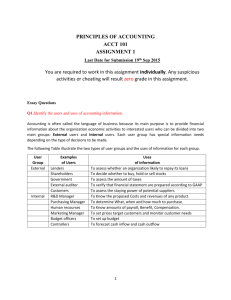

Accounting: Tools for Business Decision Making Eighth Edition Kimmel ● Weygandt ● Mitchell Chapter 1 Introduction to Financial Statements Prepared by Diane Tanner University of North Florida This slide deck contains animations. Please disable animations if they cause issues with your device. Copyright ©2022 John Wiley & Sons, Inc. Chapter Outline Learning Objectives LO 1 Identify the forms of business organization and the uses of accounting information. LO 2 Explain the three principal types of business activity. LO 3 Describe the four financial statements and how they are prepared. Learning Objective 1 Identify the Forms of Business Organization and the Uses of Accounting Information LO 1 Business Organization and Accounting Information Uses Forms of Business Organization Sole Proprietorship Partnership Corporation LO 1 Sole Proprietorship • Owned and controlled by one person • Simple to establish • Tax advantages Examples • Small owner-operated businesses such as barber shops, law offices, auto repair shops, farms, and small retail stores LO 1 Partnership • Two more owners • Simple to establish • Shared control • Broader skills and resources • Tax advantages LO 1 Corporation • A separate legal entity • Easier to transfer ownership Shares of stock are easy to sell on an organized stock exchange • Easier for corporations to raise funds Individuals can become stockholders by investing relatively small amounts of money • No personal liability • Income taxes are higher than proprietorships and partnerships LO 1 More About Corporations • Stock is traded on an organized stock exchanges Such as the New York Stock Exchange • Majority of U.S. business is done by corporations Number of total proprietorships and partnerships exceeds the number of corporations Revenue produced by corporations is many times greater than other forms of organization LO 1 Hybrid Forms of Organization • Are now allowed in all states • Combine the tax advantages of partnerships with the limited liability of corporations • Most common hybrid types o Limited liability companies (LLCs) o Subchapter S corporations LO 1 Users and Uses of Financial Information • Purpose of financial information To provide inputs for decision-making • Accounting The information system that identifies, records, and communicates the economic events of an organization to interested users Users of accounting information Internal users External users LO 1 Internal Users • Managers who plan, organize, and run a business • Questions asked by internal users LO 1 Accounting Across the Organization: Clif Bar & Company Owning a Piece of the Bar The original Clif Bar® energy bar was created in 1990, after six months of experimentation by Gary Erickson and his mother in her kitchen. Today, the company has approximately 1,000 employees and was named one of Landor’s Breakaway Brands®. One of Clif Bar & Company’s proudest moments was the creation of an employee stock ownership plan (ESOP). This plan gives its employees 20% ownership of the company. The ESOP also resulted in Clif Bar enacting an open-book management program, including the commitment to educate all employeeowners about its finances. Armed with basic accounting knowledge, employees are more aware of the financial impact of their actions, which leads to better decisions. LO 1 External Users • Investors (owners): buy, hold, or sell stock • Creditors: risk of selling on credit or lending money • Taxing authorities, such as the Internal Revenue Service • Customers: product warranties • Labor unions • Regulatory agencies LO 1 Questions Asked by External Users LO 1 Data Analytics • Analyzing data, often employing both software and statistics, to draw inferences • Common at virtually all types of companies • Collects data about a company’s economic events as well as its suppliers and customers • Helps answer questions such as What happened and why did it happen? What is likely to happen? What should we do about it? LO 1 Four Types of Data Analytics LO 1 Data Analytics Insight Netflix Using Data Science to Create Art Technology provides decision-makers and problem-solvers with access to a large volume of information called “big data.” And Netflix, the world’s leading subscription streaming entertainment service, is tapping into this big data as part of its efforts to ramp up its original content production. In a recent year, Netflix planned to spend $8 billion on content creation. Producing content involves a blend of creativity, technology, and business decisions, all of which result in costs. And by analyzing the large amounts of data from past productions, such as filming locations and production schedules Netflix can more precisely estimate costs for future productions. Further, consider that the production of a TV show or film involves hundreds of tasks. Here again, Netflix uses data science, in this case to visualize where bottlenecks might occur or where opportunities might exist to increase the efficiency of the production process. Source: Ritwik Kumar et. al., “Data Science and the Art of Producing Entertainment at Netflix,” The Netflix Tech Blog (March 26, 2018). LO 1 Ethics in Financial Reporting • Financial scandals such as Enron, WorldCom, HealthSouth, and AIG Led to a mistrust of financial reporting • Congress passed Sarbanes-Oxley Act (SOX) To reduce unethical corporate behavior To decrease the likelihood of future corporate scandals LO 1 Sarbanes-Oxley Act (SOX) • Top management certifies the fairness of financial information • Increased penalties for fraudulent financial activity • Increased the independence of the outside auditors who review the accuracy of corporate financial statements • Increased the oversight role of boards of directors LO 1 Solving an Ethical Dilemma: Step 1 • Recognize an ethical situation and the ethical issues involved Use your personal ethics to identify ethical situations and issues • Some businesses and professional organizations provide written codes of ethics for guidance in some business situations LO 1 Solving an Ethical Dilemma: Step 2 • Identify and analyze the principal elements in the situation. Identify the stakeholders who may be harmed or may benefit Ask the question: What are the responsibilities and obligations of the parties involved? LO 1 Solving an Ethical Dilemma: Step 3 • Identify the alternatives and weigh the impact of each alternative on various stakeholders. Select the most ethical alternative, considering all the consequences. Some situations involve a single correct answer • Some involve more than one right solution; these situations require you to evaluate each alternative and select the best one. LO 1 Ethics Insight: Dewey & LeBoeuf LLP “I Felt the Pressure”—Would You? “I felt the pressure.” That’s what some of the employees of the now-defunct law firm of Dewey & LeBoeuf LLP said after they helped to overstate revenue and use accounting tricks to hide losses and cover up cash shortages. These employees worked for the former finance director and former chief financial officer (CFO) of the firm. Here are some of their comments: • “I was instructed by the CFO to create invoices, knowing they would not be sent to clients. When I created these invoices, I knew that it was inappropriate.” • “I intentionally gave the auditors incorrect information in the course of the audit.” • What happened here is that a small group of lower-level employees over a period of years carried out the instructions of their bosses. Their bosses, however, seemed to have no concern about unethical practices as evidenced by various emails with one another in which they referred to their financial manipulations as accounting tricks, cooking the books, and fake income. Sources: Ashby Jones, “Guilty Pleas of Dewey Staff Detail the Alleged Fraud,” Wall Street Journal (March 28, 2014); and Sara Randazzo, “Dewey CFO Escapes Jail Time in Fraud Case Sentencing,” Wall Street Journal (October 10, 2017). LO 1 Knowledge Check: Organization Forms Identify each of the following organizational characteristics with the organizational form or forms (sole proprietorship, partnership, corporation) with which it is associated. 1. Easier to raise funds Corporation 2. Simple to establish Sole proprietorship; partnership 3. No personal legal liability 4. Tax advantages Corporation Sole proprietorship; partnership 5. Easier to transfer ownership Corporation LO 1 Knowledge Check: Users of Financial Information Which of the following consists of external users? a. Managers and creditors b. Investors and regulatory agencies c. Employees and investors d. Creditors and employees LO 1 Knowledge Check: Users of Financial Information Answer Which of the following consists of external users? a. Managers and creditors b. Answer: Investors and regulatory agencies c. Employees and investors d. Creditors and employees LO 1 Test Your Vocabulary: Flashcards and Crossword Puzzles Have some fun! Try out the vocabulary Flashcards and Crossword Puzzles available in your Wiley Course Resources. LO 4 Learning Objective 2 Explain the Three Principal Types of Business Activity LO 2 Three Types of Business Activity • Financing activities Raising money through outside sources • Investing activities Purchasing resources a company needs in order to operate • Operating activities Performing the day-to-day actions to produce and sell a product or provide a service LO 2 Financing Activities - Borrowing • Debt financing Borrowing money… … to creating a liability • Creditors Are the party to whom amounts are owed • Liabilities Amounts that are owed Notes payable – money borrowed as a loan Bonds payable – debt securities sold to investors LO 2 Financing Activities – Issuing Stock • Equity financing Issuing (selling) shares of stock for cash • Common stock The amount paid by stockholders for shares they purchase • Dividends Payments to stockholders LO 2 How Claims of Creditors and Stockholders Differ Creditors Stockholders • Loan money to a company • Owners of the company • Legal right to be paid • No claim to corporate cash until creditors’ claims are paid • May legally force the corporation to sell assets to pay its debt LO 2 Investing Activities • Purchase of resources a company needs in order to operate • Assets Resources owned by a business • Property, plant, and equipment • Includes computers, delivery trucks, furniture, buildings • Cash • Investments in securities • Stocks or bonds of other companies LO 2 Operating Activities • Activities that involve the day-to-day actions to produce and sell a product, or provide a service • Occur after a business obtains financing and invests in assets required for operation • Result in Revenue • Amounts generated from the sale of goods or performance of services Expenses • Costs consumed or services used in the process of generating revenue LO 2 Operating Activities - Revenue • The increase in assets or decrease in liabilities resulting from the sale of goods or the performance of services in the normal course of business • Arises from different sources • Identified by various names depending on the nature of the business • Common sources of revenue o Sales revenue o Service revenue o Interest revenue LO 2 Operating Activities – Assets with Shorter Lives • Result from operating activities Supplies • Assets used in day-to-day operations rather than sold to customers Inventory • Goods available for sale to customers Accounts receivable • Right to receive money in the future from a customer as the result of a sale LO 2 Operating Activities - Expenses • Are the cost of assets consumed or services used in the process of generating revenues • Common expenses Cost of goods sold Selling expenses Marketing expenses Administrative expenses Interest expense Income taxes expense LO 2 Operating Activities - Liabilities • Often arising from expenses Accounts payable • Goods purchased on credit from suppliers Interest payable • On outstanding amounts owed to the bank Wages payable • Amounts owed to employees • Sales taxes payable, property taxes payable, and income taxes payable owed to the government LO 2 Operating Activities – Net Income or Loss • Compare revenues with expenses for the period • Results in the profit for the period • Net income Exists when revenues exceed expenses • Net loss Exists when expenses exceed revenues LO 2 Concept Check: Business Activities Classify each activity as operating, investing or financing. 1. Performing a service for a customer Operating 2. Issuing shares of stock in exchange for cash Financing 3. Purchasing equipment used in operations Investing 4. Borrowing cash from a bank Financing 5. Selling goods to a customer Operating LO 2 Concept Check: Classifying Items Classify each item as an asset, liability, common stock, revenue, or expense. 1. Cost of electric bill Expense 2. Computers purchased Asset 3. Notes payable Liability 4. Issuance of ownership shares Common stock 5. Amount recorded from performing services Revenue 6. Amounts owed to suppliers Liability 7. Cash Asset LO 2 Learning Objective 3 Describe the Four Financial Statements and How They Are Prepared LO 3 The Four Financial Statements • Income statement Success of the business during a period of time • Retained earnings statement How much income was distributed to owners and how much was retained • Balance sheet A picture at a point in time of what a business owns and what it owes Statement of cash flows Where a business obtained cash during a period of time and how that cash was used LO 3 Income Statement • Are the company’s operations profitable? Past net income provides information for predicting future earnings • Lists the company’s revenues followed by its expenses for a specific period, for example a month • Net income results when revenues exceed expenses • Net loss results when expenses exceed revenues LO 3 Income Statement Presentation LO 3 Importance of Income Statement to Financial Statement Users • Investors Buy and sell stock based on their beliefs about a company’s future performance • Creditors Predict whether the company will be profitable enough to repay amounts owed LO 3 Knowledge Check: Determining Net Income Tua Corporation began operations on January 1, 2025. The following information is available for Tua on December 31, 2025: Accounts receivable Supplies expense Equipment Rent expense Dividends Service revenue Supplies Determine net income for 2025. $ 1,100 2,500 12,900 7,000 2,200 23,000 2,000 Retained earnings Accounts payable Cash Insurance expense Notes payable Common stock Salaries expense Revenues Expenses ($2,500 + $7,000 + $800 + $7,200) Net Income $ 0 1,400 2,400 800 5,700 8,000 7,200 $23,000 17,500 $ 5,500 LO 3 Retained Earnings Statement • Amounts and causes of changes in retained earnings for a specific time period • Net income increases retained earnings • Net loss decreases retained earnings • Dividends Decrease retained earnings Represent the portion of net income distributed to owners • Retained earnings ending balance Represents cumulative net income retained to allow for further expansion LO 3 Importance of the Retained Earnings Statement to Financial Statement Users • Shows investors a company’s dividend payment practices • Enables investors to determine the portion of earnings reinvested (retained) to increase growth • Allows lenders to monitor their corporate customers’ dividend payments Dividends use cash that could reduce their ability to repay debts LO 3 Retained Earnings Statement Illustrated • Time period is the same as income statement • Enables users to evaluate dividend payment practices LO 3 Knowledge Check: Determining Retained Earnings Tua Corporation began operations on January 1, 2025. The following information is available for Tua on December 31, 2025: Accounts receivable $ 1,100 Accounts payable Equipment 12,900 Cash $1,400 2,400 Dividends 2,200 Notes payable 5,700 Supplies 2,000 Common stock 8,000 0 Net income Retained earnings, December 1 5,500 $ Retained earnings Prepare a retained earnings statement (omit heading). Add: Net income 0 5,500 5,500 Less: Dividends Retained earnings, December 31 2,200 $3,300 LO 3 Balance Sheet • Assets and claims to assets at a specific time • Subdivides claims to assets into two categories Claims of creditors (liabilities) Claims of owners (stockholders’ equity) • Based upon the basic accounting equation • Lists assets first, followed by liabilities and stockholders’ equity LO 3 Components of the Balance Sheet • Assets Listed in order of liquidity, how quickly they can be converted to cash • Liabilities • Stockholders’ equity Separated into two components • Common stock • Results when the company sells new shares of stock • Retained earnings • Is the net income retained in the corporation LO 3 Importance of the Balance Sheet to Financial Statement Users Financial statements are used • To determine the likelihood the company will repay debt • To evaluate the nature of the company’s assets and liabilities • To determine whether cash on hand is sufficient • To evaluate the relationship between debt and stockholders’ equity LO 3 Balance Sheet Illustrated LO 3 Knowledge Check: Calculate Total Assets Tua Corporation began operations on January 1, 2025. The following information is available for Tua on December 31, 2025: Accounts receivable $ 1,100 Accounts payable $1,400 Equipment 12,900 Cash 2,400 Dividends 2,200 Notes payable 5,700 Supplies 2,000 Common stock 8,000 Retained earnings, Dec. 31 3,300 Net income 5,500 Cash Calculate total assets. $ 2,400 Accounts receivable 1,100 Supplies 2,000 Equipment Total assets 12,900 $18,400 LO 3 Knowledge Check: Calculate Total Liabilities Tua Corporation began operations on January 1, 2025. The following information is available for Tua on December 31, 2025: Accounts receivable $ 1,100 Accounts payable $1,400 Equipment 12,900 Cash 2,400 Dividends 2,200 Notes payable 5,700 Supplies 2,000 Common stock 8,000 Retained earnings, Dec. 31 3,300 Net income 5,500 Calculate total liabilities. Accounts payable Notes payable Total liabilities $1,400 5,700 $7,100 LO 3 Knowledge Check: Calculate Stockholders’ Equity Tua Corporation began operations on January 1, 2025. The following information is available for Tua on December 31, 2025: Accounts receivable $ 1,100 Accounts payable $1,400 Equipment 12,900 Cash 2,400 Dividends 2,200 Notes payable 5,700 Supplies 2,000 Common stock 8,000 Retained earnings, Dec. 31 3,300 Net income 5,500 Calculate stockholders’ equity. Common stock Retained earnings Total stockholders’ equity $ 8,000 3,300 $11,300 LO 3 Statement of Cash Flows • Provides financial information about the cash receipts and payments for a specific period of time • Reports the cash effects of a company’s operating, investing, and financing activities • Shows the net increase or decrease in cash during the period, and the amount of cash at the end of the period Cash is a company’s most important asset. LO 3 Importance of the Statement of Cash Flows to Financial Statement Users • Does the company generate enough cash from operations to fund its investing activities? • Provides answers to Where did cash come from during the period? How was cash used during the period? What was the change in the cash balance during the period? LO 3 Statement of Cash Flows Illustrated LO 3 People, Planet, and Profit Insight Beyond Financial Statements Columbia Sportswear doesn’t just focus on financial success. Several of its factories continue to participate in a project to increase health awareness of female factory workers in developing countries. Columbia is also a founding member of the Sustainable Apparel Coalition, which strives to reduce the environmental and social impact of the apparel industry. In addition, the company monitors all the independent factories that produce its products to ensure that they comply with the company’s Standards of Manufacturing Practices. These standards address such issues as forced labor, child labor, harassment, wages and benefits, health and safety, and the environment. With that in mind, should we expand our financial statements to take into account ecological and social performance, in addition to financial results, in evaluating a company? The idea is that a company’s responsibility lies with anyone who is influenced by its actions. In other words, a company should be interested in benefiting many different parties, instead of only maximizing stockholders’ interests. A socially responsible business does not exploit or endanger any group of individuals. It follows fair trade practices, provides safe environments for workers, and bears responsibility for environmental damage. Measurement of these factors is difficult, but many interesting and useful efforts are underway. LO 3 Interrelationships of Statements • The retained earnings statement shows net income amount from the income statement • The ending balance of retained earnings is reported on the balance sheet in the stockholders’ equity section • The cash balance on the balance sheet also appears on the statement of cash flows LO 3 Interrelationship of Income Statement to the Retained Earnings Statement LO 3 Interrelationship of Retained Earnings Statement to the Balance Sheet Ending balance in retained earnings is needed in preparing the balance sheet. LO 3 Interrelationship of Balance Sheet with the Statement of Cash Flows The cash amount on the balance sheet equals the end of period cash reported on the statement of cash flows. LO 3 Knowledge Check: Part 1 Use Accounting Equation At June 1, WestCo had total assets of $40,000 and total liabilities of $15,000. 1. If total assets increased $12,000 in June and total liabilities decreased $5,000, what is the amount of stockholders’ equity at June 30? Assets, June 30 = $40,000 + $12,000 = $52,000 Liabilities, June 30 = $15,000 − $5,000 = $10,000 Stockholders’ equity, June 30 = $52,000 − $10,000 = $42,000 LO 3 Knowledge Check: Part 2 Use Accounting Equation At June 1, WestCo had total assets of $40,000 and total liabilities of $15,000. 2. During the year, total liabilities decreased $3,000 and stockholders’ equity increased $4,000 in June. What is the amount of total assets at June 30? Liabilities, June 30 = $15,000 − $3,000 = $12,000 Stockholders’ equity, June 1 = $40,000 − $15,000 = $25,000 Stockholders’ equity, June 30 = $25,000 + $4,000 = $29,000 Assets, June 30 = $12,000 + $29,000 = $41,000 LO 3 Knowledge Check: Net Income Net income will result during a time period when a. assets exceed liabilities. b. assets exceed revenues. c. expenses exceed revenues. d. revenues exceed expenses. LO 3 Knowledge Check: Net Income Answer Net income will result during a time period when a. assets exceed liabilities. b. assets exceed revenues. c. expenses exceed revenues. d. Answer: revenues exceed expenses. LO 3 Knowledge Check: Financial Statements Which of the following financial statements is prepared as of a specific point in time? a. Balance sheet b. Income statement c. Retained earnings statement d. Statement of cash flows LO 3 Knowledge Check: Financial Statements Answer Which of the following financial statements is prepared as of a specific point in time? a. Answer: Balance sheet b. Income statement c. Retained earnings statement d. Statement of cash flows LO 3 Elements of an Annual Report Publicly traded U.S. companies must provide shareholders with an annual report. • Aids users in performing a complete financial analysis • Report elements Financial statements Management discussion and analysis Notes to the financial statements Independent auditor's report LO 3 Management Discussion and Analysis Presents management’s view on the company’s • Ability to pay near-term obligations • Ability to fund operations and expansion • Results of operations Consists of Often called MD&A • Highlights by management of favorable or unfavorable trends • Significant events and uncertainties that affect management’s views LO 3 Management Discussion and Analysis Example Columbia Sportswear Company Management’s Discussion and Analysis of Seasonality and Variability of Business Our business is affected by the general seasonal trends common to the industry, including discretionary consumer shopping and spending patterns, as well as seasonal weather. Our products are marketed on a seasonal basis, and our sales are weighted substantially toward the third and fourth quarters, while our operating costs are more equally distributed throughout the year. LO 3 Notes to the Financial Statements • An integral part of the statements • Clarify and provide additional detail • Essential to understanding a company’s operating performance and financial position • Examples Descriptions of the significant accounting policies and methods used in preparing the statements Explanations of uncertainties and contingencies LO 3 Notes to the Financial Statements Example Columbia Sportswear Company Notes to Financial Statements Revenue Recognition Revenues are recognized when our performance obligations are satisfied as evidenced by transfer of control of promised goods to our customers, in an amount that reflects the consideration we expect to be entitled to receive in exchanges for those goods or services. Within our wholesale channel, control generally transfers to the customer upon shipment to, or upon receipt by, the customer depending on the terms of sale with the customer. Within our DTC channel, control generally transfers to the customer at the time of sale within our retail stores and concession-based arrangements and upon shipment to the customer with respect to e-commerce transactions. LO 3 Auditor’s Report • Prepared by an independent outside auditor Audits performed only be certified public accountants (CPAs) Unqualified opinion • Presents an opinion that the auditor is satisfied that the financial statements provide a fair presentation of the financial position and results of operations and their conformance with generally accepted accounting principles • Includes critical audit matters • Items that are material in size that involve complex judgment LO 3 Auditor’s Report Example Columbia Sportswear Company Excerpt from Auditor’s Report We have audited the accompanying consolidated balance sheets of Columbia Sportswear Company and subsidiaries (the “Company”) as of December 31, 2019 and 2018, the related consolidated statements of operations, comprehensive income, equity, and cash flows for each of the three years in the period ended December 31, 2019, and the related notes and schedule listed in the Index at Item 15 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2019 and 2018, and the results of its operations and its cash flows for each of the three years ended December 31, 2019, in conformity with accounting principles generally accepted in the United States of America. LO 3 Accounting Across the Organization Spinning the Career Wheel How will the study of accounting help you? A working knowledge of accounting is desirable for virtually every field of business. Some examples of how accounting is used in business careers include the following. General management: Managers of Harley-Davidson, a Qdoba franchise, and a Trek bike shop all need to understand accounting data in order to make wise business decisions. Marketing: Marketing specialists at Hulu must be sensitive to costs and benefits to ensure that marketing efforts increase company profits. Finance: Do you want to work for Robinhood, E-Trade, or Goldman Sachs? Financial fields rely heavily on accounting knowledge to analyze financial statements. In fact, it is difficult to get a good job in a finance function without two or three courses in accounting. Real estate: Because a third party—the bank—is almost always involved in financing a real estate transaction, brokers at Prudential Real Estate must understand the numbers involved. Accounting: Certified public accountants (CPAs) examine (audit) the financial statements and issue opinions on the accuracy of the financial presentation. Some CPAs offer tax advice and planning. Others work for for-profit companies such as Starbucks or Google, or for non-profit entities such as the Red Cross, where they manage the accounting information systems and prepare financial statements. Opportunities also exist in government, including the Federal Bureau of Investigation (FBI). Finally, forensic accountants conduct investigations into theft and fraud. LO 3 Knowledge Check: Components of Annual Report State whether each of the following items is most closely associated with the management discussion and analysis (MD&A), the notes to the financial statements, or the auditor’s report. 1. View on the ability to pay near-term obligations MD&A 2. Explanation of uncertainties Notes 3. Unqualified opinion Auditor’s report 4. Ability to fund operations MD&A 5. Certified public accountant (CPA) Auditor’s report 6. Descriptions of significant accounting policies Notes LO 3 Knowledge Check: Annual Report Identify the area of the annual report each of the following items would be presented. If likely not found in an annual report, state as None. 1. Total cash received from customers Financial statements 2. Management’s assessment of the company’s results of operations MD&A 3. Total paid to stockholders during the year Financial statements 4. An independent assessment of whether the financial statements present a fair representation of the company’s results and financial position Auditor’s opinion 5. Explanations of uncertainties Notes to financial statements LO 3 Learning Objective 4 Appendix A Explain the Career Opportunities in Accounting LO 4 Why is Accounting A Popular Career Choice? • There are a lot of jobs • Accounting matters • Sarbanes-Oxley Act significantly increased the accounting and internal control requirements for corporations • Emerging technologies such as automation, blockchain, and data analytics are changing the way accountants work LO 4 Career Options: Public Accounting Type of Work • Auditing • Accountants audit the financial statements and issue opinions on the fairness of the financial presentation • Taxation • CPAs offer tax advice and planning • Management consulting • Accountants design and install accounting software and enterprise resource planning systems and support mergers and acquisitions Examples of Employers Certification Opportunities Deloitte, EY, KPMG, PwC, Grant Thornton, BDO, Baker Tilly Certified public accountants (CPAs), Enrolled agent (EA), Certified information systems auditor (CISA) LO 4 Career Options: Private Accounting Type of Work • Financial accountants manage the accounting information system and prepare financial statements • Managerial accountants manage costs and budgets • Internal auditors ensure compliance with policies and regulations Examples of Employers Certification Opportunities For-profit: Starbucks, Google, Under Armour Certified management accountant (CMA), Certified internal Non-profit: auditor (CIA) Salvation Army, Red Cross LO 4 Career Options: Governmental and Forensic Accounting Type of Work Examples of Employers Governmental Internal Revenue Service (IRS) • There are opportunities in government at the local, state, and federal levels Forensic accounting • Accountants conduct investigations into theft and fraud Certification Opportunities Certified government financial manager (CGFM) Federal Bureau of Investigation (FBI) Insurance companies, Certified fraud law firms, FBI examiner (CFE) LO 4 Show Me the Money Jobs in Public and Private Accounting Average salary estimates Employer Jr. Level (0-3 yrs.) Sr. Level (4-6 yrs.) Public accounting (large firm) $63,250–$83,250 $78,500–$106,500 Public accounting (medium firm $56,500–$67,750 $70,500–$96,000 Public accounting (small company) $51,500–$60,500 $63,750–$81,500 Corporate accounting (large company) $53,750–$69,500 $68,750–$87,750 Source: See www.startheregoplaces.com/students/why-accounting/salary-and-demand/ for information regarding the salaries listed. LO 4 Show Me the Money Upper-Level Management in Corporate Accounting Average salary estimates Large Company Small to Medium Company Chief financial officer $207,000–$465,750 $105,250–$208,750 Corporate controller $140,000–$224,750 $92,000–$161,250 Tax manager $112,000–$158,250 $88,000–$124,750 Position Source: See www.startheregoplaces.com/students/why-accounting/salary-and-demand/ for information regarding the salaries listed. LO 4 Knowledge Check: Career Options Which of the following may increase a starting salary about 10 to 15% more in a public accounting firm above the averages given in the chapter? a. A CMA license b. A professional resume c. A CPA license d. Professional interviewing 4 Knowledge Check: Career Options Answer Which of the following may increase a starting salary about 10 to 15% more in a public accounting firm above the averages given in the chapter? a. A CMA license b. A professional resume c. Answer: A CPA license d. Professional interviewing 4 Copyright Copyright © 2022 John Wiley & Sons, Inc. All rights reserved. Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein. 92