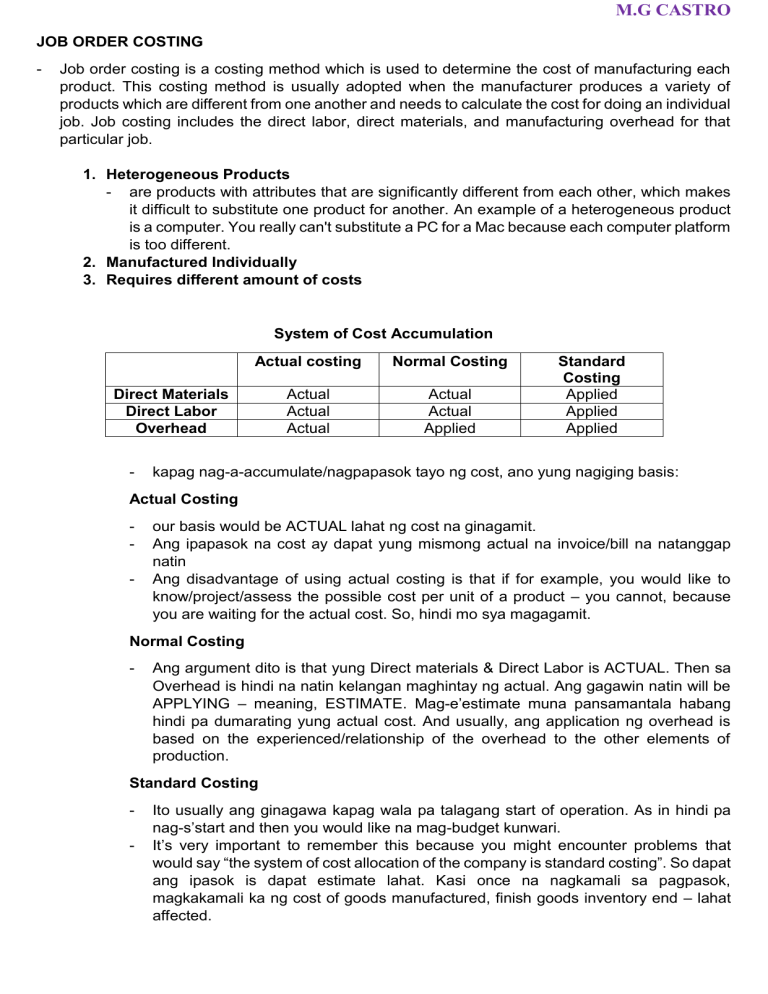

M.G CASTRO JOB ORDER COSTING - Job order costing is a costing method which is used to determine the cost of manufacturing each product. This costing method is usually adopted when the manufacturer produces a variety of products which are different from one another and needs to calculate the cost for doing an individual job. Job costing includes the direct labor, direct materials, and manufacturing overhead for that particular job. 1. Heterogeneous Products - are products with attributes that are significantly different from each other, which makes it difficult to substitute one product for another. An example of a heterogeneous product is a computer. You really can't substitute a PC for a Mac because each computer platform is too different. 2. Manufactured Individually 3. Requires different amount of costs System of Cost Accumulation Actual costing Normal Costing Actual Actual Actual Actual Actual Applied Direct Materials Direct Labor Overhead - Standard Costing Applied Applied Applied kapag nag-a-accumulate/nagpapasok tayo ng cost, ano yung nagiging basis: Actual Costing - our basis would be ACTUAL lahat ng cost na ginagamit. Ang ipapasok na cost ay dapat yung mismong actual na invoice/bill na natanggap natin Ang disadvantage of using actual costing is that if for example, you would like to know/project/assess the possible cost per unit of a product – you cannot, because you are waiting for the actual cost. So, hindi mo sya magagamit. Normal Costing - Ang argument dito is that yung Direct materials & Direct Labor is ACTUAL. Then sa Overhead is hindi na natin kelangan maghintay ng actual. Ang gagawin natin will be APPLYING – meaning, ESTIMATE. Mag-e’estimate muna pansamantala habang hindi pa dumarating yung actual cost. And usually, ang application ng overhead is based on the experienced/relationship of the overhead to the other elements of production. Standard Costing - Ito usually ang ginagawa kapag wala pa talagang start of operation. As in hindi pa nag-s’start and then you would like na mag-budget kunwari. It’s very important to remember this because you might encounter problems that would say “the system of cost allocation of the company is standard costing”. So dapat ang ipasok is dapat estimate lahat. Kasi once na nagkamali sa pagpasok, magkakamali ka ng cost of goods manufactured, finish goods inventory end – lahat affected. M.G CASTRO Cost of Goods Sold Direct Materials, Beginning Add: Direct Materials Purchases Direct Materials Available for Use Less: Direct Materials, End Direct Materials Used Direct Labor Overhead Total Manufacturing Cost Add: Work in Process, Beginning Total Cost Available put into Process Less: Work in Process, End Cost of Goods Manufactured Finished Goods, Beginning Total Goods Available for Sale Finished Goods, End Cost of Goods Sold xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx xxx Kapag magpa-problem, gumawa ng T-ACCOUNTS ASSET (Debit) *kapag normal side is DEBIT –usually BEGINNING lahat 1. Raw Materials Materials we will be using in the production 2. Work in Process Ito yung last year, prinocess mo, but nung patapos na yung financial end – hindi sya natapos/complete (hindi pa sya finished goods) 3. Finished Goods Mga natapos na Saleable/mabebenta na Raw materials Madadagdagan kapag may purchases (debit) Beginning plus Purchases (Direct Materials Available for Use) End (usually binibigay yan) Materials – moved to production (credit) Work in Process Ipasok yung Direct Materials na inalis sa ‘Raw Materials’ (Debit) Completed Goods plus Beginning (Total Goods Available for Sale) Cost of Good Sold – kapag nag alis ka finished goods M.G CASTRO Finished Goods Ipasok yung Completed Goods na inalis sa ‘Work in Process’ (Debit) Direct Labor – usually binibigay lang yan (Debit) Factory Overhead (Debit) Tignan mabuti kung Actual or Applied Factory Overhead Kapag in-add yung DM, DL, FO (Total Manufacturing Cost) Total manufacturing cost plus Beginning (Total Cost Available put into Process) Nababawasan kapag may ‘Completed/Finished Goods’ Factory Overhead Dito ipapasok yung Indirect Materials ACTUAL (Right side of T–Accounts) APPLIED (Left side of T–Accounts) – estimate lang Importante na meron tayong pinag-u-update’an ng FO-Actual para later on ma-compare natin sa Applied. Importante na i-compare kasi magkakaroon ng adjustments. Kaya pumapasok yung Over Applied & Under Applied Mag-e-estimate muna kapag Normal Costing Factory Overhead (kaya nga Applied FO), pero kahit estimate lang – kailangan at the end of the accounting period, we have to follow the actual. Kaya tayo mag-a-adjust from the APPLIED to the ACTUAL. Sa financial report, ang kailangan talagang makita ay ang Actual. Ginagawa lang Applied kasi need na yung data for the timeliness PROBLEMS 1. GHI Company employs normal costing for its production. The following data are provided during the current year: Net purchases of raw materials during the year 500,000 Total labor costs during the year 800,000 Depreciation of factory assets during the year 100,000 Utilities on the factory during the year 300,000 The entity uses a single account for its direct material and indirect materials. Indirect material used is one-fourth of the total material used. The indirect labor cost is 1/8 of the total labor costs. The overhead application rate is 80% of the direct labor costs. Any over or under application of overhead is considered material. M.G CASTRO A. What is the total manufacturing cost during the current year? B. What is the cost of goods manufactured during the current year? C. What is the over or under application of overhead? Importante na alam natin ung Direct Materials and Indirect Materials kasi ang ipapasok lang natin sa Work in Process is the Direct Materials Kahit anong Indirect – Actual sya. (Indirect Materials, Indirect Labor, Utilities, Depreciation) – pinapasok sa FO Control. Kapag pinag-uusapan yung “Application of Factory Overhead”, meron dapat tandan: kung Material / Immaterial kasi magiging iba yung adjustment. Yung 40K sa letter C na dapat i-add sa cost para mahabol yung actual na 600K since diba 560K lang yung nirecord/estimate. So, yung 40K kailangan maipasok sya as expense. If sinabi sa problem na yung Application of Overhead is Immaterial – yung 40K is kakainin ni Cost of Good Sold (COGS). Mag-add lang ng 40K sa COGS Balance – nahabol mo na yung Applied to Actual Overhead. If naman Material, i-add mo sya sa COGS, WIP & FG (basis yung end) If the problem is SILENT, we assume that the Application of Factory Overhead is Immaterial (COGS adjustment lang), because this is the generally used by companies Yung COGS sa ‘finished goods T-account’ amounting to 2,160,000 – kapag tinanong “adjusted COGS” then underapplied ka, yung 2,160,000 (unadjusted) i-add yung 40,000 na underapplied, then yung adjusted COGS mo na is 2,200,000. Kailangan yung cost mo habulin mo pa SOLUTION: M.G CASTRO 2. ABC is employing normal costing for its job orders. The overhead is applied using a predetermined overhead rate. The following information relates to the ABC for the year ended December 31, 2020: Additional information: Actual overhead for the year 2020 amounted to P350,000. Jobs No. 101 and 102 were completed and transferred to finished goods during year 2020. Job No. 101 was sold during year 2020. The gross profit rate is 20% based on cost. A. What is the total manufacturing cost for 2020? B. C. D. E. What is the cost of goods manufactured for 2020? What is the cost of goods sold for 2020? What is the gross profit for 2020? What is the cost of work in process on December 31, 2020, and the cost of finished goods on December 31, 2020, respectively? B. Tignan kung ano sa mga JOB ung natapos