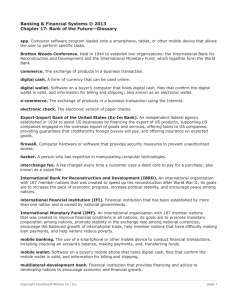

The Wallet Management App: A Literature Review A small evaluative report to convey the knowledge and ideas that have been established on our topic – The Wallet Management App. Introduction: The Digital Smart Wallet App is the result of an innovative way to manage expenses and make use of the various benefits provided by the app. A digital wallet, also known as an e-wallet, is an electronic device, online service, or software program that allows one party to make electronic transactions with another party bartering digital currency units for goods and services. The Wallet app not only helps in tracking your expenses and keeping them up-to-date but also creates a personalised graphical representation of your budget and expenses. This graphical view can be manipulated according to the time-distribution preferred by the user. Money can be deposited in the digital wallet prior to any transactions or, in other cases, an individual's bank account can be linked to the digital wallet. History: Digital wallets have grown in popularity since they were first introduced over 20 years ago. Digital wallets allow users to quickly and easily make purchases in-stores and online, withdraw cash from ATMs, and send money peer-to-peer giving the user greater flexibility and convenience in payment choice. Since 2019, there has been an explosion in use, and the coronavirus pandemic is pushing more people towards cashless options. The origin of digital wallets: The origins of digital wallets began over 25 years ago with then 21 year-old entrepreneur Dan Kohn in Nashua, New Hampshire, who sold a CD over the internet via credit card payment. 1994: First online purchase is made. A CD of Sting’s Ten Summoner’s Talesis sold for $12.48 on NetMarket. 1997: First mobile payments and first contactless payments is made. Coca-Cola installs two vending machines in Helsinki that accept payment by text message. 1999: PayPal launches electronic money transfer service. Early on, PayPal’s user base grew nearly 10% daily. TeslaCEO Elon Musk and venture capitalist Peter Thiel were among its cofounders. 2003: Alibaba launches Alipay in China. Today, the mobile payment platform has witnessed stunning growth — leveraging digital wallets accepted by merchants in over 50 countries and regions. 2007: M-PESA creates the first payments system for mobile phones. Kenya-based M-PESA launched its mobile banking and microfinancing service. Today, it has over 37 million active users on its platform across Africa. 2009: Bitcoin enables secure, untraceable payments. Satoshi Nakamoto develops the first decentralized payment network in the world. 2013: WeChat Payis rolled into the popular messaging platform. By 2018, it surpasses 800 million monthly active users. 2014: Apple Pay launches. By 2023, over $2 trillion of mobile payment transactions could be authenticated by biometric technology. Google became the first major company to launch a mobile wallet in 2011. 2012 saw Apple’s Passbook, while not for mobile payments, could be used for boarding passes, tickets and coupons. Apple Pay came two years later. Launched in the US, it quickly spread to the UK and China. 2015 brought Android and Samsung Pay. Ever since, digital wallets like GrabPay, Lazada Wallet, PayPal, Touch ‘n Go, VCash, and many more, have made this mode of payment quite popular. Digital wallets were first introduced at 7 17 Credit Union in 2016. Our first digital wallet was Apple Pay, and we have expanded to include Google Pay and Samsung Pay. Modern day digitalisation: Digital wallets are being used more frequently among Asian countries as well. One in every five consumers in Asia are now using a digital wallet, representing a twofold increase from two years ago. A MasterCard mobile shopping survey among 8500 adults, aged 18–64 across 14 markets, showed that 45% of users in China, 36.7% of users in India and 23.3% of users in Singapore are the biggest adopters of digital wallets. The survey was conducted between October and December 2015. Further analysis showed that 48.5% of consumers in these regions made purchases using smartphones. Indian consumers are leading the way with 76.4% using a smartphone to make a purchase, which is a drastic increase of 29.3% from the previous year. This has inspired companies like Reliance and Amazon India to come out with their own digital wallet. Flipkart has already introduced its own digital wallet. Notable examples of digital wallets include the following: Apple Pay: Apply Pay provides a safe and contactless way for users to make payments through iOS, iPadOS and watchOS apps and on websites through the Safari browser. Apple Cash and any debit or credit card number that a customer adds to their Apple Wallet can be used for making Apple Pay transactions. Payments made with Apple Pay are verified using a passcode set on the device and optionally through touch or Face ID. Google Wallet: Although Google Wallet replaces Google Pay in many countries, the two apps remain separate. Google Wallet uses NFC technology, enabling users to pay with a fingerprint or password. Using NFC in conjunction with cloud technology enables customers to use Google Wallet to make secure and fast digital payments by tapping their phone on any NFC-enabled POS terminal upon checkout. Samsung Wallet: Samsung Wallet is formerly known as Samsung Pay. In July 2022, it was rereleased and merged with Samsung Pay and Samsung Pass. It uses NFC technology to transfer card information to an NFC-enabled payment terminal. However, it provides limited usage as it's only compatible with Samsung devices and isn't yet set up to manage payments on websites. PayPal: PayPal is one of the oldest peer-to-peer (P2P) money transfer services used for online and in-app purchases, personal money transfers and e-commerce. Individuals can send money to each other through a linked debit or credit card or a bank account. Users can also link PayPal with other digital wallets, including Apple Pay. PayPal One Touch: This extension of the services provided by PayPal enables users to skip logging in with their email and password when making payments or transferring funds. PayPal One Touch speeds up transactions while keeping a user's financial information secure by ensuring they're always using the same device and browser combination. If the user tries to update their personal information, they're prompted to login again. Venmo: Venmo is a subsidiary of PayPal and initially started as a money-sharing app. It made it easier to request money from friends, split bills or share a portion of rent with roommates. Over time, Venmo has grown into a complete financial platform that enables users to shop online and in person with participating retailers. CashApp: This P2P payment platform enables users to send and receive money through their mobile devices. CashApp also offers users the option to purchase stock and Bitcoin and file taxes through its CashApp Taxes feature. Types of digital wallets: There are three types of digital wallets -- closed, semi-closed and open. Closed wallet: This wallet is restricted to certain individuals. For example, a company selling products and services can develop a closed wallet just for its customers. The money from returns and cancellations is stored in this wallet and users can only transact with the issuer of that wallet. Amazon Pay is an example of a closed wallet. Semi-closed wallet: With a semi-closed wallet, users can make transactions at listed merchants and locations. The payment information is stored in a centralized location for safety purposes, but a user may need to share a key or a password with another person before making a transaction. A semi-closed wallet provides ease of use by storing multiple public addresses while keeping private keys offline. Open wallet: Open wallets can be used to manage and track payment information online. Operating as easy-to-use online applications, a user can download an open wallet to any device or browser with an internet connection. Open wallets are compatible across all platforms and users can transact anytime and from anywhere. The most popular technologies digital wallets use include the following: Quick response (QR) codes: These barcodes encode information into a black and white pattern that a user can access with a smartphone camera or their digital wallet's scanning system to initiate a payment. Payment apps can encode information, including the transaction amount and the intended recipient. For example, in the PayPal app, a QR code can be generated that enables shoppers to use their accounts to pay for items in store. NFC: This wireless data transfer technology uses electromagnetic signals to enable smartphones, tablets, laptops and other devices to share and transfer data when in close proximity. Generally, two devices need to be within an inch and a half of each other to connect. Magnetic secure transmission (MST): This mobile payment technology enables smartphones to transact wireless payments with both traditional pre-chip magnetic stripe systems and modern no-swipe credit card terminals. It generates a magnetic signal similar to when someone swipes the magnetic stripe on a credit card reader. MST enables customers and retailers to transact securely without having to upgrade their equipment. By 2025, digital wallets are expected to become the second most-preferred payment method. Budgeting through the Wallet App: Digital Budgeting: A budget expresses intended expenditures along with proposals for how to meet them with resources. A budget may express a surplus, providing resources for use at a future time, or a deficit in which expenditures exceed income or other resources. The digital wallet app will enable users to create a savings goal and make it easier for them to hit savings targets by implementing roundup and automatic deposit functions. Having an overall spending budget per month is good, but breaking that budget down by each major spend category is even better. Creating different spend buckets makes you think harder about your expenses, meaning you are less likely to overspend. If your expense tracking shows an overspend in one category, you can consciously choose to offset this by making savings in another area. When you measure something, you can affect it. This scientific principle applies to all areas of our lives. By tracking your expenses against a budget, you will gain a better understanding of where you are spending unnecessarily and where you can start to make changes that make a difference. Your digital wallet is much more than simply a storage area for your digital cards because the added features mean you can drill into your transactions and learn about your spending habits. And when you know what you are currently doing, it’s much easier to adjust, change your habits, and improve your situation. Another helpful feature of some digital wallets is the option to set an alert that tells you when your spending has reached a certain percentage of your budget for the month. This helps you to avoid overspending. If you are receiving your alert earlier in the budgeted month or year than expected, then you know you need to quickly rein in your spending to stay within your budget. The wallet allows you to set reminders so that you don’t forget to pay your bills, which could save you from added penalty interest or fees. Digital wallets employ several technologies -- including mobile apps, mobile hardware devices, nearfield communication (NFC) and security methods such as tokenization -- to create a user-friendly, mobile and ostensibly secure payment experience. To use a digital wallet, a user enters their card information into the digital wallet app or site. The information is encrypted and the wallet is available for use once the device is unlocked and the user authorizes the wallet. To make a mobile payment, the user holds their smartphone close to the contactless terminal. Advantages of digital wallets: While many factors are driving the growth of digital wallets, the COVID-19 pandemic helped skyrocket their use due to a surge in online shopping and contactless transactions. The following are the main benefits of using digital wallets: Streamlined customer experience: Digital wallets streamline and expedite the checkout process, as customers aren't required to fill out lengthy checkout pages or forms. This is a win-win for everyone, as faster checkouts discourage customers from abandoning their shopping carts, which in turn increases the conversion rates for businesses. Security: Digital wallet providers, including Apple Pay and Google Wallet, use tokenization, which masks credit card details and is transaction-specific to prevent hackers from gaining access to consumers' data. Digital wallets also employ biometrics, including fingerprint and facial recognition technology, which prevents the account information from being stolen. For example, if a person drops a physical card or a wallet, their personal information can be easily stolen; whereas digital wallets add layers of security through features such as Face ID or two-factor authentication, which makes it more difficult for anyone to access the stolen information. Contactless payments: Contactless payments enable consumers to make payments without having to carry a card or search for one inside their physical wallets. Users can simply use touch or Face ID on their phones to confirm payment during the checkout process. Valuable customer insights: Digital wallets help extract real-time data for valuable insights into a customer's shopping habits, including their shopping history and preferences. This helps businesses create targeted marketing campaigns as well as helps with inventory management and budget creation. Advantages of Budgeting: Helps You Work Toward Long-Term Goals: A budget forces you to map out your goals, save your money, keep track of your progress, and make your dreams a reality. By seeing what money you earn and what money you have going out through a budget, you can create a map for where you need to go to get your goal, whether that is purchasing a home in a few years or going to graduate school. Can Keep You from Overspending: If you create and stick to a budget, you’re more likely to not find yourself in this position. You’ll know exactly how much money you earn, how much you can afford to spend each month, and how much you need to save. Can Reveal Spending Habits: Building a budget forces you to take a close look at your spending habits. When reviewing your expenses, you may notice that you’re spending money on things you don’t need, such as a cable TV subscription. Budgeting allows you to rethink your spending habits and refocus your financial goals. Taking a look at your expenses, you may see that one month, you spent more money on eating out than cooking at home. By reviewing your budget, you can make effective changes as a result. If you see that you’re overspending target amounts set in your budget for such discretionary items, you may choose to adjust how much you commit to luxury or nonessential spending in lieu of saving for a new car or a major home improvement project that could also add to your place’s resale value. Conclusion: A budget helps create financial stability. By tracking expenses and following a plan, a budget makes it easier to pay bills on time, build an emergency fund, and save for major expenses such as a car or home. Overall, a budget puts a person on stronger financial footing for both the day-to-day and the long term. It can bring you one step closer toward financial security. Having and sticking to a budget can keep your spending in check and assure that your savings for emergencies and longer-term goals, such as a comfortable retirement, stay consistent. Integrating the budgeting system with a digital wallet will not only increase productivity into better spending habits but will also help the user keep track of future expenses.