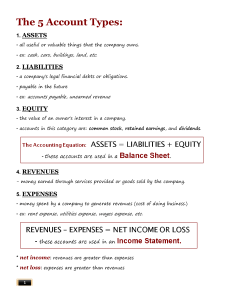

Chapter 1 The Statement of Financial Position (Balance Sheet) Reports the economic resources the entity owns and sources of financing the resources. Essentially displays the number of assets, liabilities, and shareholder’s equity at a specific time. ● The heading of the statement of FP displays four significant elements. ○ Name of the accounting entity (who) ○ Title of the statement (what) ○ Specific date of statement (when) ○ Unit of measure (ex: in thousands) ➢ Accounting Equation: Assets = Liabilities + Shareholder’s Equity ○ The equation accurately represents how the balance sheet is formatted ■ Assets are resources that are controlled by the entity from previous business events ■ Liabilities and shareholder’s equity are the sources of financing for the company’s resources ■ Liabilities display the amount of financing that is provided by the creditor, aka the company’s debts ● Contributed Capital is the investment of cash and other assets by the shareholders ● Retained Earnings is the amount of profit reinvested in the business Formatting of the SPF - Assets are listed on the SPF in the order of liquidity (most to least liquid assets) - Liabilities can be listed by the order of the due date - The $ sign is included beside the first amount in a new group of items - Single underline below the last item in a group before a total or subtotal, a double underline is placed below group totals - Underline rules apply to other financial statements The Statement of Earnings(income statement), statement of operations, statement of a comprehensive income - Reports the performance of a business and the entity’s ability to sell goods for more than their cost - Revenues - Expenses = Net Earnings The Statement of Changes in Equity - Reports all changes to shareholder’s equity during the accounting period - Displays how net earnings, dividends (distribution of net earnings) and other changes to the shareholder’s equity affected the company's financial position during the period - Format - Equity, beginning of the period - Plus: Net earnings for the year ■ - Plus: Other comprehensive Income - Minus: Dividends - Plus/Minus: Other changes, net Equity, end of the period The Statement of Cash Flows - Divides a company's cash inflows (receipts) and outflows (payments) into 3 primary categories of cash flows in a general business: - Cash flows from operating, investing, and financing activities. - Revenues do not always equal the cash collected because some sales can be on credit - Expenses reported on the SoE may not be equal to cash paid out during the period because expenses may be used in one period and paid for in another - Net Earnings do not usually equal the amount of cash received minus the amount paid during the period - SoE reports the inflows and outflows of cash -> displays the causes of change in cash that is On the balance sheet from the end of the last period To the end of the current period - - Elements of the SCF - Cash flows from operating activities are cash flows that are related to generating earnings - Cash flows from investing activities include cash flows from the acquisition or sale of the company’s property, plant, and equipment, and investments - Cash flows from Financing activities are directly related to the financing of the company itself. Involves both receipt and payments of cash from/to investors and creditors. Relationships Among the Statements - Notes to Financial Statements provide supplemental information about the financial condition of a company - 1) Provides descriptions of the accounting rules applied in the entity’s statements 2) Presents additional detail about a line on the financial statements 3) Presents additional financial disclosures about items not listed on the statement themselves - Responsibilities for the Accounting Communication Process - Effective Communication: The recipient understands what the sender intends to convey - Understandability: Foundation of effective communication - Decision makers also need to understand the measurement rules applied in computing the numbers on the statements IFRS (International Financial Reporting Standards) - A single set of globally accepted standards - Accounting standards are important because of issues regarding ethical conduct - Ethical Dilemma three-step process - Identify the effects of the decision on both parties, those who will benefit and those who will be harmed - Identify alternative courses of action - Choose the alternative that you would like to see reported on the news, typically ethical choice - Management has primary responsibility for setting up systems to prevent unethical behaviour - 3 Steps to ensure accuracy of records, 1) System of Controls 2)External Auditors 3)Board of Directors - IFRS are the broad principles, specific rules, and practices used to develop and report the information in financial statements. - Knowledge of IFRS is necessary to accurately interpret the numbers in financial statements. - Auditors are responsible for expressing an opinion on the fairness of the financial statement presentations based on their examination of the reports and records of the company. Chapter 2 Understanding The Business - The conceptual framework for external financial reporting aims to provide useful financial information about an entity to existing and potential investors, lenders, and creditors. The framework identifies fundamental and enhancing qualitative characteristics of useful accounting information and elements to be measured and reported, such as assets, liabilities, and revenues. The framework also outlines assumptions and principles for measuring and reporting information, including mixed-attribute measurement and revenue recognition. The framework aims to guide the provision of high-quality accounting information that balances relevance, faithful representation, comparability, verifiability, timeliness, and understandability to external decision-makers. Fundamental Characteristics - Relevance:makes a difference in a decision, predictive value, feedback/confirmatory value - Faithful representation: complete, neutral, and reasonably free from error or bias. - Enhancing Qualitative Characteristics - Comparability: across companies - Verifiability: similar results under independent measures - Timeliness: information must be available before it loses its usefulness - Understandability: allows reasonably informed users to see the significance of the information. Cost constraint: information should be produced only if the perceived benefits of increased decision usefulness exceed the expected costs of providing that information. - Recognition and Measurement Concepts - Separate entity assumption: Activities of the business are separate from the activities of owners. - Stable monetary unit assumption: Accounting measurements will be in the national monetary unit (i.e.,$ in Canada) without any adjustments for changes in purchasing power (i.e., inflation). - Continuity (going concerned) assumption: The is assumed to continue to operate into the foreseeable future. - Historical cost principle: Cash equivalent cost given up is the basis for the initial recording of elements. - - Assets are economic resources controlled by an entity that can be used to generate future economic benefits. - Current assets are those that will be used or converted into cash within one year - Non-current assets are those that will be used or converted into cash over a longer period. Liabilities represent present debts or obligations of the entity to transfer economic resources due to past events. - Current liabilities are short-term obligations that will be settled within a year - Non-current liabilities are obligations that are not classified as current liabilities. Elements of the Classified Statement of Financial Position - Shareholders’ equity: The financing provided to the corporation by both its owners and the operations of the business Typically, the shareholders’ equity of a corporation includes the following: 1. Contributed capital 2. Retained earnings (accumulated earnings that have not been declared as dividends) 3. Other components Nature of Business Transactions - Accounting involves recording transactions, that impact an entity. The first step in the accounting process is to determine which transactions to include in financial statements. Transactions include external events, which involve exchanges of assets, goods, or services between parties, and internal events, which directly affect the accounting entity but are not exchanged between the business and other parties. Only economic resources and debts resulting from past transactions are recorded on the statement of financial position. Account - ending balance is then reported on the appropriate financial statement. - To facilitate the recording of transactions, each company establishes a chart of accounts—a list of accounts and their unique numeric codes. The chart of accounts is organized by financial statement element, with asset accounts listed first (by order of liquidity), followed by liabilities (by order of time to maturity), shareholders’ equity, revenue, and expense accounts, in that order. Balancing Accounting Equation - Ask → What was received and what was given? Identify the accounts affected by their titles (e.g., cash and accounts payable). Make sure that at least two accounts change counting Equation - Classify each by type of account. Was each account an asset (A), a liability (L), or shareholders’ equity (SE)? - Determine the direction of the effect. Did the account increase (+) or decrease (−)? Step 2: Verify → Is the accounting equation in balance? (A = L + SE) - Journal entries do not provide ending balances in accounts by themselves, and bookkeepers must post the values to each account affected by the transaction to determine new balances. A trial balance is created to check the equality of debits and credits before preparing financial statements. The statement of financial position classifies assets and liabilities into current and non-current categories. Current assets are those to be used or transformed into cash within the upcoming 12 months, and current liabilities are those obligations to be paid or settled within the next 12 months using current assets. - Financial ratios are commonly used by users of financial information to analyze a company's past performance and predict its future potential. Comparing a company's ratios over time and to those of its competitors or industry averages can provide valuable insight into the company's operating, investing, and financing strategies. - Current Ratio = Current Assets / Current Liabilities Chapter 3 - Financial information is reported for short time periods to meet the needs of decision-makers. Two types of issues arise when reporting periodic net earnings: recognition issues, which deal with when to recognize and record transactions and their effects, and measurement issues, which deal with what amounts should be recognized and recorded for the transactions. Structure of Statement of Earnings: Net sales − Cost of sales = Gross profit − Operating expenses = Earnings from operations +/− Non-operating revenues/expenses and gains/losses = Earnings before income taxes − Income tax expense = Earnings from continuing operations +/− Earnings/loss from discontinued operations = Net earnings - - - The statement of earnings is divided into sections 1) Results of continuing operations, 2) Results of discontinued operations (optional), and 3) Earnings per share. Net earnings is the sum of sections 1 and 2, and all companies report information for sections 1 and 3, while section 2 is reported only by some companies depending on their circumstances. This passage describes the section of a statement of earnings that shows the results of normal or continuing operations. It explains that revenues are increases in assets or settlements of liabilities resulting from the ongoing operations of the business, specifically from the sale of goods or services. It also defines expenses as decreases in assets or increases in liabilities resulting from ongoing operations, which are incurred to generate revenues during the period. The primary operating expenses for most merchandising companies include cost of sales (or cost of goods sold), operating expenses, and earnings from operations. Cost of sales is the cost of products sold to customers, and in companies with a manufacturing or merchandising focus, it is usually the most significant expense. Operating expenses are the usual expenses, other than cost of sales, that are incurred in operating a business during a specific accounting period, and the expenses reported will depend on the nature of the company’s operations. Earnings from - - - - - - - operations, also called operating income, equals net sales less cost of sales and operating expenses. The statement of earnings can include other income or expenses that are not central to continuing operations, such as interest income, financing costs, and gains or losses on disposal of assets. These items are categorized as other income or expenses and are added to or subtracted from earnings from operations to obtain pretax earnings. The income tax expense is the final expense listed on the statement of earnings. For-profit corporations are required to calculate income taxes owed to governments, and the expense is calculated as a percentage of earnings before income taxes. It reflects the difference between income and expenses, and applicable tax rates are used to determine the expense. Companies disclose separately on the statement of earnings the net earnings or loss from a major line of business or a geographical area of operations that has been disposed of during the accounting period, or a specific operation that is planned to be discontinued in the near future. These financial results, known as discontinued operations, are not useful in predicting future recurring net earnings because of their non-recurring nature. Corporations must disclose earnings per share, which is a commonly used ratio to evaluate a company's operating performance and profitability. It can be calculated by dividing net earnings by the average number of shares outstanding during the period. However, the actual calculation of the ratio is more complex and is not covered in this course. The cash basis accounting is used by many small businesses, where revenues are recorded when cash is received and expenses when cash is paid, regardless of when they are actually earned or incurred. This method is not suitable for external reporting purposes and does not accurately reflect a company's assets and liabilities. Therefore, International Financial Reporting Standards (IFRS) require the use of accrual basis accounting for financial reporting. Accrual basis accounting recognizes revenues and expenses when the transaction that causes them occurs, not necessarily when cash is received or paid. Revenues are recognized when they are earned and expenses when they are incurred. The revenue recognition principle and the matching process determine when revenues and expenses are to be recorded under accrual basis accounting. The revenue recognition principle requires a company to recognize revenue when goods or services are transferred to customers, in an amount it expects to receive. Revenue is considered earned when the business delivers goods or services, regardless of when cash is received from customers. Cash can be received before, during, or after delivery. The Matching Process - 1) The matching process involves matching revenues with expenses. In the case where cash is paid before the expense is incurred to generate revenue, the company records an expense for the portion of the cost of the assets used when revenues are generated in the future. This ensures that costs are matched with the benefits they generate. Examples of assets that are purchased for future use include insurance, rent, supplies, and equipment. - - 2) Cash is paid in the same period as the expense is incurred to generate revenue. Expenses are sometimes incurred and paid for in the period in which they arise. An example is paying for repairs on sewing machines the day of the service 3)Cash is paid after the cost is incurred to generate revenue. Although rent and supplies are typically purchased before they are used, many costs are paid after goods or services have been received and used. Examples include using electric and gas utilities in the current period that are not paid for until the following period, using borrowed funds and incurring interest expense to be paid in the future, and owing wages to employees who worked in the current period. - Expanded Transaction Analysis Model - In accounting, accounts can increase or decrease, and revenues and expenses tend to increase throughout a period. Debits (dr) are written on the left side of each T-account and credits (cr) are written on the right. Every transaction affects at least two accounts. Revenues have credit balances, while expenses have debit balances. When a revenue or expense is recorded, either an asset or a liability will also be affected. Revenues increase net earnings, retained earnings, and shareholders’ equity, while expenses decrease them. Recording revenue results in either increasing an asset or decreasing a liability, while recording an expense results in either decreasing an asset or increasing a liability. Ask → Was a revenue earned by delivering goods or services? • If so, credit the revenue account and debit the account for what was received to recognize the sales transaction. or Ask → Was an expense incurred to generate a revenue in the current period? • If so, recognize the transaction, debit the expense account, and credit the appropriate accounts for what was given. • or Ask → If the transaction resulted in no revenue earned or expense incurred, what was received and given? - • Identify the accounts affected by title (e.g., cash, deferred revenue). Make sure that at least two accounts change. - • Classify the accounts by type. Was each account an asset (A), a liability (L), shareholders’ equity (SE), a revenue/gain (R), or an expense/loss (E)? - • Determine the direction of the effect. Did the account increase [+] or decrease [−]? - Step 2: Verify → Is the accounting equation in balance? (A = L + SE) - - - To prepare financial statements, a trial balance is generated to ensure debits equal credits after all transactions for the period have been recorded. Accounts are listed in a specific order on financial statements: assets, liabilities, shareholders’ equity, revenues/gains, and expenses/losses. Ending account balances that did not change are taken from the beginning trial balance, while those that changed due to transactions are taken from T-accounts. End-of-period adjustments are made to reflect all revenues earned and expenses incurred during the period, and income tax expense and net earnings are determined and reported in the statement of earnings. TOTAL ASSET TURNOVER RATIO ANALYTICAL QUESTION → How effective is management at generating sales from assets (resources)? RATIO AND COMPARISONS → The total asset turnover ratio is useful in answering this question. It is computed as follows: Total Asset Turnover Ratio= Sales or Operating Revenues/Avg Total Assets *Average total assets = (Beginning total assets + Ending total assets) ÷ 2. - The total asset turnover ratio indicates how much sales a company generates per dollar of assets. A high ratio indicates efficient asset management, while a low ratio suggests less-efficient management. A strong operating performance can improve the ratio. Creditors and security analysts use this ratio to evaluate a company's ability to control current and non-current assets. - The return on assets (ROA) measures how much a company earned from the use of its assets. It is a measure of profitability and management effectiveness that allows investors to compare investment performance against alternative options. Firms with higher ROA are considered to be doing a better job of selecting new investments, all other things being equal. ROA=Net Earnings + Interest Expense (net of tax)/ Avg total Assets The statement of earnings presents the results of operations for a specific accounting period, including the effects of discontinued operations. Publicly accountable enterprises must now disclose additional information in a statement of comprehensive income, which includes the financial effect of events causing changes in shareholders' equity. The net earnings and other comprehensive income are combined to create a final total called comprehensive income. Revenues, expenses, gains, and losses are the elements of the classified statement of earnings. Accrual accounting concepts dictate that revenues are recognized when earned, and expenses are recognized when incurred. The revenue recognition principle states that revenues are recognized when goods and services are transferred to customers in an amount they expect to receive. The matching process determines when to recognize expenses, based on when they are incurred in generating revenue. Chapter 4 Accounting Cycle: The accounting cycle is a process used by entities to analyze and record transactions, adjust the records, prepare financial statements, and prepare for the next cycle. Transactions are analyzed and recorded in the general journal, and related accounts are updated in the general ledger. End-of-period steps involve adjusting revenues and expenses and updating statement of financial position accounts for reporting purposes. - Adjusting entries are recorded at the end of the accounting period to ensure that revenues are recorded when earned, expenses are recorded when incurred, and assets and liabilities are reported at their proper amounts. This is necessary because companies need to prepare accurate financial statements for external users. Adjusting entries are not made daily because it would be too costly and time-consuming. Deferrals Receipts of assets or payments of cash in advance of revenue or expense recognition. - Accruals Revenues earned or expenses incurred that have not been previously recorded. Adjustment Process - Step 1: Ask: Was revenue earned or an expense incurred that is not yet recorded? If the answer is YES, the revenue or expense account must be increased, credit the revenue account or debit the expense account in the adjusting entry. - Step 2: Ask: Was the related cash received or paid in the past or will it be received or paid in the future? If cash was received in the past, a deferred revenue (liability) account was recorded in the past now, reduce (debit) the liability account (usually⟶ deferred revenue) that was recorded when cash was received, because the entire liability or part of it has been settled since then. If cash will be received in the future increase (debit) the receivable⟶ account (such as interest receivable or rent receivable) to record what isowed by others to the company (creates accrued revenue).: If cash was paid in the past, a deferred expense account (asset) was recorded in the past now, reduce (credit) the asset account (such as⟶ supplies or prepaid expenses) that was recorded in the past because the entire asset or part of it has been used since then. (A variation of this concept will be illustrated for the use of buildings, equipment, and some intangible assets.) If cash will be paid in the future increase (credit) the payable account⟶(such as interest payable or wages payable) to record what is owed by the company to others (creates an accrued expense). Note: Cash is never included in the adjusting entry, because it was recorded already in the past or will be recorded in the future. Step 3: Compute the amount of revenue earned or expense incurred and record the adjusting entry. Sometimes the amount is given or known. At other times it must be computed, or sometimes estimated. - - - - - This passage discusses the trail balance, which is a listing of individual accounts and their ending debit or credit balances. It also explains that if total debits do not equal total credits on the trail balance, errors have occurred. The concept of deferred revenue is also covered, which occurs when a customer pays for goods or services before they are delivered. Deferred revenue is recorded as a liability, and the recognition of revenue is deferred until the company fulfills its obligation. On the other hand, accrued revenue is earned revenue that has not been realized in cash and recorded at the end of the accounting period. Assets represent resources that provide probable future benefits to the company, and some assets are used over time to generate revenues. These assets are called deferred expenses, including supplies, prepaid rent, prepaid insurance, buildings, equipment, and intangible assets. Adjustments are made at the end of each period to record the amount of the asset that was used during that period. Accrued expenses are expenses that are incurred in the current period but not paid until the next period, such as interest expense, wages expense, and utilities expense, which are recognized in adjusting entries at the end of the period. - - - - The cost of property, plant, and equipment is expensed over its estimated useful life through depreciation. Depreciation is accumulated in a contra account called accumulated depreciation, which has a credit balance. The net book value of property, plant, and equipment is calculated as its carrying amount, which is the ending balance in the property, plant, and equipment account minus the ending balance in the accumulated depreciation account. Materiality refers to the importance of financial statement information in affecting the decisions of financial statement users. It indicates that insignificant items should be treated in the most cost-beneficial way in accordance with accounting standards. Materiality is a qualitative factor that allows accountants to balance the cost of reporting accounting information against its benefit to users when recording transactions and preparing financial disclosures. The statement of earnings is prepared first, as net earnings is a part of retained earnings, which is reported on the statement of changes in equity. The statement of earnings includes the earnings per share (EPS) ratio, which is important in evaluating the profitability of a company. The EPS is calculated by dividing the net earnings available to common shareholders by the weighted average number of common shares outstanding during the period. The Statement of Changes in Equity shows the changes in equity of a company, including the net earnings carried forward from the Statement of Earnings and deducting dividends declared during the period. The ending balances of the Statement of Changes in Equity are included in the Statement of Financial Position, where assets are listed in order of liquidity, and liabilities are listed in order of time to maturity. Current assets and liabilities are those used or turned into cash within one year. - The net profit ratio margin measures how much profit is earned as a percentage of revenues generated during the period. A rising net profit margin ratio signals more efficient management of sales and expenses. Financial analysts expect well-run businesses to maintain or improve their net profit margin ratio over time. - ROE measures how much the firm earned as a percentage of shareholders’ investment. In the long run, firms with higher ROE are expected to have higher share prices than firms with lower ROE, all other things being equal. Managers, analysts, and creditors use this ratio to assess the effectiveness of the company’s overall business strategy (its operating, investing, and financing strategies). - The statement of financial position contains permanent accounts that are not reduced to zero at the end of the accounting period, while revenue, expense, gain, loss, and dividend accounts are temporary accounts that are closed at the end of each period. Closing entries transfer the balances in temporary accounts to retained earnings and establish a zero balance in each account to start the accumulation in the next period. Adjusting entries are necessary to measure earnings properly, correct errors, and provide for adequate valuation of financial statement accounts. The net profit margin ratio and the return on equity (ROE) ratio are used to assess a company's profitability and overall business strategy.