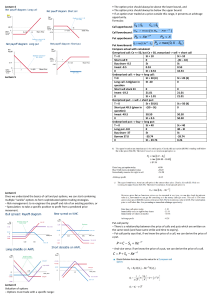

EIN 3354: Engineering Economy Fall 2022 Homework # 7: Binomial No-Arbitrage Pricing Model This homework is due on Tuesday, November 29, 2022 at 12:30 pm. file should be named "lastname-firstname-HW7". The submitted 1. Consider six months European put option with a strike price of $100 on a stock with current price $100. There are two time steps and in each time step the stock price either moves up by 10% or moves down by 10%. Risk-free interest rate is r = 5% (on 3 months). (a) Find the current option price. (b) Compute the number of shares of stock which should be held by the replicating portfolio at time 0 and 1 (after 3 months). 2. Consider the 3-period binomial model with S0 = 100, u = 2, d = 21 and r = 14 . Find the current price and compute the number of shares of stock which should be held by the replicating portfolio at time 0, 1 and 2 for: (a) Lookback call option with a strike price of $100 that pays off (at time three) V3 = max Sn − 100 . 0≤n≤3 + (b) Lookback put option with a strike price of $100 that pays off (at time three) V3 = 100 − min Sn . 0≤n≤3 + (c) Asian call option with a strike price of $100 whose payoff (at time three) is 1 Y3 − 100 , V3 = 4 + where Y3 = 3 P Sk is the sum of stock prices between time 0 and time 3. k=0 1