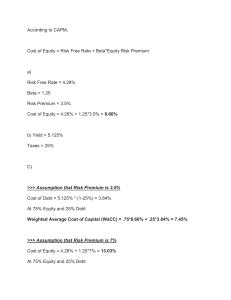

Week 2 Work Problems and Explanations 1. A company is 33% financed by risk-free debt. The risk-free interest rate is 1%, the expected market risk premium is 7%, and the beta of the company’s common stock is 0.60. What is the company’s after-tax WACC, assuming that the company pays tax at a 35% rate? a. b. c. d. 5.20% 8.00% 3.70% 5.57% Explanation: CAPM implies: rE = 0.01 + (0.60)(0.07) = 5.20%. After-tax WACC = (0.01)(1 − 0.35)(0.33) + (.0520)(1 – 0.33) = 3.70%. 2. EZCUBE Corp. is 51% financed with long-term bonds and 49% with common equity. The bonds have a beta of 0.16 and the equity has a beta of 1.24. What is EZCUBE’s unlevered (or asset) beta? a. b. c. d. 0.620 1.400 0.689 Cannot be determined Explanation: βU = 0.51 × 0.16 + 0.49 × 1.24 = 0.689. 3. Following information for Golden Fleece Financial: Long-term debt outstanding: Bond rating Current yield to maturity (rD): Number of shares of common stock: Price per share: Book value per share: Expected rate of return on stock (rE): $310,000 AAA 9% 10,500 $50.10 $26.00 16% Calculate Golden Fleece's unlevered (all-equity) cost of capital. Assume continuous leverage rebalancing. a. b. c. d. 13.40% 12.50% 14.10% 10.00% Explanation: The total market value of outstanding debt is $310,000. The cost of debt capital is 9%. For the common stock, the outstanding market value is: $50.1 × 10,500 = $526,050. The cost of equity capital is 16%. Thus, Golden Fleece’s company cost of capital is: 𝑟𝑟𝑈𝑈 = 𝐸𝐸 𝐷𝐷 526,050 310,000 (0.16) + (0.09) 𝑟𝑟𝐸𝐸 + 𝑟𝑟𝐷𝐷 = 𝐸𝐸 + 𝐷𝐷 𝐸𝐸 + 𝐷𝐷 526,050 + 310,000 526,050 + 310,000 = 13.40% 4. Binomial Tree Farm’s financing includes $5.8 million of bank loans and equity capital. The balance sheet in its latest annual report indicates an equity value $6.75 million. It has 500,000 shares of common stock outstanding that trade on the Wichita Stock Exchange at a value of $17.20 per share. Calculate the debt-to-value ratio appropriate for calculating the after-tax weighted-average cost of capital. a. b. c. d. 46.2% 40.3% 50.0% 52.2% Explanation: We should use the market value of the stock, not the book value shown on the annual report. This gives us an equity value of 500,000 shares times $17.20 per share = $8.6 million. Therefore the total value of the company is $8.6 million + $5.8 million = $14.4 million. So Binomial Tree Farm has a debt/value ratio of 5.8/14.4 = 0.403 or 40.3%. 5. Suppose a firm uses its company cost of capital to evaluate all projects. Will it underestimate or overestimate the value of higher-risk projects? a. Underestimate b. Overestimate c. Correctly estimate Explanation: Overestimate. Higher-risk projects will have a higher cost of capital than the company’s existing securities. Therefore, the value of a high-risk project would be overestimated if the company cost of capital is used. 6. Which one of the projects in the following pairs of projects is likely to have the higher asset beta, other things equal? i. Project A’s sales force is paid a fixed annual salary. Project B’s sales force is paid by commissions only. ii. Project C is a first-class-only airline. Project D is a well-established line of breakfast cereals. a. b. c. d. Project A and Project C Project B and Project C Project A and Project D Project B and Project D Explanation: Project A because a project with higher fixed costs generally has higher operating leverage, which, in turn, leads to a higher beta. Project C because more cyclical revenues lead to a higher beta. 7. The company cost of capital is the correct discount rate for all projects, because the high risks of some projects are offset by the low risk of other projects. a. True b. False Explanation: False. The company cost of capital is the correct discount rate for new projects only if the new projects have the same risk level as the existing business. If a new project is riskier, a higher cost of capital should be used. If the new project is less risky, a lower cost of capital should be used. 8. Graucho Services starts with an all-equity capital structure and a cost of equity of 12%. Suppose it subsequently refinances to the following market-value capital structure: Debt/Value Equity/Value 49% with rD = 10% 51% Calculate Graucho’s new cost of equity capital and new after-tax weighted-average cost of capital. Assume Graucho continuously rebalances leverage and pays taxes at a marginal rate of TC = 35%. a. b. c. d. rE = 13.92%; WACC = 12.00% rE = 13.92%; WACC = 10.29% rE = 12.00%; WACC = 10.29% rE = 22.00%; WACC = 18.50% Explanation: Initially, rE = rU = 12%. Leverage causes rE to increase to rE = rU + (rU – rD)(D/E) = 0.12 + (0.12 – 0.10)(49/51) = 0.1392, or 13.92%. After-tax WACC = 0.10(1 – 0.35)(0.49) + 0.1392(0.51) = 0.1028, or 10.29%. 9. Omega Corporation has 11.2 million shares outstanding, no debt, and an expected rate of return to shareholders of 12.00%. Now, the firm issues $190 million of bonds rated AAA yielding 9%. The firm invests the funds raised in new assets of identical risk to the firm’s initial assets. After the debt issue, the firm’s shares trade at $53 per share. Assume the firm pays taxes at a marginal rate of 35% and continuously rebalances leverage. Calculate Omega’s cost of equity capital (rE) and after-tax WACC after the debt issue? a. b. c. d. rE = 21.01%; WACC = 24.25% rE = 11.82%; WACC = 8.51% rE = 12.00%; WACC = 12.00% rE = 12.96%; WACC = 11.24% Explanation: E = $53 × 11.2 million = $593.6 million; V = D + E = $190 million + $593.6 million = $783.6 million. D/V = $190/$783.6 = 0.2425 or 24.25%. rE = rU + (rU – rD)(D/E) = 0.12 + (0.12 – 0.09) × (190/593.6) = 0.1296 or 12.96%. After-tax WACC = (0.09)(1 – 0.35) (0.2425) + (0.1296)(1 – 0.2425) = 0.1124 or 11.24%. 10. In perfect financial markets with no taxes or financial distress costs, which of the following statements is correct? i. The weighted-average cost of capital is constant for all leverage ratios. ii. The cost of equity capital is constant for all leverage ratios. iii. The cost of debt capital is constant for all leverage ratios. a. b. c. d. i only ii only iii only i, ii, iii 11. Whispering Pines, Inc., is all-equity-financed with an expected rate of return on the company’s shares of 12.25%. Suppose the company issues debt, repurchases shares, and moves to a 30.25% debt-to-value (D/V) ratio. What will the company’s after-tax weighted-average cost of capital be at the new capital structure if the borrowing rate on its debt is 7.75% and its marginal tax rate is 30%. a. b. c. d. 11.55% 12.25% 14.20% 7.75% Explanation: rE = 0.1225 + (0.1225 – 0.0775)(30.25/69.75) = 0.1420 WACC = 0.0775(1 – 0.30)(0.3025) + 0.1420(1 – 0.3025) = 0.1155, or 11.55%. 12. The table below shows a book balance sheet for the Wishing Well Motel chain. The company’s long-term debt is secured by its real estate assets, but it also uses shortterm bank loans as a permanent source of financing. It pays 12% interest on the bank debt and 10% interest on the secured debt. Wishing Well has 10 million shares of stock outstanding, trading at $93 per share. The expected return on Wishing Well’s common stock is 22%. $ Millions Accounts receivable Inventory 280 Current assets 450 Real estate Other assets Assets 170 2,350 130 2,930 Accounts payable Bank loan Current liabilities Long-term debt Equity Liab & Equity 160 260 420 2,210 300 2,930 Calculate Wishing Well’s after-tax WACC. Assume that the book and market values of Wishing Well’s debt are the same and the marginal tax rate is 35%. a. b. c. d. 20.20% 8.30% 7.85% 10.84% Explanation: Netting accounts payable against current assets and recognizing the bank debt is a permanent source of financing, the market-value capital structure of the firm is: Market Values Bank loan Long-term debt Equity ($93/share x 10 million shares) Liab & Equity 260 2,210 Market Value % 7.65% 65.00% Cost of Capital % 12% 10% 930 27.35% 22% 3,400 100% $ Million WACC = 0.12(1 − 0.35)( 0.0765) + 0.10(1 − 0.35)(0.6500) + 0.22(0.2735) = 0.1084 or 10.84%. 13. The table below shows a simplified balance sheet for Rensselaer Felt. The debt has just been refinanced at an interest rate of 7.50% (short term) and 9.50% (long term). Short-term debt is a permanent part of the firm’s capital structure. The expected rate of return on the company’s shares is 16.50%. There are 7,620,000 shares outstanding, and the shares are trading at $40. The tax rate is 35%. $ Thousands Accounts receivable Inventory 124,700 Current assets 251,300 PP&E Other assets 306,800 87,400 Assets 126,600 645,500 Accounts payable Short-term debt Current liabilities Long-term debt Deferred taxes Sharehld’s Equity Liab & Equity 63,600 77,200 140,800 210,200 46,600 247,900 645,500 Calculate the company’s after-tax weighted-average cost of capital. a. b. c. d. 8.93% 10.77% 11.32% 9.32% Explanation: Three adjustments to the balance sheet are necessary: Deferred taxes are an accounting entry and represent neither a liability nor a source of funds and should be ignored. Accounts payable should be netted against current assets. The market value of equity (7,620,000 shares x $40/share) should be used. Now, the market-value capital structure of the firm is: Market Values Short-term debt Long-term debt Equity ($40/share x 7,620,000 shares) Liab & Equity 77,200 210,200 Market Value % 13.0% 35.5% Cost of Capital % 7.5% 9.5% 304,800 51.5% 16.5% 592,200 100% $ Thousands WACC = 0.075(1 − 0.35) (0.130) + 0.0950(1 − 0.35)(0.355) + 0.1650(0.515) = 0.1132 or 11.32% 14. (Version 1) Abercrombie & Fitch, Inc. is attempting to estimate the cost of capital for use in analyzing a proposed expansion into jewelry products. The firm hires you to help them compute the cost of capital. You have collected the following data from Bloomberg for jewelry companies: Pure Players βE D/(E+D) Tiffany & Co. Signet Jewelers Ltd. Zales 2.00 1.90 20% 15% Bond Rating BB BB 1.80 10% BB Abercrombie targets a debt-to-value ratio of 25% and has a bond rating of BB and a βE of 1.00 for current operations. You estimate that the market risk premium (rM-rf) is 7 percent, the risk-free rate is 1%, and the marginal tax rate for all firms is 40%. Assume the beta on debt rated BB is 0.17. a. Calculate its after-tax weighted-average cost of capital for Abercrombie’s current operations. b. Calculate the unlevered beta for each pure player and estimate the unlevered beta in the jewelry industry by averaging your estimates for the pure players. Recall the formula: 𝑬𝑬 𝑫𝑫 𝜷𝜷𝑬𝑬 + 𝜷𝜷 𝑬𝑬 + 𝑫𝑫 𝑬𝑬 + 𝑫𝑫 𝑫𝑫 c. Calculate the after-tax weighted-average cost of capital appropriate for Abercrombie’s proposed expansion into jewelry. Recall the formula: 𝜷𝜷𝑼𝑼 = b: 𝒓𝒓𝑾𝑾𝑾𝑾𝑾𝑾𝑾𝑾 = 𝒓𝒓𝑼𝑼 − 1.900 c: 𝑫𝑫 𝒓𝒓 𝑻𝑻 𝑬𝑬 + 𝑫𝑫 𝑫𝑫 𝒄𝒄 i. a: 6.35% 8.00% ii. a: 6.33% b: 1.637 c: 12.24% iii. a: 6.88% b: 1.501 c: 12.46% iv. a: 7.00% b: 1.612 c: 9.19% Explanation: a. Abercrom bie TC D/(E+ D) βE rE βD rD WACC 40% 25.0% 1.00 8.00% 0.17 2.19% 6.33% b. Tiffany & Co. Signet Jewelers Ltd. Zales D/(E+D) 20% βE 2.00 βD 0.17 βU 1.634 15% 1.90 0.17 1.641 10% 1.80 0.17 Average: 1.637 1.637 c. D/(E+D) Abercrombie 25.0% βD βD βU rU rU – (D/(E+D))*rD*TC 0.17 2.19% 1.637 12.46% WACC=12.24% 15. (Version 2) These results are estimates and may slightly differ from the estimates of Version 1. Abercrombie & Fitch, Inc. is attempting to estimate the cost of capital for use in analyzing a proposed expansion into jewelry products. The firm hires you to help them compute the cost of capital. You have collected the following data from Bloomberg for jewelry companies: Pure Players βE D/(E+D) Tiffany & Co. Signet Jewelers Ltd. Zales 2.00 1.90 20% 15% Bond Rating BB BB 1.80 10% BB Abercrombie targets a debt-to-value ratio of 25% and has a bond rating of BB and an equity beta of 1.00 for current (non-jewelry) operations. You estimate that the market risk premium (rM-rf) is 7%, the risk-free rate is 1%, and the marginal tax rate for all firms is 40%. The bond yield is 3.5% for BB-rated bonds, the probability of default for BB-rated bonds is 2.0%, and the expected loss rate in default is 60% for all firms. Recall the following formula: 𝒓𝒓𝑫𝑫 = 𝒀𝒀𝒀𝒀𝒀𝒀 − 𝑷𝑷𝑷𝑷𝑷𝑷𝑷𝑷(𝑫𝑫𝑫𝑫𝑫𝑫𝑫𝑫𝑫𝑫𝑫𝑫𝑫𝑫) × (𝑬𝑬𝑬𝑬𝑬𝑬𝑬𝑬𝑬𝑬𝑬𝑬𝑬𝑬𝑬𝑬 𝑳𝑳𝑳𝑳𝑳𝑳𝑳𝑳 𝑹𝑹𝑹𝑹𝑹𝑹𝑹𝑹) a. Calculate Abercrombie’s after-tax weighted-average cost of capital for current operations. (Do not round intermediate results and provide your answer to 0.01%.). b. Now, calculate the unlevered required return rU for each pure player and estimate the unlevered required return in the jewelry industry by averaging your estimates for the pure players. Recall the formula: 𝑬𝑬 𝑫𝑫 𝒓𝒓𝑬𝑬 + 𝒓𝒓 𝑬𝑬 + 𝑫𝑫 𝑬𝑬 + 𝑫𝑫 𝑫𝑫 c. Calculate the after-tax weighted-average cost of capital appropriate for Abercrombie’s proposed expansion into jewelry. Recall the formula: 𝒓𝒓𝑼𝑼 = 𝒓𝒓𝑾𝑾𝑾𝑾𝑾𝑾𝑾𝑾 = 𝒓𝒓𝑼𝑼 − 𝑫𝑫 𝒓𝒓 𝑻𝑻 𝑬𝑬 + 𝑫𝑫 𝑫𝑫 𝒄𝒄 i. a: 6.33% b: 14.30% c: 8.00% ii. a: 6.88% b: 8.25% 12.46% iii. a: 7.00% b: 12.28% c: 9.20% iv. a: 6.35% b: 12.48% c: c: 12.25% Explanation: a. TC Abercrombie 40% D/(E+D) βE rE 25.0% 1.00 8.00% Bond yield 3.5% Prob Default 2.0% Loss Rate 60% rD WACC 2.30% 6.35% b. D/(E+ D) Tiffany & Co. 20% Signet Jewelers Ltd. 15% Zales 10% βE rE 2.0 0 1.9 0 1.8 0 15.00 % 14.30 % 13.60 % Bond yield Prob Defaul t Loss Rate rD rU 3.5% 2.0% 60% 2.30% 12.46% 3.5% 2.0% 60% 2.30% 12.50% 3.5% 2.0% 60% 2.30% 12.47% Average: 12.48% c. D/(E+ D) Abercrombie 25.0% Bon d yield Prob Defau lt 3.5% 2.0% Loss Rate 60% rD 2.30 % rU 12.48 % rU – (D/(E+D))*rD*TC WACC=12.25% 16. Sharp Products, Inc. seeks a potential expansion into solar heating. Sharp has hired you to help them compute estimates of the appropriate after-tax WACC for assessing new solar heating projects. Based upon the technology of Sharp's proposed expansion, you are able to find two companies engaged in similar solar heating activities. However, each company also operates a division that manufactures home generators: Comparables Advance Energy, Inc. NuEnergy, Inc. βE D/(E+D) % Assets Solar Heating % Assets Home Generators 1.10 20% 40% 60% 1.30 25% 60% 40% Assume the debt betas for all companies are approximately zero, the corporate tax rate is 35% for all companies, and Sharp desires a target debt-to-value ratio of 30%. In addition, you estimate that the market risk premium (rM-rf) is 5% and the risk-free rate of interest is 1%. HINT: You’ll need to solve a system of two equations in two unknowns. Here are two links for a refresher on this topic. You might want to take a look before proceeding with the problem: http://www.algebra.com/algebra/homework/coordinate/Solution-of-the-lin-system-of-two-eqns-by-the-Substmethod.lesson http://www.algebra.com/algebra/homework/coordinate/lessons/Solution-of-the-lin-syst-of-two-eqns-with-two-unknownsElimination-method.lesson a. Calculate the unlevered beta βU for each comparable firm. Do not round intermediate results, and provide numerical values to three decimal places: b. A firm is a portfolio of businesses and the beta of a portfolio is the investment weighted average of the betas of each asset in the portfolio. Here, each comparable firm is a portfolio of the assets of two businesses. Hence, the unlevered beta for each comparable firm (calculated in b.) is the asset weighted average of the unlevered betas for each of its two businesses. Use a system of two equations in two unknowns (the unlevered beta for each industry) to calculate the unlevered beta U fo r the solar heating and home generator industries. (Do not round intermediate results and provide numerical values to three decimal places.) c. Estimate the after-tax weighted-average cost of capital for Sharp that is appropriate for projects in the solar heating industry. (Do not round intermediate results and provide numerical values as a % to two decimal places.) i. a: Advanced Energy: 1.050; NuEnergy: 1.050 b: Solar Heating: 0.880; Home Generators: 0.975 c: 5.40% ii. a: Advanced Energy: 0.917; NuEnergy: 1.040 b: Solar Heating: 0.917; Home Generators: 1.040 c: 6.83% iii. a: Advanced Energy: 0.880; NuEnergy: 0.975 b: Solar Heating: 1.165; Home Generators: 0.690 c: 6.72% iv. a: Advanced Energy: 1.165; NuEnergy: 0.690 b: Solar Heating: 1.050; Home Generators: 1.050 c: 6.25% c. Explanation: rM-rf 5.0% rf 1.0% TC 35% a. Advance Energy 20% βE 1.10 βD 0 βU 0.880 NuEnergy 25% 1.30 0 0.975 Advance Energy 0.880 = 0.40*βU_Solar + 0.60*βU_HomeGen NuEnergy 0.975 = 0.60*βU_Solar + 0.40*βU_HomeGen D/(E+D) b. Solving these two equations gives: βU_Solar 1.165 βU_HomeGen 0.690 c. Sharp TC D/(E+D) 35% 30.0% βD 0 rD 1.00% βU 1.165 rU rU – (D/(E+D))*rD*TC 6.83% WACC=6.72% 17. When using the overall firm’s weighted-average cost of capital (WACC) to discount cash flows from a project, we assume which of the following? I) The project's risks are the same as those of the firm's other assets and remain so for the life of the project. II) The project supports the same fraction of debt to value as the firm's overall capital structure, and that fraction remains constant for the life of the project. III) The cash flows from the project occur in perpetuity. a. b. c. d. I only II only I and II only I, II, and III 18. Which of the following is an important assumption required if using the WACC formula? a. Companies rebalance their capital structure to maintain a constant debt ratio. b. WACC must be used on public companies with actively traded securities. c. Management bonuses must be added back to free cash flows. d. The firm cannot issue any further debt. Explanation: A company can issue more debt and still use WACC, but an equity issue may be required as well to maintain a constant leverage ratio. 19. The bonds of Casino, Inc. have a 12% coupon rate and yield to maturity of 14.0%. However, investors expect Casino to default for a total loss with 3.2% probability implying an expected return on debt of 10.8%. What cost of debt should be used in Casino's WACC? a. b. c. d. 14.0% 10.8% 12.0% 9.1% Explanation: WACC uses the expected return on debt rather than the promised return, which is: 𝑟𝑟𝐷𝐷 = 𝑌𝑌𝑌𝑌𝑌𝑌 − 𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃(𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷) × (𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸 𝐿𝐿𝐿𝐿𝐿𝐿𝐿𝐿 𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅) = 14% − (3.2%)(100%) = 10.8% 20. Generally, which of the following is true? a. b. c. d. βD > βA > βE βE > βD > βA βE > βA > βD βA > βE > βD 21. An example of diversifiable risk that a financial manager should ignore when analyzing a project's risk would include: a. b. c. d. Commodity price risk Labor cost risk Firm’s stock price risk Government rejection of the project for environmental risks 22. Projects with great amounts of diversifiable risk should generally have higher costs of capital. True False 23. A sensible way for a manager to account for overoptimistic cash-flow forecasts is to adjust the discount rate upward. True False 24. A manager who adjusts discount rates upward by using a "fudge factor" is more likely to penalize short-term projects as opposed to long-term projects. True False