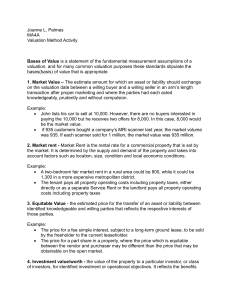

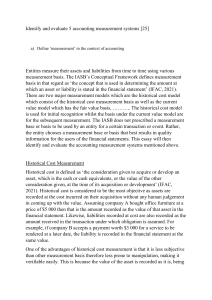

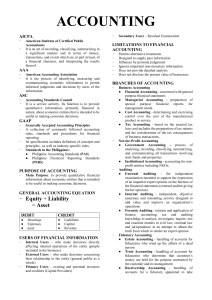

INTERPRETING DIFFERENT CONCEPTS OF VALUATION The value of a business can be basically linked to three major factors: • • • Current Operations Future Prospects Embedded Risk The definition of value may also vary depending on the context and objective of the valuation exercise. • • • • Intrinsic Value – refers to the perceived or calculated value of an asset, investment, or entity based on its fundamental characteristics and inherent attributes. Going Concern Value – refers to the value of a business entity as an ongoing, operational concern rather than as a sum of its individual assets. It reflects the idea that a business has the potential to continue its operation and generate profits into the foreseeable future. Liquidation Value – refers to the estimated value of an asset or a company’s assets when they are sold quickly. Fair Market Value – is the estimated price at which an asset would change hands between a willing buyer and a willing seller, in which both have reasonable knowledge of the relevant facts and neither of whom is under any compulsion to buy or sell.