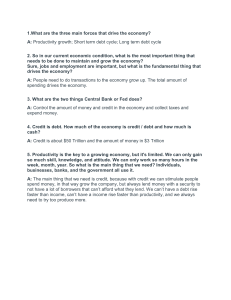

Navigating Big Debt Crises: Principles & Archetypal Cycle

advertisement