“Purchase Money” Financing Assignment 8: Automatic Perfection Money Security Interest)

advertisement

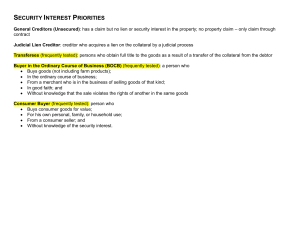

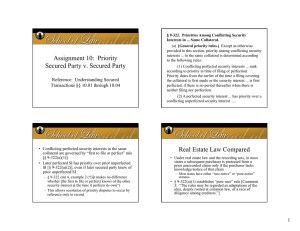

Assignment 8: Automatic Perfection (with an Introduction to the Purchase Money Security Interest) Reference: Understanding Secured Transactions §§ 1.05, 7.01, 7.02 “Purchase Money” Financing • Debtors often obtain financing to enable them to acquire the item(s) in which they are granting a security interest – This is “purchase money” financing • “Purchase money” status can be important – For priority purposes (PMSI may get priority over previously filed UCC-1 covering collateral) – For perfection purposes “Purchase Money” Definitions • SI in goods is a “purchase-money SI” if goods are “purchase-money collateral” [§ 9-103(b)(1)] • Goods are “purchase-money collateral” if they secure a “purchase-money obligation” with respect to the collateral [§ 9-103(a)(1)] • “Purchase-money obligation” is one: – Incurred to seller, to secure all/part of the price of the collateral, or – Incurred to lender, in exchange for value given to enable the debtor to acquire the collateral (and actually so used by debtor) [§ 9-103(a)(2)] Automatic Perfection • PMSI in consumer goods is automatically perfected upon attachment (no need for secured party to make UCC-1 filing) [§ 9309(1)] – Rationale 1: cost of filing would drive up price of consumer goods – Rationale 2: even without a UCC-1 filing, lenders can anticipate that debtor may have obtained consumer goods using PM credit 1 • Carl H. Esbeck borrows $20,000 from Putnam County Bank to buy a guillotine Problem 1 – He signs agreement granting Bank a SI in (1) 1,000 shares of Apple stock and (2) the guillotine – PCB files a UCC-1, but it mistakenly identifies the debtor as “Carl Hesbeck” • Does Bank have a perfected SI? Problem 1 Analysis • Q1: PCB appears to have a PMSI in guillotine [§ 9-103(a), (b)], but not the Apple stock – PCB loaned $20K to Esbeck to buy the guillotine – Esbeck used that $20K to buy the guillotine – Esbeck granted PCB a SI in the guillotine • Q2: Is the guillotine “consumer goods” in the hands of Esbeck? Problem 1: Questions • PMSI in consumer goods is automatically perfected upon attachment, even if no UCC-1 filing covers the collateral [§ 9-309(1)] • Answer to Problem 1 thus depends on 2 questions: – Question 1: Does Bank have a PMSI? – Question 2: Is the collateral “consumer goods”? • If Esbeck acquired the guillotine for personal use, it is “consumer goods” [§ 9-102(a)(23)], and thus Bank’s PMSI in it was automatically perfected when it attached [§ 9-309(1)] – If so, the mistake in Esbeck’s name on UCC-1 is irrelevant, b/c PMSI was automatically perfected • If Esbeck’s primary use was for a business purpose, the guillotine is “equipment” – No automatic perfection; UCC-1 would be necessary to perfect [§ 9-310(a)] – Bank’s UCC-1 is ineffective (error in name was seriously misleading) [§§ 9-502(a), 9-506(b)] 2 • Abrams buys a minivan from Columbia Honda for personal use • Abrams agrees to pay $25,000 sale price in 72 equal monthly installments by contract stating “Debtor hereby grants Columbia Honda a PMSI in the collateral [the minivan].” • Is Columbia Honda’s SI in the minivan automatically perfected upon attachment? • You sold a 60-inch TV to Joe Smith for $1,000 – Smith paid with a check, but it bounced – You let Smith keep the TV if (1) he paid by end of month, with interest and (2) he granted you a SI in the TV – Smith signed an agreement to this effect • Do you have to file a UCC1 to perfect? Synthesis Problem PMSIs and Titled Goods • § 9-309(1) automatic perfection rule for PMSIs in consumer goods does NOT apply if the collateral is a titled vehicle (“Except as otherwise provided in Section 9-311(b) with respect to consumer goods that are subject to [certificate of title act]….)” – Perfection requires compliance w/certificate of title act [§ 9-311(a)] – This makes sense, as 3d parties will look to title certificate for relevant information Problem 2 Problem 2 • Problem: at time Smith signed the security agreement, Smith already had acquired rights in the TV, which you originally sold him on unsecured credit (by check) – In that situation, is it proper to call the TV “purchase money collateral” and to call the SI a PMSI? 3 § 9-103, Official Comment 3 “The concept of ‘purchase-money security interest’ requires a close nexus between the acquisition of collateral and the secured obligation. Thus, a security interest does not qualify as a purchasemoney security interest if a debtor acquires property on unsecured credit and subsequently creates the security interest to secure the purchase price.” Problem 2 Compared • Question: Is Problem 2 different from the previous example (where debtor bought furniture “90 days same as cash”)? Is there an argument for treating the secured party in Problem 2 as having a PMSI? • If so, what specific language in the UCC supports that argument? § 9-103, Comment 3 Example • January 1: X buys furniture from Dealer for $5,000 on “90 days same as cash” basis • April 1: X still hasn’t paid; offers to grant Dealer a SI in the furniture if Dealer will give X an additional 90 days to pay – This SI would not be a PMSI, b/c it didn’t enable X to acquire the furniture (X already owned rights in the furniture) Problem 2: Your Argument? • Because Smith paid for the TV with a “bad check,” his title in the TV was “voidable” [§ 2-403(1)(b)] • Thus, you could “void” his title, and then agree to re-sell the TV to him on a secured basis – If so, the re-extension of credit would have enabled him to re-acquire rights in the TV (after previous rights were “voided”), so this would be a “purchase money obligation” under § 9-103 • Note: This argument would not apply in the “90 days same as cash” hypo (in that example, X’s title would not have been “voidable” under § 2-403(1)) 4 • Lambert buys a flat screen TV at BestBuy, signing a contract to pay in 24 monthly installments; BestBuy retains PMSI in TV Troupe Hypo – Contract: “Buyer warrants that he is buying the goods for personal, family, or household use” – BestBuy doesn’t file a UCC-1 – But, Lambert places the TV in the waiting room of his law office! • Is BestBuy’s SI perfected? • At one level, Troupe reasoning seems problematic, if not wrong – A 3rd party dealing with Lambert would believe that the TV was equipment, not consumer goods – Here, because the issue is perfection (3rd party rights), why should a statement in the security agreement control? • Still, other decisions are consistent with Troupe – Contrary result would potentially increase consumer credit costs (additional secured party “due diligence” would increase cost of consumer credit) Troupe • Court held that the secured party could rely on the debtor’s representation, in security agreement, that debtor was acquiring goods for personal use [p. 5] – On this reasoning, TV is consumer goods, and Best Buy’s PMSI is automatically perfected under § 9-309(1), even if the representation turns out to have been false • Is this a good result? Is there a persuasive counterargument? Purchase Money Security Interests • Most PMSI transactions are what might be called “one-to-one” transactions, e.g., – Purchase money secured party extends credit for debtor to buy a specific asset (e.g., Seller of TV extends credit to Buyer of TV), and – Purchase money secured party takes SI in only that asset (e.g., Seller takes SI in that TV) 5 • In some cases, however, this is not true • E.g., Problem 1: Esbeck takes out loan to buy a guillotine and grants SI in the guillotine, but also in Apple stock he already owns • E.g., a security agreement may “cross-collateralize” multiple loans – Suppose that ABC, Inc. buys a bulldozer and a copier in separate secured transactions – Each time, ABC borrows the money for the purchase price of each item, and signs a security agreement that says: “Debtor hereby grants Bank a SI in [the bulldozer] [the copier], and Debtor agrees that the collateral shall secure all sums owed to Bank, presently owed or incurred in the future.” “Transformation Rule” • Prior to 2000, some courts held that if a SI in an item of collateral also secured a debt other than the purchase price of that collateral, the SI could not be a PMSI [see, e.g., In re Parish] – Rationale: PM status required “one-to-one” nexus between debt and collateral; cross-collateralization destroyed PM character of each individual transaction • Transformation rule (if applied) could defeat Secured Party’s ability to rely on automatic perfection rule • In ABC, Inc. example, this agreement would “cross-collateralize” the two loans – I.e., the copier would now secure repayment of (a) the loan used to acquire the copier AND (b) the loan used to acquire the bulldozer – Likewise, the bulldozer would secure repayment of both (a) the loan used to acquire it AND (b) the loan used to acquire the copier • What’s the advantage of such a clause? “Dual Status Rule”: Pre-2000 • Other courts instead applied the “dual status” rule – Old § 9-107: “A security interest is a PMSI to the extent that” it secures the purchase price – Under the “dual status” rule, a SI can be both a PMSI (to the extent of the unpaid balance of the PM obligation) and a nonPMSI (to the extent it secures repayment of nonPM obligations) 6 “Dual Status Rule” • Revised Article 9 adopted the “dual status” rule [§§ 9-103(b)(1), 9-103(f)] § 9-103(f). In a transaction other than a consumergoods transaction, a purchase money security interest does not lose its status as such, even if: (1) the purchase money collateral also secures an obligation that is not a purchase money obligation; (2) collateral that is not purchase money collateral also secures the purchase money obligation; or (3) the purchase money obligation has been renewed, refinanced, consolidated, or restructured. • Note, however, that § 9-103(f) does not mandate that the court apply the “dual status” rule in a “consumer-goods transaction” [§ 9-102(a)(24)] • § 9-103(h): in a “consumer-goods transaction,” courts are free to apply “established approaches,” which includes the transformation rule – Thus, a court that had applied the transformation rule prior to 2000 (as in Parish) could continue to do so in consumer goods transactions – In those states, a consumer lender whose documents use cross-collateralization provisions could not rely on automatic perfection (but would have to file to perfect) 7