Concept Questions

advertisement

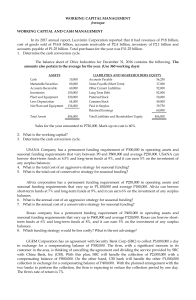

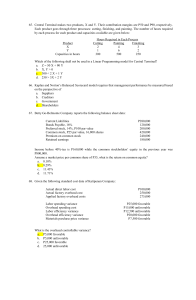

Concept Questions 1. Your firm currently does sales on a cash basis but is considering moving to net 30 terms. Discuss two arguments in favor of the change and two arguments against. 2. Describe the following terms: 2/10, net 30, dating 90 – Consignment – 3. Do businesses prefer payment for services using compensating balances or fees? Why? Which do banks prefer? Why? 4. In the end, why would a firm consider a lockbox system? 5. Identify the benefits derived from a cash concentration system. 6. What are the advantages and disadvantages are related to the anticipation rule? 7. As the U.S. financial system moves to nationwide branch banking, how will this impact the collection systems used by corporations? 8. Summarize the check availability provisions of Regulation CC. 9. What is the conceptual relationship between the firm’s investment rate, the late payment penalty fee, and the discount rate in determining the appropriate date to make payment? 10. What are the main differences faced by US credit managers when selling on credit abroad? 11. Why is inventory needed? What role does it play? 12. Interpret a current ratio of 2.00. 13. How is a balance fraction approach to inventory monitoring an improvement over the DIH?