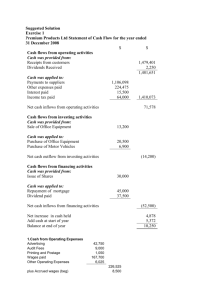

Cash Flow Statements Cash Flow Statement • Definition: A Cash Flow Statement is a financial statement that shows a company's inflows and outflows of cash and cash equivalents over a specific period of time. • Importance: Helps investors, creditors, and other stakeholders assess a company's liquidity, solvency, and financial performance. • Purpose: To provide information about a company's cash receipts and cash payments, its ability to generate cash, and its cash requirements for future operations. • Overview: Components of a Cash Flow Statement, Operating/Investing/Financing Activities, Direct and Indirect Methods, Cash Flow Statement Analysis, Numerical Examples, and Case Study. Components of CFS • Operating Activities: Cash flows related to day-today business operations. • Investing Activities: Cash flows related to the acquisition and disposal of long-term assets and investments. • Financing Activities: Cash flows related to transactions with owners and creditors. • The Direct Method: Presents cash inflows and outflows separately for each category. • The Indirect Method: Begins with net income and adjusts for non-cash transactions and changes in operating working capital. Operating Actvities • Definition: Activities that generate revenue and expenses, contributing to net income. • Examples: Cash received from customers, cash paid to suppliers, wages, taxes, and interest payments. • Cash inflows and outflows: Cash received from customers (+), cash paid to suppliers (-), cash paid for wages (-), etc. • Direct method: List individual cash inflows and outflows, then calculate the net cash flow. • Indirect method: Start with net income, adjust for noncash items (e.g., depreciation), and changes in working capital. Example of Operating Activities (Indirect Method) • • • • • • Example (Indirect Method): Net Income: $100,000 Add: Depreciation Expense: $20,000 Less: Increase in Accounts Receivable: $10,000 Add: Increase in Accounts Payable: $5,000 Cash Flow from Operating Activities: $115,000 Investing Activities • Investing activities include cash inflows and outflows related to the acquisition and disposal of long-term assets and investments. Examples of cash inflows from investing activities: • Sale of property, plant, and equipment (PPE) • Sale of marketable securities Examples of cash outflows from investing activities: • Purchase of PPE • Purchase of marketable securities • Investing activities numerical example: Investing Activities Example • Sale of PPE: $15,000 • Purchase of PPE: $25,000 • Investing Cash Flow: -$10,000 Financing Activities • Financing activities show cash flows related to borrowing and raising capital, as well as repaying loans and returning capital to investors. Examples of cash inflows from financing activities: • Issuance of shares or other equity instruments • Borrowings from banks or other lenders Examples of cash outflows from financing activities: • Repayment of loans or other borrowings • Dividend payments to shareholders Financing Activities Example • • • • Issuance of shares: $50,000 Repayment of loans: $30,000 Dividend payments: $10,000 Financing Cash Flow: $10,000 Direct Method Vs Indirect Method • Key Differences: • a. Direct Method: Presents cash inflows and outflows from operating activities separately, detailing cash receipts from customers, cash paid to suppliers, and cash paid for operating expenses. • b. Indirect Method: Begins with net income and adjusts for non-cash items, such as depreciation, and changes in working capital (accounts receivable, inventory, and accounts payable). Direct Method Vs Indirect Method • Advantages and Disadvantages: • a. Direct Method: • i. Advantages: Provides more detailed information on cash inflows and outflows, offering better insights into cash management. • ii. Disadvantages: More complex and time-consuming to prepare, requiring more detailed data and recordkeeping. • b. Indirect Method: • i. Advantages: Easier and faster to prepare, as it utilizes data readily available from income statements and balance sheets. • ii. Disadvantages: Offers less detailed insights into cash management, focusing on adjustments to net income rather than direct cash flow transactions. Interpreting the Cash Flow Statement • When interpreting the cash flow statement, it is essential to look at each section individually and understand its implications: • a) Operating Activities: A positive cash flow from operating activities indicates that the company is generating enough cash to sustain its operations, while a negative cash flow suggests that the company may struggle to meet its operational expenses. Interpreting the Cash Flow Statement • b) Investing Activities: A negative cash flow from investing activities indicates that the company is investing in its future growth, while a positive cash flow suggests that the company may be selling off assets or not investing enough in growth opportunities. • c) Financing Activities: A positive cash flow from financing activities indicates that the company is raising capital, while a negative cash flow suggests that the company is paying off debt or distributing dividends. Free Cash Flow • Free cash flow is a measure of a company's ability to generate cash from its operations after accounting for capital expenditures. It is calculated by subtracting capital expenditures from cash flows from operating activities. • Free cash flow is important because it shows how much cash a company has available for other purposes, such as paying dividends, repurchasing stock, or investing in new projects. A positive free cash flow is generally a good sign, indicating that a company has enough cash to cover its obligations and invest in growth opportunities. Cash Flow Ratios • Cash flow ratios are financial ratios that use cash flow numbers to evaluate a company's financial performance. • Some common cash flow ratios include the cash flow coverage ratio, the operating cash flow ratio, and the free cash flow yield ratio. Cash Flow Ratios • Cash flow coverage ratio: • The cash flow coverage ratio is a financial ratio that measures a company's ability to cover its interest payments and other fixed expenses using cash generated from its operations. It is calculated by dividing cash flows from operating activities by the sum of interest payments and fixed expenses. • A high cash flow coverage ratio indicates that a company is generating enough cash from its operations to cover its interest payments and fixed expenses, which is generally a positive sign. On the other hand, a low ratio may indicate that the company is having difficulty generating enough cash to cover its fixed expenses, which could be a warning sign. Cash Flow Ratios • Operating cash flow ratio: • The operating cash flow ratio is a financial ratio that measures a company's ability to pay off its current liabilities using cash generated from its operations. It is calculated by dividing cash flows from operating activities by current liabilities. • A high operating cash flow ratio indicates that a company has enough cash generated from its operations to cover its current liabilities, which is generally a positive sign. Conversely, a low ratio may indicate that the company is having difficulty generating enough cash to cover its current obligations, which could be a warning sign. Cash Flow Ratios • Free cash flow yield ratio: • The free cash flow yield ratio is a financial ratio that measures the amount of free cash flow a company generates relative to its market capitalization. It is calculated by dividing free cash flow by market capitalization. • This ratio is useful for investors looking for companies that are generating a significant amount of free cash flow relative to their size. A higher free cash flow yield ratio indicates that a company is generating more free cash flow relative to its market capitalization, which could be a positive sign. However, it is important to consider other factors, such as the company's overall financial health and growth prospects, before making an investment decision. Preparing A Cash Flow Statement Using The Indirect Method • Fictional Company XYZ Ltd has the following financial data for the year: • Income Statement: • • • • Net Income: $120,000 Depreciation Expense: $10,000 Interest Expense: $5,000 Balance Sheet (Beginning and End of Year): • Accounts Receivable: BOY $25,000; EOY $30,000 • Inventory: BOY $40,000; EOY $35,000 • Accounts Payable: BOY $15,000; EOY $20,000 Preparing A Cash Flow Statement Using The Indirect Method • Investing and Financing Activities: • Purchased equipment: $20,000 • Issued common stock: $10,000 • Paid dividends: $12,000 • We will calculate the cash flow from operating, investing, and financing activities step by step. • Cash Flow from Operating Activities (CFOA): • Start with Net Income: $120,000 • Add back Depreciation Expense (non-cash item): + $10,000 • Add back Interest Expense (financing item, but reported in net income): + $5,000 • Adjust for changes in Accounts Receivable: - ($30,000 - $25,000) • Adjust for changes in Inventory: + ($40,000 - $35,000) • Adjust for changes in Accounts Payable: + ($20,000 - $15,000) • CFOA = $120,000 + $10,000 + $5,000 - $5,000 + $5,000 + $5,000 = $140,000 • Cash Flow from Investing Activities (CFIA): • Purchase of equipment (outflow): - $20,000 • CFIA = -$20,000 • • • • • Cash Flow from Financing Activities (CFFA): Issuance of common stock (inflow): + $10,000 Payment of dividends (outflow): - $12,000 Payment of interest (outflow): - $5,000 CFFA = $10,000 - $12,000 - $5,000 = -$7,000 Now, we will prepare the cash flow statement: Cash Flow Statement for XYZ Ltd: Cash Flow from Operating Activities: $140,000 Cash Flow from Investing Activities: -$20,000 Cash Flow from Financing Activities: -$7,000 Net Increase in Cash: $140,000 - $20,000 - $7,000 = $113,000 • Let's say the company's beginning cash balance was $50,000. To find the ending cash balance, we add the net increase in cash to the beginning cash balance: • Ending Cash Balance: $50,000 + $113,000 = $163,000 • • • • • • • This cash flow statement shows that XYZ Ltd generated $140,000 from operating activities, spent $20,000 on investing activities, and had a net cash outflow of $7,000 from financing activities. The company's cash balance increased by $113,000 during the year, resulting in an ending cash balance of $163,000. • In the previous example provided for Company XYZ Ltd, we used the indirect method to prepare the cash flow statement. If we were to prepare the same statement using the direct method, we would detail cash receipts from customers, cash paid to suppliers, and cash paid for operating expenses to calculate the cash flow from operating activities, rather than adjusting the net income. Importance of Cash Flow Statements in Financial Decision-Making: • Cash flow statements are an essential tool for understanding the financial health of a business. They provide valuable information on the inflows and outflows of cash within a company, which helps with financial decision-making in various ways: • Liquidity Assessment: Cash flow statements show the ability of a company to meet its short-term financial obligations. This helps in assessing liquidity, which is crucial for a company's survival and growth. • Profitability Analysis: While the income statement focuses on revenues and expenses, the cash flow statement indicates the actual cash generated from operations. This helps investors and management determine if a company is generating positive cash flow, which is an essential indicator of profitability. • Investment Decision-making: Investors can assess the cash flow efficiency of a company to decide whether to invest in it. Positive cash flow indicates effective management of resources, which can contribute to higher returns on investment. Importance of Cash Flow Statements in Financial Decision-Making: • Financial Planning: By analyzing cash flow statements, management can make better financial decisions, such as planning capital investments, expansions, or paying off debts. It helps them anticipate future cash needs and potential challenges. • Cash Flow Management: Cash flow statements help identify cash flow trends and patterns, enabling management to take corrective actions when necessary, such as cutting costs or increasing revenue sources. Further Resources and Readings • "Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports" by Thomas R. Ittelson – This book provides a comprehensive introduction to financial statements, including cash flow statements, and explains how to read and interpret them. • "Analysis of Financial Statements" by Pamela P. Peterson and Frank J. Fabozzi – This book offers detailed insights into the techniques used to analyze financial statements, including cash flow analysis. • Investopedia (www.investopedia.com) – Investopedia is a comprehensive online resource that provides educational content on various financial topics, including cash flow statements and their importance in decision-making. • Corporate Finance Institute (www.corporatefinanceinstitute.com) – CFI offers courses and resources on a range of financial topics, including cash flow statement analysis and financial modeling. • Financial Accounting Standards Board (www.fasb.org) – FASB is responsible for setting financial accounting standards in the United States. Their website provides information on accounting standards, including those related to cash flow statements.