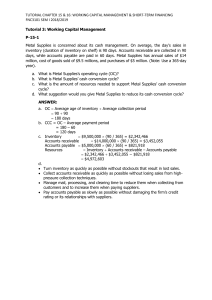

WORKING CAPITAL MANAGEMENT /rcroque WORKING CAPITAL AND CASH MANAGEMENT In its 2017 annual report, Luzvimin Corporation reported that it had revenues of P18 billion, cost of goods sold of P16.8 billion, accounts receivable of P2.4 billion, inventory of P2.1 billion and accounts payable of P1.25 billion. Total purchases for the year was P11.25 billion. 1. Determine the cash conversion cycle. The balance sheet of Olive Industries for December 31, 2016 contains the following. The amounts also pertain to the average for the year. (Use 360 working days) ASSETS Cash Marketable Securities Accounts Receivable Inventories Plant and Equipment Less: Depreciation Net Plant and Equipment 10,000 80,000 60,000 100,000 220,000 64,000 156,000 LIABILITIES AND SHAREHOLDERS EQUITY Accounts Payable 56,250 Notes Payable (Short Term) 17,000 Other Current Liabilities 52,000 Long Term Debt 82,000 Preferred Stock 50,000 Common Stock 49,000 Paid in Surplus 39,750 Retained Earnings 60,000 Total Assets 406,000 Total Liabilities and Shareholders' Equity 406,000 Sales for the year amounted to P720,000. Mark up on cost is 60%. 2. What is the working capital? 3. Determine the cash conversion cycle. USANA Company has a permanent funding requirement of P300,000 in operating assets and seasonal funding requirements that vary between P0 and P800,000 and average P250,000. USANA can borrow short-term funds at 6.5% and long-term funds at 9%, and it can earn 5% on the investment of any surplus balances. 4. What is the total cost of an aggressive strategy for seasonal funding? 5. What is the total cost of conservative strategy for seasonal funding? Alivia corporation has a permanent funding requirement of P250,000 in operating assets and seasonal funding requirements that vary up to P1,100,000 and average P180,000. Alivia can borrow short-term funds at 7% and long-term funds at 9%, and it can earn 6% on the investment of any surplus balances. 6. What is the annual cost of an aggressive strategy for seasonal funding? 7. What is the annual cost of a conservative strategy for seasonal funding? Roxas company has a permanent funding requirement of P400,000 in operating assets and seasonal funding requirements that vary up to P600,000 and average P120,000. Roxas can borrow shortterm funds at 6% and long-term funds at 8%, and it can earn 5% on the investment of any surplus balances. 8. Which funding strategy would be less costly? What is the net advantage? GGEM Corporation has an agreement with Security Bank Corp (SBC) to collect P3,000,000 a day in exchange for a compensating balance of P500,000. The firm, with a significant increase in its customer in the area, is thinking of cancelling the agreement and dividing the service provided by SBC with China Bank, Inc (CBI). With this plan, SBC will handle the collection of P2,000,000 with a compensating balance of P800,000. On the other hand, CBI bank will handle the other P1,000,000 collection in exchange for a compensating balance of P400,000. With the planned arrangement with the two banks to perform the collection, the firm is expecting to reduce the collection period by one day. The firm's rate of return is 7%. 9. What is the amount of incremental income or loss if GGEM will pursue the division of service between SBC and CBI? It takes CELLSENTIALS several days to receive and deposit collections from customers to its three banks. Therefore, lockbox system is being considered. The bankers explain that with the system in place, the expected float time will be reduced. The following shows the packages offered by the banks: Banks: China Land Metro Average daily collections Current float Expected float if lockbox is availed Rate of return P500,000 7 days 420,000 8 days 350,000 9 days 5 days 10.00% 6 days 12.00% 6 days 12.00% Cost of lockbox system P8,000 Monthly P24,500 Quarterly P48,000 Semi-annually 10. How much is the advantage (disadvantage) of the lockbox system offered by China? 11. How much is the advantage or disadvantage of the lockbox system offered by Land? 12. How much is the advantage or disadvantage of the lockbox system offered by Metro? ABC company is a retail mail order that currently uses a central collection system that requires all checks to be sent to its headquarters. An average of 6 days is required for mailed checks to be received, 3 days to process them and 2 days for the checks to clear through its bank. A proposed lockbox system would reduce the mailing and processing time to 2 days and the check clearing time to 1 day. An entity has an average daily collection of P150,000. 13. How much would be the increase in the average cash balance if the company adopts the lockbox system? Assume that the fixed cost of selling marketable securities is P10 per transaction and the interest rate on marketable securities is 8% per year. The company estimates that it will make cash payments of P12,500,000 per quarter. 14. Optimal transcaction size 15. Average cash balance 16. the number of times (during the year) the company has to convert marketable securities to cash 17. the total cost of converting marketable securities to cash, 18. the total carrying cost of cash. RECEIVABLE MANAGEMENT Assume that your firm is considering relaxing its current credit policy. Currently the firm has annual sales, all credit, of P16 million and an average collection period of 30 days. The firm is considering a change in credit terms from the current terms of net 30 to 1/30 net 60. The change is expected to generate additional sales of P2 million. The firm has variable costs of 75% of the selling price. The information provided here, plus additional information, is summarized in the table below. New sales (all credit) Original sales (all credit) Contribution margin Percent bad debt losses on new sales New average collection period Original average collection period Additional inventory investment Pre-tax required rate of return New percent cash discount Percent of customers taking the discount P18,000,000 P16,000,000 25% 6% 45 days 30 days P50,000 15% 1% 50% 1. If the credit policy change is made, the change in bad debt losses will be: 2. If the credit policy change is made, the change in profit will be: 3. If the credit policy change is made, the additional investment in accounts receivable will be: 4. If the credit policy change is made, the cost of the additional investment in accounts receivable and inventory will be: 5. If the credit policy change is made, the change in the cost of the cash discount will be: 6. If the credit policy change is made, the net effect will be: Stop and Chop has an inventory conversion period of 60 days, a receivable conversion period of 35 days, and a payment cycle of 26 days. Sales for the period just ended amounted to P972,000 while cost of sales amounted to P1,260,000. Credit purchases amounted to P684,000. (Assume 360 days a year.) 7. How much is the investment in accounts receivable? 8. How much is the cash conversion cycle? The Sales Director of Sweet Bites suggests that certain credit terms be modified. He estimates that sales will increase by at least 20% and accounts receivable turnover will be reduced to 8 times from the present turnover of 10 times. Bad debts, now at 1% of sales will increase to 1.5%. Sales before the proposed changes is at P900,000. Variable cost ratio is 55% and desired rate of return is 20%. Fixed expenses amount to P150,000. 9. How much is the increase in profit from the sales? 10. How much is the cost of marginal investment in accounts receivable? 11. How much is the cost marginal bad debt? Kisha Company has annual credit sales of P4 million. Its average collection period is 40 days and bad debts are 5% of sales. The credit and collection manager is considering instituting a stricter collection policy, whereby bad debts would be reduced to 2% of total sales, and the average collection period would fall to 30 days. However, sales would also fall by an estimated P500,000 annually. Variable costs are 60% of sales and the cost of carrying receivables is 12%. (Assume 360 days a year) 12. How much is the decrease in profit from the sales? 13. How much is the savings from marginal investment in accounts receivable? 14. How much is the savings from marginal bad debt? Chopstop company plans to tighten its credit policy. The projected sales for the coming year are P50M. The new policy will decrease the average number of days in collection from 75 to 50 days and reduce the ratio of credit sales to total revenue from 70% to 60%. The company estimates that the projected sales would be 5% less if the proposed new credit policy were implemented. The firm’s shortterm interest cost is 10%. (assume a 360-day year) 15. How much is the average accounts receivable for the coming year using the present/current credit policy? 16. How much is the average accounts receivable for the coming year using the proposed change in credit policy? 17. How much would be the benefit (cost) of implementing this new policy on income before taxes? Lodi Optical, Inc, offers branded designer prescription eyeglasses. All sales are currently on credit and with no cash discount. The firm is considering a 2 percent cash discount for payment within 10 days. The firm's current average collection period is 90 days, sales are 700 units per year, selling price is ₱25,000 per unit, variable cost per unit is ₱18,750, and the average cost per unit is ₱21,000. The firm expects that the change in credit terms will result in a minor increase in sales of 15 units per year, that 75 percent of the sales will take the discount, and the average collection period will drop to 72 days. The firm's bad debt expense is expected to become negligible under the proposed plan. The bad debt expense is currently 0.025 percent of sales. The firm's required return on equal-risk investments is 20 percent. (Assume a 360-day year.) 18. What is the marginal investment in accounts receivable under the proposed plan? 19. What is the cost of marginal investment in accounts receivable under the proposed plan? 20. What are the savings of marginal bad debts under the proposed plan? 21. What is the cost of the marginal cash discount? 22. What is the net result of increasing the cash discount? INVENTORY MANAGEMENT Barter Corporation had been buying Product A in lots of 1,200 units which represents a four month's supply. The cost per unit is P100; the order cost is P200 per order; and the annual inventory carrying cost for one unit is P25. The lead time is 5 days. (Use 360-day year) 1. What is the economic order quantity? 2. Frequency of order 3. Total inventory cost 4. Reorder point 5. Safety stock if the maximum daily usage is 14 units Neggie Corp has a secret ingredient in its production. This ingredient costs the company P60 each from the supplier and requires a 6-day lead time. The demand every quarter is 13,680 units. The ordering cost is P12.50 per order. (EOQ is 1200 units) 6. The carrying cost per unit is 7. The desired safety stock if the maximum daily usage is 175 units is 8. The total inventory cost amounts to The General Chemical Company uses 150,000 gallons of hydrochloric acid per month. The cost of carrying the chemical in inventory is 50 cents per gallon per year, and the cost of ordering the chemical is P150 per order. The firm uses the chemical at a constant rate throughout the year. 9. The chemical’s economic order quantity is The General Chemical Company uses 150,000 gallons of hydrochloric acid per month. The cost of carrying the chemical in inventory is 50 cents per gallon per year, and the cost of ordering the chemical is P150 per order. The firm uses the chemical at a constant rate throughout the year. It takes 18 days to receive an order once it is placed. 10. The reorder point is The General Chemical Company uses 150,000 gallons of hydrochloric acid per month. The cost of carrying the chemical in inventory is 50 cents per gallon per year, and the cost of ordering the chemical is P150 per order. The firm uses the chemical at a constant rate throughout the year. It takes 18 days to receive an order once it is placed. 11. If the maximum usage is 162,000 gallons per month, the safety stock is The ReignLyn Tags Company produces a luggage and bag tag product, and has the following information available concerning its inventory items: Annual demand Purchase price Ordering costs Carrying costs - 50,000 units per year ₱35 per package ₱250 per purchase order 10% of purchase price plus: ₱4.50 12. What is the economic order quantity? 13. What are the total relevant costs at the economic order quantity? 14. What are the total relevant costs, assuming the quantity ordered equals 1,000 units? The Polly Company wishes to determine the amount of safety stock that it should maintain for Product D that will result in the lowest cost. The following information is available: Stock-out cost per occurrence Carrying cost per unit of safety stock Number of purchase orders per year The available options open to Polly are as follows: P80 P4 5 Units of Safety stock 20 30 40 50 60 Probability of Running out of Safety stock 50% 40% 25% 10% 5% 1. Determine the number of units of safety stock that will result in the lowest cost. SHORT TERM FINANCING MANAGEMENT 1. What is the effective annualized cost of foregoing the trade discount on terms 2/10 net 80 2. What is the effective annualized cost of foregoing the trade discount with terms 2/15 net 70 Stanley Shoe Company established a line of credit with a local bank. The maximum amount that can be borrowed under the terms of the agreement is P100,000 at an annual rate of 12%. A compensating balance averaging 10% of the amount borrowed is required. Prior to the agreement, the company had no deposit with the bank. Shortly after signing the agreement, the company needed P50,000 to pay off a note that was due. It borrowed the P50,000 from the bank by drawing on the line of credit. 3. What is the effective annual cost of credit? Smith & Smith Enterprises has a line of credit with National Bank that allows the company to borrow up to P350,000 at an interest rate of 15%. However, the firm must keep a compensating balance of 10% of any amount borrowed on deposit at the bank. The company does not normally keep a cash balance account with the bank. 4. What is the effective annual cost of credit? The Azurin Corporation was recently quoted terms on a commercial bank loan of 7% discounted interest with a 20% compensating balance. The term of the loan is 1 year. 5. The effective cost of borrowing is Salguero, Inc. can issue 3-month commercial paper with a face value of P1,000,000 for P980,000. Transaction costs will be P1,200. 6. The effective annualized percentage cost of the financing, based on a 360-day year, will be: 7. When a company offers credit terms of 2/10, net 30, the annual interest cost, based on a 360-day year, is: 8. If a firm's credit terms require payment within 45 days but allow a discount of 2% if paid within 15 days (using a 360-day year), the approximate cost or benefit of the trade credit terms is: 9. Tolentino, Inc. buys on terms of 2/10, net 30 days. It does not take discounts, and it typically pays 35 days after the invoice date. Net purchases amount to P720,000 per year. What is the nominal annual cost of its non-free trade credit? 10. Assume that the current borrowing rate is at 15%. Which of the following discounts should the firm take? a. 2/10, net/45 b. 1/15, net/75 c. 3/10, net/80 d. 1/10, net/45 Graveler Mining plans to borrow P100,000 for one year under a line of credit with a stated interest rate of 7.5 percent and a 15 percent compensating balance. Case A: If the firm normally keeps a balance of about P10,000 in its checking account and is willing to accept loan proceeds lesser than P100,000. 11. The loan proceeds would be P______________________ 12. The interest to be repaid on the amount borrowed would be P______________________. 13. The effective annual interest rate on the loan is ________% Case B: If the fi rm normally keeps almost no money in its checking account. Loan proceeds: P100,000. 12. The interest to be repaid on the amount borrowed would be P______________________. 13. The amount borrowed would be P______________________ . A company obtained a short-term bank loan of P250,000 at an annual interest rate of 6%. As a condition of the loan, the company is required to maintain a 20% compensating balance in its checking account. Ordinarily, the company maintains a balance of P25,000 in its checking account for transactions purposes. 14. What is the effective interest rate of the loan? Precious Company has a revolving line of credit of P300,000 with a one-year maturity. The terms call for a 6% interest rate and a ½% commitment fee on the unused portion of the credit line. The average loan balance during the year was P100,000. 15. How much is the annual cost (in pesos) of this financing arrangement? “Successful men and women keep moving. They make mistakes, but they don’t quit.”