t

rP

os

F-959-E

October 2020

HBP# IES793

AB InBev, Costs of Capital

Introduction

op

yo

Jan Simon

It was mid-August 2019 and Maddox Marcus was fidgeting in his chair. He was flipping through

some notes he had taken the previous year during his MBA, while tapping away on his

Bloomberg. He felt edgy. His boss, Luis Felipe Pedreira, CFO & CTO of AB InBev, had requested

a presentation by the end of the month on the firm’s cost of capital and leverage, as well as how

potential changes to both would affect it.

More specifically, he had asked Maddox to: “have a look at how our cost of capital would be

affected in two scenarios: a) if we had 25% more debt and b) if we had 25% less debt, keeping

assets the same. Also, calculate the respective Economic Value Added (EVA) and EVA-spreads

and let me know what you think.”

tC

Upon graduating from one of Europe’s leading business schools, Maddox had joined AB InBev’s

Finance Group. Finance groups, areas or departments typically include planning, budgeting,

treasury, auditing and accounting, as well as controlling for the company’s finances. Among

other things, they are responsible for producing the company’s financial statements.

In companies driven by shareholder value creation, by mergers and acquisitions or where capital

structure optimization is important, the finance area plays a central role in the decision-making

processes of the board and the company’s senior leadership. AB InBev is such a company.

Do

No

Prior to pursuing his MBA, Maddox had been a management consultant, involved in the food

and beverage industry and AB InBev had been one of the firm’s most prominent clients. Though

he had enjoyed the professionalism and work ethic he found in management consulting, he and

his fiancée had envisioned a different life post-MBA. When AB InBev presented its MBA

internship programs on campus, he was quick to apply. The internship had fully met his

expectations and he was made an offer before returning to finish B-school. He had gladly signed

on the dotted line and joined full-time after graduating.

This case was prepared by Professor Jan Simon. October 2020.

IESE cases are designed to promote class discussion rather than to illustrate effective or ineffective management of a given

situation.

Copyright © 2020 IESE. To order copies contact IESE Publishing via www.iesepublishing.com. Alternatively, write to

publishing@iese.edu or call +34 932 536 558.

No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form

or by any means - electronic, mechanical, photocopying, recording, or otherwise - without the permission of IESE.

Last edited: 6/10/20

This document is authorized for educator review use only by FELIPE TEODORO, FGV - EAESP until Nov 2022. Copying or posting is an infringement of copyright.

Permissions@hbsp.harvard.edu or 617.783.7860

AB InBev, Costs of Capital

rP

os

Company Background1

t

F-959-E

Headquartered in Leuven, Belgium, and with over 500 beer labels and 175,000 employees

globally, AB InBev’s roots go back more than 800 years, when a group of Belgian monks began

brewing a beer called Leffe. The company’s portfolio also included the brand Hoegaarden, a

citrusy wheat beer, produced by brethren in another part of Belgium. It was said that

parishioners skipped church to enjoy the heavenly pleasures produced by these early monks.

Over the years, AB InBev had expanded its activities and brands in other countries: Argentina

(Quilmes), Brazil (Brahma), Canada (Labatt), England (Bass), Germany (Bush), Paraguay

(Paraguaya), Peru (Backus and Johnston), and the U.S. (Anheuser).

op

yo

AB InBev2 was the product of various mergers and acquisitions. The name itself hinted at that

fact. “AB” represented the initials of Anheuser-Bush, which was created in 1860 when Adolphus

Bush partnered with Eberhard Anheuser (who had created Anheuser & Co in St.-Louis in 1852)

to form Anheuser-Bush. Its beers include: Budweiser, Busch, Michelob, Natural Light and Ice.

“In” comes from Interbrew, which was formed in 1987 when Belgian breweries Piedboeuf,

established in 1812, and Artois, established in 1366, merged. In 1995, the firm acquired Canada’s

largest brewery: Labatt Brewing Company, founded in 1847. It added Germany’s Beck’s,

established in 1847, to its portfolio in 2002. Readers may have enjoyed Stella Artois, Hoegaaarden,

Becks, Labatt, Piedboeuf3 or Jupiler4, to name a few of its brands.

Brazilian Ambev contributed “Bev” (Companhia de Bebidas das Americas) to the name. It was

created in 1999 by merging Antarctica, established in 1880, with Brahma, established in 1886.

Its beers include Quilmes, Antarctica, Bohemia and Skol.

tC

Interbrew merged with Ambev in 2004 to form InBev. In 2008, it acquired Anheuser-Bush,

becoming AB InBev. Finally, in 2016, it acquired SABMiller.

No

While spirits, wine and beer markets had been growing at a fast clip up until 2010, they began

to recede in 20115. Luckily, M&A was a core element in AB InBev’s strategy long before this

development. This approach was aimed partly at buying market power in maturing markets, and

partly at buying growth in developing markets.

Do

1 Home. Accessed September 17,

2020. https://www.ab-inbev.com.

2 The company name is Anheuser-Bush InBev SA/NV, but is better known as AB InBev.

3 Favorite table beer of case writer’s parents.

4 For

more than three decades sponsor of De Rode Duivels, Belgium’s national soccer team, as well as a favorite drink of

Belgian Special Forces, off-duty (at least during the years the case writer served in them). Its codename was Joe Pyler.

5 “Around the World, Beer Consumption is Falling.”

The Economist. Last modified June 13, 2017.

https://www.economist.com/graphic-detail/2017/06/13/around-the-world-beer-consumption-is-falling.

2

IESE Business School-University of Navarra

This document is authorized for educator review use only by FELIPE TEODORO, FGV - EAESP until Nov 2022. Copying or posting is an infringement of copyright.

Permissions@hbsp.harvard.edu or 617.783.7860

F-959-E

t

AB InBev, Costs of Capital

op

yo

rP

os

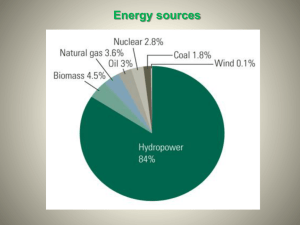

Figure 1

Source: “Around the World, Beer Consumption is Falling.” The Economist. Last modified June 13, 2017.

https://www.economist.com/graphic-detail/2017/06/13/around-the-world-beer-consumption-is-falling.

Maddox’s Thoughts and Notes

On Strategy

tC

Maddox recalled that mergers and acquisitions, through geographic and product extension, had

been a proven model for shareholder-value creation in mature markets. He had made many

presentations on the subject during his consultant years, convincing clients either to “dress the

company up for sale” or start developing an M&A strategy.

Do

No

Reviewing AB InBev’s6 stock price over the past 10 years, he could appreciate the value that

M&A had helped to create, especially in markets where alcohol consumption was decreasing.

Indeed, AB InBev’s stock performance had comfortably beaten the market index it belonged to

(Bel20) and was on par with SP500 performance, an index that arguably included some of the

world’s largest and most important companies. Many of them, such as Amazon, Alphabet

(parent company of Google), Facebook or Netflix were in fast growing industries. Compared with

its peers, it was keeping pace with most.

6 AB InBev is quoted on the Belgian Stock Exchange and has Bloomberg code ABI BB.

IESE Business School-University of Navarra

3

This document is authorized for educator review use only by FELIPE TEODORO, FGV - EAESP until Nov 2022. Copying or posting is an infringement of copyright.

Permissions@hbsp.harvard.edu or 617.783.7860

AB InBev, Costs of Capital

op

yo

rP

os

Figure 2

AB InBev Stock Performance, August 2009-August 2019

t

F-959-E

Source: Bloomberg, September 2019.

Do

No

tC

Figure 3

AB InBev (white) Stock Performance vs. Bel20 (green), August 2009-August 2019

Source: Bloomberg, September 2019.

4

IESE Business School-University of Navarra

This document is authorized for educator review use only by FELIPE TEODORO, FGV - EAESP until Nov 2022. Copying or posting is an infringement of copyright.

Permissions@hbsp.harvard.edu or 617.783.7860

F-959-E

t

AB InBev, Costs of Capital

op

yo

rP

os

Figure 4

AB InBev (white) Stock Performance vs. SP500 (yellow), August 2009-August 2019

Source: Bloomberg, September 2019.

Do

No

tC

Figure 5

AB InBev (white) Stock Performance vs. Carlsberg (green), Heineken (yellow)

and Diageo (magenta), August-2009-August 2019

Source: Bloomberg, September 2019.

IESE Business School-University of Navarra

5

This document is authorized for educator review use only by FELIPE TEODORO, FGV - EAESP until Nov 2022. Copying or posting is an infringement of copyright.

Permissions@hbsp.harvard.edu or 617.783.7860

AB InBev, Costs of Capital

t

F-959-E

rP

os

At the same time, Maddox couldn’t miss the hammering that AB InBev’s stock had received

following the 2016 acquisition of SABMiller. Several things had not gone according to plan. First,

AB InBev had missed earnings estimates for the first three quarters of 2016. This was due to

lower consumption globally, but especially in key markets (Brazil, China, Germany and the U.S.),

combined with a stronger dollar (70% of sales are outside the U.S.).

Second, integration issues had been harder to manage than expected. The number no. 1 player

acquiring the sector’s no. 2 wasn’t expected to be easy, and this had proved to be correct.

op

yo

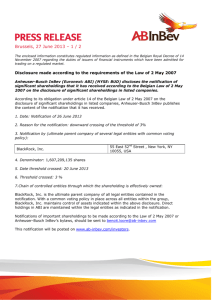

Integration issues, a high debt burden and the sales of premium brands had all had negative

effects on the stock price. Trying to forge one culture while laying off people7 in a sector under

pressure affects company performance. Also, to finance the SABMiller acquisition, AB InBev’s

debt had ballooned by more than $100 billion, substantially affecting the company’s beta, as

both operational risk and financial risk had increased. Additionally, its credit rating had been

downgraded by Moody’s (from A3 to Baa1, 3-notches above junk) while Standard & Poor’s had

put its A- (A minus) rating under “review for downgrade”8 (See Exhibit 1). To avoid further

downgrades, AB Inbev had halved its dividend. As if this weren’t enough, regulators worldwide

had required the merged entity to sell some important assets as a condition for approval.

So far, 2019 had seen a reversal of fortunes and been a great year to be an AB InBev investor.

Its second-quarter earnings had beaten consensus and the company had lowered its leverage

without sacrificing growth (See Exhibit 2 for some of its assets sales). It had innovated with

products and entered new markets. Finally, Standard & Poor’s had confirmed its A- rating. This

was all good news, not to mention that calling off the IPO of its Asian business had had no

negative effect on its stock price.

tC

Maddox noted that while senior management still defended the deal, not in the least for its

access to its fastest growing market, Africa, some sell-side analysts had started to wonder if the

price paid – leverage, price and divestments – had not been excessive9.

On Cost of Capital and Value Creation

Maddox was staring at some of the notes taken in his corporate finance class (See Exhibit 3). He

then scanned some of AB InBev’s financial statements (Exhibit 4). Why had Felipe sounded

nervous? Was there trouble ahead?

Do

No

Tapping on his Bloomberg keyboard, he looked for data which could assist him in calculating AB

InBev’s cost of capital at present capital structure, as well as if it had 25% more debt and if it had

25% less debt (keeping price per share, tax rate and total assets constant). He had already

calculated that the interest coverage ratio would lower from the present ratio to 2.5 in the former

case and increase to 4.25 in the latter. Presently, the company had €125.7 billion in LT-debt,

€34.5 billion in ST-debt and €7 billion in cash. Its equity book value was €71.9 billion on total assets

of €232.1 billion. “If we only had a crystal ball,” thought Maddox, “we could have taken on more

short term.”

7 Thomas Buckley. “AB InBev Said to Plan 5,500 Job Cuts After SABMiller Deal.” Chicagotribune.com. Last modified August 26,

2016. https://www.chicagotribune.com/business/ct-ab-inbev-sabmiller-layoffs-20160826-story.html.

8

“AB InBev Cut by Moody's Amid Struggles to Trim Massive Debt Pile.” Bloomberg.com. Last modified December 11, 2018.

https://www.bloomberg.com/news/articles/2018-12-10/ab-inbev-cut-by-moody-s-amid-struggles-to-trim-massive-debt-pile.

9 “How Deal for SABMiller Left

AB InBev with Lasting Hangover.” Financial Times. Last modified July 24, 2019.

https://www.ft.com/content/bb048b10-ad66-11e9-8030-530adfa879c2.

6

IESE Business School-University of Navarra

This document is authorized for educator review use only by FELIPE TEODORO, FGV - EAESP until Nov 2022. Copying or posting is an infringement of copyright.

Permissions@hbsp.harvard.edu or 617.783.7860

F-959-E

t

AB InBev, Costs of Capital

op

yo

rP

os

Figure 6

AB InBev General Description and Specs, August 2019

Source: Bloomberg, September 2019.

Do

No

tC

Figure 7

AB InBev Beta, August 2019

Source: Bloomberg, September 2019.

IESE Business School-University of Navarra

7

This document is authorized for educator review use only by FELIPE TEODORO, FGV - EAESP until Nov 2022. Copying or posting is an infringement of copyright.

Permissions@hbsp.harvard.edu or 617.783.7860

AB InBev, Costs of Capital

rP

os

op

yo

Figure 8

AB InBev Credit Ratings, August 2019

t

F-959-E

Source: Bloomberg, September 2019.

Do

No

tC

Figure 9

AB InBev Risk Premium, August 2019

Source: Bloomberg, September 2019.

8

IESE Business School-University of Navarra

This document is authorized for educator review use only by FELIPE TEODORO, FGV - EAESP until Nov 2022. Copying or posting is an infringement of copyright.

Permissions@hbsp.harvard.edu or 617.783.7860

F-959-E

t

AB InBev, Costs of Capital

Do

No

tC

op

yo

rP

os

With all this data, Maddox was ready for the first part of the task: to calculate AB InBev’s cost of

capital at present level and with +/- 25% in debt as well as the respective EVA and EVA-spreads.

It was getting late though and his friends were awaiting him at his favorite bar, De Rector on De

Oude Markt. It was Friday and they were meeting to enjoy a Karmeliet 10, a good discussion and

each other’s company.

10 Karmeliet Beer is a Tripel of 8.4%. Brewed by Brewery Bosteels (Kwak and Deus), it is the winner of the 2008 World Beer

Awards.

IESE Business School-University of Navarra

9

This document is authorized for educator review use only by FELIPE TEODORO, FGV - EAESP until Nov 2022. Copying or posting is an infringement of copyright.

Permissions@hbsp.harvard.edu or 617.783.7860

AB InBev, Costs of Capital

Exhibit 1

rP

os

t

F-959-E

Ratings, Interest Coverage and Spreads

Int. cov. Ratio

>

<

Rating (S&P)

Spread

0.1999999

D

19.38%

0.2

0.6499999

C

14.54%

0.65

0.7999999

CC

11.08%

0.8

1.2499999

CCC

9.00%

1.25

1.4999999

B-

6.60%

op

yo

-100000

1.5

1.7499999

B

5.40%

1.75

1.9999999

B+

4.50%

2

2.2499999

BB

3.60%

2.25

2.4999999

BB+

3.00%

2.5

2.9999999

BBB

2.00%

3

4.2499999

A-

1.56%

4.25

5.4999999

A

1.38%

5.5

6.4999999

A+

1.25%

6.5

8.4999999

AA

1.00%

8.5

1000000

AAA

0.75%

Do

No

tC

Source: “Ratings and Coverage Ratios.” Welcome to Pages at the Stern School of Business, New York University.

Accessed September 17, 2020. https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ratings.htm.

10

IESE Business School-University of Navarra

This document is authorized for educator review use only by FELIPE TEODORO, FGV - EAESP until Nov 2022. Copying or posting is an infringement of copyright.

Permissions@hbsp.harvard.edu or 617.783.7860

F-959-E

t

AB InBev, Costs of Capital

rP

os

Exhibit 2

No

tC

op

yo

Deleveraging AB Inbev

Do

Source: “How Deal for SABMiller Left AB InBev with Lasting Hangover.” Financial Times. Last modified July 24, 2019.

https://www.ft.com/content/bb048b10-ad66-11e9-8030-530adfa879c2.

IESE Business School-University of Navarra

11

This document is authorized for educator review use only by FELIPE TEODORO, FGV - EAESP until Nov 2022. Copying or posting is an infringement of copyright.

Permissions@hbsp.harvard.edu or 617.783.7860

AB InBev, Costs of Capital

t

F-959-E

rP

os

Exhibit 3

Maddox Corporate Finance Notes – Cost of Capital/Capital Structure

1. Why Is Cost of Capital (CoC) Such a Central Concept in Finance and Management?

op

yo

Important for Managers:

If I use my assets in such a way that Ra (return on assets) < CoC=> destroying value

(for shareholders). If Ra> CoC => creating value.

It is one of the measures shareholders will judge me against.

Debt Holders: Will I get dividends and interest back when I expect it?

Equity: Am I getting compensated for risk (via dividend and capital gains)?

+ If value destroyed => Share price down

+ If value created => Share price up

Management should run company (Cy) this way so that through new opportunities,

innovation, new products/markets, improved sales, leaner operations, providers of capital

will be happy.

Will be a function of risk (higher risk, higher return) and alternatives (hence benchmarking).

Important for Investors:

Investing in management you think will create value.

Capital Structure Arbitrage funds will take advantage where there is (perceived) mispricing

between the different instruments of a same capital structure (e.g. debt and equity).

Note that some investors like to look at EVA (Economic Value Added) and EVA-spread as a

way to see how much shareholder value is created above the cost of capital.

NPV = -I+ CF1/(1+r) + CF2/(1+r)^2 + …

Re= Rf + βe (Rm-Rf) note: βe reflection of a.o. financial risk

Ra=Rf + βa (Rm-Rf)

note: βa is a constant

Rd= Rf + βd (Rm-Rf) note: treat βd as constant for small changes in leverage

Rd = Rf + RP

βa= βe E/(D+E) + βd D/(D+E)

Ra=Re if there is no leverage thus Re=Ra

Re=Ra + D/E (Ra-Rd) if there is leverage

WACC=D/(D+E) (1-Tx) Rd + E/(D+E) Re

EVA=NOPAT- (WACC * Invested Capital), with Invested Capital = Equity + Long- Term Debt

EVA-spread= ROIC-WACC

NOPAT=EBIT * (1-Tx)

Interest Coverage Ratio: EBIT/Interest payments (accountants like a number above 2.5)

ROIC = NOPAT/Invested Capital

NOPAT=Net Operating Profit After Tax or EBIT * (1-Tx)

Terminal Valuet= {FCFt+1 /r} Perpetuity without growth

Terminal Valuet= {FCFt+1 /(r-g)} Perpetuity with constant growth (aka Gordon Shapiro)

EV = Equity + Net Debt (EV: Enterprise Value)

EBIT is a reasonable proxy for operating cash flow

EBITDA is a good proxy for FCFF (Free Cash Flow to the Firm)

Do

No

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

tC

2. Important Formulas

12

IESE Business School-University of Navarra

This document is authorized for educator review use only by FELIPE TEODORO, FGV - EAESP until Nov 2022. Copying or posting is an infringement of copyright.

Permissions@hbsp.harvard.edu or 617.783.7860

F-959-E

Exhibit 4

AB InBev Financial Statements (Selected)

rP

os

t

AB InBev, Costs of Capital

EUR Mio

2018

2017

2016

2015

Volumes

567,066

612,572

500,242

502,246

Revenue

54,619

56,444

45,517

43,604

-20,359

-21,386

-17,803

-17,137

34,260

35,058

27,714

26,467

-17,118

-18,099

-15,171

-13,732

CoGS

Gross Profit

SGA

680

854

732

1,032

Norm EBIT

17,822

17,813

13,275

13,767

Norm EBITDA

22,080

22,084

16,753

17,057

Norm EBITDA %

40%

39%

37%

39%

Tax rate

33%

17%

37%

21%

Net Fin. Cost

-8,729

-6,507

-8,564

-1,453

Interest Expense

-5,941

-5,938

-5,310

-3,442

5,691

9,155

2,769

9,867

2.17

3.98

0.71

4.96

PROFIT

tC

EPS (DIL)

op

yo

Other

Do

No

Source: Company financial statements and instructor adjustments.

IESE Business School-University of Navarra

13

This document is authorized for educator review use only by FELIPE TEODORO, FGV - EAESP until Nov 2022. Copying or posting is an infringement of copyright.

Permissions@hbsp.harvard.edu or 617.783.7860