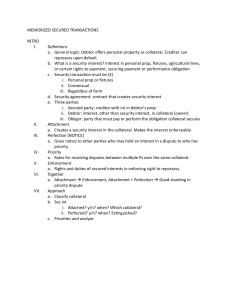

SECURITY INTEREST PRIORITIES General Creditors (Unsecured): has a claim but no lien or security interest in the property; no property claim – only claim through contract Judicial Lien Creditor: creditor who acquires a lien on the collateral by a judicial process Transferees (frequently tested): persons who obtain full title to the goods as a result of a transfer of the collateral from the debtor Buyer in the Ordinary Course of Business (BOCB) (frequently tested): a person who Buys goods (not including farm products); In the ordinary course of business; From a merchant who is in the business of selling goods of that kind; In good faith; and Without knowledge that the sale violates the rights of another in the same goods Consumer Buyer (frequently tested): person who Buys consumer goods for value; For his own personal, family, or household use; From a consumer seller; and Without knowledge of the security interest. SECURITY INTEREST PRIORITIES Party 1 General Creditors Judicial Lien Creditors Transferee Priority Status < > Party 2 Secured Party Unperfected SI < Perfected SI < Secured Party Buyer > Unsecured Party Buyer < Secured Party Circumstance If the transferee is not a buyer, the SI continues unless released by the SP SP still has an interest in the collateral Takes free IF: B gives value Receives delivery Without knowledge of the SI Takes subject to the SI unless the SP releases the SI Exceptions Only has a claim through contracts Even if the SI is unperfected when the lien arises the SP will have priority only if the perfection was delayed because the SP had not given value yet SECURITY INTEREST PRIORITIES Party 1 Buyer in the Ordinary Course of Business Consumer Buyer Priority Status > Party 2 Secured Party > Secured Party Circumstance Exceptions Takes free event if the SI is perfected Will not take free if SP has a filed financing statement covering the goods PMSI – automatic perfection; CB will take subject to the SI Perfected SI #1 Perfected SI Unperfected SI #1 PMSI ** Extends to PMSI in Proceeds from Goods PMSI: Inventory & Livestock Depends First to File or Perfect has priority > Depends First to attach has priority > Perfected SI #2 Unperfected SI Unperfected SI #2 > SI Non PMSI A PMSI in goods other than inventory or livestock prevails over all other security interests in the collateral, even if the other security interests perfected earlier, so long as the PMSI is perfected before or within 20 days after the debtor receives possession of the collateral. PMSI is perfected by the time the debtor receives possession of the collateral, and The purchase‐money secured party sends an authenticated notification of the PMSI to the holder of any conflicting security interest before SECURITY INTEREST PRIORITIES the debtor receives possession of the collateral. PMSI Construction Mortgage Proceed SI # 1 Depends First to File Financing Statement or Perfect has priority > Depends First to file or perfect has priority PMSI SI & PMSI in Fixtures Proceed SI #2 Construction mortgage must be recorded before the goods become fixtures, and it Covers only goods that become fixtures before completion of the construction The filing or perfection date for the original collateral is treated as the filing or perfection date for the proceeds