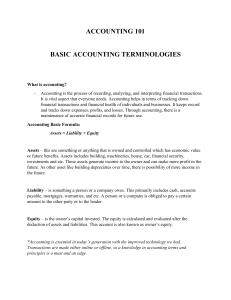

ACCOUNTING − AICPA − − American Institute of Certified Public Accountants It is an art of recording, classifying, summarizing in a significant manner and in terms of money, transactions, and events which are, in part at least, of a financial character, and interpreting the results thereof. AAA − − American Accounting Association It is the process of identifying, measuring and communicating economic information to permit informed judgments and decisions by users of the information. LIMITATIONS TO FINANCIAL ACCOUNTING − − − − − − − Accounting Standards Council It is a service activity. Its function is to provide quantitative information, primarily financial in nature, about economic entities that is intended to be useful in making economic decisions. GAAP − − − − Generally Accepted Accounting Principles A collection of commonly followed accounting rules, standards and procedures for financial reporting. Its specification includes definition of concepts and principles , as well as industry-specific rules. Standards in the Philippines: ● Philippine Accounting Standards (PAS) ● Philippine Financial Reporting Standards (PFRS) PURPOSE OF ACCOUNTING − − − Main Purpose: to provide quantitative financial information about economic entities that is intended to be useful in making economic decisions. GENERAL ACCOUNTING EQUATION − Equity + Liability = Asset DEBIT CREDIT ● ● ● ● ● ● Drawings Expenses asset Liabilities Capital Revenue USERS OF FINANCIAL INFORMATION − − − Internal Users – who make decisions directly affecting internal operations of the entity (people included in the business) External Users – who make decisions concerning their relationship to the entity (general public as a whole) Primary Users – existing and potential investors and creditors (Capital Providers) Permits alternative treatments Designed to supply past information Influence by personal judgement Ignores important non-monetary information Does not provide detailed analysis Does not disclose the present value of businesses BRANCHES OF ACCOUNTING ASC − − Secondary Users – Residual Enumeration − Business Accounting ● Financial Accounting - concerned with general purpose financial statements ● Managerial Accounting - preparation of special purpose financial reports for management needs. ● Cost Accounting - determining and exercising control over the cost of the manufactured product or service ● Tax Accounting - based on the enacted tax laws and includes the preparation of tax returns and the consideration of the tax consequences of business transactions. Not-for-Profit Accounting ● Government Accounting - process of analyzing, recording, classifying, summarizing, and communicating all transactions involving state funds and properties ● Institutional Accounting - accounting for nonprofit entities including NGOs. Auditing ● External Auditing - the independent examination intended to support the expression of an impartial expert opinion on the fairness of the financial statements (external auditor giving his/her opinion) ● Internal Auditing - independent, objective assurance and consulting activity designed to add value and improve an organization’s operations ● Forensic Auditing - relation and application of finance, accounting, tax and auditing knowledge to analyze, investigate, inquire, test and examine matters in civil law, criminal law and jurisprudence in an attempt to obtain the truth from which to render an expert opinion Fiduciary Accounting ● Estate Accounting - handling of accounts for fiduciaries who wind up the affairs of a dead person ● Trust Accounting - handling of accounts for fiduciaries who determine that customer’s money are held for the purpose contracted by the customer and its management ● Receivership Accounting - handling of accounts for a fiduciary appointed to take charge of a financially unstable business pending its disposition or the attainment of an imposed objective ● FORMS OF BUSINESS ORGANIZATIONS − − − Sole Proprietorship ● The simplest business form under which one can operate a business. It is not a legal entity. It refers to a person who owns the business and is personally responsible for its debts. ● Advantages: → easy to start up and organize → few legal restrictions → full autonomy as to the business → easy to discontinue or dissolve only owner is taxed → owner gets all the profits ● Disadvantages: → unlimited liability → owner bears all responsibility → owner bears all losses → less source of capital Partnership ● By contract, two or more persons bind themselves to contribute money, property or industry to a common fund with the intention of dividing the profit among themselves ● General Professional Partnership – compose of professionals who want to practice their profession or who want to make their profession available to the public ● Advantages: → greater source of capital → specialization of managerial skills → few legal restrictions → tax on individual partner ● Disadvantages: → difficult to start up and organize → restricted transfer of ownership → unlimited liability → partner’s action can legally bind the business → partnership agreement may cause dissolution → double taxation (national revenue code: also tax the distributive share of the partner) Corporation ● An artificial being created by operation of law, having the right of succession and the powers, attributes and properties expressly authorized by law or incident to its existence ● Existence: should be register to the Security and Exchange Commission and should have an issue of the articles of incorporation, certification of incorporations and by laws ● Advantages: → ownership is easily transferable → limited liability → greater source of capital → specialization of managerial skills Disadvantages: → difficult to organize → moral legal restriction → higher tax → double taxation → little control over management → more government controls TYPES OF BUSINESS ACTIVITIES − − − Service Firms – those that perform/rendered services for a fee Merchandising Firms – those that will buy and sell merchandise or goods that are in salable for to its customers Manufacturing Firms – those that buy raw materials, convert them into finished goods and sell the manufactured products to other companies or individual HISTORICAL DEVELOPMENTS − − − − − − − Classical Notion of Stewardship – God provided all the things in the world and it is the duty of man to take care of it and to account for this blessings ● Stewardship of Management – the management has the duty to account and make financial statements for the funds, assets that are provided by the capital providers to the company Florentine Approach – It was created in 14th century by Amanito Manucci, It is a recording system (journal entries) Venetian Approach – debits and credits was first used by the Venetian merchants in Italy in the 15th century. (general ledger) Savary Commercial Code – provides historical cost Napoleon Commercial Code – provides current cost or fair market value Schamalenbach – made the chart of accounts in order to uniform accounting in all jurisdictions Luca Pacioli – the Father of Accounting RA 9298 – PHILPPINE ACCOUNTACY ACT OF 2004 − Serves as the regulating law for the certified public accountants (CPAs) in the Philippines 1. The scope of the profession’s practice 2. The creation of the Regulatory Body for CPAs known as the Professional Regulatory Board of Accountancy (BOA) 3. The admittance and licensure of qualified candidates for the CPA profession 4. The guiding rules and law in the practice of accountancy which includes prohibitions, 5. limitations, accreditations and the continuing professional education (CPE) The Penal and Final provisions PURPOSES OF THE FRAMEWORK − Assist the FRSC in the development of future FRS and in its review of existing PAS * CPD POINTS of CPAs are about 120 units in 3 years * Attends Seminars − Assist prepares of financial statements in applying FIELDS OF SPECIALIZATION − − − − − Public Practice Commerce and Industry Government Education ACCOUNTING STANDARDS SETTING BODIES − − − Financial Reporting Standards Council (FRSC) – successor of the Accounting Standards Council whose main function is to establish GAAP. FRSC was establish by the Board of Accountancy (BOA). It monitors the technical activities of the IASB and issue invitations to comment on exposure drafts of proposed IFRS and IFRIC. Accounting Standards Council (ASC) – created by the Philippine Institute of Certified Public Accountants to establish GAAP. International Accounting Standards Board (IASB) – sole responsibility for setting International Financial Reporting Standards. CONCEPTUAL FRAMEWORK − The framework sets out the concepts that underlie − − − − the preparation and presentation of financial statements for external users. It is an attempt to provide an overall theoretical foundation for accounting It is not a Philippine Financial Reporting Standard hence it does not define standards for any particular measurement or disclosure issue In cases of conflict, PFRS will prevail over the framework The management is not mandated to automatically apply the conceptual framework; it is directed to consider the applicability of the conceptual framework HIERARCHY GUIDE − The Accounting Standards (PFRS, PAS) − In the absence of standards, the preparer will use judgement and shall consider the following: 1. Requirement in other PFRS dealing with similar transactions 2. Conceptual Framework 3. Management may consider the following: → Pronouncement issued by other standard setting bodies → Other accounting literature and industry practices − − PFRS and in dealing with topics that have not yet to form the subject of the PFRS Assist auditors in forming an opinion as to whether financial statements conform with the PFRS Assist uses of financial information in interpreting the information contained in financial statements prepared in conformity with PFRS Provide those who are interested in the work of FRSC with information about its approach to the formulation of PFRS PERVASIVE CONSTRAINTS − − Materiality – information is material if its omission or misstatement could influence the decisions that users make on the basis of an entity’s financial information Cost-benefit Analysis – the benefits of providing the financial reporting information should justify the cost of providing that information QUALITATIVE CHARACTERISTIC − − Are attributes that make the information provided in financial statements useful to users There are kinds of qualitative characteristics: ● Fundamental (RFP) – more on the content → Relevance – to be useful, information must be relevant to the decision-making needs of the users ▪ Predictive Value – must influence the economic decisions of users by helping them evaluate past, present and future events. ▪ Confirmatory Value – must influence the economic decisions of users by helping them confirm or correct past evaluations. → Faithful Representation – implies that financial information represent faithfully the economic phenomenon that is purports to represent or could reasonably be expected to represent ▪ Completeness – relevant information should be presented in a way that facilitates understanding and avoids erroneous implications. o Standard of Adequate Disclosure – all significant and relevant information leading to the preparation of financial statements shall be clearly reported. ▪ Neutrality – a neutral depiction is without bias in the preparation of financial information ▪ ● Free from Error – there are no material errors or omissions in the description of the phenomenon or transaction * Substance over Form – information is to represent faithfully the transactions and other events it purpose is to represent, it is necessary that the transactions and events are accounted in accordance with their substance and reality and not merely their legal form * Conservatism or Prudence – when alternatives exist, the alternative, which has the least favorable effect on equity, should be chosen. Is the inclusion of a degree of caution in the exercise of judgement needed in making the estimates required under conditions of uncertainty. Enhancing (VCUT) – how the content are presented to the users → Comparability – refers to the ability to identify similarities and differences between two sets of economic phenomena ▪ Consistency – use of the same accounting policies and procedures within an entity from period to period, or a single period across entities. ▪ Intra-comparability/ Horizontal Comparability – must be able to compare the financial statement of an entity through time in order to identify trends in financial position and performance. ▪ Inter-comparability/ Dimensional Comparability – in a single period, must be able to compare the financial statement of different entities in order to evaluate their relative financial position and performance → Timeliness – information must be available when the users’ needs it. → Understandability – able users to comprehend the information’s meaning and likewise enables users who have reasonable knowledge of business and economic and financial diligence to comprehend the information. → Verifiability – implies that knowledge and independent observers could reach a general consensus that the information does represent faithfully the economic phenomena it supposed to represent UNDERLYING ASSUMPTIONS / POSTULATE − A basic notion that serves as the understructure of accounting in order to prevent misunderstanding of the use of the financial statements − − − − − − Going Concern – financial statements are normally prepared on the assumption that the entity will continue in operation for the foreseeable future. Economic Entity Assumption – assumes that the entity is separate and distinct from the owners or other business units. Monetary Unit Assumption – transactions in. the Philippines are measured and reported in Philippine Peso ● Quantifiability – the accounts should be stated in terms of a unit of measure ● Stability of the Peso – the purchasing power of the peso is stable or constant Periodicity Assumption – the life of an entity can be divided into time period for the purpose of providing periodic reports ● 1 month (monthly basis) ● 3 months (quarterly basis) ● 6 months (semi-annual basis) ● 12 months (annual basis) ● Calendar year - Jan. 1 to dec. 31 ● Fiscal year - the period will begin ● on the 1st day of any month of the year except January and will end on the last day of the twelfth month completing the one year period. ● Natural business year - it is a twelve-month period that ends on any month when the business month is at the lowest or experiencing slack season. Accrual Accounting – assumes that an income is earned regardless of when cash is received; and an expense is incurred regardless of when cash is paid. Cash Basis – only recognized income/ expense if there is cash received or cash paid FINANCIAL STATEMENTS − − − − − Statement of Financial Position Statement of Financial Performance Statement of Owner’s Equity Statement of Cash Flows Notes to Financial Statements – provide details of the amounts in the financial statements and also includes the policies that the company follows ELEMENTS OF THE FINANCIAL STATEMENTS − − − Asset – the resources controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity Liability – financial obligations of an entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits. Equity – residual interest in the assets of an entity after deducting all its liabilities. In other words, whatever is left, that belongs to the owner of a business − − Income – the increase in economic benefit during the accounting period in the form of inflow or increase in asset or decrease in liability that results in increase in equity, other than contribution from equity participants Expense – the decrease in economic benefit during the accounting period in the form of outflow or decrease in asset or increase in liability that results in decrease in equity, other than distribution to equity participants RECOGNITION AND DERECOGNITION − − − Recognition – process of capturing for inclusion in the statement of financial position or financial performance an item that meets the definition of the financial statements Carrying Amount – the amount at which an asset, a liability or equity is recognized in the statement of financial position An item that meets the definition of an element should be recognized if: ● Probable – any future economic benefit associated with the item will flow to or from the entity ● Measured Reliably – item has a cost or value ACCOUNTING CYCLE − − − − − − − − − − ASSET − − RECOGNITION AND DERECOGNITION FOR EXPENSES − − − Matching Principle – on the basis of a direct association between cost incurred and the earning of specific item of income Systematic and Rational Allocation – when economic benefits are expected to arise over several accounting periods and the association with income can be broadly or indirectly determined. Immediate Recognition – when expenditure produces no future economic benefits or when, to the extent that, future economic benefit do not qualify, or cease to qualify for recognition. Process of determining or assigning monetary amounts at which the elements of the financial statement are to be recognized and reported ● Historical Cost – amount of cash or cash equivalent paid or the fair value of the consideration given to acquire an asset at the time of acquisition ● Current Cost – the amount of cash or cash equivalent that would have to be paid if the same or equivalent asset was acquired currently. ● Realizable Cost – the amount of cash or cash equivalent that could currently be obtained by selling the asset in an orderly disposal ● Discounted Cost – the discounted value of the future net cash inflows that the item is expected to generate in the normal course of business Current Asset ● Unrestricted ● Primarily for the purpose of Trading (rendering of service/ selling of goods/ lending) ● Accounts Receivable (on account) ● Notes Receivable (promissory note) ● Entity expects to realize the asset (convert to cash) ● Intends to sell or consume it within 12 months Non-Current Asset ● Use for Production or Supply of goods and services, for rental or administrative ● Tangible Assets ● Property, Plant & Equipment ● Long-term Investment ● Accretion of wealth through capital distribution ● Intangible Asset LIABILITIES − MEASUREMENT − Analysis of Business Transactions and Source Documents Journalizing of Entries in the General Journal Posting of Entries in General Ledger Preparation of the Unadjusted Trail Balance Journalizing and Posting of Adjusting Entries Preparation of the Adjusted Trail Balance Preparation of the Financial Statements Closing Entries Preparation of the Post-Closing Trial Balance Reversing Entries − Current Liabilities ● Entity expects to settle the liability within the entity normal operating cycle ● Purpose of Trading (buying, borrow or acquiring services) ● Does not have Unconditional Right to defer settlement Non-Current Liabilities ● More than 12 months OWNER’S EQUITY − − − Net Asset or Net Worth Owner's Equity (Sole Proprietorship), Partners' Equity (Partnership), Stockholders' Equity (Corporation) Residual interest in the assets of the entity after deducting all of its liabilities * DOUBLE LINE = FINAL TOTAL * SINGULAR LINE = TOTAL / THERE IS ANOTHER SET OF COMPUTATION