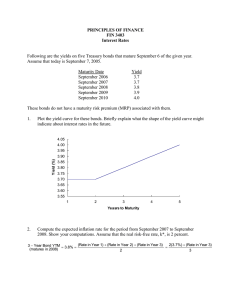

UNSW Business School/ Banking & Finance FINS2624 Lecture 1 Introduction to Bond Pricing and Term Structure of Interest Rates I Lecture Outline 1 q Bond characteristics Ø Elements in pricing a bond Ø Bond Cash Flows q Bond pricing Ø Arbitrage pricing Ø PV of a bond – discounting future cash flows q Yield / return measures Ø Yield to Maturity (YTM) Ø Holding Period Return Ø Realised Compound Yield q Introduction to the term structure of interest rates Ø Yield Curve Ø Inferring future interest rates What is a Bond? q A bond is a certificate specifying a debt obligation for a fixed sum between the Issuer (borrower) and the Bondholder (lender) Ø Issuers (borrowers) typically include corporates, Governments etc Ø Bondholders (creditors) typically include fund managers q Essentially a borrowing-lending contract where the issuer makes interest and principal payments on designated dates to repay the debt obligation Ø The Indenture is the contract between the issuer and the bondholder describing the terms, conditions and protections for bondholders q Default risk - risk that the issuer will not repay their debt obligations Ø Bondholder is unable to collect all the expected cash flows from the bond Ø While default risk is very important in practice it will generally be ignored in this course BKM 14.1 2 Characteristics Pricing Yield Term Structure Bond Characteristics q q A bond is a claim on fixed future cash flows CF There are five key parameters in pricing a bond (P): Ø Term (T): the period of time to maturity of the bond (ie when the bond pays its last cash flow) ie the “term to maturity” Ø Face Value (FV) or par value: the principal or loan amount of the bond, typically repaid in full as one large cash flow at maturity • Typically $1000 lots Ø Coupon (C): series of smaller cash flows paid before maturity. These are essentially interest payments Ø Coupon frequency: the number of times per annum, the coupon is paid. May be zero, one or more coupons in a given year • Typically semi-annual Ø Yield to Maturity (YTM): the actual (market) interest rate applied to discount the cash flows from the bond (including principal and coupons) BKM 14.1 3 Characteristics Pricing Yield Term Structure Bond Cash Flows q This figure illustrates the cash flows of a 2-year bond with a FV of 100 and a yearly coupon of 5 We denote the coupon ($5) as Ct where t is the time period when we get the coupon q The sum of the annual coupons are often expressed as a fraction of the FV, e.g. 5 %. We call this the Coupon Rate = C / FV q Note that although coupons are treated as interest income to bondholders the coupon rate is not necessarily equal to the YTM (see YTM discussion) BKM 14.1 4 Characteristics Pricing Yield Term Structure Approaches to Pricing There are two approaches to pricing: q Fundamental pricing Ø Prices are set in a supply-demand equilibrium Ø The properties of an asset tell us what that price is likely to be q Arbitrage pricing Ø Replicate the future cash flows of an asset with a portfolio of similar assets with known prices (called the replicating portfolio or synthetic asset) Ø Under no-arbitrage condition, the market value of the asset we are trying to price should equal the market value of the replicating portfolio Ø We use this approach when pricing bonds and derivatives BKM 14.2 5 Characteristics Pricing Yield Term Structure What is Arbitrage? q An arbitrage is a (set of) trade(s) that: Ø Require no net capital outlay (zero net cash flow upfront) AND generate positive but risk-free cash flow in the future Ø Or alternatively, a positive and risk-free cash flow today with no net outlay (ie zero cash flow) in the future Ø The proverbial “free lunch” q Law of one price states that two assets with the same payoff (identical cash flows) should have the same price in equilibrium Ø For example – two identical bonds should sell for the same price Ø If not, simultaneously buy the cheaper bond and sell the more expensive bond – this is an arbitrage trade q All arbitrage pricing is based on the no-arbitrage principle (the law of one price) BKM 10.2 6 Characteristics Pricing Yield Term Structure Arbitrage Example: Zero Coupon Bond q Replicating portfolio (or “synthetic asset”): construct a portfolio of other assets that exactly mimic the cash flows of the asset we wish to price q Arbitrage pricing is all about constructing a replicating portfolio using assets with known prices. With a replicating portfolio we can execute an arbitrage and price the subject asset correctly q Simple example: How would you price the risk-free one-year zero-coupon bond below? BKM 14.2 7 Characteristics Pricing Yield Term Structure Arbitrage Example: Zero Coupon Bond q From previous course work you would know we “discount” the future cashflow with some appropriate discount rate y to get the present value (if not see the Lecture 0 slides) q Assuming y = 10% then the price of Bond A is: PA = 100 100 = » 90.9 (1 + y ) 1.10 q The appropriate discount rate y is the return we could have earned on an alternative investment with the same risk q What would be a replicating portfolio for the bond ie an alternative investment that mimics its cash flows exactly? BKM 14.2 8 Characteristics Pricing Yield Term Structure Arbitrage Example: Zero Coupon Bond q Say there is a bank where you can lend and borrow money at 10% interest Ø In this simple example we just put an amount of money M in the bank Ø To replicate the bond, after one year in the bank account earning 10%, M should have grown to match the bond’s cash flow of $100 Ø We must have: 1.1M = 100 100 M= » 90.9 1.1 q q What if the $90.90 bank deposit replicates the bonds cash flow (is a synthetic bond) but differs from the bond price Ø For example, say the bond was trading at $80.90? What would we do? BKM 14.2 9 Characteristics Pricing Yield Term Structure Arbitrage Example: Zero Coupon Bond q Arbitrage typically involves two trades: we buy the cheaper instrument and sell (or short) the more expensive instrument (the synthetic in this case) q In executing an arbitrage, we typically need to short sell (or short) a security (i.e., selling a security we don’t own). We will expand on this later q “Selling” a bank deposit means borrowing the money q The arbitrage trade is as follows: q ① Today: Borrow $90.90 from the bank: Buy the bond: Remaining Cash: + 90.90 - 80.90 + 10.00 ② In one year: Receive bond principal (FV) Repay bank loan: Remaining (zero net cash flow): + 100.00 - 100.00 - Our “free” $10 upfront is an arbitrage profit BKM 14.2 10 Characteristics Pricing Yield Term Structure Arbitrage Achieves Price Equilibrium q In reality, true arbitrage opportunities are rare and short-lived as traders close asset mispricing by trading on them in significant quantities q In our example, traders borrow from the bank to buy the bond. This will: Ø é increase demand for the bond and raise its price Ø é increase the bank borrowing rate (ie above 10%) Ø continue until no further arbitrage trades are possible ie when the two trades yield exactly the same payoff, and prices are in equilibrium q We can not say whether it was the bond price or the bank’s interest rate that was wrong. We can only say the prices are internally inconsistent and violate the no-arbitrage principle (ie the law of one price) q This course focuses on finding arbitrage-free price equilibrium BKM 14.2 11 Characteristics Pricing Yield Term Structure Arbitrage Pricing: General Case q Arbitrage pricing also holds for coupon paying bonds q Replicate the entire CF-stream we want to price q The bond is just a combination of future cash flows (CFs) Ø The bond price (P) is the sum of the present value (PV) of its future cash flows (as it is for any financial asset) Ø For there to be no arbitrage the PV of the CF-stream must be the same as the PV of the replicating portfolio Ø The process of calculating the PV of future CFs is called discounting BKM 14.2 12 Characteristics Pricing Yield Term Structure Arbitrage Pricing: General Case q Replicate each cash flow: eg if C2 is a $5 coupon in year 2, deposit a specific amount of money in the bank which will give you $5 in 2 years q Together, all deposits (T deposits for T cash flows) will form a replicating portfolio q Note that the interest rate we get for each deposit may differ (eg interest rate for a 1-year deposit may differ from a 2-year deposit) Ø The market determines the appropriate interest rate (or discount rate) for each and every future time horizon Ø To indicate the time horizon of an interest rate, we typically use a time index: yt BKM 14.2 13 Characteristics Pricing Yield Term Structure Arbitrage Pricing: General Case q Replicating cash flows before maturity (coupons) at any time t: Ct is a cash flow (coupon) at any time t (t = 1, 2, …, T-1) Today: Deposit Mt such that Mt(1 + yt)t = Ct The correct deposit amount Mt is therefore: Mt = Ct / (1 + yt)t q Replicating the cash flow at maturity, time T: Today: Deposit MT such that MT(1 + yT)T = FV + CT The correct deposit amount Mt is therefore: MT = (FV + CT) / (1 + yT)T q To execute the complete strategy therefore costs an amount equal to the price of the bond: P = M1 + M2 + … + MT-1 + MT Therefore: P = !! "# $! ! + !" "#$" " +…+ !#$! "#$#$! BKM 14.2 14 Characteristics Pricing Yield Term Structure # _! + (&'# !# ) "# $# # Example of Bond Price Quotes www.asx.com.au 15 Characteristics Pricing Yield Term Structure Yield To Maturity (YTM) q As we saw, the bond price is derived by discounting its future cash flows: q But how do we derive the appropriate discount rates yt ? Ø These interest rates are determined by the market – essentially as a result of the supply and demand for investments producing cash flows in year t (with identical risks as those from this bond) q Under constant interest rates, the bond price formula would be restated as: !! !" !& !# &' P = ! + "+ … + & + # + "#$ "#$ "#$ "#$ "#$ # This constant interest rate y that makes the present value of the bond’s cash flows equal to its price is called the Yield to Maturity (YTM) BKM 14.3 16 Characteristics Pricing Yield Term Structure Yield To Maturity (YTM) q Yield to Maturity (YTM) Ø Bond’s internal rate of return Ø YTM is the one average rate which results in the bond price Ø Assumes that all coupons can be reinvested at the YTM Ø Expressed on an annual basis, and denoted y q How do we derive y? Ø In the equation below where y is constant (from the previous slide), take P as given and solve for y (typically with a financial calculator or excel): P Ø = !! "#$ ! + !" "#$ " +…+ !& "#$ & + !# "#$ + To derive the YTM (y), the bond price (P) must be given BKM 14.3 17 # Characteristics Pricing Yield Term Structure &' "#$ # Bond Pricing as an Annuity q Note that if we assume both the interest/discount rate (ie the YTM - y) and the coupons are constant, we can significantly simplify the bond pricing formula q In this case, the bond pricing formula can be seen as an annuity stream followed by a repayment of principal: PV of Coupon Payments Annuity Factor 1− 1+𝑦 𝑃=𝐶 𝑦 PV Factor _𝑇 + 𝐹𝑉 1 + 𝑦 _𝑇 PV of Principal (Par) Repayment That is: Price = Coupon x Annuity Factor + FV x PV Factor q Note that for this course, it isn’t essential to memorise this annuity formula. At most we will test up to T=3, which can be done just as easily with the basic, expanded bond formula BKM 14.2 18 Characteristics Pricing Yield Term Structure YTM and Bond Prices q It is important to note that bond price always has an inverse relationship with YTM (ie as YTM é P ê and vice versa) q The graph shows the price of a 30-year bond with a FV of $100 and a coupon rate of 10 % for different YTMs. It clearly shows the inverse relationship between YTM and P: Premium Bond: P > FV (C > YTM) 350 300 Price 250 Par Bond: P = FV (C = YTM) 200 150 100 Discount Bond: P < FV (C < YTM) 50 0 0% 5% 10% 15% 20% 25% YTM BKM 14.3 19 Characteristics Pricing Yield Term Structure YTM and Realised Returns q If actual interest rates are constant and equal to the YTM, then the annualized actual return over any holding period will be the YTM q However, in reality this is rarely the case, and most of the time the YTM does not equal the realized returns over a specific holding period because: Ø Actual market interest rates do not equal the YTM Ø Actual market interest rates do not remain constant and change over time q Therefore we have measures for the actual return on a bond: Ø Holding Period Return (HPR) Ø Realised compound yield (which is simply the HPR annualised) BKM 14.3 20 Characteristics Pricing Yield Term Structure YTM and HPR YTM HPR q It is the annualized average return if the bond is held to maturity q It is the rate of return over a particular investment period (not necessarily annualized) q Assumes one constant future re-investment rate q Allows for a changing future reinvestment rate q Depends on coupon rate, bond price, maturity, and face value q q All of these variables are readily observable Depends on future interest rates and bond price at the end of the holding period (if sold) q Can only be forecast and is not readily observable BKM 14.3 21 Characteristics Pricing Yield Term Structure YTM vs Realised Compound Yield q If interest rates fall, coupons will be re-invested at lower rates and the return from holding the bond – the Holding Period Return (HPR) will be lower q The annualised HPR for a bond held to maturity is its realised compound yield (sometimes called simply “realised yield”) q Consider a 2-year 10% coupon $1000 bond purchased at par (ie P0=$1000) with a reinvestment rate of 10% and 8%: BKM 14.3 22 Characteristics Pricing Yield Term Structure YTM vs Realised Compound Yield q q Changes in rates affect the HPR (and the price of the bond) because coupons are re-invested at different rates to the YTM In the example from the previous slide the HPR is: At 10%: HPR At 8%: HPR 𝑻𝒐𝒕𝒂𝒍 𝑩𝒐𝒏𝒅 𝑷𝒓𝒐𝒄𝒆𝒆𝒅𝒔∗ = 𝑷𝟎 𝑻𝒐𝒕𝒂𝒍 𝑩𝒐𝒏𝒅 𝑷𝒓𝒐𝒄𝒆𝒆𝒅𝒔∗ = 𝑷𝟎 −𝟏= −𝟏= 𝟏𝟐𝟏𝟎 𝟏𝟎𝟎𝟎 𝟏𝟐𝟎𝟖 𝟏𝟎𝟎𝟎 − 𝟏 = 𝟐𝟏. 𝟎% − 𝟏 = 𝟐𝟎. 𝟖% * includes re-invested coupons at re-investment rate q In the example from the previous slide the realized compound yield is: At 10%: Realised Yield = 𝟏 + 𝑯𝑷𝑹 At 8%: Realised Yield = 𝟏 + 𝑯𝑷𝑹 𝟏 /𝑻 𝟏 /𝑻 − 𝟏 = 𝟏. 𝟐𝟏 𝟏 /𝟐 − 𝟏 = 𝟏𝟎. 𝟎% − 𝟏 = 𝟏. 𝟐𝟎𝟖 𝟏 /𝟐 − 𝟏 = 𝟗. 𝟗𝟏% BKM 14.3 23 Characteristics Pricing Yield Term Structure Realised Compound Yield q In summary, the steps to derive the realised compound yield are: ① Reinvest all interim cash flows to the end of holding period (at the market interest rates available at different horizons) ② Calculate the aggregate cash flow (Total Bond Proceeds) to the end of the holding period ③ Calculate HPR : divide Total Bond Proceeds by the original price P0 q q ④ Annualise the return: Realised Yield = 1 + 𝐻𝑃𝑅 1/𝑇 − 1, where T is the holding period in years Realised compound yield could be calculated for any holding period Note that: Realised compound yield < YTM if interest rates fall Realised compound yield > YTM if interest rates rise Realised compound yield = YTM if interest rates remain constant BKM 14.3 24 Characteristics Pricing Yield Term Structure Realised Compound Yield: Example 2 q q Assume the following bond parameters 0 1 2 Ø FV: $100 face value Bond Ø T: 2 years of time to maturity 96.62 10 10 100 Ø C: $10 annual coupons Ø YTM: 12% yield to maturity (calculate and derive price of $96.62) Suppose we can reinvest the year 1 coupon at 10% Calculation Ø The Total Bond Proceeds (aggregate cash flow) at T (note: T=2) is: CF2 = 100 + 10 + 10(1+0.1) = 121 Ø The 2-year HPR = 121/96.62 - 1 = 0.25 (25%) Ø The realized compound yield = (1.25)1/2 – 1 ≈ 11.9% BKM 14.3 25 Characteristics Pricing Yield Term Structure Term Structure: the Yield Curve q The term structure of interest rates essentially refers to how interest rates vary over different investment horizons q The term structure of interest rates is often referred to as the Yield Curve Ø The yield curve displays the relationship between yield and maturity Ø The yield curve can imply market expectations on future interest rates q Interest rates can be thought of as the price of future cash flows. When these prices change, the yield curve shifts q As seen in the graph, the yield curve is typically upward sloping but can also be flat or downward sloping (“inverted”) BKM 15.1 26 Characteristics Pricing Yield Term Structure Zero Coupon Bonds q If the coupon rate is zero, the entire return comes from price appreciation ie all return is capital gain q Zero coupon bonds avoid reinvestment risk (no coupons to re-invest) q Zeros trade at a deep discount to par as all return is back-ended q A coupon bond can be viewed as a portfolio of zeros Ø Each coupon can be considered a maturing zero-coupon bond of the same term q Bond stripping is the process of spinning off each coupon and principal payment as a separate zero q Technically, the yield curve should be derived from the market interest rate on a series of zeros – this is known as the pure yield curve. However, this is not always possible BKM 15.1 27 Characteristics Pricing Yield Term Structure Types of Yield Curves Pure Yield Curve On-the-run Yield Curve q The pure yield curve uses stripped or zero-coupon bonds q q The pure yield curve may differ significantly from the on-the-run yield curve The on-the-run yield curve uses recently issued coupon bonds selling at or near par q On-the-run bonds have the greatest liquidity in the market q The financial press typically publishes on-the-run yield curves q In reality it may be difficult to derive the pure yield curve, as relevant zeros may not be available in the market BKM 15.1 28 Characteristics Pricing Yield Term Structure Spot Rate q The pure yield curve is derived from the yields on zero-coupon bonds of differing maturities q These zero-coupon yields are known as the spot rate (yt) q The spot rate is the interest rate today (ie at time 0) for a t-period zero coupon bond (ie starting today and ending at time t) q Conceptually, the spot rate (yt) can differ from the YTM (y) of a t-period bond because the YTM applies to any type of bond whereas the spot rate specifically refers to zero-coupon bonds Ø For zero-coupon bonds, these two values are the same Ø Spot rate is sometimes informally called the “pure yield” BKM 15.1 29 Characteristics Pricing Yield Term Structure Inferring the Term Structure from Zeros q We have a 1-year zero coupon bond and a 2-year zero coupon bond as y y follows: 1 1 A Bond A -PA FVA -90.91 y2 B Bond B -PB q FV B Therefore: 1 t FV (1 + yt ) PA = 90.91 = PB = 79.72 = t æ FV ö Û yt = ç ÷ -1 è P ø 100 100 Û y1 = - 1 » 10% 1 + y 90.91 ( 1) 100 (1 + y2 ) 2 Û y2 = 100 - 1 » 12% 79.72 BKM 15.1 30 0 The price of a t-year zero coupon bond is given by: P= q -79.72 100 y2 Characteristics Pricing Yield Term Structure 100 Example 2: Zero + Coupon Bond q Now consider a 1-year zero coupon bond and a 2-year coupon bond: y1 Bond A -PA FVA y2 -PB c Bond B q C+FV B How do we derive the 1-year and 2-year spot rates – y1 and y2? Ø y1 can be inferred from bond A’s price as shown on the previous slide Ø Bond B’s pricing equation is given by: P = Ø !! "#$! ! + (&'# !") "#$" " So we can easily calculate 𝑦2 based on Bond B’s price given y1 BKM 15.1 31 Characteristics Pricing Yield Term Structure Example 2: Zero + Coupon Bond (cont) q Consider the following 1-year zero coupon bond and 2-year coupon bond: y1 Bond A -90.91 100 y2 Bond B 10 -95.78 q 110 We derive y1 and y2 (and thus the term structure) as follows: Ø y1 = 10% as shown in the previous example Ø y2 is derived as: 𝑃! = 95.78 = "# ""# + ("%"#%) ("%(! )! BKM 15.1 32 Characteristics Pricing Yield Term Structure → 𝑦) ≅ 12.65% Generalised Method q For a 1-period zero and a 2-period coupon bond the generalised steps are: ① Find y1 from the price equation of the 1-period zero coupon bond ② Substitute y1 into the price equation for the 2-period coupon bond, and find y2 q We can repeat this for any number of periods to find the spot rate for any t, by substituting y1, y2, …, yt-1 into the price equation of any t-period coupon bond (this iterative method is called bootstrapping) BKM 15.1 33 Characteristics Pricing Yield Term Structure Inferring from Coupon Bonds Only q Now consider two 2-year coupon paying bonds: Bond A -PA CA CA+FVA -PB CB CB+FVB Bond B q How do we derive the 1-year and 2-year spot rates – y1 and y2? Ø We have two price equations here (for Bonds A and B). Solve the two equations for two unknowns y1 and y2 simultaneously q Similarly, if we are pricing any t-period coupon bond (with maturity equal or less than t), we can solve those equations to find y1, y2, … up to yt Ø Unlikely anything above a 2-equation system will be asked in an exam BKM 15.1 34 Characteristics Pricing Yield Term Structure Next Lecture q Future Interest Rates and Duration Key Concepts Ø Bond Arbitrage Ø Future interest rates – short rates and forward rates Ø Term structure hypotheses Ø Interest rate risk Ø Duration, convexity and immunization Readings Ø BKM 15 Term Structure of Interest Rates: 15.2 – 15.4 Ø BKM 16 Managing Bond Portfolios: 16.1 – 16.3 35