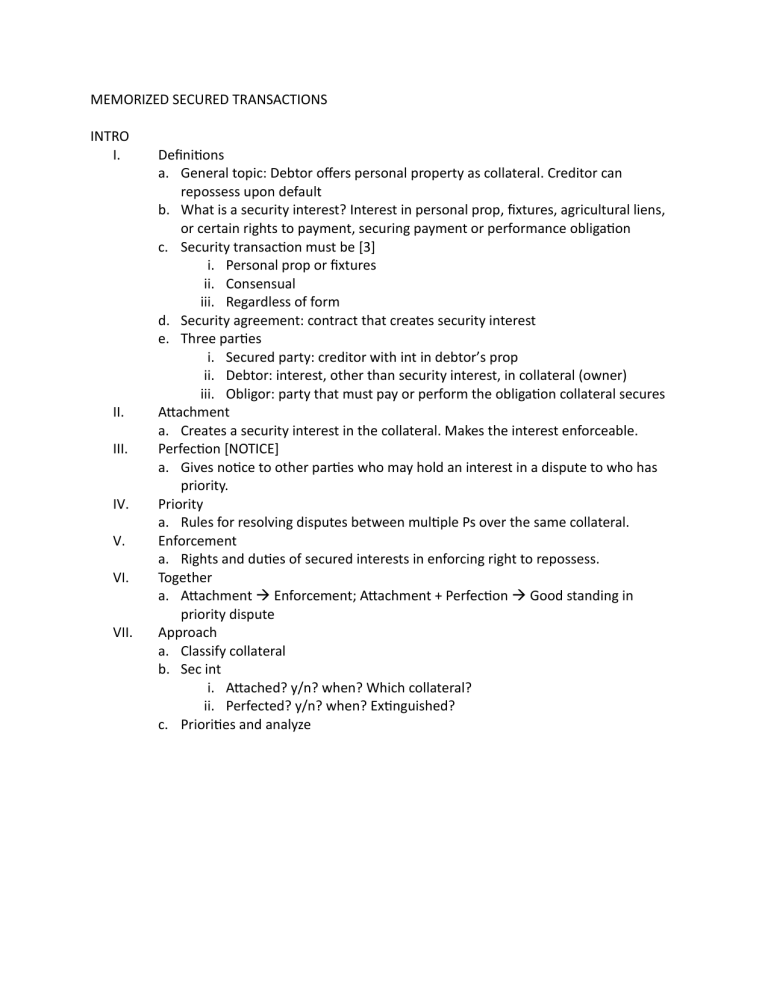

MEMORIZED SECURED TRANSACTIONS INTRO I. II. III. IV. V. VI. VII. Definitions a. General topic: Debtor offers personal property as collateral. Creditor can repossess upon default b. What is a security interest? Interest in personal prop, fixtures, agricultural liens, or certain rights to payment, securing payment or performance obligation c. Security transaction must be [3] i. Personal prop or fixtures ii. Consensual iii. Regardless of form d. Security agreement: contract that creates security interest e. Three parties i. Secured party: creditor with int in debtor’s prop ii. Debtor: interest, other than security interest, in collateral (owner) iii. Obligor: party that must pay or perform the obligation collateral secures Attachment a. Creates a security interest in the collateral. Makes the interest enforceable. Perfection [NOTICE] a. Gives notice to other parties who may hold an interest in a dispute to who has priority. Priority a. Rules for resolving disputes between multiple Ps over the same collateral. Enforcement a. Rights and duties of secured interests in enforcing right to repossess. Together a. Attachment Enforcement; Attachment + Perfection Good standing in priority dispute Approach a. Classify collateral b. Sec int i. Attached? y/n? when? Which collateral? ii. Perfected? y/n? when? Extinguished? c. Priorities and analyze COLLATERAL CATEGORIES I. Classify based on PRINCIPLE use at time SI created a. Change of classification possible II. Goods – anything movable at time SI created [CGFP;IE] a. Consumer goods – personal, family, household use b. Farm products – materials used in or produced by farming op c. Inventory – items on shelf for sale or lease d. Equipment – catchall III. Rights to Payment [CPPNAPI] [Cruel Poodles Poking Needles At Peaceful Iguanas] a. Chattel paper i. Two components 1. Monetary obligation 2. SI or lease b. Promissory note (checks, instruments) c. Accounts i. Right to repayment of money for 1. Prop sold, leased, licensed 2. Servs rendered d. Payment intangible – catchall, rare, for right to repayment of money e. Strategy i. Look for third party owing debtor and debtor uses that as collateral IV. Misc Categories [DID u C LG? F!] a. Documents – showing right to title in goods held by another b. Investment prop – bonds, stocks c. Deposit (bank) acct d. Commercial tort – indiv or org arising out of business activities e. Letter of right to credit – payment or performance f. General intangibles – catchall (copyrights, software) g. Fixtures – attached to house ATTACHMENT I. General: arrangement linking a debt to a particular piece of collateral a. Rule: for a party to have an interest in the collateral it must first attach b. Result: lender may sue debtor and repossess II. Requirements for attachment [3] [Violet Roses Smell Amazing] a. Value – by secured party i. Includes money for line of credit b. Rights – in the collateral i. SI only attaches to debtor’s int in the collateral 1. But: voidable title conveyed to BFP will create an attached/enforceable SI c. Security Agreement i. One of two requirements (EITHER/OR] 1. Authenticated record – piece of paper with three requirements [RAD] a. Record—retrievable by others b. Authenticated—by debtor (i.e., signature) c. Describe—collateral sufficiently (medium specific) i. Exception: consumer goods and commercial tort claims must be VERY specific 2. Possession or control of collateral pursuant to an ORAL OR AUTHENTICATED security agreement a. Attachment by possession pursuant to security agreement i. Available for anything you can hold in your hands (Consumer goods, Farm products, Equipment, Chattel Paper, e.g.) ii. Rights and duties of secured party in possession 1. SP must act with reasonable care w/r/t collateral 2. Keep collateral identifiable 3. Relinquish once obligation satisfied 4. Can charge for reasonable expense of storing and maintaining collateral b. Attachment by control pursuant to a security agreement i. Maybe available for things you cannot hold in your hands (investment property, electronic chattel paper, deposit account) III. Special rules a. After-acquired property clause i. Rule: after-acquired property is only included in debtor’s SI if there’s an after acquired prop clause 1. Unless: for inventory or accounts, then rebuttable presumption of A-A prop b. Accessions [opposite commingled] IV. i. Goods physically united with other goods but not losing identity ii. SI does not terminate at unity c. Commingled Goods [opposite accession] i. Goods physically united w other goods but YES losing identity ii. SI does terminate in original good, but attaches then to larger product or mass d. Proceeds – of lease, sale, license, exchange, or disposal i. Rule: if SI attaches to original collateral, it also attaches to proceeds automatically Purchase Money Security Interests (PMSI) in GOODS or SOFTWARE – IMPORTANT a. General – SI only in goods or software b. Two components i. Acquire – value given to debtor allows debtor to acquire goods or software collateral ii. Secure – goods or software acquired secure the loan c. Fact Patterns i. Lender PMSI – lender loans money to debtor to buy goods 1. Required a. Value actually used to acquire goods b. Lender takes SI in same goods to secure the loan ii. Seller PMSI –goods bought on credit iii. Partial PMSI – good has a PMSI and non-PMSI security interest PERFECTION I. Six Methods of Perfection [Famous People Can’t Avoid Attention] a. Filing by Financing Statement i. Where? 1. Central filing office of appropriate state a. Indivs: where debtor has principle residence (unless real prop-related, then where the prop is) b. Corp: state of incorp c. Business w/o reg: where operates business ii. How long? 1. Five years after filing 2. Continuation can be filed w/I six months before lapse 3. Effect of lapse is loss of perfection (and potential loss of priority) 4. Fulfillment of obligation voids FS iii. To what kinds of collateral? 1. All except depsit (bank) accts, money, and cars iv. Requirements [DSA Dani] 1. Debtor’s name—correct, legal a. Corp: incorporated name, not trade name b. Indiv: majority rule is name on state ID/license; minority rule is name on state ID but other docs can be OK 2. Secured party’s name 3. Authorization a. No need for debtor to sign, enough to authenticate SA secured party can file FS 4. Description of collateral—two descriptions a. Same description as in SA b. More generic description than in SA v. Non-essential info [can still perfect w/o] 1. Addresses for both debtor and secured party 2. Indication of debtor is indiv or org vi. For real prop also have: 1. FS has to say this type of collateral covered in SA 2. Note to file in local real prop records 3. Owner of real prop’s name if debtor isn’t same [recording mortgage can suffice] vii. Your Errors 1. Minor errors don’t affect perfection unless SERIOUSLY MISLEADING a. Debtor’s name error is seriously misleading unless can still be found w error viii. Filing office errors 1. Must refuse if a. Lacks required info b. Creditor fails to pay fee c. FS improperly submitted 2. Errant refusal still perfected a. Unless: BFP or secured party gave value in reasonable reliance on absence of record from files II. III. b. Possession i. Applies to tangible collateral where secured party has possession (money, goods, instruments, tangible chattel paper) 1. Only way for money to perfect ii. As long as secured party has possession, int is perfected c. Control i. Applies to intangible collateral where secured party has control (bank accounts, electronic chattel paper, investment property, letter of credit rights) 1. Only way for deposit accounts and letter of credit to perfect ii. Deposit (bank) accounts—three ways to gain control 1. Secured party is bank w/ the deposit account 2. Secured party, bank, debtor all agree in authenticated record that secured party has control over bank account (deposit account control agreement) 3. Secured party can become bank’s customer w/r/t deposit account d. Alternate perfection i. State certificate of title statute requires perfection by noting a security interest on certificate of title ii. Cars, vehicles with title 1. Except: when car is brand-new inventory e. Automatic perfection i. ONLY for 1. PMSI in consumer goods 2. Casual, isolated assignments only transferring small parts of outstanding accounts receivable 3. Sales of Promissory Notes or Payment Intangibles (CP PN A PI) PMSIs a. PMSI in consumer goods automatically perfected (absent certificate of tile law, i.e., vehicle) b. PMSIs in software or other goods perfected by: i. SP files FS ii. SP takes possession Post- perfection changes a. Debtor name change i. Name change becomes seriously misleading, four months discover and amend ii. Failure to amend makes all collateral after 4 months not in FS b. Move state IV. i. Debtor 1. Debtor moves, four months to discover and re-file in new state 2. Failure to amend makes all collateral after 4 months not in FS and not perfected ii. Collateral 1. Debtor still owns, no need to re-file 2. Collateral goes to new debtor in new state, one year to re-file and list new debtor 3. Failure to re-file makes collateral not perfected c. Secured party perfected by possession gives collateral back to debtor i. Rule: secured party is only perfected as long as it has possession ii. Exception (limited): if possession in instrument, negotiable doc, certificated security or goods stored with another person can be given back without destroying perfection if given back to: 1. Sell 2. Exchange 3. Enforce debtor’s rights in collateral iii. Temporary automatic perfection (above) lasts for 20 days; must file financing stmt or repossess after Proceeds Perfection a. General i. Def: money from leasing, selling, destroying, licensing collateral ii. SI attaches automatically to proceeds even if the SA does not explicitly say b. Perfection Rules i. Initially 1. Automatic perfection for 20 days after sale; after 20, lapse unless [A CuP, SO…..] a. Amendment: amend FS before 20 days b. Cash proceeds rule: cash proceeds perfected indefinitely as long as identifiable (i.e., sep bank acct) c. Same office rule: i. FS covers original collateral ii. Proceeds are collateral that can be perfected by filing FS in same office as orig iii. Proceeds not acquired w cash PRIORITY I. II. III. IV. V. VI. Issues a. Party v Party over Collateral Collateral Claimants a. Secured Creditor i. Attached? ii. Perfected? iii. PMSI? b. Unsecured Creditor i. Creditor w/ no SI in collateral ii. Rights 1. None in property a. Gain by lien or SI 2. In contract against debtor c. Lien Creditor – judicial or statutory d. Purchasers of CPPNAPI i. Secured party w SI attached (may not be perfected) 1. Automatic perfection for (Promissory Notes and Payment Intangibles) e. Buyers or Transferees of Other Collateral—can take free of secured party’s SI Type 1: Security Interest v. Security Interest (neither PMSI – goods and software) a. Perfected SI v. Perfected SI i. First in time to file FS OR perfect (whichever first) takes priority b. Perfected SI v. Unperfected SI i. Perfected takes priority c. Unperfected SI v. Unperfected SI i. First in time to attach OR take effect takes priority Type 2: Security Interest v. Judicial Lien Creditors a. Perfected SI v. Lien Creditor i. Perfected SI takes priority over LC b. Unperfected SI v. Lien Creditor i. LC takes priority over unperfected SI 1. Exception: filed but unattached SI where has authenticated SA and FS but no value yet, SP wins over LC Type 3: Security Interest v. Statutory Lien a. SL has priority over SI (perfected or not) as long as: i. Lien effective only if lienholder possesses the goods ii. Lien secures payment or performance in ord course of business iii. Statute doesn’t negate Type 4: Priority over future advances a. Secured Party v. Secured Party over Future Advances i. First to file or perfect w/r/t future advances 1. OK even if SP knows of competing SI VII. b. Secured Party v. Lien Creditor over Future Advances i. SP has priority over LC if SP’s advance is within 45 days of lien arising ii. After 45 days, LC over SP unless EITHER: 1. Advance made w/o knowledge of lien 2. Advance made pursuant to commitment entered into w/o commitment of lien Type 5: Secured Parties v. Buyers [free of OR subject to] a. Question: did the buyer take the collateral free of SI or subject to SI? b. Buyer v. Perfected SI i. Unless SP authorizes sale free and clear of SI, buyer takes subject to perfected SI 1. Exception 1 Buyer-Merchant (knowledge OK): buyer in ord course of business can take free even if knew of SI as long as: a. Bought from merchant b. Merchant sells this and it’s the ord course of business c. Good faith and without knowledge of harming rights of another person w rights to same goods d. Not a pawnbroker 2. Exception 2 Consumer-Consumer (knowledge NOT OK): buyer of consumer goods can take free of perfected SI as long as: a. Value b. For personal, family, or household use c. From consumer seller d. Without knowledge of SI 3. Exception 2 does not apply if SP has filed an FS covering the goods before purchase. a. PMSIs in consumer goods are automatically perfected, lender must AFFIRMATIVELY file FS to get out of Exception 2 c. Buyer v. Unperfected SI i. [SAME AS LAST] Unless SP authorizes sale free and clear of SI, buyer takes subject to unperfected SI 1. Exceptions for Buyer-Merchant and Consumer-Consumer also apply 2. Exception: a. Value b. Delivery of collateral c. w/o knowledge of SI d. Buyers and future advances i. Applies: buyer purchases subject to SI and SP makes future advance ii. Rule: free and clear of future advance if: 1. SP knew of purchase OR 2. 45+ days after purchase e. Transferees of Money or Funds VIII. i. Transferee of $ from bank account subject to SI takes free of SI unless 1. Transferee colludes w debtor to violate SP’s rights Type 6: PMSI a. PMSI v. Lien Creditor i. Perfected PMSI has priority over lien creditor ii. Lien creditor has priority over unperfected PMSI 1. Note 20-day grace period for PMSIs a. If perfects w/i 20 days of possession by debtor, PMSI wins over lien creditor b. PMSI v. Security Interests i. PMSI Super-Priorities 1. Goods other than Inventory or Livestock a. PMSI takes priority over all other SI—regardless of other SI’s perfected date—as long as SP perfects w/i 20 days of possession by debtor i. If not, SP v. SP rules (first in time to file or perfect) b. Priority applies to proceeds of collateral 2. Inventory or Livestock a. PMSI takes priority over all other SI as long as: i. Perfected before delivered to debtor ii. Sending authenticated notification to other SPs b. Priority only applies to proceeds that are up-front cash payments for inventory sold c. PMSI v PMSI i. Seller PMSI (credit) beats lender PMSI (money to buy good) ii. Or SP v SP rule d. Fixtures i. Fixture SI v. Real Property Interest 1. Fixture SI priority over RPI if a. filed FS with local real prop before RPI recorded 2. PMSI in fixtures priority over RPI if both: a. Debtor has int of rec in real prop or possesses real prop b. SI perfected by FS before goods become fixture or w/i 20 days thereafter ii. Construction Mortgage v. PMSI 1. Construction mortgage has priority over fixture SI—including PMSIs—if a. Recorded before goods become fixtures b. Goods become fixtures before construction completed iii. Fixture SP v. Fixture SP 1. General priority LEASES & CONSIGNMENTS (WHEN IS A LEASE OR CONSIGNMENT A SECURED TRANSACTION?) I. II. Leases a. Bright-line test: what does lessor get back? If nothing, ST i. Two prongs 1. Lease can’t terminate early 2. Lessor doesn’t get anything at end of lease term a. Goods used up at end of lease b. Goods must be used up by extending lease time c. Option to extend until goods used up for no or nominal consid d. Option to buy at end of lease for no or nominal consid ii. Result if test is met 1. Lessor is SP and needs to perfect SI iii. Result if test is failed—factual inquiry Consignments a. Parties i. Consignor – owner of goods (SP) ii. Consignee – seller of goods on behalf of consignor b. Requirements i. Consigner deliver to consignee merchant regularly dealing in these goods ii. Consignee is merchant who isn’t generally selling others’ stuff iii. 1K per delivery iv. Not consumer goods DEFAULT AND ENFORCEMENT I. General a. Cumulative, simultaneous rights to enforcement b. SP can: i. Seek possession of tangible ii. Seek judgment iii. Use other agreed on methods II. Repossession of Goods and Other Tangible Collateral a. Two ways i. Judicial process ii. Self-help repossession that doesn’t breach the peace b. Disposition of Collateral – can sell, lease, license dispose of repossessed collateral as long as commercially reasonable i. Commercially reasonable standard (safe harbors/”either/or”) 1. Sold in reasonable manner in market 2. Price current in that market 3. In conformity w reasonable commercial pracs of other sellers in that market ii. Details of Disposition 1. Pub or priv 2. SP can buy collateral at pub sale, but not priv sale, unless collateral is fixed or standardized price iii. Notice 1. Who a. Debtor; secondary obligors; SPs 2. When a. Commercially reasonable time; if non-commercial, 10 days before sale 3. What must it include a. SP and debtors names; description of collateral; how to be sold; debtor entitled to an accounting 4. Exceptions a. Not required if goods perishable or destroyed value soon b. Sold on recognized market c. Notice waived iv. Proceeds 1. Distributed in following order a. Reasonable expenses for collection and enftmt b. Debt to foreclosing SP i. If not enough, deficiency judgment against obligor c. Subordinate SIs pursuant to demand from those SPs d. Surplus to debtor III. Other Enforcement Methods a. Acceptance of collateral “strict foreclosure” – SP can accept collateral in full or part w conditions i. Full satisfaction 1. Debtor consent in authenticated record a. No objection within 20 days after proposal sent, consent 2. ONLY CONSUMER GOODS: a. SP can only accept in full b. 60% rule: if debtor has paid back 60%+, goods must be sold and acceptance not permitted ii. Partial satisfaction 1. Debtor consent in authenticated record a. No objection not consent b. Redemption rights i. Redemption available for debtor, obligor, other SPs by paying entire obligation plus expenses for sale 1. BEFORE SP sold or SP accepted collateral ii. No waiver c. Special enforcement rules for i. Fixtures 1. If SP has priority, can remove from real estate but must pay for repairs if damage occurs ii. Accessions 1. SP w priority can remove accession from among other goods iii. Rights to payment (CPPNAPI) 1. SP can take place of debtor to collect debts from third parties a. When third party has notice, must pay to SP not debtor 2. Surplus (goes to debtor) and deficiency (owed by debtor) rules don’t apply d. Remedies for secured party’s failure to comply i. Injunctive relief – debtor or other SP can halt improper enforcement ii. Actual dams – debtor or SP can be compensated for loss from improper enforcement iii. Statutory dams – available for consumer goods for violations of Art. 9 iv. Violation of Art 9 1. Commercial transactions – Rebuttable Presumption rule prevents SP from getting deficiency if not sold in commercially reasonable manner (unless compliance w Art 9 would CREATE deficiency) 2. Consumer transactions – Absolute Bar rule prevents SP from getting deficiency if failure to comply w Art 9 v. Conversion tort liability