net income from operations

P1,000,000

600,000

P 400,000

Current assets

Property, plant and equipment

Total Assets

P 600,000

P1,000,000

P1,600,000

Liabilities

Capital

Net income from operations

Total liabilities and Capital

P 800,000

400,000

400,000

P1,600,000

Determine Entity MM's "Cash in Joint Operation interests in Joint Operation)" (credit

balance) arising from share in assets. liabilities, revenue and expenses:

P110,000

P 240,000

P420,000

Nil

Question 23

1/1

point

Determine Entity MM's "Cash in Joint Operation" (Interests in Joint Operation)"

ending balance:

P 190,000

P 540,000

P 820,000

Nil

Question 24

1/1

point

The share in net income/gross profit of Entity MM's amounted to:

P300,000

P240,000

P220,000

P190,000

Question 25

1/1

point

Use the following information for questions 25 and 26:

Because the scale of the project exceeded the capacity of entities MM and NN

individually they tendered jointly for a public contract with a government to

construct a motorway between wo cities. Following the tender process the

government awarded the contract jointly to entities MM and NN.

In accordance with the contractual arrangements entities MM and NN are jointly

contracted with the government for delivery of the motorway in return for

P19,600,000 (a fixed price contract). In 20x4, in accordance with the agreement

between entities MM and NN.

entities MM and NN each used their own equipment and employees in the construction

activity

entity MM constructed three bridges needed to cross rivers on the route at a cost of

P5.6 million

entity NN constructed all of the other elements of the motorway at a cost of PB.4

million. entities MM and NN shared equally in the P19,600,000 jointly invoiced to (and

received from) the government.

Determine the net income generated by Joint Operator - Entity MM:

P9,800,000

P5,600,000

P4,200,000

None of the above

Question 26

1/1

point

Determine the net income generated by Joint Operator - Entity NN:

P9,800,000

P8,400,000

P1,400,000

None of the above

Question 27

1/1

point

Use the following information for questions 27 to 29:

L Inc., M Co., and N Inc. sign an agreement to collectively purchase an oil pipeline and

to hire a

company to manage and operate the pipeline on their behalf. The costs involved in

running the pipeline and the revenue earned from the pipeline are shared by the

three parties based on their ownership percentage. All major operating and financing

decisions related to the pipeline must be agreed to by the three companies. The cost

of purchasing the pipeline was P70,000,000. The pipeline has an estimated 20-year

useful life with no residual value. The management fee for operating the pipeline for

20x4 was P14,000,000. Revenue earned from the pipeline in 20x4 was P23,100,000. L

invested P21,000,000 for a 30% interest.

Compute the share of L Inc. in the revenue of the joint operation for 20x4:

P 1,680,000

P 6,930,000

P14,000,000

P21,000,000

Question 28

0/1

point

Compute the share of L Inc. in the expenses of the joint operation for 20x4:

P1,050,000

P4,200,000

P5,250,000

P6,930,000

Question 29

1/1

point

Compute the share of L Inc. in the net income of the joint operation for 20x4:

P1,680,000

P6,930,000

P14,000,000

P21,000,000

Question 30

Use the following Information for questions 30 and 31:

1/1

point

On 1 January 20x4 entities MM, NN, OO, PP and QQ (the joint operators) jointly buy a

jet aircraft for P14,000,000 cash. The operators are the registered as equal joint

owners of the aircraft. They enter into an agreement whereby the aircraft is at the

disposal of each operator for 70 days each year. The aircraft is in maintenance for the

remaining days each year. The operators may decide to use the aircraft, or, for

example, lease it to a third party. Decisions regarding maintenance and disposal of

the aircraft require the unanimous consent of the operators. The contractual

arrangement is for the expected life (20 years) of the aircraft and can be changed

only if all of the operators agree. The residual value of the aircraft is zero.

In 20x4 the operators each paid P140,000 to meet the joint costs of maintaining the

aircraft (e.g., hangar rental and aviation license fees).

In 20x4 each operator also incurred costs of running the aircraft when they made use

of the aircraft (e. g., entity MM incurred costs of P70,000 on pilot fees, aviation fuel

and landing costs).

In 20x4 entity MM also earned rental income of P532,000 by renting the aircraft to

others

Determine the net income generated by Joint Operator - Entity MM:

P182,000

P322,000

P392,000

None of the above

Question 31

1/1

point

The net book value of property, plant and equipment Determine the net income

generated by Joint Operator - Entity MM:

P2,660,000

P2,590,000

P2,268,000

None of the above

Question 32

1/1

point

Use the following information for questions 32 to 35:

Instead of contributing cash for a 30% Interest in the pipeline, L contributed steel

pipes to be used by the company constructing the pipeline, L had manufactured the

pipes at a cost of P15,400.000. All parties to the contract agreed that the fair value of

these pipes was P21,000,000 and the fair value of the pipeline once it was completed

was P70,000,000. All other facts are the same as in the previous problem. The other

operators have a 70% interest in the joint operation.

Determine the realized gain upon the contribution of the steel pipes:

P 5,600,000

P 3,920,000

P 1,680,000

Zero

Question 33

1/1

point

Determine the unrealized gain upon the contribution of the steel pipes at year end:

P 5,600,000

P 3,920,000

P1,680,000

Zero

Question 34

Determine the amortization expense for the year 20x4:

P0

P 84,000

P 966,000

0/1

point

P1,050,000

1/1

point

Question 35

Determine the pipeline's net cost at the end of 20x4

P0

P19,320,000

P19,404,000

P21,000,000

1/1

point

Question 36

Books of JOINT OPERATION Entity- PARTNERSHIP in Nature

The Investment in joint operation accounts in the books of the joint operators, X, Y

and Z show the balances below, upon termination of the joint operation and

distribution of the profits:

Accounts

with

X

Y

Z

X

Dr (Cr)

P4,000

(6,500)

Y

Dr (Cr)

P2,500

(6,500)

Z

Dr (Cr)

P2,500

P4,000

-

Final settlement of the joint operation will require payments as follows:

X pays P2,500 to Z, and Y pays P4,000 to Z.

Z pays P2,500 to X, and P4,000 to Y.

Y pays P6,500 to X, and Z pays P2,500 to Y.

None of these.

Question 37

Use the following Information for questions 37 and 38:

The following information for the operations of joint operation is as follows:

1/1

point

Investment in Joint Operation (Anton Company)

20x4:

20x4:

11/6-Merchandise - Jose

P8,500

11/20-Cash Sales-Ampon

11/8-Merchandise-Deyro

7,000

11/20-Cash Sales-Ampon

11/10-Freight paid-Ampon 200

11/28-Merchandise-Deyro

11/12-Advertising-Ampon 150

12/8-Purchase-Ampon

3,500

12/14-Selling expense

400

P20,400

4,200

1,210

The operation agreement provided for the division of gains and losses among Jose,

Deyro and Ampon in the ratio of 2:3:5. The operation was to close as of December

31, 20x4

The total gain from the joint operation amounted to:

P 6,060.

P12,120.

P18,180.

Some other answer.

Question 38

1/1

point

As final settlement, Jose received in cash:

P6,060

P7,608

P8,080

P9,712

Question 39

1/1

point

Use the following information for questions 39 through 42:

On September 30, 20x4 Roxas, Silverio and Tan agreed on a joint operation to sell

their common stock shares of the Golden Copper Mines. Gains and losses are to be

shared in proportion to the contributed shares.

Roxas contributes 6,000 shares, which had cost him P42 a share; Silverio gave 10,000

shares which had cost P58 each and Tan 4,000 shares which had cost P62 per share.

The par value of the shares was P50 and when the operation began market value was

P40 a share. Tan was to manage the operation for a flat fee of P3,000 plus expenses.

On October 20 he sold 4,500 shares for P44 a share. On November 1, Golden Copper

distributed a stock dividend of 20%. Tan sold 5,000 shares, ex-stock dividend, on

November 5 for P25 a share. On November 15, Golden Copper paid a cash dividend

of P1 per share. On November 22, he said 6,000 shares for P28. On December 20, the

remainder of the shares was sold for P35 a share. Tan's expenses were P4,700.

The 20,000 shares contributed to the joint operation should be valued at:

P 800,000.

P1,000,000.

P1,080,000.

Some other answer.

Question 40

1/1

point

Assuming the joint operation is ended on December 31, the share of Roxas operation

in the loss of the operation would be:

P10,130.

P11,130.

P13,130.

Some other answer.

Question 41

1/1

point

If a distribution of proceeds is made on December 31, the share of Silverio would

amount to:

P374,650.

P378,500.

P381,450.

P385,300.

Question 42

1/1

point

Tan's loss on the disposition of his Investment in Golden Copper is:

P95,420.

P98,140.

P105,420.

P120,140.

Question 43

0/1

point

Use the following information for questions 43 and 44:

On July 1, 20x4, Andres, Bantug, and Carlos formed a joint operation for the sale of

merchandise. Andres was designated as the managing operator. Profits or losses are

to be divided as follows: Andres, 50%; Bantug, 25%; and Carlos, 25%. On October 1,

20x4, though the joint operation was still uncompleted, the operators agreed to

recognize profit or loss on the operation to date. The cost of inventory on hand was

determined at P25,000. The joint operation account has a debit balance of P15,000

before distribution of profit and loss. No separate books is maintained for the joint

operation and the operators record in their individual books operation transactions.

The joint operation profit or loss on October 1, 20x4 is:

P10,000 profit

P25,000 profit

P15,000 loss

No profit or loss

Question 44

0/1

point

The distribution of the operation profit (loss) on October 1, 20x4 to the operators

shall be as follows:

Andres, P5,000; Bantug, P2,500; and Carlos, P2,500.

Andres, P12,500; Bantug, P6.250; and Carlos, P6,250.

Andres, (P7,500); Bantug, (P3,750): and Carlos, (P3,750)

No distribution yet because operation is uncompleted.

Answer not given.

0/1

point

Question 45

Use the following information for questions 45 and 46:

Anson and Burgos are operators in a operation for the acquisition of construction

supplies of an auction. The two operators agreed to contribute cash of P20,000 each

to be used in purchasing the supplies and to share profits and losses equally. They

also agreed that each shall record his purchases, sales and expenses in his own

books.

Several months later, the two operators terminated the operation. The following data

relate to the operation activities:

Joint Operation account balance

Value of inventory taken

Expenses paid from Joint Operation cash

Anson

P16,000 Cr

600

800

Burgos

P18,400 Cr

2,200

1,800

The amount of joint operation sales is:

P77,000

P27,000

P34,400

None of these.

Question 46

In the final settlement, Anson would receive

1/1

point

P 2,000

P18,600

P38,000

None of these.

Question 47

1/1

point

Use the following information for questions 47 and 48:

Reyes and Santos formed a joint operation to acquire and sell a particular lot of

merchandise Reyes was to manage the operation and to furnish the capital, and the

operators were to share equal in any gain or loss. On June 10, 20x4, Santos sent

Reyes P10,000 cash, which was the merchandise purchased. On June 24, one half

merchandise was sold for P7,200 cash. Reyes paid the cost of delivering merchandise

to customers, which amounted to P260. No further transactions occurred on June 30,

20x4.

The profit (loss) of the operation for the period June 10-June 30, 20x4 is:

P1,820.

P1,950.

(P1,700).

Some other answer.

Question 48

1/1

point

On June 30, 20x4 after recognizing the profit (loss) on the uncompleted operation,

the account of Santos on the books of Reyes will show a debit (credit) balance of:

(P10,910).

(P10,975).

P10,850.

Some other answer.

1/1

point

Question 49

Use the following information for questions 49 and 50:

Joint Operation activities for M, N. and O having proved to be unprofitable, the joint

operators agree to dissolve the operation. Accounts with the operation and cooperators on the books of M, the managing joint operator, are as follows just before

dissolution and liquidation:

Joint Operation Cash

Joint Operation

N, Capital

O, Capital

Debit

P12,000

6,500

Credit

P14,500

6,500

The balance of joint operation assets on hand is sold by M for P3,500. M is allowed

special

compensation of P300 for winding up the operation: remaining profits or loss is

distributed equally.

The Joint Operation profit (loss) is:

P3,000.

P19,000.

(P3,000).

None of these.

Question 50

1/1

point

In the final settlement, N and O received:

N, P13,400; O, P5,400.

N, P10,500; O, P3,500.

N, P15,850; O, P7,850.

None of these.

Question 51

1/1

point

Use the following information for questions 51 and 52:

Al Benin and Rey Sucat formed à joint operation on January 1, 20x4 to operate two

stores to be managed by each operator. They agreed to contribute cash as follows:

Benin, P30,000; Sucat, P20,000. Profits and losses are to be divided in the capital

ratio. All the operation transactions are for cash, and the cash receipts and

disbursements of the venture during the four-month period, handled through the

operators' bank accounts, are as follows:

Receipts

Disbursements

Benin

P78,920

62,275

Sucat

P65,425

70,695

On April 30, 20x4, the remaining joint operation's non-cash assets in the hands of the

operators were sold for P60,000 cash. The operation was terminated and settlement

was made between Benin and Sucat.

The operation profit (loss) for the four-month period, after selling the remaining noncash assets, was

P11,375.

P21,375.

(P31,375)

(P38,625)

None of these.

Question 52

1/1

point

The P60,000 cash was divided between the two operators in the following manner:

Benin, P16,180; Sucat, P43,820.

Benin, P21,905; Sucat, P38,095.

Benin, P26,180; Sucat, P33,820.

None of these.

Question 53

1/1

point

The books of three joint operators contain the following account balances:

N's Books

Account with N

Account with O

Account with P

O's Books

P2,000 Cr

5,000 Dr

P's Books

P2,000 Cr

3,000 Cr

P3,000 Cr

P5,000 Dr

When P makes final settlement of the operation, the entries are:

a.

b.

c.

d.

e.

N's Books

Debit

P

P5,000

Credit

O

3,000

Cash

2,000

Debit

Cash

P2,000

O

3,000

Credit

P

5,000

Debit

P

P5,000

Credit

Cash

3,000

O

2,000

Debit

Cash

P2,000

O

3,000

Credit

P

5,000

None of the above

N

P

Cash

Cash

N

P

N

P

Cash

N

P

Cash

O's Books

P5,000

2,000

3,000

P2,000

3,000

5,000

P5,000

3,000

2,000

P2,000

3,000

5,000

P's Books

Cash

N

O

N

O

Cash

Cash

N

O

N

O

Cash

P5,000

2,000

3,000

P3,000

2,000

5,000

P5,000

3,000

2,000

P2,000

3,000

5,000

V, W, X, Y and Z each hold a 20% interest in entity . Decisions in entity J need to be

approved by 80% vote of the parties. Is Entity J jointly controlled?

Yes, since all five parties have equal interest.

Yes, since four out of five parties need to give their consent.

No, but the five parties have significant influence.

No, the five parties neither have control nor significant influence

Question 2

0/1

point

MNO Co.'s articles of association require a 75% majority to approve decisions

regarding the relevant activities of the entity. It also outlines that each shareholder

is entitled to vote in proportion to their respective ownership interests.

Shareholder M and N have 51% and 30% of the voting stock of MNO Co.

respectively while various other investors hold the rest. Is MNO Co. jointly

controlled?

No, M has sole control and N has significant influence.

Yes, all the parties have joint control.

Yes, M and N have joint control.

No, both M and N have significant influence.

Question 3

1/1

point

Four separate space technology companies form a consortium to jointly

manufacture a space craft. A consortium agreement is signed, which outlines the

activities of the arrangement and establishes a joint operating committee. A

representative from each company sits on the joint operating committee; decisions

are made by unanimous consent.

Each company carries responsibility for different areas of expertise such as

propulsion, control boards, antennae and radiation-hardened parts. The companies

carry out different parts of the manufacturing process, each using its own

resources and expertise in order to manufacture market and distribute the aircraft

jointly.

The four companies share the revenues from the sale of the spacecraft and jointly

incur expenses. The revenues and common costs are shared as contractually

agreed in the consortium agreement.

A separate bank account is established through which revenue is received and

shared costs paid. The bank account is in the name of the four parties trading as

the consortium.

Each company also incurs their own separate costs such as labor costs,

manufacturing costs, supplies, inventory of unused parts and work in progress.

Each company recognizes their separately incurred costs in full.

What is the classification of the joint arrangement?

Joint operation, since each company has direct rights to the assets and

obligations for the liabilities of the arrangement.

Joint venture, since the arrangement is structured through a separate

vehicle.

Joint operation, since the arrangement is not structured through a

separate vehicle.

Joint venture, since each company has rights to the net assets of the

arrangement.

Question 4

0/1

point

A mining company (Gaia) is seeking to establish operations in a relatively

undeveloped country. The in-country requirements do not allow a local entity with

a mining license to be controlled by a foreign company.

Gaia establishes a separate company with a local investor to allow Gaia to enter

this market. The legal form of the company confers the rights to the assets and

obligations for liabilities to the company itself.

A shareholders' agreement is also established between and the local investor that

requires all decisions to be made jointly. The arrangement also confirms:

The assets of the arrangement are owned by the company. Neither party will be able

to sell, pledge, transfer or otherwise mortgage the assets.

The liability of the parties is limited to any unpaid capital.

Profits of the company will be distributed to Gaia and the investor 60/40, being the

parties' interest in the arrangement respectively.

What is the classification of the joint arrangement?

Joint operation, since each company are co-owners of the assets and

co-debtors of the liabilities of the arrangement.

Joint operation, since the arrangement itself owns the assets and

bears the liabilities of the arrangement.

Joint venture, since the arrangement is structured through a

separate vehicle.

Joint venture, since each company has rights to the net assets of the

arrangement.

1/1

point

Question 5

Which of the following statement(s) is/are true, according to PFRS 11?

PFRS 11 applies to all entities that are party to a joint arrangement.

The legal structure of an arrangement is the most significant factor in determining the

accounting.

There are now only two forms of joint arrangement – joint operations and joint

ventures.

Equity method of accounting should be used in joint ventures.

II, III and IV only

I, III and IV only

I, II, III and IV

I and II only

Question

6

0/3

points

On January 1, 2020 , A, B, and C (all are corporations) establish a joint undertaking

to manufacture a product they agree to share equally. Each will contribute

P150,000 into the operation; A and B are to contribute cash while C is to contribute

equipment with a carrying value of 175,000 and fair value of P150,000. The

equipment has a remaining life of 15 years when contributed. The difference

between the fair value and carrying value represents a reduction in the net

realizable value of the equipment contributed i.e., loss is recognized in full by C.

(1) Determine the net amount C will show the Equipment in JO account in its balance sheet

at January 1, 2020.

___150,000___ (50,000)

(2) Determine the net amount C will show the Equipment in JO account in its balance sheet

at December 31, 2020.

___140,000___ (46,666.67)

(3) Determine the net amount A (or B) will show the Equipment in JO account in its balance

sheet at December 31, 2020.

___0___ (46,666.67)

0 / 3 points

W, X, Y, and Z are joint operators of Joint Operation WXYZ (each having an equal

share in interest). On January 1, 2020, A sells equipment having a book value of

P65,500 to the OPERATION for P98,250. The equipment had an estimated useful

economic life of 10 years at that date.

(1) Determine the net amount A (or B) will show the Equipment in JO account in its balance

sheet at January 1, 2020. (Hint: Share in FV of asset less unrealized gain)

___65,500___ (16,375)

(2) Determine the net amount C will show the Equipment in JO account in its balance sheet

at December 31, 2020. (Hint: Share in FV of asset less depreciation less unamortized

unrealized gain)

___58,950___ (14,737.50)

(3) Determine the net amount A (or B) will show the Equipment in JO account in its balance

sheet at December 31, 2020. (Hint: Share in FV of asset less depreciation

___91,700___ (22,106.25)

0 / 1 point

In December 2020, Kiki and Lala contribute P6,000 each to buy and chocolates during

Valentines and divide profits in the ratio of 4:6, respectively. Cash purchases amount to

P5,000, expenses are P1,400 and cash sales are P12,000. The unsold fruits are taken by Kiki

and are charged to him for P600 or 40% of cost. How much is the net income of the joint

operation?

___18,200___ (6,200)

0 / 3 points

Teresa and Gabriela in a joint operation, contributed P35,000 each in order to

purchase merchandise which were sold in lots at a closing-out sale. They agree to

divide their profits equally and each shall record her purchases, sales and expenses

in her own books. After almost all merchandise had been sold, they wind up their

operation.

The following are the venture transactions:

Teresa

P35,000

1,500

(25,000)

800

Purchases of merchandise

Expenses paid from JT Operation Cash

JT Operation credit balances

Undisposed merchandise upon termination of JO

Gabriela

P35,000

2,000

(20,000)

1,200

All transactions for the joint venture are in cash. The operators are to take over the

unsold merchandise at cost.

(1) Calculate the net profit of the joint operation undertaking.

___71,500___ (47,000)

(2) Compute the amount of sales of the joint operation.

___68,000___ (117,000)

(3) Determine the amount of cash Gabriela would receive/(pay) from/to Teresa upon final

cash settlement by the venturers.

___15,800___ (4,700)

0 / 3 points

Lovely and Pretty in a joint operation, contributed P28,000 each in order to

purchase canned goods which were sold by lots at a closing-out sale. They agreed

to divide their profits equally and each shall record his purchases, sales and

expenses in her own books. After selling almost all the canned goods, they wind up

their operation. The following are the operation transactions:

Joint Operation credit balances were Lovely (P17,600) and Pretty (P15,400).

Expenses paid from Joint Operation cash were P3,600 by Lovely and P4,120 by

Pretty. Cost of unsold canned goods which Lovely and Pretty agreed to assume

were P660 and P1,040 respectively. (Hint: Net profit is balancing figure of

Investment in JO balance and cost of unsold merchandise.)

(1) Net profit of the joint operation was:

___62,500___ (34,700)

(2) Total sales of the joint operation were:

___54,300___ (96,720)

(3) In the final settlement, the amount due to Lovely including her investment was:

___9,740___ (44,690)

1 / 1 point

F, G and H formed a joint operation. F is to act as manager and is designated to

record the joint operation transactions in his books. As manager, F is allowed a

management fee of P12,000. Profits and losses are to be divided equally. The

following balances appear at the end of 2020 before adjustments for venture

inventory and distribution of profits and losses:

Joint operation cash

G, capital

H, capital

Debit

P48,000

3,000

Credit

P27,000

The operation is terminated on December 31, 2020 with unsold merchandise

costing P10,400.

Assuming that the joint operation profit is P5,000, what is the unadjusted balance of the joint

operation account before the distribution of profit? (Indicate whether debit or credit after

the amount)

___5,400 debit___

1 / 1 point

A, B, and C formed a joint operation to sell fruits during the Christmas season. The

following joint operation account reflects the transactions of the venture in the

books of manager A.

Joint Operation

2017

Nov. 5 Merchandise – C

17 Merchandise – B

22 Freight in -- A

Dec. 3 Purchases – A

13 Expenses -- A

P12,750 Nov. 18 Cash sales – A

10,500 Dec. 12 Cash sales – A

525

28 Merchandise -- B

5,250

600

P30,600

6,300

1,815

The contractual arrangements include distribution of gains and losses as follows: A,

50%; B, 30%; and C, 20%. The operation is completed and terminated on December

31, 2019.

How much should B receive in the final settlement?

___11,412___

1 / 1 point

Which of the following statements define a joint arrangement?

All of the above

B and C

A joint arrangement is an arrangement of which one party has joint control

A joint arrangement is an arrangement of which two parties have joint

control

A joint arrangement is an arrangement of which more than two parties

have joint control

Question 2

1/1

point

Which of the following is correct?

All joint arrangements which are not structured through a separate

vehicle are classified as joint ventures

In considering the legal form of the separate vehicle, if the legal form

establishes rights to individual assets and obligations, the arrangement

is a joint operation. If the legal form establishes rights to the net assets

of the arrangement, then the arrangement is a joint venture.

Where the joint operators have designed the joint arrangement so that

its activities primarily aim to provide the parties with an output it will

be classified as a joint venture.

For a joint venture, the rights pertain to the rights and obligations

associated with individual assets and liabilities, whereas with a joint

operation, the rights and obligations pertain to the net assets.

Question 3

1/1

point

Which of the following statement(s) is/are false, with regards to the concept of

"joint control" under PFRS 11?

I. Joint control is defined as the contractually agreed sharing of control of an

arrangement, which exists only when decisions about the relevant activities

require the majority consent of the parties sharing control.

II. No single party to an agreement is able to act unilaterally to control the

activity of the arrangement when joint control exists.

III. The existence of joint control means that every party to the arrangement

will have joint control.

IV. Joint control and control are mutually exclusive.

II and III only

I and III only

I and IV only

III and IV only

Question 4

0/1

point

MNO Co.'s articles of association require a 75% majority to approve decisions

regarding the

relevant activities of the entity. It also outlines that each shareholder is entitled to

vote in proportion to their respective ownership interests. Shareholder M and N

have 51% and 30% of the voting stock of MNO Co. respectively while various other

investors hold the rest. However, shareholder M has an option to buy shareholder

N's shares in MNO Co. The option may be exercised by shareholder M at any time

in the event that shareholder M and M do not agree on a decision regarding the

relevant activities. The option price is not remote. Is MNO Co. Limited jointly

controlled?

No, M has sole control and N has significant influence.

Yes, M and N have joint control.

Yes, all the parties have joint control.

No, both M and N have significant influence.

Question 5

1/1

point

A mining company (Gaia) is seeking to establish operations in a relatively

undeveloped country. The in-country requirements do not allow a local entity with

a mining license to be controlled by a foreign company.

Gaia establishes a separate company with a local investor to allow Gaia to enter

this market. The legal form of the company confers the rights to the assets and

obligations for liabilities to the company itself.

A shareholders' agreement is also established between and the local investor that

requires all decisions to be made jointly. The arrangement also confirms:

The assets of the arrangement are owned by the company. Neither party will be able

to sell, pledge, transfer or otherwise mortgage the assets.

The liability of the parties is limited to any unpaid capital.

Profits of the company will be distributed to Gaia and the investor 60/40, being the

parties' interest in the arrangement respectively.

What is the classification of the joint arrangement?

Joint venture, since each company has rights to the net assets of the

arrangement.

Joint venture, since the arrangement is structured through a separate

vehicle.

Joint operation, since the arrangement itself owns the assets and

bears the liabilities of the arrangement.

Joint operation, since each company are co-owners of the assets and

co-debtors of the liabilities of the arrangement.

3/3

points

Question

6

On January 1, 2020 , A, B, and C (all are corporations) establish a joint undertaking

to manufacture a product they agree to share equally. Each will contribute

P150,000 into the operation; A and B are to contribute cash while C is to contribute

equipment with a carrying value of 175,000 and fair value of P150,000. The

equipment has a remaining life of 15 years when contributed. The difference

between the fair value and carrying value represents a reduction in the net

realizable value of the equipment contributed i.e., loss is recognized in full by C.

(1) Determine the net amount C will show the Equipment in JO account in its balance sheet

at January 1, 2020.

___50,000___(33.33 %)

(2) Determine the net amount C will show the Equipment in JO account in its balance sheet

at December 31, 2020.

___46,666.67___(33.33 %)

(3) Determine the net amount A (or B) will show the Equipment in JO account in its balance

sheet at December 31, 2020.

___46,666.67___(33.33 %)

0 / 3 points

W, X, and Y are joint operators of Joint Operation WXY (each having an equal share

in interest). On January 1, 2020, W sells equipment having a book value of P60,000

to the OPERATION for P90,000. The equipment had an estimated useful economic

life of 15 years at that date.

(1) Determine the net amount W will show the Equipment in JO account in its balance sheet

at January 1, 2020. (Hint: Share in FV of asset less unrealized gain)

___15,000___ (20,000)

(2) Determine the net amount W will show the Equipment in JO account in its balance sheet

at December 31, 2020. (Hint: Share in FV of asset less depreciation less unamortized

unrealized gain)

___14,000___ (18,666.67)

(3) Determine the net amount X (or Y) will show the Equipment in JO account in its balance

sheet at December 31, 2020. (Hint: Share in FV of asset less depreciation

___21,000___ (28,000)

1 / 1 point

In December 2020, Kiki and Lala contribute P8,000 each to buy and chocolates during

Valentines and divide profits in the ratio of 4:6, respectively. Cash purchases amount to

P7,000, expenses are P2,300 and cash sales are P15,000. The unsold fruits are taken by Kiki

and are charged to him for P800 or 80% of cost. How much is the net income of the joint

operation?

___6,500___

1 / 3 points

Teresa and Gabriela in a joint operation, contributed P40,000 each in order to

purchase merchandise which were sold in lots at a closing-out sale. They agree to

divide their profits equally and each shall record her purchases, sales and expenses

in her own books. After almost all merchandise had been sold, they wind up their

operation.

The following are the venture transactions:

Teresa

Purchases of

merchandise

Expenses

paid from JT

Operation

Cash

JT Operation

credit

balances

Undisposed

merchandise

upon

termination

of JO

All transactions for the joint venture are in cash. The operators are to take over the

unsold merchandise at cost.

(1) Calculate the net profit of the joint operation undertaking.

___68,000___(33.33 %)

(2) Compute the amount of sales of the joint operation.

___150,500___ (129,500)

(3) Determine the amount of cash Gabriela would receive/(pay) from/to Teresa upon final

cash settlement by the venturers.

___72,000___ (2,000)

3 / 3 points

Lovely and Pretty in a joint operation, contributed P25,000 each in order to

purchase canned goods which were sold by lots at a closing-out sale. They agreed

to divide their profits equally and each shall record his purchases, sales and

expenses in her own books. After selling almost all the canned goods, they wind up

their operation. The following are the operation transactions:

Joint Operation credit balances were Lovely (P15,500) and Pretty (P12,400).

Expenses paid from Joint Operation cash were P2,900 by Lovely and P3,800 by

Pretty. Cost of unsold canned goods which Lovely and Pretty agreed to assume

were P450 and P900 respectively. (Hint: Net profit is balancing figure of Investment

in JO balance and cost of unsold merchandise.)

(1) Net profit of the joint operation was:

___29,250___(33.33 %)

(2) Total sales of the joint operation were:

___84,600___(33.33 %)

(3) In the final settlement, the amount due to Lovely including her investment was:

___39,175___(33.33 %)

0 / 1 point

F, G and H formed a joint operation. F is to act as manager and is designated to

record the joint operation transactions in his books. As manager, F is allowed a

management fee of P10,000. Profits and losses are to be divided equally. The

following balances appear at the end of 2020 before adjustments for venture

inventory and distribution of profits and losses:

Joint operation cash

G, capital

H, capital

Debit

P40,000

2,000

Credit

P20,000

The operation is terminated on December 31, 2020 with unsold merchandise

costing P750.

Assuming that the joint operation profit is P3,000, what is the unadjusted balance of the joint

operation account before the distribution of profit? (Indicate whether debit or credit after

the amount)

___2,250 debit___ (2,250 credit)

1 / 1 point

A, B, and C formed a joint operation to sell fruits during the Christmas season. The

following joint operation account reflects the transactions of the venture in the

books of manager A.

Joint Operation

2017

Nov. 5 Merchandise – C

17 Merchandise – B

22 Freight in -- A

Dec. 3 Purchases – A

13 Expenses -- A

P10,250 Nov. 18 Cash sales – A

8,200 Dec. 12 Cash sales – A

310

28 Merchandise -- B

4,120

450

P25,700

4,200

950

The contractual arrangements include distribution of gains and losses as follows: A,

40%; B, 35%; and C, 25%. The operation is completed and terminated on December

31, 2019.

How much should B receive in the final settlement?

___9,882___